According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- MetaTrader5

- FCA

- FSC

- 2008

Our Evaluation of Key to Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Key to Markets is a moderate-risk broker with the TU Overall Score of 5.26 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Key to Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Key to Markets is a universal broker that provides low trading costs and attractive starting conditions. There is a demo account. Traders can work on top platforms without any restrictions on trading strategies. This broker provides four options for additional income, such as savings accounts, PAMM accounts, copy trading, and partnership programs. In general, it is a competitive broker with a modern client-oriented service. Among the special advantages, one can note training, which is highly evaluated by experts, and regular analytical materials that make it easier for traders to work. The main disadvantages are the absence of 24/7 support and no difference between account types except for spreads and fees.

Brief Look at Key to Markets

Key to Markets uses ECN (Electronic Communication Network) technology to execute exchange trades without intermediaries. It offers a free demo account and two live accounts, namely Standard and Pro. The accounts differ only in spreads and fees. This broker provides more than 180 instruments, including currency pairs and CFDs on stocks, indices, and commodities. This company's clients work on MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Also, traders can open savings accounts at 0.5% per annum, while with a balance of €500,000, the broker offers an increased rate on individual conditions. Other options for passive income are standard PAMM accounts and the AutoTrade copy trading service. Funds can be deposited in nine ways and withdrawn in four ways, namely via bank transfer, Skrill, Neteller, and Sticpay, wherein transfers to bank accounts are not subject to fees. This broker offers high-quality educational materials and many analytical options.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Free demo account and a minimum deposit of $100 provide a low entry threshold;

- Over 180 assets from 4 groups and leverage up to 1:500 increase the trader's profit potential;

- Trading through MT4 and MT5 makes it possible to individualize working conditions through plug-ins;

- Basic options for deposits and withdrawals are available, there is either no withdrawal fee, or it is 1% of the amount;

- Traders can open savings accounts that provide for receiving a stable passive income;

- Copy trading provides additional income and unique experience, also the broker offers joint accounts;

- Traders have access to basic training, webinars, expert analytical materials, and special trading tools.

- All groups of assets, except for currency pairs, are available in the form of CFDs;

- Trading accounts differ only in spreads or fees, and the broker does not individualize the offer;

- Call center is available on weekdays from 9:00 to 18:00, and there is no live chat to contact technical support.

TU Expert Advice

Author, Financial Expert at Traders Union

Key to Markets offers diverse trading services with over 180 instruments encompassing Forex and CFDs on stocks, indices, and commodities, supported by MetaTrader 4 and MetaTrader 5 platforms. The broker provides a free demo account and two live account types with differences mainly in spreads and fees. With leverage up to 1:500 and additional income opportunities like PAMM accounts and copy trading, Key to Markets enables both active and passive income strategies. The trading conditions are enhanced by educational resources and regular analytics, supporting varied trading styles.

However, Key to Markets primarily offers asset trading CFDs, except for currency pairs, which may not suit traders preferring traditional asset ownership. The absence of 24/7 client support and the lack of live chat could be inconvenient, especially during urgent issues. Despite these drawbacks, Key to Markets, backed by FCA and FSC regulation, can be a solid choice for both novice and experienced traders interested in low-cost trading and a range of passive income options. It is recommended for traders comfortable with the standard account features who do not need extensive customization.

Key to Markets Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4 and MetaTrader 5 |

|---|---|

| 📊 Accounts: | Demo, Standard, and Pro |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Visa, MasterCard, bank transfer, Skrill, Neteller, Sticpay, Sepa, UnionPay, and Alipay |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, and commodities |

| 💹 Margin Call / Stop Out: | 120%/100% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Free demo account; Two live account types, which differ only in spreads and fees; Currency pairs and CFDs on three types of assets; ECN system; There are savings and joint accounts; AutoTrade copy trading service is integrated |

| 🎁 Contests and bonuses: | Rebates from Traders Union |

Usually, if a broker offers multiple account types, the minimum deposit is determined by the account chosen by the trader. Key to Markets has two live accounts that differ only in spreads and trading fees. The minimum deposit is $100 for both types. A demo account does not require a deposit. Leverage does not depend on the account type, but on the asset. The highest trading leverage is always for currency pairs which is 1:500. Of course, you do not have to trade using leverage, you can choose a smaller one or trade without it at all. Client support is available via phone, email, and tickets on weekdays from 9:00 to 18:00 GMT.

