According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- MOCI

- 2022

Our Evaluation of SwissFS

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

SwissFS is a broker with higher-than-average risk and the TU Overall Score of 4.53 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SwissFS clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

SwissFS will be of interest to traders who prefer STP execution. This broker does not operate on the ECN model, so it does not offer the lowest spreads or the fastest order execution speeds.

Brief Look at SwissFS

SwissFS broker serves traders worldwide and operates on the STP technology in jurisdictions where over-the-counter trading is allowed. Established in 2002, the company is registered in Kuwait and regulated by the Ministry of Commerce and Industry of Kuwait. SwissFS offers access to Forex trading, as well as CFDs for indices, stocks, commodities, and ETFs. This broker’s clients are allowed leverage, algorithmic, and copy trading. The SwissFS MAM service allows investment via the trading of experienced traders.

We've identified your country as

SG

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

SG :

- Minimum deposit of $50;

- Operating under a government regulator's license;

- Bonus on every deposit made within the first month of trading;

- Access to margin trading;

- Assignment of a personal manager to each client;

- Trading on MetaTrader 4 platforms.

- A demo mode of the trading platform and WebTrader for browser-based transactions.

- Spreads considerably higher than those of its competitors, starting from 2 pips on the EUR/USD pair.

- In terms of the assortment of trading assets, especially currency pairs, the company lags behind other Forex brokers.

- Traders cannot choose a suitable type of trading account; all clients are on equal terms.

TU Expert Advice

Author, Financial Expert at Traders Union

SwissFS offers Forex and CFD trading through the MT4 platform, with a minimum deposit of $50 and leverage up to 1:200. Traders have access to Forex, indices, stocks, commodities, and ETFs, and may benefit from deposit bonuses, copy trading, and algorithmic trading. The broker operates under the Ministry of Commerce and Industry of Kuwait, providing a wide array of trading and educational resources, including MAM accounts and a personal manager for each client.

However, SwissFS presents several drawbacks, such as higher spreads starting from 2 pips and a limited selection of trading assets, which may not meet the needs of more diversified or cost-sensitive traders. The broker's registration in Kuwait and limited regulation may concern those prioritizing stringent regulatory oversight. SwissFS may be more suitable for traders comfortable with these conditions and who prefer using the MT4 platform.

SwissFS Trading Conditions

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Demo, User |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | GCC & International Cards, credit cards, KNET, online payment systems such as Neteller and others, depending on the client's country |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Currencies; CFD format includes indices, stocks, commodities, and ETFs |

| 💹 Margin Call / Stop Out: | Not available |

| 🏛 Liquidity provider: | Global providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant |

| ⭐ Trading features: | Unified account type for all clients, advisors and copy trading allowed |

| 🎁 Contests and bonuses: | Deposit bonus and recurring bonuses in the form of rebates from Traders Union |

Trading conditions at SwissFS depend on the selected asset, not the account type, as this broker does not offer various account types to choose from. After opening an account with SwissFS and depositing a minimum of $50, clients gain access to the Forex market and more than 80 types of CFDs. The maximum trading leverage varies for different assets, ranging from 1:10 to 1:200. Cryptocurrency trading is not available at SwissFS. Spreads, along with a slight broker markup (included in the spreads), are applied as trading commissions and are not deducted separately.

SwissFS Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To create a user account with SwissFS, you need to visit the official website of this brokerage company. Here is a brief registration guide:

On the main page of the website, locate and click the "Open Account" button.

