Myinvestor Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1

- Myinvestor

- Inversis

- No

- No minimum fee per order

- Derivatives trading is not available.

Our Evaluation of Myinvestor

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Myinvestor is a high-risk broker with the TU Overall Score of 2.78 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Myinvestor clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Myinvestor combines features of a neo bank and a stockbroker, which allows its clients to use a unified platform for investing and working with banking products (deposits, loans, and savings accounts, and retirement plans).

Brief Look at Myinvestor

Myinvestor is a Spanish digital bank, broker, and lending organization. Its trading platforms allow users to invest in a wide range of securities in both national and international financial markets. Its clients can trade stocks of over 100 Spanish companies, 17 countries of Europe and the U.S., as well as ETFs on 23 international exchanges. MyInvestor Banco, S.A., the owner of Myinvestor, was incorporated in 2017. The brokerage division has been operating since 2022. Its activities are regulated by Banco de España (the Spanish National Central Bank) and the National Securities Market Commission (CNMV). Client investments are protected by the Spanish state Deposit Guarantee Fund (FGD) with up to €100,000 coverage per client.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- 7,300+ financial instruments;

- Investments in stocks and ETFs listed on exchanges outside Spain;

- Wide choice of investment solutions with a low initial threshold;

- State regulation of activities and client investment protection;

- Unified fee for trading on Spanish and international exchanges;

- Trading and fund management are conducted from any device;

- Brokerage, banking, insurance, and lending products are available in one mobile app.

- High conversion fees for trading outside Spain;

- Options and futures trading is not available;

- No physical offices.

TU Expert Advice

Financial expert and analyst at Traders Union

Originally founded as a credit and retirement services provider, Myinvestor has significantly expanded its offerings. Since 2020, it has included index fund investments, and as of 2022, it has become a fully-fledged securities broker. In addition to proprietary mobile and web platforms, it offers access to the Inversis platform. Investments in funds do not require minimum amounts, while there are limites for other financial instruments, although the conditions can be met even by novice investors.

Myinvestor strives to make investing accessible for everyone, including minors and those interested in retirement planning. The company is focused on providing services to stock traders and investors in various funds, therefore it does not provide access to the derivatives market.

The website blog contains information for novice investors. Moreover, Myinvestor clients can send investment-related questions to a dedicated email, answers to which are generated in a single article in the blog. Therefore, traders gain access to answers to popular questions on numerous investment products from real people.

Myinvestor Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Myinvestor and Inversis |

|---|---|

| 📊 Accounts: | Cash and securities accounts: Cuenta remunerada 2,5% TAE, Cuenta remunerada 2,5% TAE Junior, and Roboadvisor Cuenta |

| 💰 Account currency: | EUR |

| 💵 Deposit / Withdrawal: | Bank transfers, SEPA, Google Pay, and bank cards |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 1 share, 1 ETF unit, and €1 for investment funds |

| 💱 EUR/USD spread: | Exchange |

| 🔧 Instruments: | Stocks, ETFs, ETCs, ETNs, investments and index funds, and alternative investments (crowdfunding, venture capital, etc.) |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | MyInvestor Banco, S.A., AXA Spain, Andbank, etc. |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Exchange |

| ⭐ Trading features: |

No minimum fee per order; Derivatives trading is not available. |

| 🎁 Contests and bonuses: | No |

Myinvestor offers investing in over 100 Spanish stocks, more than 4,000 U.S. stocks, 2,000 EU stocks, and over 1,300 ETFs, ETNs, and ETCs. To limit losses, traders can use stop-loss orders, however, they are only available when trading on certain exchanges like Bolsa de Madrid, Nasdaq, Xetra, and NYSE. Both limit and market orders expire four weeks after they are opened.

