According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- WebTrader

- MetaTrader5

- AxiaTrader

- 2022

Our Evaluation of AXIA Investments

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

AXIA Investments is a broker with higher-than-average risk and the TU Overall Score of 4.35 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by AXIA Investments clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

AXIA Investments attracts traders worldwide with an extensive pool of trading instruments and favorable conditions. The choice of five different account types allows its clients to receive the most individualized conditions that meet their personal trading style. AXIA Investments does not impose any restrictions on traders. The minimum deposit is only $500 (relevant for Bronze account types). Also, high leverage of up to 1:400 and adequate stop-outs of 20%-40%, subject to the account, are worth noting. The broker offers educational programs, regular analytics, a range of welcome bonuses, and additional options, including trading signals.

Brief Look at AXIA Investments

AXIA Investments is managed by SmartTool Trading SC Limited, which is regulated by the Financial Services Authority (FSA) of Seychelles. The platform offers five account types. The minimum deposit is $500 and the maximum leverage is 1:400. Available financial instruments are currency pairs, indices, stocks, commodities, and contracts for difference (CFDs). Spreads are floating and it ranges from 0.4 to 1.8 pips, depending on the account type. Trading is carried out through MetaTrader 5 (MT5), WebTrader, and the broker's own trading platform, which is highly appreciated by experts. Additional options include an economic calendar and trading signals, the number of which is determined by the account type. The broker offers a range of bonuses for new clients and an extensive education system, which is considered one of the best in the segment. There are no investment options.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Low entry threshold, intuitive interface of the website and the user account, and a functional trading platform;

- Several account types and hundreds of trading instruments from the five most popular groups;

- There are no trading restrictions, so traders can hedge, scalp, trade news, and use advisors;

- The broker uses innovative IT solutions, providing advanced protection for users’ funds and information;

- Spreads are the market average;

- There are no trading fees and leverage for selected assets is up to 1:400;

- Access to educational programs for traders of different levels, which depend on the account type;

- Technical support works from 9:00 am to 6:00 pm Pacific Time on weekdays and is represented by a call center, email, and live chat.

- The company does not offer options for passive income, there is only a standard referral program;

- Although client support is highly rated, it is available only 5 days a week;

- The broker does not provide its services to residents of the European Economic Area countries, the U.S., British Columbia, and some other regions.

TU Expert Advice

Financial expert and analyst at Traders Union

AXIA Investments is regulated by the Financial Services Authority of Seychelles and is registered in Limassol, Cyprus. The license number and legal address are verified and are real. Analysis of the broker's activities showed that it always fulfills its obligations to clients, its activities are transparent, and there are no problems with taxes. Assessment of the platform’s technical condition confirms that it uses advanced IT solutions, such as virtual servers with increased performance.

The trading conditions of AXIA Investments are quite competitive. The broker offers five account types that differ in leverage, spread, stop out, and other parameters. The minimum deposit is $500, which is higher than the market average, but top brokers almost never have lower rates. The company's clients like its high adaptability and individualization. For example, traders can work through MetaTrader 5, WebTrader, and AxiaTrader, which is its proprietary platform.

There is the minimum trade size of 0.01 lots and market execution, which are standard indicators. Its obvious advantages include free expert market analysis, trading signals (not available on all accounts), and the absence of a trading fee. A large pool of assets is also a plus, as is an extensive education system. It is complimented by traders of all levels. Many lessons are available to unregistered users, which makes it possible to evaluate the approach of AXIA Investments. Few brokers offer this amount of knowledge.

AXIA Investments Trading Conditions

| 💻 Trading platform: | MetaTrader 5, WebTrader, and AxiaTrader |

|---|---|

| 📊 Accounts: | Bronze, Silver, Gold, Platinum, and Diamond |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank cards, bank transfers, and AstroPay |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:400 subject to the account type and the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3-0,7 pips |

| 🔧 Instruments: | Currency pairs, stocks, indices, commodities, and CFDs |

| 💹 Margin Call / Stop Out: | Subject to the asset |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Five account types; Hundreds of financial instruments; Many CFDs; Floating spreads; Own trading platform with a mobile version; Extensive education system; Additional options; No investment |

| 🎁 Contests and bonuses: | Yes |

The minimum deposit depends on the account type. The lowest value on Bronze accounts is $500. To open a Diamond account requires a deposit of at least $250,000. Trading leverage is also determined by the account type. The lowest value is 1:100 and the highest is 1:400. Technical support for all accounts is available from 9:00 am to 6:00 pm on weekdays. Silver and Gold accounts offer personal managers, and applications from Platinum and Diamond account holders are always a priority.

AXIA Investments Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with the broker, register on its official website, verify (confirm) your personal information, open a trading account, and make a deposit. Below is a step-by-step guide for registration.

Go to the broker's website and click the "Start Trading" button in the upper right corner or the "Register Now" button.

