Unicaja Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1

- Spanish Stock Exchange Interconnection System

- Allfunds Bank platform

- No

- Spanish and international securities are available

Our Evaluation of Unicaja

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Unicaja is a high-risk broker with the TU Overall Score of 2.86 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Unicaja clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Unicaja is a regulated broker, focused on securities trading. It boasts a large client base, including novice traders, due to the absence of initial deposit requirements and zero fees for new clients.

Brief Look at Unicaja

Unicaja is a brokerage branch of a large Spanish bank, Unicaja Banco, established in 1991 and serving over 4 million clients. The broker offers trading securities in Spanish and international markets, including stocks, bonds, ETFs, currencies, interest rates, and commodities. Unicaja is supervised by CNMV (the National Securities Market Commission of Spain), Banco de España (the Central Bank of Spain), and the European Central Bank (ECB). Client investments are protected with FOGAIN (the General Fund for Investment Guarantees). Unicaja also provides portfolio management services and investments in mutual funds for passive investors.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Regulation by the Spanish state commission and participation in the investment guarantee fund;

- Reliable parent bank with a large market cap and stable financial performance;

- Access to trading local and international securities;

- Free trading account opening and maintenance;

- Fee-free trading Spanish securities during the first year for the trading volume below €5,000;

- Wide branch network across Spanish provinces;

- Passive income options.

- No access to derivatives markets;

- High fees for trading foreign stocks;

- Limited choice of commodities.

TU Expert Advice

Financial expert and analyst at Traders Union

Unicaja has been operating in Spanish and international securities markets for many years. It specializes in underlying assets without providing access to trading stock options, futures, or other derivatives. The broker does not provide access to the interbank currency market either, however, its clients can trade currencies on stock exchanges. 16 currencies can be bought for EUR and 14 for USD. Trading USD/GBP and USD/NZD pairs is not supported.

Unicaja does not provide leverage, but traders are offered margin trading with securities as collateral. This allows them to invest part of the money necessary to buy certain shares, indices, bonds, etc., and repay the broker’s loan with purchased assets or money.

The broker allows its clients to buy or sell subscription rights. With this service, shareholders can buy a certain number of new shares at a predefined price. These rights can be granted to holders of existing shares when new ones are issued or as a result of corporate actions such as conversion of bonds into shares. Purchase or sale of subscription rights is conducted on the Madrid Stock Exchange (Bolsa de Madrid).

Unicaja Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | Spanish Stock Exchange Interconnection System (Sistema de Interconexión Bursátil Español, SIBE) and Allfunds Bank platform for investing in funds |

|---|---|

| 📊 Accounts: | Securities, Digital Banking, and Fund |

| 💰 Account currency: | EUR |

| 💵 Deposit / Withdrawal: | Unicaja Banco’s ATMs, Visa, Mastercard, bank transfers, online banking, and asset transfers from/to accounts held with other brokers |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Fractional share |

| 💱 EUR/USD spread: | Exchange |

| 🔧 Instruments: | Currencies, stocks, stock and commodity indices, (oil, natural gas, metals, and agricultural and livestock products), interest rates, bonds, ETFs, IPOs, and investment funds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Unicaja Banco SA |

| 📱 Mobile trading: | Through a web platform |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Exchange |

| ⭐ Trading features: | Spanish and international securities are available |

| 🎁 Contests and bonuses: | No |

Unicaja provides access to stock exchanges of Madrid, Barcelona, and Valencia offering a wide range of investment opportunities, including trading stocks, bonds, funds, and other financial instruments offered by Spanish and international companies. While there are no mobile apps for investors, they can trade from their smartphones or tablets through a web platform.

Unicaja Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To access the user account on the Unicaja website, sign in with your ID and password. To register with the broker, follow the below instructions:

Click the “Hazte cliente (Become a client)” button in the upper menu of the Unicaja official website. The system automatically redirects you to the account opening page. There, click the “Abrir Cuenta (Open Account)” button.

