RoboForex CopyFX | Full Guide

RoboForex's CopyFX platform is designed for copy trading, allowing investors to replicate trades from top-performing traders and manage associated fees and risks effectively. The system supports multiple trading platforms, providing investors flexibility in choosing traders and strategies suited to their risk tolerance. For optimal results, users should review traders' historical performance, fees, and risk indicators before subscribing..

CopyFX by RoboForex is a convenient and effective copy trading tool that is suitable for both beginners and experienced investors. CopyFX allows you to copy trades of successful traders, making it accessible to those who want to use the experience of professionals. The platform keeps updating, and among the latest changes are the flexibility of copy settings and updated commission schemes that allow investors to choose the best conditions for each trade. CopyFX also offers updated risk management tools, making the copy trading process more controllable and safe. In this guide, we will discuss the CopyFX service in detail, consider how to choose the right traders, set up commissions and manage risks using the latest CopyFX features.

CopyFX — basic provisions

CopyFX by RoboForex is a copy trading system that allows investors to automatically copy trades of traders represented on the platform. For the convenience of users, the MetaTrader 4, MetaTrader 5 and R StocksTrader platforms are available, each of which offers its own specifics: for example, MetaTrader is more popular among traders, and R StocksTrader is available through a mobile application and a web version.

Home page CopyFX

CopyFX has three copy modes that provide users with flexible settings to adapt to their financial goals and risk management:

-

Proportional, in which the volumes of transactions are automatically adjusted to the deposits of the trader and the investor;

-

Classic, where transactions with a fixed volume set by the investor are copied;

-

Fixed mode, copying transactions with a specified lot regardless of the volume of the trader's transactions.

Updated terms of commissions and rewards

CopyFX offers three types of commissions to reward traders: Performance Fee (based on profit), Volume Fee (for successful trades) and Trader without Commission (without commission). These schemes allow traders to flexibly choose payment terms depending on their strategy and investor preferences:

-

Performance fee — the trader receives a fixed percentage of the investor's total profit for all copied trades. The commission range can vary from 5% to 50%, which is suitable for strategies focused on long-term profitability.

-

Volume fee — a fixed commission from $1 to $10 for each successful trade. This model is beneficial for traders with frequent profitable trades, as the commission is paid for each profitable trade if it covers the commission amount.

-

Trader without commission — a new option for beginner traders who want to attract subscribers by offering copying without a commission. This is often used as a method for establishing a reputation on the platform.

Investment period and payment terms

The investment period, after which the commission is paid, can be 1, 2 or 4 weeks. The commission for the performance fee and volume fee schemes is transferred every Saturday at 01:00 server time. If you use the subscription fee (available on MT5), payments are made once a week in case of a positive result of copying trades.

How to choose a commission type

When choosing a commission scheme, you should consider the nature of the trading strategy of the trader whose trades you decide to copy. Volume fee may be suitable for frequent profitable trades, while performance fee is better suited for strategies with long-term profitability. We also recommend considering the trader's profitability history and choosing a commission option that minimizes the costs of copying in the long term.

Choosing the best traders: rating system

To view the available traders to copy, click on the “Rating” tab. At CopyFX, trader selection is done using an updated rating system that provides investors with useful statistics for decision making. The trader rating displays indicators such as profitability, maximum drawdown, number of active investors, and profit stability. This data helps investors evaluate the success and risks of each strategy.