Key to Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

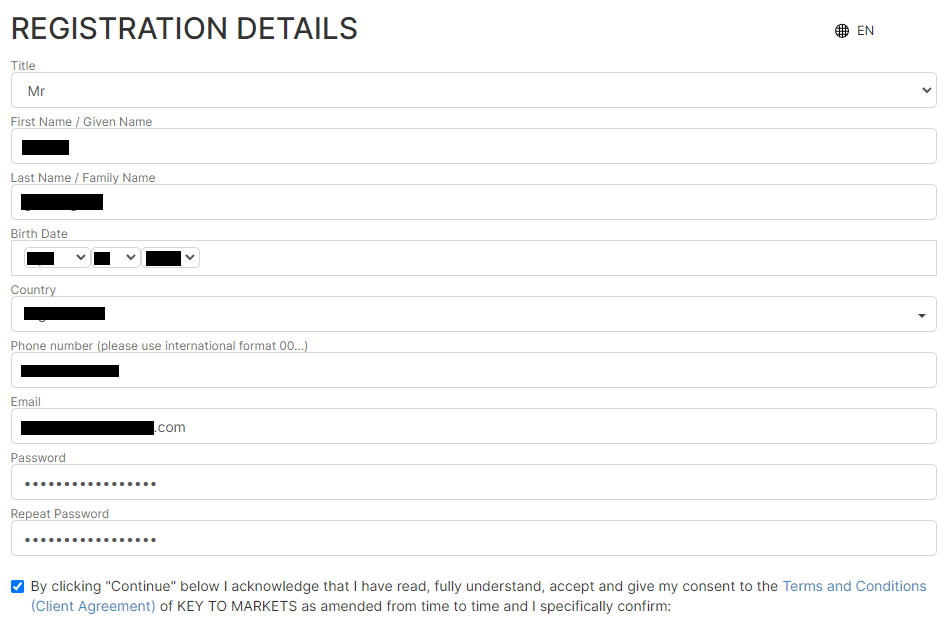

Trading Account Opening

To start working with the broker, register an account on its official website. Further, it is necessary to get verified (confirm your personal information) and make a deposit not lower than the minimum. After that, you can download MT4/MT5 and start trading. TU experts have prepared a detailed guide on registration and the functions of the Key to Markets’ user account.

Go to the broker's official website. Select the interface language at the top and click the “Open an Account” button.

Choose your title, enter your first and last names, date of birth, and country of residence. Enter your email and phone number, then create a password and enter it twice. Agree to the terms of service by ticking the box and click the “Continue” button.