Myinvestor Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

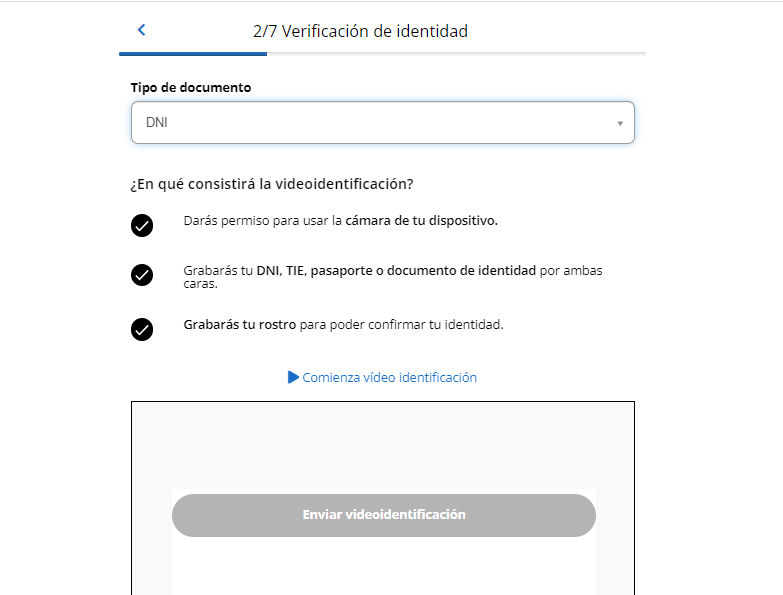

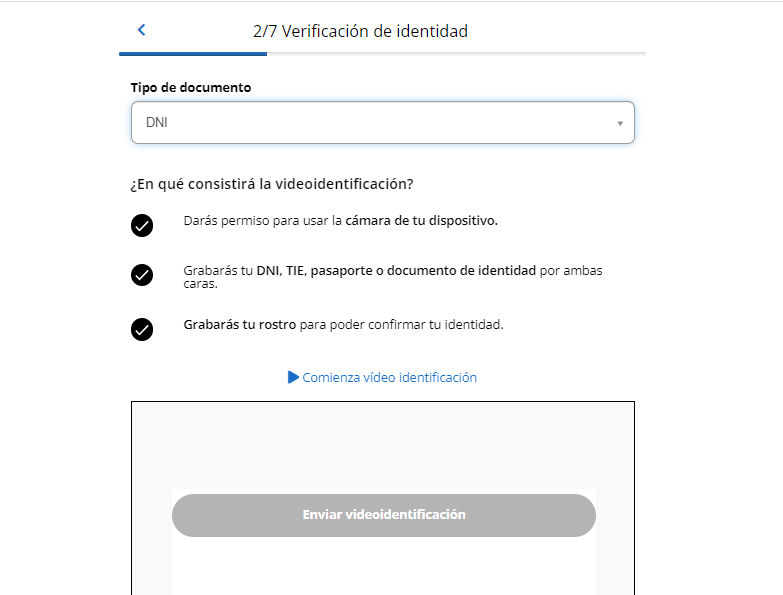

Trading Account Opening

Myinvestor’s user account is designed for its clients. Its features allow traders to manage their portfolios, quickly transfer funds, and adjust their positions.

To sign into the user account, enter your login and password or register on the website or in the mobile app.

To create the user account, click the “Hazte cliente” button on the website and choose the Un titular account that implies one account holder.

Provide your email, phone number, and IBAN for the existing account with a European bank. To pass video identification, use a mobile device with a camera and a reliable internet connection. To pass verification, provide your passport, DNI (the National Identity Document), TIE (the Foreigner's Identity Card), or NIE (the Foreigner’s Identification Number) with an attached photo.

Activation of the user account may take from 48 hours to one month, depending on the client. Once the account is opened, the broker notifies you of that by email and sends you an SMS with an 8-digit code for secure access to mobile apps and a web platform.

Regulation and safety

Myinvestor mobile apps are managed by MyInvestor Banco, S.A., overseen by Banco de España and registered with CNMV under number 1544. Both authorities are responsible for ensuring the stability and integrity of the country's financial markets through ongoing oversight and monitoring.

