According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1

- Web platform

- Mobile Apps

- No

- Access to trading underlying assets and derivatives

- Investments with zero trading fees.

Our Evaluation of Scalable Capital

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Scalable Capital is a high-risk broker with the TU Overall Score of 2.38 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Scalable Capital clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Scalable Capital offers competitive trading conditions, featuring low fees and access to liquid markets. While experienced investors seeking flexibility and a diverse selection of investment products benefit from market analysis and risk management tools, high-quality educational resources and the ability to start with €1 make Scalable Capital accessible to novice traders.

Brief Look at Scalable Capital

Scalable Capital is a leading European investment company providing brokerage and digital capital management services to businesses and retail investors. Founded in 2014 and regulated by BaFin (the German Federal Financial Supervisory Authority), it has offices in Munich, Berlin, and London. Scalable Capital combines traditional investment services with cutting-edge technology and machine learning, offering access to the European Investor Exchange (the Hanover Stock Exchange), gettex (the Munich Stock Exchange), and Xetra (the Frankfurt Stock Exchange operated by Deutsche Börse). Its services are available to residents of Germany, metropolitan France, Austria, Italy, Spain, and the Netherlands.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- BaFin regulation;

- Wide range of trading instruments;

- Savings plans from €1 with potential zero trading fees;

- Transparent fee structure with no hidden charges;

- Convenient investment management via a mobile application;

- Digital capital management through a robo-advisor;

- Participation in annual shareholder meetings via the platform.

- Exclusive access to German stock exchanges;

- No choice of account currencies;

- Wealth service available only in Austria and Germany.

TU Expert Advice

Financial expert and analyst at Traders Union

Scalable Capital offers integrated investment solutions tailored to diverse client needs and preferences. Investors can use the company for securities trading, asset management, or savings account services.

Scalable Capital also provides a variety of educational resources, including articles on financial instruments like stocks and bonds, and explanations of stock market concepts. A financial glossary is available on the website to simplify complex terminology for novice investors. The company further organizes educational programs and webinars focused on ETF investing and releases the Asset Class podcast, which covers stock market topics and long-term investment strategies.

For experienced investors, Scalable Capital offers an independent trading platform with access to stocks, ETFs, cryptocurrencies, and derivatives, enabling the creation of personalized portfolios based on individual strategies and objectives. For those favoring professional asset management, the company provides digital wealth management services, including automated investing through low-cost ETFs.

Scalable Capital Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Web platform and mobile apps |

|---|---|

| 📊 Accounts: | FREE and PRIME+ |

| 💰 Account currency: | EUR |

| 💵 Deposit / Withdrawal: | Bank transfers |

| 🚀 Minimum deposit: | €1 |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No requirements, but a minimum fee of €0.99 per trade applies |

| 💱 EUR/USD spread: | Vary by account (for example, €0.99 per trade for the FREE account) |

| 🔧 Instruments: | Stocks, ETFs, bonds, commodities, cryptocurrency ETFs and ETPs, investment funds, derivatives, Forex, and private equity |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Exchange |

| ⭐ Trading features: |

Access to trading underlying assets and derivatives; Investments with zero trading fees. |

| 🎁 Contests and bonuses: | No |

Scalable Capital provides access to independent investing in a wide range of financial instruments, both underlying assets and derivatives. Trading is conducted exclusively online and phone orders are not accepted. Intraday trading is permitted. Spot cryptocurrencies are not available but are traded through exchange-traded products (ETPs), enabling investment in Bitcoin, Ethereum, and other coins without the need for a separate cryptocurrency wallet.

Scalable Capital Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To access the user account on the Scalable Capital website, register with the broker and open an account following the instructions below:

