M4Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $5

- MT4

- MT5

- FSA

- CySEC

- DFSA

- FSCA

- 2019

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $5

- MT4

- MT5

- FSA

- CySEC

- DFSA

- FSCA

- 2019

Our Evaluation of M4Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Brief Look at M4Markets

The M4Markets broker offers contracts for difference (CFDs) on currency pairs, cryptocurrencies, stocks, indices, commodities, energies, and metals. This broker provides a free demo account, four real accounts, and an Islamic (swap-free) account option. Spreads and commissions depend on the selected account, with minimum spreads starting from 0 pips and fees from $0. The initial minimum deposit is $5. Traders can use USD, EUR, JPY, or ZAR as the base currency for their accounts. Trading with dynamic leverage up to 1:5000 is available. This broker does not impose restrictions on trading styles and strategies, and traders can use expert advisors. Additional earning opportunities include a copy trading service, MAM and PAMM accounts, and a “Refer a Friend” program. Educational materials and basic analytical tools are also provided. Client support is available 24/7 and offered in 10 languages.

- Low entry barrier due to a minimum deposit of $5.

- MT4 and MT5 trading platforms are available.

- This broker offers several hundred assets across seven groups, providing a high-profit potential when combined with dynamic leverage up to 1:5000.

- Traders can expect optimal trading conditions by choosing from four real accounts (plus a swap-free trading option).

- The platform offers various alternative earning options, including joint accounts, copy trading, and a referral program.

- Trader costs are minimized, as some accounts have no trading commissions, and this broker does not charge withdrawal fees.

- Desktop and mobile versions of MT are available, and the copy trading service is presented as an integrated proprietary solution.

- This broker's website features an economic calendar, various calculators, signals, market sentiment indicators, and other tools.

- This broker has an extensive pool of financial instruments, but it's important to note that all of them are CFDs.

- This broker does not cooperate with residents of Cuba, Sudan, Syria, North Korea, and several other countries.

TU Expert Advice

Financial expert and analyst at Traders Union

The brand is owned by Trinota Markets (Global) Ltd, which is part of the Oryx group. It is a conglomerate of fintech projects operating in major exchange markets. The organization has been existing for many years and is regulated by both the FSA SD035 (Financial Service Authority), CySEC 301/16 (Cyprus Securities and Exchange Commission), DFSA (F007051) and FSCA (49648). During its operation, M4Markets has not been found to violate its obligations to its clients. All disputes are promptly resolved internally without involving regulators.

M4Markets is a CFD broker, offering only one asset type, which is contracts for difference. They provide CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, energies, and metals. Clients can start with a free demo account and then switch to a real Standard or Swap Free account. Standard accounts are offered in four variations, differing in the spread, trading commission, leverage, stop-out level, and margin call.

The minimum raw spread starts from 0 pips, with no commissions or commissions ranging from $2.5 to $3.5 per standard lot. There are no fees for deposits and withdrawals. Traders can use various financial channels for depositing and withdrawing funds, including bank transfers, cards, Skrill, Neteller, Perfect Money, PayRedeem, FasaPay, and regional solutions. The platform operates with 100% transparency, and all transaction fees are known in advance (excluding third-party commissions).

Passive income is available through managed accounts and their copy trading service, along with a “Refer a Friend” program. As a result, this broker is equally convenient for clients who focus on active and passive trading, catering to beginners, intermediate traders, and professionals.

While there are some constructive drawbacks, they are not critical and are common among many brokers. Examples include regional limitations and imperfect client support. This broker provides educational resources such as e-books and webinars, although they may not be top-tier. The technical analysis tools are basic, but extensive tools are not required when working with MT trading platforms. Taking all these factors into account, M4Markets can be recommended for exploration.

