Fake Forex Brokers List in the UK

A Forex scam in the UK is a fraudulent scheme where individuals or entities promise high returns through trading in the foreign exchange market but instead deceive traders, often resulting in financial losses. To avoid Forex scams, conduct thorough research on brokers or platforms, be cautious of unrealistic promises of guaranteed profits, and only invest with reputable, regulated entities.

The UK became one of the first countries to regulate brokers and control their relationships with traders. Owning a license issued by the local FCA regulator is considered very prestigious, and many financial institutions seek to obtain it. A client who opens an account with a broker registered and licensed in the UK can be sure that the company will faithfully comply with the requirements of international legislation and will be liable in case of violation of agreements.

From this material, you will find out how to distinguish a reliable financial partner from a typical scammer and what advantages FCA protection gives to traders. The Traders Union will also present the Fake Forex Brokers List in the UK and tell you how you can quickly identify a scam.

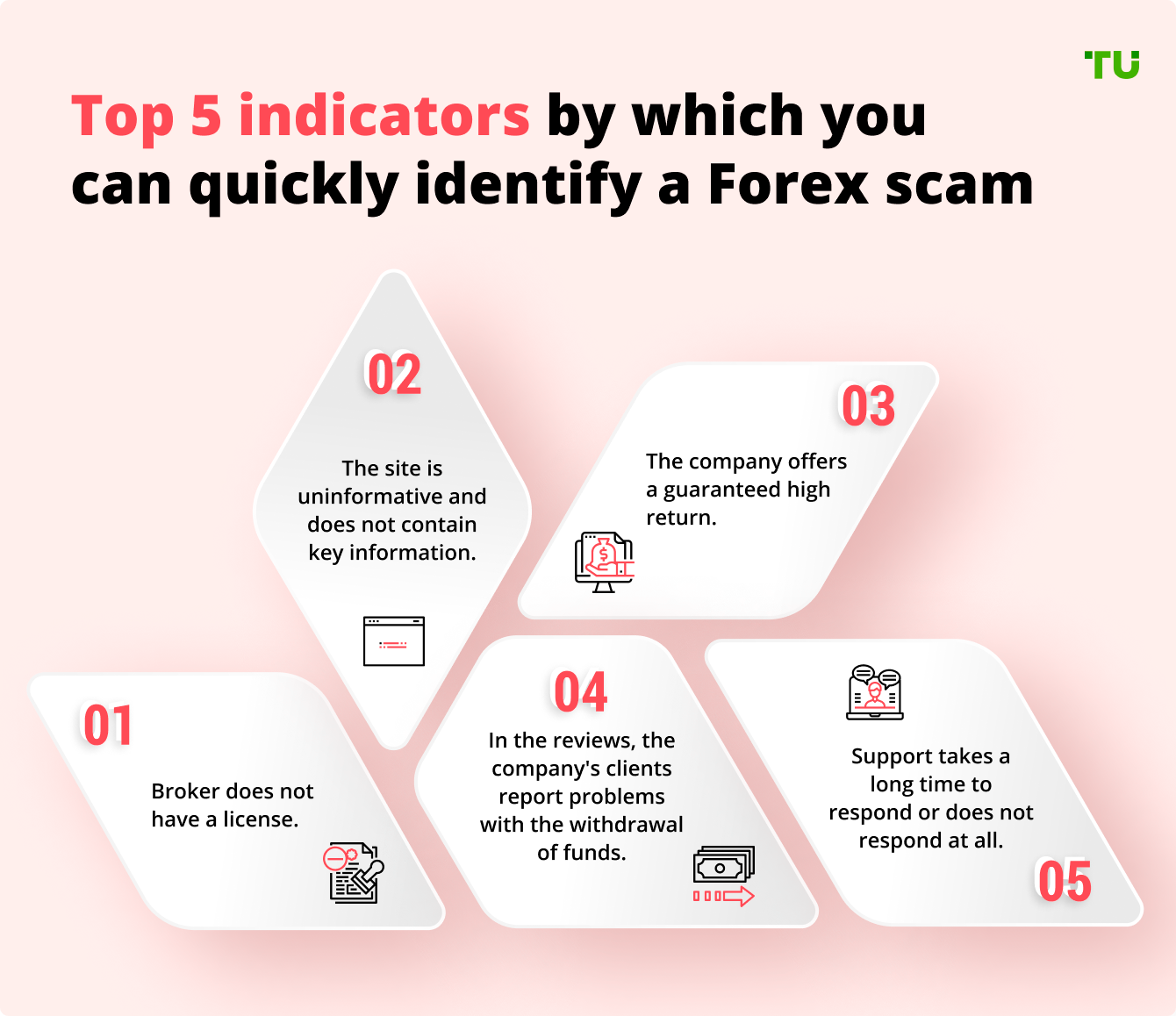

Indicators by which you can identify a Forex scam

