According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 100$

- MetaTrader5

- Mobile platforms

- CAPEX WebTrader

- FSCA

- CySec

- ADGM

- FSA

- ASF

- 2016

Our Evaluation of CAPEX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

CAPEX is a moderate-risk broker with the TU Overall Score of 6.71 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CAPEX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

CAPEX is mostly a broker for professional traders prepared to work with the company long-term.

Brief Look at CAPEX

CAPEX.com was launched in 2016 with the core mission to transform online trading procedures. CAPEX.com implements cutting-edge technology offering traders modern ways to invest in the financial markets. CAPEX.com offers a customer-friendly trading environment due to its customer-oriented educational approach. Capex gives traders access to more than 2100 financial tools in various asset classes to trade in the financial markets across the world.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Diversification of trading assets. The broker offers access to currencies, commodity and stock market assets (including ETFs, indices, bonds) and cryptocurrencies. There are also thematic investment portfolios.

- Big educational base: CAPEX Academy, market reviews, podcasts, articles, etc.

- License issued by CySEC (Cyprus, 292/16). It is a reputable regulatory authority that operates in compliance with the European law.

- High minimum deposit: USD 100 on Standard account, from USD 1,000 and more on other account types. Trading conditions seem to be more of a marketing nature than to provide specific information.

CAPEX Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

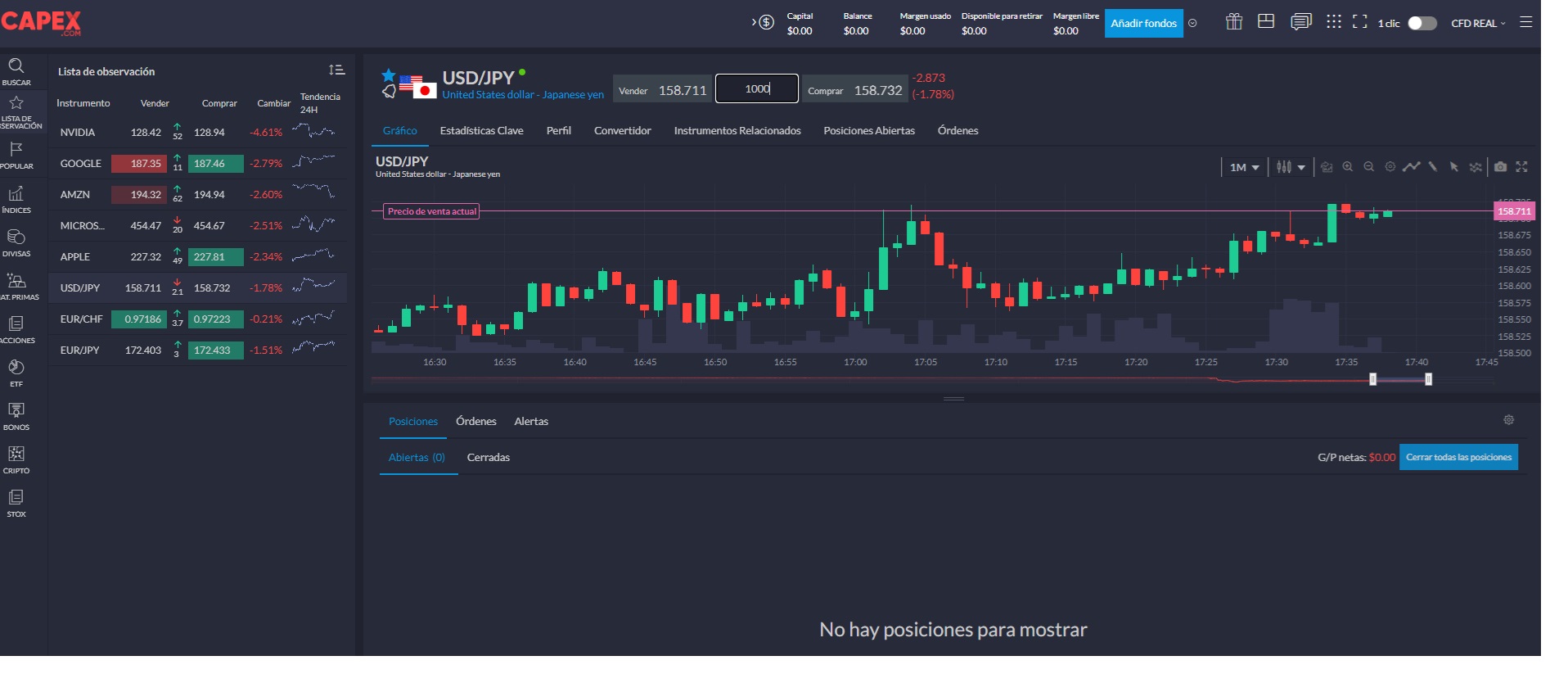

| 💻 Trading platform: | CAPEX WebTrader, MetaTrader5, Mobile Platforms |

|---|---|

| 📊 Accounts: | Basic, Essential, Classic, Original, Premium, Signature |

| 💰 Account currency: | USD, CZK, DKK, EUR, GBP, HUF, PLN, RON, SEK, ZAR |

| 💵 Deposit / Withdrawal: | Bank Card, Wire transfer, Neteller/Skrill |

| 🚀 Minimum deposit: | 100$ |

| ⚖️ Leverage: | 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | Forex, Indices, Commodities, Bonds, ETFs, Shares, Crypto, Blends |

