According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- MT5

- OANDA TMS Brokers

- The Polish Financial Supervision Authority (UKNF)

Our Evaluation of TMS Brokers

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TMS Brokers is a moderate-risk broker with the TU Overall Score of 5.39 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TMS Brokers clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

TMS Brokers is similar to its competitors in some respects, and it outperforms them in other parameters. Its main advantages are a free demo account, a large pool of assets, availability of the Pro account, its proprietary trading platform, and support for MT5. Favorable trading costs are minimized due to tight spreads and the absence of trading fees. The broker provides a good education system, online quotes, and an economic calendar. To make additional income, traders can use a standard referral program.

Brief Look at TMS Brokers

TMS Brokers is a Forex and CFD broker that offers trading currency pairs, stocks, and CFDs on stocks, indices, commodities, and cryptocurrencies. Spreads start from 0 pips and there are no trading fees. MetaTrader 5 (MT5) and the broker’s proprietary OANDA TMS Brokers platform are available. A free demo account with virtual €50,000 is provided. No minimum deposit is required to open a live account. Upon reaching a certain trading volume, traders can transform their accounts into Pro accounts. The Pro account provides negative balance protection and increased leverage up to 1:200. Deposits and withdrawals are made via bank transfers, Visa, Mastercard, and the Trustly platform. The company offers an educational block with articles, videos, and ebooks. Also, the broker holds live webinars. A partnership program is available.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Free demo account; no requirements for the minimum deposit for a live account;

- Spreads are floating from 0 pips; no trading fees;

- Experienced market participants can qualify to get more favorable conditions;

- Traders can work through the OANDA TMS Brokers platform which is highly rated by experts;

- Thousands of assets from 6 different groups; leverage is 1:20 or 1:200 for the Pro account;

- No restrictions on trading strategies and methods; traders can use advisors;

- Multi-currency e-wallet and international exchange services are provided.

- Lack of transparency; in particular, there is no open data on withdrawal fees;

- No additional income options, except for a referral program;

- Technical support is available 9.00-17.00 (CET) on weekdays.

TU Expert Advice

Financial expert and analyst at Traders Union

TMS Brokers SA entered the market 20 years ago. In 2020, it was bought by OANDA, a Canadian company. The broker has retained its original trademark, but its legal name is OANDA TMS Brokers SA. Its head office is still located in Warsaw and it is licensed by the Polish Financial Supervision Authority (KNF). For the entire time of its operation, no cases of the broker’s failure to fulfill its obligations to its clients have been recorded.

A demo account is free to open, it is not limited in time, and a virtual deposit of €50,000 is provided to traders. There are no requirements for the minimum deposit on a live account. MetaTrader 5 and the broker’s proprietary platform are offered. The OANDA TMS Brokers platform is highly rated by users and experts for its intuitive interface, statistics visualization, and various charts and indicators. However, it is inferior to MT4/5 solutions regarding customization.

Spreads start from 0 pips and they are more than competitive. The absence of trading fees provides for low trading costs. Unregistered users can’t get information about withdrawal fees. These fees are charged, but they are quite low. Withdrawals and deposits are available via bank transfers, bank cards, and Trustly.

There are several options for a referral program. Individuals can receive a referral link and earn from referred users when sharing it. Companies get a full set of opportunities, ranging from promo materials to sales support. Unfortunately, the broker doesn’t offer traditional passive income options, such as copy trading and MAM and PAMM accounts. User reviews point to this as the broker’s main disadvantage along with the lack of transparency on certain aspects of the broker’s activities.

The website provides an economic calendar and online quotes. The educational block offers a lot of useful materials for both novice and experienced traders. The company regularly holds seminars and webinars. Also, a multi-currency e-wallet with conversion and international transfers is provided. In summary, I recommend the broker for review.

