According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $20

- Mobile Apps

- Web

- Proprietary platform

- FCA

- CySEC

- ASIC

- FSA

- SCB

- 2007

Our Evaluation of Capital.com

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Capital.com is a moderate-risk broker with the TU Overall Score of 6.69 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Capital.com clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The Capital.com broker is universal. It provides the same trading conditions for both experienced traders and beginners. On the company's website, you may find training materials and the opportunity to receive passive income through an affiliate program.

Brief Look at Capital.com

Capital.com (Capital) is a British Forex broker that provides its services to traders and investors worldwide. The company's activities are regulated by five bodies: CySEC — the Cyprus Securities and Exchange Commission ( 319/17), the FCA — the UK Financial Conduct Authority ( 793714), ASIC ( AFSL 513393), FSA (AFSL SD101) and SCB (SIA-F245). The company is audited by Deloitte and cooperates with two large European banks (Raiffeisen, RBS).

Capital is ready to cooperate with active traders regardless of their experience, as well as with active investors who use shares of various companies for their work.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Fast registration procedure, which takes no more than three minutes.

- Multiple ways to deposit and withdraw funds.

- Customer funds are held in segregated accounts.

- A large number of training materials and tools for market research and study.

- Multilingual support department - the company provides support in 13 languages.

- A wide range of trading instruments.

- The broker does not offer clients investment programs such as PAMM accounts or copying trades.

- Trading on an account without identity verification is available only for 15 days from the first deposit. For further work, the trader must verify the account.

TU Expert Advice

Financial expert and analyst at Traders Union

Capital.com is a trusted broker that is controlled by two reputable financial regulators: the Cyprus Securities and Exchange Commission (CySEC) and the UK Financial Conduct Authority (FCA). Capital.com is audited by an independent company, Deloitte, and clients’ funds are kept in segregated accounts in European banks and protected by compensation funds.

The company offers traders only one trading account, which gives access to all training materials, trading tools, and indicators. Capital is focused on active traders and investors, offers a wide range of assets to work with, and does not provide services for copying trades and other methods of generating passive income. Additional earnings here are possible only by participating in the referral program or winning contests.

The broker cooperates with clients from different countries and offers a choice of languages on the main page of the site. The support service is multilingual, providing help in 13 languages.

- You prefer a user-friendly platform with diverse market access. This broker offers a platform with a simplified and easy-to-navigate trading interface. Further, users can trade over 3,700 of the world's biggest markets, including DAX 40, gold, and Apple shares, all within one app.

- You prefer AI-powered trading insights. This broker offers an AI-powered trading bias detection system that can help you enhance your trading skills.

- Regulatory assurance is crucial for you. This broker is regulated by reputable authorities, including FCA, CySEC, ASIC, FSA, and SCB, ensuring a secure trading environment.

- You are averse to trading leveraged assets. Many traders aren’t comfortable with CFDs and other leveraged products given their inherent risks, including magnified losses and potential exposure to counterparty risk. However, for this broker, such assets are among the core focus groups.

Capital.com Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Web, Mobile application, MT4, Tradingview |

|---|---|

| 📊 Accounts: | Live-account, demo account |

| 💰 Account currency: | USD, EUR, GBP, PLN, RUB |

| 💵 Deposit / Withdrawal: | Bank transfer, PayPal, credit and debit card payment systems, iDeal, 2c2p, AstropayTEF, Sofort, Giropay, Multibanko, Trustly, Przelewy24 |

| 🚀 Minimum deposit: | USD 20, EUR 20, GBP 20, PLN 100 |

| ⚖️ Leverage: | FCA - 1:30, CYSEC/ASIC - 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | 2,813 stocks, 239 cryptocurrencies, 138 currency pairs, 27 indices, 38 commodities, futures |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Trading Contracts for Difference (CFDs) |

| 🎁 Contests and bonuses: | Yes |

Capital provides traders with optimal trading conditions for clients from different countries. The minimum deposit on a real account is USD/EUR/GBP 20 or PLN 100. The same currencies are available for replenishment and withdrawal of funds through bank cards or electronic payment systems. Leverage and spread vary depending on the trading instrument used. When the amount on the account reaches 100% of the set margin, the client receives a warning; upon reaching 50%, trades are automatically closed.

Capital.com Key Parameters Evaluation

Video Review of Capital.com

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with the Capital.com broker, you need to follow a few simple steps.