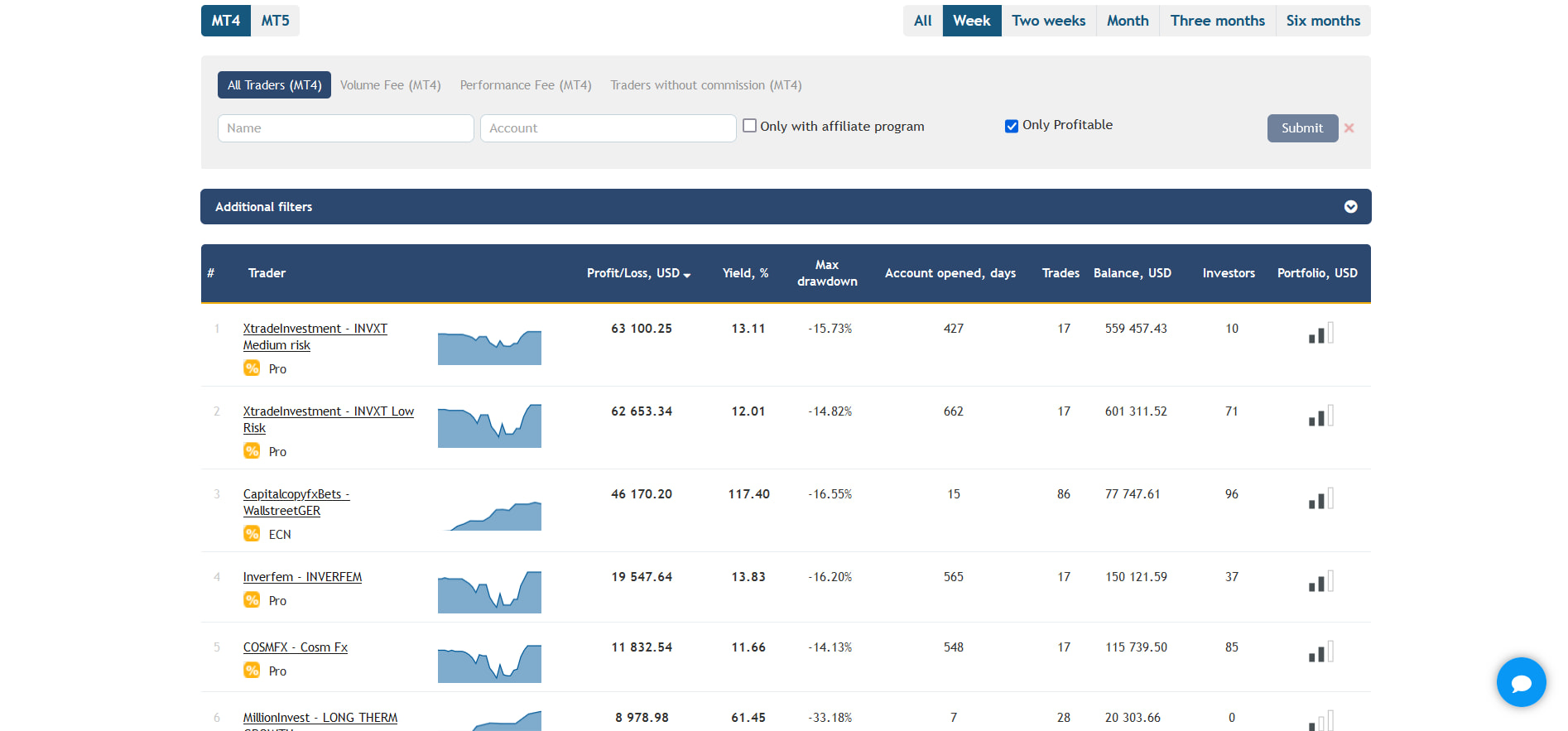

Traders rating with key metrics

Key metrics to look at include:

-

Trader Profitability, which shows the overall profitability of strategies;

-

Maximum Drawdown, which shows the largest capital loss the trader has experienced, helping to assess the level of risk;

-

Active investors and their portfolio — an indicator of popularity and trust in the trader, as it reflects the interest of other investors;

-

Results stability — an important factor in choosing a trader with predictable income.