TMS Brokers Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. TMS Brokers and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT5 and OANDA TMS Brokers |

|---|---|

| 📊 Accounts: | Demo, Standard, and Pro |

| 💰 Account currency: | EUR |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, and online payment systems |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Up to 1:20 (1:200) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Currency pairs, stocks, CFDs on stocks, indices, commodities, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Free demo account with virtual €50,000; One live account type; Possibility to qualify to get the Pro account; Thousands of assets from 6 groups; Moderate leverage; Low trading fees; Support for MetaTrader and the broker’s proprietary platform; High-quality training; Basic analysis tools. |

| 🎁 Contests and bonuses: | Yes (rebates from Traders Union) |

Often, if a broker offers several live account types, the minimum deposit and trading conditions on them differ. TMS Brokers offers only one live account type without a minimum deposit. Traders can deposit €10, €100, €1,000, or any other amount sufficient for them. The broker also offers leverage that depends on a traded asset. The highest leverage of 1:20 is for currency pairs. If traders are experienced and successful, and deposit large amounts, they can get the Pro account and increase the available leverage up to 1:200. Technical support is not prioritized, that is, it’s available to all users under the general procedure. It works from 9.00-17.00 (CET) on weekdays. The client service isn’t available on weekends.

TMS Brokers Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working with this broker, register on its official website and get a user account. Verification, which is confirmation of your personal information, is also required. Once traders open a live account, they can make a deposit and download the trading platform. TU experts have prepared a step-by-step guide to eliminate many questions and have described the features of the user account.

