According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader5

- 2021

Our Evaluation of Dizicx

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Dizicx is a moderate-risk broker with the TU Overall Score of 5.16 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Dizicx clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Dizicx is suitable for CFD trading on different strategies and various markets. It focuses on experienced traders, but investors can also use Dizicx for earning profits in Forex. However, it is important to assess the risks of a partnership with an unregulated offshore broker before opening a live account.

Brief Look at Dizicx

Dizicx is a broker that has been offering currency pairs and CFD [contract for (price) differences] trading since 2016. With a wide range of assets and account types, it allows its clients to choose the best partnership model and suitable pricing structure. Dizicx is an international brand that provides services worldwide. Traders have access to 9 deposit funding methods without any commission, accounts with spreads starting from 0 pips, investment solutions, and various trading calculator types.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Ability to choose between instant or market execution.

- Available support for advanced order types, one-click trading, and copy trading.

- Quotes are from 25 institutional liquidity providers.

- Availability of swap-free accounts and negative balance protection.

- Deposits and withdrawals using e-wallets, cards, and cryptocurrencies.

- PAMM service available for additional passive income.

- 24-hour technical support on Forex market trading days.

- The broker has no license, it is registered in an offshore zone – in the Republic of Mauritius.

- The minimum deposit for a Standard account is $100; cent accounts are not provided.

- Trading cannot be conducted through the MetaTrader 4 trading platform, which is more user-friendly for beginners.

TU Expert Advice

Financial expert and analyst at Traders Union

Dizicx has been operating since 2016 and continuously expands its range of trading instruments, payment systems, and useful tools for traders. To offer the most comfortable trading conditions to each client, the company has developed accounts with the market and instant execution. They also provide swap-free and demo accounts, and PAMM investing.

From time to time, Dizicx offers a no-deposit bonus that allows users to generate real profits without depositing funds. The broker provides an advanced version of the MetaTrader 5 trading platform with support for one-click trading, advanced order types, Level 2 market depth, and an integrated risk calculator. To earn passive income, traders can use the “Signals” service, which is a platform for copying trades of experienced traders.

Overall, Dizicx offers many advanced solutions in the field of online trading. However, it lags behind its competitors in some criteria. For example, the broker does not offer the ability to trade on cent accounts, which is important for beginners and traders who want to test its conditions. Additionally, Dizicx is an unregulated Forex broker, which means the interests of its clients are not protected by third-party financial supervisory organizations.

- You prefer flexibility in your execution methods, as this broker allows you to choose between instant or market execution, catering to your trading preferences and needs.

- You're an experienced trader seeking advanced order types, prefer one-click trading for fast execution, or interested in copy trading to replicate the strategies of successful traders, as this broker offers the necessary support and features to enhance your trading experience.

- Regulatory oversight and compliance are important to you, as the lack of a license and registration in an offshore zone like the Republic of Mauritius may raise concerns about the broker's credibility and the security of your funds.

- You're looking for lower minimum deposit requirements or prefer cent accounts for trading smaller volumes, as the $100 minimum deposit for a Standard account may be too high for your preferences. Additionally, the absence of cent accounts limits your options if you prefer to trade with smaller position sizes.

Dizicx Trading Conditions

| 💻 Trading platform: | MetaTrader 5 (desktop, mobile, WebTrader) |

|---|---|

| 📊 Accounts: | Demo, МТ5, Standard, Premium, Star VIP, and ECN Pro |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Deposit / Withdrawal: | Bank wire transfer, Visa, cryptocurrencies (BTC and USDT), Skrill, Neteller, Perfect Money, and WebMoney |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Forex (55 currency pairs), CFDs on indices, cryptocurrencies, stocks, gold, silver, gas, and oil |

| 💹 Margin Call / Stop Out: | On Standard, Premium, Star VIP accounts they are 100%/80%; and on ECN Pro they are 200%/100% |

| 🏛 Liquidity provider: | 25 international providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market and instant executions |

| ⭐ Trading features: | Hedging is allowed, and swap-free accounts are available |

| 🎁 Contests and bonuses: | Deposit bonuses periodically only |

Dizicx clients have access to trading with over 100 assets, including 55 currency pairs. The leverage and spread levels vary depending on the account type. The broker offers instant and market execution. The execution type depends on the trading account, there is instant execution for Standard and Premium accounts and market execution for Star VIP and ECN Pro accounts. Trading can be started with $100, but if you deposit $500 or more, you will have the opportunity to trade with near-zero spreads using ECN technology.

