According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $0

- MT4

- WebTrader

- Stocks Trading Platform

- SCA

Our Evaluation of Noor Capital

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Noor Capital is a moderate-risk broker with the TU Overall Score of 5.54 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Noor Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Noor Capital suits both professional and novice traders, investors, and those interested in earning through partnership programs.

Brief Look at Noor Capital

Noor Capital is a company providing brokerage services since 2005, regulated by the UAE Securities and Commodities Authority (SCA). The broker is licensed for financial services across five categories, including Forex trading. It offers various trading instruments such as currencies, indices, stocks, metals, and energy resources.

We've identified your country as

PL

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

PL :

- Provision of services under a brokerage license;

- No limits on deposit amounts;

- Availability of PAMM and MAM accounts for passive income;

- No fees for depositing or withdrawing funds;

- Accessible partnership programs for earning through referrals and establishing own branches using the company's infrastructure.

- Limited choice of payment methods for deposits and withdrawals;

- Absence of cent accounts for low-risk trading;

- Prohibition on scalping (orders must be closed no sooner than three minutes after opening).

TU Expert Advice

Author, Financial Expert at Traders Union

Noor Capital offers a range of trading opportunities including currency pairs, indices, stocks, metals, and energies through MT4, WebTrader, and the Stocks Trading Platform. The company provides flexibility with no specific minimum deposit for the Standard account and leverage up to 1:400. Traders can benefit from market execution and enjoy fee-free deposit and withdrawal transactions, while passive income seekers can explore PAMM and MAM accounts. The availability of educational resources also supports traders in improving their skills.

However, Noor Capital has certain drawbacks such as limited payment methods for transactions and an absence of cent accounts, which may affect low-risk traders. Additionally, scalping is restricted. While it offers a diverse asset range, it may not suit traders who prioritize payment flexibility or favor scalping strategies. Suitable for both novice and experienced traders, potential clients should weigh these factors alongside their trading needs.

Noor Capital Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Noor Capital and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4, Stocks Trading Platform, WebTrader |

|---|---|

| 📊 Accounts: | Demo, Standard |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Visa, Mastercard, bank transfer |

| 🚀 Minimum deposit: | From $0 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,05 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, metals, energy |

| 💹 Margin Call / Stop Out: | Depends on the deposit and traded instruments (set individually and specified in the individual agreement) |

| 🏛 Liquidity provider: | Own providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Scalping (trades opened for less than three minutes) is prohibited |

| 🎁 Contests and bonuses: | Yes, from Traders Union |

At Noor Capital, trading is available for currency pairs, metals, oil, gas, and indices, as well as stocks of major companies. Clients can use the following platforms: MT4, WebTrader, and Stocks Trading Platform. The maximum permissible leverage is 1:400. For testing trading conditions, the broker provides a demo account.

