According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- TRY 50,000

- TradeAll FX

- TradeAll TR

- TradeAll UP

- TradeAll UP Plus

- Instant Stock Exchange

- Akbank Internet

- Akbank Mobil

- Akbank Yatırımcı uygulaması

- iDeal

- CMB

Our Evaluation of Ak Yatırım

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Ak Yatırım is a moderate-risk broker with the TU Overall Score of 5.18 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Ak Yatırım clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Ak Yatırım is a regulated Turkish broker that provides access to BIST, VIOP, global exchanges, and Forex. It offers high-quality services to traders and investors, provides professional support, and conducts regular research on markets of currencies, securities, and capital.

Brief Look at Ak Yatırım

Ak Yatırım was established in 1996 as an investment division of Akbank TAŞ. For over 25 years of operation, it has become one of the largest brokerage companies in Turkey that provides access to trading on global stock exchanges and on the Forex market. The company is listed on the Borsa İstanbul (BIST) exchange and Turkish Derivatives Exchange (VIOP). It has obtained its intermediary license from the Capital Markets Board (MCB). Ak Yatırım provides its services through a network of 10 offices that are located in different cities within Turkey. The broker offers its proprietary TradeAll platforms for electronic trading. The company provides individual and corporate services, investment consultations, and ready-made investment portfolios and strategies.

We've identified your country as

RU

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

RU :

- Presence in the market since 1996 and regulation by CMB;

- Multi-functional trading platforms that focus on specific markets;

- Several mobile apps with convenient and simple interface;

- Access to Forex trading and investment on Turkish and foreign stock exchanges;

- Low trading fees for stocks, futures, and options on Turkish stock exchanges;

- Accounts can be opened both online and in the company’s offices;

- Platform for trading Forex and CFDs is based on MetaTrader 5.

- High spreads for Forex and high fees per lot for CFDs;

- Minimum deposit is a USD equivalent of TRY 50,000 (about 1,584 USD);

- Deposits and withdrawals are made only by bank transfers.

TU Expert Advice

Author, Financial Expert at Traders Union

Ak Yatırım provides access to trading on BIST, VIOP, global stock exchanges, and the Forex market. Traders can utilize user-friendly, proprietary TradeAll platforms designed for various markets, including TradeAll FX for Forex and CFDs. The company offers both individual and corporate account types with a minimum deposit requirement equivalent to TRY 50,000. Ak Yatırım supports multiple trading instruments, including stocks, futures, and options, with professional client service provided in Turkish and comprehensive market research available to clients.

Despite its advantages, Ak Yatırım has some drawbacks, including high spreads for Forex and commissions per lot for CFDs. The minimum deposit requirement may not suit all traders, potentially excluding those with limited capital. Furthermore, payments are processed solely through bank transfers, limiting deposit and withdrawal flexibility. These conditions may be more suitable for experienced investors comfortable with higher fees and larger investments, whereas less experienced or budget-conscious traders may need to explore other options.

Ak Yatırım Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Ak Yatırım and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: |

TradeAll FX, TradeAll TR, TradeAll UP, and TradeAll UP Plus; Instant Stock Exchange, Akbank Internet, Akbank Mobil, Akbank Yatırımcı uygulaması, Matriks, and iDeal for trading stocks |

|---|---|

| 📊 Accounts: | TradeAll FX Deneme Hesabı (Demo), TradeAll UP Deneme Hesabı (Demo), TradeAll FX Gerçek Hesap, and TradeAll UP Gerçek Hesap |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers |

| 🚀 Minimum deposit: | USD equivalent of TRY 50,000 |

| ⚖️ Leverage: | Up to 1:10 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 for Forex and CFDs |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | 30+ currency pairs; CFDs on indices, gas, oil, and metals; stocks, ETFs, futures, options, mutual funds, bonds, warrants, derivative instruments based on stocks and stock indices, and debt instruments |

