According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 50 000 TRY

- MetaTrader4

- GCM Trader

- MASAK

- CMB

- 2009

Our Evaluation of GCM Forex

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

GCM Forex is a moderate-risk broker with the TU Overall Score of 6.23 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by GCM Forex clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The operation of GCM Forex aims at working with experienced traders, as low leverage, which the broker offers, implies that the traders have to use a considerable amount of their own funds for opening a position.

Brief Look at GCM Forex

GCM Forex is a brand of Global Capital Markets, established in 2012. The company is currently one of the largest brokers in Turkey. It operates under the regulation of the Capital Markets Board (CMB, G-039 (398)), a respected regulator of Turkey. GCM Forex has equity of 39 million Turkish lira. The company received the Leveraged Volume Leader Award. GCM Forex has credit rating AA, according to rating agencies, which means high creditworthiness and very low probability of financial collapse.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Proprietary software for trading in a browser.

- Demo account is provided for free and can be opened again after the trial period expires.

- The company’s operation is controlled by a reputable authority at the place of its actual location.

- There is a 24-hour live chat on the GCMForex website for addressing urgent issues.

- Provision of currency pair quotes in real time mode for technical analysis.

- Trading support by phone.

- The broker offers an ECN account with no spread, where the orders are executed quicker and at better prices thanks to the direct access to the market without preliminary processing.

- Limited choice of deposit and withdrawal methods.

- Customer support does not work on weekends and holidays.

- Maximum leverage is 1:10.

TU Expert Advice

Author, Financial Expert at Traders Union

GCM Forex offers a variety of trading instruments, including Forex pairs, CFDs, and stocks, through its proprietary GCM Trader platform and MT4. Account types include Standard and ECN, with zero spreads on the ECN account. The broker caters to professional traders with a minimum deposit requirement of TRY 50,000 and offers leverage up to 1:10, which requires substantial personal capital. GCM Forex provides real-time quotes and trading support via phone, along with a free demo account.

Drawbacks of GCM Forex include limited deposit and withdrawal methods and the absence of weekend client support. Additionally, the lack of client deposit insurance could concern some traders. While GCM Forex may be suitable for experienced traders due to its trading conditions, high minimum deposit, and leverage requirements, it may not serve beginners or those preferring lower capital commitments and diverse asset access.

GCM Forex Trading Conditions

| 💻 Trading platform: | GCM Trader, MetaTrader 4 |

|---|---|

| 📊 Accounts: | Demo, Standard, ECN |

| 💰 Account currency: | USD, EUR, TRY |

| 💵 Deposit / Withdrawal: | Wire transfer |

| 🚀 Minimum deposit: | TRY 50,000 |

| ⚖️ Leverage: | Up to 1:10 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Currency pairs (51), CFDs on commodities (21), indices (14), stocks (137), bonds and promissory notes (3) |

| 💹 Margin Call / Stop Out: | Margin Call: 50% |

| 🏛 Liquidity provider: | Large Turkish banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Positive swaps are applied to some instruments |

| 🎁 Contests and bonuses: | No |

GCM Forex offers a wide range of trading instruments, including currency pairs and CFDs. The broker has no restrictions on the trading styles: intraday trading, position hedging and scalping are allowed. GCM Forex provides leverage 1:10, which is why you need a sufficient amount of your own funds in order to trade successfully.

