According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- MT4

- MT5

- WebTrader

- BVIFSC

- FSC

- FSA

- VFSC

- 2010

Our Evaluation of TitanFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TitanFX is a moderate-risk broker with the TU Overall Score of 6.27 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TitanFX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

TitanFX is a broker for active trading with your own funds and copying trades, which is suitable for experienced traders and professionals who prefer to work on ECN accounts with minimal spreads.

Brief Look at TitanFX

TitanFX is a Forex and CFD broker that has served retail and institutional clients around the world since 2014. The company is regulated by the Vanuatu Financial Services Commission (VFSC, 40313), BVIFSC (2080481), FSC (GB20026097), FSA (SD138). It offers traders STP and ECN accounts with minimal execution delays, tight market spreads, and leverage up to 1:500, as well as MT4 and MT5 trading platforms.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Wide range of trading platforms. The broker provides MetaTrader 4 and MetaTrader 5, desktop, mobile, as well as WebTrader terminals.

- Control of activities by several international regulators such as Vanuatu Financial Services Commission and The Financial Commission.

- Variety of trading instruments. Clients have access to transactions with more than 70 currency pairs, as well as CFDs on cryptocurrencies, commodities, precious metals, indices, and American stocks.

- Almost zero spreads on ECN accounts and the market average commission for a traded lot.

- Cooperation with more than 50 liquidity providers, including large international banks and brokerage companies.

- The possibility to connect to the world-famous social trading platform ZuluTrade.

- The availability of an online chat with competent operators who answer users’ questions within a couple of minutes after the request is formed.

- Limited choice of passive income solutions. The only option available is copying trades through ZuluTrade.

- Lack of bonuses, cent, and Islamic accounts.

- High first deposit on Standard accounts. To start trading, you need to fund your balance by at least $200.

TU Expert Advice

Author, Financial Expert at Traders Union

TitanFX provides a range of trading services, including Forex and CFDs, accessible via MetaTrader 4, MetaTrader 5, and WebTrader platforms. It offers STP and ECN account types, featuring tight spreads and leverage up to 1:500. The broker supports trading over 70 currency pairs, cryptocurrencies, metals, indices, and U.S. stocks. The absence of bonuses and a $200 initial deposit requirement may be offset by the direct market execution and partnership with over 50 liquidity providers.

Drawbacks include limited passive income options, with ZuluTrade as the primary feature, and the lack of Islamic account offerings. TitanFX's high initial deposit may not appeal to novice traders looking for lower entry barriers. However, its advanced trading infrastructure may attract experienced traders seeking minimal spreads and fast execution. While TitanFX suits active traders, those focusing on passive income or requiring specialized account types may consider alternatives.

TitanFX Trading Conditions

| 💻 Trading platform: | МТ4 (desktop, mobile), МТ5 (desktop, mobile), WebTrader |

|---|---|

| 📊 Accounts: | Demo, МТ4, Demo, МТ5, Standard STP account, Blade ECN account |

| 💰 Account currency: | USD, EUR, JPY, and SGD |

| 💵 Deposit / Withdrawal: | Credit cards Visa, Mastercard are for clients of all jurisdictions, STICPAY, bank transfer and bitwallet are for residents of certain countries, AMEX is only for funding |

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | 1:1 to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs (70), crypto CFDs (24), commodities (5), precious metals (11), indices (21), US stocks (65) |

| 💹 Margin Call / Stop Out: | Stop out: 20% |

| 🏛 Liquidity provider: | More than 50 major banks, including JPMorgan Chase, BNP Paribas, HSBC, Bank of America, Goldman Sachs, Nomura Holdings, Inc |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | You can trade cryptocurrencies, scalping and hedging are allowed, you can use an automated expert advisor |

| 🎁 Contests and bonuses: | No |

TitanFX clients have access to over 190 financial instruments, trading via MetaTrader4 and 5 from Standard STP and ECN accounts. The size of the first deposit is $200. In the future, the account can be funded with any amount, but it should be borne in mind that the minimum payment through STICPAY is $30. The maximum leverage is 1:500, however, with such a high level, you can only trade currency pairs, commodities, and precious metals. TitanFX withholds swap fees, and Islamic accounts are not available.

