AssetsFX Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MetaTrader4

- MetaTrader5

- 2021

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MetaTrader4

- MetaTrader5

- 2021

Our Evaluation of AssetsFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

AssetsFX is a high-risk broker with the TU Overall Score of 2.01 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AssetsFX clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. AssetsFX ranks 403 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

AssetsFX is a broker that offers good trading conditions but is not regulated by financial commissions. It is suitable for experienced traders, as it is not engaged in educational activities.

Brief Look at AssetsFX

AssetsFX is a Forex broker with ECN (Electronic Communication Network) and STP (straight-through processing) execution with high commercial-level liquidity. The main difference between ECN brokers and STP brokers is that ECN firms execute by matching the orders of their clients and STP brokerages execute by passing client orders directly to an external liquidity provider, which is faster and often cheaper.

AssetsFX was founded in 2013 for online currency trading, however, five years later it became a full-fledged brokerage company that offers trading on currencies and CFDs on metals, indices, as well as US and EU stocks. AssetsFX’s services are currently used by more than 180,000 traders globally. The high-quality work of the broker has been recognized with international awards in the field of online trading.

- Instant deposits and fast withdrawals;

- Accounts for various purposes and trading strategies;

- Minimum deposit is $10 on the Standard account and $50 on ECN accounts;

- Spreads are from 0 pips on professional account types;

- A wide range of bonus offers;

- 24/7 multilingual support;

- Various types of partnerships for retail and institutional clients.

- The broker is registered in St. Vincent and the Grenadines, where a license to provide brokerage services is not required;

- Absence of own investment services and offers;

- The company provides neither training for traders nor ready-made training materials.

TU Expert Advice

Financial expert and analyst at Traders Union

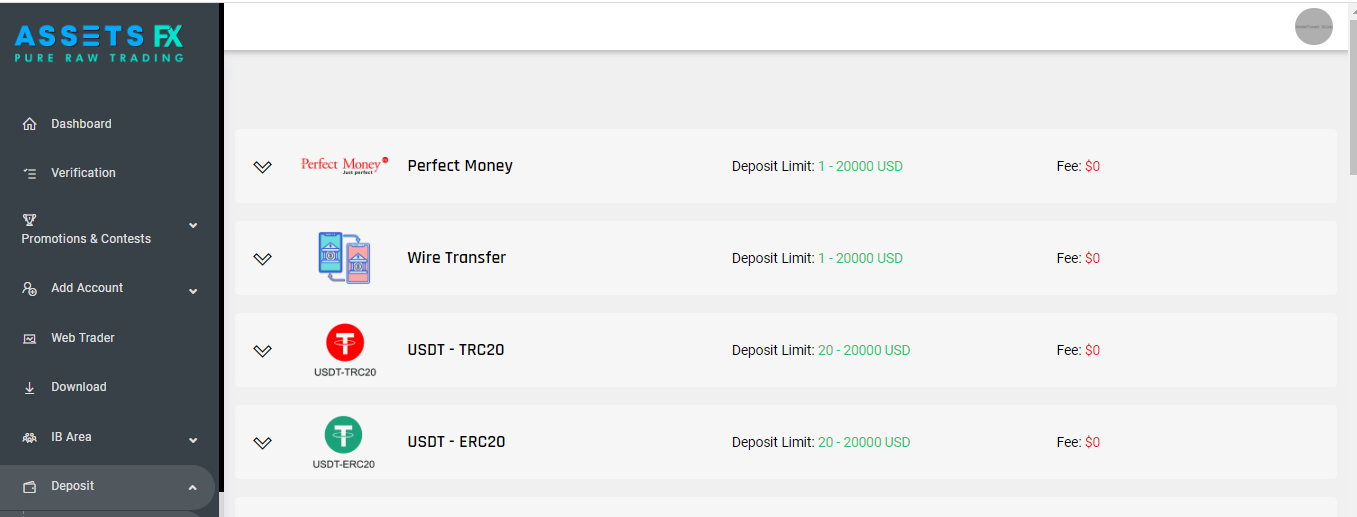

AssetsFX offers a wide range of assets, account types, and bonus offers, as it strives to provide the best trading conditions. Traders can deposit USD using bank transfers, Perfect Money, and cryptocurrency. If traders want to deposit local currencies, they have to make a transfer from an account opened with a local bank. Money sent by bank transfer is credited to your AssetsFX account within one business day, otherwise instantly.

