According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MT4

- MT5

- 2021

Our Evaluation of Nash Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Nash Markets is a broker with higher-than-average risk and the TU Overall Score of 4.41 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Nash Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Nash Markets tries to take into account the trading preferences of both novice traders and professionals. Conditions of the account types offered by the broker differ, which allows them to be used for various strategies and markets.

Brief Look at Nash Markets

Nash Markets is a broker that has been offering STP (Straight-Through Processing) and ECN (Electronic Communication Network) accounts for trading currencies and various types of CFDs since 2020. Its clients can trade 138 Forex pairs, including exotics and crosses. Nash Markets provides leverage up to 1:500, a proprietary mobile app for position calculation, and a two-level partnership program. The broker’s clients can copy trades of experienced traders through MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as deposit and withdraw funds in cryptocurrencies.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Demo, ECN, STP, and Mini accounts;

- Wide choice of CFDs, crypto assets, and currency pairs;

- Leverage is up to 1:500;

- Trading through MT4 and MT5 is available;

- Partnership program with favorable conditions;

- Cashback for new clients;

- Competitive spreads.

- Absence of official license for carrying out brokerage activities;

- Islamic swap-free accounts are not available;

- Popular e-wallets such as Neteller, Skrill, and Perfect Money are not supported.

TU Expert Advice

Financial expert and analyst at Traders Union

Nash Markets is a relatively new STP and ECN broker, so it strives to provide its clients with the best conditions and quality of service on the market. Traders Union (TU) has no complaints about its support team, and its live chat operators are available 24/7 and respond almost instantly. The broker has some disadvantages in respect of trading conditions that all potential clients need to consider.

These disadvantages include the absence of its own investment solutions and a $200 deposit for standard trading currencies and various types of CFDs. Clients have access to account types with smaller lot sizes, where spreads are calculated in cents. At the same time, they have a $1 fee per lot, which does not make these conditions favorable. Also, Nash Markets still does not offer Islamic accounts, so fees for holding positions overnight apply.

