ThinkMarkets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- ThinkTrader

- FCA

- ASIC

- FSCA

- FSA

- CySEC

- JFSA

- 2010

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- MT5

- ThinkTrader

- FCA

- ASIC

- FSCA

- FSA

- CySEC

- JFSA

- 2010

Our Evaluation of ThinkMarkets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ThinkMarkets is a moderate-risk broker with the TU Overall Score of 5.22 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ThinkMarkets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

ThinkMarkets’ terms and conditions are aimed at Western traders who use their own free capital to trade.

Brief Look at ThinkMarkets

ThinkMarkets was launched in 2010 and has grown to offer Forex & CFD trading services globally since then. ThinkMarkets is duly licensed by the FCA (629628) in the UK, ASIC (ACN: 158 361 561) in Australia, CySEC (215/13) in Cyprus, JFSA (1536) in Japan, FSCA (49835) in South Africa, and the FSA (SD060) in Seychelles. With ThinkMarkets, one can trade more than 3,500 global assets, including Forex, Indices, Commodities, Shares & ETFs, CFDs, and Crypto CFDs. ThinkMarkets is an award-winning broker with offices in several countries of the world, in particular in Johannesburg (South Africa), Tokyo (Japan), Limassol (Cyprus), Dubai, London (the United Kingdom), and Melbourne (Australia).

- narrow market spreads - from 0.0 pips;

- minimum deposit of $0 on the Standard account;

- regulated in countries with a high level of control over the activities of Forex brokers;

- availability of the social trading platform ZuluTrade for copying trades of successful traders.

- there are no cent accounts;

- there are no bonus programs, contests nor promotions that are held among its clients;

- trading terminals often freeze;

TU Expert Advice

Financial expert and analyst at Traders Union

ThinkMarkets is an international brokerage firm that positions itself as a multi-regulated broker with favourable trading conditions. It is part of the TF Global Markets Limited holding, whose divisions have received FCA, ASIC, FSA, CySEC, JFSA, FSCA licenses. The broker offers accounts for beginners and professional traders with tight market spreads. It provides ZuluTrade - a social trading platform with its own risk assessment system.

The ThinkMarkets brokerage company takes care of the technical component. To increase the speed of trades, it cooperates with proven data centers and also provides customers with a VPS server for uninterrupted trading. The company's specialists have developed a unique ThinkTrader trading platform that allows you to use more than 125 indicators and deep chart settings for technical analysis, close multiple orders in one click, and track news in real-time.

The company's website is quite informative and has 19 versions in different languages. Technical support answers customer questions in multiple languages, including English, Spanish, Italian, Arabic and Portuguese.

ThinkMarkets Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, MT5, ThinkTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, ThinkZero |

| 💰 Account currency: | EUR, USD, AUD, CHF, GBP, JPY, CAD, NZD, SGD |

| 💵 Replenishment / Withdrawal: | Bank transfer, credit and debit cards Visa / Mastercard, Neteller, Skrill, Cryptowallet |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.0 pips on ThinkZero, from 0.4 pips on Standard |

| 🔧 Instruments: | Forex, CFDs on stocks, CFDs on indices, precious metals, commodities, cryptocurrency, ETFs & Futures |

| 💹 Margin Call / Stop Out: | 50%/50-100% |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant Execution |

| ⭐ Trading features: | Yes |

| 🎁 Contests and bonuses: | No |

The trading conditions of ThinkMarkets are suitable for both novice and experienced traders. The broker offers low spreads - from 0.0 pips and leverages up to 1:500. There are no requirements on the Standard account for the amount of the minimum deposit: it starts from $0 (or another account currency). The minimum trade volume is 0.01 lots. It is possible to open an Islamic account with standard conditions, but no swaps are charged.