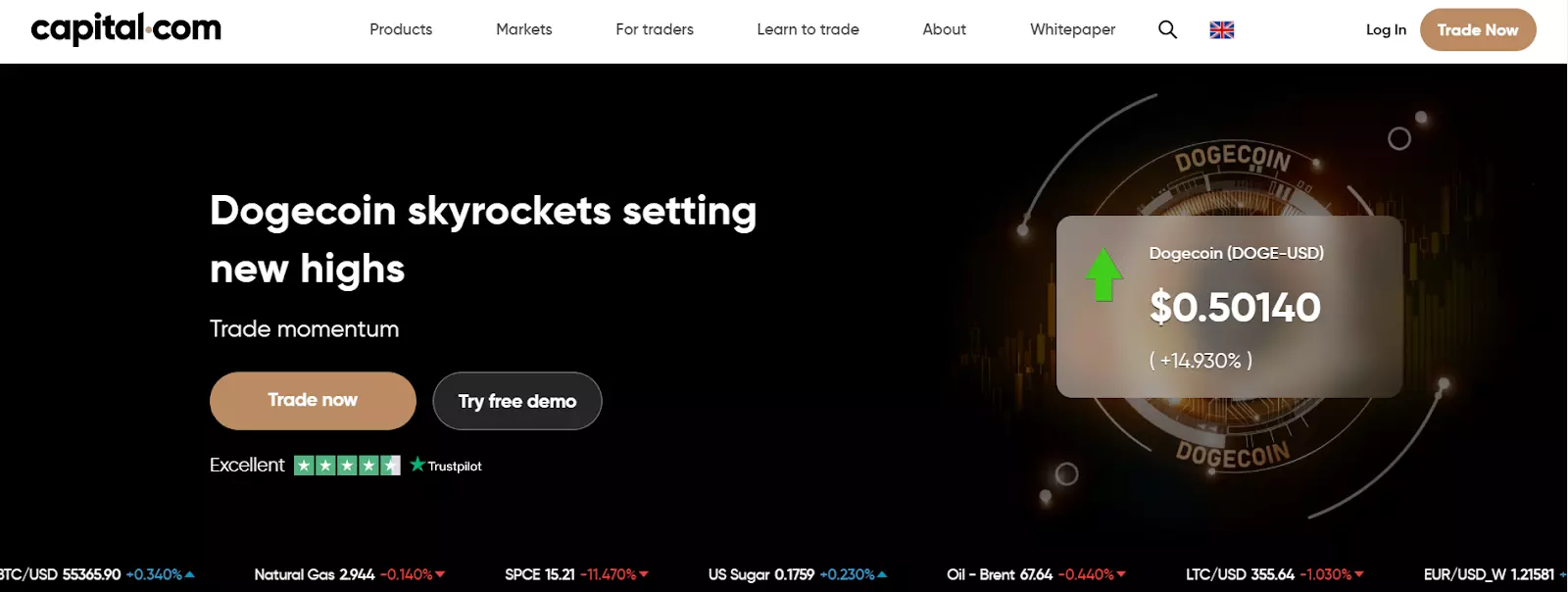

Open the official website of the Capital.com broker. On the main page in the upper right corner, there is a button labeled "Create an account". Click on it to start registration.