We checked the office of the M4Markets brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

Spyrou Kyprianou Ave 78, Limassol 3076

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office

-

M4Markets Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, МТ5 |

|---|---|

| 📊 Accounts: | Demo, Standard, Raw Spread, Premium, Dynamic Leverage, Swap Free |

| 💰 Account currency: | USD, EUR, JPY, ZAR |

| 💵 Replenishment / Withdrawal: | Bank transfer, Visa, MC, Skrill, Neteller, Perfect Money, FasaPay, and PayRedeem |

| 🚀 Minimum deposit: | $5 |

| ⚖️ Leverage: | Up to 1:5000 (dynamic leverage) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, energies, and metals |

| 💹 Margin Call / Stop Out: | Depends on the account type |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

Free demo, four real accounts plus Swap Free Many assets from seven groups (all represented by CFDs) Support for top-end trading platforms Passive income available copy trading service |

| 🎁 Contests and bonuses: | Yes (50% Credit Bonus and rebates from TU) |

Usually, the minimum deposit depends on the selected account type, and the same applies to M4Markets. To open a “Standard” account, a minimum deposit of $5 is required. For the “Raw Spread” account type, a minimum deposit of at least $500 is needed. The highest minimum deposit is for the “Premium” account, requiring a deposit of $10,000 or more. The account with dynamic leverage has the same minimum deposit as the “Standard” account, starting from just $5.

On the “Raw Spread” and “Premium” accounts, the maximum trading leverage may not exceed 1:500, while for the “Standard” account, it is set at 1:1000. On the account with dynamic leverage, the leverage can go up to 1:5000. This broker provides technical support through all major communication channels, operates 24/7, and supports multiple languages.

