According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- MT4

- MT5

- FSC

Our Evaluation of IC Trading

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

IC Trading is a moderate-risk broker with the TU Overall Score of 6.91 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by IC Trading clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

IC Trading is a reliable broker with a wide range of trading services and access to various markets. It is suitable for both experienced traders and beginners, but potential clients should carefully review account conditions and fees before starting trading.

Brief Look at IC Trading

IC Trading is a brokerage firm specializing in providing trading services in the Forex and CFD markets. IC Trading is authorized and regulated by the Financial Services Commission of Mauritius (FSC) with license number GB21026834.

IC Trading holds client funds in separate trust accounts at Westpac and National Australia Bank (NAB). All client funds are managed following client money handling rules and kept separate from IC Trading company funds.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- A wide range of assets for trading: CFDs on Forex, indices, commodities, stocks, bonds, futures, and cryptocurrencies;

- Reliable trading platforms such as WebTrader, MetaTrader, and ZuluTrade, are available for both desktop and mobile devices;

- Fast order execution and low spreads, starting from 0 pips on some accounts;

- Multiple timeframes for price action and pattern analysis;

- Adjustable settings for technical indicators.

- Possible commissions for depositing and withdrawing funds, depending on the chosen transaction method;

- The minimum deposit required to open an account may be higher than average;

- No option for opening PAMM-type accounts for investment.

TU Expert Advice

Author, Financial Expert at Traders Union

IC Trading provides a range of trading services, including Forex, CFDs, stocks, and cryptocurrencies, across MetaTrader 4, MetaTrader 5, and ZuluTrade platforms. With Standard, Raw Spread, and Islamic accounts, the broker caters to various trading preferences. Key advantages include fast execution speeds, competitive spreads starting from 0 pips, and a diverse selection of over 2,250 trading instruments. Additionally, traders benefit from advanced trading tools, client funds security with segregation, and the potential for demo account practice.

However, IC Trading presents drawbacks such as possible transaction fees and a $200 minimum deposit, which may not appeal to all traders. The lack of Tier-1 regulation and PAMM accounts can also be considered disadvantages. Overall, IC Trading may be suitable for experienced traders seeking low spreads and diverse instruments, while less suitable for those prioritizing low entry costs or stringent regulatory conditions.

IC Trading Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. IC Trading and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | МТ4 (desktop, mobile, web), МТ5 (desktop, mobile, web) |

|---|---|

| 📊 Accounts: | Demo, Standard, Raw Spread |

| 💰 Account currency: | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF |

| 💵 Deposit / Withdrawal: | Credit and debit cards, PayPal, Neteller, bank transfers, Broker to Broker |

| 🚀 Minimum deposit: | From $200 |

| ⚖️ Leverage: | 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Forex CFDs (61), indices (25), stocks (2100+), commodities (24), bonds (9), cryptocurrencies (21) |

| 💹 Margin Call / Stop Out: | 50% |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Equinix NY4 server, average execution speed under 40 ms |

| ⭐ Trading features: | No |

| 🎁 Contests and bonuses: | Yes, including rebates from Traders Union |

IC Trading offers clients over 2,250 trading instruments, classic MetaTrader platforms, and the ability to trade micro-lots. Traders receive raw spreads from 0.0 pips. Potential clients can test trading conditions on demo accounts. Muslim traders have access to trading on Islamic accounts.

