Moneyfarm Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- £500

- Moneyfarm mobile app

- No

- Automated rebalancing

- Fractional shares

- Low fees

- Globally diversified funds.

Our Evaluation of Moneyfarm

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Moneyfarm is a high-risk broker with the TU Overall Score of 2.52 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Moneyfarm clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Moneyfarm is a suitable broker for European investors seeking simple and reliable investment management.

Brief Look at Moneyfarm

Moneyfarm, founded in 2011, is an investment platform with offices in London, Milan, and Cagliari. It offers investment management and financial services through its website and a mobile app. Moneyfarm specializes in personalized investment plans that combine global index funds with active management.

Investments at Moneyfarm are managed by MFM Investment Ltd, regulated by the Financial Conduct Authority (FCA) in the UK.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Personalized investment portfolios;

- Low fees and transparent conditions;

- Reliable regulation and licensing;

- User-friendly mobile apps and online services;

- Focus on long-term investments.

- Limited accessibility for non-European investors;

- Focus on passive investment strategies.

TU Expert Advice

Author, Financial Expert at Traders Union

Moneyfarm provides investment services through a user-friendly mobile app and online platform. The company offers Stocks and Shares ISA, Junior ISA, Pension, and General Investment accounts. Key trading advantages include automated rebalancing, fractional shares, and globally diversified funds. Moneyfarm emphasizes low fees, a transparent fee structure, and seamless portfolio management, making it an attractive option for passive investors looking for long-term growth.

However, Moneyfarm's focus on passive investment strategies may not meet the needs of active traders seeking comprehensive trading tools or those looking for a diverse range of trading assets. Its services are predominantly tailored for European investors, which could be a drawback for others. Overall, Moneyfarm is suitable for passive investors prioritizing low fees, automated investing, and regulatory safety.

Moneyfarm Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Moneyfarm mobile app |

|---|---|

| 📊 Accounts: | Stocks and Shares ISA, Junior ISA, Pension, and General Investment Account (GIA) |

| 💰 Account currency: | GBP and EUR |

| 💵 Deposit / Withdrawal: | Bank transfers and bank cards |

| 🚀 Minimum deposit: | £500 |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | Management fees range from 0.35% to 0.75% based on the investment amount |

| 🔧 Instruments: | Globally diversified stock and bond portfolios |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Automated rebalancing |

| ⭐ Trading features: |

Automated rebalancing; Fractional shares; Low fees; Globally diversified funds. |

| 🎁 Contests and bonuses: | No |

Moneyfarm is focused on providing a simplified investment experience for passive investors. Management fees depend on the amount of assets under management, with no additional transaction or withdrawal fees. Note that for UK residents, tax benefits depend on individual circumstances and may change in the future.