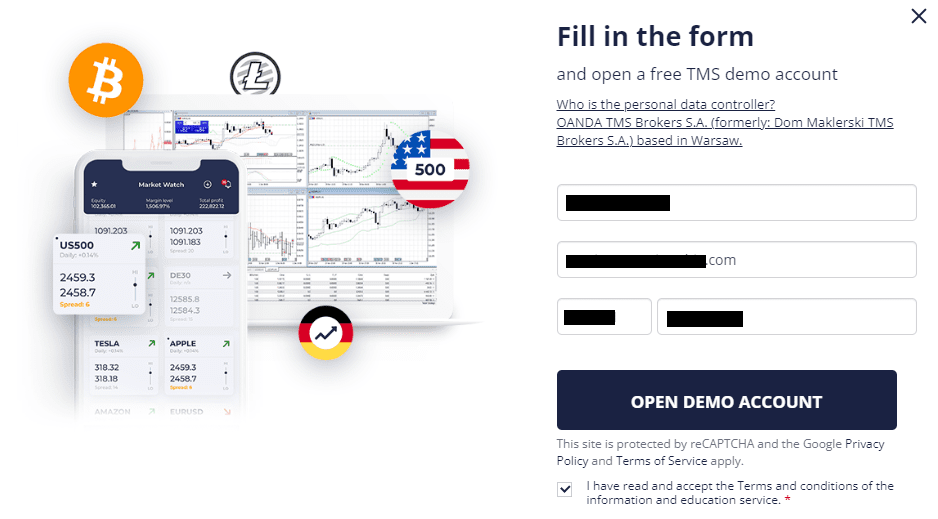

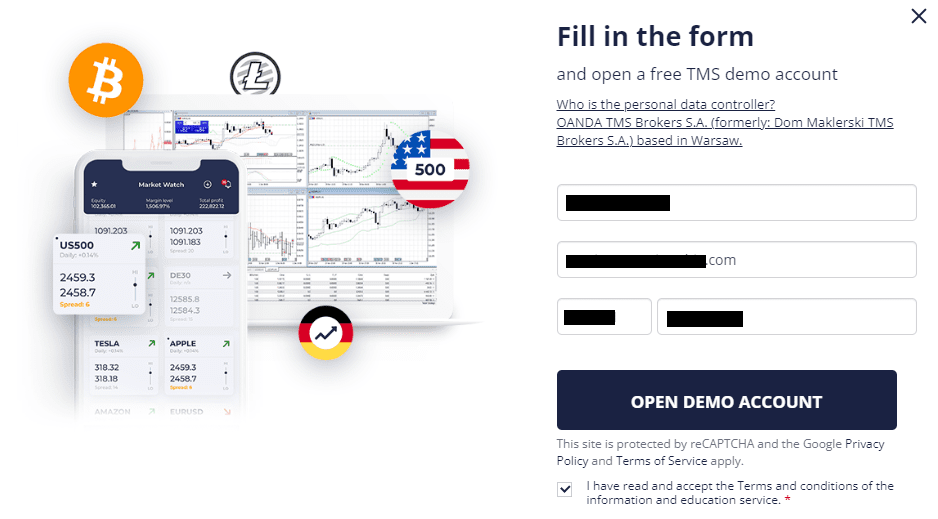

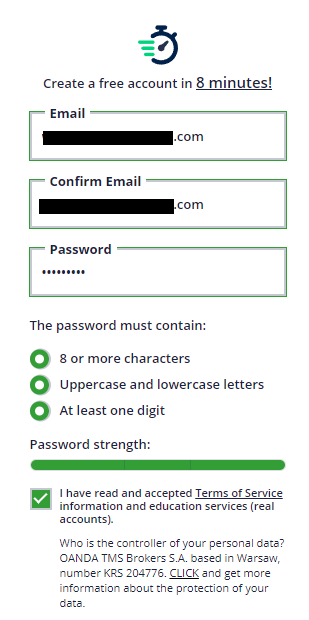

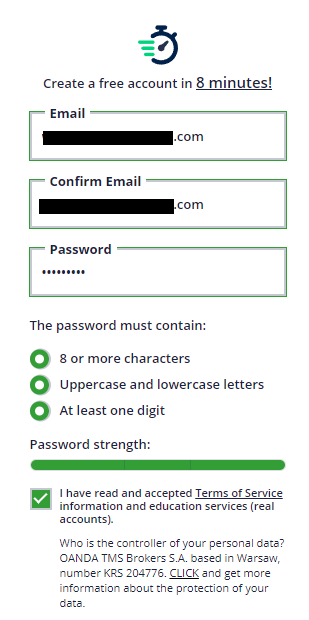

Go to the broker's website and click the “OPEN DEMO ACCOUNT” button.

Enter your name, email, and phone number. Agree to the terms of service by ticking the box below and click the “OPEN DEMO ACCOUNT” button.

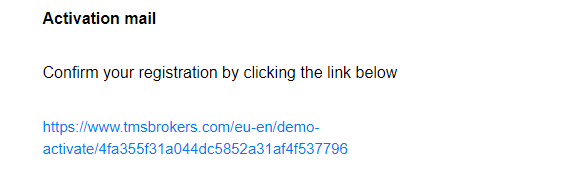

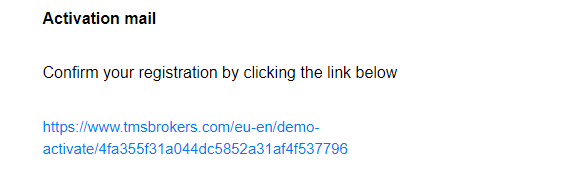

A message with a confirmation link will be sent to the specified email. Follow the on-screen instructions to start trading on your demo account.

You can open a live account on the main page of the website, similar to a demo account. The difference is that you will have to provide detailed information about yourself, including your registration address.

Follow the on-screen instructions to upload photos of your ID documents. Identity verification is required to open a live account.

Make a deposit in the corresponding section of your user account. Download the distribution kit of OANDA TMS Brokers or MetaTrader 5 platforms on the broker's website. Install it on your device, enter your registration details, and start trading.

Features of TMS Brokers’ user account:

-

Traders can monitor the status of their active accounts and receive detailed statistics on them;

-

Traders can open and close accounts (there can only be one demo account);

-

Traders can make deposits, withdrawals, and internal transfers between their accounts;

-

Traders can monitor their status in the referral program and view statistics on their referees;

-

Traders can view online quotes, the economic calendar, and the broker’s blog;

-

Traders are able to connect additional services, such as the multi-currency e-wallet and international transfers;

-

Traders have the possibility to change their personal data and security settings of the user account;

-

You can contact technical support in the live chat at the bottom right corner.

Regulation and safety

TMS Brokers has a safety score of 1.5/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Negative balance protection

- Not tier-1 regulated

- Not regulated

- Track record of less than 8 years

TMS Brokers Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

TMS Brokers is Not a Regulated Broker

Commissions and fees

The trading and non-trading commissions of broker TMS Brokers have been analyzed and rated as Low with a fees score of 10/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of TMS Brokers with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, TMS Brokers’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

TMS Brokers Standard spreads

| TMS Brokers | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

TMS Brokers RAW/ECN spreads

| TMS Brokers | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,00 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,10 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with TMS Brokers. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

TMS Brokers Non-Trading Fees

| TMS Brokers | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

If a broker offers several account types, their conditions often differ greatly. TMS Brokers offers only one live account type with universal conditions. Thereafter, traders can get the Pro account with negative balance protection and increased leverage, if they comply with certain broker’s requirements. To aim for the Pro account isn’t obligatory, since the Standard account also offers profitable conditions. Many traders prefer working on the popular MetaTrader 5, as it is easy to use, quick, reliable, and can be customized for a specific user. The OANDA TMS Brokers app can’t be as customized, however, it has many integrated options. There are technical indicators, analytical tools, and chart blocks. Traders who want to work with TMS Brokers should try both platforms to choose the best one for themselves.