ThinkMarkets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To become a client of ThinkMarkets and trade with a Forex broker, you need to:

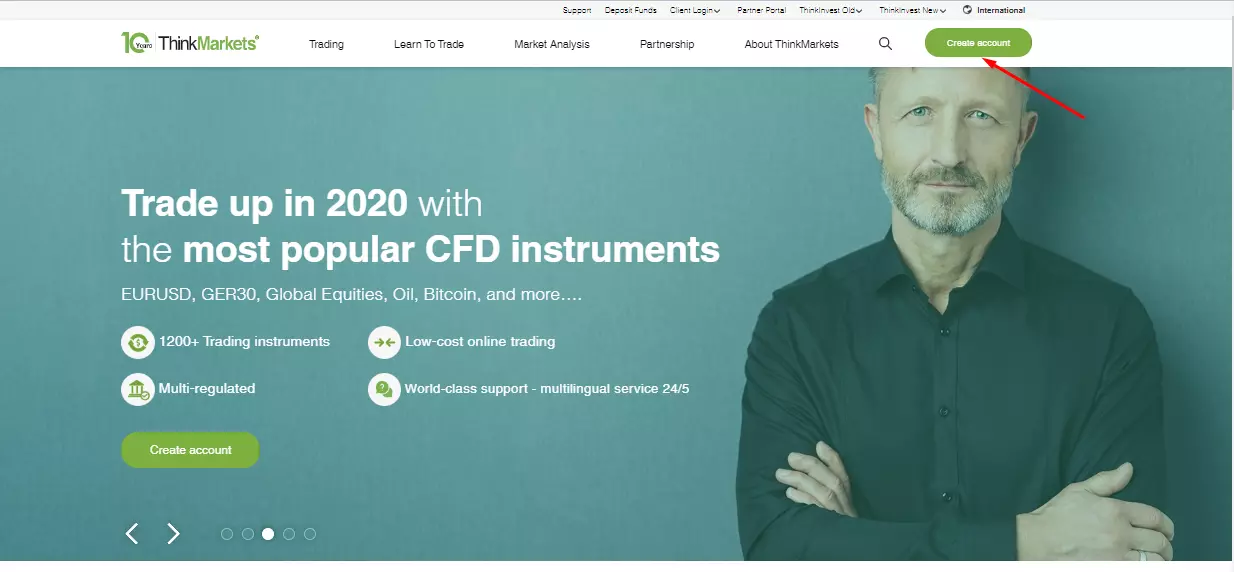

Register on the official website of the company and open a trading account. To do this, on the main page, click the "Create Account" button.

Indicate your full name, phone number, email address, country of residence. Choose an account type: demo, individual, joint, or corporate. Download the terminal (or go to the web version) and enter the login and password generated by the broker in it. Verification is required before making a deposit.