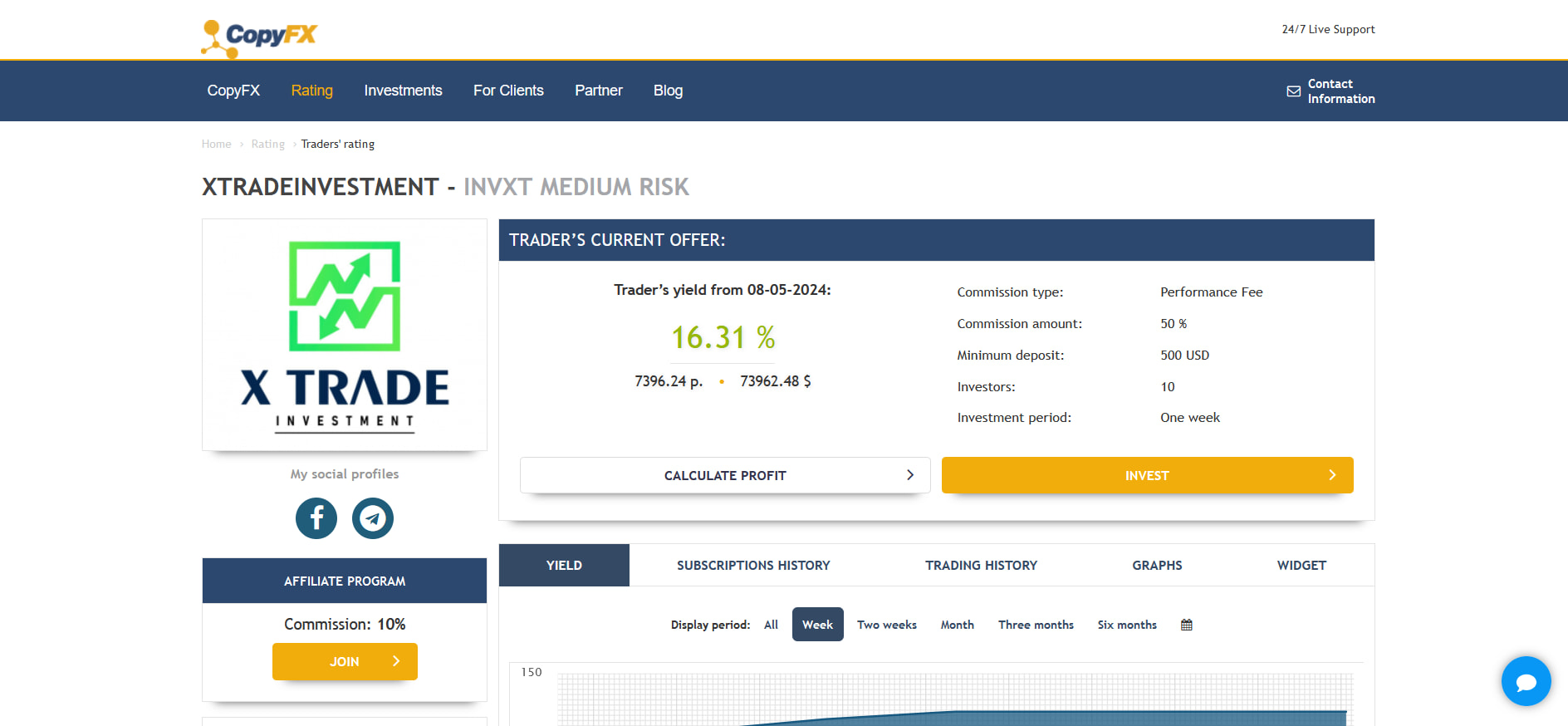

Trader profile

By subscribing to a trader, all actions on his account will be copied to your account. At the same time, all your funds are under your complete control. We recommend choosing traders who demonstrate stable profits with low drawdown. You can use the available settings on the platform to filter and compare traders — this allows you to tailor your choice depending on your own financial goals and acceptable risk level. You can stop copying at any time and subscribe to another trader and strategy.

You can track the performance of your investments on your personal account card in the investor rating section of CopyFX.

