deposit:

- €99

Trading platform:

- MetaTrader4

- Trading through FXCH broker

- Up to 1:100

Summary of Fidelcrest Trading Company

Fidelcrest is a moderate-risk prop trading firm with the TU Overall Score of 6.43 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Fidelcrest clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. Fidelcrest ranks 7 among 40 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Fidelcrest offers experienced traders virtual accounts with the possibility of their further conversion into real accounts for trading with currency and CFDs using the company's funds.

Fidelcrest is a proprietary trading company created by professional Forex market participants with more than 10 years of experience working for companies providing brokerage services. It was registered in 2018 in Cyprus but cooperates with traders from all over the world, including those residing in the USA. Fidelcrest offers Pro and Micro accounts for the MT4 terminal for trading currency pairs and CFDs on stocks, indices, metals, and commodity market assets. After passing the assessment and fulfilling the trading requirements, the trader gets the opportunity to trade using Fidelcrest funds. The minimum amount of funding is $10,000, and the maximum is $2 million.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | €99 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | From 0 pip |

| 🔧 Instruments: | Forex, CFDs on stocks, indices, metals, commodities, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Fidelcrest:

- Low service broker fees for the execution of trading orders.

- Availability of accounts with different levels of risk.

- Financing of up to $2 million is available.

- The one-time subscription fee is unlike the monthly fees, as with other proprietary trading companies.

- A wide range of CFDs and currency pairs are available for trading.

- The ability to make transactions with leverage.

- Bonuses in the form of an accelerated plan, a free additional account, and a capital double.

👎 Disadvantages of Fidelcrest:

- The client cannot receive passive income.

- Expert advisors, trading robots, and copy trading are prohibited.

- Technical support service is not available on Saturdays and Sundays.

Evaluation of the most influential parameters of Fidelcrest

Trade with this prop-trading company, if:

- You are a seasoned trader with a proven track record, as Fidelcrest programs cater to experienced traders with a strong understanding of risk management and a consistent history of profitability. Their flagship Pro Trader program requires at least 12 months of verified trading experience and a minimum of $10,000 in profits over that period.

- You have a diversified and adaptable trading style. Unlike some prop firms with strict trading restrictions, Fidelcrest allows a wide range of instruments and strategies.

- You are comfortable with a one-time fee structure, as Fidelcrest charges a one-time fee for their evaluation programs, with no recurring costs or hidden charges.

Do not trade with this prop-trading company, if:

- You require extensive support and hand-holding as Fidelcrest primarily focuses on evaluation and funding, offering limited ongoing support or training.

Table of Contents

Geographic Distribution of Fidelcrest Traders

Popularity in

Video Review of Fidelcrest i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Fidelcrest

Fidelcrest is not a broker and does not accept client deposits. The company uses the Proprietary Trading Company business model. That is, it transfers its capital under the management of professional traders and retains part of the profit received from their trading activity. As a result, it is a win-win for all parties to the contract: the company earns on transactions and subscription fees, and a trader without a fund reserve can use large capital for trading.

To get access to Fidelcrest capital, you need to go through two phases. The first (Trading Challenge) spans 30 days. The trader must fulfill the trading requirements for the size of losses and profits. After that, the trader proceeds to Phase 2, which is verification. It has more strict requirements that must be met within 60 days. If the trader copes with the tasks, then they receive Fidelcrest capital in management, and can also withdraw part of the deposit in fiat money (up to $30,000, depending on the type of account).

Fidelcrest covers the losses of clients within the established maximum limits, which allows you to prevent the loss of all funds provided by the company. Based on the results of successful trading, a trader can get access to the management of real capital in the amount of up to $1 million. If the trader used an Aggressive mode, then this amount doubles to $2 million.

Dynamics of Fidelcrest’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Fidelcrest prioritizes traders who trade themselves and do not rely on automated trading programs. However, the company may, at its discretion, make an exception for investors using expert advisors or trading robots. To get permission to connect them, the trader must submit a request to the support service.

As for copy trading, such activity is prohibited at Fidelcrest. Moreover, the company does not allow copying the transactions of other traders or providing a user’s account to a third party for trading activities.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Fidelcrest’s affiliate program

The standard affiliate commission under the conditions of the affiliate program is 15%. When you move to a higher level (Advanced or Super levels), the rate increases. Also, the partner can receive a bonus of up to $5,000. The minimum withdrawal amount is $200. Money can be withdrawn once a month via bank transfer or in Bitcoins to a crypto wallet.