Is Forex legal in the UK?

Forex trading is completely legal in the UK. The basic law is the Financial Services Act 2012, according to which all clients of brokers with a local license are protected from losses of up to 50,000 GBP (the FSCS compensation fund is in force).

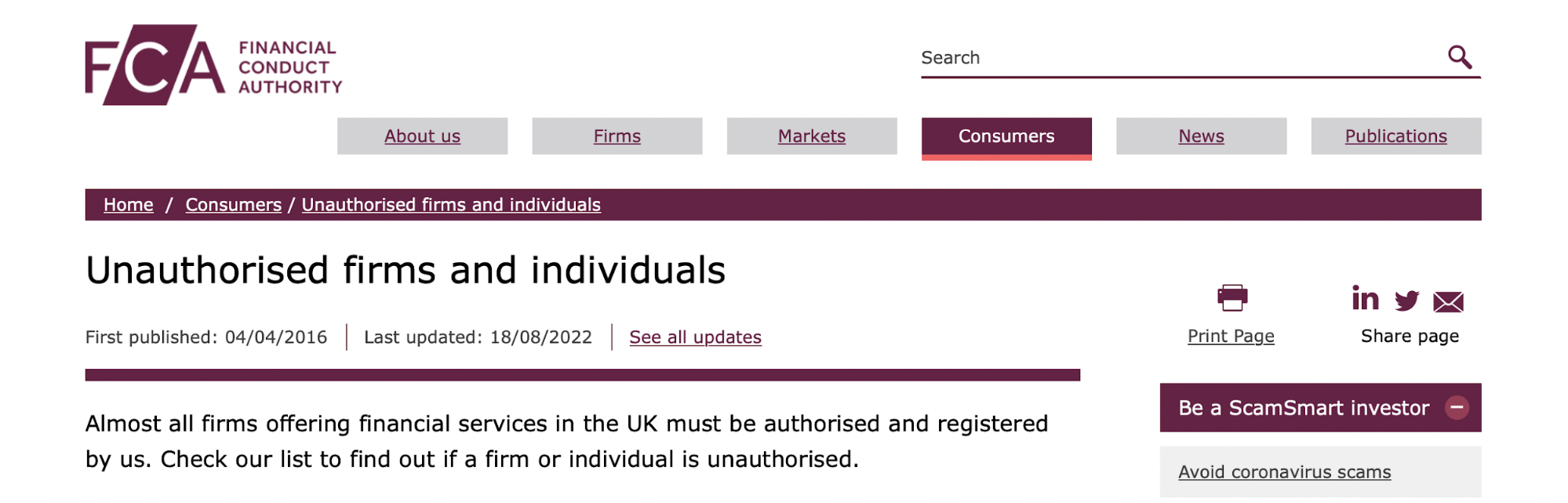

The main regulator that monitors the activities of brokers in the United Kingdom is the FCA (initially called the FSA). It has been operating since 2013 and guarantees the legal protection of traders. This body ensures an audit of brokers' activities and investigates complaints from their clients. The regulator cares about the financial security of users and also strives to maximize the integrity of the UK financial system.

Forex is a highly liquid market, and transactions worth trillions of dollars are carried out there every day. You can earn money, but for this, you need to have adequate knowledge and practical experience, plus choose the right broker that will meet the FCA standards.

The regulator has the right to:

-

monitor the financial statements of trading companies;

-

suspend work for up to 1 year for suspected financial fraud;

-

revoke licenses;

-

add the broker to the blacklist, which can be found directly on the regulator's website.