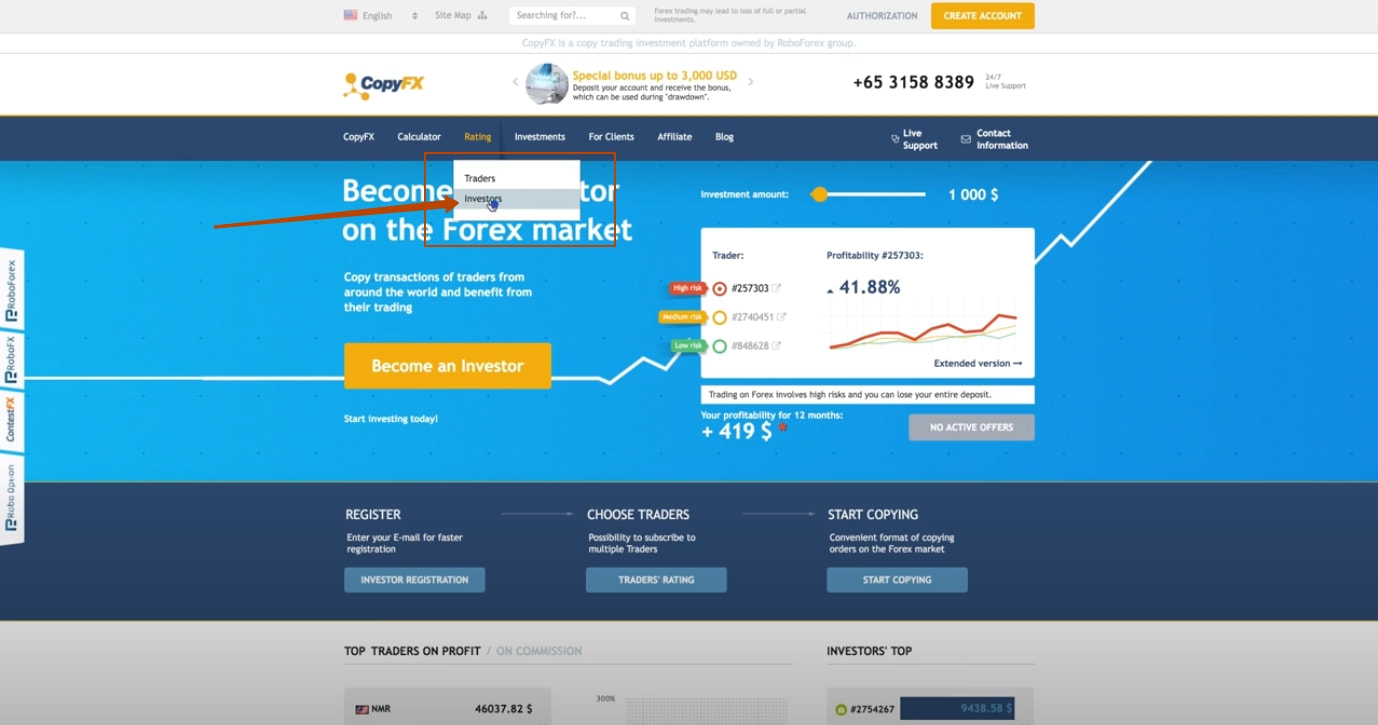

Investor rating section of CopyFX

At the same time, you can be both an investor who copies the deals of successful traders, and a trader who offers his own strategies.