Noor Capital Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

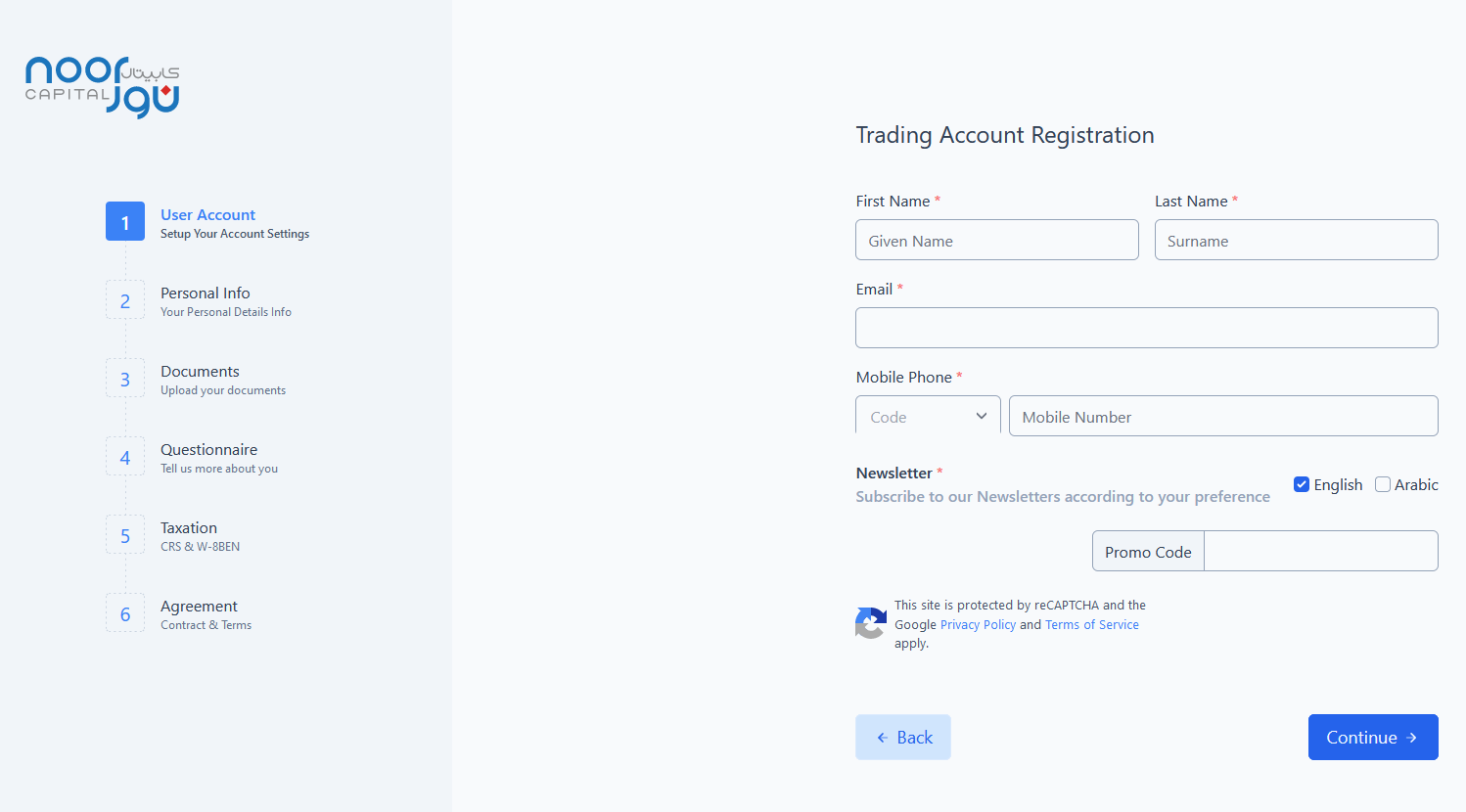

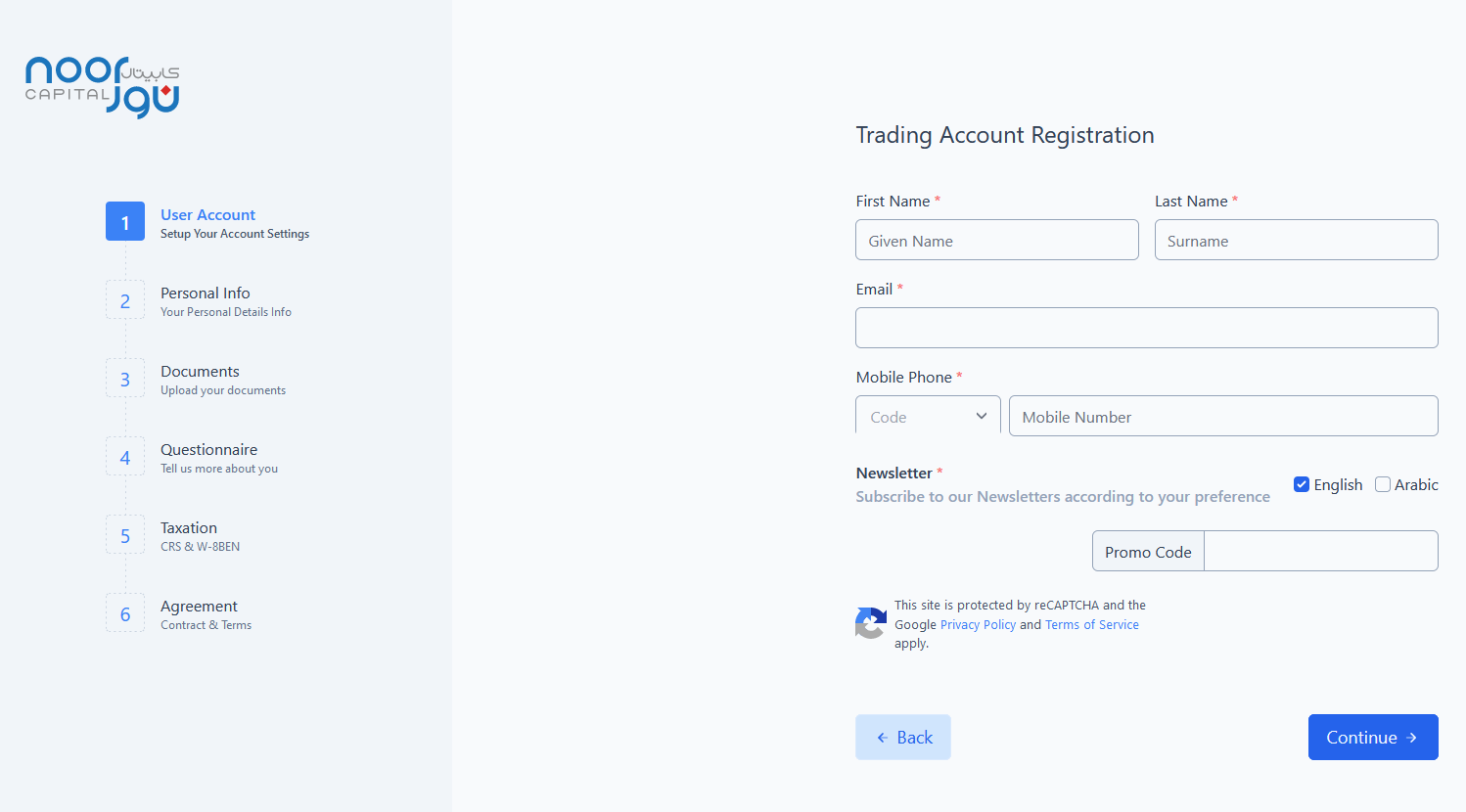

Trading Account Opening

To trade with Noor Capital, one needs to become a client of the broker. The registration and account opening procedures are as follows:

Click on "Register user account." Choose the trading instruments and the account type: individual or corporate.

Fill out the registration form: name, surname, email, and phone number. Complete a questionnaire with personal information, upload documents for verification, provide tax details, and agree to the company's terms and conditions.

Regulation and safety

Noor Capital has a safety score of 5.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

Noor Capital Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

| ESCA (UAE) | Emirates Securities and Commodities Authority | United Arab Emirates | Varies depending on the case, no fixed limit. | Tier-2 |

Noor Capital Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Noor Capital have been analyzed and rated as Low with a fees score of 10/10. Additionally, these commissions were compared with those of the top two competitors, Eightcap and XM Group, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Noor Capital with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Noor Capital’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Noor Capital Standard spreads

| Noor Capital | Eightcap | XM Group | |

| EUR/USD min, pips | 0,4 | 0,4 | 0,7 |

| EUR/USD max, pips | 0,8 | 1,5 | 1,2 |

| GPB/USD min, pips | 0,5 | 0,8 | 0,6 |

| GPB/USD max, pips | 1,1 | 1,5 | 1,2 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Noor Capital RAW/ECN spreads

| Noor Capital | Eightcap | XM Group | |

| Commission ($ per lot) | 2,50 | 3,5 | 3,5 |

| EUR/USD avg spread | 0,05 | 0,1 | 0,2 |