M4Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

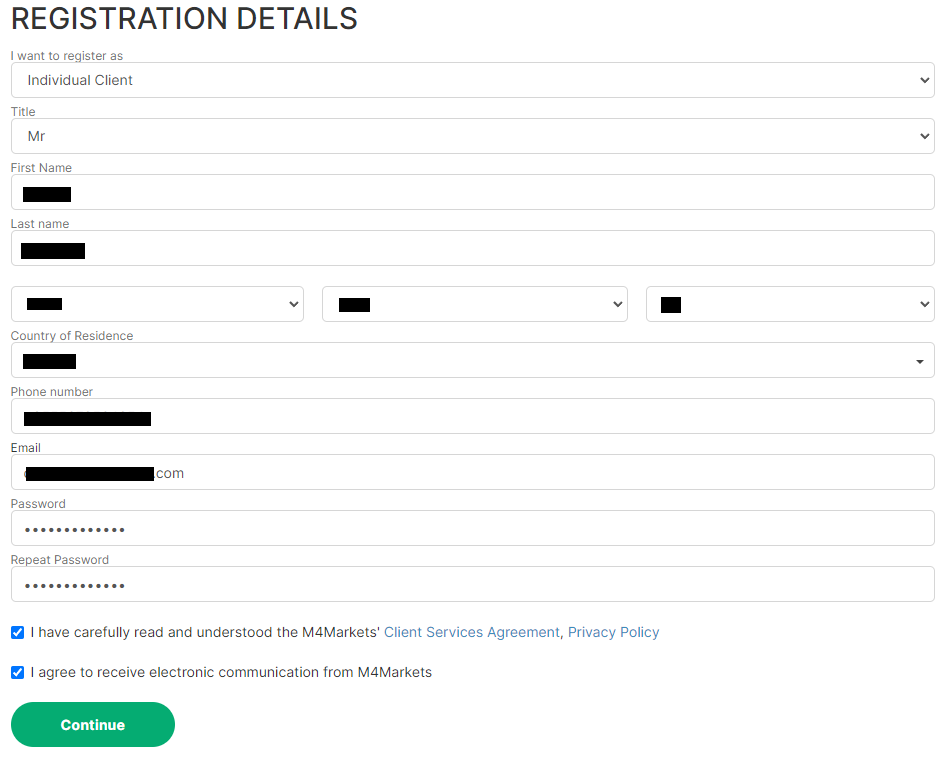

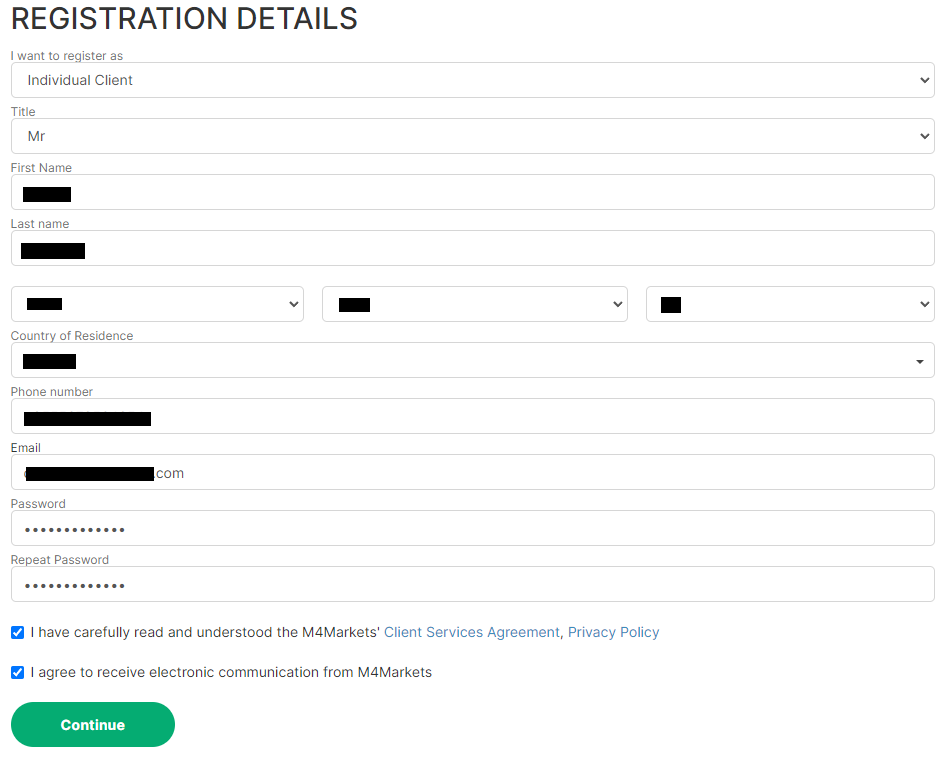

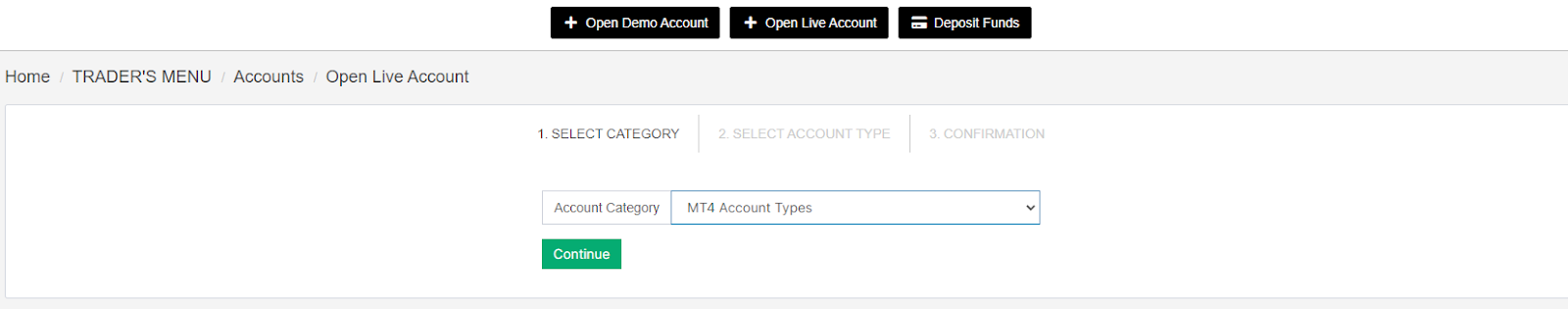

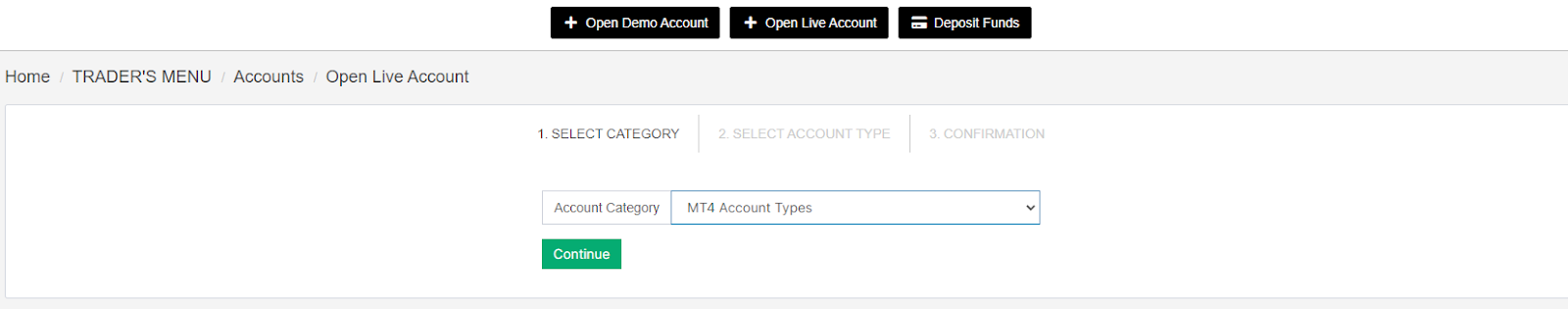

Trading Account Opening

To start collaborating with this broker, you need to register on its official website. Then, you'll need to open a real account, make a minimum deposit, and download the trading platform. Once you log into the platform, you can start trading. The experts at TU have prepared the below step-by-step guide for your convenience. TU experts will walk you through each stage of registration and describe the features of the M4Markets user account.

Go to this broker's website. In the top right corner, select your preferred language. Click on “Open Account”.

Choose the account type (individual or corporate) and your salutation. Enter your first and last names, and date of birth. Specify the country of your residence. Next, provide your contact details, including your phone number and email address. Create a password and enter it twice. Agree to the terms and conditions by ticking the checkboxes at the bottom. Click “Continue”.

You will receive an email with a PIN code to the provided email address. Enter the PIN code in the corresponding field on the website. Alternatively, you can click on the “Confirm Email” button in the email.

