According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $300

- CQG

- TT Platform

- BCR Trader (based on MT4)

Our Evaluation of JB Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

JB Markets is a moderate-risk broker with the TU Overall Score of 5.62 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by JB Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

JB Markets goes beyond CFD and currency markets, offering management services for investors keen on passive gains.

Brief Look at JB Markets

JB Markets is a broker that gives traders access to the Forex market and offers software for CFD trading and investments. The brand JB Markets was registered in 2017 and currently operates underlicense from the Australian regulator ASIC. It has offices in Sydney and Brisbane and a network of brokers globally. Liquidity is provided by major financial institutions that use DMA technology for direct exchange trading.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Reliable regulation by ASIC;

- Clients' funds are held in a segregated trust account in Australia;

- Different account options;

- Mobile trading is available;

- Spreads from 0.1 pips for algorithmic trading;

- High leverage, defaulting to 1:100 and up to 1:400;

- Investment services allow account management by pros.

- High trading fees;

- No cent accounts;

- Minimum deposit of $300.

TU Expert Advice

Author, Financial Expert at Traders Union

JB Markets offers access to Forex markets and supports CFD trading through BCR Trader, CQG, and TT platforms. Traders can operate various account types, including Standard, Platinum, Alpha, and MDA. The broker provides advanced features such as algorithmic trading, mobile access, and leverage up to 1:400. Advantages include its ASIC regulation, competitive spreads starting from 0.1 pips, and professional account management services for passive investors.

Drawbacks of JB Markets include relatively high trading fees and a minimum deposit requirement of $300. Additionally, the range of tradable assets and payment options remain limited. JB Markets may suit traders who prioritize strong regulatory oversight and leverage but may not be ideal for beginners or those seeking low-cost entry.

JB Markets Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. JB Markets and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | BCR Trader (based on MT4), CQG, TT |

|---|---|

| 📊 Accounts: | Simulated (demo), Standard, Platinum, Alpha, MDA (Managed Discretionary Account) |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, credit cards, UnionPay |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0,01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Forex, CFDs, indices, futures, stocks, commodities, options, managed funds |

| 💹 Margin Call / Stop Out: | Margin Call — 100% |

| 🏛 Liquidity provider: | Saxo Bank, other major banks in Australia and the EU |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution (MT4), DMA (CQG, TT) |

| ⭐ Trading features: | Cryptocurrency trading is unavailable |

| 🎁 Contests and bonuses: | Cash back |

The broker offers 36 currency pairs and 56 contracts for difference (CFDs). The latter include CFDs on gold, silver, crude oil (WTI), 6 major indices, and transactions with 10 popular US stock contracts. The trading fee comprises spreads, position processing fees, and overnight charges. Mobile trading is possible through MetaTrader 4 applications. The broker does not provide swap-free accounts.

JB Markets Key Parameters Evaluation

Share your experience

No entries yet.

