Smartbroker+ Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- no

- Mobile application

- Smartbroker+ web

- No

- Real-time trading, two-factor authentication, low commissions

Our Evaluation of Smartbroker+

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Smartbroker+ is a high-risk broker with the TU Overall Score of 2.44 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Smartbroker+ clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Smartbroker+ is an attractive option for European investors seeking a cost-efficient broker with a broad range of trading options and a user-friendly platform.

Brief Look at Smartbroker+

Smartbroker+ is a German broker offering a free deposit account and trading via web and mobile applications. The broker provides access to trading stocks, ETFs, derivatives, funds, and soon, bonds on 25 domestic and international exchanges. Key features include commission-free trades for orders over €500 on gettex, various order types, and access to over 2,000 free savings plans.

Smartbroker+ complies with the Markets in Financial Instruments Directive II (MiFID II), ensuring enhanced investor protection and market transparency. The Federal Financial Supervisory Authority of Germany (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin) oversees Smartbroker+'s activities.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Commission-free trades on gettex for orders over €500.

- No fees for deposit accounts.

- Wide selection of securities and exchanges.

- Real-time trading and two-factor authentication for added security.

- Extensive selection of free savings plans.

- Limited information on additional fees.

- Client support is primarily available in German.

TU Expert Advice

Financial expert and analyst at Traders Union

Smartbroker+ is a platform tailored for European investors seeking a comprehensive and cost-effective trading solution. One of its standout features, as I've found, is the commission-free trading for orders over €500 on gettex, which is a significant benefit for cost-conscious active traders like me. The platform provides access to stocks, ETFs, derivatives, and funds, enabling me to apply a full range of strategies.

The platform's fee structure is straightforward and competitive: there are no fees for deposit accounts, and it offers more than 2,000 free savings plans. That said, I believe Smartbroker+ could enhance its offering by introducing more advanced trading tools and improving the responsiveness of client support. These upgrades would further solidify its position as a leading brokerage platform. Overall, I consider Smartbroker+ an excellent choice for investors seeking an affordable, secure, and versatile trading platform.

Smartbroker+ Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Smartbroker+ web and mobile application |

|---|---|

| 📊 Accounts: | Standard live account |

| 💰 Account currency: | EUR |

| 💵 Deposit / Withdrawal: | Wire Transfer |

| 🚀 Minimum deposit: | No minimum deposit requirement |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | No commission for orders over €500 on gettex |

| 🔧 Instruments: | Stocks, ETFs, derivatives, funds, bonds (coming soon) |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Different order types |

| ⭐ Trading features: | Real-time trading, two-factor authentication, low commissions |

| 🎁 Contests and bonuses: | No |

Smartbroker+ is focused on providing a comprehensive, low-cost trading experience for a wide range of investors. Clients can trade a variety of securities (with bonds to be added soon) on 25 domestic and international exchanges.

While Smartbroker+ doesn't explicitly advertise automated rebalancing features, it offers diverse order types and tools to facilitate effective investment management. However, fractional shares are not currently available. A significant advantage is the absence of additional fees for gettex trades exceeding €500. Other fees may apply to trades on other exchanges and services. Notably, there's no minimum deposit requirement to open an account with Smartbroker+.