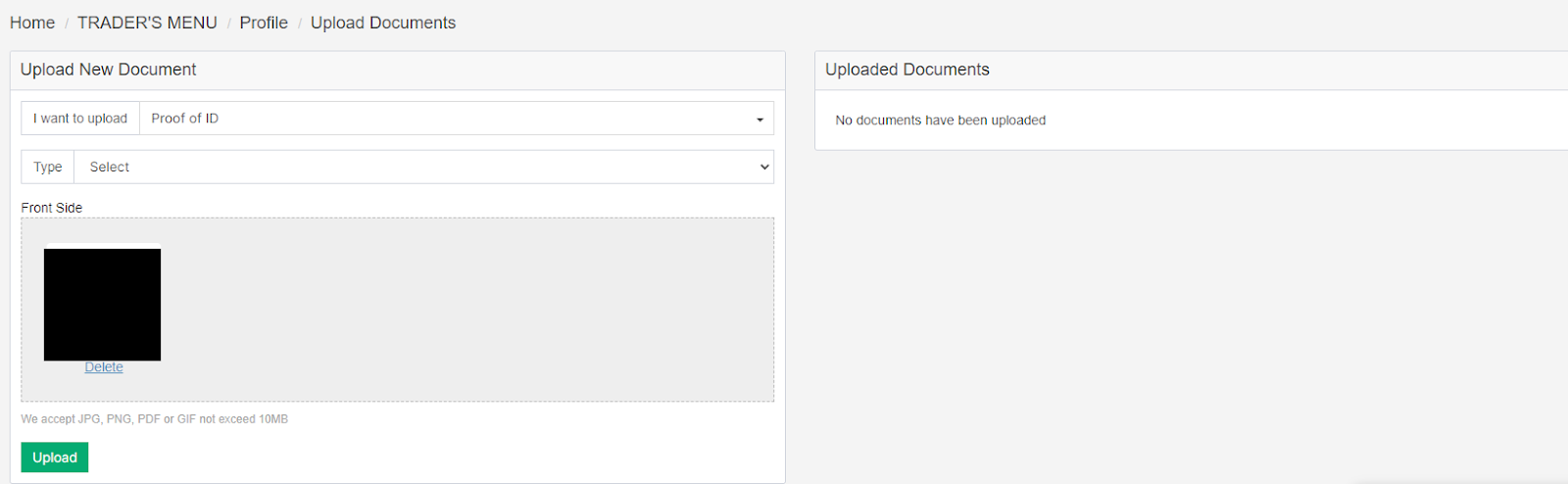

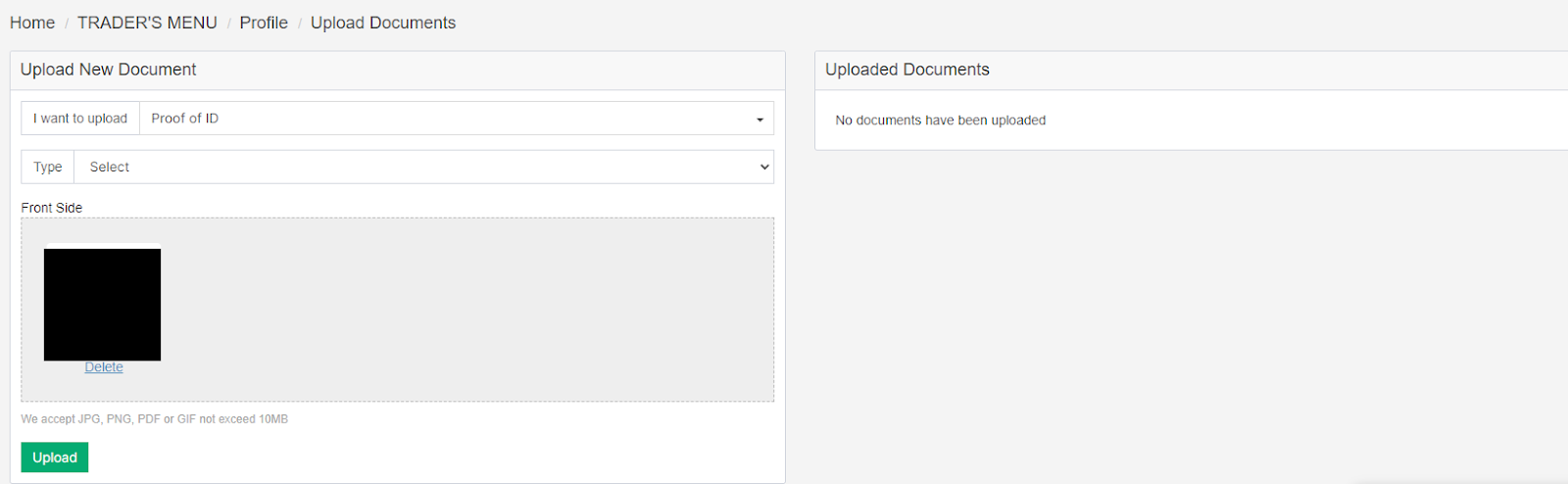

Click on the link at the top of the screen (message prompting verification). On the following page, the required documents will be listed on the right side. Upload their scanned copies/photos, following the on-screen instructions. Wait for the managers to verify the information.

In the top part of the screen, click on the “Open Real Account” button. Choose the account type and its specifications.

