How to Open DEGIRO Account - TU Expert review

When choosing a broker to trade financial markets, it is important to consider how difficult it is to open an account. DEGIRO is quite popular and many novice traders consider this brokerage company. Therefore, it is important to find out how difficult it is to open an account with this broker and know in advance what kind of information you will need to provide. Traders Union experts prepared a guide on How to Open DEGIRO Account. The article explains what a trader needs to open an account and what information the broker requests traders to provide.

Short introduction of DEGIRO

DEGIRO is a Dutch investment company operating since 2008. The broker has been providing online services since 2013. Today DEGIRO is headquartered in Amsterdam and has offices in 18 European countries. Its activities are controlled by the Financial Conduct Authority (FCA, 574048), as well as regulators in the Netherlands: Financial Markets Authority (AFM, 12048408) and Central Bank (DNB, R128868). DEGIRO was awarded over 86 international awards: financial publications of Germany, France, Denmark, and the Netherlands have repeatedly recognized the company as the best stock market broker. How to open a DEGIRO account

| 💰 Account currency: | State currency of the client’s residence country |

| 🚀 Minimum deposit: | From 1 unit of the base account currency |

| ⚖️ Leverage: | Not indicated |

| 💱 Spread: | No |

| 🔧 Instruments: | Shares, ETFs, Currencies, Leveraged products, Bonds, Options, Futures |

| 💹 Margin Call / Stop Out: | No |

DEGIRO Pros and Cons

👍 DEGIRO Pros:

•Low brokerage fees for trading stock market assets;

•The ability to open transactions on European and American exchanges;

•Simple trading platform functionality.

👎 DEGIRO Cons:

•There is no online chat on the company's website.

Things to know about registering an account with a broker?

Only users who registered with a broker can trade financial markets. A trading account determines conditions (brokers may offer several account types), serves as a wallet and stores trader’s settings. It is impossible to work in financial markets without a personal account.

Brokers have different registration procedures. Some companies ask only for general information, while others request more detailed personal information that involves filling out several forms.

Basic information requested by all brokers includes the following:

-

First name and last name;

-

Date of birth;

-

Email;

-

Password (can be sent to your email);

-

Place of residence (country, city, address).

Brokers also may request additional information, such as marital status, sources of income, etc.

Is verification mandatory?

It is important that you carefully fill out all the forms and provide truthful information, because you will need to pass verification next. ID verification is an important requirement of brokers registered in reliable jurisdictions. The companies that are licensed in the U.S., the EU, Australia, etc., operate in compliance with AML/KYC.

Therefore, they require traders to provide the following:

-

Proof of Identity. It could be a national ID or a foreign passport. Some brokers also accept a driver’s ID;

-

Proof of Address. It could be utility bills, bank statements, etc.

If a trader plans to work with a reliable and trustworthy broker, he will need to pass verification. As a rule, it takes 24-48 hours.

How to Open DEGIRO Account and Review of the User Account

To start trading on the stock market through the DEGIRO broker, please:

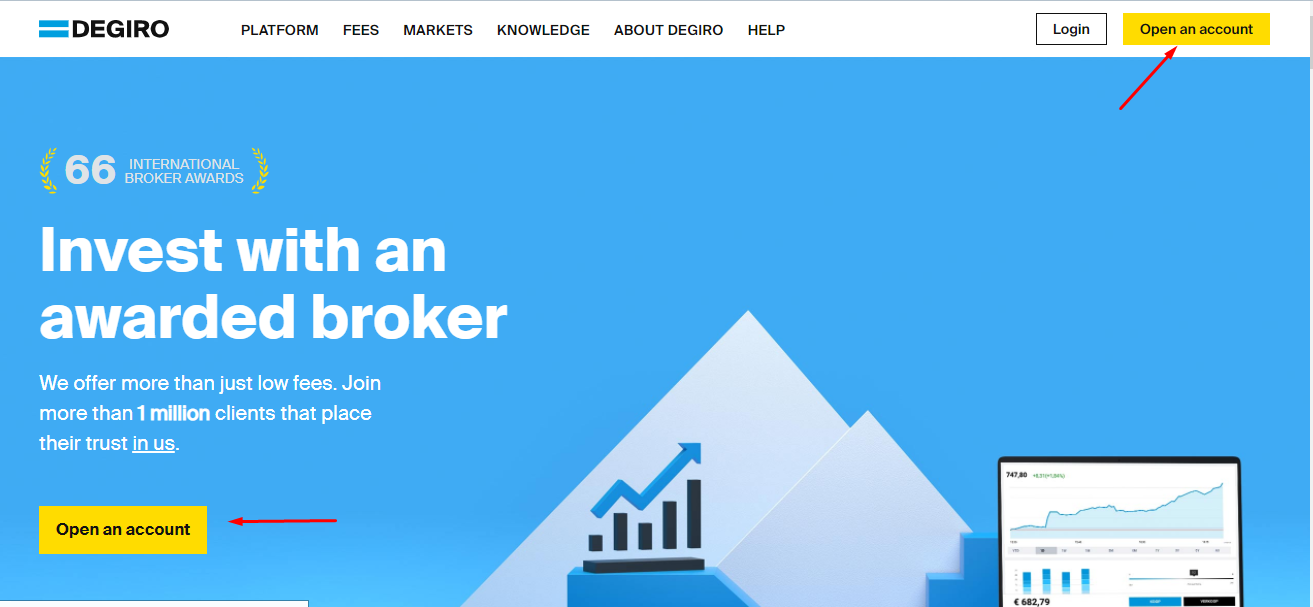

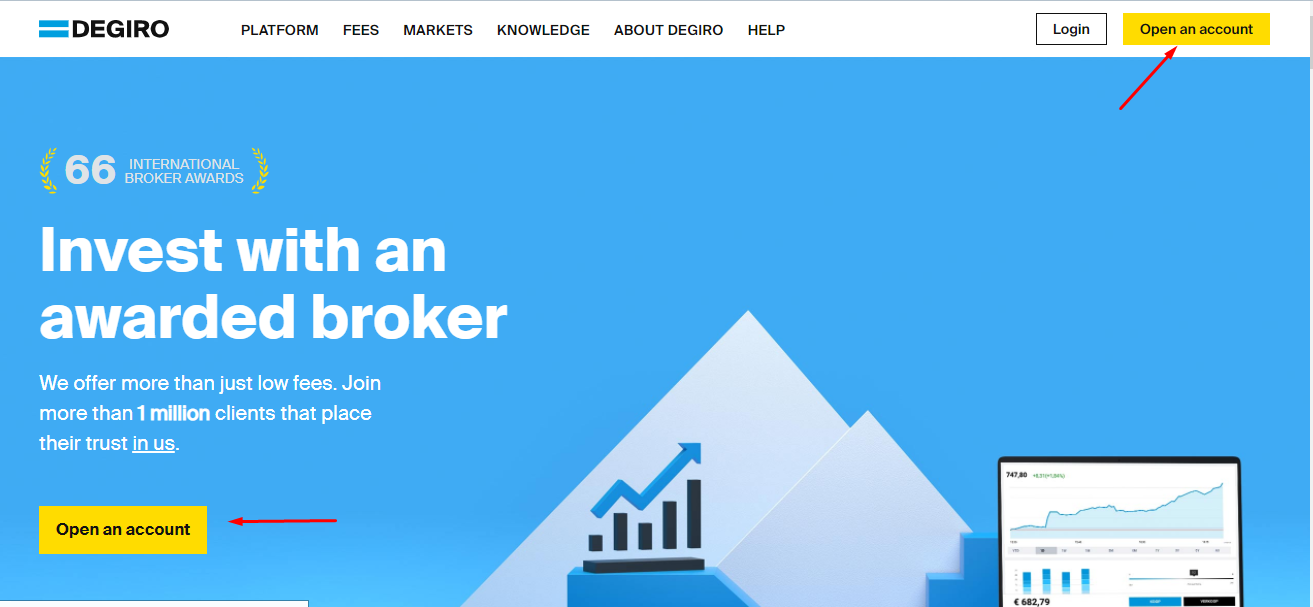

Visit the broker's website and select your country of residence. Click "Open an account” on the regional website.

