According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MetaTrader4

- MetaTrader5

- CRYPTOS

- BigBoss QuickOrder

Our Evaluation of BigBoss

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

BigBoss is a high-risk broker with the TU Overall Score of 2.83 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by BigBoss clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker.

Brief Look at BigBoss

BigBoss is a broker offering access to Forex, CFD, and cryptocurrency markets through MetaTrader platforms and the proprietary CRYPTOS platform. While registered in the Seychelles, the company operates in the Philippines. BigBoss services clients worldwide, except for certain countries including the U.S., Iran, Malaysia, and Japan. Currently, it boasts over 200,000 clients with an annual trading volume exceeding $1 trillion. The broker provides various account types, including options for automated trading and funds management. BigBoss allows its clients to implement any trading strategy and to use Expert Advisors (EAs). However, as an unregulated entity, it does not ensure client investment protection.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Extensive choice of CFDs and currency pairs;

- High leverage up to 1:1111-1:2222 depending on the instrument and the account type;

- Diverse account types, including a dedicated account for trading crypto CFDs;

- Floating spreads and competitive commissions per lot;

- Cryptocurrency deposits can be made in any amount, while other deposit methods require a minimum of $50.

- Limited educational materials;

- No CFDs on stocks or ETFs;

- Unregulated status.

TU Expert Advice

Financial expert and analyst at Traders Union

BigBoss offers access to trading Forex and CFDs. It also provides a proprietary platform for trading crypto CFDs. The broker offers various account types featuring variable leverage and negative balance protection. BigBoss utilizes a multi-execution model, combining NDD (No Dealing Desk), STP (Straight-Through Processing), and ECN (Electronic Communication Network) technologies to attract traders of different skill levels.

BigBoss offers floating spreads and competitive commissions per lot. Additionally, the broker provides fee-free accounts and swap-free options for Muslim traders. Moreover, BigBoss offers various ongoing bonus programs that allow both new and existing clients to earn additional trading funds and potentially reduce trading fees.

BigBoss offers MT4 and MT5 accounts denominated in USD, JPY, and popular cryptocurrencies. Its clients can choose from a variety of deposit and withdrawal methods and can open accounts for automated trading. The broker also provides a loyalty program and a wide range of trading instruments.

- You want to trade crypto CFDs on a specialized platform. BigBoss offers a web platform tailored for digital assets, enabling traders to both trade and invest in cryptocurrencies.

- You are seeking fee-free account types. The Standard account only charges spreads and has no commissions per lot. BigBoss clients can also trade crypto CFDs without commissions provided they do not engage in high-frequency trading.

- You prefer high leverage. BigBoss offers leverage up to 1:1111-1:2222 for currency trading, depending on the account type, with negative balance protection.

- You need a regulated broker. BigBoss currently does not hold any active licenses. Additionally, it is not a member of any investor compensation funds or insurance schemes.

BigBoss Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4 (MT4), MetaTrader 5 (MT5), BigBoss QuickOrder, and CRYPTOS |

|---|---|

| 📊 Accounts: | Demo МТ4, Demo МТ5, Standard, Pro Spread, Deluxe, and CRYPTOS |

| 💰 Account currency: | USD, JPY, BTC, USDT, ETH, EXC, XRP, RSVC, and BXC |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, bitwallet, STICPAY, Peska, BXONE, and cryptocurrencies |

| 🚀 Minimum deposit: |

Cryptocurrencies — any amount; Other methods — $50 |

| ⚖️ Leverage: | Up to 1:2222 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: |

Forex and CFDs on cryptocurrencies — 0.01 lots; Other instruments — 0.1 lots |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | Forex and CFDs on metals, energies, indices, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 50%/20% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Floating spreads; Fixed and variable leverage. |

| 🎁 Contests and bonuses: | Yes |

BigBoss is focused on serving active traders. If a Forex account with the broker remains inactive for 120 days without any trading or fund transfers, a monthly inactivity fee of $5 is charged as long as there are funds in the account. Once the balance reaches zero, the account is closed automatically.