Fidelcrest also invites companies from different countries to become its local representatives and provide proprietary trading services in their region.

Trading Conditions for Fidelcrest Users

Fidelcrest accepts payments from cards, electronic wallets, bank accounts, and cryptocurrency. The client pays the subscription fee in euros but receives US dollars at their disposal. Initially, the currency is in virtual form, and after passing the assessment and verification, it is converted into real funds. Trades are executed via FXCH Forex broker, which offers an MT4 terminal and leverage of up to 1:100. Unprocessed spreads start from 0 pips, and fees start from $0. There are four types of trading accounts available.

Fidelcrest profile details€99

Minimum

deposit

1:100

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Pro Trader Normal, Pro Trader Aggressive, Micro Trader Normal, Micro Trader Aggressive |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer, Skrill, Neteller, Bitcoin, cards (deposit only), PayPal (withdrawal only) |

| 🚀 Minimum deposit: | €99 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pip |

| 🔧 Instruments: | Forex, CFDs on stocks, indices, metals, commodities, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Trading through FXCH broker |

| 🎁 Contests and bonuses: | Yes |

Comparison of Fidelcrest to other prop firms

| Fidelcrest | Topstep | FTMO | Funded Trading Plus | Earn2Trade | OneUp Trader | |

| Trading platform |

MetaTrader4 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | NinjaTrader, R Trader Pro, Finamark | Ninja Trader, RTrader, iTrader, Photon, QScalp |

| Min deposit | $99 | $1 | $155 | $119 | $90 | $125 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1 |

From 1:1 to 1:1 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

10% / 10% | 1% / 1% | 50% / 50% | No | 10% / 10% | No |

| Execution of orders | Market Execution | ECN | Instant Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Fidelcrest | Topstep | FTMO | Funded Trading Plus | Earn2Trade | OneUp Trader | |

| Forex | Yes | No | Yes | Yes | No | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | No | No |

| CFD | Yes | No | Yes | Yes | No | No |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | No | Yes | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

Fidelcrest Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Micro Trader Normal | From $2 | No |

| Micro Trader Aggressive | From $2 | No |

| Pro Trader Normal | From $2 | No |

| Pro Trader Aggressive | From $2 | No |

Spreads and other trading fees are charged to the trader by the broker, not Fidelcrest.

Detailed Review of Fidelcrest

Due to the existing pool of investment capital, Fidelcrest can provide up to $2 million in management capital to each of its clients who successfully passes the assessment and confirm their competence. The company has been operating since 2018, but already has representative offices in many countries, such as the USA, Great Britain, Australia, Africa, and EU countries. Fidelcrest has no restrictions on supported jurisdictions, so unlike other proprietary trading companies, it accepts traders from the USA and Canada.

Fidelcrest by the numbers:

-

It has offices in 10 countries.

-

The company's services are used by more than 6,000 traders.

-

More than 175 financial instruments are available for transactions.

-

Spreads and fees of the service broker start from $0.

Fidelcrest is a proprietary trading company providing services for trading Forex and CFD instruments.

Traders who have become Fidelcrest clients get access to trading currency pairs, cryptocurrencies, as well as stocks, indices, commodities, and metals in CFD format. Trading is performed through an FXCH (FX Clearing House) partner, which is a broker serving institutional clients who have deposited $500,000 or more. Thanks to Fidelcrest, ordinary retail traders have the opportunity to become professional capital managers and trade under the most favorable conditions. FXCH provides the MetaTrader 4 terminal. Unfortunately, there is no option to choose another broker. When choosing an Aggressive mode, swing trading is allowed.

Fidelcrest Challenge Conditions Explained

As many as 64 currency pairs, gold, silver, 53 stocks, 11 indices, UKOIL (Brent crude oil), and USOIL (WTI oil) are available for transactions. Traders can also trade 17 cryptocurrencies. Transactions can be left open overnight, including on weekends and holidays.

Useful Fidelcrest services:

-

TradingView charts. These provide technical analysis of currency pairs, indices, stocks, metals, commodities, and cryptocurrencies.

-

Economic calendar. It provides forecasts for the most traded financial instruments and displays important news. The calendar is available in the user account section.

-

NeuroStreet Trading Academy. It is software for training the brain to maximize attention and concentration, to control traders’ reactions, and improve one’s memory.

Advantages:

Fidelcrest offers each client capital of 10 thousand to 2 million dollars.

The trader himself differentiates the amount of profit received by choosing a trading mode.