Trading Account Opening

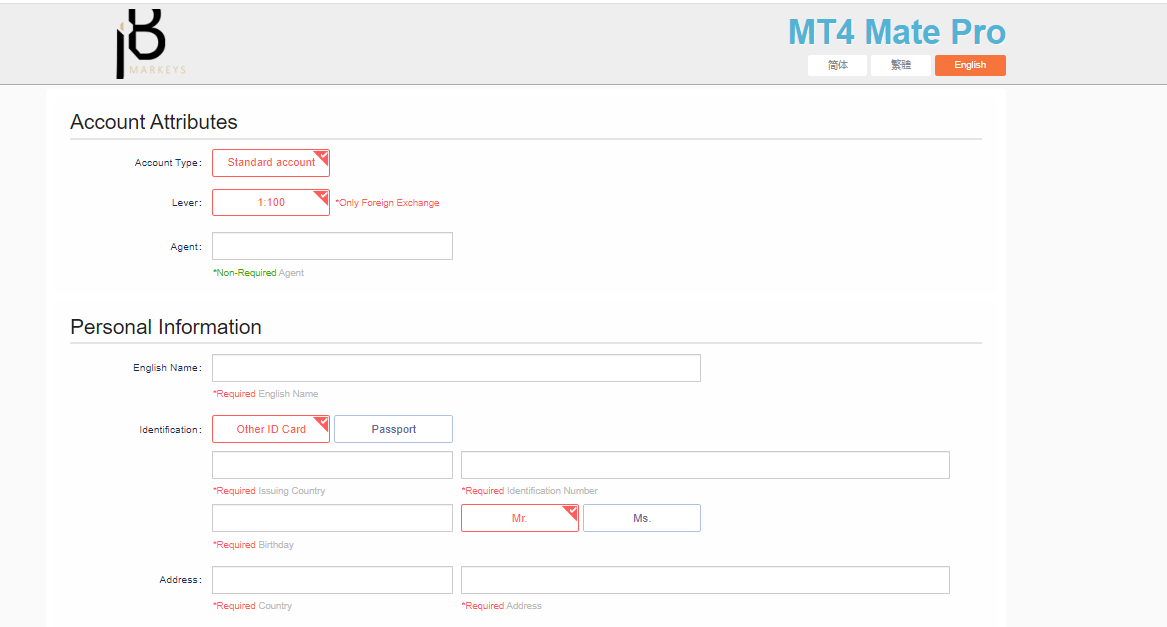

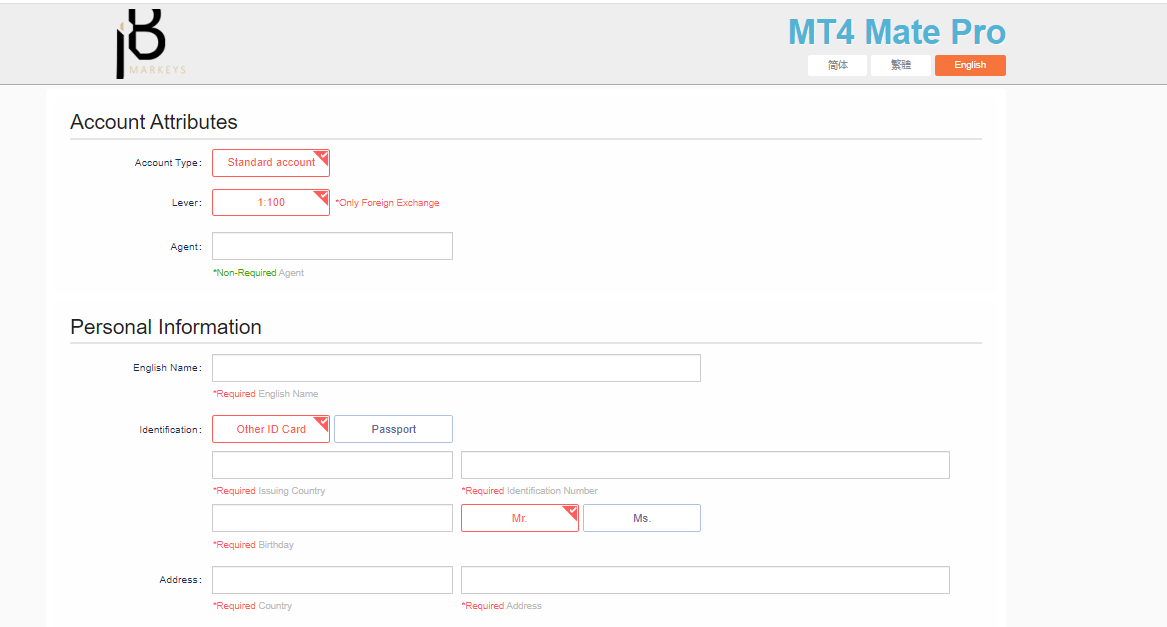

If you plan to trade through JB Markets in Forex, visit the broker website and create an account there by following the instructions below:

Go to the homepage of the site and click on "Opening A Real Account." Clicking on "Simulated Account" will initiate the process of registering a demo account.

Choose the account type, specify the agent code if you were referred to JB Markets. The available leverage size is displayed automatically. Required personal information includes: name, country, identification number, address, phone number, email, bank account details. Additionally, you'll need to upload a photo of your ID and credit card.

After verifying the provided information, the company will send an email to the specified email address with the trading account number and password. These details are used to access the user account where you can top up your balance, manage your account, and monitor trading positions. Requests to withdraw profits are also submitted through the user account.

Regulation and safety

JB Markets has a safety score of 8.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record of less than 8 years

JB Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

| KNF (Poland) | Komisja Nadzoru Finansowego (KNF) – Polish Financial Supervision Authority | Poland | Up to €20,000 per investor | Tier-1 |

JB Markets Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker JB Markets have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of JB Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, JB Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

JB Markets Standard spreads

| JB Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,8 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,8 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

JB Markets RAW/ECN spreads

| JB Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,50 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,12 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with JB Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

JB Markets Non-Trading Fees

| JB Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

After registering an account on the JB Markets website, it's necessary to open a trading account. The broker offers accounts for active trading and for entrusting funds to experienced trade managers. Depending on the account's purpose, requirements for the initial deposit amount vary, and so do fees. The range of trading assets and the leverage values on accounts for independent trading are the same.

Types of accounts:

The broker also offers demo accounts known as simulated accounts. These are intended for testing trading conditions and practicing trading on the over-the-counter market via the BCR Trader platform.

JB Markets provides a wide range of products designed to meet the diverse needs of traders and investors. Offering variable leverage enables potential profit growth during successful trades, while variable spreads help reduce fee expenses when the market is calm.

Deposit and withdrawal

JB Markets received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

JB Markets offers limited payment options and accessibility, which may impact its competitiveness.

- No deposit fee

- No withdrawal fee

- Minimum deposit below industry average

- Bank wire transfers available

- PayPal not supported

- BTC not available as a base account currency

- Limited deposit and withdrawal flexibility, leading to higher costs

What are JB Markets deposit and withdrawal options?