| 💹 Margin Call / Stop Out: | 100%/150% |

| 🏛 Liquidity provider: | Bank of America, Barclays, BNP Paribas, Deutsche Bank, Goldman Sachs, JP Morgan, Morgan Stanley, RBS, Nomura, Standard Chartered Bank, Swissquote, UBS, and XTX |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Any strategies are allowed |

| 🎁 Contests and bonuses: | No |

The broker provides leverage up to 1:10 to trade Forex and CFDs. Stocks are traded without leverage but it is variable for futures. The maximum CFD trade sizes are 100 lots for Euro Stoxx 50; 125 lots for spot indices; and 20 lots for other instruments. Available order types for Forex and CFDs are market, buy limit, sell limit, buy stop, sell stop, buy stop limit, and sell stop limit. Hedging, scalping, and other Forex strategies are allowed.

Ak Yatırım Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

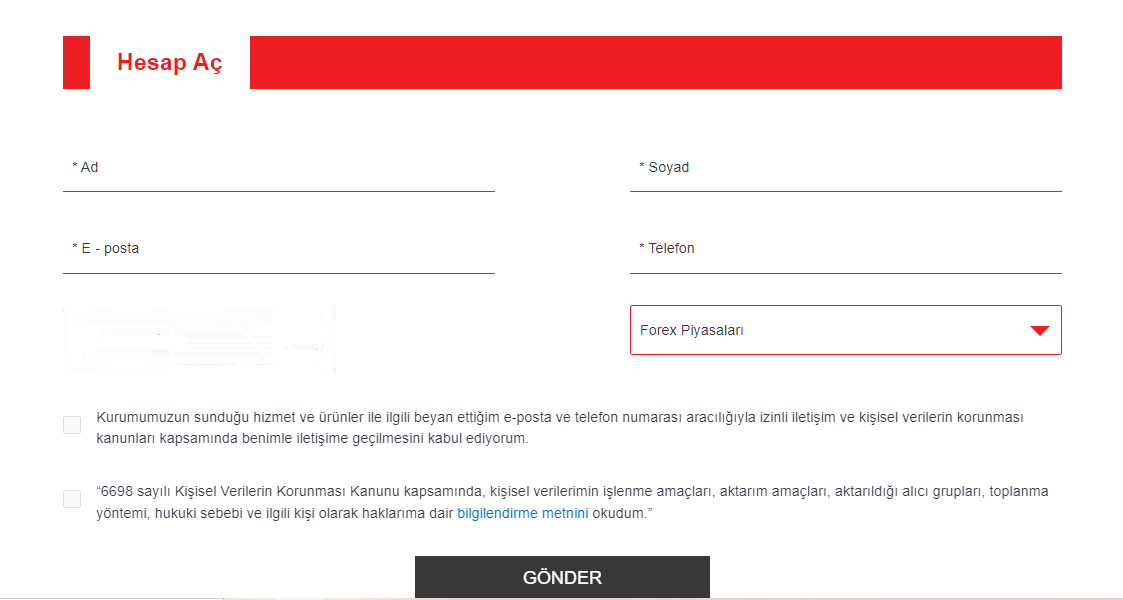

Trading Account Opening

Only traders and investors who open brokerage accounts with Ak Yatırım can access user accounts on the broker’s website

To open an account with the broker, click the “Be our client (Müşterimiz olun)” button at the top of the screen.

Fill in the registration form by entering the data requested by the broker. Choose the market with which you are going to work.

Next, Ak Yatırım’s representative contacts you and describes your further steps to activate your trading account. One of the mandatory steps is to upload documents that confirm your identity and residence. Also, link your personal bank account to your Ak Yatırım user account.