Dizicx Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

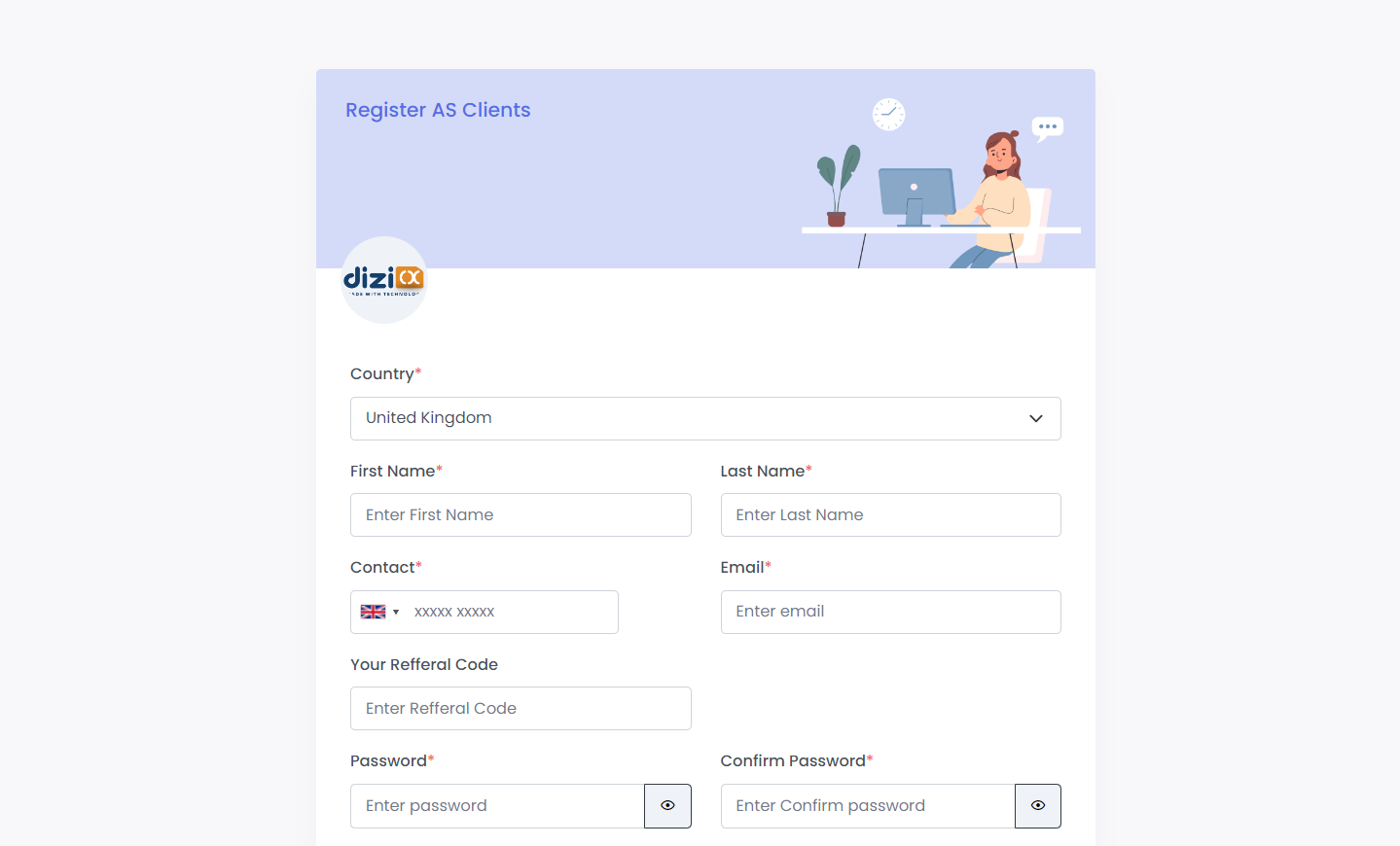

Trading Account Opening

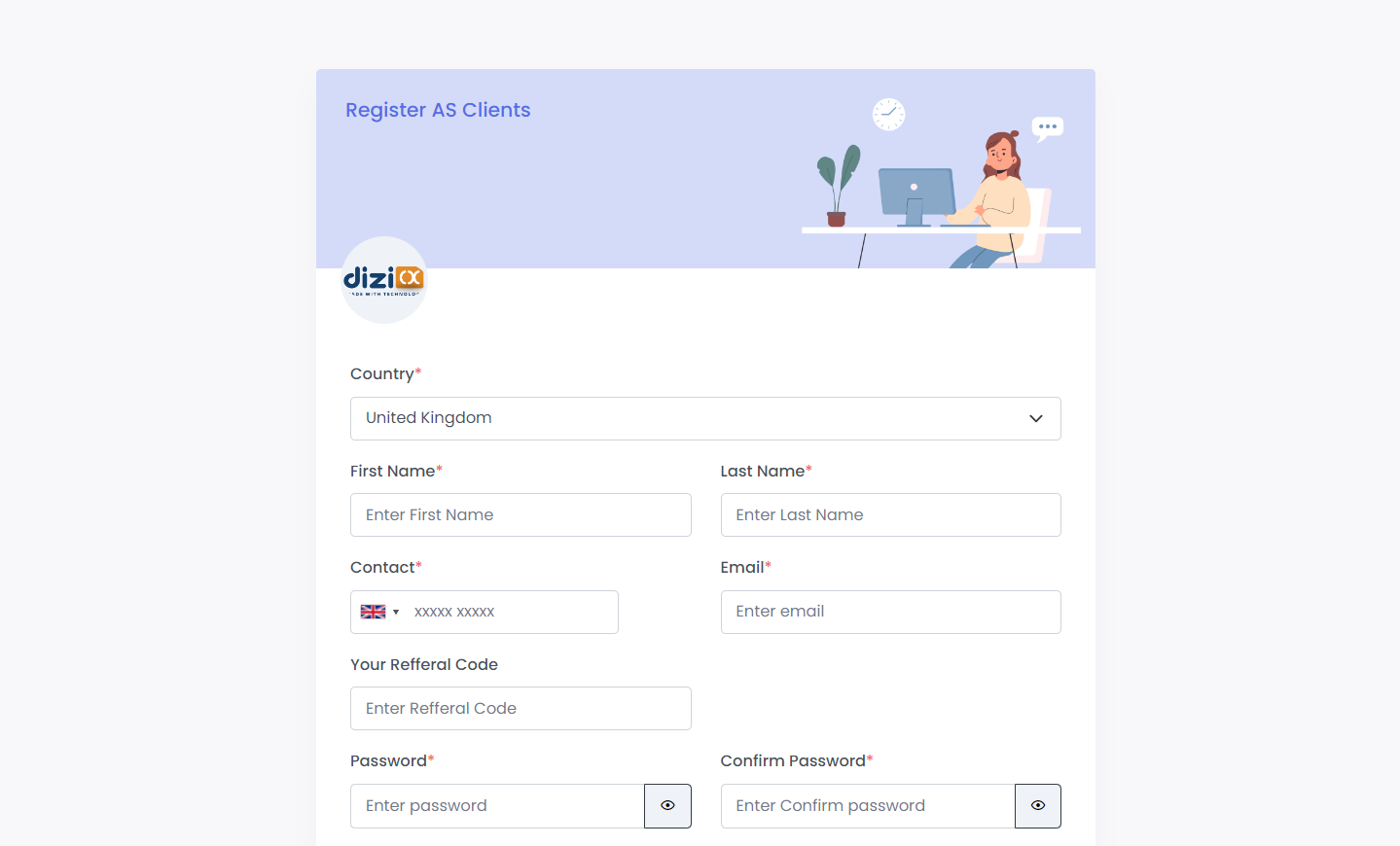

To create a Dizicx user account, complete a simple registration process on its official website. It consists of the following steps:

Access the registration form by clicking the “Open Live Account” button.