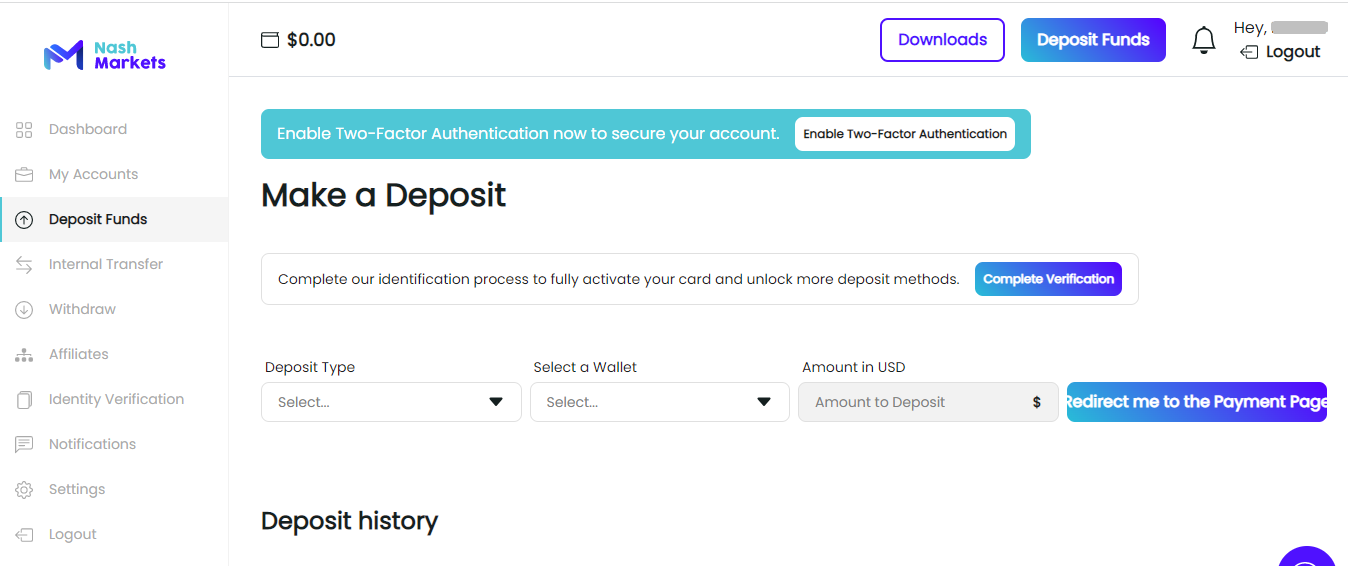

If you deposit funds using cryptocurrencies, the minimum amount is $10. Transactions are available in BTC, ETH, LTC, XRP, DOGE, and USDT (ERC20). It is also possible to make deposits from bank cards through a third-party provider, but not less than $25, €25, or £25. The minimum amount for a bank transfer is $50. Nash Markets does not charge deposit or withdrawal fees, which can be considered an advantage.

Nash Markets Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Nash Markets Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | МТ4 (Android, iOS, Windows, and MAC);МТ5 (Android, iOS, Windows, MAC, and WebTrader) |

|---|---|

| 📊 Accounts: | Demo МТ4, Demo МТ5, Mini, Standard, Pro, Crypto, and Var |

| 💰 Account currency: | USD, EUR, GBP, CAD, AUD, and BTC |

| 💵 Deposit / Withdrawal: | Cryptocurrency (BTC and Altcoins), bank cards, and wire transfers;Vload is coming soon |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Forex currency pairs (Majors, Crosses, and Exotics), commodities, indices, cryptocurrencies, stocks (U.S.), and stocks (EU) |

| 💹 Margin Call / Stop Out: | 100%/70% |

| 🏛 Liquidity provider: | Sources of quotes are kept secret |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | Scalping, hedging, trading news, and copy trading are allowed |

| 🎁 Contests and bonuses: | Cashback for new clients |

Nash Markets’ clients can trade over 200 financial instruments. Trading leverage depends on the asset, market situation, and the overall balance of a trading account. The broker offers account types with different execution parameters, fees, and minimum deposits. Cent trades and trading with a zero fee per lot are available. The minimum deposit in cryptocurrencies is $10, in fiat currencies, it is $50.