Enter your first and last names, email, and phone number. Create a password. Then agree to the terms of service by ticking the box and clicking the "Join Now" button.

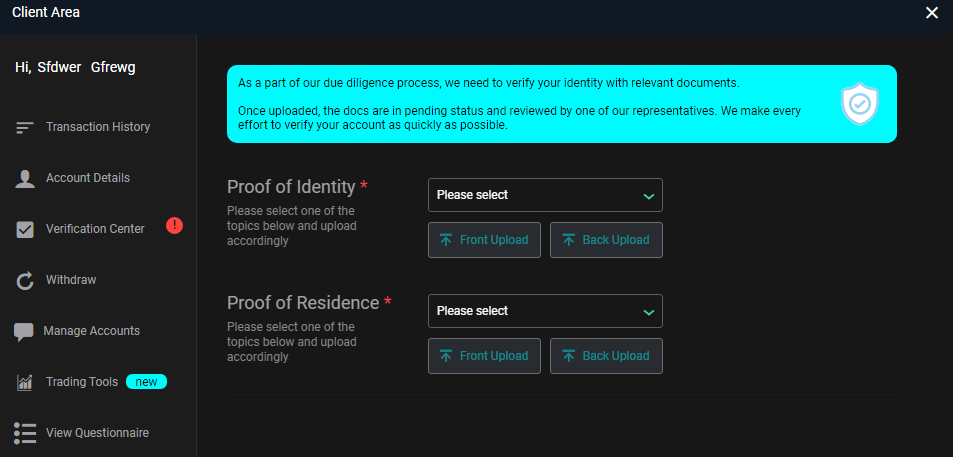

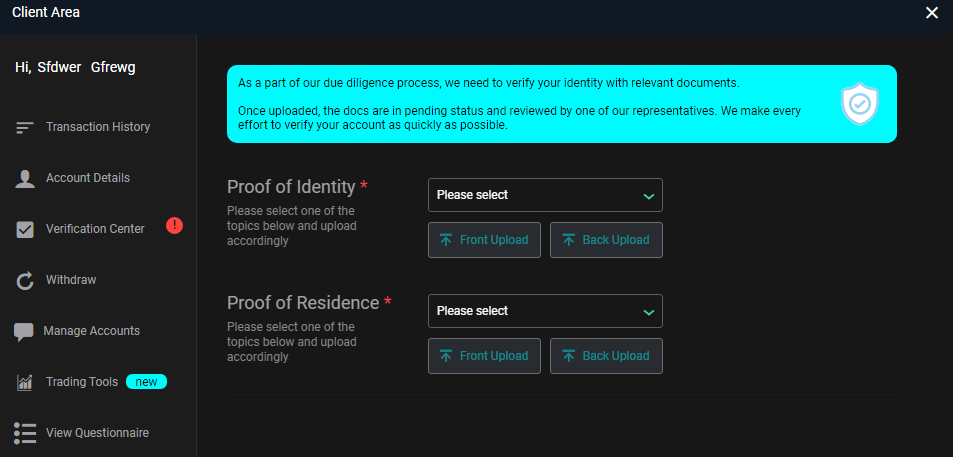

Wait for the registration to complete. After that, you will get access to your user account, but to open a trading account, verification is required. Click the profile button in the upper left corner and select the "Verification Center" section in the context menu, which is marked with a red exclamation mark.

Upload a scan or photo of two documents. The first document must prove your identity (for example, a passport). The second document must confirm your actual place of residence (for example, a receipt for payment). After uploading the scans, wait until the broker's specialists check the information. This may take up to several days.