TitanFX Key Parameters Evaluation

Video Review of TitanFX

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

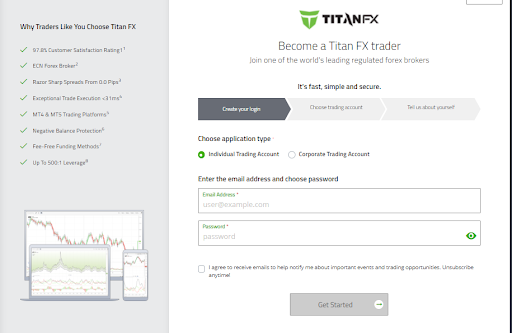

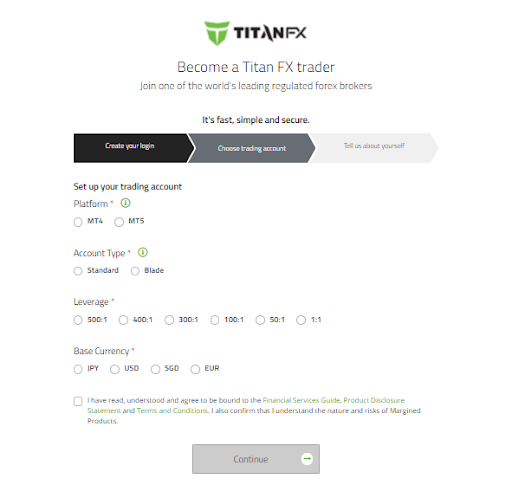

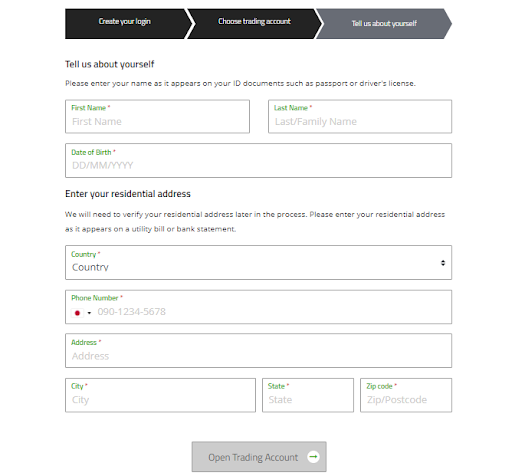

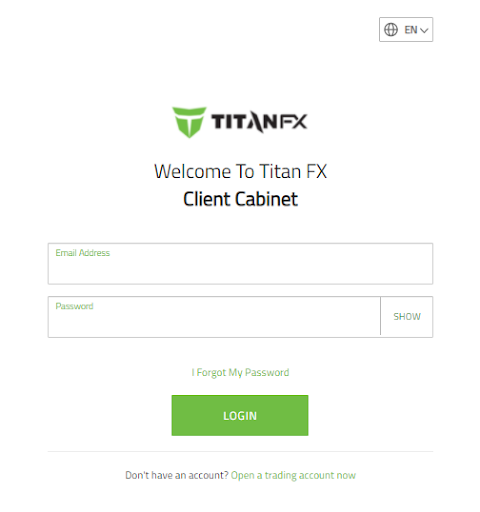

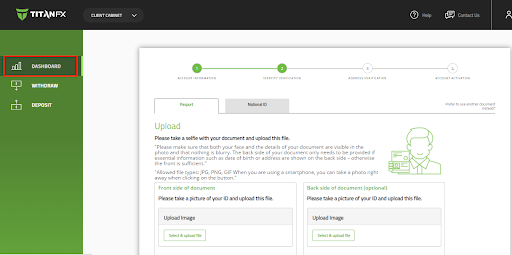

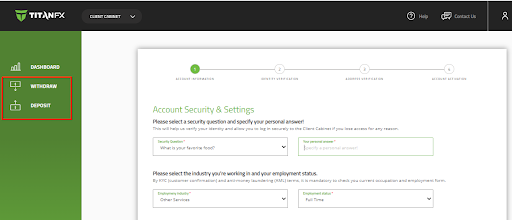

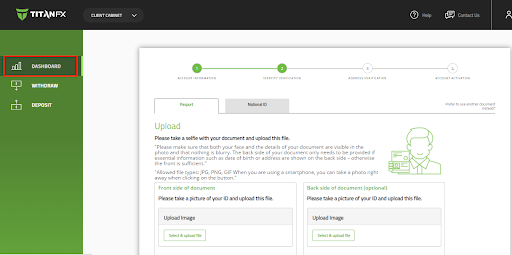

To create a personal account within the TitanFX website, you first need to register with the broker. This procedure consists of the following stages:

After going to the official website of the company, you need to select the interface language, and then click Open a live Account.