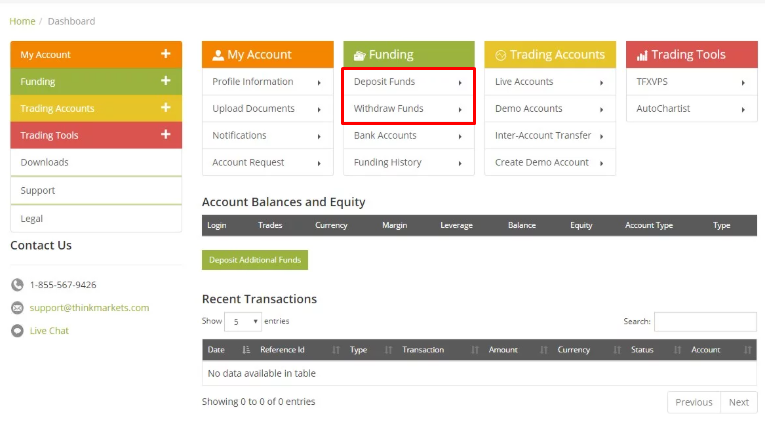

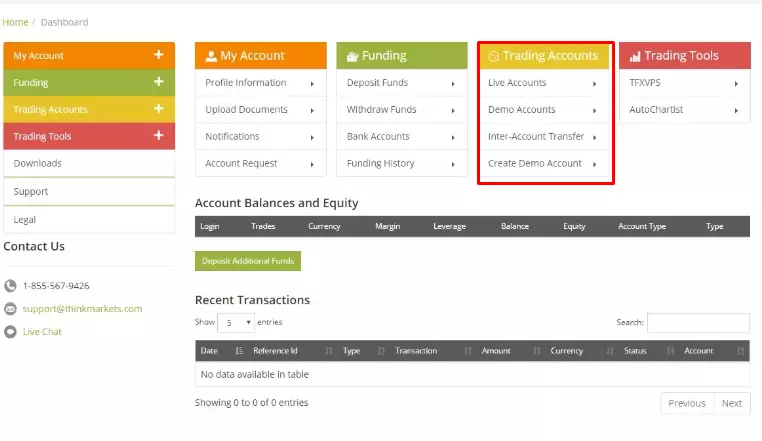

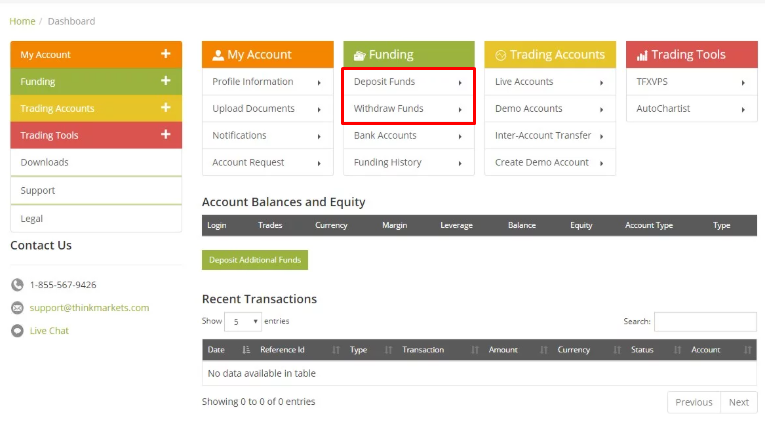

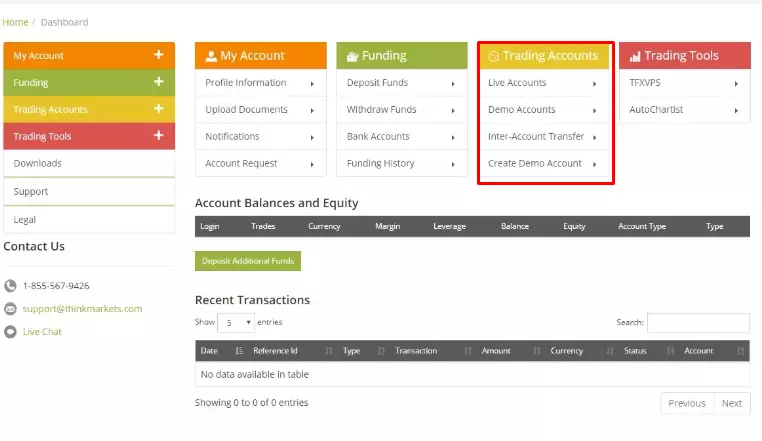

In the ThinkMarkets personal account, the broker's client can:

In your personal account, you will have access to the following functions:

-

connection to a free VPS server;

-

prompt communication with technical support specialists;

-

viewing the history of transactions carried out on accounts.

Regulation and Safety

The ThinkMarkets broker is part of TF Global Markets Limited, a holding company, which has six licenses: FCA (UK), ASIC (Australia), CySEC in Cyprus, JFSA in Japan, FSCA (South Africa) and FSA (Seychelles).

These regulators act strictly within the legal framework of the state under whose jurisdiction they fall. The broker-licensee is obliged to responsibly fulfill its tasks, ensure the transparency of all transactions, and further ensure the safety of its clients' money.