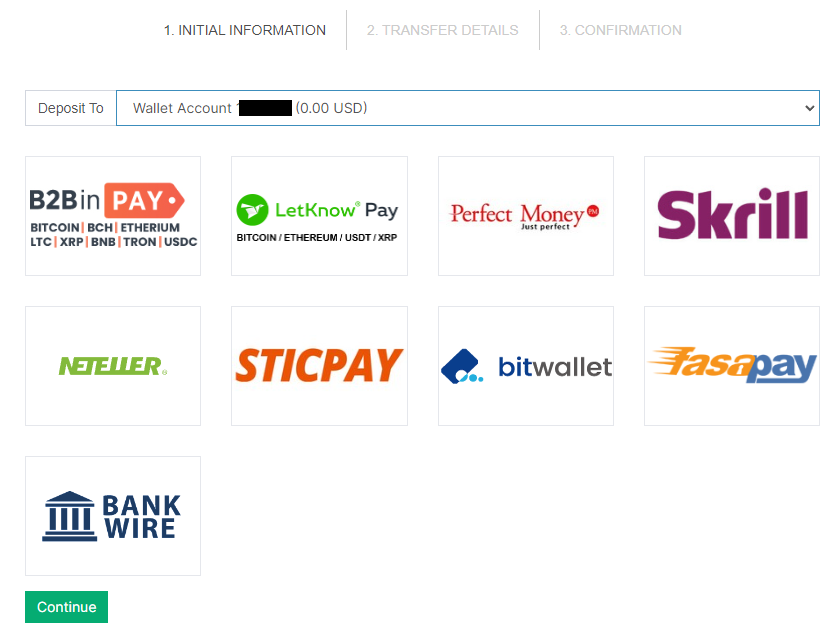

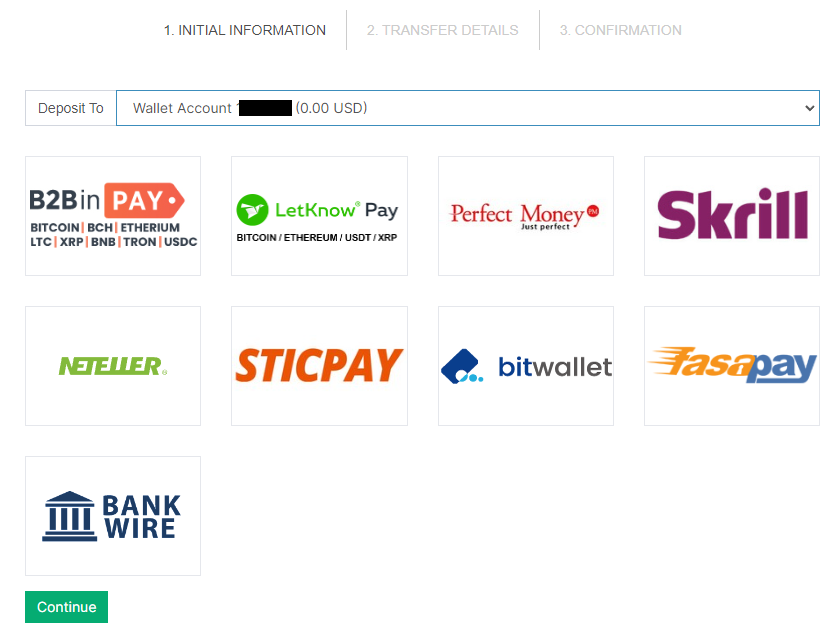

Click on the “Deposit” button in the top menu. Choose a suitable deposit method and follow the on-screen instructions to fund your account.

Go to the “Downloads” section. Select the appropriate trading platform and its version (desktop or mobile). Download the distribution file, install the platform, log in, and start trading.

Your M4Markets user account also provides access to:

Traders can open/close demo and real accounts, with detailed information available for each account.

In the corresponding sections, traders can deposit/withdraw funds and track transaction status.

The “Profile” section allows traders to update personal information and set security parameters.

A separate section provides distributions of available trading platforms which are MT4 and MT5.

Access to joint accounts and copy trading service is available through the user account.

There is a section dedicated to participants of the “Refer a Friend” referral program.

Educational materials, a section for contacting technical support, and a LiveChat are also available.

Regulation and Safety

When it comes to a broker, the guarantee of security can only be provided through registration and regulation. Official registration indicates that the platform operates legally, while regulation ensures transparency and the fulfillment of stated obligations towards traders. The company Trinota Markets (Global) Ltd, which owns the M4Markets broker, is registered in Seychelles. It is regulated by two regulators, FSA (Financial Service Authority) and CySEC (Cyprus Securities and Exchange Commission). The company's activities are also regulated by the DFSA and FSCA. This potentially eliminates any issues for this broker's clients.

Advantages

- To the client support of this broker M4Markets

- To the FSA regulator

- To the CySEC regulator

- Contact Traders Union’s legal department for a free consultation and representation. It protects its members’ rights without charge.

Disadvantages

- To financial control authorities outside Seychelles and Cyprus

- To regulators that do not monitor the activities of Trinota Markets (Global) Ltd company.