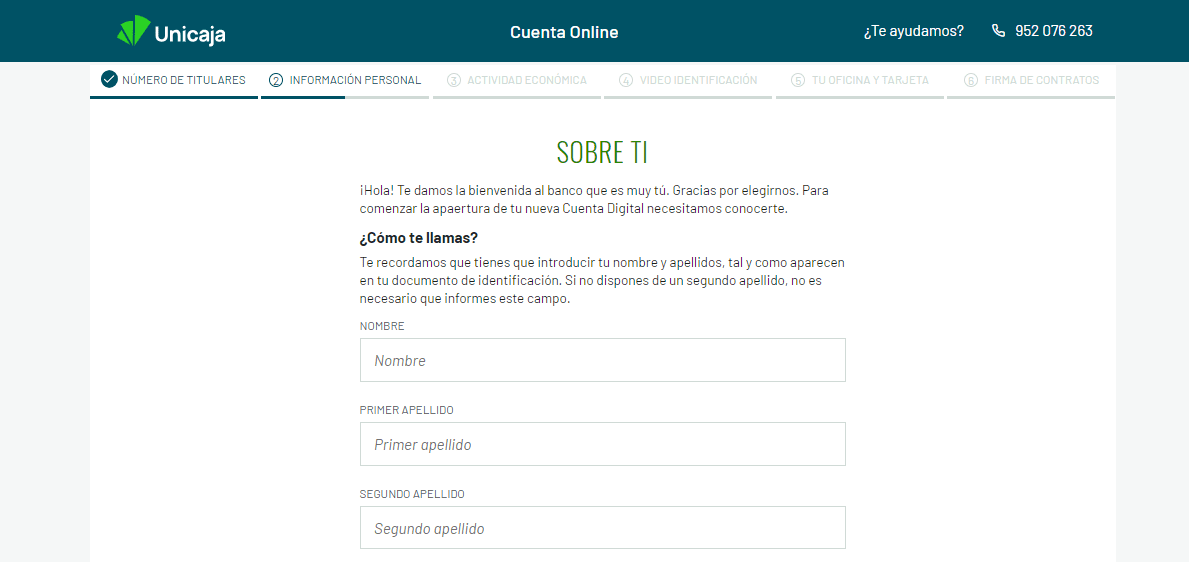

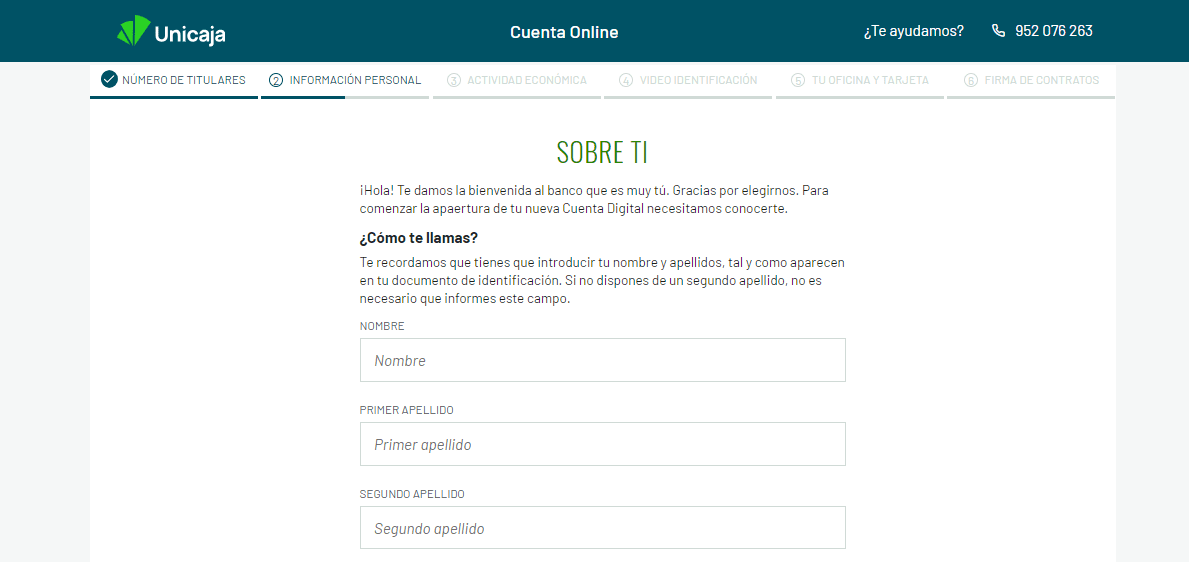

Next, follow the instructions on the registration page to fill in the form with your personal information and employment, go through video identification, link your bank account and card, and sign the service agreement.

Once verification is completed, Unicaja Banco opens an account for you and sends your password to the registered email.

The user account allows traders to open the required account type, Securities or Fund, make a deposit, and access all necessary tools for asset trading.

Regulation and safety

The Unicaja brand is managed by Unicaja Banco SA, regulated by Banco de España and ECB.

Unicaja Banco SA is also supervised by CNMV, a state agency for controlling Spanish financial markets, including stock exchanges, brokerage companies, investment funds, etc. CNMV ensures transparency, efficiency, and stability of financial markets of Spain, as well as investor protection.

The bank participates in FOGAIN that provides insurance coverage of up to €100,000 per client in case of its member’s insolvency or bankruptcy. Hence, FOGAIN ensures trust of investors in Spanish financial markets, protecting them from potential losses.

Advantages

- Highly rated parent bank

- Investment protection for retail clients

- Unicaja’s financial statements are publicly available on regulatory websites

Disadvantages

- EU regulators forbid tools that enhance trading activity (deposit bonuses, fee cashback, etc.)

- Trading account can be opened only upon opening an account with Unicaja Banco

- Complicated procedure for filing a complaint with regulators

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Securities | €0 | Bank transfer fees |