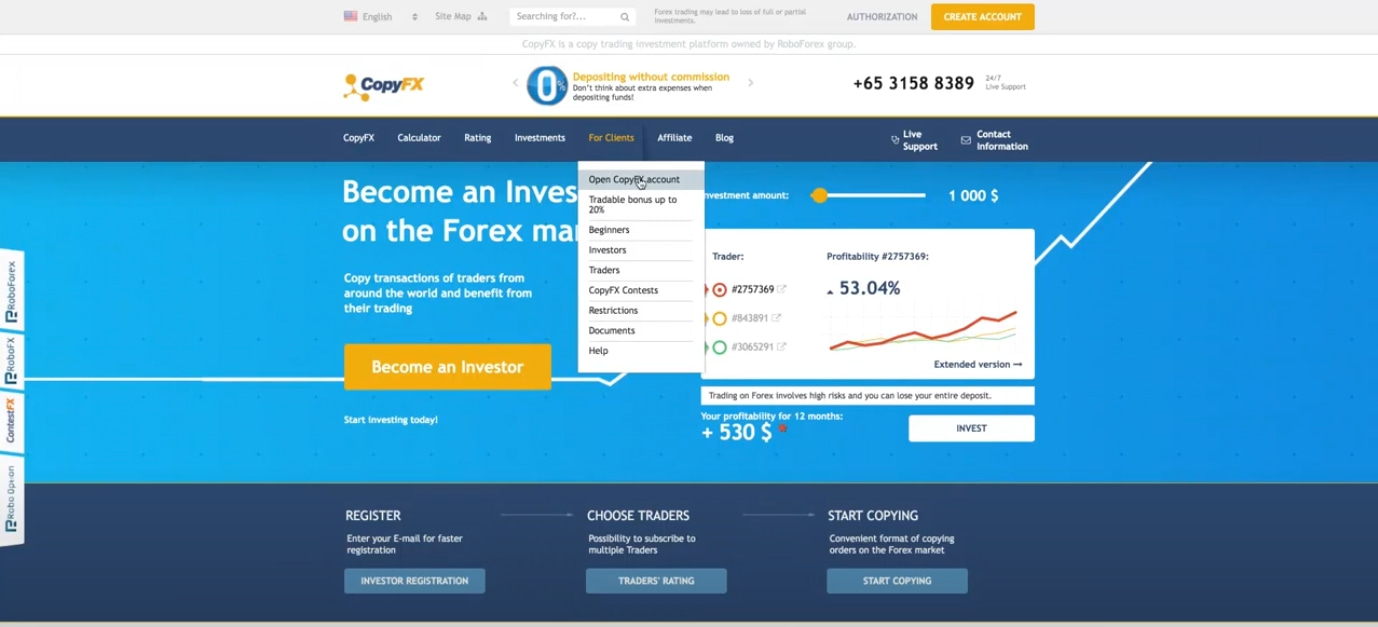

Joining RoboForex CopyFX

This is available in the section “for clients” → “open CopyFX account”