Smartbroker+ Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

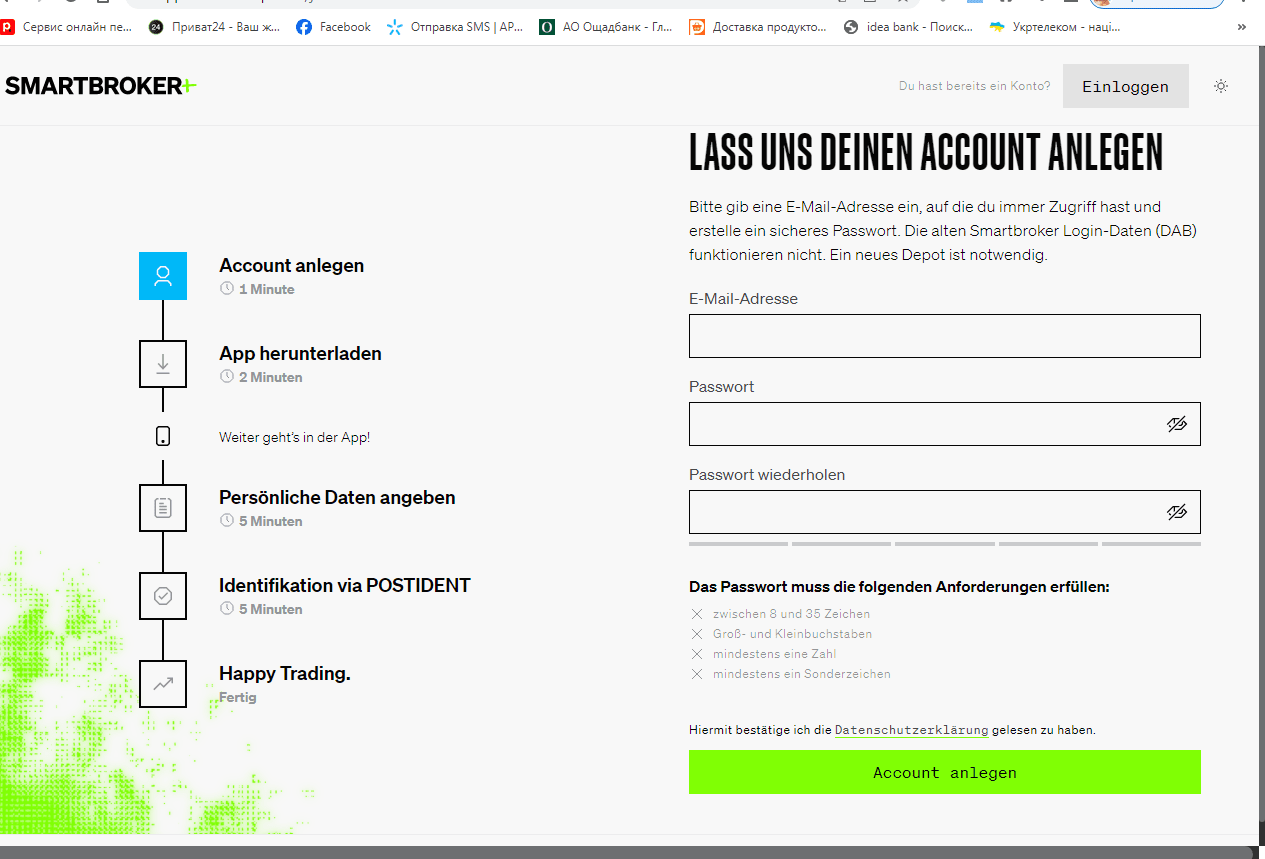

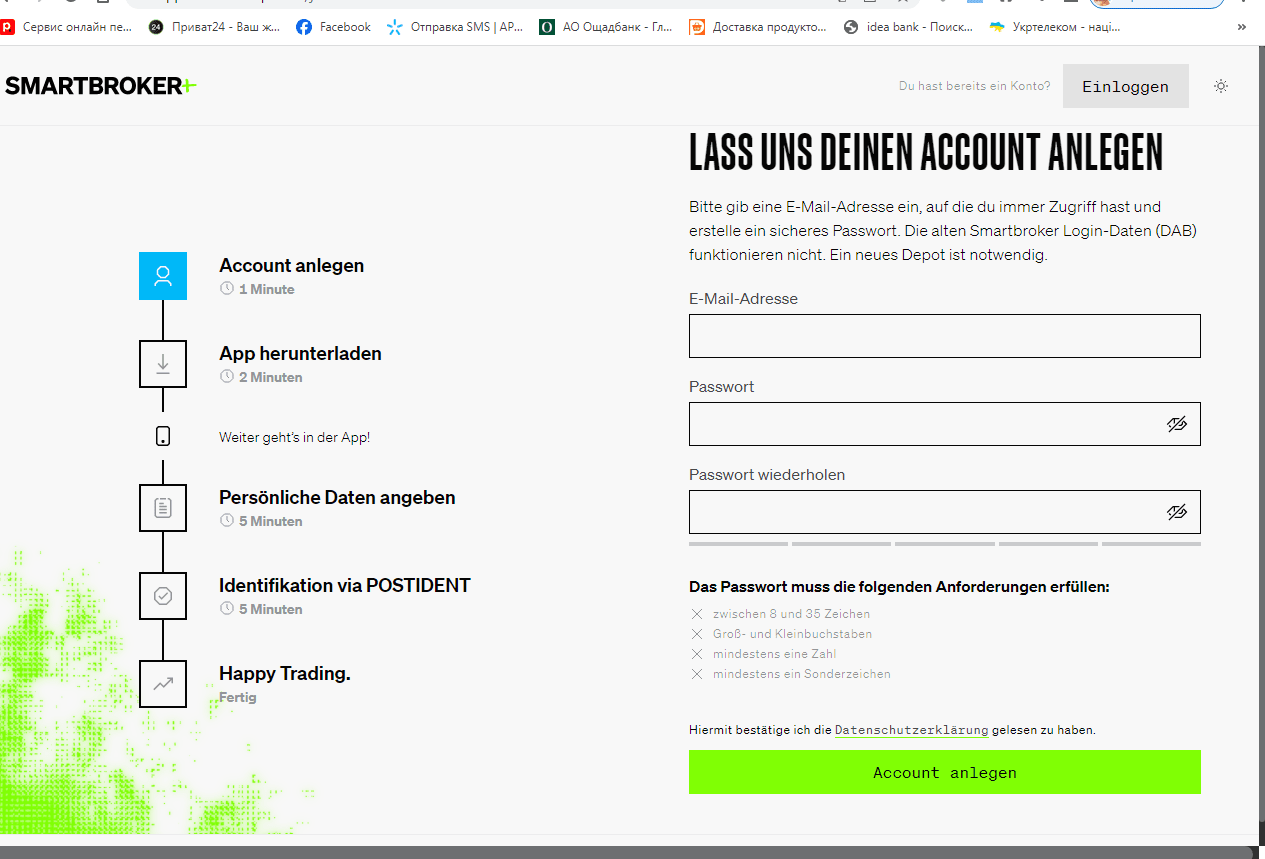

Trading Account Opening

To begin investing with Smartbroker+, create an account. It is a straightforward process that can be completed online.

Go to the Smartbroker+ website.

Create an account. Go to the Smartbroker+ website and click "Depot eröffnen" (Open a deposit account). You will be prompted to provide your email address and create a password.

Steps for opening an account:

Additional features of Smartbroker+ user account allow traders to:

-

Customize your investment strategies and plans to match your goals.

-

Easily manage funds through your account.

-

Access detailed financial data and performance reports.

-

Communicate with the support team for assistance whenever needed.

Regulation and safety

Smartbroker+ provides multiple levels of investor protection:

-

Deposit insurance. Client funds are protected up to €100,000 under Germany's statutory deposit insurance scheme.

-

Compliance with the Securities Trading Act. Smartbroker+ operates under the supervision of the Federal Financial Supervisory Authority (BaFin), ensuring adherence to Germany's Securities Trading Act.

-

BaFin oversight. BaFin monitors Smartbroker+'s activities, ensuring strict regulatory compliance.

-

MiFID II compliance. Smartbroker+ follows the Markets in Financial Instruments Directive II (MiFID II), enhancing investor protection and market transparency.

Advantages

- Regulated by BaFin

- Ensures the highest standards of financial management and regulatory compliance.

- Deposit insurance

- Protects client funds up to €100,000, providing an additional layer of security.

- MiFID II compliance

- Enhances investor protection and market transparency through strict regulations.

Disadvantages

- Limited global availability

