List Of Fake Forex Brokers In Nigeria

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Forex scammer list in Nigeria:

KS-Securities, Atlantika, and Royaltd24 – blacklisted or operating without proper regulation.

LibraMarkets, ForexCT, and New Forex – accused of refusing withdrawals and causing fund losses.

STForex and Axiory – criticized for unjustified account blocks and misleading practices.

RMT500 – imposes unwanted bonuses and restricts profit access.

Panteon Finance – faces ongoing technical issues and failure to meet client obligations.

General concern – traders report widespread legal, technical, and financial problems across multiple brokers in 2025.

Nigeria has a thriving Forex trading scene, with over 300,000 active traders. It’s now one of Africa’s biggest currency trading hubs, second only to South Africa. New and experienced traders are attracted to the possibility of making strong profits.

However, just like in other countries, Forex trading in Nigeria comes with risks, including scams and unregulated brokers. Although the Central Bank of Nigeria oversees the industry, traders still need to be cautious to avoid fraud. In this guide, Traders Union highlights known Forex scams and shares key tips to help traders spot and avoid fraudulent brokers.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Blacklist of Forex brokers in Nigeria

Nigeria’s Forex market is growing fast, attracting both genuine traders and scammers looking to take advantage of investors. These fraudsters pretend to be legitimate brokers, using fake promises to convince people to invest. Many traders lose large amounts of money before realizing they’ve been scammed.

To help investors avoid these traps, we’ve compiled a list of fraudulent Forex brokers operating in Nigeria. These companies have built a reputation for deception, and we’ll break down the key warning signs that expose their scams.

| Broker name | Year established | Minimum loss | Notable red flags |

|---|---|---|---|

| STForex | 2014 | $200 | Unjustified account blocks, lack of legal documentation, numerous negative reviews. |

| KS-Securities | 2019 | $1,000 | False claims of regulation, blacklisted by multiple financial authorities. |

| LibraMarkets | 2018 | $250 | Unauthorized account restrictions, disappearance of funds, unresponsive support. |

| RMT500 | 2019 | N/A | Imposition of unwanted bonuses, difficulties in withdrawing profits, controlled trading platform. |

| Atlantika | 2019 | N/A | Operating without a financial license, blacklisted by regulators, numerous negative reviews. |

| Royaltd24 | 2011 | $250 | Lack of legal authority, hidden fees during withdrawals, manipulated trading software. |

| Axiory | 2014 | $10 | False information on website, trading disruptions, non-payment of funds. |

| ForexCT | 2006 | $500 | Failure to fulfill obligations, refusal to process withdrawals, trading manipulations. |

| New Forex | 2014 | $200 | Numerous negative comments, platform errors, unjustified refusal of withdrawals. |

| Panteon Finance | 2010 | $200 | Negative reputation, platform errors, failure to meet obligations. |

Note: The information provided is based on available data and may not encompass all fraudulent brokers. It's essential to conduct thorough research and exercise caution when selecting a Forex broker.

How to verify a Forex broker’s legitimacy in 5 simple steps

Many fraudulent brokers lure traders with unrealistic promises of high profits, trading assistance, and seemingly favorable conditions. Each year, new scam tactics emerge, making it harder for traders to identify fraudulent platforms before numerous negative reviews surface online.

To safeguard your funds, it’s essential to conduct thorough research before registering with a broker. Evaluating key risk factors will help you avoid financial losses and find a trustworthy trading partner. Here are the crucial steps to verify whether a Forex broker is legitimate.

Verify the broker’s regulatory status

Always check if a broker is licensed to operate in Nigeria before opening an account. A regulated broker follows strict financial rules, which helps protect traders and ensure fair dealings. Brokers offering services in Nigeria may also hold licenses from respected financial regulators such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or the Federal Financial Supervisory Authority (BaFin).

Legit brokers are open about their credentials and display their license numbers clearly on their websites. You can usually find this information in the website footer or a dedicated legal section. Important: Never trust a broker’s claims without verifying their license details first!

Cross-check with the regulatory authority’s database

To verify a broker’s license, look it up directly on the regulator’s official website. Use the license number or company name to confirm whether the broker is registered. If a broker isn’t listed in the regulator’s database, it is likely unlicensed and should be avoided.

Assess the broker’s website

A trustworthy broker has a well-organized website with clear details on fees, policies, and security measures. Serious financial companies provide key information such as:

Company background and strategic plans.

Legal policies and risk disclosures.

