deposit:

- $100

Trading platform:

- MT4

- MT5

- IRess

- ASIC

- VFSC

- FMA

- 0%

deposit:

- $100

Trading platform:

- MT4

- MT5

- IRess

- ASIC

- VFSC

- FMA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Trademax Trading Company

Trademax is a moderate-risk broker with the TU Overall Score of 5.84 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Trademax clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Trademax ranks 67 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Trademax (TMGM) is an ECN-based CFD broker offering services to clients from 150+ countries.

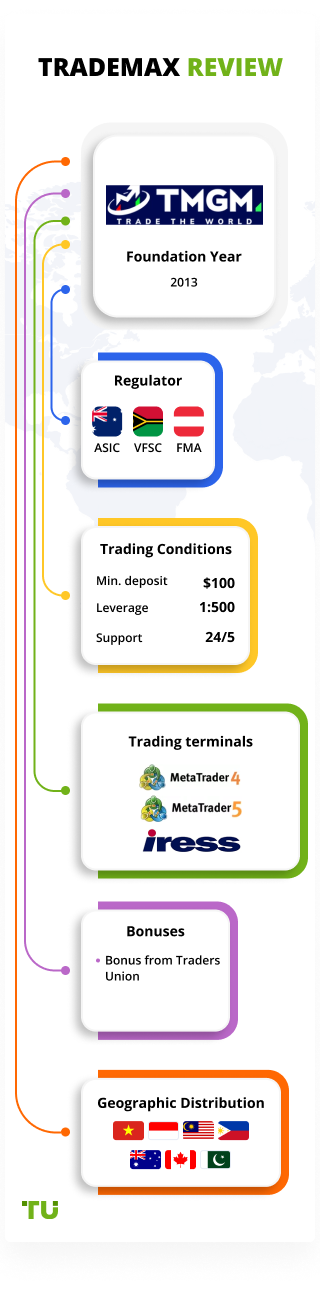

Trademax (TMGM) is a CFD and Forex broker that has been operating since 2013. The company offers clients trading in five asset classes, including currency pairs, contracts for stocks, indices, energies and precious metals. Trademax has two offices, one in Australia (where the broker was founded) and the other in Vanuatu. Services are provided under the licenses of the Australian Securities and Investments Commission (ASIC) and Vanuatu Financial Services Commission (VFSC).

| 💰 Account currency: | USD, EUR, GBP, AUD, CAD, NZD |

|---|---|

| 🚀 Minimum deposit: | USD 100 |

| ⚖️ Leverage: | Up to 1:100 for energy CFDs, up to 1:400 for metal CFDs, up to 1:500 for other instruments |

| 💱 Spread: | From 1 pip (Variable Spreads Account), from 0.0 pips (Raw Spreads Account) |

| 🔧 Instruments: | Currency pairs (50), CFDs on shares (15,000), indices (15), metals (3), energy resources (2) |

| 💹 Margin Call / Stop Out: | 100%/40% |

👍 Advantages of trading with Trademax:

- 15,000+ trading instruments.

- Spreads from 1.0 pips.

- HUBx copy trading service.

- 3 trading terminals.

- Education for traders

👎 Disadvantages of Trademax:

- No MAM or PAMM accounts.

- You cannot access your account without verification.

- Support works 24/5.

Evaluation of the most influential parameters of Trademax

Geographic Distribution of Trademax Traders

Popularity in

Video Review of Trademax i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Trademax

The Trademax (TMGM) broker has been providing financial services to clients for over eight years. Within this time, the total volume of the company's trades exceeded USD 100 billion. The company provides services in 150+ countries. The broker uses ECN technology, so all traders have direct access to liquidity providers. Trademax clients can work with the market execution type of trade.

TMGM offers clients two types of trading accounts: Raw spreads and Variable spreads. In the first case, traders pay a fixed commission for trades (USD 7); in the second, the commission is charged in the form of a spread (from 1.0 pips for EUR/USD). The clients of the company have access to margin trading with a maximum leverage of up to 1:500. Each trader can choose the amount of leverage for himself at the time of registration. For passive investors, the HUBx trades copy service is provided.

The company provides three types of trading terminals: MT4, MT5, and iRess. Beginners can take advantage of the broker's training course, which is divided into three levels. You can polish up your trading skills on a free demo account. You can contact the broker's technical support through three communication channels, and the response speed, as a rule, does not exceed two minutes.