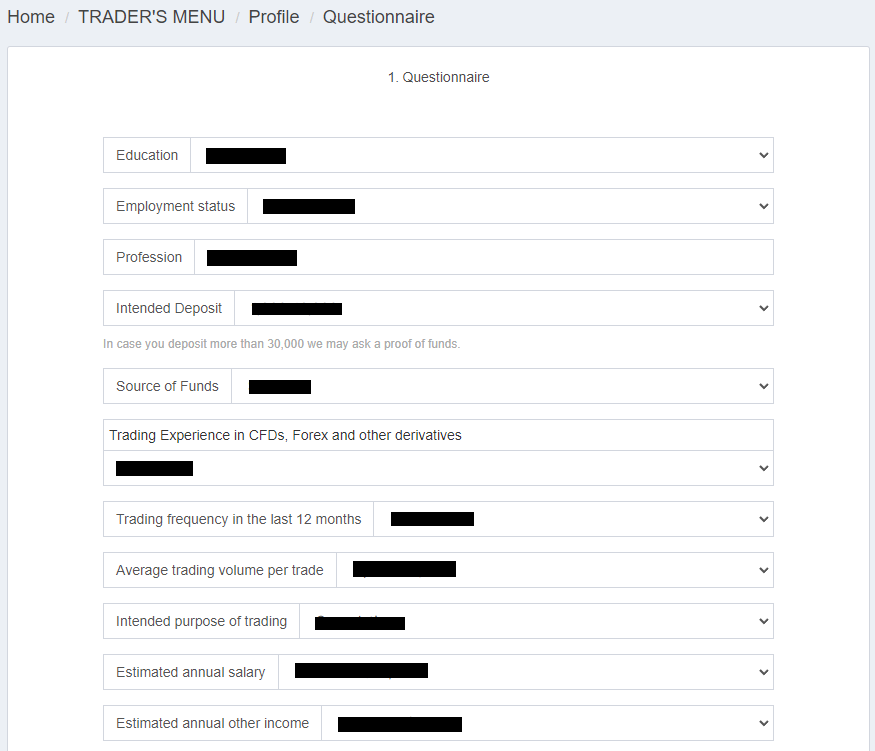

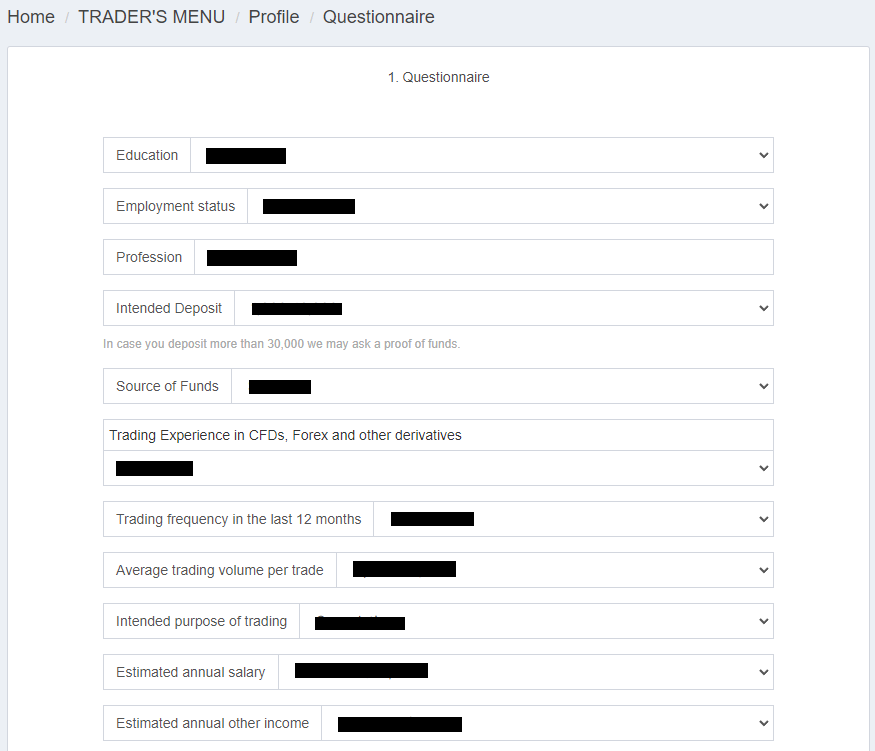

Answer a few questions about your education, profession, income, and trading experience. Click the “Continue” button.