Enter personal details such as name, surname, phone number, and email. After confirming your email and phone number, provide your residential address and date of birth. Also, create a password that will be used to log into your user account.

Additional features of the Dizicx user account:

Your Dizicx user account also provides access to:

My Profile. Allows entering additional personal information, passing of verification, and change of a login password.

My Account. Allows opening and configuring trading and demo accounts and gives comprehensive statistics on the previously created accounts.

Market Analysis. Provides Forex market news, forecasts, and reviews.

Withdrawals. Here traders can submit a request for funds withdrawal.

Internal Transfer. Allows transferring funds between accounts belonging to one client.

My Transaction. Provides a payment history for the last 3 days to 6 months.

Regulation and safety

Dizicx has a safety score of 3.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

Dizicx Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

Dizicx Security Factors

| Foundation date | 2021 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Dizicx have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Dizicx with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Dizicx’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Dizicx Standard spreads

| Dizicx | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,7 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,9 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Dizicx RAW/ECN spreads

| Dizicx | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,50 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Dizicx. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Dizicx Non-Trading Fees

| Dizicx | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Dizicx clients can trade from four account types with different commissions, leverage, and minimum deposit requirements. The accounts also differ in the order execution type, maximum trading volume, and the number of orders a trader can have open simultaneously.

Account types:

Each visitor to the Dizicx website can create a demo account on the MT5 trading platform.

Dizicx is not a newcomer in the online trading industry. Its experience allows it to provide each client with a comfortable environment for conducting trades.