Blacklist of Forex brokers in the UK

Fake brokers are well aware that having a British registration and FCA license is highly respected. That is why many such companies falsely indicate the presence of such a permit on their platforms. Moreover, they steal other people's banking details from the open register of legal entities of the Companies House and pass them off as their own. The scammers hope that novice traders will not go into legal details and verify the information.

You can see the Forex scammer list in the table below. The British regulator has already warned the public about the dangers of partnering with them.

FCA Warning

The Traders Union will tell you about the main signs of a scam that its experts detected in these companies. Be careful; don't fall for the empty promises of financial scammers!

| Name | Established | Minimal losses |

|---|---|---|

Lucror Capital Markets |

2017 |

$10 |

Zenfinex |

2017 |

$50 |

Europa Trade Capital |

2002 |

$10,000 |

Brown Finance |

2021 |

€10,000 |

Saxofx-24 |

2018 |

$250 |

BenefFX |

2017 |

$250 |

TDX Markets |

2019 |

$500 |

PRB Capitals |

2021 |

$100 |

GLOBAL FX |

2009 |

$300 |

Baimaas FX |

2020 |

$5 |

DEVON FINANCE FX |

2018 |

N/A |

UproFX |

2018 |

EUR 250 |

|

Trade Global Market |

2015 |

$100 |

|

KayaFX |

2017 |

$250 |

Lucror Capital Markets

Lucror Capital Markets LP is a brokerage company registered in New Zealand. This company promises profitable cooperation with both institutional clients and retail traders. However, real users in their reviews note that this company has major non-compliance issues with both trading and payment discipline. It pursues exclusively its own interests and does not care about the comfort and safety of trading.

The main signs of its scam are:

-

the absence of decent client service;

-

non-compliance with trading discipline and profit payment;

-

blocking accounts for no reason;

-

constant technical failures;

-

misleading trading tips.

Zenfinex

Zenfinex was founded in 2017, and initially, the company received an FCA license. The broker promises comfortable trading in currency pairs, indices, commodities, and spot metals. The financial partner has a universal MT4 terminal, a demo account with 10,000 virtual dollars, and a bunch of "goodies". However, all promises remain unfulfilled. It is because of numerous complaints that this company was blacklisted by the British regulator, and its license was revoked.

The main signs of its scam:

-

fraud warning from the FCA;

-

fraud with transactions (use of fake quotes or charts);

-

non-compliance with payment discipline;

-

non-provision of legal protection;

-

blowing deposits without the participation of a trader;

-

difficulties with support, which does not care about client problems.

Europa Trade Capital

Europa Trade Capital is an offshore broker registered in Saint Vincent and the Grenadines. The brand is managed by FD Trade Llc. The company claims to have been successfully providing services for 20 years. At the same time, it has not yet taken care of regulation. The FCA blacklisted this broker because numerous complaints were received against it and because of non-compliance with trading and payment discipline. There are several tariff plans, and access to margin trading with a leverage of up to 1:500. The minimum losses in the project are $10,000.

The main signs of its scam:

-

negative reputation on the internet;

-

presence on the FCA blacklist;

-

manipulation of the trading process and blowing user deposits;

-

refusal to withdraw profit for fictitious reasons;

-

partial or complete cancellation of transactions;

-

unauthorized change of the commission policy in the process of cooperation and hidden payments.

Brown Finance

On the Brown Finance platform, it is stated that the brand is managed by Old Mutual Funds and Wellness Management. The broker promises a wide range of tools for increasing capital such as transactions with stocks, digital currencies, etc. According to its false claims, this brokerage company is the leader of the FinTech revolution. However, the company neglects to get a license. Moreover, the FCA has already included Brown Finance in its blacklist of brokers and warned the public about the dangers of cooperation with it.

The main signs of its scam:

-

absence of a legal basis for legitimate work;

-

issues with the execution of transactions due to requote and gapping, plus constant technical failures;

-

an exorbitant entry barrier of $10,000;

-

disclaimer of financial liability (at the same time, the company actively provides trading advice and imposes the services of a personal manager on every beginner);

-

noncompliance with payment discipline.