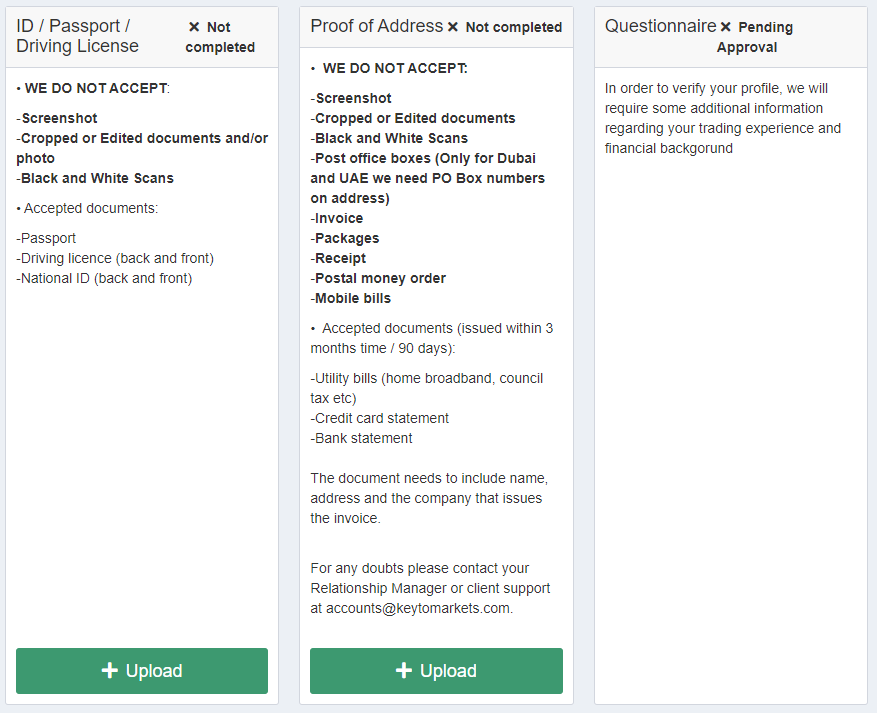

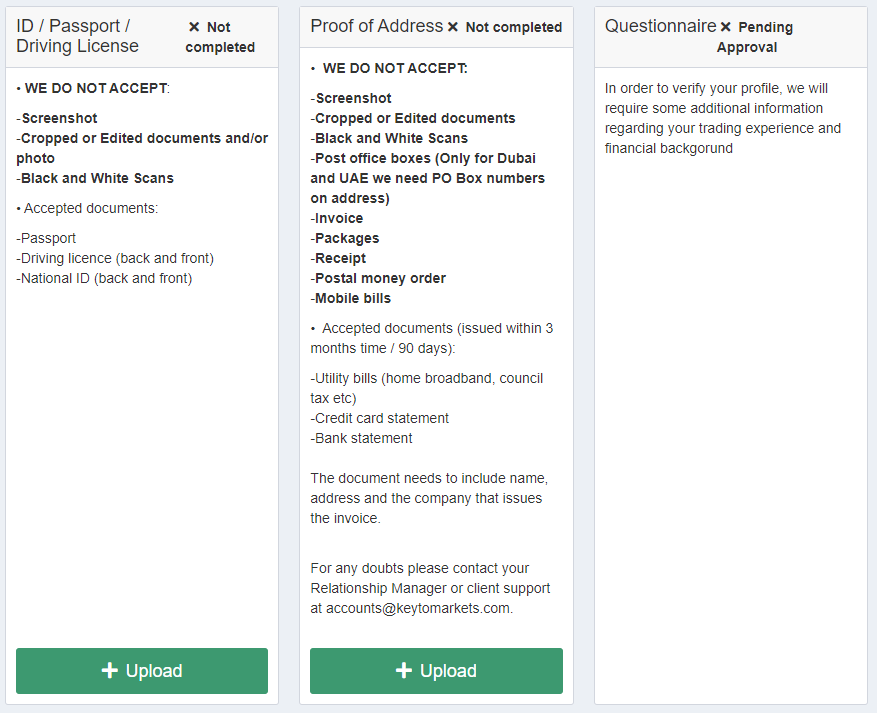

Select the document which can verify your identity. Provide a scan/photo of this document by following the instructions on the screen. Then wait until the specialists confirm the provided data.