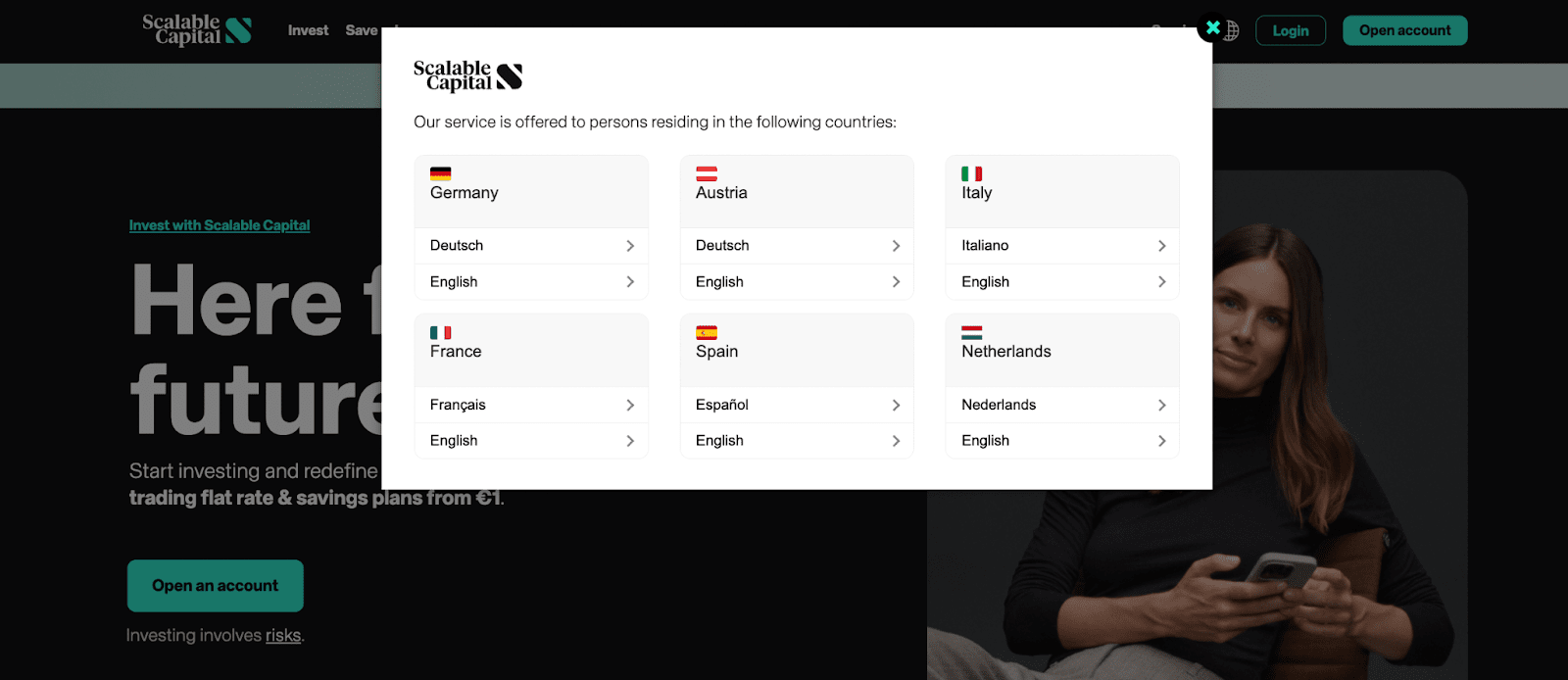

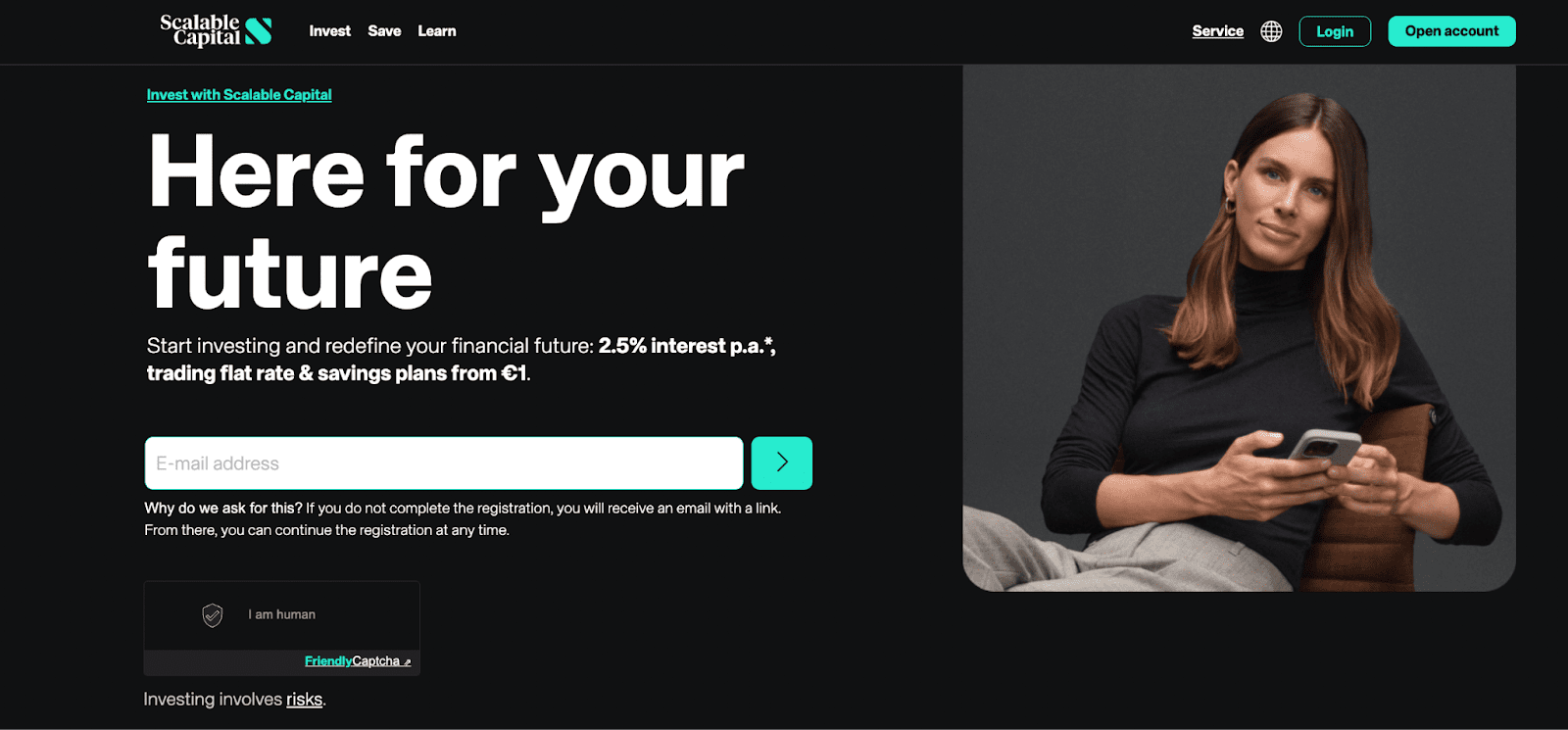

Go to the Scalable Capital website. Select your country and preferred interface language.

Click ‘Open account’. Enter your email address and confirm that you are a human.

Once your email is confirmed, follow the onscreen instructions.

Traders can access their user account upon providing their personal information and subsequent verification with required documents.

Regulation and safety

Scalable Capital has been providing brokerage services under a BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht/the German Federal Financial Supervisory Authority) license since 2015, adhering to stringent EU financial service provision standards.

In the event of bankruptcy of Scalable Capital or its partner banks, client funds are protected up to €100,000, while securities are protected without limitation.

Advantages

- Compliance with stringent EU financial service provision standards

- Client funds protection

- Client funds are held in segregated accounts

Disadvantages

- Limited funds protection up to €100,000

- Regional restrictions apply to brokerage or particular services

- Payment methods are limited to bank transfers

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| FREE | €0.99 | Bank fees may apply |

| PRIME+ | €0 | Bank fees may apply |

Cryptocurrency trading incurs a minimum fee of 0.69%, depending on the trade.

The table below compares average fees of Scalable Capital with those of other brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$0.6 | |

|

$2 |

Account types

Scalable Capital offers two account types: FREE and PRIME+. Demo accounts are not available.

Deposit and withdrawal

-

Traders can request fund transfers from their investment accounts into dedicated bank accounts through their Scalable Capital’s user account.

-

Withdrawals are exclusively processed to accounts held in a client’s name. Transfers to third-party accounts or corporate entities are not supported.

Investment Options

Scalable Capital offers the following investment options:

-

ETF savings plan. It enables investing small amounts starting from €1 in selected ETFs on a regular basis. The plan automatically purchases ETF shares, regardless of the current price, ensuring gradual capital accumulation. Investment continues until the owner changes or cancels the plan.

-

Interest on cash balances. This option provides an opportunity to earn 2.5% per annum (variable rate) on cash balances up to €500,000 in the PRIME+ account and up to €50,000 in the FREE account. This interest is paid through partner banks and qualified money market funds.