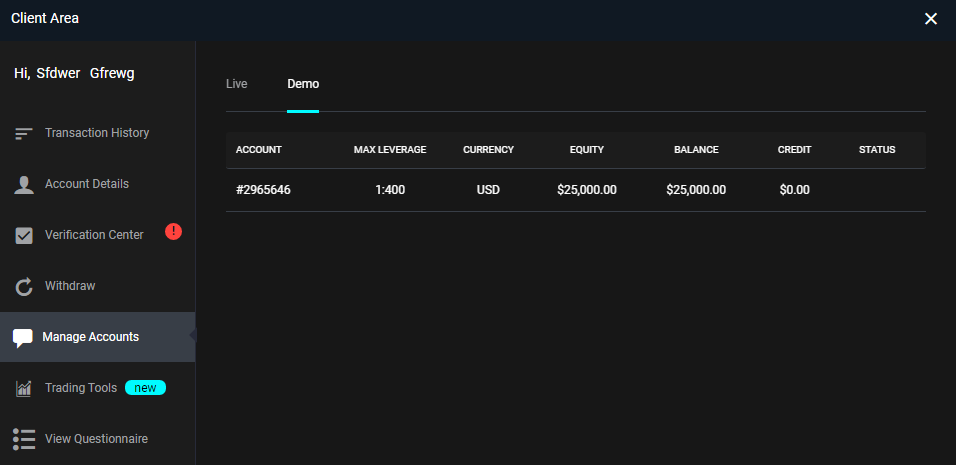

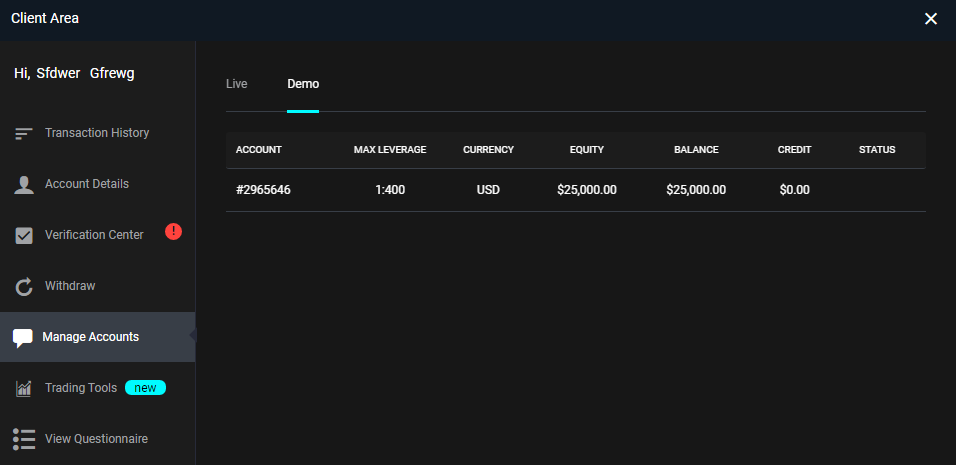

After verification, go to the "Manage Account" menu. Here you can choose the desired account type, including a demo account. To deposit funds to your account, use the "Deposit" button in the main menu.

Additional features of AXIA Investments’ user account:

Transaction History. This section displays all deposits and withdrawals, indicating their status;

Personal details. Here traders indicate their personal information, such as name, date of birth, etc. This information can be changed, if necessary;

Verification center. In this section traders confirm their information by uploading the required documents;

Withdraw and deposit menus. These are needed, respectively, to withdraw funds from the platform and replenish the trader’s balance;

Manage account. In this block, traders have the opportunity to open new accounts. Each trader may have several accounts;

Trading tools. This section provides access to signals (determined by the account type);

Invite a friend. This block is dedicated to the partnership program and it displays data on referrals and bonuses;

Contact us. This section redirects traders to client support.

Regulation and safety

AXIA Investments has a safety score of 8.2/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record of less than 8 years

AXIA Investments Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

AXIA Investments Security Factors

| Foundation date | 2022 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker AXIA Investments have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of AXIA Investments with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, AXIA Investments’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

AXIA Investments Standard spreads

| AXIA Investments | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,7 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,7 | 1,4 | 0,5 |

Does AXIA Investments support RAW/ECN accounts?

As we discovered, AXIA Investments does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with AXIA Investments. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

AXIA Investments Non-Trading Fees

| AXIA Investments | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0,5 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The first step is choosing an account type. It determines many trading parameters, including the minimum deposit, available leverage, stop-outs, and spreads. AXIA Investments’ accounts also affect the quantity/quality of trading signals provided by the broker. There is also the possibility of connecting additional financial instruments, plus an excellent Knowledge center. Basic education is offered for initial account types, while life hacks and deep work with the market are available only to users of Platinum and Diamond accounts.

Account types:

The account type also affects the size of the welcome bonus, the availability of signals via WhatsApp, and the possibility to contact the trading floor directly.

Deposit and withdrawal

AXIA Investments received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

AXIA Investments offers limited payment options and accessibility, which may impact its competitiveness.

- Bank wire transfers available

- No deposit fee

- Bank card deposits and withdrawals

- Low minimum withdrawal requirement

- Limited deposit and withdrawal flexibility, leading to higher costs

- Withdrawal fee applies

- Minimum deposit above industry average

What are AXIA Investments deposit and withdrawal options?

AXIA Investments offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire. This limitation may restrict flexibility for users, making AXIA Investments less competitive for those seeking diverse payment options.

AXIA Investments Deposit and Withdrawal Methods vs Competitors

| AXIA Investments | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are AXIA Investments base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. AXIA Investments supports the following base account currencies:

What are AXIA Investments's minimum deposit and withdrawal amounts?

The minimum deposit on AXIA Investments is $500, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact AXIA Investments’s support team.

Markets and tradable assets

AXIA Investments provides a standard range of trading assets in line with the market average. The platform includes 600 assets in total and 60 Forex currency pairs.