IC Trading Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

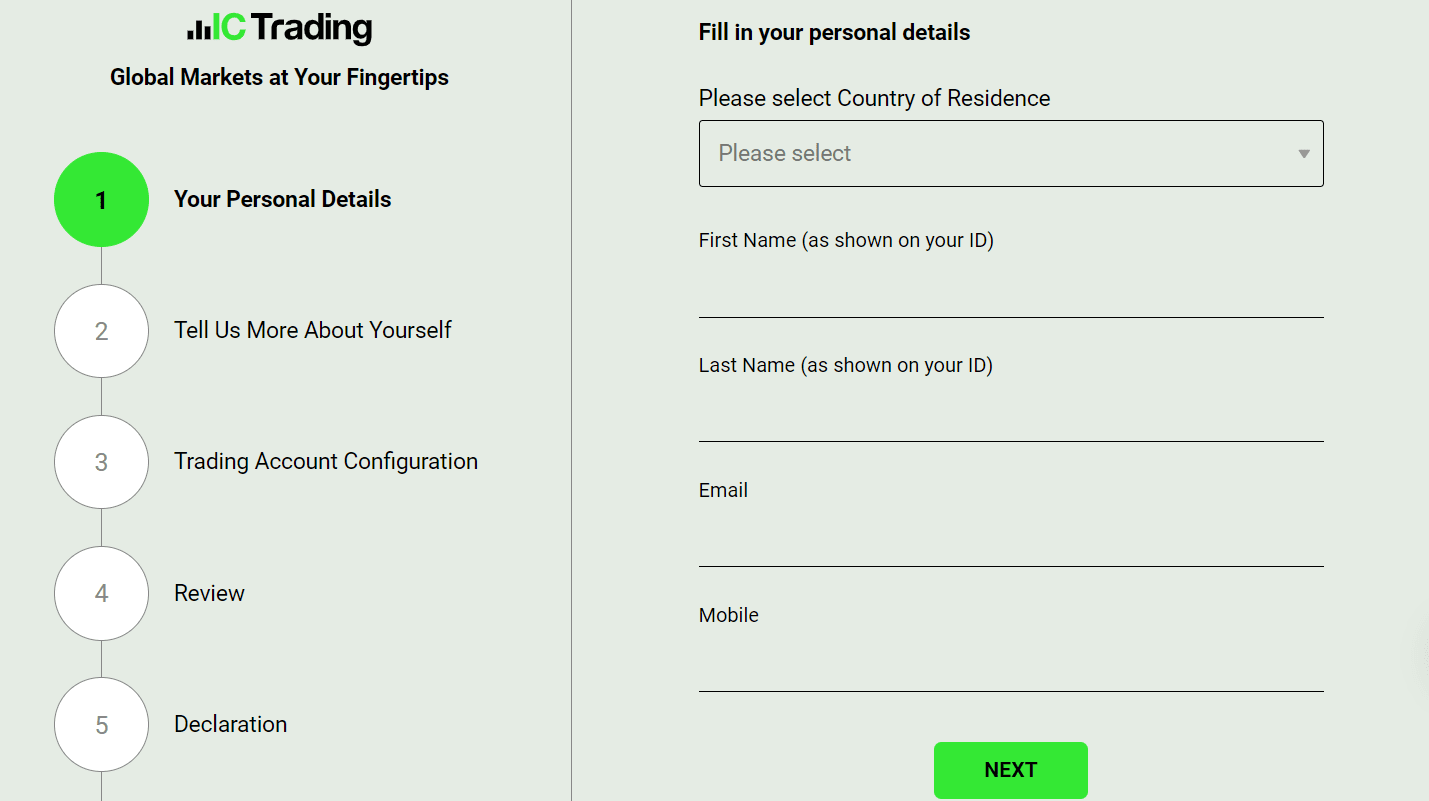

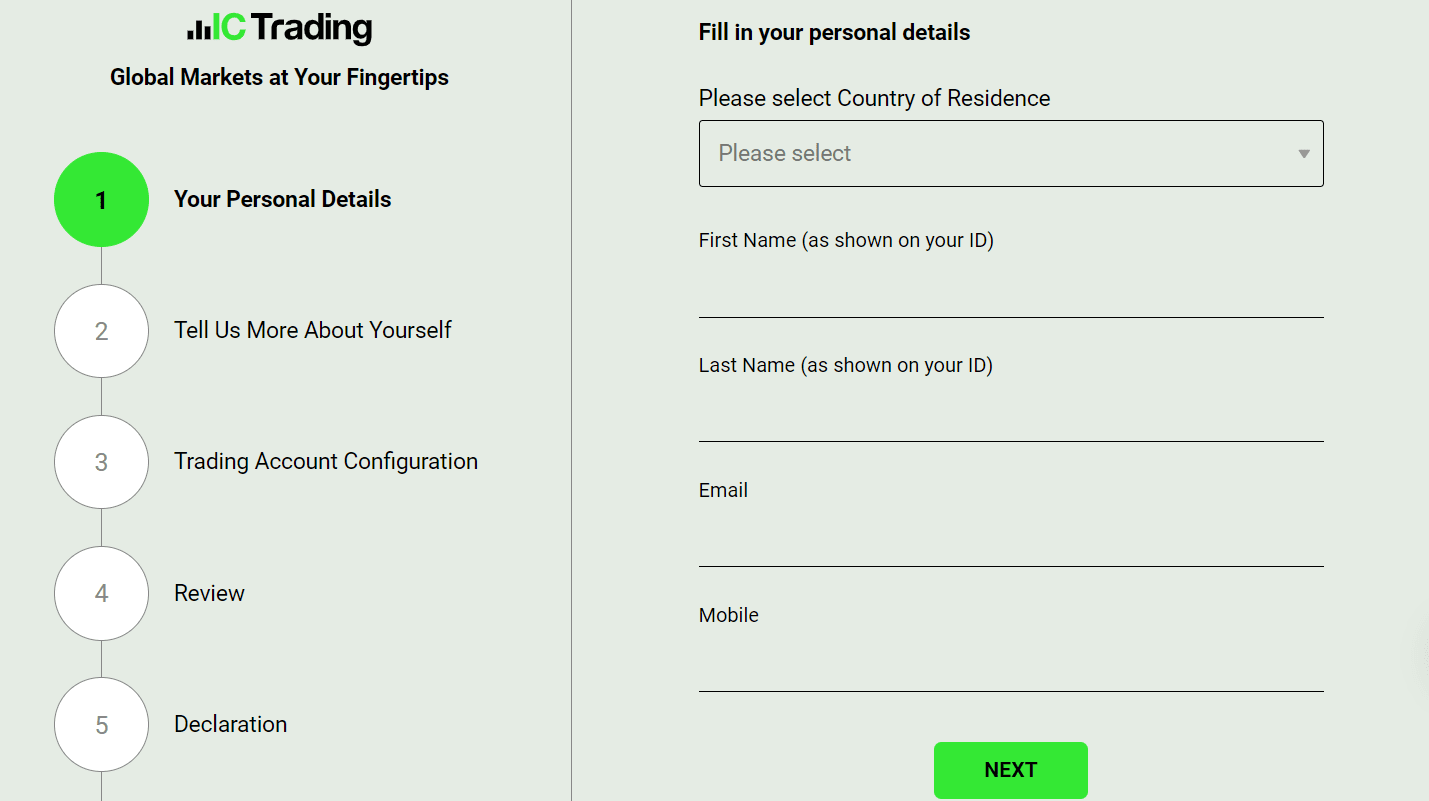

To start working with IC Trading, create a user account and open a trading account. The brief instructions are as follows:

On the main page of the website, go to the registration form by clicking the "Start Trading" button and enter the requested data. Before the registration process is considered complete, the trader must upload copies of certain documents. The platform will require photo identification with personal details (name, date of birth, address).

The broker may ask additional questions to ensure the security and protection of the platform from dishonest users. The broker may inquire about the user's trading experience, investment goals, or sources of funding.

Select an account type: Standard (suitable for beginners) or Raw Spread (narrow spreads, plus $3.50 fee). Then make the minimum deposit of $200 for any account.

Functions of the IC Trading user account:

Also available in the trader's user account:

-

Economic calendar: Important news and events affecting the markets;

-

Trade strategy planning: Analytical materials, market news, technical analysis, and educational articles;

-

Adjustment of trading conditions: Leverage, stop loss and take profit, margin call levels;

-

Market quotes: Forex, stocks, indices, bonds, and real-time prices.

Regulation and safety

IC Trading has a safety score of 3.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

IC Trading Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

IC Trading Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker IC Trading have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of IC Trading with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, IC Trading’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

IC Trading Standard spreads

| IC Trading | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,7 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

IC Trading RAW/ECN spreads

| IC Trading | Pepperstone | OANDA | |

| Commission ($ per lot) | 4,0 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with IC Trading. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

IC Trading Non-Trading Fees

| IC Trading | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

IC Trading offers 3 account types, including Islamic, for MetaTrader platforms, adapted to different trading strategies and styles. The maximum leverage for retail clients is 1:500. The minimum deposit amount for all account types is $200.

Account Types:

Demo accounts are available for all platforms. IC Trading is a reliable broker that provides its clients with all the necessary tools for successful CFD trading.

Deposit and withdrawal

IC Trading received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

IC Trading provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Bank wire transfers available

- Bank card deposits and withdrawals

- No withdrawal fee

- USDT payments not accepted

- BTC not available as a base account currency

- Limited deposit and withdrawal flexibility, leading to higher costs

What are IC Trading deposit and withdrawal options?

IC Trading provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, PayPal, Neteller.

IC Trading Deposit and Withdrawal Methods vs Competitors

| IC Trading | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | Yes | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are IC Trading base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. IC Trading supports the following base account currencies:

What are IC Trading's minimum deposit and withdrawal amounts?

The minimum deposit on IC Trading is $200, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact IC Trading’s support team.