-

Wealth. This is a robo-advisor providing automated investment management services with a minimum monthly contribution of €20. Users can choose from various investment strategies, including globally diversified portfolios and specific approaches. Scalable Capital creates and manages the portfolio using low-cost ETFs, ensures regular monitoring, and automatically adapts to the market situation. This service is exclusively available to clients in Germany and Austria.

-

Staking. This option offers passive income on cryptocurrencies. Participants earn 3% to 5% per annum for holding assets after purchase. 17 cryptocurrencies are available. The minimum participation amount is €1.

Partnership program from Scalable Capital

Scalable Capital offers a referral program with bonuses for inviting new clients. For each referred friend, traders receive up to €50 for capital management services and up to €25 for brokerage services.

Conditions of the program:

-

Partners receive the bonus after their referrals successfully open a brokerage account using their link and execute one or more trades (individual orders or investment plans) totaling at least €250.

-

Referred clients must maintain a positive cash balance in their accounts for six months after registration.

-

Partners can share their referral link via email, SMS, WhatsApp, or other messaging applications.

In the event of attempted program manipulation, including link distribution on public or private resources without recipient consent, the broker reserves the right to withhold bonuses.

Customer support

Scalable Capital provides client support via multiple communication channels in English, German, French, and other languages. Support is available Monday through Friday, from 09:00 to 19:00 (GMT+2).

Advantages

- Multilingual support

- Contact details are available for each representative office

Disadvantages

- No support for alternative communication channels

Available communication channels:

-

Email;

-

Phone;

-

Live chat;

-

Munich office.

Contacts

| Registration address | Seitzstr. 8e, 80538 Munich, Germany |

|---|---|

| Regulation |

BaFin

Licence number: BaFin-ID 10141823 |

| Official site | https://de.scalable.capital/en |

| Contacts |

+49 (0) 89 / 38038067 (Germany), +49 (0)89 / 215292790 (France)

|

Education

To help its clients improve their financial literacy and become successful investors, Scalable Capital offers various educational resources. Its website features articles, a glossary, and sections dedicated to the basics of finance and the stock market.

Scalable Capital offers a 30-day course with text and video materials covering both basic and advanced investment strategies.

Detailed review of Scalable Capital

Scalable Capital integrates three key areas: Broker, Wealth, and Save. The Broker provides an independent investment platform that facilitates trading stocks, ETFs, cryptocurrencies, and other financial instruments. Regular investment plans are also available with a minimum contribution of €1. The Wealth offers digital capital management services, including creation and management of diversified ETF portfolios. Traders can choose stable investment strategies that align with their financial goals. The Save enables setting up savings plans and investing from €1. Plans can be flexibly adjusted by choosing the execution date, investment frequency, and automated contribution increase.

Scalable Capital by the numbers:

-

Operations since 2014;

-

3 representative offices;

-

Asset management services exceed €20 billion;

-

Minimum investment is €1;

-

Availability of 17 cryptocurrencies, 2,700+ ETFs, 375,000+ derivatives, 3,800 funds, and 8,000+.

Scalable Capital is a broker offering margin investing and instant deposits

Scalable Capital provides the Deposits via Instant feature, enabling its clients to fund their brokerage accounts and start trading immediately. When choosing this payment method, deposits become available for trading within seconds, while the funds are debited from the bank account within 1-2 days. However, this service incurs a fee, varying by the chosen plan: for PRIME+ users, the fee is 0.69% of the deposit amount, and it is 0.99% for FREE users. The fee does not apply to deposits above €5,000.

Scalable Capital also offers margin loans for securities trading backed by the securities available in the portfolio. For clients using the PRIME+ account, the annual interest rate is 3.74%, and it is 4.74% for FREE.

Useful services offered by Scalable Capital:

-

Robo-advisor. This is an automated system designed to create and manage investment portfolios based on the financial goals and risk tolerance of individual investors.

-

Savings plans. This service offers setting up regular investments with a minimum contribution of €1, facilitating gradual capital accumulation.

-

Analytical tools. This option provides access to various analytical tools and data for making informed investment decisions.

-

Automated rebalancing. This service facilitates the regular adjustment of traders' portfolios to uphold the desired risk level and consistency with their investment goals.

Advantages:

Low trading and asset management fees;

Wide choice of ETFs and investment funds;

Streamlined online account opening;

Availability of free savings plans;

Regular investment plans with a €1 minimum contribution.

Scalable Capital also offers the ability to dynamically adjust investment contributions and automatically reinvest dividends into assets.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i