In the registration form that opens, you need to specify your email address, as well as come up with or generate a strong password.

Next, you should select the account type (Standard/Blade), trading platform (MT4/MT5), leverage (from 1:10 to 1:500), and account currency (USD/EUR/JPY/SGD).

On the form, you have to indicate your name, surname, phone number, date of birth, residence address.

After confirming the email by clicking the link that the system sends to the specified email address, you need to log in to your personal account.

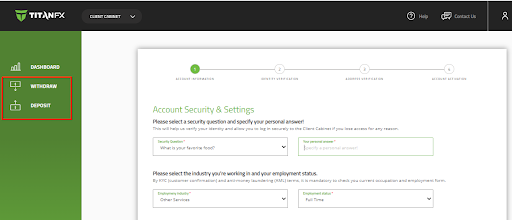

In the TitanFX’s personal account, the client has access to:

Also, the functionality of the personal account allows a trader to:

-

Get quick access to information from the Help section.

-

Transfer funds between your trading accounts.

-

Generate reports on the referral program.

-

Track trading statistics.

-

View account statements.

Regulation and safety

TitanFX has a safety score of 7.6/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 15 years

- Not tier-1 regulated

TitanFX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

BVI FSC BVI FSC |

British Virgin Islands Financial Services Commission | British Virgin Islands | No specific fund | Tier-2 |

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

The Financial Commission The Financial Commission |

The Financial Commission | International | Up to €20,000 | Tier-3 |

TitanFX Security Factors

| Foundation date | 2010 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker TitanFX have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- Above-average Forex trading fees

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of TitanFX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, TitanFX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

TitanFX Standard spreads

| TitanFX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,4 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

TitanFX RAW/ECN spreads

| TitanFX | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with TitanFX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

TitanFX Non-Trading Fees

| TitanFX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0,5-1 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

TitanFX offers 2 types of accounts (STP and ECN) with a minimum deposit of $200 (or the equivalent in euros, yen, or Singapore dollars). The available leverage depends on the asset being traded and ranges from 1:1 to 1:500.

Account types:

The broker also offers demo accounts for MT4 and MT5, which completely copy the conditions of real accounts. Each demo account is valid for 30 days and allows trading with $50,000 of virtual funds.

TitanFX offers accounts for both experienced traders who prefer ECN technology, and for beginners who are keen to work with standard accounts.

Deposit and withdrawal

TitanFX received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

TitanFX provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank card deposits and withdrawals

- Low minimum withdrawal requirement

- Minimum deposit below industry average

- No deposit fee

- Only major base currencies available

- BTC payments not accepted

- Wise not supported

What are TitanFX deposit and withdrawal options?

TitanFX provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller.

TitanFX Deposit and Withdrawal Methods vs Competitors

| TitanFX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are TitanFX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. TitanFX supports the following base account currencies:

What are TitanFX's minimum deposit and withdrawal amounts?

The minimum deposit on TitanFX is $200, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact TitanFX’s support team.

Markets and tradable assets

TitanFX offers a limited selection of trading assets compared to the market average. The platform supports 250 assets in total, including 70 Forex pairs.

- Copy trading platform

- Crypto trading

- Indices trading

- No ETFs

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by TitanFX with its competitors, making it easier for you to find the perfect fit.

| TitanFX | Plus500 | Pepperstone | |

| Currency pairs | 70 | 60 | 90 |

| Total tradable assets | 250 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products TitanFX offers for beginner traders and investors who prefer not to engage in active trading.

| TitanFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

The broker’s support representatives are available via live chat or telephone 24 hours a day, Monday through Friday.

