According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- SaxoTraderGO

- GPM Online

- TWS (Trader Workstation) by Interactive Brokers

- eTrading by Swissquote

- CNMV

- 2021

Our Evaluation of GPM Broker

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

GPM Broker is a moderate-risk broker with the TU Overall Score of 5.9 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by GPM Broker clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

GPM Broker is a company regulated in Spain that offers proprietary investment services and active trading on third-party platforms such as TWS (Trader Workstation) by Interactive Brokers, SaxoTraderGO (Saxo Bank), and eTrading (Swissquote).

Brief Look at GPM Broker

GPM Broker is a Spanish stock broker that has been on the market since 1987. In 1990, it was registered by CNMV (Comisión Nacional del Mercado de Valores) and FOGAIN (Fondo General de Garantía de Inversiones). The company is an introducing broker (IB) of Saxo Bank, Interactive Brokers, and Swissquote which are internationally regulated companies, and therefore it offers trading platforms of these brokers. GPM Broker focuses on asset management services provided using model portfolios and investment funds, including companies with variable capital SICAV (Société d'investissement à Capital Variable). The broker’s head office is located in Madrid, however, it also has offices in Barcelona and other major Spanish cities.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- FOGAIN compensation to retail brokers from Spain in the amount of up to €100,000;

- Huge range of available markets — up to 100,000 assets subject to the trading platform;

- The broker is supervised by CNMV, the Spanish national regulator;

- Four account types each with unique trading conditions;

- Over 40 ready-made asset portfolios differentiated by risk level and initial investments;

- Access to 50+ stock exchanges in the U.S., Europe, and Asia;

- Offices where traders can get personal advice on investment products are located throughout Spain.

- No education on the broker’s official website;

- GPM Broker withholds intermediary fees for providing trading on partner platforms;

- High fees for U.S. stocks and ETFs.

TU Expert Advice

Financial expert and analyst at Traders Union

GPM Broker offers a wide choice of trading platforms and financial instruments, as well as access to the world’s major exchanges. Traders and investors can work with 100,000 assets and 40 management models with minimum initial deposit requirements. The broker provides market data and its experts help investors to choose a ready-made portfolio. However, GPM Broker doesn’t offer trading and investment education.

The company has been an intermediary in financial markets for over 30 years. It offers trading fund assets with dividend payments and CFDs. Liquidity is provided by major companies that are the broker’s partners under the IB program. This ensures execution at the best prices accumulated from many sources.

All GPM Broker’s trading fees are available on its website and in the documents provided there. The company declares rewards from Interactive Brokers, Saxo Bank, and Swissquote, received for expanding their client base and increasing the total trading volume. The broker’s disadvantages are high fees and the limited choice of payment systems. Currently, only bank transfers are available for deposits and withdrawals.

GPM Broker Trading Conditions

| 💻 Trading platform: | GPM Online, TWS (Trader Workstation) by Interactive Brokers, eTrading by Swissquote, and SaxoTraderGO by Saxo Bank |

|---|---|

| 📊 Accounts: | Demo, GPM Professional Broker, GPM SV, GPM Swissquote, and GPM Trader |

| 💰 Account currency: | USD, EUR, GBP, and other currencies |

| 💵 Deposit / Withdrawal: | Wire transfer |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: |

Up to 1:40 for retail clients Up to 1:200 for professional clients |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | 0,2-0,5 pips |

| 🔧 Instruments: | Stocks, futures, options, warrants, ETFs, CFDs, Forex, fixed-income instruments (REPOs and bonds), mutual and investment funds, and asset portfolios |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | JPMorgan, Barclays, Citibank, UBS, Interactive Brokers, Swissquote, and Saxo Bank |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Additional fees for trading on SaxoTraderGO, TWS, and eTrader |

| 🎁 Contests and bonuses: | No |

The range of trading instruments differs, since the broker offers four trading platforms, and three of them are developments of third-party companies. You can start trading with any amount, however, regional peculiarities can apply. For example, if UK traders want to start trading on the eTrading platform offered by Swissquote, they must deposit $1,000. Residents of Spain can deposit an amount sufficient to buy assets and to pay brokerage fees. The minimum investment amount for them is €0-€5,000 and is subject to the chosen portfolio type and the requirements of the fund.