- Copy trading platform

- Crypto trading

- 60 supported currency pairs

- Futures not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by AXIA Investments with its competitors, making it easier for you to find the perfect fit.

| AXIA Investments | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 600 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products AXIA Investments offers for beginner traders and investors who prefer not to engage in active trading.

| AXIA Investments | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical support is conceptually important for every broker because all traders can face situations that they cannot resolve on their own. When that happens, clients should be able to contact a competent specialist who can quickly solve the problem. AXIA Investments’ support is represented by a call center, email, and live chat. All channels are available from 9:00 am to 6:00 pm Pacific Time, but only on weekdays.

Advantages

- Non-clients of the broker can contact technical support

- All communication channels respond quickly within working hours

- Traders get expert help regardless of the account type

Disadvantages

- Client support is not available from 6:00 pm to 9:00 am on weekdays and it does not work on weekends

If you have any questions that you cannot answer on your own, contact the broker's technical support using the following communication channels:

-

general call center (additional phone numbers are indicated in the website footer);

-

email;

-

live chat on the website and in the user account.

AXIA Investments has its official profiles on Instagram, Facebook, and Twitter. Subscribe to them to learn the broker’s news, bonuses, promotions, and special offers on time.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address |

Suite 3, Global Village, Jivan's Complex, Mont Fleuri, Mahe, Seychelles, Archiepiskopou Makariou III, 198 Marinos Court, 1st Floor, Flat/Office 13, 3030, Limassol, Cyprus |

| Official site | https://axiainvestments.com/ |

| Contacts |

+965 22067388

|

Education

It is in the interests of traders to improve their own skills. They need to constantly learn new strategies and trading methods. Many brokers who are interested in increasing their clients’ loyalty, offer educational systems for them. The AXIA Investments Knowledge Center is considered one of the most advanced. The broker has a huge number of useful materials that are presented in different formats, from structured articles to video instructions.

The AXIA Investments Knowledge Center offers a full course of study, ranging from the basics of the interbank market to an in-depth study of individual strategies and instruments. The caveat is that the available number of materials is determined by the account type. For example, for Bronze account holders only basic free materials are available, while Gold accounts offer an extended list of guides. Full training is available only to Platinum and Diamond account holders.

Comparison of AXIA Investments with other Brokers

| AXIA Investments | Eightcap | XM Group | RoboForex | AMarkets | InstaForex | |

| Trading platform |

MetaTrader5, WebTrader, AxiaTrader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, AMarkets App | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $500 | $100 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:400 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.4 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 50% / 20% | 30% / 10% |

| Order Execution | Instant Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed review of AXIA Investments

SmartTool Trading SC Limited is well known in the world market. AXIA Investments is not its only project. Specifically, AXIA Investments is a platform with a strong financial and technological basis, which can offer its clients optimal trading conditions, impeccable performance, and high-quality support. Its conceptual advantage is the opportunity to choose one of five account types, which are adapted to a certain skill level of traders and offer the appropriate instruments. That is why AXIA Investments is considered a universal broker, which is equally convenient for both novice traders and professionals.

AXIA Investments by the numbers:

-

5 account types;

-

3 trading platforms;

-

Leverage is up to 1:400;

-

Stop out is from 20%;

-

Welcome bonus is up to 25%.

AXIA Investments is a professional broker for working with various trading instruments

Sometimes brokerage companies focus on one group of assets, usually, this is currency pairs. Sometimes stocks and/or indices are added to them. Many companies work only with CFDs. Although CFDs have their advantages, most traders tend to work with different assets. The advantage is that there is no need to limit yourself by choosing from a limited number of instruments. In addition, the more assets there are, the more diverse the investment portfolio is. This directly determines the level of diversification of trading risks. Many traders like AXIA Investments because it offers an extensive pool of instruments from five groups.

Useful services offered by AXIA Investments:

-

Financial news. The broker's press office regularly updates its newsfeeds. The most important events from the world of politics and economics are not just briefly described here, but experts make their forecasts based on them;

-

Economic calendar. This is a typical service that reflects the milestones determining the state of global markets. All traders use the calendar data as a basis for technical analysis;

-

Trading signals. The broker provides its clients with free trading signals. The number and quality of these are determined by the account type, the best opportunities are available for Diamond accounts.

Advantages:

The broker has clear account parameters, simple registration, and fast verification;

The company works transparently, that is traders learn about all fees in advance, before making a transaction;

Traders do not need to limit themselves, as the broker offers three trading platforms and hundreds of assets from the most popular groups;

AXIA Investments has objectively competitive conditions. There are no trading fees, high leverage, and adequate stop-outs and margin calls;

The broker helps its clients to improve via an extensive education system, which includes text and video guides.

Most of the benefits are universal, that is, they apply to all account types. For example, there is no trading fee. But some advantages are available only to premium account types. For example, only Diamond account holders receive unlimited trading signals.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i