| 💹 Margin Call / Stop Out: | 50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Mobile Platforms |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution, Instant Execution |

| ⭐ Trading features: | Affiliate program; Mobile trading: top of the line iphone and android apps. |

| 🎁 Contests and bonuses: | No |

CAPEX is a classic CFD trading company. The broker's arsenal includes currency pairs, assets of commodity markets, indices, stocks, and papers of ETF funds. The minimum deposit is 100 USD. Account types differ in their available functionality: the number of non-standard indicators, advanced access to the Trading Central service, pattern recognition using the tools of the TradingView service, a multi-account management system, etc.

Order execution type - STP. The broker takes traders' orders directly to liquidity providers, which provide instant execution at the best prices. The possibility of slippage is practically excluded. A small spread widening occurs when volatility rises when key news is released.

CAPEX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

PA Panama City

PA Panama City  CL

CL Trading Account Opening

An account with the broker is opened through its official website by following these steps:

Complete the registration form by providing your first name, last name, phone number, and email address.

Select your preferred account currency, such as USD, EUR, or AED.

Create a secure password, either manually or with the help of a password generator.

Verify your identity and address by uploading the required supporting documents.

Regulation and safety

CAPEX has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 9 years

- Strict requirements and extensive documentation to open an account

CAPEX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

BaFin BaFin |

Federal Financial Supervisory Authority | Germany | Up to €20,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

| CONSOB (Italy) | Commissione Nazionale per le Società e la Borsa | Italy | Up to €20,000 | Tier-1 |

| ASF (Romania) | Comisia Națională a Valorilor Mobiliare | Romania | Up to €20,000 | Tier-2 |

CAPEX Security Factors

| Foundation date | 2016 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker CAPEX have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of CAPEX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, CAPEX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

CAPEX Standard spreads

| CAPEX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

CAPEX RAW/ECN spreads

| CAPEX | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,5 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with CAPEX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

CAPEX Non-Trading Fees

| CAPEX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 30 | 0 | 0 |

Account types

Traders can start by opening a Basic account with a minimum deposit of $100 and later upgrade by increasing the deposit amount. Each account type includes unique features tailored to different experience levels and investment capacities.

Account types:

CAPEX also offers a demo account with virtual funds, allowing traders to explore the platform and practice trading without risking real money. The demo account becomes available upon registration and the opening of any real account.

Deposit and withdrawal

CAPEX received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

CAPEX provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Minimum deposit below industry average

- Bitcoin (BTC) accepted

- BTC available as a base account currency

- No deposit fee

- USDT payments not accepted

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

What are CAPEX deposit and withdrawal options?

CAPEX provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC.

CAPEX Deposit and Withdrawal Methods vs Competitors

| CAPEX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are CAPEX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. CAPEX supports the following base account currencies:

What are CAPEX's minimum deposit and withdrawal amounts?

The minimum deposit on CAPEX is $100, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact CAPEX’s support team.

Markets and tradable assets

CAPEX offers a wider selection of trading assets than the market average, with over 2100 tradable assets available, including 40 currency pairs.

- Crypto trading

- 2100 assets for trading

- Indices trading

- Futures not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by CAPEX with its competitors, making it easier for you to find the perfect fit.

| CAPEX | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 2100 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products CAPEX offers for beginner traders and investors who prefer not to engage in active trading.

| CAPEX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

The company provides support through multiple channels, enabling current and prospective clients to reach out in the most convenient way. Support hours are Monday through Thursday from 7:00 to 01:00 and Friday from 7:00 to 00:00 (GMT).

Advantages

- Multilingual support

- Chat on the website

Disadvantages

- Online assistance only for basic questions

CAPEX’s communication methods:

-

Chat on the official website (chatbot and live operators)

-

Phone

-

Email

-

Company offices

Contacts

| Foundation date | 2016 |

|---|---|

| Registration address | 18 Spyrou Kyprianou Avenue, Suite 101, Nicosia 1075, Cyprus |

| Regulation |

FSCA, CySec, ADGM, FSA, ASF

Licence number: 37166, 292/16, 190005, SD020, PJM01SFIM/400013 |

| Official site | capex.com |

| Contacts |

+357 22 000 358, +40 312 295 982, +349 10 607 360

|

Education

The broker offers a comprehensive educational platform, CAPEX Academy, designed for traders at all experience levels. It features free online courses covering a broad range of topics, from trading fundamentals to advanced strategies. The materials are structured for self-paced learning and include articles, video lessons, and analytical insights.

CAPEX regularly hosts free webinars led by experienced market analysts. These sessions cover current market events, trend analysis, and include real-time responses to participant questions.

Comparison of CAPEX with other Brokers

| CAPEX | Eightcap | XM Group | RoboForex | TeleTrade | FxPro | |

| Trading platform |

MT5, WebTrader, MobileTrading | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | $100 | $100 | $5 | $10 | $10 | $100 |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | 1.00% | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 70% / 20% | 25% / 20% |

| Order Execution | Market Execution, Instant Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Latest CAPEX News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i