Dynamics of Trademax’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The Trademax Global Markets (TMGM) broker offers clients opportunities to generate passive income. In particular, the HUBx trades copy service operates on the platform. With its help, the company's clients can receive income from successful trades of more experienced traders. After subscribing, all trades of signal providers are opened in the subscriber's terminal, thanks to which he receives the same profit. Also, TMGM has affiliate programs.

The HUBx copy trading platform from Trademax

The TMGM broker offers clients the ability to copy trades from successful traders. The company's clients can subscribe to a signal provider, after which all trades after opening will be automatically copied to the trading terminal. Due to this, you can receive additional income and learn how to analyze the market and how trading strategies work with illustrative examples. To copy trades, a trader needs to:

-

Open a trading account on Trademax and go to the HUBx section in the user account.

-

Analyze traders and choose the most suitable ones. You can analyze signal providers based on profitability, trading instruments used, degree of risk, etc.

-

Subscribe to the trader after you have chosen one. To do this, you need to click on the appropriate button in his profile, after which all trades will be copied in your terminal.

The TMGM broker does not charge any additional commission for trades made through HUBx. However, signal providers may also charge fees, and payment for services is carried out depending on the performance. The average commission on HUBx is 20% of the profit.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Trademax’s affiliate programs

-

The fund manager. It‘s an offer for MAM managers. Clients are offered to work through the MetaTrader 4 trading terminal. The Trademax multi-manager allows you to connect an unlimited number of accounts. The company offers two fee structures that account managers can charge - fixed or based on profits.

-

Introducing Broker (IB). It’s an affiliate program for brokers and financial institutions that need software. Trademax provides the MGM platform. It provides complete statistics, advertising materials are available to attract customers, etc.

-

White Label. The company's clients can use Trademax software, working under a unique brand. The broker also provides access to the MGM platform. Trademax does not limit the number of available currency pairs and CFDs for White Label clients.

Trading Conditions for Trademax Users

The Trademax (TMGM) broker offers clients access to five classes of trading instruments. These include currency pairs and CFDs on stocks, indices, energies, and metals. Traders have access to margin trading with a leverage of 1:100 for energy CFDs, up to 1:400 for CFDs on metals and up to 1:500 for other types of instruments. The company's clients can test strategies on a free demo account. There is also swap-free trading (for traders who have opened a Raw spreads account).

$100

Minimum

deposit

1:500

Leverage

24/5

Support

| 💻 Trading platform: | МТ4 (desktop, mobile, web), МТ5 (desktop, mobile), iRess |

|---|---|

| 📊 Accounts: | Edge, Classic |

| 💰 Account currency: | USD, EUR, GBP, AUD, CAD, NZD |

| 💵 Replenishment / Withdrawal: | Credit cards, wire transfer, Neteller, Skrill, Paytrust, Sticpay, Fasapay, Revolut, Wise, Regional Operators |

| 🚀 Minimum deposit: | USD 100 |

| ⚖️ Leverage: | Up to 1:100 for energy CFDs, up to 1:400 for metal CFDs, up to 1:500 for other instruments |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1 pip (Variable Spreads Account), from 0.0 pips (Raw Spreads Account) |

| 🔧 Instruments: | Currency pairs (50), CFDs on shares (15,000), indices (15), metals (3), energy resources (2) |

| 💹 Margin Call / Stop Out: | 100%/40% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | There is an inactivity fee on the account |

| 🎁 Contests and bonuses: | No |

Comparison of Trademax with other Brokers

| Trademax | RoboForex | Eightcap | Exness | Pocket Option | FxPro | |

| Trading platform |

MT4, MT5, IRess | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | Pocket Option, MT5, MT4 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $100 | $10 | $100 | $10 | $5 | $100 |

| Leverage |

From 1:100 to 1:500 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 1.2 point | From 0 points |

| Level of margin call / stop out |

100% / 40% | 60% / 40% | 80% / 50% | No / 60% | 30% / 50% | 25% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Trademax | RoboForex | Eightcap | Exness | Pocket Option | FxPro | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Trademax Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Variable Spreads Account | From $10 | No |

| Raw Spreads Account | From $7 | No |

There are swaps (commission for transferring a position to the next day). The analysts of the Union also compared the size of the average trading commission of Trademax (TMGM), Admiral Markets, and FxPro. The comparative results are presented in the form of a table.

| Broker | Average commission | Level |

| Trademax | $8.5 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of Trademax (TMGM)

The Trademax broker provides clients with attractive trading conditions. The platform features over 15,000 trading instruments, including currency pairs and contracts for difference (CFDs). The broker offers clients Market execution for the execution of orders. The company supports automated trading, and trading advisors can be used in the MetaTrader 4 and MetaTrader 5 terminals. Demo accounts and Islamic accounts are also available to users.