The company offers many ways to make subscription payments and withdraw funds, including by way of cryptocurrency transactions.

After receiving Fidelcrest's capital from the management, there are no requirements for the target profit. You only need to observe the maximum and daily drawdown levels.

If the trader fails to fulfill the requirements for the profit size and drawdown for the first time, they can try again for free.

Fidelcrest allows you to use various active modes, including news trading.

Guide on how traders can start earning profits

Fidelcrest Scaling Plan review

Fidelcrest offers Micro Trader and Pro Trader accounts, each of which allows you to choose a risk mode, such as Normal or Aggressive. Accounts differ in the size of the deposit provided, requirements for drawdown levels, and target profits. Aggressive risk accounts provide bonuses in the form of capital doubling, a second free account, and an accelerated mode. After receiving full financing (Phase 3), the trader receives 80% of the profit for trading under Normal risk and 90% under Aggressive risk.

Account types:

How to get funded with Fidelcrest

Each of the accounts provided in the first and second phases is a training account and becomes a real one only after the trader has successfully traded for 90 days.

Fidelcrest is a company that offers accounts with different subscription fees and the amount of virtual deposit provided. The trader can choose the appropriate option depending on their attitude to risk and the available capital.

Fidelcrest - How to open, deposit and verify a trading account | Firsthand experience of TU

Investment Education Online

Fidelcrest does not educate trading in financial instruments, because it is intended for experienced traders who want to trade with the funds of proprietary trading companies. However, the Fidelcrest website has a Knowledge Base section, but it doesn't have trading tutorials.

To improve psychological stability and concentration of attention, traders can use a simulator from the partner — NeuroStreet Trading Academy.

Security (Protection for Investors)

Fidelcrest is not a brokerage company and does not store clients' money, so it does not require a license from financial regulators to provide services.

Fidelcrest is registered in Cyprus, therefore it operates under the legislation of that country. If the client has a claim to the fulfillment of the company's obligations stipulated in the contract, they can apply to the court of the Republic of Cyprus.

Fidelcrest safety and regulation

👍 Advantages

- A trader can file a claim with any Cyprys court

👎 Disadvantages

- The company is not related to the execution of trading orders and withdrawal of funds

- To start work, you need to pass a verification

Withdrawal Options and Fees

-

Profit payouts are made automatically and in the currency that the trader used to pay the subscription fee.

-

To withdraw funds, you can use bank transfers, PayPal, Skrill, Neteller, or Bitcoin transactions. Credit and debit cards can be used only for deposits.

-

There is no minimum withdrawal amount.

-

If a client withdraws profits to a bank account outside the SEPA zone, then a transaction fee of 50 euros is withheld. Fees from electronic payment systems are also possible. The company does not charge a withdrawal fee, regardless of the withdrawal method.

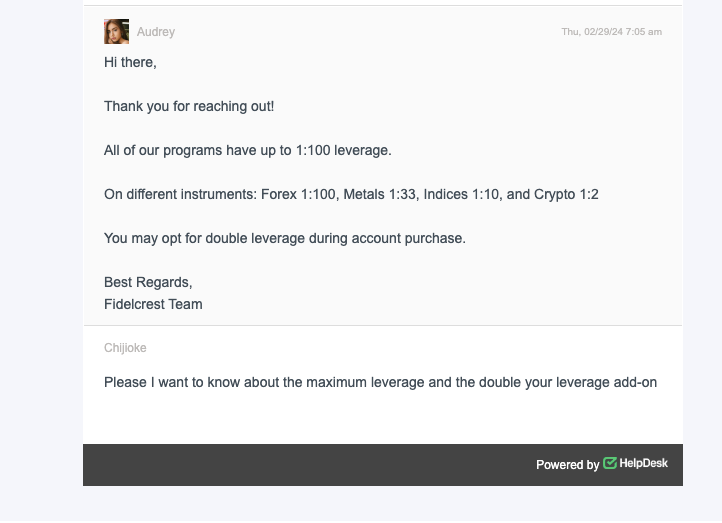

Customer Support Service

Technical support is available 24 hours a day, 5 days a week.

👍 Advantages

- Technical support is available not only to clients but also to website guests

- 24-hour access on company business days

👎 Disadvantages

- Saturday and Sunday are days off

- Only two communication channels

Channels of communication with technical support available for a trader:

-

online chat;

-

email.

Fidelcrest is represented on social networks. Facebook and Instagram profiles contain a lot of useful information for potential and existing clients.