Moneyfarm Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

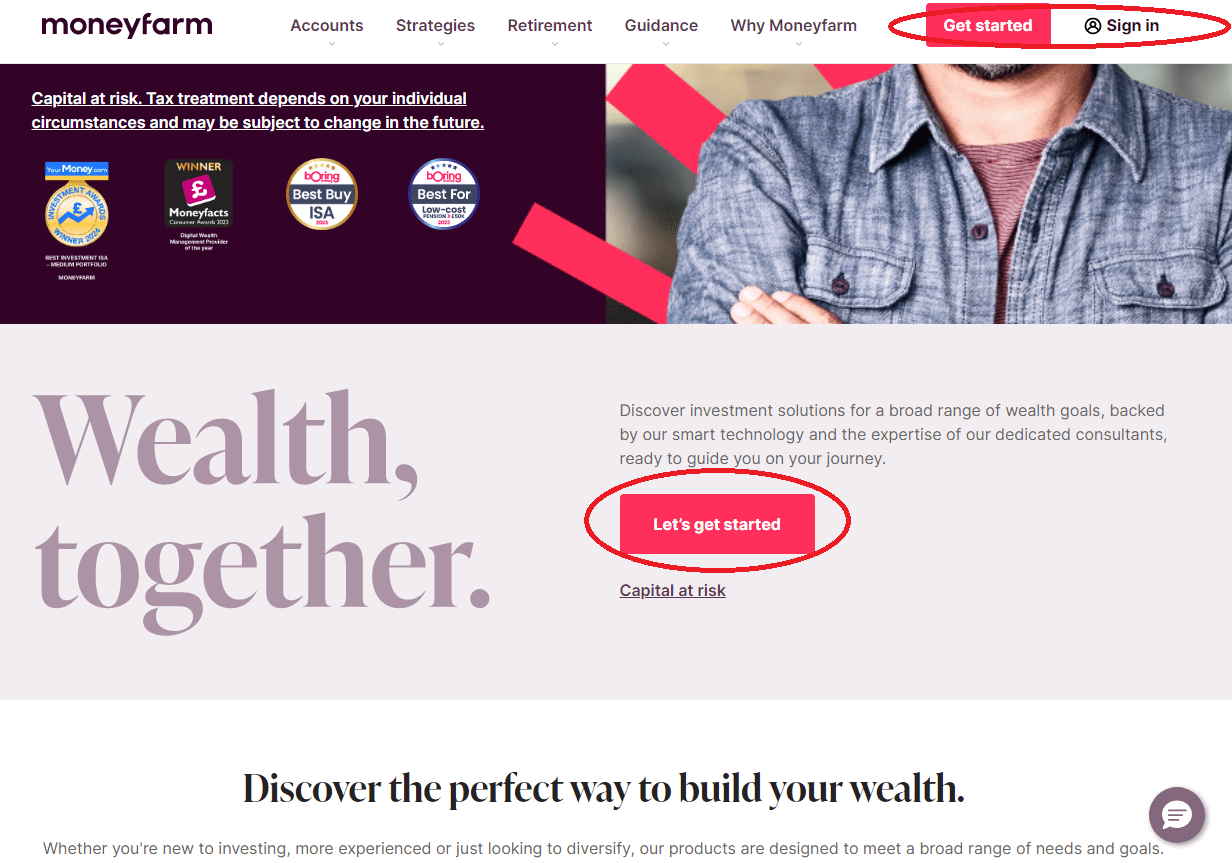

Trading Account Opening

To start investing with Moneyfarm, create a user account by following the instructions below.

Go to the Moneyfarm website or download its mobile app from Apple Store or Google Play Market.

Go to the registration page and follow the instructions to create a user account. Provide your personal information and complete a short risk tolerance questionnaire.

Verify your identity by providing the required documents.

Provide your bank details to enable seamless deposits and withdrawals.

Additional features of Moneyfarm’s user account allow traders to:

-

Set up and manage investment plans;

-

Make deposits and withdrawals;

-

View financial statistics and reports;

-

Contact technical support.

Regulation and safety

Moneyfarm ensures the safety of investor funds through regulation and protection provided by FCA and the Financial Services Compensation Scheme (FSCS) in the UK. FSCS offers compensation of up to £85,000 per investor in case of the broker's insolvency, which guarantees a high level of protection for its clients.

Advantages

- FCA regulation

- FSCS funds protection

- Transparent fee structure

Disadvantages

- Limited investment options

- Focus on European investors

Commissions and fees

-

Management fees: Investments up to £10,000 incur fees of 0.75% of the amount, from £10,000 to £50,000 — 0.70%, from £50,000 to £65,000 — 0.65%, and a 0.70% fee applies to amounts over £100,000.

-

Other fees: Total Expense Ratio (TER) includes all annual costs associated with owning the investment fund and ranges from 0.21% to 0.31%. It is automatically deducted from the fund's returns.

Moneyfarm also offers a flexible ISA that allows investors to withdraw and deposit money during the tax year without losing tax benefits.

Conclusion. Moneyfarm offers a transparent and competitive fee structure for passive investors. With management fees ranging from 0.60% to 0.75%, Moneyfarm is a great option for those seeking automated investment management without hidden transaction or withdrawal fees. Features like fractional shares and automated rebalancing make it a perfect fit for long-term investors.

| Broker | Average commission | Level |

|---|---|---|

|

$0.6 | |

|

$2 |

Account types

Moneyfarm offers a simplified investment platform, focused on passive investments through globally diversified portfolios.

Account types:

Steps to start investing with Moneyfarm:

-

Download the Moneyfarm mobile app from App Store or Google Play Market.

-

Register and create a user account by following the on-screen instructions. Provide personal information and complete a short risk tolerance questionnaire.

-

Choose the investment plan based on the risk profile and financial goals.

-

Set up automated monthly contributions by choosing the investment amount.

-

Monitor investments and make portfolio adjustments. Automated portfolio rebalancing is available.