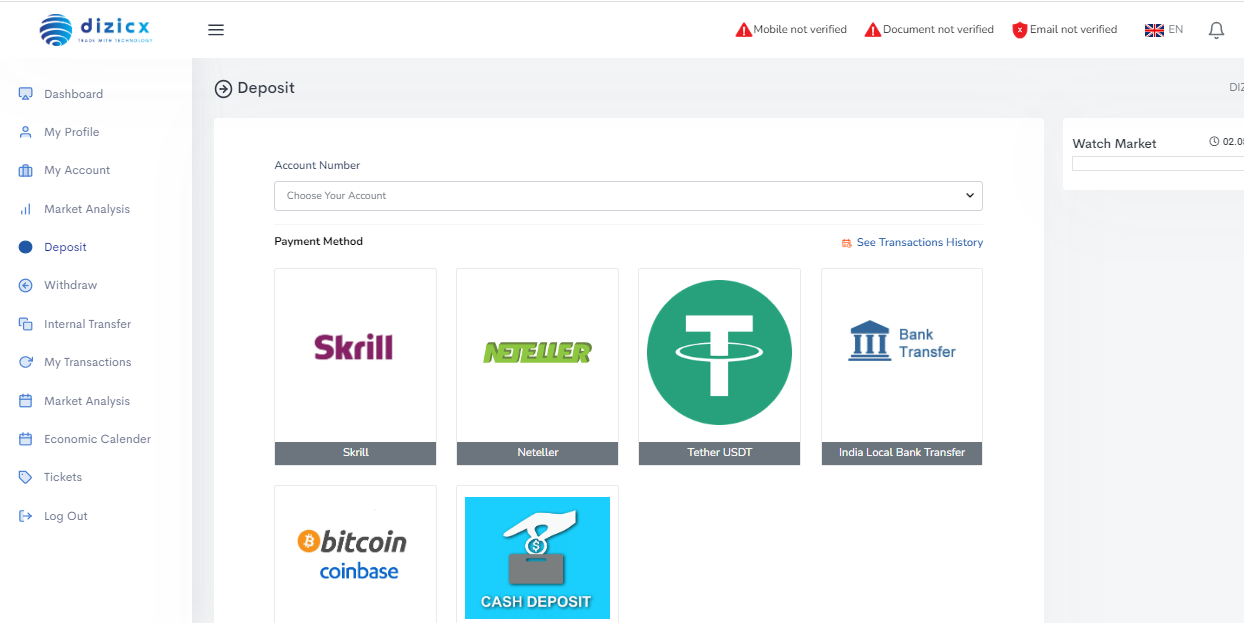

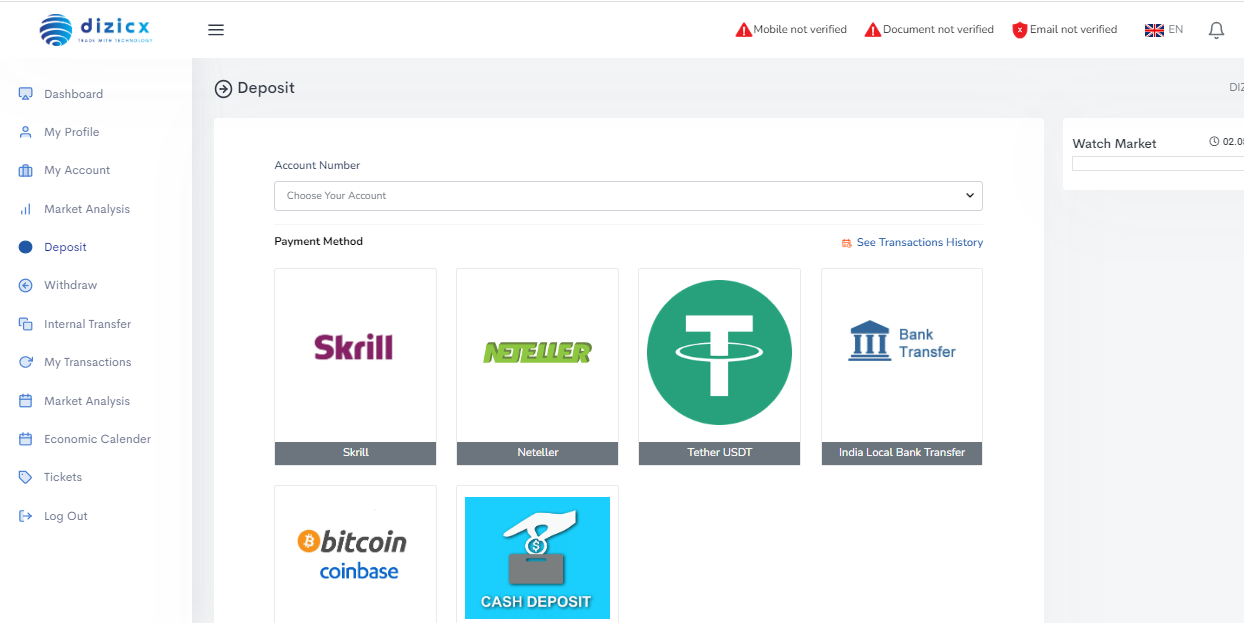

Deposit and withdrawal

Dizicx received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Dizicx provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- BTC available as a base account currency

- Minimum deposit below industry average

- No withdrawal fee

- USDT (Tether) supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

- Only major base currencies available

What are Dizicx deposit and withdrawal options?

Dizicx provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

Dizicx Deposit and Withdrawal Methods vs Competitors

| Dizicx | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Dizicx base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Dizicx supports the following base account currencies:

What are Dizicx's minimum deposit and withdrawal amounts?

The minimum deposit on Dizicx is $1, while the minimum withdrawal amount is $25. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Dizicx’s support team.

Markets and tradable assets

Dizicx offers a limited selection of trading assets compared to the market average. The platform supports 180 assets in total, including 55 Forex pairs.