Regulation and safety

Ak Yatırım has a safety score of 5.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

Ak Yatırım Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

| SPK (Turkey) | Sermaye Piyasası Kurulu (SPK) – Capital Markets Board of Turkey | Turkey | TL 160,000 | Tier-2 |

Ak Yatırım Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Ak Yatırım have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Bybit and XM Group, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Ak Yatırım with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Ak Yatırım’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Ak Yatırım Standard spreads

| Ak Yatırım | Bybit | XM Group | |

| EUR/USD min, pips | 1,5 | Not supported | 0,7 |

| EUR/USD max, pips | 2,1 | Not supported | 1,2 |

| GPB/USD min, pips | 1,7 | Not supported | 0,6 |

| GPB/USD max, pips | 2,6 | Not supported | 1,2 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Ak Yatırım RAW/ECN spreads

| Ak Yatırım | Bybit | XM Group | |

| Commission ($ per lot) | 3,00 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,2 |

| GBP/USD avg spread | 0,10 | 0,2 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Ak Yatırım. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Ak Yatırım Non-Trading Fees

| Ak Yatırım | Bybit | XM Group | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0 |

| Inactivity fee ($, per month) | 0 | 0 | 10 |

Account types

To start trading financial instruments through Ak Yatırım, open the corresponding account type with the broker. It is done online or in the broker’s office. If you are a client of Akbank, you can open an account in the Akbank Mobil app or in any of its offices.

Account types:

Both account types are available in a demo version. It helps to test trading on stock exchanges and OTC assets with virtual funds.

Ak Yatırım provides for trading financial instruments on domestic and international markets, as well as on the Forex market using its convenient in-house platforms.

Deposit and withdrawal

Ak Yatırım received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Ak Yatırım offers limited payment options and accessibility, which may impact its competitiveness.

- Bank wire transfers available

- No deposit fee

- Low minimum withdrawal requirement

- No withdrawal fee

- No bank card option

- Wise not supported

- Only major base currencies available

What are Ak Yatırım deposit and withdrawal options?

Ak Yatırım offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making Ak Yatırım less competitive for those seeking diverse payment options.

Ak Yatırım Deposit and Withdrawal Methods vs Competitors

| Ak Yatırım | Bybit | XM Group | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | Yes | No |

| BTC | No | Yes | Yes |

What are Ak Yatırım base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Ak Yatırım supports the following base account currencies:

What are Ak Yatırım's minimum deposit and withdrawal amounts?

The minimum deposit on Ak Yatırım is $50000 TRY, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Ak Yatırım’s support team.

Markets and tradable assets

Ak Yatırım offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 40 Forex pairs.

- Commodity futures are available

- Passive income with bonds

- ETFs investing

- Limited asset selection

- Crypto trading not available

Ak Yatırım Supported markets vs top competitors

We have compared the range of assets and markets supported by Ak Yatırım with its competitors, making it easier for you to find the perfect fit.

| Ak Yatırım | Bybit | XM Group | |

| Currency pairs | 40 | 61 | 57 |

| Total tradable assets | 132 | 1400 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | No |

| Stock indices | Yes | Yes | Yes |

| Options | Yes | No | No |

Investment options

We also explored the trading assets and products Ak Yatırım offers for beginner traders and investors who prefer not to engage in active trading.

| Ak Yatırım | Bybit | XM Group | |

| Bonds | Yes | No | No |

| ETFs | Yes | No | No |

| Copy trading | Yes | Yes | Yes |

| PAMM investing | No | No | No |

| Managed accounts | No | No | No |

Customer support

Technical support responds to phone calls and emails on workdays from 9:00 to 18:00 (GMT+3). Breaks are from 13:00 to 14:00. Support in TradeAll apps is available 24/5.

Advantages

- Round-the-clock support in mobile apps

Disadvantages

- No live chat on the broker’s website

- WhatsApp, Snapchat, and other messengers are not available

Communications channels available with Ak Yatırım:

-

Telephone;

-

Email;

-

Live chat in AllTrade mobile apps.

The Contact section has a feedback form where registered and non-registered users can request information, send offers of gratitude, or file complaints.