AssetsFX's order execution speed varies depending on the current market situation. For MT4 ECN accounts, the average execution time is 300-500 ms. The company's servers are located in the London LD4 data center and are set to the GMT+1 time zone. Traders cannot change this setting, as at the end of a trading day, the server time must correspond to the New York session close time.

An important advantage of AssetsFX is the availability of cent accounts, which are necessary for both novice and experienced traders who wish to practice or improve their trading strategies, etc. All accounts have negative balance protection, that is, clients cannot lose more funds than they invested even when they use leverage.

AssetsFX Summary

| 💻 Trading platform: | MetaTrader 4 and MetaTrader 5 |

|---|---|

| 📊 Accounts: | Demo МТ4, demo МТ5, cent, Standard, ECN, and ECN Pro |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Perfect Money, bank transfer, Bitcoin, Ethereum, Tether, Ripple, and Litecoin |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pips for ECN, from 1 pips for Standard, and from 2.2 pips for cent |

| 🔧 Instruments: | Forex pairs, commodities, indices, cryptocurrencies, and stocks |

| 💹 Margin Call / Stop Out: | 50%/30% |

| 🏛 Liquidity provider: | 20 major banks and hedge funds, including Barclays, Citi Bank, RBS, Bank of America, etc. |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution |

| ⭐ Trading features: | Scalping, automated trading, and copy trading are allowed |

| 🎁 Contests and bonuses: | Deposit bonus, NFP bonus, cashback, etc. |

AssetsFX offers 4 trading accounts for MT4 and MT5. All provide for trading currencies and CFDs with variable spreads. Bank cards cannot be used for depositing and withdrawing funds. However, the broker allows cryptocurrency transactions. AssetsFX’s clients have access to bonuses, partnership programs, and trades with trading leverage up to 1:500. Automated trading and scalping are allowed.

AssetsFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

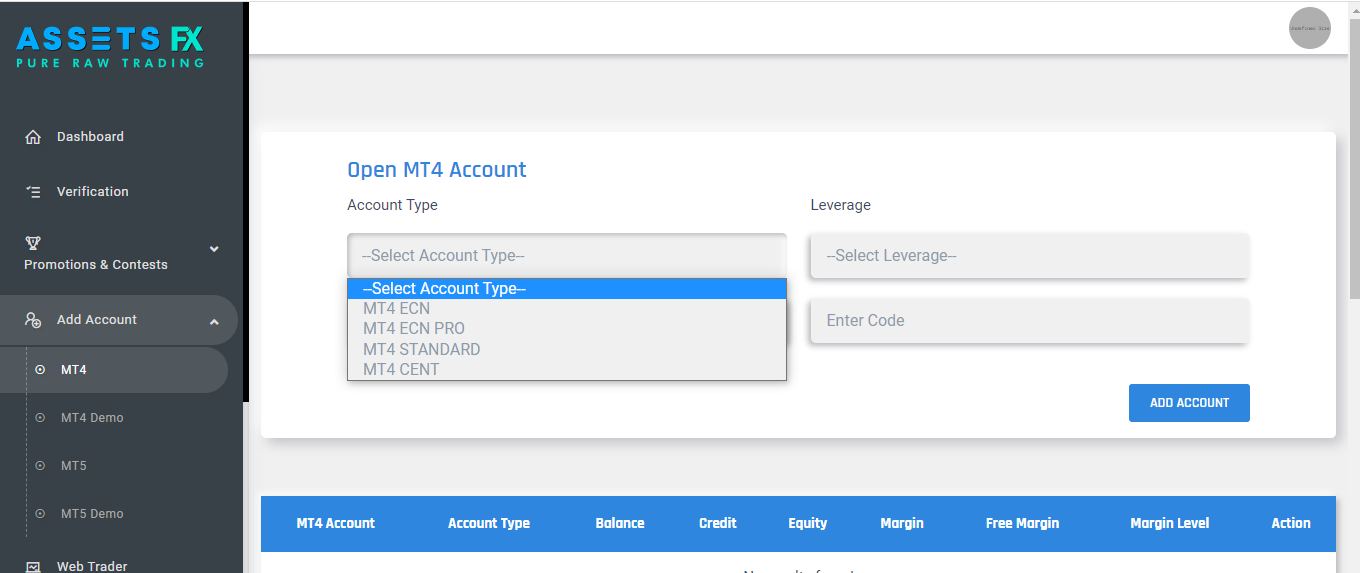

Trading Account Opening

Below is a quick guide to creating a user account on the AssetsFX website:

Click the “Open Account” or “Start Trading” buttons.