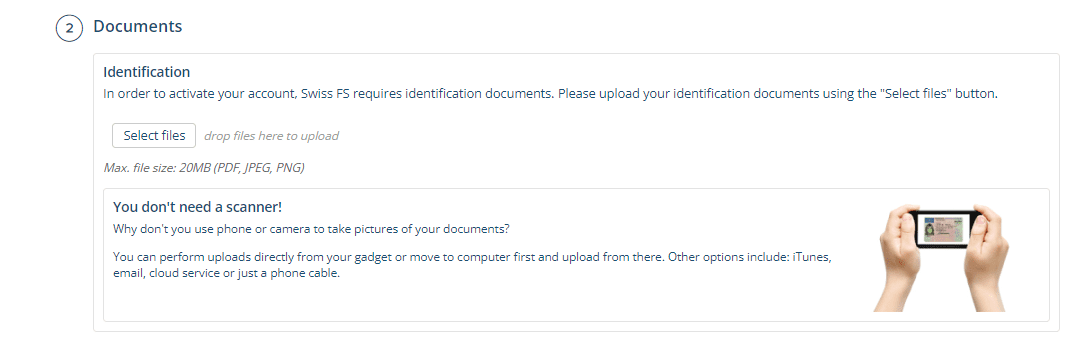

To complete the registration, enter your email, first name, last name, phone number, date of birth, and country. An email will be sent to the provided address with your login (consisting of 10 digits) and password. You should use these credentials for your initial login to the user account, and later you can change your password.

Functions of the SwissFS user account:

Also available in the user account are:

-

A list of open and closed trading positions for selected dates or for the entire period of the account's existence;

-

Operations for depositing and withdrawing funds, as well as reports on previously conducted transactions;

-

Contact information for communicating with a personal manager;

-

Installation files for trading platforms for different devices;

-

Technical support center and answers to questions about SwissFS services and products;

-

Educational materials and financial news;

-

Menu for changing the interface language and access to password.

Regulation and safety

SwissFS has a safety score of 1.5/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Negative balance protection

- Not tier-1 regulated

- Not regulated

- Track record of less than 8 years

SwissFS Security Factors

| Foundation date | 2022 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

SwissFS is Not a Regulated Broker

Commissions and fees

The trading and non-trading commissions of broker SwissFS have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Eightcap and XM Group, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of SwissFS with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, SwissFS’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

SwissFS Standard spreads

| SwissFS | Eightcap | XM Group | |

| EUR/USD min, pips | 0,1 | 0,4 | 0,7 |

| EUR/USD max, pips | 0,4 | 1,5 | 1,2 |

| GPB/USD min, pips | 0,2 | 0,8 | 0,6 |

| GPB/USD max, pips | 0,6 | 1,5 | 1,2 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

SwissFS RAW/ECN spreads

| SwissFS | Eightcap | XM Group | |

| Commission ($ per lot) | 3,00 | 3,5 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,2 |

| GBP/USD avg spread | 0,10 | 0,3 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with SwissFS. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

SwissFS Non-Trading Fees

Account types

To access SwissFS broker's services, you need to fill out the registration form on their website. Afterward, you can choose the account type that suits your goals, which is either demo or user. This brokerage company does not allow trading from different types of user accounts; all clients have the same conditions.

Account Types:

SwissFS does not offer cent accounts, so there is no option to try trading with minimal investments. The company also allows you to open an STP account in the MT4 platform for trading with floating spreads and prices from global liquidity providers.

Deposit and withdrawal

SwissFS received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

SwissFS provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No withdrawal fee

- No deposit fee

- Minimum deposit below industry average

- Bank card deposits and withdrawals

- USDT payments not accepted

- BTC not available as a base account currency

- PayPal not supported

What are SwissFS deposit and withdrawal options?

SwissFS provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller.

SwissFS Deposit and Withdrawal Methods vs Competitors

| SwissFS | Eightcap | XM Group | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| BTC | No | Yes | Yes |

What are SwissFS base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. SwissFS supports the following base account currencies:

What are SwissFS's minimum deposit and withdrawal amounts?

The minimum deposit on SwissFS is $50, while the minimum withdrawal amount is $200. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact SwissFS’s support team.

Markets and tradable assets

SwissFS offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 55 Forex pairs.

- 55 supported currency pairs

- ETFs investing

- Copy trading platform

- Futures not available

- Bonds not available

SwissFS Supported markets vs top competitors

We have compared the range of assets and markets supported by SwissFS with its competitors, making it easier for you to find the perfect fit.

| SwissFS | Eightcap | XM Group | |

| Currency pairs | 55 | 40 | 57 |

| Total tradable assets | 100 | 800 | 1400 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | No |

| Stock indices | Yes | Yes | Yes |

| Options | No | No | No |

Investment options

We also explored the trading assets and products SwissFS offers for beginner traders and investors who prefer not to engage in active trading.

Customer support

Technical support representatives are fluent in both Arabic and English.