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | Spread is regular, from 11$, and without commission | No |

| Raw Spread | Raw Spread, from 0$, and commission is $3.5 per lot | No |

| Premium | Unprocessed Spread, from 0$, and commission is $2.5 per lot | No |

| Dynamic leverage (1:5000) | Spread is regular, from 16$, and without commission | No |

Withdrawal fees can be fixed or dynamic (e.g., 1% of the withdrawn amount). Often, the withdrawal fee depends on the chosen withdrawal method. M4Markets, like many other brokers, does not charge any withdrawal fees.

| Broker | Average commission | Level |

|---|---|---|

|

$2.4 | |

|

$1 | |

|

$8.5 |

Account Types

First, determine the account type that suits you. The “Standard” account is versatile in most aspects, with no commission and a moderate spread starting from 1.1 pips. The spread is higher only on the “Dynamic Leverage” account, starting from 1.6 pips, but there are no commissions. On the “Raw Spread” account, the commission is the highest at $3.5, but the spread starts from 0 pips. On the “Premium” account, the spread also starts from 0 pips, with lower commissions ($2.5), but the minimum deposit is significantly higher ($10,000 compared to just $500 on the “Raw Spread” account). Also, consider that the accounts differ in margin call and stop-out levels. There are no differences in terms of base currency, trade size, and available assets.

Account types:

The optimal approach is to first open a demo account to familiarize yourself with the platform. Then, open a real account based on your capital, strategic preferences, and ambitions as a trader. Representatives of the Islamic religion can open a swap-free account.

Deposit and Withdrawal

-

If a trader is trading on a demo account, he is working with virtual currency and cannot receive or withdraw real profits.

-

Once he opens a real account, he gains access to full-fledged trades capable of generating income.

-

This broker's clients can withdraw their profits at any time by submitting a request in the user account on the website.

-

The following withdrawal channels are available: bank transfer, Visa, and Mastercard, Skrill, Neteller, Perfect Money, FasaPay, PayRedeem.

-

This broker does not charge any withdrawal fees regardless of the chosen channel, withdrawn amount, or other factors.

-

However, traders should be aware that fees may be imposed by other parties involved in the withdrawal process (e.g., banks).

Investment Options

Most traders who register on brokerage platforms do so to earn profits through active trading. However, passive income can also be of interest to them, and the availability of such opportunities is an undeniable advantage for any broker. The most popular options for passive income are copy trading and joint accounts, both of which are offered by M4Markets. Additionally, there is a referral program that allows socially active traders to earn a decent additional income, although such programs are not entirely passive.

MAM and PAMM accounts

A trader can act as an account manager or investor. In addition to their account, the manager controls multiple sub-accounts and places trades using the combined capital. Investors who own these sub-accounts can limit the amount of funds available to the manager. If a trade is successful, everyone receives profits according to their proportional contribution. In the case of an unsuccessful trade, each participant loses their trade, including the manager. In addition to earning the main profits, the manager charges a small commission for their services from the investors.

Copy trading

This broker has a proprietary platform for copying trades which is integrated in the website. A trader can register as a signals provider or investor. The provider trades as usual, but their trades are transmitted to other traders who can replicate them. An investor interested in a particular provider can copy their trades with individual restrictions. For example, if the provider places a $10,000 trade, the investor can limit it to $1,000. Everything else works similarly to joint accounts. For example, in the case of a successful trade, participants receive profits proportional to their trades, and in the case of an unsuccessful trade, they lose their funds. The provider charges a fee from each investor connected to them. The uniqueness of copy trading is the investor can observe and learn from the actions of the signals provider, gaining knowledge and skills from an experienced colleague.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

“Refer a friend”

Referral programs exist with almost all brokers, although they may have different names. In this case, the program is called “Refer a Friend” and is presented in the form of an ongoing promotion that is regularly extended for another year. According to its conditions, each trader can generate a referral link in his user account. Then he can freely share this link on the internet, and anyone who clicks on it becomes their referral. The referring trader receives $5 for each traded lot brought in by the referee. There is no limit to the number of payouts from referees or the number of referrals.

Customer Support

Technical support is crucial for any company. For brokers, it is especially important because traders often encounter disputed or problematic situations. Whether it's a technical glitch, an unclear aspect of deposit or withdrawal, or something else, occasionally users need to receive prompt and competent assistance. If the client service is not satisfactory in terms of speed or quality, traders can easily become disappointed and switch to a competitor. To prevent this, M4Markets offers various communication options with their technical support such as a call center, email, and LiveChat. All channels operate 24/7, and the specialists are proficient in multiple languages, with their expertise confirmed.

Pros

- You can contact technical support even if you are not a client of this broker.

- Communication through all channels is quite prompt.

- Managers are available 24/7.