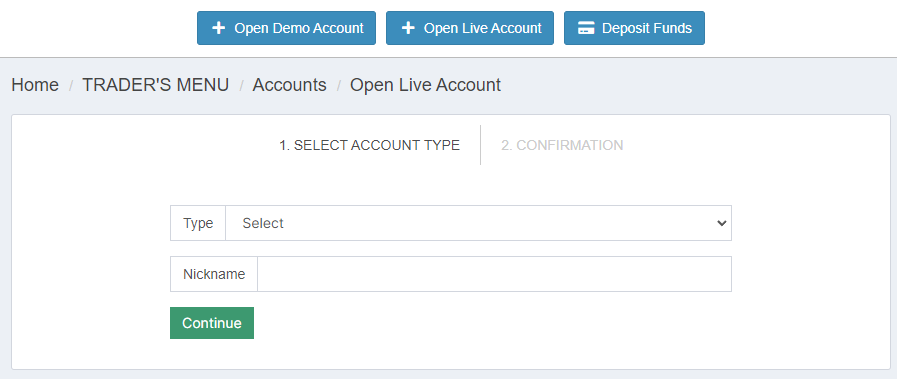

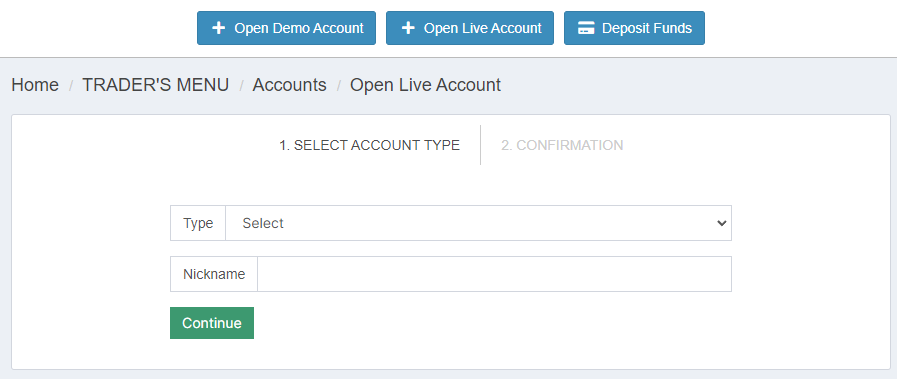

Go to the “Accounts” section. Select the “Open Live Account” tab and follow the instructions on the screen.

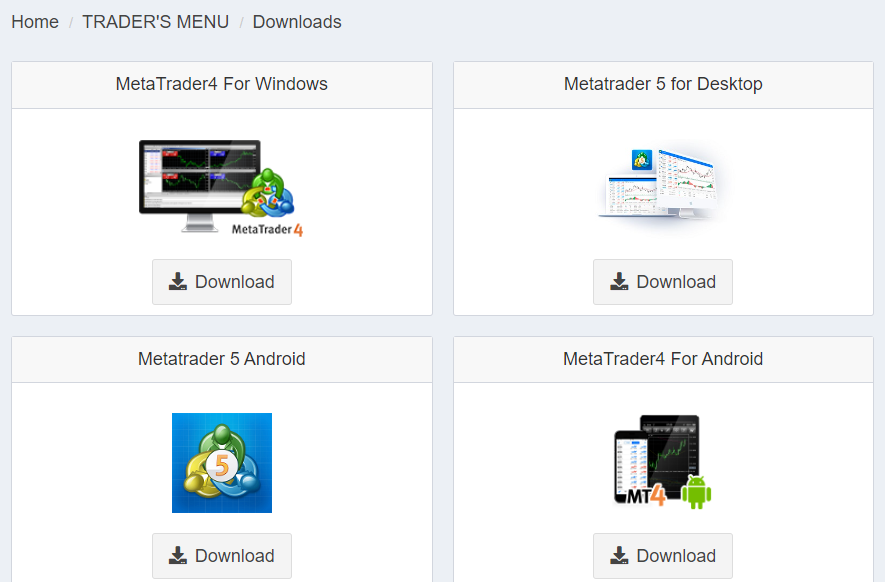

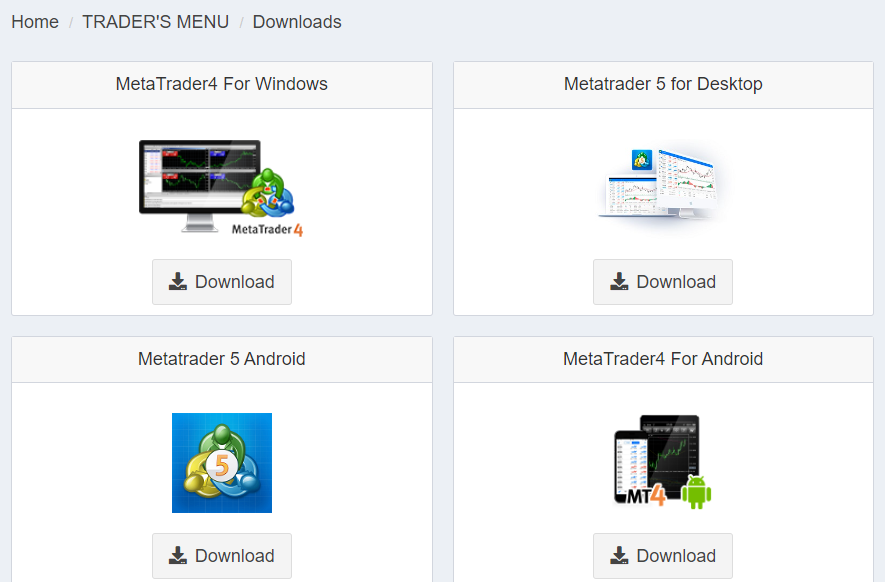

Go to the “Finance” section and select the "Deposit" tab. Select your preferred deposit option and follow the on-screen instructions to fund your account. After that, go to the “Download” section and download the trading platform that suits you. As soon as the platform is installed on your PC or mobile gadget, use your registration data to log in and start trading.