JB Markets offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire. This limitation may restrict flexibility for users, making JB Markets less competitive for those seeking diverse payment options.

JB Markets Deposit and Withdrawal Methods vs Competitors

| JB Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are JB Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. JB Markets supports the following base account currencies:

What are JB Markets's minimum deposit and withdrawal amounts?

The minimum deposit on JB Markets is $100, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact JB Markets’s support team.

Markets and tradable assets

JB Markets offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 50 Forex pairs.

- Copy trading platform

- Indices trading

- 50 supported currency pairs

- Bonds not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by JB Markets with its competitors, making it easier for you to find the perfect fit.

| JB Markets | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products JB Markets offers for beginner traders and investors who prefer not to engage in active trading.

| JB Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | Yes | No | No |

Customer support

All traders seeking assistance from JB Markets are serviced in English, as the company's offices are located in Sydney and Brisbane, Australia.

Advantages

- Live chat and email communication with a broker representative are available

- Phone support is available

Disadvantages

- The chat is not accessible 24/7, queries are redirected to email

- Email responses are received within 1-2 business days

Ways to contact JB Markets:

-

оnline chat;

-

email;

-

phone number;

-

feedback form on the website.

The Brisbane branch specializes in serving Forex traders, allowing clients to personally visit their office and consult with an advisor.

Contacts

| Registration address | JB Markets Pty Ltd, Brisbane Level 9, Riverside Centre 123 Eagle Street BRISBANE QLD 4000 |

|---|---|

| Official site | https://www.jbmarkets.com/ |

| Contacts |

+61 2 8188 9776,

+61 405 185 211, 1300 648 165 |

Education

JB Markets' website provides only introductory information about the currency market and contracts for difference. While the main information is housed in the "Educational Resources" section, useful data is also scattered across the entire site. It can be found in sections like "Contract for Difference", "Investment Guidance", and the FAQs section.

Despite the company not giving sufficient attention to enriching its educational section, it does offer one of the most effective tools for gaining practical skills, which is a demo account with a virtual deposit.

Comparison of JB Markets with other Brokers

| JB Markets | Eightcap | XM Group | RoboForex | Octa | Kama Capital | |

| Trading platform |

BCR Trader (based on MT4), CQG, TT Platform | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, OctaTrader | MetaTrader5 |

| Min deposit | $300 | $100 | $5 | $10 | $25 | No |

| Leverage |

From 1:1 to 1:400 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:40 to 1:1000 |

From 1:1 to 1:400 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 1.7 point | From 0 points | From 0.8 points | From 0 points | From 0.6 points | From 0 points |

| Level of margin call / stop out |

No / 100% | 80% / 50% | 100% / 50% | 60% / 40% | 25% / 15% | 20% / No |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed review of JB Markets

JB Markets caters to different groups of traders by offering platforms with all the basic functions, trading instruments, and investment products depending on each trader’s goals, experience, and capital. Collaborating with major liquidity providers, JB Markets also uses the TradingView service for the most objective quotes. The broker provides access to trading on margin across different account types, with regulated leverage and floating spreads.

JB Markets by the numbers:

-

6 years of licensed operation in financial markets;

-

Over 200 employees in the company;

-

3 types of accounts and 3 varieties of trading platforms.

JB Markets allows choosing software according to specific strategies

The broker provides leverage only for trading outside stock exchanges, i.e., for Forex and CFDs traded on the BCR Trader platform. Currently, the default account leverage is set at 1:100 upon account opening, but traders can increase trading leverage to 1:200 - 1:400 or decrease it to 1:20 - 1:50. To do this, existing clients need to contact their account manager, while new ones need to send an email with the corresponding request before creating an account.

JB Markets clients have access to three platforms — CQG, TT, and BCR Trader. CQG and TT, due to their complex interface yet maximum functionality, are used by professional traders interested in advanced order types and analytical capabilities. BCR Trader is JB Markets' proprietary development based on the MetaTrader 4 technology. The BCR platform supports over 50 built-in indicators, charts ranging from 1 minute to a month, and hedging options. The interface is available in 35 languages.

Useful functions of JB Markets:

-

Management services. Professional traders can trade on behalf of novices, while strictly adhering to the defined investment strategy and independently making decisions regarding potentially profitable trades;

-

Trading simulator. It allows users to explore the functionality of the BCR Trader platform, test JB Markets fees, order execution quality, and the range of available assets;

-

TradingView Tape. It provides real-time prices for popular assets — currency pairs, stock indices, agricultural products, and metals.

Advantages:

Simple registration process and quick opening of a trading account;

Online and telephone support;

Rapid execution of orders at the best prices from time-tested quote providers;

Segregation of client funds from JB Markets' capital;

No fees for payment transactions such as deposits and withdrawals of funds;

JB Markets provides a choice of trading platforms. You can use the classic MetaTrader 4, modified in BCR Trader, and professional platforms with advanced functions.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i