Enter your personal information and create a reliable password. A confirmation pin will be sent to the specified email address. After creating an account, you can enter your user account by using the previously indicated email and password.

Features of the AssetsFX’s user account:

Other features of the user account:

Identity verification;

Submitting a withdrawal request;

Enabling two-factor authentication;

Viewing the transaction history;

Information on available bonus offers;

Launching WebTrader, downloading files for installing MT4 and MT5;

IB Area with partner fee statistics.

Regulation and Safety

AssetsFX Global Ltd, which owns the AssetsFX brand, is registered in St. Vincent and the Grenadines. Here the broker does not need a license to provide its services on financial markets.

Advantages

- Client funds are kept in segregated accounts

- Negative balance protection

- This unregulated broker offers higher leverage as compared to some licensed companies

Disadvantages

- Clients of the broker cannot be sure of the complete safety of their funds

- Traders cannot address any regulator in the event of a dispute

- Clients cannot receive coverage from compensation funds if AssetsFX terminates its services

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Cent | $0.22 | Charged by payment systems |

| Standard | $10 | Charged by payment systems |

| ECN | $0 | Charged by payment systems |

| ECN Pro | $0 | Charged by payment systems |

Swaps, which are fees for keeping positions overnight, are charged on all account types, except for Islamic. TU experts have compiled a comparative table of AssetsFX’s average spreads and those of its closest competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$2.6 | |

|

$1 | |

|

$8.5 |

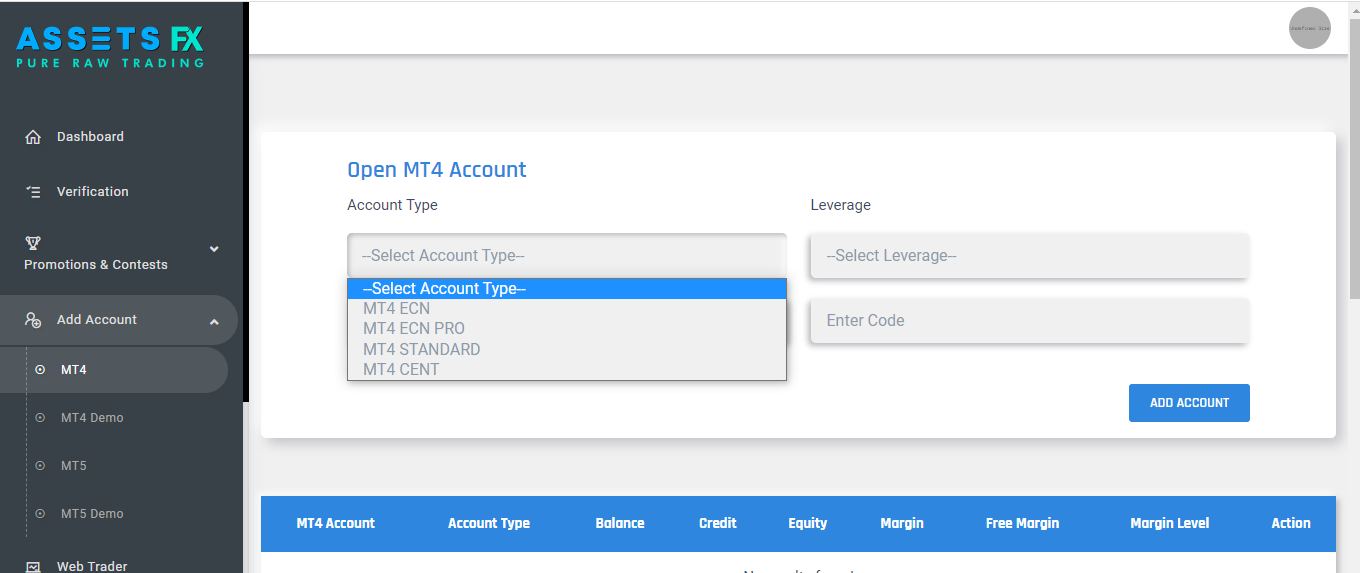

Account Types

AssetsFX offers three account types, namely Standard, cent, and ECN. ECN is available in two variants, which differ in the requirements for the minimum deposit and a fee for the traded lot. Moreover, any of the accounts provided by AssetsFX can be transferred to a swap-free account. It is an account for traders who, for religious reasons, cannot receive income or pay percentage fees.