Nash Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

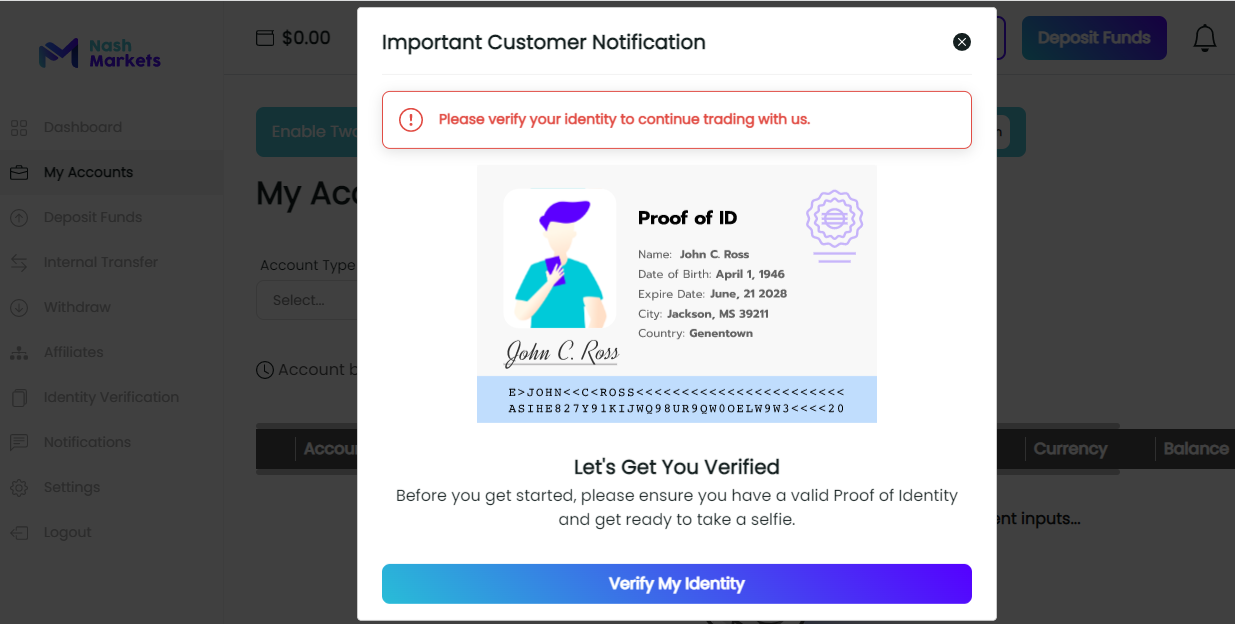

Trading Account Opening

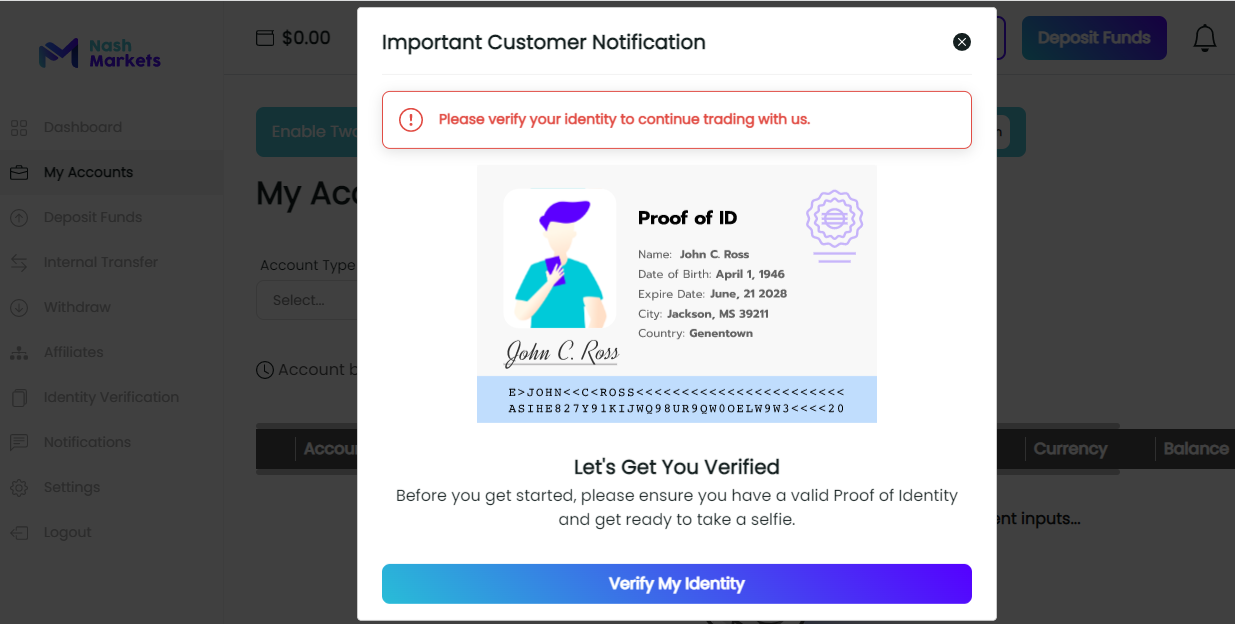

A user account is necessary to open a trading account and make a deposit. Through it, you can also download the trading platform and verify your identity. Below are instructions for potential clients of Nash Markets:

Go to the official Nash Markets website and click the “Sign Up” button.

Next, enter the information requested by the company, create a password, and then confirm your email. After that, log in to your user account using your email and password.

Features of Nash Markets’ user account:

Additional features of Nash Markets’ user account:

Opening live or demo accounts;

Download the trading platform or launch MT5 WebTrader;

Statistics of partner accruals;

Transferring money between accounts within a user account;

Submission of withdrawal requests;

Generating a pin code for quick contact with technical support;

Enabling two-factor authentication using SMS or an identity verification app such as Google Authenticator.