Saxofx-24

The platform states that Saxofx-24 was created by a group of traders. Initially, it was an education center, but then in 2018, the company moved into the category of Forex brokers. The website promises excellent customer support, transparent trading conditions, and an entry threshold of $250, even for beginners. It sounds tempting, but in the reviews, real clients are writing many complaints about this broker. Actually, that's why he was blacklisted.

The main signs of its scam:

-

offering bonuses but imposing unrealistic conditions for their processing;

-

inability to withdraw funds;

-

blocking accounts without explanation;

-

questionable quality of services;

-

absence of financial liability;

-

constant extortion of funds;

-

quotes manipulation;

-

absence of legal framework.

BenefFX

BenefFX is an offshore brand from the Marshall Islands. It is owned by Optium Ltd, which does not have any license. The platform offers trading of 1,000+ assets, including currency pairs, indices, stocks, cryptocurrencies, and commodities. The entry barrier is $250. There are opportunities for margin trading, training, and support from a personal manager. The brokerage organization got onto the Forex scam list of FCA because of numerous negative reviews.

The main signs of its scam:

-

fake trading recommendations;

-

extortion of new investments with threats;

-

hidden commission fees;

-

blocking personal accounts and embezzlement;

-

junk information instead of high-quality training materials;

-

the terminal is controlled by scammers.