MyInvestor Banco, S.A. is a member of FGD, a deposit guarantee scheme funded by various banks, including the Spanish Central Bank. FGD provides coverage up to €100,000 per client, thus ensuring the state protection for Myinvestor client investments.

Advantages

- Reliable regulation

- Client funds are protected with a compensation scheme

- Legal operations in Spain

Disadvantages

- Cryptocurrency settlements are not supported

- Closed-end funds are not available for retail clients

- Long processing times for claims and complaints

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Securities accounts | 0.12% of the position size + 0.30% conversion fee | SEPA transfers are free |

The broker does not charge account maintenance, inactivity, depositary, securities custody fees, or fees for transferring securities outside Myinvestor. Dividend withdrawals are also fee-free.

When buying or selling U.S. stocks for $1,000, traders pay a total of $4.2, including a $3 conversion fee. Below is the fee comparison for Myinvestor and two other brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$4.2 | |

|

$2 |

Account types

Since the Myinvestor mobile app requires a video identification to simply verify your identity, the company recommends opening accounts from your smartphone. Once you fill in the registration form, you get two account types — cash and securities. A current cash account is used for holding funds. Myinvestor offers various account types, including joint and minor accounts.

Account types:

While Myinvestor does not offer demo accounts, its user account is created free of charge, allowing traders to become the broker’s clients without funding their accounts to explore its mobile and browser platforms.

Myinvestor clients can combine trading stocks and ETFs with investing in asset portfolios and funds within one mobile app. This ensures comfort and simplified monitoring of the overall performance.

Deposit and withdrawal

-

Following the withdrawal request, funds are transferred from a trading account to a cash account. Further, clients can transfer their money to a third party’s account both in Spain and within the SEPA system. The maximum amount is €50,000 per one transfer. Transfers outside SEPA are made by phone.

-

To receive the money the same day, submit a request by 12:00 GMT+2. For withdrawals requested in the afternoon, on weekends, or holidays, the money is credited the next business day.

-

Funds from a cash account can be transferred to a bank card. A free withdrawal from any ATM worldwide is available once a month. Holders of investment portfolios exceeding €3,000, can use the free ATM withdrawal service four times a month.

Investment Options

Myinvestor allows its clients to invest their funds in diverse investment funds and portfolios. The company also offers alternative investments such as crowdfunding and venture capital for startups.

Investment offers from Myinvestor

For passive income in financial markets, Myinvestor clients can invest in the following instruments:

-

Funds. Users can invest in over 1,700 funds of five types: fixed income, variable income, mixed, global, and thematic. The risk level ranges from 1 to 7. Funds like Fidelity, Vanguard, iShares Amundi, Invesco, JP Morgan AM, etc. do not have minimum investment requirements and allow traders to withdraw their funds at any time. Fees vary by fund.

-

Roboadvisor. It implies investing in portfolios consisting of several index funds. They are chosen based on returns and risk criteria. There are 5 portfolio types, Classic, Pop, Indie, Rock, and Heavy Metal, with different risk levels that depend on the ratio of fixed and variable profitability instruments in the portfolio. The portfolio is selected based on results of an online test. The minimum investment is €150 and the annual management fee is 0.42%-0.45% of the portfolio amount.

-

Finanbest hybrid wallets. These wallets include index and actively managed funds, and support 6 risk profiles. The depositary fee is 0.15% and management fees are 0.13%-0.37% depending on the portfolio value. The minimum investment is €150. Automated deposits over €150 can be set up.

Also, for new accounts, Myinvestor automatically accrues 2.5% per annum on funds not used for investing and ensures dividend tax benefits. For example, the tax for U.S. stocks is 15%, instead of 30%. Moreover, the broker offers savings accounts with a 3.6% projected annual return. For example, with an initial investment of €150 and monthly deposits of €20, the portfolio is projected to reach a minimum of €3,899 or maximum of €4,969 in 15 years.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Myinvestor:

-

Amigo. It is a referral program for existing clients. To get rewards, share your unique code with a friend and fulfill one of three requirements: deposit a minimum of €1,000 in cash, invest from €100, or open a deposit. Referrals are also required to fulfill the above conditions.