Features of the user account:

Accounts. Here a trader can open/close a live or demo account;

Funding. This is the section for deposits, withdrawals, and internal transfers; here you can also get a report of transactions;

Profile. This block is for entering and correcting personal information, as well as for setting security parameters;

Download. Here the distributions of the current versions of MetaTrader 4 and MetaTrader 5 are available;

Economic calendar. This is a basic tool for fundamental analysis;

Trader's calculator. It provides for calculating the main parameters of a trade based on the input data;

PAMM accounts. This block is for managing joint accounts;

Login to PAMM. This block is for registration in the service of joint accounts or logging into it;

Reporting system. All requests and responses are displayed here;

Partnership request. This option allows you to apply for a partnership with the broker.

Regulation and safety

Key to Markets has a safety score of 9.2/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 17 years

- Strict requirements and extensive documentation to open an account

Key to Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

Key to Markets Security Factors

| Foundation date | 2008 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Key to Markets have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- Above-average Forex trading fees

- Deposit fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Key to Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Key to Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Key to Markets Standard spreads

| Key to Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,8 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,0 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,0 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Key to Markets RAW/ECN spreads

| Key to Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,9 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Key to Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Key to Markets Non-Trading Fees

| Key to Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0-2,5 | 0 | 0 |

| Withdrawal fee, % | 0-1 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

If a broker offers several account types and the conditions of these accounts are very different, it is important to make the right choice. However, the Key to Markets’ Standard and Pro accounts differ only in spreads and fees. According to traders, the costs are approximately equal. The minimum deposit, available assets, and leverage are the same. In this situation, it is more important to understand which trading platform suits you best. MetaTrader 4 and MetaTrader 5 have a lot in common, but there are also many differences. It is recommended to look at the reviews and try the demo mode on each of the platforms. Note that both platforms have a mobile version. Also, passive income options are worth considering and a savings account is a great opportunity.

Account types:

As a rule, traders first open a demo account in order to explore the possibilities of the trading platform. Then they choose one of two live accounts, based on their preferences. It is convenient that there are no restrictions on depositing and withdrawing funds, neither for the number of transactions nor for their volume. The availability of the most popular channels simplifies interaction with the platform.

Deposit and withdrawal

Key to Markets received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Key to Markets offers limited payment options and accessibility, which may impact its competitiveness.

- Bank wire transfers available

- Low minimum withdrawal requirement

- Minimum deposit below industry average

- USDT (Tether) supported

- Only major base currencies available

- Withdrawal fee applies

- PayPal not supported

What are Key to Markets deposit and withdrawal options?

Key to Markets offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT. This limitation may restrict flexibility for users, making Key to Markets less competitive for those seeking diverse payment options.

Key to Markets Deposit and Withdrawal Methods vs Competitors

| Key to Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Key to Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Key to Markets supports the following base account currencies:

What are Key to Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Key to Markets is $50, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Key to Markets’s support team.

Markets and tradable assets

Key to Markets offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 50 Forex pairs.

- Indices trading

- 50 supported currency pairs

- Crypto trading not available

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Key to Markets with its competitors, making it easier for you to find the perfect fit.

| Key to Markets | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 100 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Key to Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Key to Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | `0 | No | No |

Customer support

Technical support has a conceptual significance for any broker because most traders will face situations that require qualified assistance. The reason may be either a user’s inattention or an atypical but serious situation. Also, no system is 100% protected from failures, albeit minimal. One way or another, when traders contact client support, they expect prompt and qualified advice. Without receiving the required level of help, they may go to a competing broker. Key to Markets offers up-to-date service, available on weekdays from 9:00 to 18:00 GMT.