Account types:

The company offers MT4 and MT5 demo accounts. They can be created in any version of the trading platforms.

AssetsFX offers such account types as cent, STP, and ECN, so traders are not limited in choice and can comfortably trade on favorable conditions.

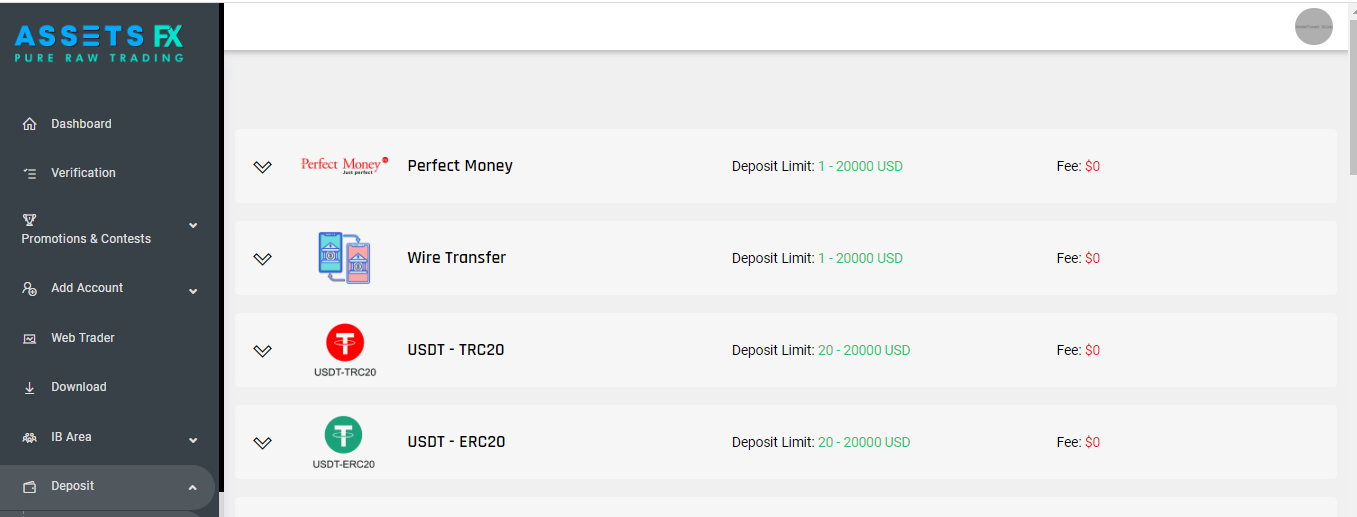

Deposit and Withdrawal

-

Traders can withdraw USD using Perfect Money, international bank transfers, and cryptocurrencies. To withdraw other currencies, use an account opened with a local bank;

-

Funds are credited to your Perfect Money account and crypto wallets instantly but to a bank account they are credited within one business day;

-

The broker does not charge withdrawal fees. Traders pay additional fees to payment systems, banks, and blockchains.

Investment Options

To receive passive income, AssetsFX’s clients can use the standard functionality of the MetaTrader platforms. A partnership program, which is aimed to earn additional income by inviting new clients, is also available. The broker offers neither PAMM nor MAM accounts or other investment solutions.

Passive income options from AssetsFX

AssetsFX does not have its own platforms and services for investors, therefore, in order to earn additional profit, they must use third-party programs. One of these is MetaQuotes, a software developed by the owners of MetaTrader. To get access to investment solutions of this company, become a member of MQL4.community or MQL5.community depending on the trading platform you use. After that, investors can trade:

by signals, that is, automatically copy positions of traders with successful strategies;

using expert advisors (EAs), which are algorithmic trading robots.