| GBP/USD avg spread | 0,10 | 0,3 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Noor Capital. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Noor Capital Non-Trading Fees

| Noor Capital | Eightcap | XM Group | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0 |

| Inactivity fee ($, per month) | 0 | 0 | 10 |

Account types

Noor Capital provides standard accounts for private and corporate clients. There are no minimum deposit requirements across all accounts, and the available leverage goes up to 1:400. Trading can be conducted in the browser, MetaTrader 4 desktop, and Noor Capital's proprietary platform — Stocks Trading Platform — for mobile devices and web trading.

Account Types:

Demo accounts can be opened on all trading platforms provided by the company. Noor Capital offers various trading instruments, competitive trading conditions, and the opportunity for passive income through investment accounts.

Deposit and withdrawal

Noor Capital received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Noor Capital offers limited payment options and accessibility, which may impact its competitiveness.

- Bank wire transfers available

- No deposit fee

- No withdrawal fee

- Low minimum withdrawal requirement

- Limited deposit and withdrawal flexibility, leading to higher costs

- USDT payments not accepted

- PayPal not supported

What are Noor Capital deposit and withdrawal options?

Noor Capital offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire. This limitation may restrict flexibility for users, making Noor Capital less competitive for those seeking diverse payment options.

Noor Capital Deposit and Withdrawal Methods vs Competitors

| Noor Capital | Eightcap | XM Group | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| BTC | No | Yes | Yes |

What are Noor Capital base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Noor Capital supports the following base account currencies:

What are Noor Capital's minimum deposit and withdrawal amounts?