- Client service specialists are ready to assist in 10 languages.

Cons

- This broker does not cooperate with residents of Cuba, Sudan, Syria, North Korea, and several other countries.

If you intend to work with M4Markets or are already a client of this broker, you can contact support using the following methods:

-

Request a callback on the website.

-

Email.

-

LiveChat on the website and in the user account.

This broker has official profiles on various social platforms, such as Facebook, Instagram, LinkedIn, Twitter, and YouTube. You can also contact support through any of these platforms. It is recommended to follow at least one profile to stay current with the latest company news.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | JUC Building, Office No. F4, Providence Zone 18, Mahé, Seychelles |

| Regulation |

FSA, CySEC, DFSA, FSCA

Licence number: SD035, 301/16, F007051, 49648 |

| Official site | https://www.m4markets.com/ |

| Contacts |

+248 463 2013

|

Education

Only those traders who trade regularly and actively study specialized materials can be continuously successful. The theory is equally as important as the practice. That's why some brokers offer educational materials and even full-fledged courses to their clients. M4Markets is no exception. Their website includes a section with e-books, as well as a block with webinars. While the books will be more useful for beginners, even experienced traders will find a lot of interesting content in the webinars. Additionally, there are standard FAQs available to facilitate the use of the platform and trading platforms.

As an additional source of information, the “Expert Hub” can be identified, where besides technical analysis, insights from professional market participants are also published. Moreover, investors connected to experienced signals providers in the copy trading service can gain unique firsthand experience.

Comparison of M4Markets with other Brokers

| M4Markets | RoboForex | Pocket Option | Exness | IC Markets | XM Group | |

| Trading platform |

MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, cTrader, MT5, TradingView | MT4, MT5, MobileTrading, XM App |

| Min deposit | $5 | $10 | $5 | $10 | $200 | $5 |

| Leverage |

From 1:1 to 1:5000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.6 points |

| Level of margin call / stop out |

100% / 20% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of M4Markets

As the M4Markets platform is owned by the Oryx group of companies, there is no doubt that they have sufficient resources and technologies to provide services by advanced standards. That's why trade execution usually takes place within 30 ms, and besides active trading, this broker offers a range of passive earning options, including its copy trading service. M4Markets uses virtual servers and employs SSL protocols and modern cryptographic methods to ensure data protection.

M4Markets by the numbers:

-

The minimum deposit is $5.

-

The minimum spread is 0 pips.

-

The maximum dynamic leverage is 1:5000.

-

There are 7 types of contracts for difference (CFDs) available.

-

The withdrawal fee is $0.

M4Markets is a CFD broker with convenient working conditions

In addition to this broker's reasonable fees, the number and variety of assets are conceptually important for trading. M4Markets offers hundreds of CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, energies, and metals. This is more than enough to form a diversified investment portfolio, where the negative trend of one asset is offset by the stable and progressive position of others. Moreover, the more instruments available, the wider the strategic opportunities for traders. Plus, this broker does not impose any restrictions against scalping, hedging, news trading, or the use of advisors.

M4Markets’ analytical services:

-

Copy trading. Traders can register as signals providers or investors. Investors copy the trades of the signals providers and pay them a certain commission for the service. They can earn passively with reduced risk and gain unique knowledge and experience.

-

Joint accounts. MAM and PAMM accounts allow managers to control multiple sub-accounts of investors and place trades using combined capital to increase profits. The manager charges a small fee from the investors.

-

Expert hub. Similar to other brokers' “Trading Center” services, M4Markets' Expert Center includes specialized tools such as trading signals and market sentiment analysis, significantly simplifying a traders' work.

Advantages:

It is easy for beginner traders to get started. There is a free demo account, and the minimum deposit for a real “Standard” account is only $5. The MetaTrader platforms are user-friendly, intuitive, and convenient.

Market participants have access to hundreds of assets across seven groups, high leverage, and customizable trading platforms.

This broker maintains a 100% transparent commission policy. Transaction fees are known in advance, and there are no withdrawal fees.

In addition to active earning opportunities, clients can focus on passive income options through managed accounts and copy trading.

The trader's user account is intuitive and comfortable, and technical support is available via call center, email, and LiveChat, providing prompt assistance 24/7.

User Satisfaction