GCM Forex Key Parameters Evaluation

Video Review of GCM Forex

Share your experience

- Best

- Last

- Oldest

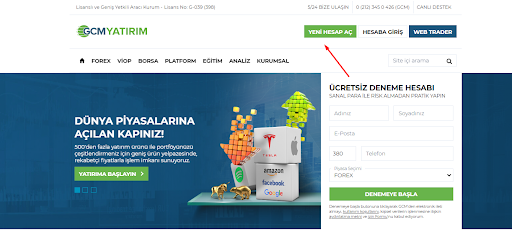

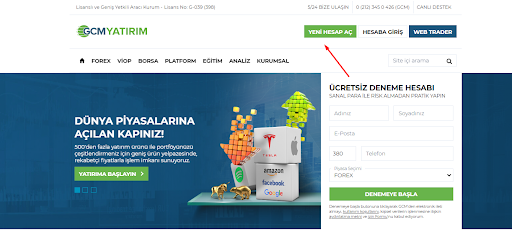

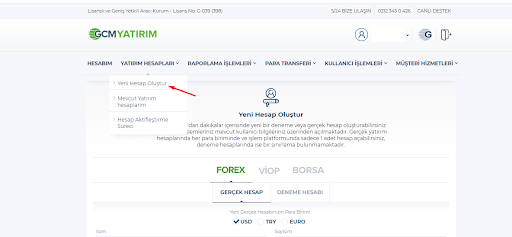

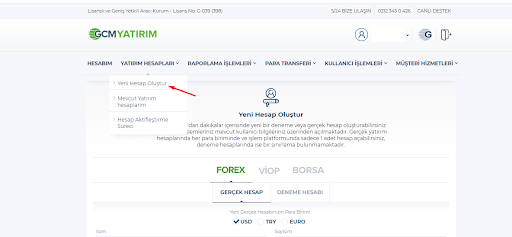

Trading Account Opening

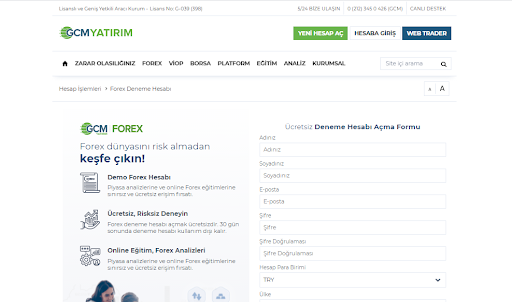

In order to create a Personal Account on GCM Forex, you need to choose an account type and go through a simple registration:

On the website of GCM Forex click on the Open a New Account button.

Enter personal data in the registration form: First Name, Last Name, Phone and Email. Also come up with a reliable password and choose account currency.

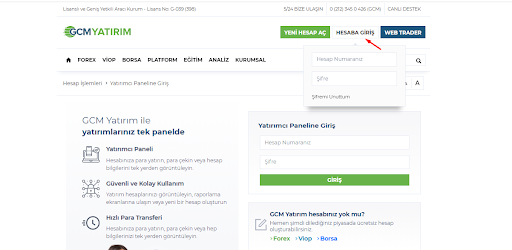

In order to access your Personal Account, provide your account number (the broker will send it to the email address specified during registration) and password.

Features of the Personal Account on GCM Forex:

In the Personal Account, a trader can perform the following actions:

-

Create a statement on all opened trading accounts.

-

Pass verification.

-

Review economic calendar, news and market analysis.

-

View movement of funds on investment accounts.

-

Receive a report on closed trades with specification of the price and the time of opening and closing of the position.

-

Read about the security guarantees of funds, which the company offers.

-

Contact customer support.

Regulation and safety

GCM Forex has a safety score of 6.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 16 years

- Not tier-1 regulated

GCM Forex Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

| SPK (Turkey) | Sermaye Piyasası Kurulu (SPK) – Capital Markets Board of Turkey | Turkey | TL 160,000 | Tier-2 |

GCM Forex Security Factors

| Foundation date | 2009 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker GCM Forex have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- Above-average Forex trading fees

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of GCM Forex with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, GCM Forex’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

GCM Forex Standard spreads

| GCM Forex | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,8 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

GCM Forex RAW/ECN spreads

| GCM Forex | Pepperstone | OANDA | |

| Commission ($ per lot) | 5 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with GCM Forex. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

GCM Forex Non-Trading Fees

| GCM Forex | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0-0,5 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Depending on the trading strategy, a client can choose from two account types offered by GCM Forex. The minimum deposit on both accounts is TRY 50,000.

Account types:

The broker offers each trader a free demo account for gaining experience and strategy testing. The demo account is valid for 30 days. After this period expires, you can open a new Demo Account. The number of available demo accounts is unlimited.

GCM Forex offers standard and ECN accounts. However, high minimum deposit indicates that the broker is more focused on professional traders with substantial capital.

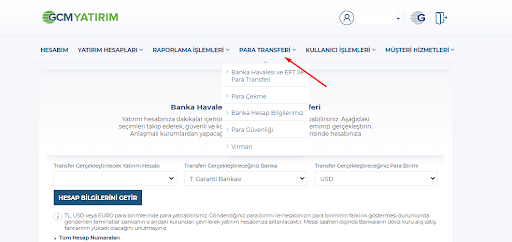

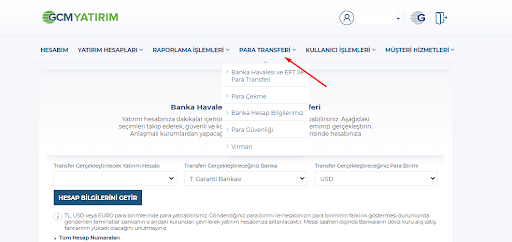

Deposit and withdrawal

GCM Forex received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

GCM Forex offers limited payment options and accessibility, which may impact its competitiveness.

- Low minimum withdrawal requirement

- No deposit fee

- Bank wire transfers available

- Only major base currencies available

- Withdrawal fee applies

- BTC payments not accepted

What are GCM Forex deposit and withdrawal options?

GCM Forex offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making GCM Forex less competitive for those seeking diverse payment options.

GCM Forex Deposit and Withdrawal Methods vs Competitors

| GCM Forex | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are GCM Forex base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. GCM Forex supports the following base account currencies:

What are GCM Forex's minimum deposit and withdrawal amounts?

