A Comprehensive OctaFX Review In India

OctaFX is a legally registered international company operating in more than 180 countries worldwide. Although OctaFX does not have a local license in India, OctaFX has FSCA licenses in South Africa and CySEC in Cyprus.

In recent years, more and more Indians have been looking for ways to increase their income and achieve their financial goals. Forex trading has become one of the most popular options in that regard. Still, there are several factors that new traders have to consider. One of them is the broker they are going to trade with. In this review, we are going to have a close look at OctaFX and its offerings, as well as answer whether OctaFX is legal in India.

What is OctaFX?

OctaFX (recently renamed to Octa) is an international broker operating in more than 180 countries worldwide. Active since 2011, it offers commission-free access to financial markets and trading services to the client base with more than 42 million trading accounts opened. OctaFX provides free educational webinars, articles, and analytical tools that help clients reach their investment goals.

The company is involved in a variety of charitable and humanitarian initiatives, dealing with improvement of educational infrastructure and emergency relief projects supporting local communities.

Since its foundation, OctaFX has won more than 60 awards, including the “Best FX Broker India 2022” award and the “Most Reliable Broker Asia 2023” award from World Finance and Global Forex Awards, respectively.

OctaFX’s website

Trading platforms

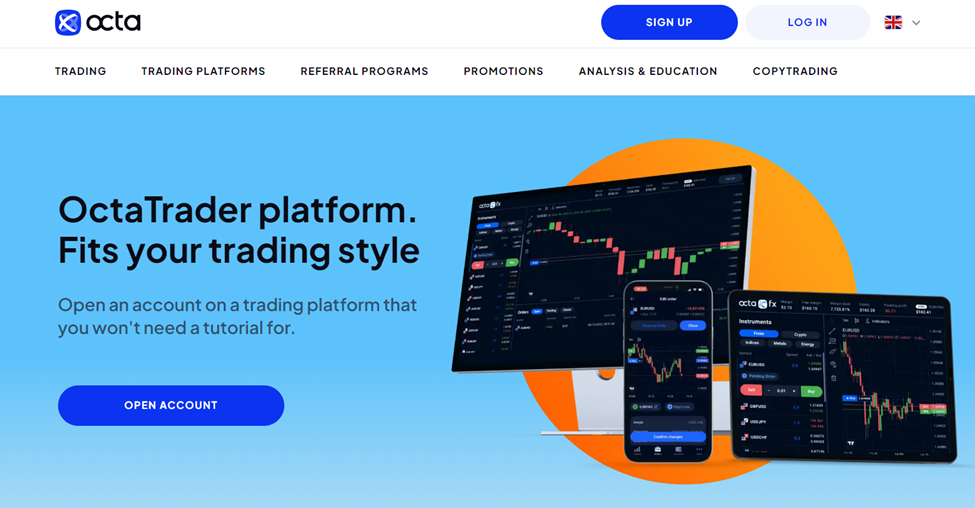

Apart from MetaTrader 4 and MetaTrader 5 OctaFX has its own innovative trading platform, OctaTrader. This platform aims to integrate everything a trader needs into one seamless space where expert analytics, deposits and withdrawals, and profile management options are all at hand. OctaTrader allows users to trade without any extra logins or app switches, helping them save time, which is especially important in the fast-paced financial markets.

The OctaTrader platform is available for mobile users using iOS and Android devices, as well as for web traders. Some of the extensive web trading functionality includes charts, the most popular indicators, technical analysis tools, multiple timeframes, and much more. The platform has a multilingual user interface.

OctaFX’s own platform, OctaTrader

Account types

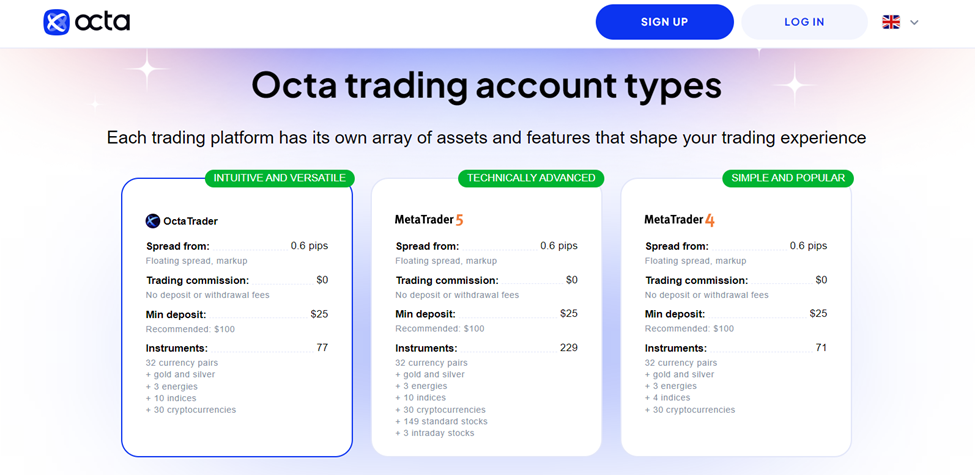

OctaFX offers two types of trading accounts. The first one, MT4, caters to regular traders, featuring a user-friendly and minimalist design that is particularly suited for beginners. On the other hand, the more advanced MT5 provides a broader range of trading tools and supports higher trading volumes, making it the preferred choice for experienced traders.