Once all program conditions are fulfilled, both referral and referrer receive €20 (€16,2 after tax deduction). Any number of referrals are allowed, but only the first 20 generate rewards for their referrers. Yet, all new referrals receive €20 rewards.

Customer support

Technical support is available 24/7 through the Myinvestor app. Call center operates from 08:00 to 21:00 (GMT+2) Monday through Friday and from 10:00 to 19:00 (GMT+2) on Saturday and Sunday. Communication is provided in Spanish.

Advantages

- 24/7 availability

- Live chat on the website and in the app

Disadvantages

- Chatbot often responses to requests

- No callback option

Available communication channels include:

-

Call center for domestic and international calls;

-

Live chat;

-

Email;

-

Facebook.

Holders of portfolios exceeding €30,000 have access to the instant live chat through mobile apps, available from 09:00 to 20:00 on weekdays.

Contacts

| Registration address | Paseo de la Castellana, 55 3 Planta Madrid, 28046 Spain |

|---|---|

| Regulation | CNMV, Banco de España |

| Official site | https://www.myinvestor.es |

| Contacts |

Education

The Myinvestor website contains a section with basic information on all available instruments. Information for novice investors is provided in Myblog in the footer of the website. The most useful block for novice traders is Escuela MyInvestor.

Myinvestor experts and invited speakers regularly hold webinars for novice investors. Each online session lasts one hour, where participants can ask questions and get simple answers.

Detailed review of Myinvestor

Myinvestor platforms provide access to a diverse range of Spanish stocks, ETFs, ETNs, and ETCs. Additionally, its clients can invest in U.S. and EU stocks. Myinvestor offers flexible trading options, including limit and market orders, as well as loans for security purchases. To mitigate portfolio risks, clients can use various investment strategies and styles.

Myinvestor by the numbers:

-

In 2023, the broker’s trading volume exceeded €3 billion;

-

Over 170,000 registered clients;

-

1,700+ investment funds and 7,000 securities are available;

-

CET1 (the Common Equity Tier 1) exceeds 19.5%.

Myinvestor is a broker for a wide range of investors in Spain and abroad

Any Spanish citizen can open a securities account with Myinvestor, including accounts for their minor children. Non-Spanish citizens can also open this account type provided they hold an operational account with a Spanish bank. Moreover, Myinvestor allows all Spanish citizens residing in other EU countries to invest through its platform.

The company offers two types of loans for buying securities: Flexible and Límite x2. Flexible loans allow investors to use any part of the loan over €3,000. The amount used as a collateral is blocked. The Límite x2 loans provide twice the usual broker funding, but they require investing the entire amount immediately. Both the collateral and the invested amount are blocked. A minimum of €5,000 is required as collateral.

Useful services offered by Myinvestor:

-

Exclusive content for investors with portfolios exceeding €30,000. It includes various ratings, analyses, and investment ideas from international resources, as well as market, economic, and political reviews and Financial Times articles in Spanish.

-

Blog. It features information for novice investors, news, useful videos, tips, and recommendations. Articles for more experienced traders are provided in the blog’s expert level.

-

Deposit range. Alongside investing, Myinvestor clients can open a fixed-term deposit for 3-12 months earning 3%-4% annually. The minimum deposit is €10,000.

Advantages:

The broker operates remotely, allowing its clients to trade and resolve all issues online;

Comprehensive informational assistance for novice investors;

Wide choice of investment funds and pre-built diversified portfolios;

Lending programs allow traders to increase their capital used for asset trading;

Access to alternative instruments for experienced investors.

As a neobank, Myinvestor offers a comprehensive range of financial services, including lending, insurance, bank card issuance, and a diverse choice of investment products.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i