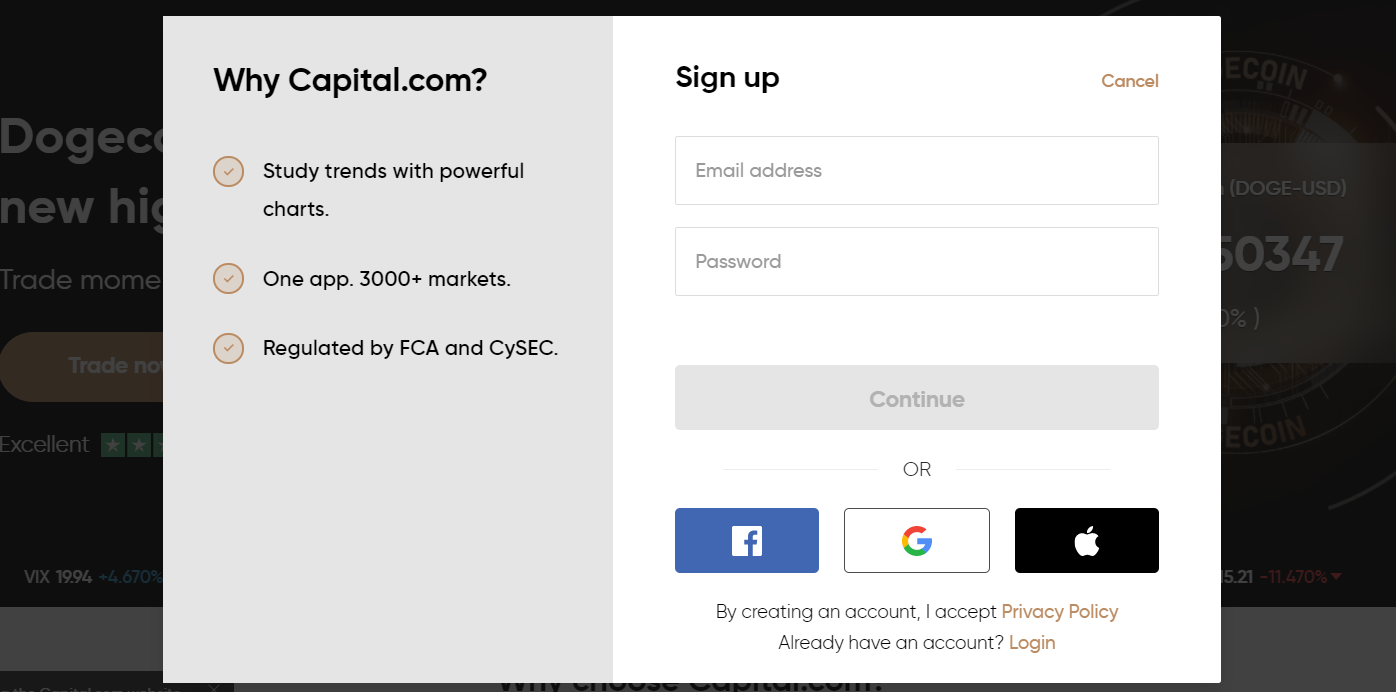

In the window that opens, enter your valid email address and create a password that you will use to enter your personal account on the Capital.com website. You can also register using your existing Facebook, Google, or Apple accounts.

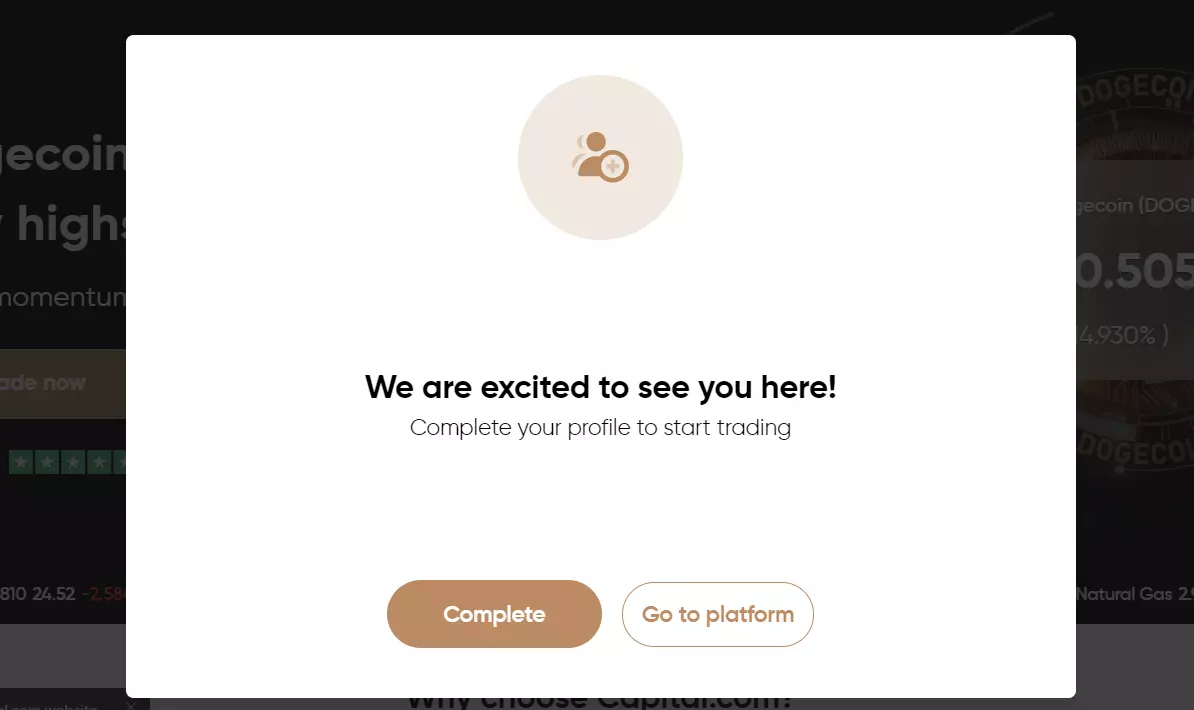

Now you can go directly to the Capital.com trading platform by clicking the “Go to the platform” button or continue registration through the “Finish” button.