Contacts

| Foundation date | 2017 |

| Registration address | Fidelcrest Ltd, Arch. Makariou III & 1-7 Evagorou, MITSI 3, 1st Floor, Office 102 C, 1065 Nicosia, Cyprus |

| Official site | https://fidelcrest.com/ |

| Contacts |

Email:

support@fidelcrest.com,

|

Review of the Personal Cabinet of Fidelcrest

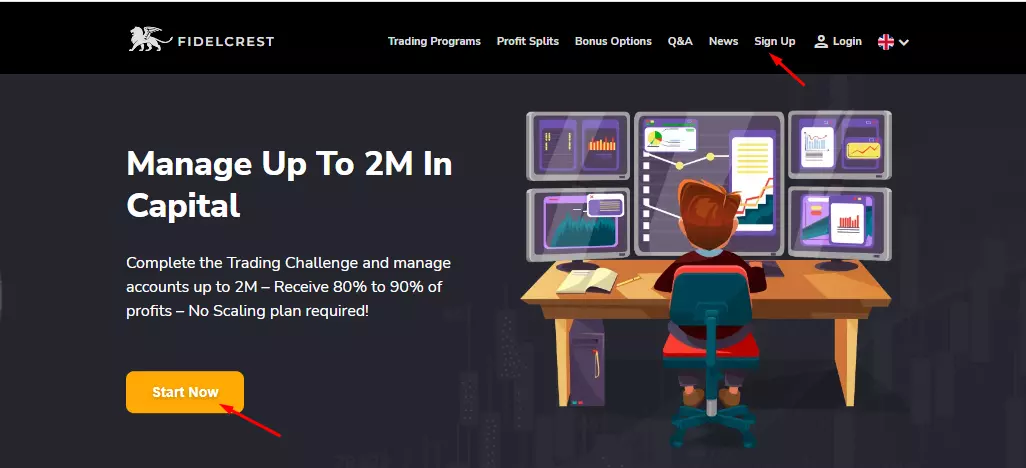

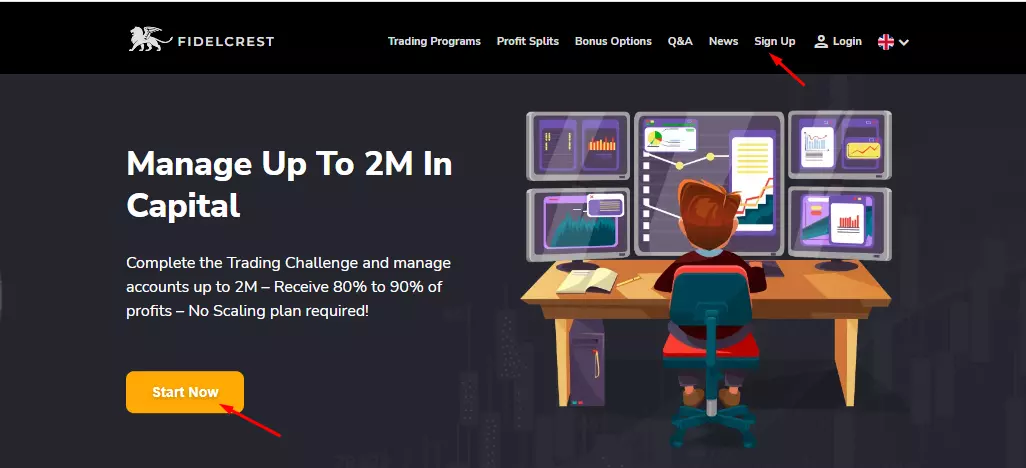

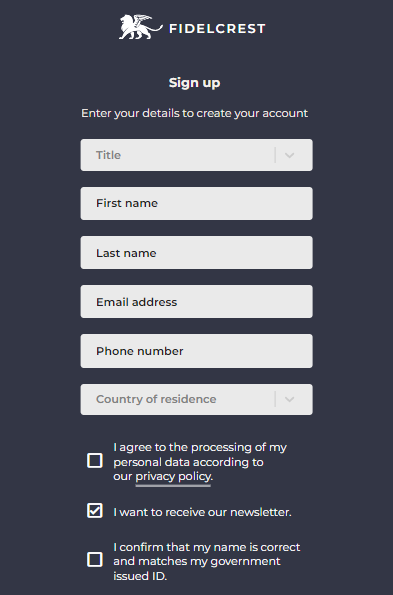

If you do not have a user account with Fidelcrest, then you can create one on its official website. To do this, follow these instructions:

First, pass the registration process. To start, click the Start Now or Sign Up button on the main page of the Fidelcrest website.