Advantages

- Keeping traders' funds in segregated accounts with verified state banks

- Negative balance protection

- Availability of insurance for $1 million in the event of company bankruptcy

Disadvantages

- A private trader cannot file a claim if the amount is insignificant

- Mandatory verification of identity, credit card, and bank account with the provision of personal information and copies of documents

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| ThinkZero | From $1 | No |

| Standard | From $4 | Yes, under certain conditions |

The broker charges for swaps, which is a commission for the transfer of an open position to the next day. Also, to identify average commissions, a comparative analysis of trading fees at ThinkMarkets and similar indicators of competitors was carried out. The comparison results are shown in the table below.

| Broker | Average commission | Level |

|---|---|---|

|

$2.5 | |

|

$1 | |

|

$8.5 |

Account Types

ThinkMarkets offers two types of trading accounts: Standard and ThinkZero. Their conditions are suitable not only for professional traders but also for beginners in Forex. The accounts differ in the size of the minimum deposit and spreads, and the existence or non-existence of a commission.

Account types:

Before opening a real account with a broker, every interested trader can test the speed of the terminals and trading conditions on a demo account.

ThinkMarkets is a regulated international broker whose trading conditions are suitable for traders of any Forex experience.

Deposit and Withdrawal

-

The ThinkMarkets finance department processes a withdrawal request within 24 hours. There is no limit on the number of requests. Withdrawal fees depend on the chosen electronic system. An international bank transfer costs $25.

-

Withdrawal of money is carried out by bank transfer, to Visa / Mastercard, Neteller, Skrill, and Bitpay wallets.

-

Depending on the method chosen, receiving funds takes from 1 to 7 working days.

-

The minimum withdrawal amount via wire transfer is $100. The amount limit for e-wallets is 10,000 units of the account currency.

-

Trading profits or any account balance exceeding the initial deposit amount will be returned by bank transfer.

Investment Programs, Available Markets and Products of the Broker

The ThinkMarkets broker offers its clients to combine active trading with passive investing. The company has developed conditions that allow increasing the profitability of passive investments with minimal risks. To generate income without independent trading, the broker provides a social trading platform, trust management, and several types of affiliate programs.

ZuluTrade — a unique social trading platform

ZuluTrade is an automated platform that allows you to customize your trade copying strategy based on a given parameter. An investor can choose a trader from the rating by the number of subscribers who have connected to him, trading hours and the indicator of the risk percentage. Any ThinkMarkets client can connect to the platform, even without knowledge of the basics of market analysis. To start automatic copying, an investor needs to select a trader and join his account.

-

The investor pays the trader 25% of his profit when making a profitable trade.

-

Trades are copied instantly and do not require the investor's personal intervention.

-

The ZuluTrade mobile app for Android and iOS allows you to access the markets and manage your trading account anytime, anywhere in the world.

-

Combos + is a professional portfolio management service provided by ZuluTrade certified specialists.

The rating of the best ZuluTrade traders is formed based on the opinion of the expert council, which evaluates candidates on the effectiveness of their trading, as well as on the feedback received from their subscribers. Thus, the higher the profitability of a trader's transactions and the number of positive reviews about his work, the higher his score rises in the overall rating.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

ThinkMarkets’ affiliate program:

-

Affiliate. This is a program that assigns a fixed fee to website owners and bloggers for each referee who registered on the broker's website using an affiliate link or banner.

-

Money Manager. This app pays a commission for traders for being included in the rating of fund managers of other clients of this broker.

-

API Trading. It is a fee for providers of proprietary trading algorithms and strategies, as well as brokers who have joined the ThinkMarkets brand.

-

Introducing Broker (IB). This program rewards traders for introducing brokers for partnership in referral campaigns.

-

White Label. It gains profits from each client's trade for qualified individuals/companies who have become brokers.