Deposit and withdrawal

-

Moneyfarm offers two withdrawal methods: bank transfers (Wire Transfer) and bank cards. E-wallets are not supported.

-

Withdrawal fees do not apply.

-

Withdrawal requests are processed quickly, however the website does not provide exact processing times.

Investment Options

Moneyfarm is designed for investors seeking long-term growth and simple asset management. The platform offers a variety of investment solutions that make investing accessible and convenient.

Automated investment plans

-

Personalized investment portfolios. Moneyfarm offers seven various portfolios each customized for different risk levels, ranging from conservative to aggressive. These portfolios include stocks, bonds, and other assets distributed globally.

-

Low fees. Moneyfarm charges fees ranging from 0.35% to 0.75%, depending on the investment amount. These fees apply to both management and advisory services.

-

Automated rebalancing. Moneyfarm regularly adjusts user portfolios to ensure they align with investment goals and risk profiles.

-

Fractional shares. These allow users to invest any amount, maximizing their investment potential.

Personalized investment portfolios

-

P1. Designed for investors seeking minimal risks and stable returns, this less risky portfolio primarily consists of bonds and focuses on capital preservation with minimal fluctuations.

-

P2. This portfolio combines bonds and low-risk assets, offering a higher potential return compared to P1.

-

P3. It includes more stocks than P2 and is designed for investors with a low risk tolerance. It maintains a focus on stability but offers higher potential returns.

-

P4. It is a balanced portfolio with an equal allocation between stocks and bonds, suitable for investors with a moderate risk tolerance, offering a balanced approach to risk and returns.

-

P5. This portfolio offers more stocks, making it more susceptible to market fluctuations with potentially higher returns. It is suitable for investors ready for moderate risks.

-

P6. With a primary focus on stocks, this portfolio is designed for investors with a high risk tolerance, offering high potential returns.

-

P7. This is a high-risk portfolio, primarily composed of stocks. It is designed for investors accepting significant market fluctuations for the highest possible returns.

All portfolios are managed using strategic and tactical asset allocation, helping investors optimize their returns and manage risk.

Trader comfort

Moneyfarm offers an easy and convenient way to manage investments, providing continuous portfolio monitoring and allowing investors to focus on their long-term goals.

Customer support

Moneyfarm provides several communication channels to contact technical support.

Advantages

- Availability of phone and email support

- Comprehensive FAQ section

Disadvantages

- No live chat on the website

Available communication channels:

-

Email;

-

Phone;

-

FAQs.

Contacts

| Registration address | 90-92 Pentonville Road, London N1 9HS, United Kingdom |

|---|---|

| Regulation |

FCA

Licence number: 629539 |

| Official site | https://www.moneyfarm.com/ |

| Contacts |

0800 433 4574

|

Education

The Moneyfarm website and mobile app feature diverse educational resources to help its clients understand and optimize their investment strategies.

Available educational resources:

-

Educational blog features insightful articles on diversification, passive investing, and tips for novice investors.

-

Tutorials on investments describe the investment process at Moneyfarm, including automated rebalancing, fractional shares, and fee structure.

-

Support and FAQs help investors with any issues.

Detailed review of Moneyfarm

Moneyfarm offers a simplified platform for passive investors, prioritizing user-friendliness, low fees, and automated investment management to access globally diversified index fund portfolios.

Key features of Moneyfarm:

-

Investment options. Moneyfarm specializes in globally diversified portfolios composed of stocks, bonds, and other assets. The platform does not offer trading options, cryptocurrencies, or metals.

-

Security and regulation. Investments are managed by FCA-regulated MFM Investment Ltd, which ensures client funds protection.

-

User experience. Moneyfarm is designed with user convenience in mind, offering both a mobile app and a web platform to simplify the investment process. Its clients can set up automated monthly investment plans and take advantage of features like automated rebalancing and fractional shares.

Competitive advantages are:

-

User-friendly mobile app and web platform.

-

Automated investment plans, offering continuous growth without active management.

-

Transparent fee structure with tiered rates that decrease as the investment amount grows.

-

No additional transaction or withdrawal fees.

Useful services offered by Moneyfarm:

-

Pension Calculator. This tool helps users estimate their future pension savings.

-

Portfolio Selection. Moneyfarm selects suitable portfolios based on trader risk profile and investment goals.

-

Broker Comparison. It helps traders choose the best brokers for trading ETFs based on fees and available options.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i