Since AssetsFX is not a provider of these services, it is not responsible for the unsuccessful trading of signal providers or EAs. Investors themselves choose who to follow and which programs to connect. AssetsFX does not charge any copy trading or algorithmic trading fees.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from AssetsFX:

Introducing Broker (IB). The size of the IB’s fee depends on the account type. The fee for a full lot on ECN is $4; on ECN Pro, it is $1; on Standard, it is $10; and on a cent account, the fee is $12;

Regional Representative. This is a more advanced type of partnership than IB, as it involves opening a local office under the AssetsFX brand. Regional dealers also earn fees from their clients’ trades up to $10 per lot.

Multi-Level Partnership. Under this program, the partners’ reward is up to 56% of spreads on trades executed by their referrals. Moreover, this type of partnership has a 3-level loyalty program. If a referral's profit is $100-$4,999, the partner’s fee increases by 10%; with a $5,000-$29,999 profit, the fee increases by 15%; and with a profit from $30,000, the fee increases by 20%.

AssetsFX presents tourist trips and gadgets to the most efficient partners. When determining the winners, the size of the total net capital of clients, the number of new clients, and the lots traded by them are taken into account.

Customer Support

The broker’s clients and website guests are served 24/7 in 10 languages.

Advantages

- Many communication channels are available

- Support is multilingual

Disadvantages

- Live chat operators answer general questions without detailing trading conditions

Communication with the brokerage company is available by:

-

live chat on the website;

-

email;

-

phone;

-

WhatsApp.

Forms for requesting support by email and for ordering a callback are available on the website. The broker’s clients can also submit tickets to technical support in their user accounts.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | 59 Dimitriou Kitrou, DAKA BUILDING, 4102 Agios Athanasios, Limassol, Cyprus |

| Official site | https://assetsfx.org/ |

| Contacts |

+35725251492

|

Education

The AssetsFX website does not have a tutorial section. The broker does not train traders. Novice traders in the foreign exchange market can study the FAQs, which contain answers to the most relevant questions of potential clients.

To practice the gained knowledge on trading financial assets, a virtual demo account is available.

Comparison of AssetsFX with other Brokers

| AssetsFX | RoboForex | Pocket Option | Exness | TeleTrade | Forex4you | |

| Trading platform |

MetaTrader4, MetaTrader5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading, MT5 |

| Min deposit | $1 | $10 | $5 | $10 | $1 | No |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:10 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.8 points | From 0.1 points |

| Level of margin call / stop out |

50% / 30% | 60% / 40% | 30% / 50% | No / 60% | 70% / 20% | 100% / 20% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of AssetsFX

AssetsFX is an actively developing and modern company. Since 2014, it has been offering access to trading through MetaTrader 4, cent accounts since 2015, and ECN accounts since 2020. Since 2018, its clients can trade currencies and various types of CFDs, and since 2023, they can trade through MetaTrader 5. AssetsFX accepts and withdraws cryptocurrencies without charging a fee for such transactions.

AssetsFX by the numbers:

-

Over 11 years of experience in the industry;

-

Almost 185,000 clients from 80 countries;

-

Over 30 prestigious online trading awards.

AssetsFX is a broker for novice, experienced, and professional traders

AssetsFX allows each trader to choose an account with priority characteristics such as the tightest spreads possible, loyal requirements for the first deposit, etc. Professional market participants can become VIP clients and receive additional benefits depending on the amount of their deposit. The company offers three account levels, namely Silver for deposits of $3,000-$29,999; Gold, for deposits of $30,000-$99,000; and Platinum, for a minimum deposit of $100,000. Members of the VIP program receive cashback on trading volume increased by 10%-25% and a deposit bonus increased by 20%-35%.

An important advantage of AssetsFX is the opportunity to trade through classic MT4 and MT5. At the same time, traders can choose the most convenient version of the platform for Windows, Mac, Android, and iOS devices. WebTrader is also available.

Useful services offered by AssetsFX:

-

VPS hosting. It provides for round-the-clock trading with minimal delays. The company offers three packages with different characteristics. They are provided free of charge when making deposits of $1,000, $5,000, or $10,000. A paid subscription starts at $30 per month;

-

Contract specification. Information on the pips size, fee per lot, and minimum and average spreads is available for each trading instrument. Swaps for short and long positions are also specified.

Advantages:

A wide range of depositing methods;

Ultra-fast execution without requotes;

Easy and fast registration of the user account;

Trading platforms adapted for Forex traders;

No deposit or withdrawal fees.

The broker does not lower the available leverage for retail traders, which allows them to trade on equal conditions with experienced market participants.

User Satisfaction