Regulation and safety

Nash Markets has a safety score of 3.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

Nash Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

Nash Markets Security Factors

| Foundation date | 2021 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Nash Markets have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Nash Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Nash Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Nash Markets Standard spreads

| Nash Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,7 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,7 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Nash Markets RAW/ECN spreads

| Nash Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Nash Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Nash Markets Non-Trading Fees

| Nash Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Nash Markets clients can trade on ECN and STP accounts. Account types differ in the minimum deposit, fees, and available choice of assets.

Account types:

A demo account can be opened in both MT4 and MT5. Training accounts are available in mobile applications, on the desktop platform, and in WebTrader.

A wide range of account types allows each client of Nash Markets to choose a priority option for themselves and trade a specific instrument with optimal conditions.

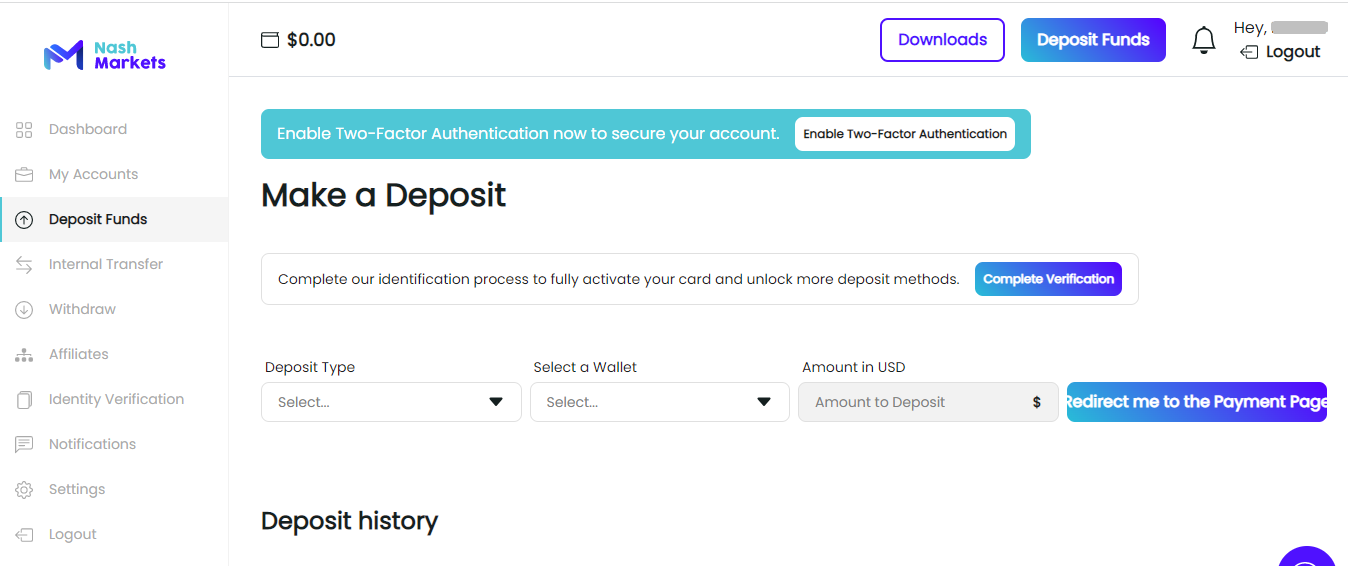

Deposit and withdrawal

Nash Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Nash Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Minimum deposit below industry average

- BTC available as a base account currency

- Bank wire transfers available

- No withdrawal fee

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- Only major base currencies available

What are Nash Markets deposit and withdrawal options?

Nash Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Neteller, BTC, USDT.

Nash Markets Deposit and Withdrawal Methods vs Competitors

| Nash Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Nash Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Nash Markets supports the following base account currencies:

What are Nash Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Nash Markets is $10, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Nash Markets’s support team.

Markets and tradable assets

Nash Markets offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 52 Forex pairs.

- Indices trading

- 52 supported currency pairs

- Crypto trading

- Futures not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by Nash Markets with its competitors, making it easier for you to find the perfect fit.

| Nash Markets | Plus500 | Pepperstone | |

| Currency pairs | 52 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Nash Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Nash Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical support can be contacted 24/7.