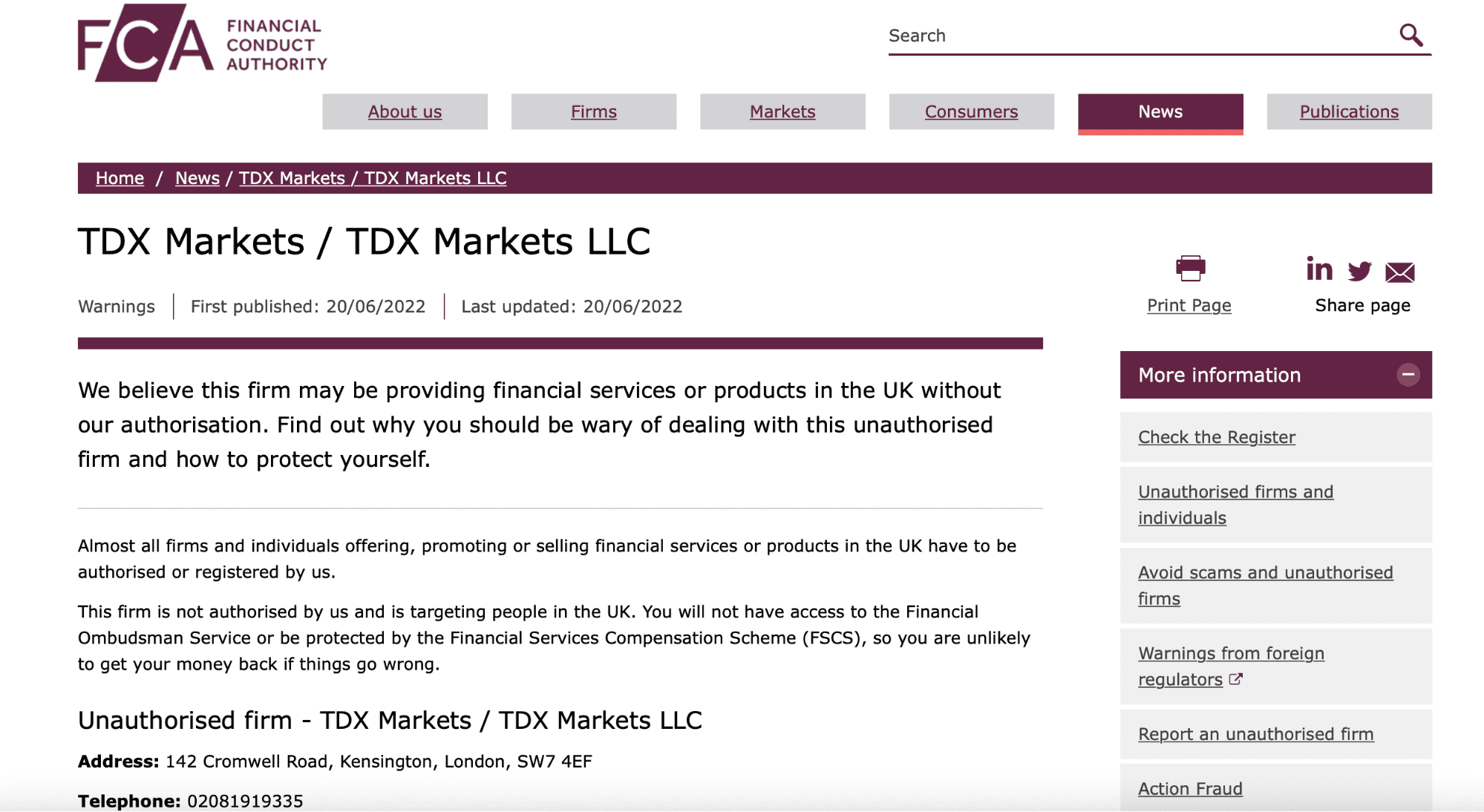

TDX Markets

TDX Markets presents itself as one of the most progressive and fast-growing brokers, cooperation with which is open to both professionals and beginners. The platform website states that the broker is managed by an offshore company from Saint Vincent and the Grenadines and registered in the island state in 2019. The platform does not have a license for legitimate activities, but there are many complaints from clients who have suffered from these scammers.

FCA Warning

The main signs of its scam:

-

offshore registration;

-

cleaning out clients' deposit accounts;

-

rude and indifferent attitude of support;

-

deleting accounts for no reason;

-

embezzlement;

-

refusal to pay profits and preventing the withdrawal of personal savings of its traders;

-

a controversial terminal with quotes and charts controlled by scammers.

PRB Capitals

PRB Capitals calls itself a British broker, but it operates in the UK illegally. The FCA could not ignore such impudence and quickly added the organization to its blacklist. However, this fraudulent broker continues to work and lures beginners with a wide range of tools, promises of transparent financial policies, and the opportunity to practice for free. The initial deposit is $100.

The main signs of its scam:

-

absence of a license and internal documents regulating the rights and obligations of the parties;

-

financial extortion;

-

the platform works only for receiving deposits;

-

fake reasons for refusing to cooperate;

-

imposing trade recommendations, for which the company then refuses to be financially liable;

-

fabricated technical failures in the software;

-

the absence of decent support services.

Global FX

Global FX is a Canadian broker registered in 2009. The company claims that it operates under STP technology and provides access to trading a wide range of assets (1200+ financial instruments). Despite the promises of faithful and stable work, this broker has no legal grounds for activity. Traders note that the organization refuses to fulfill its obligations and does not guarantee the withdrawal of funds.

The main signs of its scam:

-

illegitimate trading activity;

-

presence on the blacklist of the British regulator;

-

absence of trade and payment discipline;

-

embezzlement;

-

disclaiming a financial liability;

-

exorbitant commissions;

-

expanding spreads to improbable parameters.

Baimaas FX

Baimaas FX states it has been operating since 2020 and is registered in the UK. However, the company does not have a license, it is a broker that refuses to bear financial responsibility, or compensate for the losses caused to its traders. The entry barrier is $5, but with the use of psychological pressure and empty promises, the company manages to deceive investors into parting with four-digit amounts.

The main signs of its scam:

-

financial extortion;

-

blowing user deposits using a controlled terminal;

-

promises of high profitability but with a complete absence of guarantees;

-

absence of legal grounds for its trading activities;

-

fraudulently blocking accounts of its clients.

DEVON FINANCE FX

Devonfinanceltdfx is an unregulated forex and CFD broker based in the British Virgin Islands. It lacks regulation by any financial authority, raising concerns about its legitimacy. The company purports to provide a range of financial services, including forex, cryptocurrency, and binary options trading; however, there is no substantiation of these claims. Regrettably, Devonfinanceltdfx is a fraudulent operation that preys on unsuspecting individuals by offering unrealistic returns. The Financial Conduct Authority (FCA) has issued a strong warning, particularly for traders in the UK, advising against engaging with this dubious broker.