Markets and tradable assets

IC Trading offers a wider selection of trading assets than the market average, with over 2250 tradable assets available, including 75 currency pairs.

- Passive income with bonds

- Copy trading platform

- 2250 assets for trading

- No ETFs

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by IC Trading with its competitors, making it easier for you to find the perfect fit.

| IC Trading | Plus500 | Pepperstone | |

| Currency pairs | 75 | 60 | 90 |

| Total tradable assets | 2250 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products IC Trading offers for beginner traders and investors who prefer not to engage in active trading.

| IC Trading | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Support operators are on call 24 hours a day, 7 days a week.

Advantages

- In the online chat, you can ask a question without being a client of the company

- Support via email is available

Disadvantages

- Support is available only in English

- To ask a question, you need to provide your details

The broker provides the following communication channels:

-

phone (specified in the Contact Us section);

-

email;

-

online chat on the website and in the user account;

-

feedback form.

Even an unregistered user can get an answer to their question.

Contacts

| Registration address | Suite 803, 8th Floor, Hennessy Tower, Pope Hennessy Street, 11328, Port Louis, Mauritius |

|---|---|

| Regulation |

FSC

Licence number: GB21026834 |

| Official site | https://ictrading.com/ |

| Contacts |

+23 080 2049 0079

|

Education

The official IC Trading website provides useful education information. The only option for gaining knowledge for novice traders is to study brief guides on trading various Forex assets and CFDs.

The broker does not offer cent accounts, so the simplest way to apply the acquired knowledge is to practice on a demo account.

Comparison of IC Trading with other Brokers

| IC Trading | Eightcap | XM Group | RoboForex | Markets4you | Vantage Markets | |

| Trading platform |

MT4, MT5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5 | MT4, MT5, TradingView, ProTrader, Vantage App |

| Min deposit | $200 | $100 | $5 | $10 | No | $50 |

| Leverage |

From 1:1 to 1:50 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points | From 0 points |

| Level of margin call / stop out |

50% / No | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 20% | 100% / 50% |

| Order Execution | Equinix NY4 server | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of IC Trading

IC Trading builds its work on providing traders with the most advantageous spreads, regardless of market fluctuations.

IC Trading uses modern trading technologies, such as market depth (DoM), built-in spread monitoring, ladder system trading, and automatic order closure using special order templates. The broker's trading applications for iPhone and Android are optimized for trading 24/7.

Clients can open trades from 1 micro lot (1,000 units of the base currency) to 200 lots (20 million base currency) via the broker's bridge.

Traders have access to standard, Islamic, Raw Spread, and demo accounts.

IC Trading by the numbers:

-

Over $29 billion in currency transactions processed daily;

-

Access to more than 2100+ instruments;

-

Average trade execution speed is about 35 milliseconds on currency pairs.

IC Trading is a broker with narrow spreads and favorable trading conditions.

In addition to standard accounts, IC Trading offers a Raw Spread account with the lowest spreads, starting from 0.0. Thanks to deep liquidity and fast execution, the IC Trading Raw Spread account is suitable for day traders, scalpers, and expert advisors. Company clients can trade currency pairs, cryptocurrencies, as well as CFDs on stocks, indices, Forex currencies, bonds, and commodities.

The broker offers MetaTrader 4 and 5 trading platforms, as well as MT iOS/Android and MT Mac. Executable streaming prices (ESP) are provided by the IC Trading pricing provider so that clients can trade without manually dealing, price manipulation, or re-quotes. For passive investors, the broker offers the ZuluTrade social trading platform.

Useful functions of IC Trading:

-

Forex calculator. Users can select the necessary currency pairs and trade size to calculate pip prices. The tool also helps to calculate margins, swaps, and income;

-

Currency converter. Helps with calculating the cost of conversions;

-

Glossary of Terms. Users can find all the necessary information about precise terminology and professional expressions; especially convenient for beginners;

-

Trading schedule for all available assets. This tool provides traders with information about the trading hours for all instruments available on the IC Trading platform, including currency pairs, metals, CFDs on indices, cryptocurrencies, stocks, and bonds.

Advantages:

7 asset classes available for trading;

All client funds are held in separate trust accounts in leading international banks;

Narrow spreads (starting from 0.0 pips);

Popular social trading platform ZuluTrade available for investors;

The broker provides free analytics and online tools to enhance trading quality;

Standard, Islamic, demo, and Raw Spread accounts are available to all clients, regardless of the deposit size.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i