Advantages

- Support is available 24/7

- Chat operator responds within 1 minute after entering a request

Disadvantages

- The website does not provide a phone number for communication, traders need to order a callback

- Chat operators do not always answer questions in detail

A representative of the company can be contacted by:

-

live chat;

-

phone or email feedback form;

-

email;

-

tickets in the Contact section of the website or in the user account;

-

Twitter, Facebook, or Instagram.

You can chat with other Nash Markets’ clients on Discord.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | Nash Markets LLC, Suite 305, Griffith Corporate Centre, Beachmont, Box 1510 Kingstown, St. Vincent and the Grenadines |

| Official site | https://nashmarkets.com/ |

| Contacts |

Education

Nash Markets does not teach Forex trading. Novice traders can get informational support in the “Support” section. It contains answers to potential clients' questions about the trading conditions of Nash Markets, MetaTrader platforms, and the rules for registering the user account.

Nash Markets’ clients have to learn to trade on third-party resources, but they can practice their knowledge on demo accounts offered by the broker.

Comparison of Nash Markets with other Brokers

| Nash Markets | Eightcap | XM Group | RoboForex | LiteFinance | NPBFX | |

| Trading platform |

MT4, MT5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, MultiTerminal, Sirix Webtrader | MT4 |

| Min deposit | $10 | $100 | $5 | $10 | $10 | $10 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:200 to 1:1000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | 10.00% | 7.00% | No |

| Spread | From 0.5 points | From 0 points | From 0.8 points | From 0 points | From 0.5 points | From 0.4 points |

| Level of margin call / stop out |

100% / 70% | 80% / 50% | 100% / 50% | 60% / 40% | 50% / 20% | No / 30% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of Nash Markets

Nash Markets is a direct-processing STP broker that uses ECN technology. Top-level liquidity allows the company to provide its clients with low spreads and minimal slippage. Support for crypto payments ensures a quick recapitalization of the trading account, which positively influences trading effectiveness. Nash Markets allows its clients to trade using their preferred strategies, also it offers a wide range of assets and classic Forex trading platforms.

Nash Markets by the numbers:

-

Over 200 assets;

-

Over 25 CFDs on stocks (U.S.) and 10 CFDs on stocks (EU);

-

23 cryptocurrencies;

-

9 commodities;

-

13 stock indices.

Nash Markets is a broker expanding the trading opportunities of its clients through leverage

Nash Markets offers two leverage options. If the balance of a trading account is up to 500,000 units of the basic currency, the maximum leverage for Forex is 1:500, for metals, indices, and energies it is 1:200, and for cryptocurrencies it is 1:100. For accounts with a balance of more than 500,000 units, leverage is reduced to 1:200 for currencies and to 1:50 for other types of CFDs. There are two instruments that offer unique trading conditions. Leverage for the Turkish lira (TRY) pairs does not exceed 1:50, and for the SHB/USD1000 cryptocurrency, it is 1:30. The maximum leverage for CFDs on stocks is 1:20, regardless of the equity amount. However, it should be borne in mind that the broker can limit leverage in case of noticeable market fluctuations.

Nash Markets provides its clients with MetaTrader 4 and MetaTrader 5. MT4 is available as a mobile application and a desktop version. MT5 can be downloaded to a smartphone, PC, and laptop; also, trading in a browser-based web platform is available.

Useful services offered by Nash Markets:

-

Analytical reports. These are formed for each client separately. The report provides analytics on clients’ trading performance over the past week. It helps to find flaws in their strategies and improve them;

-

Nash Markets app. It is a calculator for counting the optimal position size depending on the acceptable risk (leverage), stop loss, and take profit levels. The app is available for Android and iOS devices;

-

Market trading hours. The company's website lists weekends and short days for trading Forex, energies, stocks, metals, and stock indices. Sorting by three time zones, such as UTC (GMT+0), MT4 (GMT+2), and Local Time is available.

Advantages:

24/7 client support;

Functional and easy-to-use user account;

Easy registration of a user account;

Possibility to start trading after depositing $10-$50;

Copy trading and high-frequency trading are allowed;

Demo accounts for MT4 and MT5.

Nash Markets allows its clients to hedge, scalp, and trade news.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i