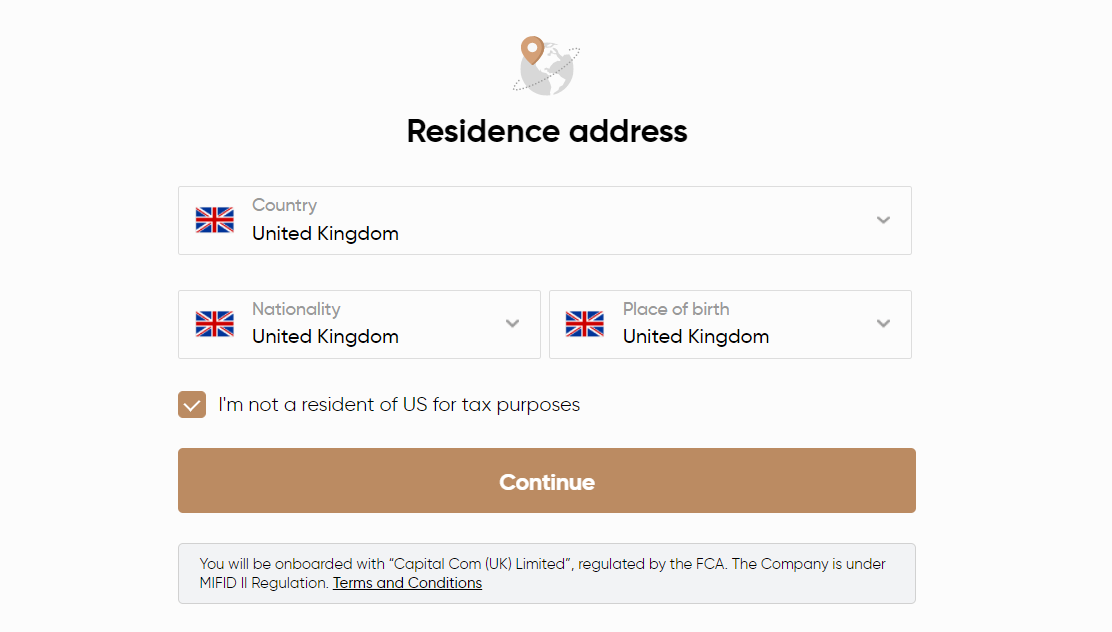

If you selected the "Finish" option, continue to enter your personal information. In this window, indicate your nationality, country of citizenship, and residence.

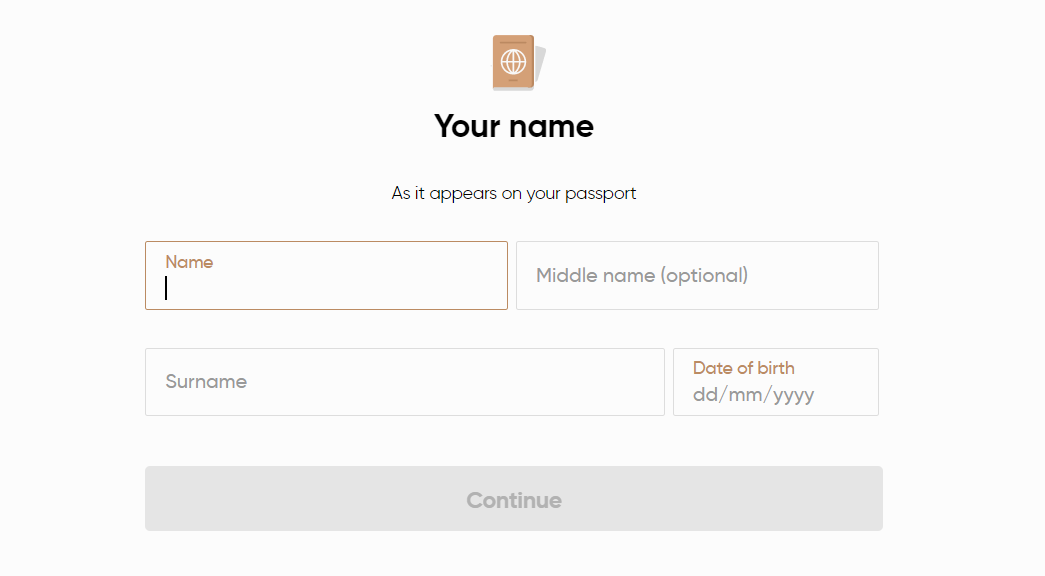

Enter the name that appears on your passport. You can specify the patronymic, but it is not necessary.

In the next window, enter the city where you live, select the street, then specify the house and apartment number.

Enter your current phone number.

Select the currency in which you want to open an account: USD, EUR, or GBP. The PLN currency is available for residents of specific countries.

Read the terms of use of the site and company policy, then click on the Agree button.