To create an account with OctaFX, traders need to provide their name and email, set up a password. In general, the OctaFX login procedure is straightforward, only necessitating an email address and a password.

Account types at Octa

Spread, commission, and leverage

OctaFX offers some of the most competitive spreads in the industry for its trading instruments. Both MT4 and MT5 accounts feature floating spreads that begin at 0.6 pips. OctaFX doesn’t charge swaps, which makes its services basically commission-free.

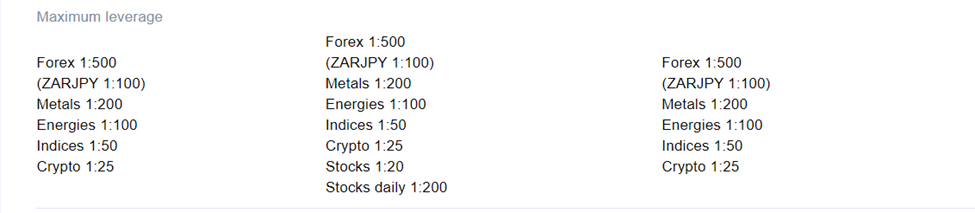

OctaFX provides varying leverage options for different trading instruments. For all currency pairs, except for ZAR/JPY, the maximum leverage is set at 1:500. Meanwhile, other instruments can be traded with the following leverage:

-

1:200 for metals

-

1:100 for energies

-

1:50 for indices

-

1:25 for cryptocurrencies

-

1:20 for stocks

-

1:200 for daily stocks

| MT4 | MT5 | OctaTrader |

Note that leverage may differ across platforms

Trading instruments

OctaFX provides a wide selection of trading instruments across diverse asset categories, including Forex, commodities, indices, stocks, and cryptocurrencies. This broad spectrum enables traders to diversify their investment portfolios and seize various market opportunities. Moreover, CFD trading enables traders to speculate on both upward and downward market movements, maximizing their profit potential.

Bonuses and promotions

OctaFX presents a range of bonuses and promotions to its clients. These offerings include engaging contests with the chance to win premium gadgets, smartphones, exclusive branded items, and other rewards. OctaFX has a loyalty program that allows traders to convert their accumulated traded lots into valuable gifts. Additionally, the broker offers a free status program that provides traders with various benefits, such as trading signals, accelerated transfers, lower spreads, and more.

Free education

OctaFX provides a comprehensive educational program with frequent webinars, tutorials, and articles on the fundamentals of Forex trading. Additionally, the broker maintains a blog featuring in-depth articles for those seeking a more profound understanding of the financial markets and trading.

Deposits and withdrawals

OctaFX provides a diverse selection of safe and convenient payment options for both deposits and withdrawals. These include bank transfers, credit/debit cards, popular e-wallets, and cryptocurrencies. Deposits are typically processed instantly, while withdrawal requests are handled within a reasonable timeframe. It's worth noting that OctaFX does not impose any deposit or withdrawal fees. However, there may be minimum deposit requirements for some of the deposit options. You can find more information about payment methods available in India in the table below:

| Payment option | Min. deposit | Min. withdrawal |

|---|---|---|

|

UPI |

1500 INR |

350 INR |

|

India NetBanking |

1500 INR |

350 INR |

|

India Cash |

5,00,000 INR |

5,00,000 INR |

|

50 USD/ 50 EUR |

5 USD/ 5 EUR |

|

|

0.0003 BTC |

0.00009 BTC |

|

|

0.3 Ł |

0.11 Ł |

|

|

230 Ð |

75 Ð |

|

|

Tether TRC20 |

50 ₮ |

10 ₮ |

|

Tether ERC20 |

50 ₮ |

10 ₮ |

|

0.02 ETH |

0.005 ETH |

Is OctaFX legal in India?

OctaFX is a legally established international company with a track record spanning over 12 years.

Throughout this period, it has gained the trust of millions of clients from over 180 countries. The broker's credibility has been consistently proven by numerous industry accolades, including recent distinctions such as the “Best FX Broker India 2022” and “Most Reliable Broker Asia 2023” awards from World Finance and Global Forex Awards, respectively.

Although OctaFX lacks a local license in India, it's important to note that many international Forex brokers choose not to obtain local licenses. In most cases, they get them only in jurisdictions where regulatory constraints do not restrict the distinctive features that enable them to compete with other players in the global Forex arena. Notably, OctaFX possesses licenses from FSCA in South Africa and CySEC in Cyprus.

The regulatory frameworks imposed by local authorities, such as the RBI, on Forex brokers seeking local licenses are often overly stringent, covering various aspects like trading instruments, terms and conditions, promotional offers, and more. These regulations may even limit the number of liquidity providers a broker can engage with, potentially leading to more frequent slippages, chart irregularities, and liquidity shortages.

To enhance the security of its clients’ funds, OctaFX maintains a robust security infrastructure, incorporating measures like segregated accounts and negative balance protection to align with international standards. As an added layer of security, the broker requires identical payment details for both deposits and withdrawals. This precautionary step serves as a safeguard against unauthorized third parties attempting to withdraw funds, even if they gain access to a user's account. Additionally, OctaFX employs 3D secure technology for processing credit and debit card transactions, ensuring the transparency and security of all Visa transactions.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).