Terms of service and trading conditions.

Deposit and withdrawal fees clearly outlined.

Secure payment methods with clear processing times.

Multiple customer support channels, including phone, live chat, and email.

If a broker hides legal information or makes it hard to find, that’s a major red flag.

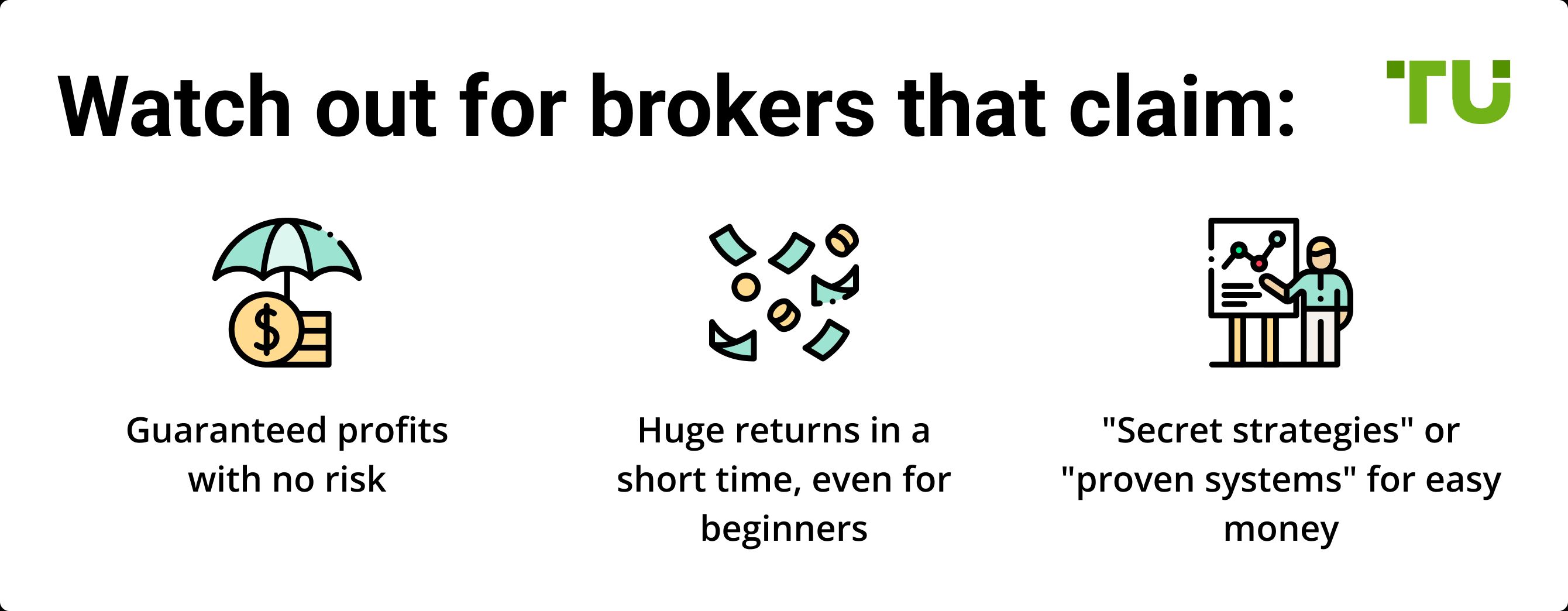

Beware of unrealistic profit guarantees

No broker can promise guaranteed profits — trading always involves risk. A broker’s job is to offer a stable trading platform, fair order execution, and analytical tools, not ensure success.

If a broker advertises risk-free trading or unrealistic gains, it’s likely a scam.

Read trader reviews and feedback

Reading real trader reviews can reveal a broker’s strengths and weaknesses. If many traders report issues like withdrawal delays, hidden fees, or unfair trade execution, it’s best to stay away.

Websites like Traders Union provide authentic reviews from real users, helping you compare brokers based on actual experiences. Checking multiple sources ensures a well-rounded view before making a decision.

Since scams are common in Forex, taking the time to research a broker can save you from costly mistakes. By verifying regulatory status, checking databases, reviewing the website, avoiding profit scams, and reading trader feedback, you can protect yourself and trade with confidence.

Perform due diligence before investing, and always choose a broker with a proven track record of transparency and fair trading practices.