GPM Broker Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

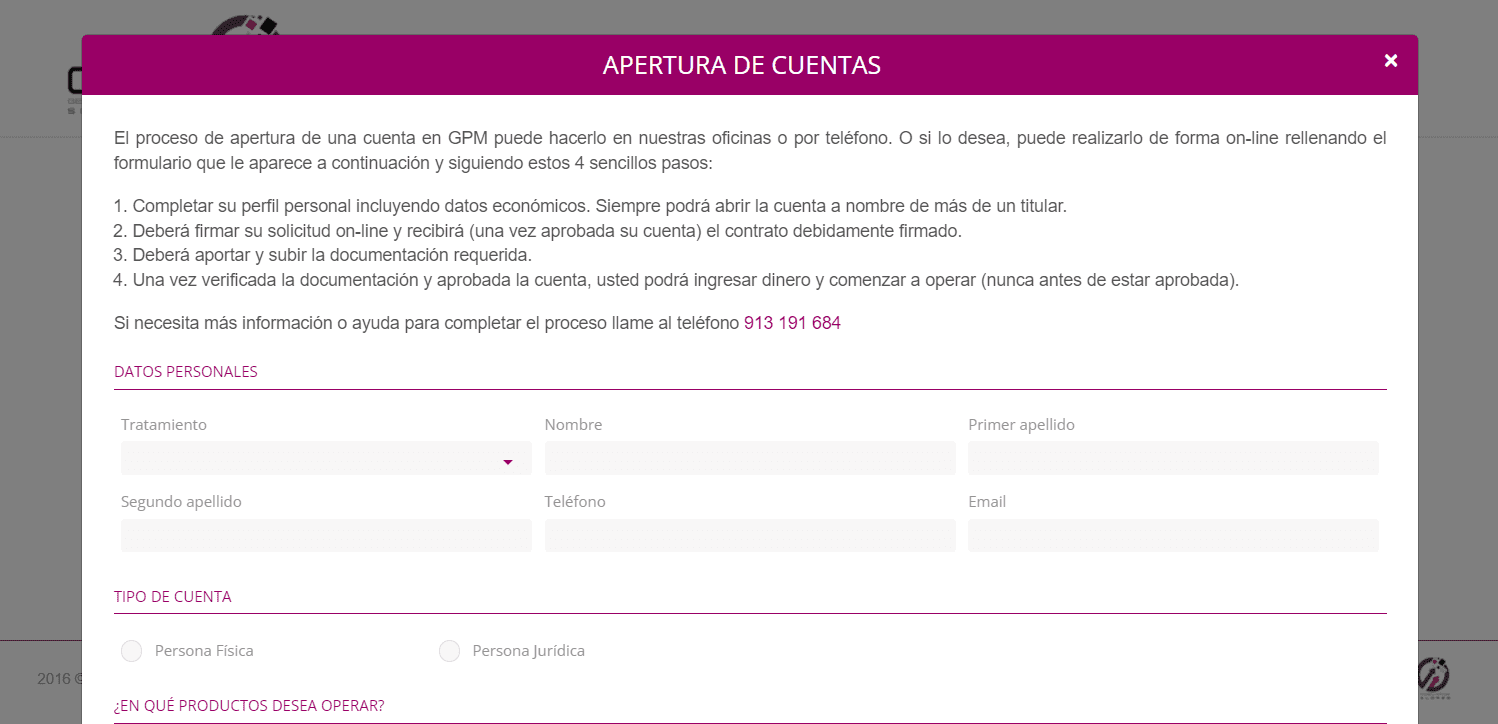

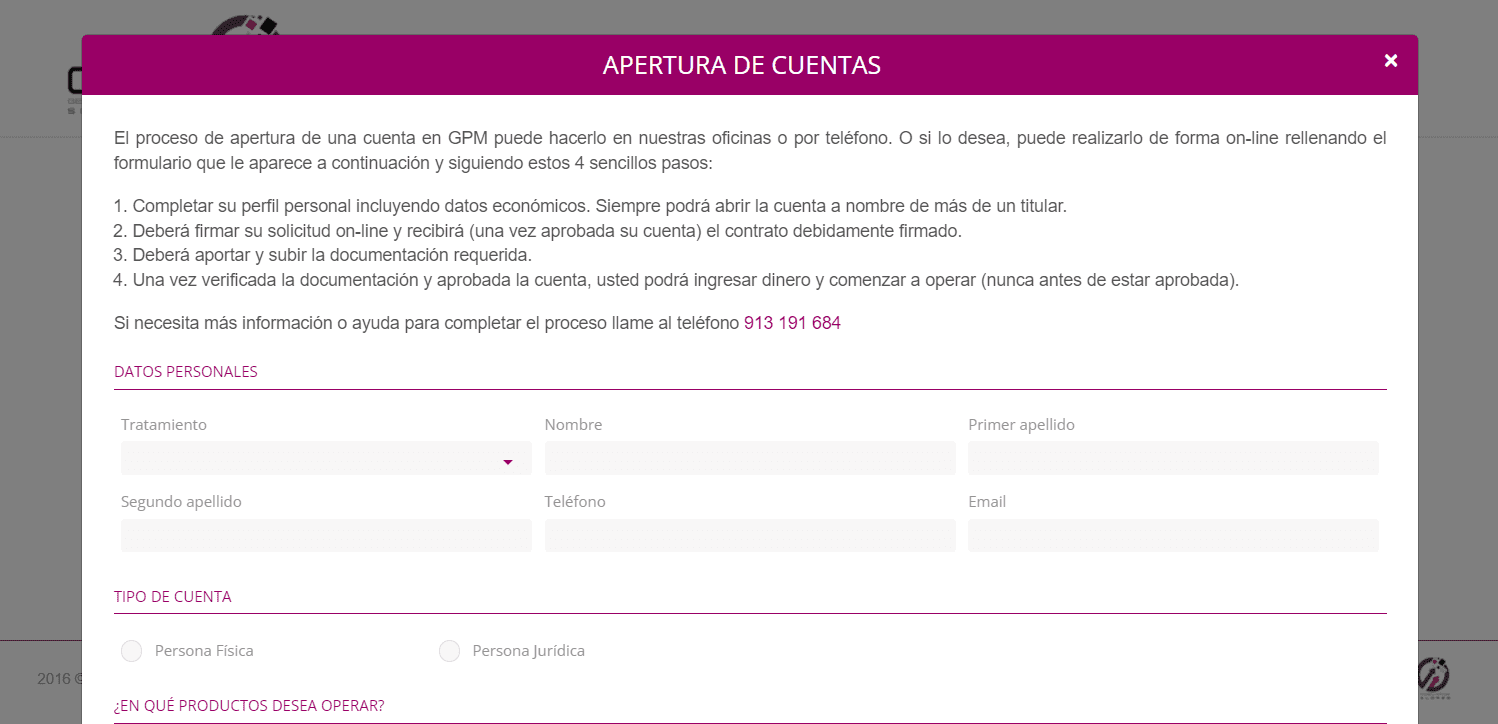

Trading Account Opening

To start trading on any of the broker’s account types, create a user account on its official website. Below are a few instructions on how to register:

Click the “Abrir cuenta” button at the top of the screen.

To open a registration form, click the “Apertura de Cuenta” button.

In the form, provide your personal information, choose the account type and trading instruments, and create a username and password.

Confirm your email and sign into your user account entering your username and password. Next, complete your profile, link your bank account, upload your documents, and sign the agreement. Deposit funds only after you receive confirmation that the company has approved your registration.

Regulation and safety

GPM Broker has a safety score of 8/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- No negative balance protection

GPM Broker Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CNMV CNMV |

Comisión Nacional del Mercado de Valores | Spain | Up to €100,000 | Tier-1 |

GPM Broker Security Factors

| Foundation date | 2021 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker GPM Broker have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of GPM Broker with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, GPM Broker’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

GPM Broker Standard spreads

| GPM Broker | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,7 | 1,4 | 0,5 |

Does GPM Broker support RAW/ECN accounts?

As we discovered, GPM Broker does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with GPM Broker. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

GPM Broker Non-Trading Fees

| GPM Broker | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Traders can open accounts with GPM Broker in any of its offices, by phone, or online. Upon confirmation of personal and payment data, choose the platform on which you want to create an account. If you are going to use the platform offered by another company, open the account with this company as well, since GPM Broker is an IB in this case, that is, an intermediary between a trader and the executive broker.

Account types:

GPM Broker offers a demo account for training and exploring the platform’s features and trading conditions of the broker.

The broker divides its clients into Minoristas and Profesionales, which influences the trading conditions and the range of available markets.

Deposit and withdrawal

GPM Broker received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

GPM Broker offers limited payment options and accessibility, which may impact its competitiveness.

- Bank wire transfers available

- Minimum deposit below industry average

- No withdrawal fee

- No deposit fee

- No bank card option

- PayPal not supported

- BTC payments not accepted

What are GPM Broker deposit and withdrawal options?

GPM Broker offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making GPM Broker less competitive for those seeking diverse payment options.

GPM Broker Deposit and Withdrawal Methods vs Competitors

| GPM Broker | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are GPM Broker base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. GPM Broker supports the following base account currencies:

What are GPM Broker's minimum deposit and withdrawal amounts?