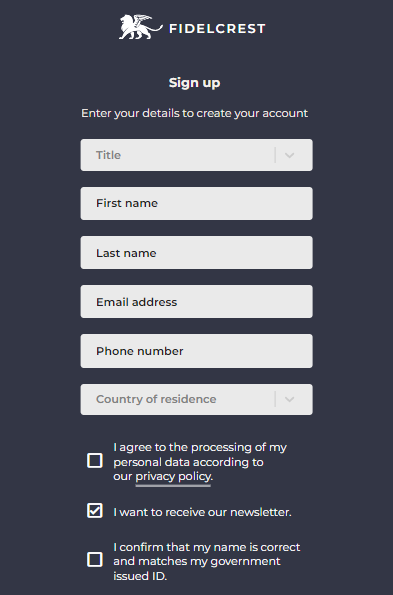

Fill out the registration form. Enter your first and last name (as in the documents), email address, and phone number. You also need to choose the country where you are located at the time of registration.

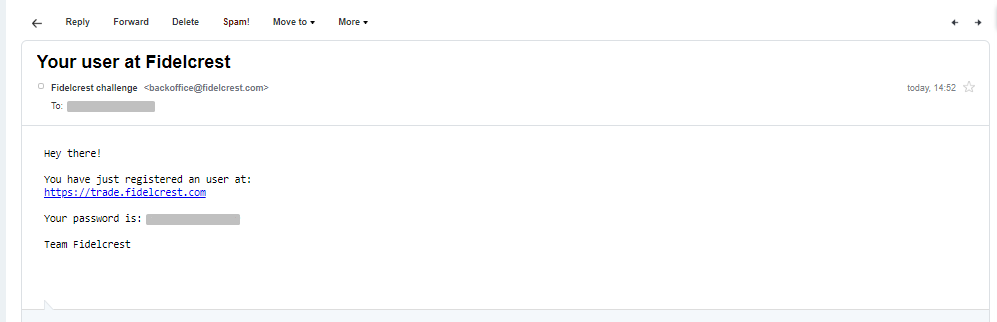

After that, check your email inbox. The company will send an automatically generated password to your email. You need to use it for the first time to log in to your user account, and you can change it later.

Now go back to the main page of Fidelcrest website and click Login. Enter the email address and password from the email message.

After creating a user account on the Fidelcrest website, the new client must go through the following steps:

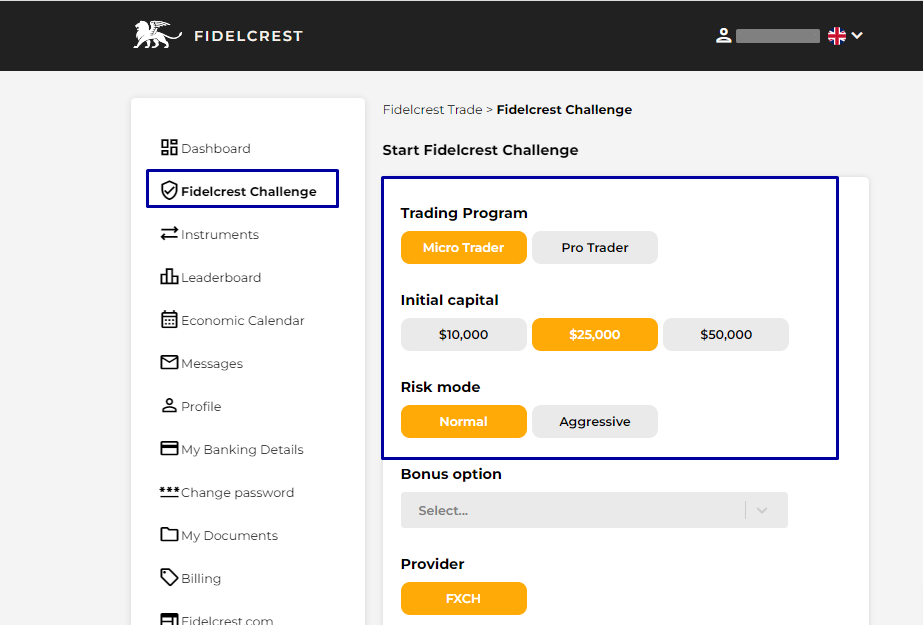

1. Choose the type of account (Micro, Pro), the amount of the virtual deposit, and the risk mode:

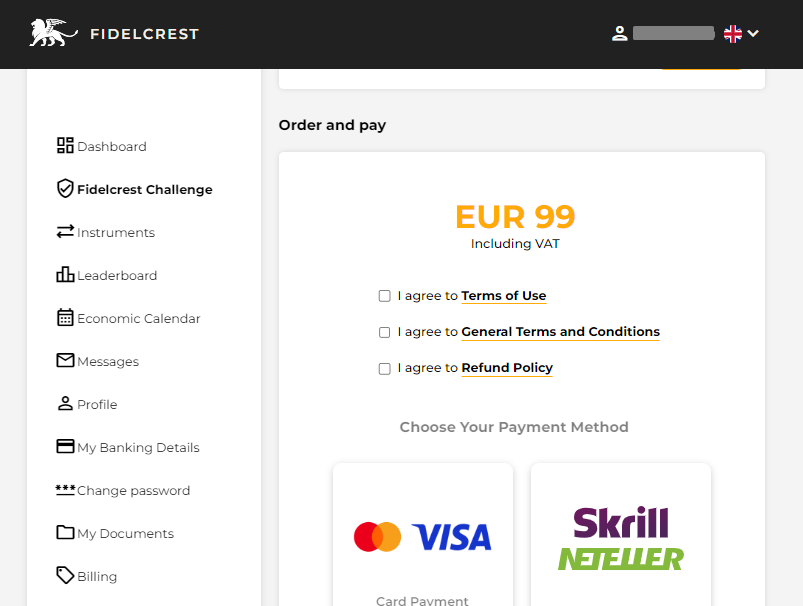

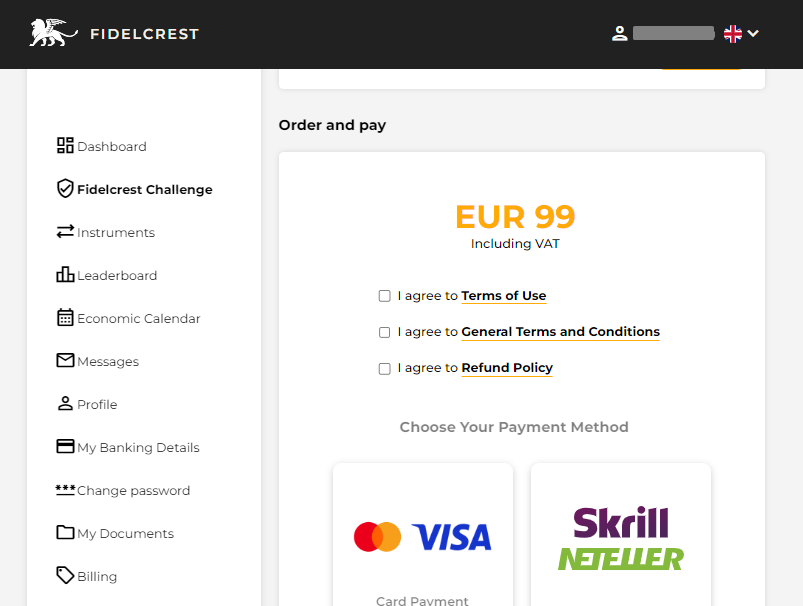

2. Pay the subscription fee:

1. Choose the type of account (Micro, Pro), the amount of the virtual deposit, and the risk mode:

2. Pay the subscription fee:

Also, the user account provides the trader with access to the following options:

-

Change verification and password.

-

See TradingView's analytical data on various types of financial instruments.

-

Leaderboard of Fidelcrest clients who show the most profitable trading.

-

Link a personal bank account, and choose the transfer currency.

-

Enter personal data and configure your profile.

-

Review billing data for withdrawal of funds.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Find out how Fidelcrest stacks up against other brokers.

Articles that may help you

FAQs

How do client reviews impact Fidelcrest rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Fidelcrest you need to go to the company's profile.

How can I leave a review about Fidelcrest on the Traders Union website?

To leave a review about Fidelcrest , you need to register on the Traders Union website.

Can I leave a comment about Fidelcrest if I am not a Traders Union client?

Anyone can post a comment about Fidelcrest in any review about the company.

Traders Union Recommends: Choose the Best!

Diana Shapovalova

Diana Shapovalova  SE Uppsala

SE Uppsala