TMGM by the numbers:

-

More than USD 100 billion in accumulated trade volume since its launch.

-

More than 150 countries are represented by the broker's clients.

-

More than 15,000 trading instruments.

Trademax (TMGM) is the broker for trading and investment

Trademax offers its clients trading using ECN (Electronic Communication Network) technology. Traders get direct access to high liquidity providers. This ensures a high speed of order execution and minimal spreads. TMGM clients have access to currency pairs and CFDs on stocks, precious metals, energies, and stock indices. For passive investments, traders can use the HUBx trade copy service.

Trading on Trademax is carried out through desktop and mobile trading terminals. There is also Webtrader. The company does not impose restrictions on the use of any trading strategies.

Useful services of Trademax (TMGM):

-

Economic calendar. The company's clients can track all the important events that are expected in the trading world. The economic calendar shows the schedule for the next two weeks. You can also set up filters and sort by assets, volatility, etc.

-

Market Buzz is a market sentiment indicator. Traders can set it up on timeframes from 1 hour to 1 month. The indicator shows the number of buy/sell deals, the number of news articles and publications in social networks regarding an asset, etc.

-

VPS. The company provides traders with VPS servers, which will allow them to keep trades open, even if the trading terminal is closed. VPS is available to all clients of the broker.

Advantages:

There are five asset classes available for trading.

All client funds are held in segregated accounts.

Negative balance protection is active.

The popular HUBx trading platform is available to investors.

Automated trading is allowed.

The broker provides free analytics and online tools to improve the quality of trading.

All analytical tools, a VPS server, and other options are provided for TMGM traders free of charge.

How to Start Making Profits — Guide for Traders

The TMGM broker provides five types of trading accounts for clients. In particular, the Raw Spreads Account and Variable Spreads Account are available. The maximum leverage on both types of accounts is up to 1:500, but it can vary depending on the trading instruments selected - up to 1:100 for energy carriers and up to 1:400 for precious metals. All account types have a minimum deposit of USD 100. For trading accounts, the market execution type is provided.

Account types:

Demo accounts are available for all trading terminals of the broker.

Trademax (TMGM) is an ECN broker that gives traders freedom of choice in terms of trading instruments and commissions for trades.

Bonuses Paid by the Broker

At the moment, the TMGM broker does not provide bonuses to its clients. Traders who have opened an account here have to use 100% of their personal funds when trading.

Investment Education Online

There is a training course on the Trademax (TMGM) website. It is divided into three blocks - for beginners, advanced, and experienced traders. You need to go through in order, and each new block opens after studying the previous one.

Trademax (TMGM) does not offer cent accounts to clients, therefore, users can only practice and apply their knowledge on a demo account.

Security (Protection for Investors)

The TMGM broker has two offices - a central office in Australia and an additional one in Vanuatu. The company operates under three licenses. This is Australia's license - ASIC AFSL # 436416, and this is the Vanuatu license - VFSC # 40356, FMA (569807).

👍 Advantages

- Client funds are segregated from TMGM and held in segregated bank accounts

- Negative balance protection is activated

- In case of violation by the broker of the obligations prescribed in the offer, the client can file a complaint with the regulator

👎 Disadvantages

- To open an account, you must provide detailed financial information

- Without verification, you cannot make a deposit or withdraw funds

Withdrawal Options and Fees

-

The company processes requests for withdrawal of funds within 1 business day.

-

Withdrawals from a broker are possible through credit cards, bank transfer, Neteller, Skrill, Paytrust, Sticpay, Fasapay, Revolut, Wise, as well as through payment systems of Asian regional banks.

-

A bank transfer request is processed within 1 business day. The timing of funds transfer through the banking system depends on the financial institution.

-

The company does not charge commissions for financial transactions.

-

To replenish your account and withdraw funds, you must go through verification.

Customer Support Service

Support operators are available 24 hours a day, 5 days a week. It doesn’t work on weekends.

👍 Advantages

- In the online chat, you can ask a question without being a client of the company

- Support available in 10 languages

👎 Disadvantages

- Works 24/5

The broker provides the following communication channels:

-

telephone;

-

email;

-

online chat.

Both Trademax (TMGM) clients and traders without an active account can ask the support questions.