Advantages

- Requesting a callback is possible

- Every client is assisted by a personal manager

Disadvantages

- Chat support is exclusively available to registered traders with this broker

- Chat support may lack in-depth information

SwissFS provides various communication channels:

Email.

Fax.

Phone support (requires self-initiated calls or filling out a call-back request form).

Online chat (exclusive to clients).

WhatsApp messenger (exclusive to clients).

The WhatsApp contact number for a personal manager is provided by the operator during initial chat interactions.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address |

Swiss Intl. Financial Brokerage Co. K.S.C.C., City Tower (Al Madina Tower) Floor 16 Khalid Ibn Al Waleed Street, Sharq Kuwait, P.O.BOX 26635, SAFAT 13127 |

| Regulation | MOCI |

| Official site | https://swissfs.com/ |

| Contacts |

+965 - 22020490

|

Education

The SwissFS website offers a minimal number of educational materials, all of which are presented in the Tutorials section. After mastering the basics of trading, you can practice in a special simulator known as the demo mode.

In the SwissFS client's user account, you will find video courses on Forex at two levels: Beginner and Advanced. Additionally, there are 8 lessons on the MetaTrader platform, covering topics such as working with indicators, One-Click Trading, using trailing stop, stop loss, and take profit.

Comparison of SwissFS with other Brokers

| SwissFS | Bybit | Eightcap | XM Group | Pocket Option | |

| Trading platform |

MT4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | Pocket Option, MT5, MT4 |

| Min deposit | $50 | No | $100 | $5 | $5 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No |

| Spread | From 2 points | From 0 points | From 0 points | From 0.8 points | From 1.2 point |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 30% / 50% |

| Order Execution | Instant Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No |

| Cent accounts | No | No | No | No | No |

Detailed review of SwissFS

SwissFS provides inclusive trading conditions for all its clients, irrespective of their trading experience or available capital. This broker caters to both active traders and those interested in passive financial market activities like copy trading and investing in managed MAM accounts. SwissFS follows an STP model, meaning there are no extra trading commissions for transactions; the company generates revenue through a slight markup on spreads.

SwissFS by the numbers:

3 operational offices in North Africa and Asia;

Over 20 years of providing brokerage services;

Over 100 trading instruments;

3 types of partnership programs.

SwissFS is a broker suitable for trading currencies and CFDs from various markets

This broker specializes in Forex trading, offering trading in 27 currency pairs with leverage up to 1:200. Additionally, clients can engage in CFD trading on US, German, French, and UK stock indices with leverage up to 1:33. Commodities like gold, silver, and oil are also traded with leverage up to 1:33, with the fee currency being US dollars. Furthermore, SwissFS provides access to the stock markets through CFDs, primarily focusing on the US stock market, but also offering CFDs on Chinese and EU stocks. The leverage for stocks is limited to 1:10, and the same leverage applies to more than 20 ETFs.

To simplify access to financial markets for its clients, SwissFS supports the MetaTrader 4 platform in various versions. Traders can use both the desktop terminal and WebTrader for making transactions. Mobile MT4 applications are available in the App Store and on Google Play.

Useful functions of SwissFS:

Financial news is provided in real-time in the trader's user account. The news is sourced from investing.com and other informational platforms;

Social media profiles. SwissFS shares useful trader data, analytics, and company news on its Instagram, Facebook, and X (formerly Twitter)pages;

WhatsApp support. Clients with active real and demo accounts can communicate with company representatives via this messenger.

Advantages:

SwissFS has been engaged in brokerage activities since 2002, focusing on online trading with modern order execution models and data encryption.

Clients can use various versions of MT4, including the web platform and smartphone/tablet applications.

SwissFS offers educational materials that allow novice traders to learn the basics of Forex trading, while experienced market participants can expand their knowledge further.

The company provides phone support, allowing clients to speak with support staff or their assigned personal consultants.

Opening an account with SwissFS is a quick process, typically taking under 10 minutes, and there's no need for identity verification when opening a demo account.

SwissFS offers its services globally, in countries where Forex trading is permitted. You can initiate your trading journey with a modest initial deposit, and there's also the possibility to boost your capital through deposit bonuses.

Latest SwissFS News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i