Opening an account CopyFX

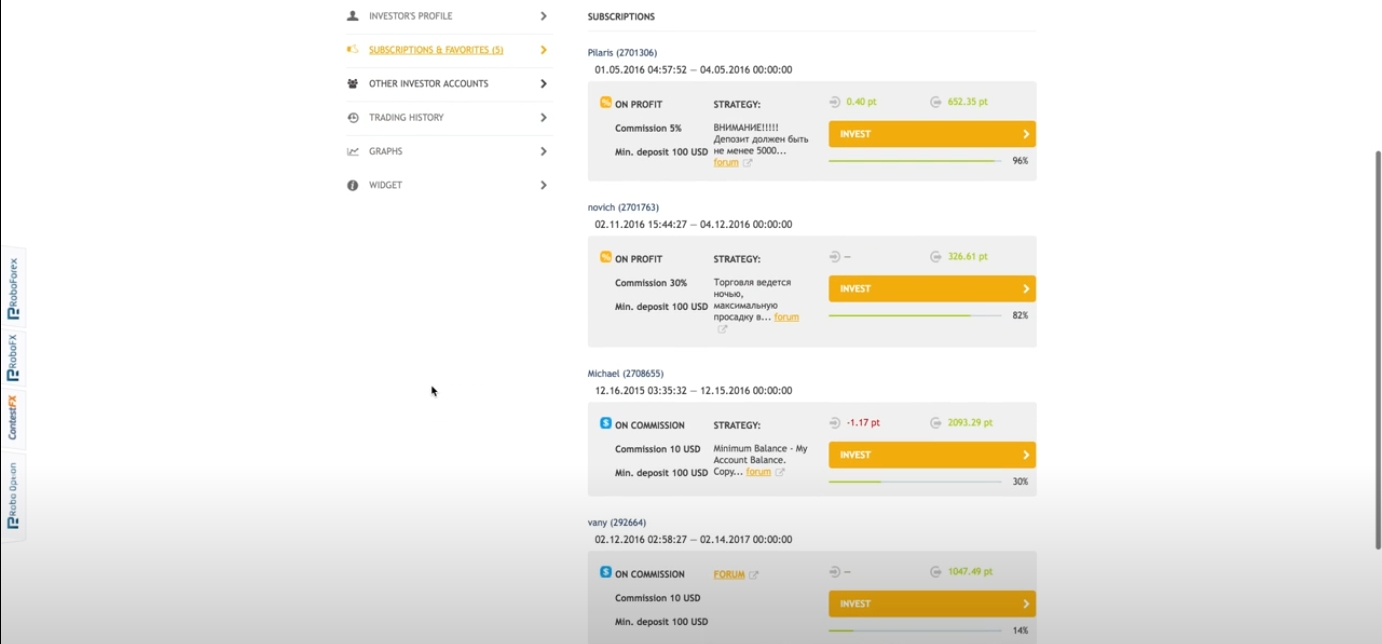

As an investor, you can open multiple accounts and copy trades from different traders' accounts. You can also copy trades from different traders' accounts to the same investor account, creating your own investment portfolio.

Subscriptions page CopyFX

How to manage risks on CopyFX

Risk management on the CopyFX platform from RoboForex requires taking into account the specifics of copy trading itself and the dynamics of trading operations. One of the most important indicators is the maximum drawdown, which reflects the largest decline in the trader's capital over a period. You can assess the risk level by analyzing the ratio between profitability and drawdown: stable profit with minimal drawdown indicates a sustainable strategy that reduces the likelihood of large losses.

Regularly analyze the maximum drawdown and copy settings. For example, the "Pause" function allows you to temporarily suspend copying if the trader's risk level increases. This setting suspends copying of new transactions, but preserves existing positions that can be closed upon the trader's signal. This is especially useful for controlling capital during periods of high volatility.

RoboForex also offers the "Proportional" copy mode, which automatically adjusts the volume of copied transactions based on the ratio of funds in the trader's and investor's accounts. This mode also allows you to set a coefficient to adjust the copied volumes, making it a flexible risk management tool. Investors can reduce the copy volume for traders with more aggressive strategies, thereby limiting their potential losses.

Choose traders with stable strategies and use the "Pause" option when volatility is high

Try experimenting with copy ratios in the "Proportional" mode. If you find a trader with a moderate strategy, you can use a higher ratio to get the most out of their trades. For aggressive traders, on the contrary, it is advisable to lower the ratio to reduce the impact of potential losses on your account. This approach allows you not only to diversify risks, but also to more flexibly control capital, even with minimal investments.

In copy trading, it is useful to monitor the news background and economic events, especially if the traders you are copying are working with instruments that are sensitive to changes in the economy. Such situations can greatly affect trades, so setting the "Pause" option before important news releases or during high volatility can be a profitable tactic for preserving capital.

Conclusion

In conclusion, CopyFX by RoboForex is a convenient and flexible tool for copy trading, which is suitable for both beginners and experienced investors. Using updated parameters, investors can effectively select traders, set up commissions and manage risks. The proportional copy mode and the “Pause” function provide additional opportunities for flexibility in capital management. Trader rating and available indicators help make more informed decisions, minimizing potential losses. By applying a comprehensive approach to choosing strategies and settings, CopyFX users can improve their results and increase the sustainability of their investments.

FAQs

What is the optimal deposit to start copy trading?

The deposit size depends on the level of risk you are willing to accept and the number of selected traders. For diversification, it is better to invest small amounts in several traders with different strategies. This reduces risks and allows you to adapt to different returns.

How to determine how stable a trader's returns are?

Pay attention to the drawdown indicator and the ratio of return to drawdown. If the returns are high and the drawdown is minimal and stable, the trader is demonstrating stability. It is also useful to analyze data over a long period to exclude the influence of single successful trades.

How often should you check the results of copy trading?

We recommend checking the results at least once a week, especially if you use aggressive strategies. Regular monitoring allows you to adjust copied trades in time, including activating the "Pause" mode when risks increase.

What indicators can indicate an overly risky trader?

High drawdown, frequent and large fluctuations in profitability are signs of an aggressive style. If a trader has unpredictable dynamics, it is reasonable to reduce the copied volume or choose a trader with a more moderate approach.

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).