The broker offers accounts for trading on popular MT4 and MT5 platforms, as well as a specialized CRYPTOS account for trading crypto CFDs. The proprietary CRYPTOS platform, originally launched in 2013 as FOCREX, has been significantly upgraded. It now features a 100-fold increase in data processing speed, additional liquidity providers, and a user interface optimized for desktop and mobile devices. BigBoss aims to expand its offering to 1,000 trading pairs within the next three years.

The minimum initial deposit depends on the chosen payment method. For bank transfers, the minimum is $1,000. Bank card deposits require a minimum of ¥30,000 or $300. For bitwallet, STICPAY, and Peska, the minimum is ¥10,000 or $100, and for BXONE, it is ¥5000 or $50. There are no minimum deposit requirements for cryptocurrency deposits. Leverage available for Forex trading varies based on the specific currency pair and the account type.

BigBoss Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Opening an account with BigBoss can be done on its official website by following the instructions below:

Click “Open Account”.

Choose the account type, base currency, and trading platform.

Fill in the registration form with your first and last names, date of birth, country of residence, and a valid email address.

Sign into your user account by entering your login credentials sent by email.

Verification can be completed immediately or later, before requesting a withdrawal.

Features of BigBoss’s user account allow traders to:

-

make deposits and withdrawals;

-

open demo and additional trading account types;

-

install trading platforms;

-

manage the partnership program;

-

generate a transaction history.

Regulation and safety

BigBoss has a safety score of 1.5/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Negative balance protection

- Not tier-1 regulated

- Not regulated

- Track record of less than 8 years

BigBoss Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

BigBoss is Not a Regulated Broker

Commissions and fees

The trading and non-trading commissions of broker BigBoss have been analyzed and rated as High with a fees score of 4/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- Above-average Forex trading fees

- Inactivity fee applies

- Deposit fee applies

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of BigBoss with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, BigBoss’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

BigBoss Standard spreads

| BigBoss | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,9 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 2,3 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

BigBoss RAW/ECN spreads

| BigBoss | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,6 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with BigBoss. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

BigBoss Non-Trading Fees

| BigBoss | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | |

| Withdrawal fee, % | 0 | 0 | |

| Withdrawal fee, USD | 0 | 0-15 | |

| Inactivity fee ($, per month) | 5 | 0 | 0 |

Account types

The broker provides a range of account types, including NDD STP and NDD STP/ECN for traditional markets, and a dedicated account type for cryptocurrency trading. Base currencies for Forex account types include USD and JPY, while cryptocurrency accounts are denominated in various popular digital coins.

BigBoss allows its clients to open multiple trading accounts denominated in various currencies. However, the broker may close some accounts if a client holds too many active ones. Upon registration, traders are provided with a primary account and can subsequently open additional account types through their user accounts. For those seeking to practice on MetaTrader platforms, a demo mode is available.

Deposit and withdrawal

BigBoss received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

BigBoss offers limited payment options and accessibility, which may impact its competitiveness.

- Bank card deposits and withdrawals

- BTC available as a base account currency

- Bank wire transfers available

- Minimum deposit below industry average

- Only major base currencies available

- Wise not supported

- PayPal not supported

What are BigBoss deposit and withdrawal options?

BigBoss offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire, BTC, USDT, Ethereum. This limitation may restrict flexibility for users, making BigBoss less competitive for those seeking diverse payment options.

BigBoss Deposit and Withdrawal Methods vs Competitors

| BigBoss | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are BigBoss base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. BigBoss supports the following base account currencies:

What are BigBoss's minimum deposit and withdrawal amounts?

The minimum deposit on BigBoss is $50, while the minimum withdrawal amount is $. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact BigBoss’s support team.

Markets and tradable assets

BigBoss offers a limited selection of trading assets compared to the market average. The platform supports 80 assets in total, including 42 Forex pairs.