How to steer clear of Forex scams

To safeguard your investments and avoid falling victim to scams, consider these essential precautions:

Choose a regulated broker

Only trade with brokers that follow strict regulations. Regulated brokers follow rules that keep your money safe and ensure fair trading conditions. Before signing up, double-check the broker’s credentials on official regulatory websites. You can do your own research or choose from a narrowed-down list of regulated brokers in Nigeria prepared by us:

| Available in Nigeria | Min. deposit, $ | Max. leverage | Deposit fee, % | Withdrawal fee, % | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:500 | No | No | ASIC, SCB, CySEC, FCA | 9.1 | Open an account Your capital is at risk. |

|

| Yes | 5 | 1:1000 | No | No | CySEC, FSC (Belize), DFSA, FSCA, FSA (Seychelles), FSC (Mauritius) | 9 | Open an account Your capital is at risk. |

|

| Yes | 10 | 1:2000 | No | 0-4 | FSC | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 10 | 1:2000 | No | No | FCA, CySEC, FSA (Seychelles), FSCA, BVI FSC, CBCS, CMA | 8.7 | Open an account Your capital is at risk.

|

|

| Yes | 100 | 1:500 | No | 1-3 | ASIC, FSCA, FSC Mauritius | 8.69 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Beware of too-good-to-be-true promises

If a broker promises guaranteed profits with no risk, that’s a major red flag. Forex trading comes with risks, and no real platform can guarantee easy money. Stay away from unrealistic claims that seem too good to be true.

Conduct extensive research

Check real trader reviews and look for any complaints about fraud or unfair practices before signing up. Read feedback from trusted sources and verify if the broker has any past regulatory violations or warnings.

Ignore unsolicited investment offers

Scammers love to send random messages or calls pushing shady trading schemes — don’t take the bait. Legit brokers don’t use aggressive marketing, so be suspicious of anyone pressuring you to invest fast.

Educate yourself on Forex trading

Understanding how Forex trading works — like risk management and market trends — helps you spot scams faster. When you know what to look for, you’re far less likely to fall for a fake broker or shady investment scheme. By staying vigilant, doing your research, and only engaging with reputable brokers, you can significantly reduce your chances of encountering Forex scams.

Fake broker websites and bonus scams trap Nigerian Forex traders

Most people think spotting a scam broker is as easy as checking if they’re regulated, but Nigerian Forex scammers have gotten smarter. Many fake brokers clone legitimate websites, using the same logos and layouts as trusted platforms. They create fake customer service teams that respond professionally to trick traders into depositing funds. By the time traders realize the website isn’t real, the scammers have already vanished. Always cross-check URLs and verify broker licenses directly on regulatory websites like the SEC Nigeria or the FCA UK instead of trusting a link from the broker’s site.

Another common scam is phony withdrawal restrictions disguised as "bonus terms". Some fraudulent brokers offer huge sign-up bonuses but later prevent withdrawals, claiming that traders must meet impossible trading volume requirements. They use manipulated trading dashboards that show fake profits to keep traders engaged, only for them to realize later that their funds were never actually in the market. The safest way to avoid these traps is never to accept bonuses from offshore, unregulated brokers and to test withdrawals with a small amount before committing more funds.

Conclusion

Choosing the best Forex broker in Nigeria requires thorough research, patience, and a clear understanding of what you need from a broker. Regulation, user reviews, and trading conditions are critical factors in making a sound decision. By focusing on transparency, customer support, and real trader experiences, you can avoid fraudulent brokers and enjoy a safe trading experience. Always remember — if a deal sounds too good to be true, it probably is.

FAQs

How to identify a fraudulent broker?

A fraudulent broker often makes unrealistic promises, such as guaranteed profits or risk-free trading. They may also have hidden fees, slow or blocked withdrawals, and a lack of regulatory oversight. If a broker is not registered with a well-known financial authority, it’s a major warning sign.

Where to look for broker reviews?

You can find reliable broker reviews on trusted financial websites, regulatory authority websites, and trading communities like Forex Factory, Trustpilot, and Myfxbook. However, always verify reviews, as some brokers pay for fake positive feedback.

Is Forex trading legal in Nigeria?

Yes, Forex trading is legal in Nigeria. The Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN) oversee financial regulations, but most retail Forex brokers operate under international regulations. Traders should ensure their broker is regulated by a reputable body.

What are the risks of working with fraudulent brokers?

The biggest risks include losing your funds due to unfair trading conditions, manipulated prices, withdrawal refusals, and unauthorized transactions. Scammers may also steal personal and financial data, leading to further financial losses.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).