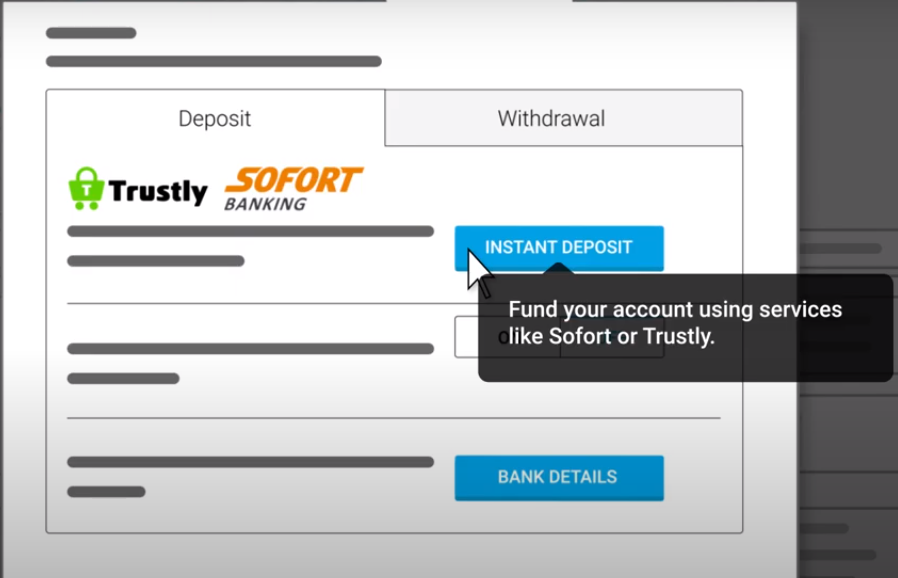

Specify a username and email address in the registration form for opening a trading account, and then come up with a password Next, confirm your email and log in to the system. Then enter your personal data according to your passport and link your active bank account to DEGIRO.