- 55 supported currency pairs

- Copy trading platform

- Crypto trading

- Bonds not available

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Dizicx with its competitors, making it easier for you to find the perfect fit.

| Dizicx | Plus500 | Pepperstone | |

| Currency pairs | 55 | 60 | 90 |

| Total tradable assets | 180 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Dizicx offers for beginner traders and investors who prefer not to engage in active trading.

| Dizicx | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Support is available 24/5, and it is available in three languages: English, Latvian, and Hindi.

Advantages

- You can request a call from a company representative.

- Support is available via phone and online.

Disadvantages

- The virtual assistant in the chat doesn't always connect to a person.

- The broker does not provide support through messengers

You can ask a question to the support service in the following ways:

-

Use chat on the website.

-

Send a question via the company's email.

-

Phone call.

Traders who have a user account on the official website of Dizicx can create a ticket in the support request section.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | Dizicx Ltd, 20 Edith Cavell Street, Level 6, Ken Lee Building, Port Louis, Mauritius |

| Official site | https://dizicx.com/ |

| Contacts |

Education

There is no training in trading currency pairs and CFDs on the Dizicx website. In different sections, there are introductory data on trading assets and trading platforms. There are no video lessons, webinars, or educational articles available on the website.

A demo account is the best tool for applying theory in practice. Dizicx offers practice accounts where you can learn to trade financial instruments without investing funds.

Comparison of Dizicx with other Brokers

| Dizicx | Bybit | Eightcap | XM Group | Exness | Markets4you | |

| Trading platform |

MetaTrader5 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 |

| Min deposit | $100 | No | $100 | $5 | $10 | No |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.5 point | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points |

| Level of margin call / stop out |

100% / 80% | No / 50% | 80% / 50% | 100% / 50% | 60% / No | 100% / 20% |

| Order Execution | Market Execution, Instant Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | Yes |

Detailed review of Dizicx

Dizicx is a company created by traders for traders, considering all the necessary components for comfortable trading such as fair pricing, excellent execution, and expert service. The mission of Dizicx is to create the best environment for efficient trading for both retail traders and institutional clients. Soon, the company plans to expand its list of services and products, as well as add new cryptocurrencies.

Dizicx by the numbers:

-

Over 7 years of successful operation.

-

Trading leverage of up to 1:1000.

-

Quotes from 25 liquidity providers.

-

Trading available for over 100 financial instruments.

Dizicx is a broker with convenient trading conditions for traders from multiple countries

Dizicx offers a wide selection of accounts and trading instruments. The Standard and Premium accounts have negative balance protection. Hedging is allowed on all account types. The maximum trading volume is 50 lots for instant execution accounts and 100 lots for market execution. Muslim traders can trade on a swap-free account, which is like the Standard account but with administrative fees instead of overnight swap commissions. Other account types do not support the swap-free option.

Dizicx does not offer a proprietary trading platform but provides the classic MetaTrader 5 as an alternative for Forex trading. It is available in three versions: desktop, mobile (Android), and WebTrader. MetaTrader 5 servers are located in the Equinix NY4 data center in New York, ensuring optimal execution speed for many trading strategies.

Dizicx’s analytical services:

-

Economic calendar. Provides real-time financial indicators that can be used by traders applying fundamental analysis to forecast asset prices.

-

Trading position calculator. Allows calculating the cost of spreads, swap sizes, profits, and losses for the market, pending, and stop orders.

-

Market analysis. Market data is sourced from the TradingView analytical platform.

Advantages:

The minimum order size on all accounts is 0.01 lots, which helps reduce trading risks.

Depending on the account type, traders can have up to 50-100 orders open simultaneously.

Scalping and algorithmic trading using expert advisors (EAs) are allowed.

Execution delays of less than 1 ms due to the trading servers' location in the NY4 data center in New York.

Favorable conditions for account funding and withdrawal because there are no commissions from the broker's side.

Dizicx is suitable for almost any trading strategy, from scalping to medium-term trading. It provides traders with the necessary data and services to achieve success in the Forex market.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i