The minimum deposit on GPM Broker is $1, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact GPM Broker’s support team.

Markets and tradable assets

GPM Broker offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 55 Forex pairs.

- 55 supported currency pairs

- Copy trading platform

- Indices trading

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by GPM Broker with its competitors, making it easier for you to find the perfect fit.

| GPM Broker | Plus500 | Pepperstone | |

| Currency pairs | 55 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | Yes | Yes | No |

Investment options

We also explored the trading assets and products GPM Broker offers for beginner traders and investors who prefer not to engage in active trading.

| GPM Broker | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Traders can contact technical support from 9:00 to 18:00 (GMT+1) Monday through Friday.

Advantages

- Support is available by phone and email

Disadvantages

- No live chat on the broker’s website

- Support isn’t available 24/7

To communicate with technical support, traders can use these channels:

Telephone;

Email;

Feedback form in the Contact section.

For a personal consultation, visit one of the company’s offices.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | Calle de Montesa 38 (Pasaje Martí) Local 1, 28006 Madrid, Spain |

| Regulation | CNMV |

| Official site | https://gpmsv.com/gpmbroker/ |

| Contacts |

+34 91 319 16 84

|

Education

GPM Broker doesn’t provide trading and investment education. The company helps traders to choose investment products only upon opening accounts and confirmation of their personal data and bank details.

Novice traders can use a demo account to learn how to trade in financial markets. The deposit is virtual, therefore traders can neither lose money nor receive real income.

Comparison of GPM Broker with other Brokers

| GPM Broker | Eightcap | XM Group | RoboForex | LiteFinance | FBS | |

| Trading platform |

eTrading by Swissquote, GPM Online, SaxoTraderGO, TWS (Trader Workstation) by Interactive Brokers | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, MultiTerminal, Sirix Webtrader | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $1 | $100 | $5 | $10 | $10 | $5 |

| Leverage |

From 1:1 to 1:200 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | 10.00% | 7.00% | No |

| Spread | From 1.1 point | From 0 points | From 0.8 points | From 0 points | From 0.5 points | From 1 point |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 50% / 20% | 40% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of GPM Broker

GPM Broker focuses on intermediary services and financial asset management. It acts as the introducing broker for Interactive Brokers, Swissquote, and Saxo Bank. Management of investor capital is the company’s main activity. Qualified experts can offer different investment solutions to both individual and corporate clients.

GPM Broker by the numbers:

35+ years of brokerage and investment activities;

Over 3,000 investors who trust their capital to the company;

10,500+ active clients;

More than 50 employees in offices across Spain;

40+ ready-made portfolios with different initial investment requirements and risk levels.

GPM Broker is a stock broker that provides access to trading on exchanges in 22 countries

GPM Broker is a member of two major stock exchanges of Spain — Bolsa de Barcelona (BCN) and Bolsa de Madrid (BM). It is also listed on Latibex, the stock market for Latin American securities, and Mercado Alternativo Bursátil (MAB). The broker’s clients can trade on over 50 global exchanges, including NYSE, Euronext, CME Group, and Deutsche Börse. Liquidity is provided by many tier 1 banks, prime brokers, and MTF (Multilateral Trading Facility) and ECN (Electronic Communication Network) networks.

The broker offers a huge range of trading platforms designed for both active trading of underlying assets and derivatives, and for investment, including long-term. Web, mobile, and desktop versions of different platforms are available. All of them are provided free of charge, but there is a fee for market data provided by third-party analytical resources.

Useful services offered by GPM Broker:

SMARTRouting. This is a special algorithm of the TWS platform that compares quotes from different liquidity providers (ECN and MTF) and offers the best price.

Trading signals provided by Javier Bernat. These are intended for investors focused on long-term strategies. Recommendations to buy, sell, or hold securities are available within 12 months.

Market analysis. The GPM Broker website regularly provides the latest news and activity reports of the most important global companies. Also, investors can subscribe to newsletters sent by email.

Demo modes of trading platforms. Trading platforms offered by the broker’s partners can be used for trading with a virtual deposit.

Advantages:

Real-time quotes, advanced charts, and extended order types;

Trading stocks, futures, options, and fixed-income instruments are available;

Technical and fundamental analyses on the platforms;

Platforms with option chain support;

Discretionary portfolio management and other investment options.

The broker offers access to multi-functional trading platforms that support over 50 order types, algorithmic trading, and direct trading from the chart.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i