The main signs of its scam:

-

Lack of regulation by any financial authority is evident in the company's operations

-

Unrealistic promises regarding returns are made by the company

-

The company imposes a high upfront fee as a requirement

-

Difficulties in contacting the company are observed

-

The company lacks transparency regarding its fees and charges

UproFx

UproFX is a CFD brokerage operating from Estonia. It is critical to note that UproFX has a parent company named Yield Enterprise Currency Software. Being a child company adds more trust to a Brokerage. This trust occurs since should the broker get involved in shady business, the parent company will also get affected.

However, UproFX does not hold any license from any Forex authority. Additionally, the broker is suspected of being a fraud since it has never been checked for compliance and safety ever since its establishment. This state of affairs means that the broker may conduct business in any way it deems fit, including unlawfully.

The UproFX website lacks transparency regarding regulatory compliance and client terms. User reviews from various websites suggest unresponsive customer support and difficulties in withdrawing funds. Such factors raise concerns regarding the credibility of this broker. Therefore, traders are advised to exercise caution before engaging UproFX as the broker of their choice.

Trade Global Market

Trade Global Market presents itself as a global trading platform. However, a deeper analysis reveals several issues. For instance, it lacks regulatory information, which is a common trait among fraudulent brokers. Users have reported instances of difficulty accessing funds and sudden account closures. Such issues indicate potential malpractices by the broker.

The company is owned and operated by TCM Financial LLC, which claims to be located in Tbilisi, Georgia. On its website, it claims to be a leading online trading brokerage specialising in international financial markets. It offers to trade with different currency pairs, indices, and CFDs. However, a deeper check shows that Trade Global Market is not regulated nor checked for safety, making it unsafe to trade with the company.

Also, the company’s address on the website actually belongs to a company named Zixipay Limited. Zixipay is a Georgian-based Payment Service Provider that is registered and regulated by the National Bank of Georgia. Therefore, Trade Global Market uses the address of another authorised entity to fool customers.

Kaya FX

KayaFX claims to provide a comprehensive trading experience for its customers. However, a thorough analysis of its website shows a lack of transparency, especially in terms of use. The terms and conditions show that clearing and billing is done by Hermes Solution DOO, which is based in Montenegro. However, reports from users highlight issues such as unresponsive customer support and delayed payments. Such issues cast doubt on the legitimacy of KayaFX.

KayaFX states that it enables trading in the most popular assets, including stocks, CFDs, commodities, currency pairs, and major financial indices. The company is owned and operated by AlphaTec Ltd. It also claims that it is located in Leeds, England. However, the company lacks a valid licence from the FCA (Financial Conduct Authority), which is the UK regulator. The company also mentions that the laws of Estonia govern its relations with its clients. Such inconsistencies raise doubts about the credibility of the broker.

Top 30 Best UK Forex BrokersHow to check if a Forex broker is legitimate | 5 Steps

The International Forex market attracts traders, but also scammers, who will not miss an opportunity to empty your wallet. The majority of scammers lure naïve investors with promises of exorbitant income, ‘assistance’ in trading, and good trading conditions.

Forex scams are increasing each year, with scammers coming up with new schemes to trick as many people as possible out of all their money, before a large number of revealing reviews appears on the Internet.

That is why before registering on a trading platform and entrusting a broker with your money, you need to perform a full analysis and evaluate all risk factors. This will help you avoid losing your money and find a truly worthy financial partner. Let’s discuss the key factors you need to consider when choosing a broker.

1. Check regulatory information about your broker

First, you need to check whether the company you are interested in operates legally in the UK. This is a guarantee that your broker will provide services in good faith and be held accountable in case of some illegal actions. A potential financial partner providing services in the RSA may also have licenses of reputable regulatory authorities from other jurisdictions (FCA, ASIC, BaFin, etc.).

Brokers operating legally do not try to conceal their legal documents, providing scanned copies of the certificate of incorporation, licenses. In the very least, a company should list the numbers of licenses on its website, so that traders could verify this information. Information about licenses can usually be found in the footer of a broker’s website or in a separate tab or section.

NOTE! Do not believe the provided information right away; always verify it!

2. Check the database on the regulatory authority’s website

You can check the broker's license directly on the website of the regulatory authority. You can search by the document number or company name. This will allow you to learn whether the company is regulated or not.