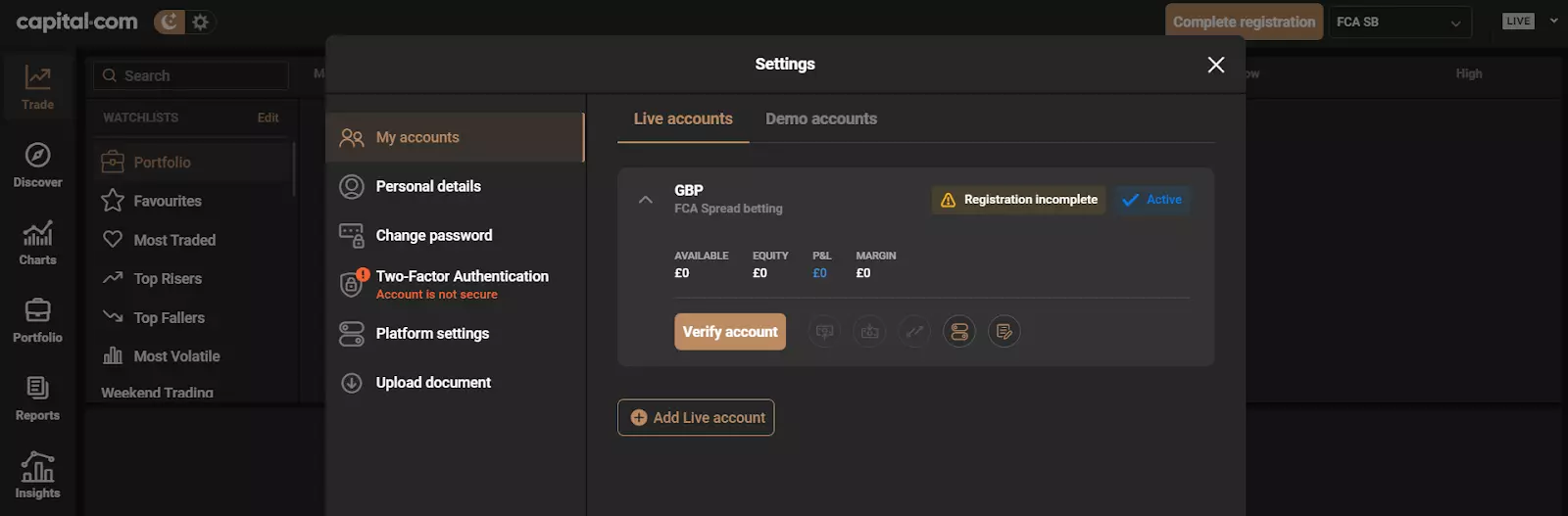

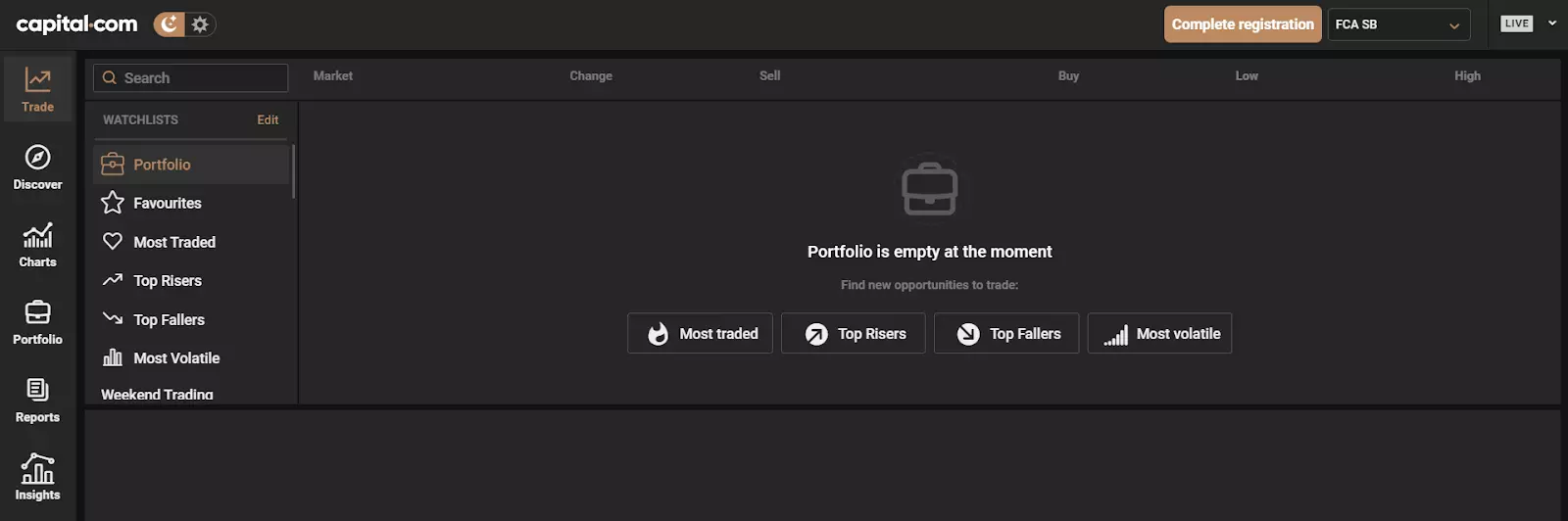

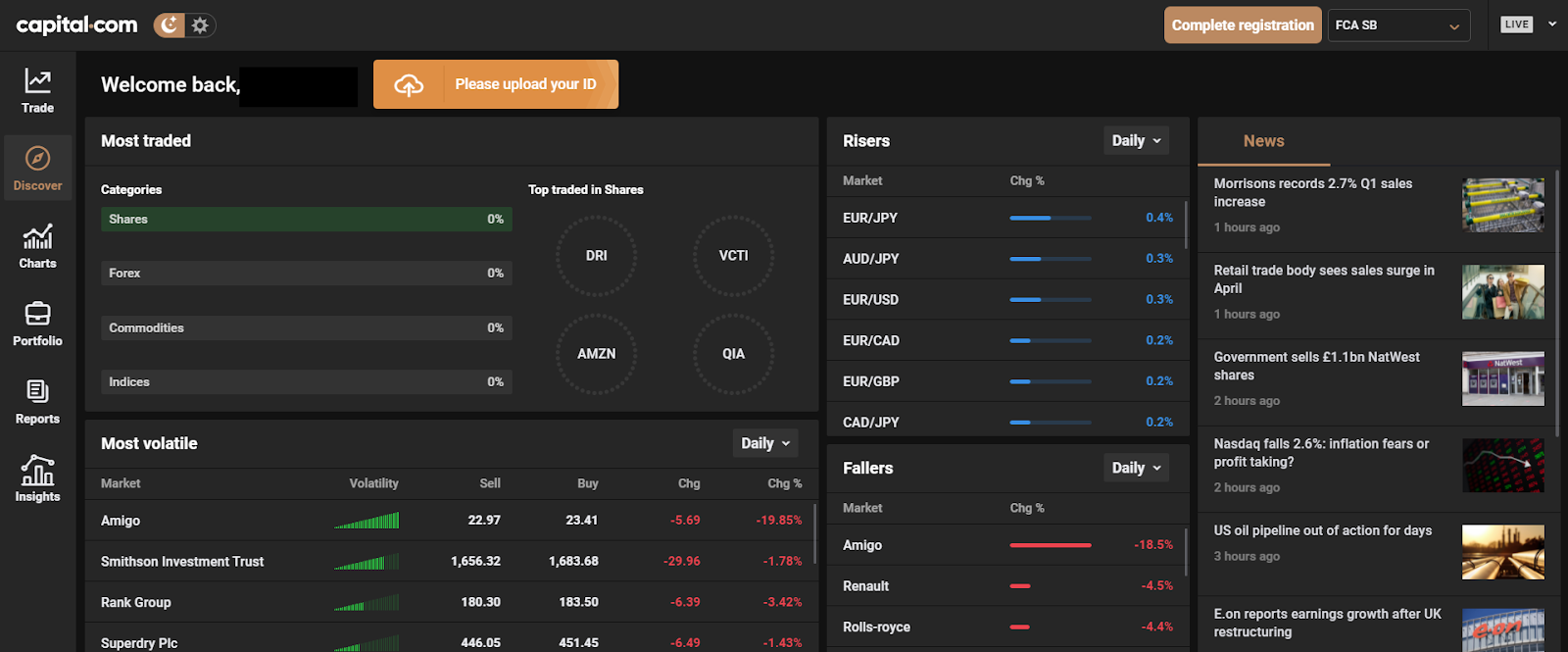

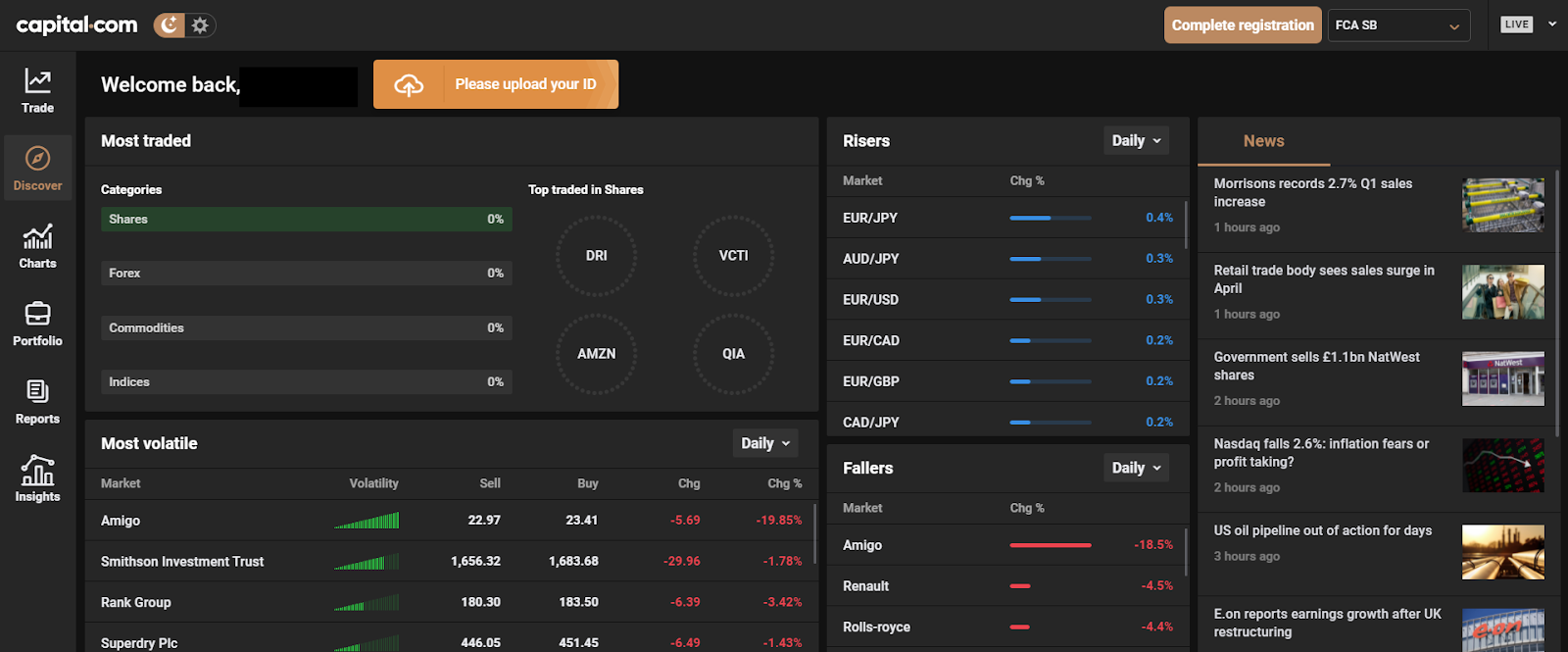

When the basic personal data is specified, go to your personal account to access the trading platform. Here you can specify the bank card number you replenish your account through or choose another method of depositing funds. If within 15 days the user does not provide the broker with identity documents, the account will be blocked. Also in the upper right corner, you can click on the Live button and switch your account from real to demo.