The minimum deposit on GCM Forex is $1500, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact GCM Forex’s support team.

Markets and tradable assets

GCM Forex offers a limited selection of trading assets compared to the market average. The platform supports 500 assets in total, including 50 Forex pairs.

- Indices trading

- 50 supported currency pairs

- 500 assets for trading

- No ETFs

- Copy trading not available

%1$s Supported markets vs top competitors

We have compared the range of assets and markets supported by GCM Forex with its competitors, making it easier for you to find the perfect fit.

| GCM Forex | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 500 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | Yes | Yes | No |

Investment options

We also explored the trading assets and products GCM Forex offers for beginner traders and investors who prefer not to engage in active trading.

| GCM Forex | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Customer support is available 24h on working days.

Advantages

- You can order a callback

- There is a FAQ section on the website

- A client can visit physical offices of the company

- You can open an account with the help of customer support

- There is a form for recommendations on how to improve the company’s work

Disadvantages

- Customer support does not work on weekends and holidays

- You have to provide personal data in the feedback form

- Chat operators respond only in Turkish

- You cannot contact customer support directly from the trading platform

There are several ways to contact customer support:

-

Write a message on a live chat;

-

Fill out the form on the company’s website;

-

Make a phone call;

-

Order a callback;

-

Send an email;

-

Request a personal meeting at an office.

You don’t have to be a company’s client to contact customer support.

Contacts

| Foundation date | 2009 |

|---|---|

| Registration address | GCM Yatırım Menkul Değerler A.Ş., Eski Büyükdere Cad. Park Plaza. No:14 Kat:14 Maslak Sarıyer / İstanbul, TÜRKİYE |

| Regulation | MASAK, CMB |

| Official site | https://www.gcmyatirim.com.tr/ |

| Contacts |

Education

The company does not offer educational courses on trading, but you can watch live streams of master classes of top traders in the Eğitim section of the website. The section also features over 10,000 minutes of educational videos on trading and the use of software.

Eğitim also features information for professional traders, including articles and expert market analysis that can help improve their own expertise.

Comparison of GCM Forex with other Brokers

| GCM Forex | Bybit | Eightcap | XM Group | Markets4you | FBS | |

| Trading platform |

GCM Trader, MetaTrader4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MobileTrading, MT5 | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $50000 | No | $100 | $5 | No | $5 |

| Leverage |

From 1:1 to 1:10 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:10 to 1:4000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 2 points | From 0 points | From 0 points | From 0.8 points | From 0.1 points | From 1 point |

| Level of margin call / stop out |

50% / No | No / 50% | 80% / 50% | 100% / 50% | 100% / 20% | 40% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed Review of GCM Forex

GCM Forex has been offering its services since 2012. The company cares about its reputation and conducts transparent business. Its website features information about the licensing and regulatory bodies that oversee and audit its operation, as well as information about the licenses and awards. You can learn about the broker’s growth and development of innovative products from the publications in the national print media and television – the links to them are available on the company’s website.

GCM Forex in figures:

-

Free capital of the company – TRY 39 million.

-

The broker has five offices in Turkey for servicing its clients.

-

Over 400 licensed employees with experience in the financial and stock markets.

GCM Forex is a broker oriented towards active brokers with sufficient amount of own funds for trading with minimum credit

The minimum deposit on GCM Forex is TRY 50,000. However, as the Turkish regulatory authorities limit the maximum leverage to 1:10, this amount may not be enough for full-fledged trading without substantial use of borrowed funds. This is why GCM Forex is primarily suitable for wealthy traders, who are prepared to invest large capital in Forex.

The broker offers the popular MetaTrader 4 platform with the feature of copying trades of clients of other companies. In addition, the company has a proprietary web platform available for all browsers. For mobile trading, MT4 and GCM Trader apps are available. They can be installed on any Android or iOS device.

Useful services by GCM Forex:

-

Market analysis with a built-in virtual assistant feature, which filters assets based on the criteria set by the user.

-

Calculator for calculating the cost of 1 pip of the quotes of the currency pair you are trading.

-

An instrument for calculation of swaps on position rollover to the following day.

-

Currency converter, which enables you to perform conversion in real time mode at the current exchange rate.

-

Economic calendar with information on the events that can impact the quotes of the financial instruments.

Advantages:

The broker offers a wide choice of instruments for calculating the risks of order execution.

Clients have access to trading not only on MT4, but also on the proprietary platform, which is compatible with all operating systems.

All registered traders can learn expert opinion on the market situation in real time mode.

Zero brokerage commissions on the standard account and no spreads on the ECN accounts.

Special analytical reviews on different financial instruments are published daily on the company’s website.

The broker’s clients can earn passive income using copy trading services or automated Expert Advisors.

GCM Forex allows the use of different trading strategies, including hedging of positions and high-frequency trading.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i