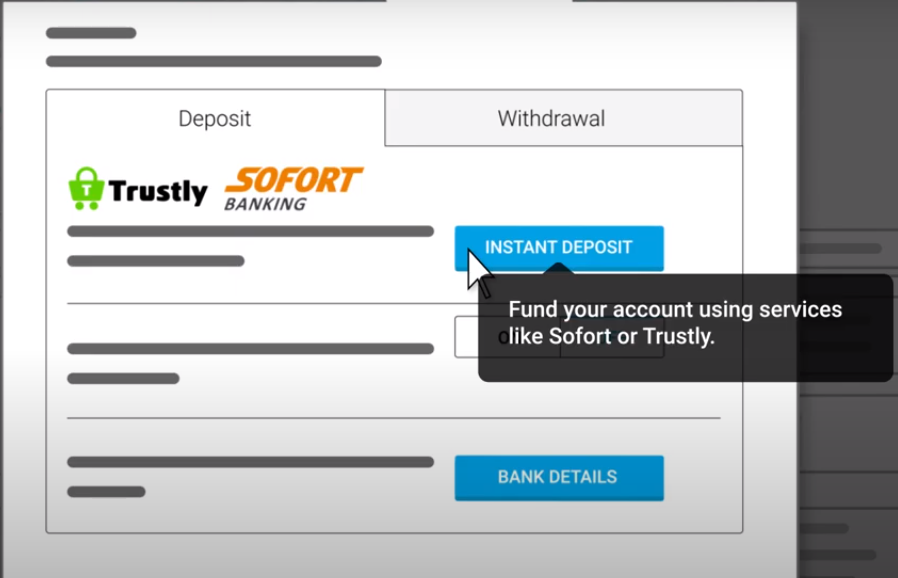

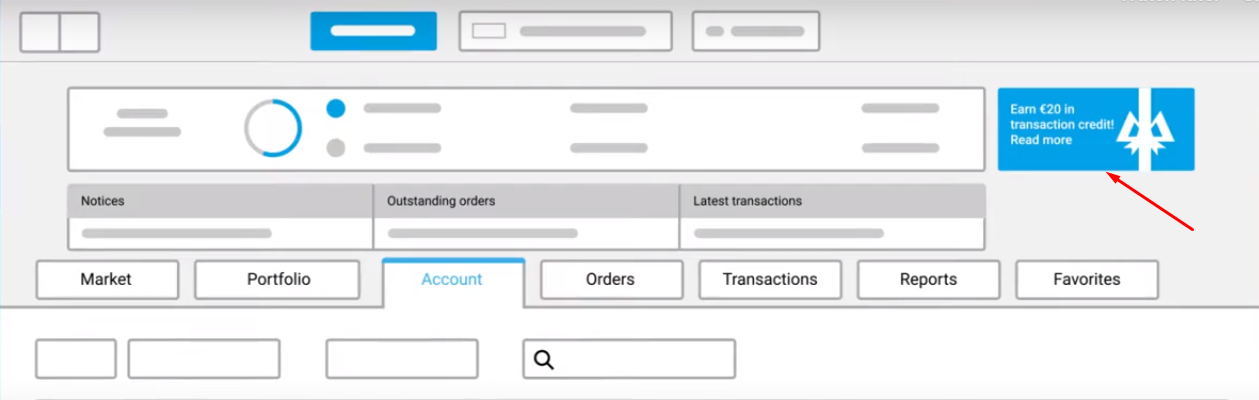

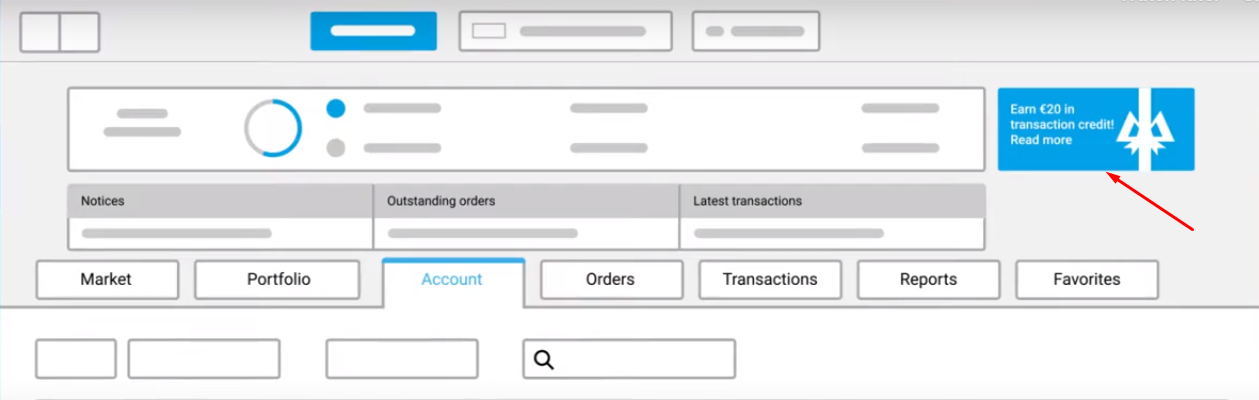

The following is available in the DEGIRO personal account:

Additional personal account functionality:

-

Transaction history.

-

Account and card management.

-

Personal data management.

-

Investment sections.

Brokers similar to DEGIRO

In order to choose the right broker, it is necessary to compare its conditions with those offered by other brokers and review the rules of different companies for opening an account. Traders Union experts prepared a comparison of trading conditions of companies and features of their trading accounts.

Comparison of DEGIRO with other Brokers

DEGIRO has a high reputation and is a trusted broker for stocks, bonds, funds, options, and ETFs. DEGIRO provides its clients access to more than four world's largest stock exchanges. Trading is carried out through a convenient platform that allows you to track the quotes of the trading instruments you are interested in real-time. Commission fees in DEGIRO are low compared to competitors. DEGIRO is a regulated broker suitable for experienced and professional traders in the Eurozone who prefer to invest in stock market assets.

eToro is an international broker for trading and investing in assets, copying trades of experienced market players and earning income on offering your own successful strategy. The activities of eToro are controlled by European financial regulators: CySEC and FCA. The broker offers its clients the opportunity to trade indices with a maximum leverage of 1:20 and ETF instruments with a leverage of 1:5. Size of leverage in eToro can also vary depending on the regulation of the division of the broker you work with.

Revolut provides its clients access to shares of international and American companies, cryptocurrencies, and metals. For investors, Revolut offers a social trading program. Revolut's copy trading platform is trendy among investors because it has a forum for traders to communicate with each other in real-time. Also, various charts and indicators are available in the Revolut trading platform for technical analysis. Revolut is a company actively developing and plans to make all of its services available to foreign citizens. Fractional share trading offered by the broker allows beginners to learn trading without high financial risks.

eOption is regulated by the following financial institutions: FINRA and SIPC. The next trading instruments are available to the clients of the company: stocks, options, ETFs, bonds, as well as fixed-income instruments. eOption fees are lower than those of competitors. In addition, a section with professional analytics is available on the official website of the broker. The eOption broker is a regulated broker focused on active US traders who prefer to trade options.

Robinhood markets is focused on working with traders from America but does not provide opportunities for active trading in currency pairs.

The conditions of the TradeStation broker are suitable for experienced traders and investors who make large trades in the US stock market.

Conclusion

Opening a trading account is something every trader goes through. This is why it is important to know how it works and what kind of information needs to be provided. In this article, traders were given an opportunity to learn about conditions and rules for opening a trading account with DEGIRO, and also compare broker’s conditions with competitors. This information is important to have when you are choosing a company to trade financial markets with.

FAQs

Could a broker refuse to register an account?

Theoretically, it is possible for a broker to refuse registration. You will need to contact the support service to find out the reason.

How long does it take for an account to get verified?

It depends on the broker. On average, verification takes 24-48 hours.

Can I learn how the broker protects data?

Yes. Every broker must have a document titled Privacy Policy. Make sure you read it before you start registering an account.

How do I verify my account?

A trader uploads images, scanned copies or screenshots of his documents. As a rule, brokers accept .jpg or .pdf formats.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.