The following functions are available to the trader in his personal account:

Regulation and safety

Capital.com has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 18 years

- Strict requirements and extensive documentation to open an account

Capital.com Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

SCB SCB |

Securities Commission of The Bahamas | Bahamas | No specific fund | Tier-2 |

Capital.com Security Factors

| Foundation date | 2007 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Capital.com have been analyzed and rated as Low with a fees score of 9/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Capital.com with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Capital.com’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Capital.com Standard spreads

| Capital.com | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,3 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,3 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Capital.com RAW/ECN spreads

| Capital.com | Pepperstone | OANDA | |

| Commission ($ per lot) | 2 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Capital.com. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Capital.com Non-Trading Fees

| Capital.com | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0-5 | 0 | 0-15 |

| Inactivity fee ($, per month) | 10 | 0 | 0 |

Account types

To access all the broker's functions, take advantage of its strengths, and increase your income, you need to go to the broker's official website and open an account.

Account types:

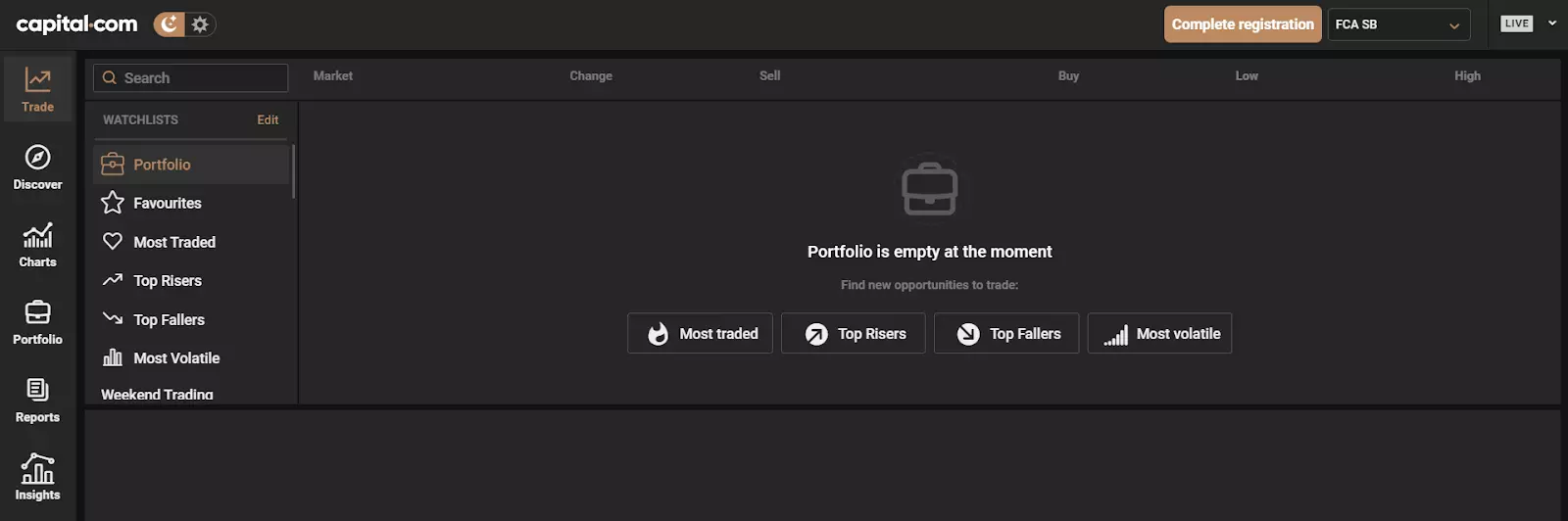

A trader can test the trading conditions of the broker and his skills on a demo account. To do this, you need to create a real account, then in your personal account, click on the "Live" button, which is located in the upper right corner of the screen, and select the "Switch to a demo account" item. Here the trader can carry out test trades without financial risks.

Deposit and withdrawal

Capital.com received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Capital.com provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Minimum deposit below industry average

- Bank card deposits and withdrawals

- No withdrawal fee

- USDT payments not accepted

- BTC not available as a base account currency

- BTC payments not accepted

What are Capital.com deposit and withdrawal options?

Capital.com provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller.

Capital.com Deposit and Withdrawal Methods vs Competitors

| Capital.com | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Capital.com base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Capital.com supports the following base account currencies:

What are Capital.com's minimum deposit and withdrawal amounts?