- Primarily designed for European investors, which may restrict access for clients from other regions.

- Complex fee structure

- While competitive, the fee structure might be challenging for new investors to understand.

Commissions and fees

Trading on gettex:

-

Orders over €500. Commission-free, with market spreads and other standard terms applied.

Orders under €500:

-

A €4 fee per trade, plus market spreads and other standard terms.

International Trading Platforms:

-

A fee of €15 per trade, plus exchange fees and any additional costs.

ETF and Fund Plans:

-

A €1 fee for each purchase or sale within the plans. Minimum contribution: €50; maximum: €2,500 per trade.

Derivative Trading:

-

Zero commission for trading derivatives through premium partners (Morgan Stanley, HSBC, UBS, Vontobel) for trades of €500 or more. A €2 fee for trades with secondary partners (BNP Paribas, Citi) for the same minimum trade amount.

Conclusion. Smartbroker+ offers a competitive fee structure, with no commission for trades over €500 on gettex, no account maintenance fees, and no withdrawal fees. These benefits make it a cost-effective option for passive and active investors.

| Broker | Average commission | Level |

|---|---|---|

|

$0.0 | |

|

$2 | |

|

$11.5 |

Account types

Smartbroker+ offers a comprehensive platform for investors seeking a wide range of trading options and low fees.

Account types

Steps to Get Started

-

Visit the Smartbroker+ website. Access the Smartbroker+ platform via their official website.

-

Register and create an account. Follow the on-screen instructions to set up an account. You’ll need to provide personal information and complete the verification process.

-

Select your investment options, including stocks, ETFs, funds, and derivatives.

-

Fund your account. Deposit funds via bank transfer.

-

Start trading. Use the web platform or mobile app to begin trading and manage your investments.