In addition to brokerage fees, traders incur expenses depending on the exchange and instrument. For example, stamp duty of 0.5% of the position size is withheld for trading UK securities, while 1% applies to Irish securities. Average fee for trading securities with Unicaja during the first year is €3.5. TU experts converted this amount into USD to compare Unicaja’s fees with those of international stockbrokers.

| Broker | Average commission | Level |

|---|---|---|

|

$3.7 | |

|

$2 |

Account types

Securities trading on SIBE is conducted through the Securities account, while the Fund account is designed for investing in funds. Both accounts can be opened online upon opening the Digital Banking account in the Unicaja Banca Online app. Uploading documents and video ID verification are mandatory.

Account types:

Unicaja does not offer a demo account. Upon opening the Securities or Fund account, a real deposit is required.

Unicaja clients can trade in stock markets and gain access to current market data, analytical reports, and portfolio management tools.

Deposit and withdrawal

-

Withdrawal requests are submitted through the user account on the broker’s website.

-

Once the request is approved, the broker transfers funds from the Securities account to the Digital Banking account. Further, traders can transfer their money to the Unicaja Banco card free of charge or withdraw it at a Unicaja Banco branch.

-

All transactions are conducted in EUR. When requesting another currency, it is converted into EUR at Unicaja Banco’s internal rate + a 0.2%-1% fee.

-

E-wallets are not supported. Also, transfers to third parties are prohibited.

Investment Options

Unicaja offers two passive income solutions for investors not willing to trade securities on the stock exchange — portfolio management and investment funds. Active stock traders can also generate passive income through dividends paid by issuers.

Discretionary portfolio management and investment funds offered by Unicaja

Every passive income option has its own features including minimum investment requirements, management rules, and fee structure.