Advantages

- Non-clients of the broker can contact technical support

- Managers respond quickly and competently

Disadvantages

- Support is not available at night and on weekends

- This broker doesn’t have a live chat

If you have a question or a technical problem, you can contact client services during business hours in one of the following ways:

-

call center;

-

emai;

-

tickets.

This broker recommends contacting technical support by email. Answers to tickets will also be sent by email. During rush hour, the call center is often overloaded.

Contacts

| Foundation date | 2008 |

|---|---|

| Registration address | United House | 9 Pembridge Road | London, W11 3JY | United Kingdom |

| Regulation |

FCA, FSC

Licence number: 527809, GB19024503 |

| Official site | keytomarkets.com |

| Contacts |

+44 20 3384 6738

|

Education

Traders are only successful if they are constantly improving. To do this, it is not enough to trade regularly, but it is necessary to communicate with colleagues and experts, study market trends, research expert analytics, read specialized books, and attend webinars. Knowing that, many brokers provide their clients with educational materials. Sometimes this is in the form of common FAQs and a trader's glossary. But these can also be full-fledged video guides. Key to Markets takes a balanced position: a lot of structured training materials are published on the broker's website, but these are not full-fledged courses, but rather thematic articles. This company also constantly holds webinars for novice and experienced traders.

This broker focuses on novice traders when preparing materials, like many of its competitors. Moreover, it does not pay much attention to money management and the psychology of trading. Nevertheless, its educational block is highly evaluated by experts, and there are a lot of interesting things at specialized webinars for professionals as well.

Comparison of Key to Markets with other Brokers

| Key to Markets | Bybit | Eightcap | XM Group | LiteFinance | FBS | |

| Trading platform |

MetaTrader4, MetaTrader5 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, MultiTerminal, Sirix Webtrader | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $100 | No | $100 | $5 | $10 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | 7.00% | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0.5 points | From 1 point |

| Level of margin call / stop out |

120% / 100% | No / 50% | 80% / 50% | 100% / 50% | 50% / 20% | 40% / 20% |

| Order Execution | NDD, STP | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed review of Key to Markets

This company has been on the market for 13 years and has gained its reputation because during all these years it has maintained the services provided at a high-quality level. This broker uses the ECN system, VPS, and advanced architecture. Execution time is no more than 30 ms, which meets advanced standards. Retrospective analysis and dynamic testing revealed no weaknesses, and the platform has never been hacked. The security system is standard and includes KYC (Know Your Client) verification and SSL protocols.

Key to Markets by the numbers:

-

Minimum deposit is $100;

-

Minimum spread is 0 pips;

-

Over 180 financial instruments;

-

Withdrawal fee for electronic systems is 1%;

-

Withdrawal to a bank account is $0.

Key to Markets is a broker for traders of all levels

The first conceptual indicator is the number of available assets. The more of them there are, the deeper is the trader's strategic potential. Moreover, different types of assets allow you to effectively diversify risks. Since Key to Markets has more than 180 instruments from four groups (currencies, indices, stocks, and commodities), this is more than enough to provide comfortable trading conditions. Second, Key to Markets’ clients can work with MetaTrader 4 and MetaTrader 5. Both solutions are simple, convenient, and highly customizable. Third, this broker offers free analytics in the form of fundamental analysis, which is necessary for the successful work of traders of any level, regardless of their preferences and trading style.

Useful features offered by Key to Markets:

-

Copy trading. Copy trading is incorporated. This broker's clients can register as investors to passively earn and gain experience, or as signals providers in order to increase their income through fees charged to investors in case of successful trades;

-

Virtual dedicated server. Upon request, the broker provides its clients with a VPS. This option is extremely important if a trader practices automated trading and needs stable round-the-clock access to the internet;

-

Joint accounts. PAMM allows you to connect any number of sub-accounts to the main account for executing trades using joint capital. Thus, investors passively earn, and managers receive a bonus in the form of fees.

Advantages:

Trading cost conditions are better than those of many of this broker’s competitors;

This broker is regulated by two competent agencies, thus it conducts transparent and strictly legal activities;

Traders work through the most popular platforms, also the most popular deposit/withdrawal channels are available;

This broker offers several options for passive income, including a full-fledged savings account;

Although technical support does not work at night and on weekends, it is highly evaluated by users and experts due to its competence.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i