- 42 supported currency pairs

- Crypto trading

- Indices trading

- No ETFs

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by BigBoss with its competitors, making it easier for you to find the perfect fit.

| BigBoss | Plus500 | Pepperstone | |

| Currency pairs | 42 | 60 | 90 |

| Total tradable assets | 80 | 2800 | 1200 |

| Stocks | No | Yes | Yes |

| Commodity futures | No | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products BigBoss offers for beginner traders and investors who prefer not to engage in active trading.

| BigBoss | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Additional Trading Tools

BigBoss clients can enhance their trading experience by utilizing various tools, including:

-

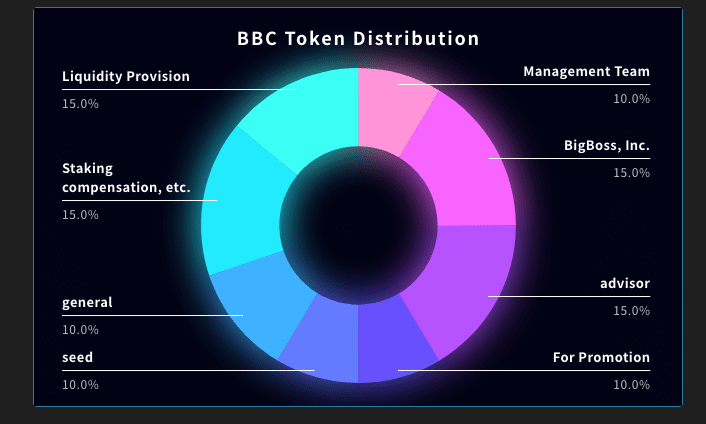

BigBoss’s native coin (BBC). BBC can be traded, staked for passive income, and used to increase leverage, upgrade IB levels, and reduce trading fees on the CRYPTOS platform.

BigBoss’s useful tools — BBC native coin -

Credit bonus. This increases the trading balance, allowing traders to open and hold more positions while maintaining a higher margin level. The bonus amount varies depending on the amount of deposited BBC.

BigBoss’s useful tools — Credit bonus -

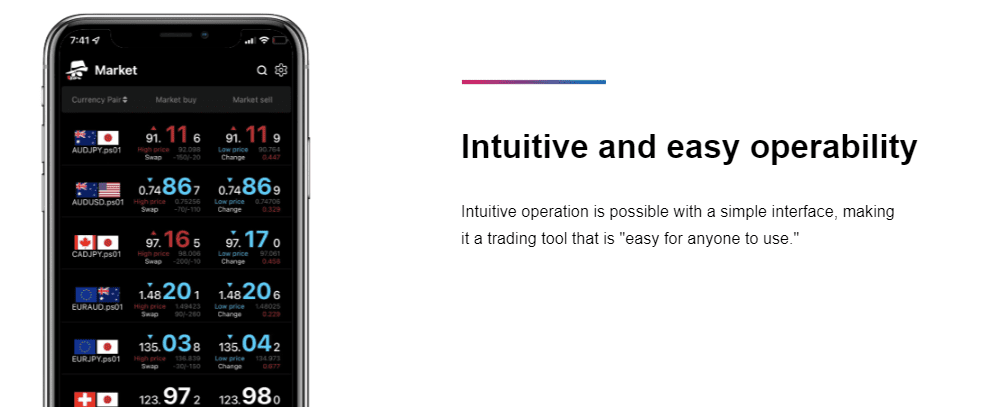

BigBoss QuickOrder. It is the proprietary mobile app that allows users to manage MT4 and MT5 accounts, perform one-click trading, and conduct in-depth technical analysis through a single interface. The app is available for both Android and iOS devices.

BigBoss’s useful tools — BigBoss QuickOrder app -

Newsfeed. The newsfeed is available in the user account and on the broker's website. It is updated regularly with important news regarding changes to trading hours in various countries or trading conditions at BigBoss.