Contacts

| Registration address | Ak Yatırım Menkul Değerler A.Ş., Sabancı Center, 4 Levent, 34330, Istanbul, Turkey |

|---|---|

| Regulation | CMB |

| Official site | https://www.akyatirim.com.tr |

| Contacts |

0 (212) 334 94 94, 0 (312) 551 93 37

|

Education

The Ak Yatırım website doesn’t provide education on Forex. However, traders can use educational materials from the website dedicated to TradeAll platforms. To visit it, go to the Our Products and Services section (Ürün ve hizmetlerimiz) and click the “Trading platforms” (İşlem Platformları) button.

The demo account allows traders to test chosen strategies and practice trading without the risk of losing real funds.

Comparison of Ak Yatırım with other Brokers

| Ak Yatırım | Bybit | Eightcap | XM Group | Vantage Markets | |

| Trading platform |

Akbank Internet, Akbank Mobil, Akbank Yatırımcı uygulaması, iDeal, Instant Stock Exchange, TradeAll FX, TradeAll TR, TradeAll UP, TradeAll UP Plus | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, TradingView, ProTrader, Vantage App |

| Min deposit | $50000 | No | $100 | $5 | $50 |

| Leverage |

From 1:1 to 1:10 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No |

| Spread | From 2 points | From 0 points | From 0 points | From 0.8 points | From 0 points |

| Level of margin call / stop out |

100% / 150% | No / 50% | 80% / 50% | 100% / 50% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No |

| Cent accounts | No | No | No | No | No |

Detailed review of Ak Yatırım

Ak Yatırım has many years of experience in providing brokerage services, investment consulting, and fund management. With its help, traders from Turkey get access to domestic and international securities markets and OTC markets. Liquidity is provided by the UK's largest providers and by Swissquote. Orders on Forex, CFDs, futures, and stocks are placed directly on markets and exchanges; opening positions against traders is impossible.

Ak Yatırım by the numbers:

-

28+ years of experience;

-

10 branches;

-

Liquidity from 13 providers;

-

TradeAll platforms are used by over 100,000 clients.

Ak Yatırım is a broker with functional software to enter global financial markets

Since 2013, Ak Yatırım clients have traded on TradeAll proprietary platforms that are regularly updated and modified. The platforms are available in several versions. TradeAll TR is intended for trading securities on Turkish exchanges, and TradeAll UP is for trading on foreign exchanges and the Forex market. Charts and technical analysis of the above platforms are a part of TradingView’s infrastructure. TradeAll UP is available in the TradeAll Up Plus version. This is a widget that allows investors to work with model portfolios and ready-made strategies on stock markets.

TradeAll FX provides for trading over 30 currency pairs, and CFDs on metals, indices, and commodities with leverage up to 1:10. It is based on MetaTrader 5 and provides direct instant access to OTC markets. The platform offers demo accounts, allows traders to conduct technical analysis with built-in indicators, and broadcasts fundamental data via the economic calendar. Its interface is in Turkish.

Useful services offered by Ak Yatırım:

-

Daily newsletters on stock and OTC markets;

-

Analytical reviews of the assets most traded on BIST;

-

Weekly reports on currencies, stock indices (BIST 30, BIST 100, and global indices), and investment funds;

-

Investor calendar with the most important fundamental data;

-

Reports on companies, profit forecasts, and newsfeeds from different sectors;

-

Recommendations on model portfolios.

Advantages:

Ak Yatırım belongs to Akbank which was established in 1948 and whose shares are included in the BIST 30 index;

The broker’s platforms are easy to use and provide all the necessary tools for any trading style or investment;

Support and services are available in Turkish with round-the-clock access for users of TradeAll platforms;

Free broadcasting of daily technical market analysis, fundamental data, news, and option strategies;

Mobile apps allow traders to efficiently manage trades and conduct qualitative market analysis.

Ak Yatırım provides the following services to private investors and companies: capital management, financial planning, general investment consulting, and assistance in choosing model portfolios.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i