Deposit and withdrawal

Smartbroker+ primarily supports withdrawals via bank transfers (Wire Transfers). Withdrawals to e-wallets or other payment methods are not supported.

-

Bank transfer (Wire Transfer). Withdrawals via bank transfer are fee-free.

-

Other methods. Withdrawals are limited to bank transfers. No fees for debit/credit card withdrawals are mentioned.

Withdrawal requests are processed promptly. While specific processing times are not detailed on the official website, funds typically reach the client's bank account within a few business days.

Investment Options

Smartbroker+ offers over 2,000 free savings plans, allowing investors to set up automatic investments in selected ETFs and funds without any trading fees. This program is ideal for those looking to build wealth over time through regular and consistent investments.

Live accounts

Smartbroker+ provides various live accounts:

-

Deposit account. Free of maintenance fees.

-

Trading on gettex. Commission-free trading for orders over €500.

-

Derivatives trading. Access to a wide range of derivatives for sophisticated trading strategies.

Customer support

Smartbroker+ offers client support during business hours, Monday to Friday, from 09:00 to 17:00.

Advantages

- Smartbroker+ offers client support during business hours.

- The broker offers multiple ways to contact client support.

Disadvantages

- No 24/7 support, which limits assistance availability outside business hours.

Clients can reach Smartbroker+ support through various channels:

-

Phone.

-

E-mail.

-

Help Center.

Contacts

| Registration address | Ritterstraße 11, 10969 Berlin, Germany |

|---|---|

| Regulation | BaFin |

| Official site | smartbroker.de |

| Contacts |

+49 (0) 30 257 708 403

|

Education

Key educational resources:

-

Help center. This resource provides answers to FAQs, guides on various aspects of trading, and investment activities. Clients can find information on getting started, using trading tools, and managing investments effectively.

-

Educational articles and blogs. Smartbroker+ regularly publishes articles on trading fundamentals, market analysis, investment strategies, and financial news. These resources help traders stay informed and develop their knowledge.

-

Product guides. Detailed instructions on using trading platforms and descriptions of available financial instruments like stocks, ETFs, bonds, and derivatives. This helps traders understand how various products work and how to use them effectively.

Detailed review of Smartbroker+

Smartbroker+ provides a comprehensive platform for both beginner and experienced investors, offering access to a wide range of securities and trading options. The broker emphasizes low fees, diverse investment options, and ease of use, making it a versatile choice for many traders.

Key Features of Smartbroker+:

-

Stocks. Trade over 40,000 stocks on more than 25 exchanges, including major markets like gettex, L&S Exchange, Nasdaq, and NYSE.

-

ETFs. Access over 2,500 ETFs, including premium offerings from partners like Amundi, SPDR, and Xtrackers. Orders over €500 are commission-free; otherwise, a €4 fee applies.

-

Funds. Over 14,000 funds with no front-end fees for one-time purchases and zero fees for execution within savings plans.

-

gettex. Commission-free for orders over €500; €4 for smaller orders.

-

Derivatives. Trade over 4.6 million options, warrants, and knock-outs from providers like HSBC, Morgan Stanley, UBS, and Vontobel.

-

Savings plans. Choose from over 2,000 free savings plans, including stocks, ETFs, and funds.

-

Account management. Free custody and account management.

E-Trading Platforms:

-

gettex: Free for orders over €500; €4 for orders under €500.

-

Tradegate, L&S Exchange, Baader OTC: €4 per order.

Fees and Services:

-

Stocks. 0.2%, with a minimum of €1 per execution.

-

ETFs. Free for Amundi, SPDR, and Xtrackers; otherwise, 0.2%, with a €1 minimum.

-

Funds. Free.

-

Crypto ETPs. Free for CoinShares; otherwise, 0.2%, with a €1 minimum.

-

Derivatives (Premium Partners). Free for orders over €500; €4 otherwise.

-

International Exchanges (e.g., Nasdaq, NYSE). €4 plus a percentage of the trade amount and minimum fees (e.g., 0.02%, minimum $8).

-

Margin Loans. 3-month EURIBOR plus 3.00% annually.

Security and Regulation:

-

Two-Factor authentication. Enhances account security.

-

Regulated environment. Operates in compliance with financial regulations, ensuring safety and transparency.

Analytical services of Smartbroker+:

-

Real-time market data for informed decision-making

-

Order flexibility.

Advantages:

Wide range of assets. Stocks, ETFs, funds, derivatives, etc.

Low Fees. No commissions for orders over €500 on gettex.

User-friendly platform. Intuitive web and mobile interfaces with real-time data and essential tools.

Secure. Robust security measures, including two-factor authentication.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i