3. Get to know broker’s website

The next important step involves assessment of the broker’s website. Financial companies that are serious about working successfully with traders will provide the following information:

Project’s roadmap and strategic development plans;

Legal information and internal documents with clearly specified details of cooperation, and key rules;

Risk disclosure;

Specifications of contracts, indicating the minimum deposit, spreads, etc.;

Diversity of payment methods with specification of payment procedures and fees;

A good choice of channels to contact customer support: phone support, live chat, pages on social media, etc.).

4. Does a broker guarantee profit?

A broker cannot guarantee that you will earn a profit, as it acts solely as an intermediary between the Forex market and traders. Brokers are responsible for prompt execution of client orders, stable operation of the platform, quality analytical instruments and good advice from a personal manager, or customer support. The following should not be on a broker’s website:

Guarantees that you will earn a profit;

Promises of colossal profit in a short time and without specialized knowledge;

Stories about ‘unique’ earning algorithms and secret schemes.

5. Read customer reviews

Reviews of real clients can tell you a lot about a broker. If a company has many negative reviews (traders point to extortion, manipulation of trading process, issues with withdrawals and failure to perform obligations), it is best not to go with such a broker. You can find reviews of real clients on the Traders Union website, where users actively share their personal opinions and tell the truth about financial companies.

How To Spot and Avoid Forex Scams?

Here are five valuable tips to help you spot and avoid forex scams:

Choose Regulated Companies

Stick to reputable brokers regulated by recognized financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, or the Australian Securities and Investments Commission (ASIC). Regulatory oversight ensures that the broker operates within established guidelines, providing a layer of protection for your funds.

Conduct Due Diligence

Before engaging with a forex broker, thoroughly research their background and reputation. Look for reviews, testimonials, and any history of complaints or regulatory actions. A reputable broker will have a transparent track record and positive feedback from traders.

Beware of Unrealistic Promises

Be cautious of brokers or individuals who promise extraordinary profits or guaranteed success. Forex trading involves inherent risks, and no legitimate broker or trading strategy can guarantee consistently high returns. Avoid falling for empty promises and get-rich-quick schemes.

Check Transparency and Legal Compliance

Legitimate brokers have clear and transparent information available on their website, including their physical address, contact details, and licensing information. Verify their compliance with regulations and ensure they adhere to industry standards.

Avoid Unregulated or Offshore Brokers

Exercise caution when dealing with brokers based in countries or jurisdictions known for lax regulations. Offshore brokers, especially in locations with weak oversight, are often associated with higher scam risks. Prioritise brokers operating within well-established financial centres that enforce strict regulatory frameworks.

The best Forex brokers in the UK

FAQs

What are the crucial elements of a scam?

Fake brokers are trying to blend into the ranks of private companies, but with a detailed analysis of the facts, you can find out the truth. Scammers work illegitimately, and they don't have an incorporation certificate or a license. Internal documents are absent on such platforms. In addition, you should not trust companies that have received negative feedback.

Where can I check the availability and authenticity of legal documents?

Brokers officially registered in the UK are listed in the Companies House register. In addition to the certificate of incorporation, the company must have a license from the FCA or another authoritative body. The search must be performed directly on the official websites of regulators.

How can I detect fraudulent or fake brokers?

Financial scammers use various patterns of fraud. Most often, newcomers who don't have sufficient knowledge and practical experience fall into their net. They fall for promises of high profitability, the availability of professional support, and a low entry barrier. In the course of cooperation, traders face numerous technical and financial problems such as cleaning out deposits, fabricated failures in the operation of the platform, abnormal expansion of spreads, etc.

Whom can I contact in case of fraud by a broker?

If the brokerage company is legitimate and has a license, in case of violation of the agreements, it will be liable under the law. Compliance with the rules in the UK is monitored by the FCA, and the same body is engaged in resolving conflict situations. If you cooperate with an illegal broker, it is useless to contact the FCA. The regulator has no legal leverage over such companies. The only hope remains for a chargeback service.

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses who want to improve their Google search rankings to compete with their competition.

Over the past four years, Alamin has been working independently and through online employment platforms such as Upwork and Fiverr, and also contributing to some reputable blogs. His goal is to balance informative content and provide an entertaining read to his readers.

His motto is: I can dream or I can do—I choose action.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.