Contacts

| Foundation date | 2007 |

| Registration address | Level 28, One International Tower, 2000 Barangaroo Avenue, 2000 Sydney NSW, Australia |

| Regulation |

ASIC, VFSC, FMA Licence number: 436416, 40356, 569807 |

| Official site | https://www.tmgm.com/ |

| Contacts |

Email:

support@tmgm.com,

Phone: +61 2 8036 8388 |

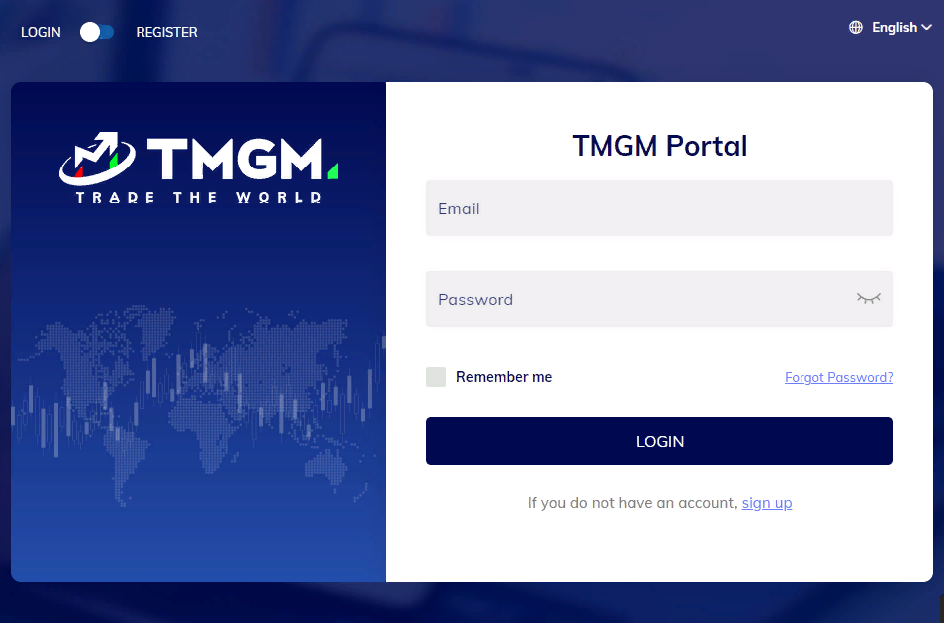

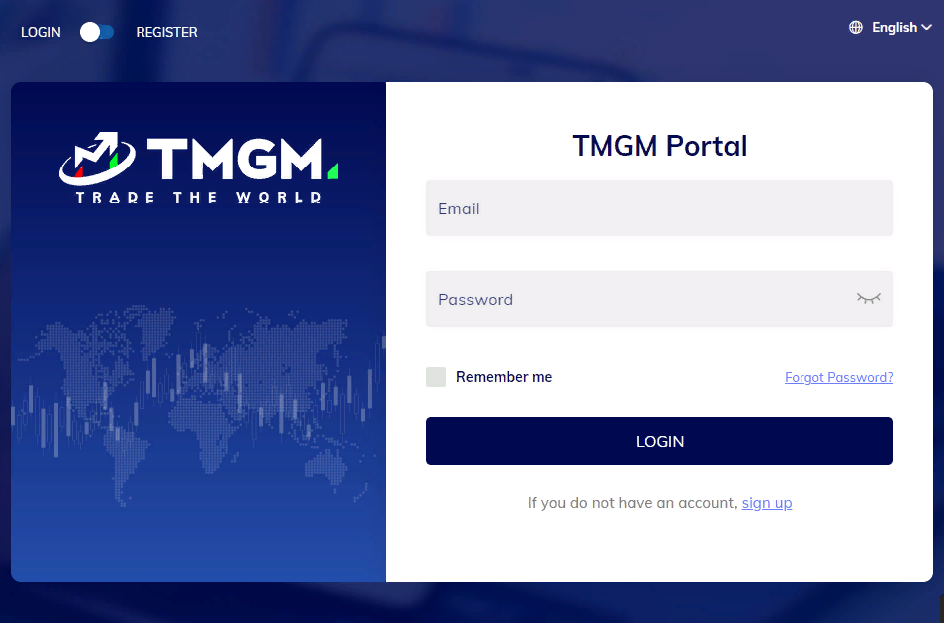

Review of the Personal Cabinet of Trademax (TMGM)

To start trading with Trademax, you need to become a client of the broker by opening a trading account. A quick guide looks like this:

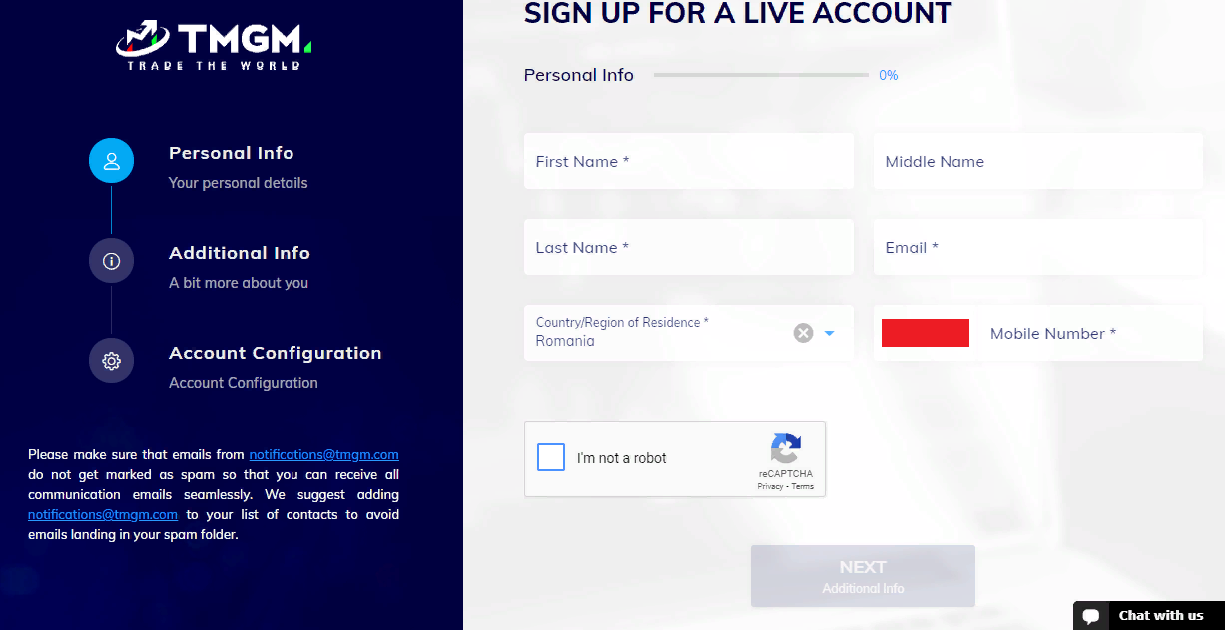

On the main page, click on the Portal button. After that, the login/registration menu will open. At the top of the screen, select Register.

Next, a registration form will open, which includes three stages - basic information, additional information, and account settings. Here you must enter all the data about the user - last name, first name, age, residential address, financial information, etc. Further, this information will have to be confirmed at the verification stage. In the Account Configuration section, you need to select the account type, leverage, and base currency.

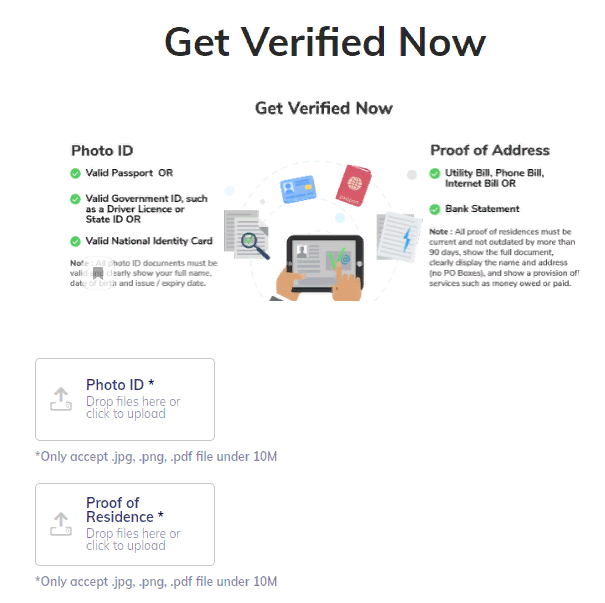

The last stage of registration is verification. To go through it, you need to upload scanned copies of your identity card and a document confirming your address of residence.

Also in the Trademax (TMGM) trading account, you have access to:

-

News and financial reports on the trading instruments featured on Trademax.

-

Trader's statistics - the platform analyzes trades, provides information on the ratio of profitable to loss-making trades, a list of trading instruments that a trader works with, the time of opening trades, etc.

-

Connection to copy trading. To do this, you need to click on the Apply HUBx button in your account, and you will see a list of traders offering their trades for copying.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the Trademax rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Trademax you need to go to the broker's profile.

How to leave a review about Trademax on the Traders Union website?

To leave a review about Trademax, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Trademax on a non-Traders Union client?

Anyone can leave feedback about Trademax on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.