-

Portfolio management is available to investors with a minimum capital of €20,000. To identify risk tolerance and investment horizons, investors pass the assessment test. Based on the results, investors can choose from 4 portfolio types: Aggressive, Dynamic, Moderate, and Conservative. A 2% annual management fee and an additional 20% reinstatement fee apply to the managed portfolio.

-

Investment funds allow traders to choose assets for their investments. Unicaja offers over 100 funds regulated by CNMV. These funds can consist of both financial assets, such as stocks, currencies, or bonds, and non-financial assets, like real estate or commodities. To invest in a fund, investors purchase shares in it. If clients require assistance in choosing the fund, they can visit the broker’s office for personalized advice.

Unicaja has a team of experienced managers and stock market experts who strictly adhere to client agreements. Nevertheless, due to market movements, this does not guarantee investment growth. When using the above passive income options, investors can withdraw their funds at any moment.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Unicaja:

The broker does not offer any partnership programs for retail traders and investors.

Customer support

The main communication channel with Unicaja is phone calls. The Help and Contact (Ayuda y contacto) section provides phone numbers for different services and products. Technical support working hours are 08:00-22:00 Monday through Saturday, excluding national holidays.

Advantages

- Retail support center is available 24/7/365

- Dedicated phone number for seniors

Disadvantages

- Virtual chat bot without live communication is available

- Limited communication channels

To get assistance, contact the broker using below channels:

-

Phone numbers provided on the website;

-

Feedback form in the Contact section;

-

Personal visit to the broker’s office.

Email is available for sending claims and complaints.

Contacts

| Registration address | Avenida de AndalucIa, 10 y 12. Málaga, 29007, Spain |

|---|---|

| Regulation | CNMV, Banco de España, and ECB |

| Official site | www.unicajabanco.es/es/particulares/ahorro-e-inversion/unicaja-broker |

| Contacts |

+34 952 07 62 63, +34 900 151 948

|

Education

To use educational materials offered by Unicaja, go to the Unicaja Broker Online website. The Información section contains information for novice investors interested in stock exchange trading.

Unicaja offers educational materials exclusively in Spanish.

Detailed review of Unicaja

Unicaja, a reliable broker, is part of Unicaja Group, which also manages Unicaja Banco, a top 10 Spanish bank. Included in IBEX35, the main Spanish stock market index, Unicaja operates under the strict regulation of the Central Bank of Spain, ensuring honest business practices and adherence to financial regulations.

Unicaja by the numbers:

-

40+ offices throughout Spain;

-

Over 100 regulated mutual funds are available for investing;

-

Supervision by 2 financial market regulators.

Unicaja is a broker with access to all major stock exchanges of Spain

Unicaja provides access to SIBE, an electronic trading platform developed by BME (Spanish Stock Exchanges and Markets). SIBE integrates all Spanish stock exchanges, providing a unified marketplace for trading stocks, bonds, and other securities.

Beyond the local market, Unicaja provides for trading on European, U.S., and Asian exchanges, offering access to a wide range of currencies, stocks, ETFs, and stock indices. Also, the broker offers trading commodity indices on gold, silver, copper, nickel, gas, oil, and agricultural products.

Useful services offered by Unicaja:

-

Economic Calendar. This tool features the most significant data for in-depth fundamental market analysis.

-

Newsfeeds. Unicaja allows its clients to view news on companies, markets, and economics of various countries. Articles from different resources, including Europa Press and AFInet are published here.

-

Chat Bot. This is AI-based software for automated interaction with users through text messages.

-

UNIBLOG. It is a collection of useful articles for novice and experienced traders with current information on economic and financial trends.

Advantages:

Trading accounts can be opened online;

Unified platform for trading national and foreign stocks;

No minimum deposit requirements;

Wide choice of trading instruments and markets;

Free education for novice investors.

Unicaja allows its clients to trade stocks, bonds, funds, and other investment instruments in various financial markets. It provides current market information, analytical tools, and online portfolio management.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i