The minimum deposit on Noor Capital is $500, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Noor Capital’s support team.

Markets and tradable assets

Noor Capital offers a wider selection of trading assets than the market average, with over 10600 tradable assets available, including 60 currency pairs.

- 10600 assets for trading

- 60 supported currency pairs

- Indices trading

- No ETFs

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Noor Capital with its competitors, making it easier for you to find the perfect fit.

| Noor Capital | Eightcap | XM Group | |

| Currency pairs | 60 | 40 | 57 |

| Total tradable assets | 10600 | 800 | 1400 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | No |

| Stock indices | Yes | Yes | Yes |

| Options | No | No | No |

Investment options

We also explored the trading assets and products Noor Capital offers for beginner traders and investors who prefer not to engage in active trading.

| Noor Capital | Eightcap | XM Group | |

| Bonds | No | No | No |

| ETFs | No | No | No |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | No |

| Managed accounts | No | No | No |

Customer support

Support operators are available around the clock from Sunday to Friday.

Advantages

- Traders who are not registered clients can ask questions via the online chat

- The online chat responds promptly and provides necessary information, including details about trading conditions

Disadvantages

- Support is not available on Saturdays

- There is no option for requesting a callback

You can reach out to support representatives through these communication channels:

-

phone;

-

feedback form;

-

email;

-

online chat.

You can also seek advice by messaging the company directly on their social media pages on X, Instagram, and Facebook.

Contacts

| Registration address | Noor Capital PSC, office 203/204, Second Floor, Al-Montazah Tower B, Zayed the First Street, Khalidiyah |

|---|---|

| Regulation | SCA |

| Official site | https://noorcapital.ae/ |

| Contacts |

+97142795400, +97142795400

|

Education

The broker's website hosts an extensive section with useful information, FAQs, and the Noor Academy, offering opportunities to learn trading from professionals. Free access to the academy is granted to clients who have deposited $1,500 or more.

Noor Capital doesn't offer cent accounts, so it's recommended to first solidify the acquired theoretical knowledge on a demo account before transitioning to a standard account.

Comparison of Noor Capital with other Brokers

| Noor Capital | Bybit | Eightcap | XM Group | Octa | IC Markets | |

| Trading platform |

MT4, Stocks Trading Platform, WebTrader | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader4, MetaTrader5, OctaTrader | MT4, cTrader, MT5, TradingView |

| Min deposit | No | No | $100 | $5 | $25 | $200 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:40 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 2 points | From 0 points | From 0 points | From 0.8 points | From 0.6 points | From 0 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 25% / 15% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Noor Capital

Noor Capital stands as one of the leading brokerage firms in the Gulf Cooperation Council (GCC) countries (comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) as it strives for capital growth and innovation. The broker collaborates with tier-1 banks, ensuring clients access to the best quotes and rapid order execution. The Noor Capital website hosts a plethora of tools for effective trading, alongside an extensive educational section offering valuable insights for both beginners and professionals.

Noor Capital by the numbers:

-

Technical support operates 6 days a week;

-

Over 18 years of experience in the financial markets;

-

The company boasts $200 million in investment capital.

Noor Capital caters to active traders, investors, and partners.

It offers standard trading accounts and promises advantageous quotes and swift responses to traders' commands, facilitated by cooperating with top-tier liquidity providers. Trading options include currencies, metals, energy resources, indices, and stocks. Investors can access PAMM and MAM accounts managed by professional market participants. Additionally, for passive income, there's the option to use social trading platforms by subscribing to successful traders' signals that will be replicated in the trading platform.

Noor Capital provides clients with the classic MetaTrader 4 platform alongside its proprietary trading platform for stock trading. Before employing scripts, advisors, or various trading strategies, it's recommended to confirm with support that the brokerage complies with its own rules.

Useful functions of Noor Capital:

-

Technical analysis helps plan trading strategies by incorporating price movements into its forecasts of financial markets;

-

Economic calendar details crucial global political and economic events that might impact quotes;

-

Live streaming offers traders online newsfeeds about price changes in assets, financial forecasts, and other relevant information;

-

Daily economic reports aid in making precise and timely decisions based on key financial sector news.

Advantages:

The company has received numerous prestigious awards;

Trading covers six classes of financial assets;

Client funds are held in segregated accounts with major banks;

Analytics, newsfeeds, forecasts, and online tools are available for traders;

The broker provides its own platform designed specifically for stock trading;

Novice traders have access to an academy consisting of two educational modules;

No registration, form filling, or document uploading is required to open a demo account.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i