BigBoss’s useful tools — Newsfeed

Customer support

BigBoss offers client support available 24/7 via email and chatbot.

Advantages

- Chatbot provides comprehensive information on trading conditions

- Multiple communication channels are available

- Support is multilingual

Disadvantages

- Chatbot does not provide live person communication, but offers a feedback form

- No callback option is offered

- Email responses are typically provided within 24 hours

Available communication channels include:

-

Call center;

-

Email;

-

Facebook and X (Twitter);

-

Feedback form.

Note that the operational office of BigBoss is located in the Philippines, not at the registered address.

Contacts

| Registration address | Vistra Corporate Services Centre, Suite 23, 1st Floor, Eden Plaza, Eden Island, Mahe, Seychelles |

|---|---|

| Official site | https://www.bigboss-financial.com/ |

| Contacts |

+63 (32) 236 8910

|

Education

BigBoss does not provide comprehensive trading education. Its website offers brief video tutorials on downloading and using trading platforms. Additionally, the FAQ section may be helpful for novice traders.

Unlike other brokers, BigBoss does not offer training seminars or webinars for novice traders.

However, desktop, mobile, and web versions of MetaTrader platforms allow users to open a demo account for practice trading with virtual funds.

Comparison of BigBoss with other Brokers

| BigBoss | Eightcap | XM Group | RoboForex | Vantage Markets | IC Markets | |

| Trading platform |

MetaTrader4, MetaTrader5, CRYPTOS, BigBoss QuickOrder | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, TradingView, ProTrader, Vantage App | MT4, cTrader, MT5, TradingView |

| Min deposit | $50 | $100 | $5 | $10 | $50 | $200 |

| Leverage |

From 1:1 to 1:2222 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 1.2 point | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 50% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of BigBoss

BigBoss offers two methods to open a trading account. The standard method requires immediate verification upon user account creation. The quick method allows traders to start trading, with KYC verification to be completed later, before the first withdrawal.

Traders with multiple accounts can transfer funds between them in USD, JPY, and BTC. Transfers are possible between Forex and cryptocurrency accounts. All these operations can be performed in the user account, which provides all features for managing and monitoring funds. Client support is always ready to provide detailed transaction history.

BigBoss is a broker offering trading with a range of leverage options

BigBoss employs a customized leverage policy. Certain assets are traded with fixed leverage. For example, leverage for CFDs on cryptocurrencies is 1:50; for CFDs on Nikkei 225 index it is 1:200; and for exotic currency pairs, CFDs on energies, and other indices, it is 1:100.

Leverage for major and minor currency pairs, and CFDs on metals, is variable and may change throughout the trading day. After 21:00 (GMT+0) in summer or 22:00 (GMT+0) in winter, margin requirements are automatically updated for each account. A higher account balance results in a lower maximum leverage. For example, with a $10,000 balance, traders on Standard and Pro Spread accounts can use leverage up to 1:1111 or 1:2222 on the Deluxe account. If the balance exceeds $100,000, the broker limits leverage to 1:100.

Big Boss’s additional tools are:

-

Zero-cut. This feature, available on the Deluxe account, prevents the automatic funding of an account balance that has reached zero. This simplifies funds management and helps to mitigate aggressive trading risks.

-

Blog. It features important company news and updates to its terms and conditions that may affect registered traders.

-

YouTube channel. It provides video tutorials on using trading platforms and on the basics of Forex trading.

-

Loyalty program. Five levels based on the number of trading days are available. Traders earn BBC that can be used for increased leverage, withdrawals, and other benefits.

Advantages:

Simple account opening procedure with the support for diverse deposit methods;

Negative balance protection;

Trading CFDs on cryptocurrencies is available on both MetaTrader and the proprietary platforms;

CFDs on metals, along with major and minor currency pairs are traded with variable leverage up to 1:2222;

Copy trading and algorithmic strategies are allowed;

Deposit and trading bonuses are available for both new and existing clients;

Account types with NDD STP and NDD STP/ECN execution models are provided.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i