-

Regional Representatives. This program pays a commission for regional representatives who promote ThinkMarkets' trading services in their region.

The amount of remuneration is negotiated with each partner on an individual basis. ThinkMarkets provides full technical support, banners, and web design services for the development of websites to promote the company.

Customer Support

Support service hours: 24/7.

Advantages

- Fast communication by phone and online chat

- Multilingual support

- 24/7 customer support

Disadvantages

- No

Available methods to contact the broker’s support service:

by phone in the UK, Australia, Spain, Italy;

-

by email;

-

in a live chat on the official website;

-

in messengers of Facebook and Twitter.

Support is available from the broker's website and through your personal account.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | Hana, 4th Floor, 70 St Mary Axe, London EC3A, United Kingdom |

| Regulation |

FCA, ASIC, FSCA, FSA, CySEC, JFSA

Licence number: 629628, 424700, 49835, SD060, 215/13, 0250 |

| Official site | thinkmarkets.com |

| Contacts |

+44 203 514 2374, +61-3-9093-3400

|

Education

To help beginners and experienced traders, this broker's website has two sections - "Learn to Trade" and "Market Analysis". The first section contains educational materials, the second contains market news, an economic calendar, and technical analyses.

A demo account is provided on which you can apply the theoretical knowledge you recently gained.

Comparison of ThinkMarkets with other Brokers

| ThinkMarkets | RoboForex | Pocket Option | Exness | Forex4you | Libertex | |

| Trading platform |

ThinkTrader, MT4, MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | Libertex, MT5, MT4 |

| Min deposit | No | $10 | $5 | $10 | No | 100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:10 to 1:2000 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.1 points | From 0.1 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 20% | 50% / 50% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed Review of ThinkMarkets

The ThinkMarkets Broker is committed to the principles of honesty, transparency, and security. All client funds are kept separately from the capital of the company itself. The funds are maintained in segregated accounts with verified international banks. Among the main priorities of the company is the introduction of advanced data transmission technologies to ensure the fastest possible execution of trades. ThinkMarkets is also constantly expanding its range of trading tools. So, in 2013, the broker's clients began to trade CFDs.

The main figures that characterize the ThinkMarkets broker are:

-

traders from 180 countries of the world became clients of the company;

-

more than 3500 trading instruments are available;

-

$1 million of insurance coverage is offered

ThinkMarkets is a multi-regulated active trading broker

ThinkMarkets is a broker with six international licenses that offers an optimal set of functionalities for active trading. Clients trade from standard accounts as well as ThinkZero accounts with average spreads from 0.1 pips. ThinkMarkets provides clients with the option to open an account that is used by two or more individuals. Islamic clients can open an account without swaps. The company strives to ensure the fastest possible trade execution speed, therefore its servers are located in the data centers LD5 (London) and HK4 (Hong Kong) of the American corporation Equinix.

The broker's clients can use the universal platforms MetaTrader 4 and MetaTrader 5 for trading, as well as ThinkMarkets' own development, the ThinkTrader terminal. All trading platforms have desktop and web versions, as well as mobile applications for devices with Android and iOS operating systems.

Useful services of ThinkMarkets investments:

-

-

Trading Central. A set of tools that allows you to make forecasts based on technical and fundamental analysis. When compiling them, automated programs are used and the opinion of Forex experts is taken into account;

-

VPS hosting. A virtual dedicated server that promotes the stable and fast operation of trading terminals under any conditions.

Advantages:

availability of an insurance fund with the possibility of compensation up to $1 million in the event of the company's bankruptcy;

keeping client funds in segregated accounts that are not related to the broker's capital;

more than 3,500 Forex and CFD trading instruments;

floating spread from 0.0 pips for volatile currency pairs;

the ability to open an Islamic account (no swaps);

there is a social trading platform ZuluTrade for instant copying of trades of successful traders.

Traders can apply any type of strategy - short, medium, or long term, including scalping.

User Satisfaction