Advantages

- Chat operators respond within 1-2 minutes

- Support is available in English and Japanese

Disadvantages

- Days off on Sunday and Monday

- Email replies come within one business day

TitanFX provides the following communication channels for its clients:

-

live chat;

-

direct call to the phone numbers specified in the Contact section;

-

email request;

-

a ready-made contact form by email.

You can ask a question in online chat even without being a client of the company.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | Titan FX Limited, 1st Floor, Govant Building, Kumul Highway, Port Vila, Vanuatu |

| Regulation | BVIFSC, FSC, FSA, VFSC |

| Official site | https://titanfx.com/ |

| Contacts |

+1 (206) 745-5058

|

Education

On TitanFX’s website, all training materials are collected in two blocks: Forex Basics and FAQs. Forex Basics is not organized as a separate section, and to find it, you need to click on the News button. In total, there are 14 educational lessons on the site. They are compiled by the company’s chief financial expert and professional trader Aayush Jindal.

Traders who want to move from theory to practice without risking money can open a demo account. Its conditions are similar to those offered by real accounts, but it is impossible to lose funds since trading with a demo is conducted using virtual funds.

Comparison of TitanFX with other Brokers

| TitanFX | Bybit | Eightcap | XM Group | Kama Capital | InstaForex | |

| Trading platform |

MT4, MT5, WebTrader | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader5 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $200 | No | $100 | $5 | No | $1 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:400 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.2 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No / 20% | No / 50% | 80% / 50% | 100% / 50% | 20% / No | 30% / 10% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | Yes |

Detailed Review of TitanFX

TitanFX offers a wide variety of Forex assets. Its clients can trade 70 currency pairs (majors, minors, crosses, exotics), 24 pairs of crypto majors and crypto minors, and 21 stock indices including NAS100, JPN225, GER30, CN50, US2000, and AUS200. You can also trade crude oil, gas, gold, silver, platinum, and palladium through a broker with up to 1:500 leverage. TitanFX offers CFD trading on major Nasdaq and NYSE shares in the US with low exchange spreads and Direct Market Access (DMA).

TitanFX by the numbers:

-

It has provided online Forex trading services for over 7 years.

-

It collaborates with over 50 liquidity providers.

-

The structural divisions of the company are located in 6 cities in 5 countries.

TitanFX is a broker that offers retail traders an infrastructure previously only available to institutional clients

The use of ZeroPoint technology allows TitanFX to achieve dynamic liquidity aggregation and ultra-fast execution at the best price without requotes. The company has multiple data centers in the United States, Asia, and Singapore. Its servers are located in the Equinix NY4 financial center (New York), which is an integral part of the infrastructure of major exchanges, banks, and brokerage companies specializing in high-frequency trading (HFT). Thanks to partnerships with a large number of liquidity providers and the use of artificial intelligence in pricing, TitanFX offers virtually zero spreads on ECN accounts.

The broker’s clients can trade through the most popular platforms among Forex terminals, like the MetaTrader 4 and MetaTrader 5. Trading applications are available not only for PCs, laptops, and Macs but also for phones and tablets based on Android, iPhone, and iPad. Clients can also use WebTrader, which works through a browser and does not require installation.

Useful services of TitanFX:

-

Market analysis. Demo and live account holders can subscribe to receive market analysis reports from Senior Strategist Aayush Jindal. New reports are generated every weekday.

-

FAQs. A section with answers to frequently asked questions about the broker’s conditions, the use of trading platforms, and the algorithm for opening an account.

-

Spread indicator. On the company’s website, in the Download Center section, you can download an indicator that, after being installed on MT4, will display the current spread in a chart window.

Advantages:

The broker allows you to practice trading on a demo account before opening a real account.

TitanFX clients’ trades are placed directly with liquidity providers through direct data servers within the Equinix financial data center.

Traders get access to transactions with over 190 Forex financial instruments.

Negative balance protection is active.

Customer funds are held separately from the company’s money in segregated bank accounts.

The broker does not prohibit scalping, hedging, or the use of automated expert advisors during trading.

Clients can simultaneously hold up to 200 positions open, including limit and stop orders.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i