The minimum deposit on Capital.com is $20, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Capital.com’s support team.

Markets and tradable assets

Capital.com offers a wider selection of trading assets than the market average, with over 3000 tradable assets available, including 120 currency pairs.

- Crypto trading

- Commodity futures are available

- ETFs investing

- Bonds not available

- Copy trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Capital.com with its competitors, making it easier for you to find the perfect fit.

| Capital.com | Plus500 | Pepperstone | |

| Currency pairs | 120 | 60 | 90 |

| Total tradable assets | 3000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Capital.com offers for beginner traders and investors who prefer not to engage in active trading.

| Capital.com | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

To quickly resolve problems and requests of traders during trading and registration, Capital.com assists using its qualified specialists. The customer support department serves customers from different countries and operates in 13 languages.

Advantages

- Multilingual support: company employees provide assistance in 13 languages

- You can contact support at any time of the day or night, 24/7

- Support is provided by qualified specialists

Disadvantages

- No callback function

To get help or an answer to your question, contact the support staff via:

-

a letter to the broker's email; the answer should come within 24 hours;

-

message to the support chat on the Capital.com website;

-

feedback form in the Contacts section;

-

a phone call to a number listed on the website. Phone numbers are indicated for Austria, Ireland, Spain, Switzerland, Sweden, the Netherlands, Cyprus, and the United Kingdom.

The broker is also on social networks such as Facebook, Instagram, Twitter, LinkedIn, and YouTube.

Contacts

| Foundation date | 2007 |

|---|---|

| Registration address | C/O Fladgate LLP, 16 Great Queen Street, London, WC2B 5DG |

| Regulation |

FCA, CySEC, ASIC, FSA, SCB

Licence number: 793714, 319/17, AFSL 513393, AFSL SD101, SIA-F245 |

| Official site | capital.com |

| Contacts |

+44 20 8089 7893

|

Education

Everyone, from a beginner to a professional, can trade with the Capital.com broker. Because traders are constantly developing and learning new information about trading rules, the company provides its clients with unlimited access to training materials.

You can try out new trading strategies or test your knowledge of the markets without the risk of losing money on a demo account.

Comparison of Capital.com with other Brokers

| Capital.com | Eightcap | XM Group | RoboForex | Markets4you | NPBFX | |

| Trading platform |

MobileTrading, WebTrader, MT4, TradingView | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5 | MT4 |

| Min deposit | $20 | $100 | $5 | $10 | No | $10 |

| Leverage |

From 1:1 to 1:200 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

From 1:200 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points | From 0.4 points |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 20% | No / 30% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed Review of Capital.com

The Capital company cooperates with traders and investors globally. The main values of the broker are reliability, optimal trading conditions, and freedom of choice. Therefore, Capital.com is a solid choice of active traders. There are no passive investment programs here, but the broker compensates for this with a large selection of stocks and other assets that are suitable for long-term investment, such as indices, cryptocurrencies, commodities, and currency pairs. The size of the spread is individual for each trading instrument, and the trader can choose which assets to use, and thus adjust the level of the spread.

Traders who are interested in working with Capital.com may wish to consider the following figures to better acquaint themselves with the broker.

-

2000 - the number of markets to which the company's clients have access.

-

1.7 million clients have trading accounts with the Capital.com broker.

-

It will take only three minutes to register on the site.

-

$0 is the size of the commission for replenishment of the account, withdrawal of funds, as well as opening and closing positions.

-

70+ trading indicators are built into the Capital.com platform.

-

$20 is the size of the minimum deposit.

-

$10,000 can be received by a trader for winning the contest offered by the Capital.com broker.

Capital.com is one of the best brokers for active trading and investing

Capital.com is the choice of active traders who prefer to independently determine the size of the spread. The broker provides clients with a convenient proprietary trading platform and mobile applications. More than 70 indicators are built into the trading platform, thanks to which traders can determine profitable entry points to the market. The company does not impose restrictions on the availability of trading experience, there is only one real account on which all functions and trading tools are available. A demo account is also available to traders, where you can test a new trading strategy or try your hand at trading without the risk of losing finances.

The Capital.com trading platform is available for download on a personal computer. You can also trade in the web version, from a browser, or a mobile application for Android or iOS. There are no investment programs, but there are assets that allow you to invest in the long term.

Useful services of Capital.com investment:

Overview.

-

Here you will find expert and analytical materials that will help you to develop your trading skills, gain new knowledge, and create strategies for trading various assets.

-

News is a constantly updated section, which presents news from the world of trading.

-

Capital.com TV is a service with videos on the topics of the psychology of trading, trading strategies, the basics of trading, and cryptocurrencies.

Advantages:

Fast and easy procedure for opening an account.

Minimum deposit available.

A large number of trading assets.

Quotes on the site are displayed in real-time and change automatically.

The trader does not need to refresh the page to get the latest information.

All information on the broker's website is free, clients do not pay for additional services or account maintenance.

Latest Capital.com News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i