Types of accounts:

If traders have never worked with this broker, they are recommended to open a demo account first. This allows them to explore the company and try different strategies without financial risks. Later, they can open the Standard account and then switch to Pro, if necessary.

Deposit and withdrawal

TMS Brokers received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

TMS Brokers provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No withdrawal fee

- Bank wire transfers available

- Minimum deposit below industry average

- Bank card deposits and withdrawals

- Wise not supported

- USDT payments not accepted

- Only major base currencies available

What are TMS Brokers deposit and withdrawal options?

TMS Brokers provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire.

TMS Brokers Deposit and Withdrawal Methods vs Competitors

| TMS Brokers | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are TMS Brokers base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. TMS Brokers supports the following base account currencies:

What are TMS Brokers's minimum deposit and withdrawal amounts?

The minimum deposit on TMS Brokers is $100, while the minimum withdrawal amount is $0. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact TMS Brokers’s support team.

Markets and tradable assets

TMS Brokers offers a wider selection of trading assets than the market average, with over 5000 tradable assets available, including 70 currency pairs.

- Indices trading

- 70 supported currency pairs

- Crypto trading

- No ETFs

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by TMS Brokers with its competitors, making it easier for you to find the perfect fit.

| TMS Brokers | Plus500 | Pepperstone | |

| Currency pairs | 70 | 60 | 90 |

| Total tradable assets | 5000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products TMS Brokers offers for beginner traders and investors who prefer not to engage in active trading.

| TMS Brokers | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Traders may have plenty of questions. They can arise due to inattention or lack of transparency of a broker. Sometimes users may face unexpected situations or problems when trading or depositing/withdrawing funds. In every controversial situation, they can contact technical support to get qualified assistance. TMS Brokers’ clients can contact support by phone, email, social media, or live chat. Technical support is available from 9.00-17.00 (CET) on weekdays in English, Polish, Checz, Latvian, and Lithuanian.

Advantages

- Multiple communication channels are available

- Support responds quickly

- Competent operators

Disadvantages

- Technical support is not available on weekends

TMS Brokers’ communication methods are:

-

Telephone;

-

Email.

The company has its profiles on Facebook, X (formerly Twitter), and LinkedIn, where you can also contact the broker’s technical support. Also, a live chat is available in the bottom right corner of the broker’s website and in the user account.

Contacts

| Registration address | Warsaw, 0000204776 str., NIP number 5262759131 |

|---|---|

| Regulation |

The Polish Financial Supervision Authority (UKNF)

Licence number: KPWiG-4021-54-1/2004 |

| Official site | www.tmsbrokers.com |

| Contacts |

+48 222 766 200,

+420 296 842 440 |

Education

Since users without knowledge of financial markets sometimes come to brokers, some companies offer free training to such traders. It varies from FAQs and a glossary to comprehensive training. The TMS Brokers website provides an Education section with articles, eBooks, lectures, and webinars. The company regularly holds online classes and continually enhances its knowledge base. The Education section is useful for both novice and experienced traders, although it is mostly focused on those who have never traded or have minimal trading and investment experience.

Almost all brokers who offer training focus on novice traders. Therefore, little information for professionals on the TMS Brokers website is a relative disadvantage and doesn’t have a negative impact on the company.

Comparison of TMS Brokers with other Brokers

| TMS Brokers | Eightcap | XM Group | RoboForex | Markets4you | FxPro | |

| Trading platform |

MT5, OANDA TMS Brokers | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5 | MT4, MobileTrading, MT5, cTrader, FxPro Edge |

| Min deposit | No | $100 | $5 | $10 | No | $100 |

| Leverage |

From 1:1 to 1:20 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points | From 0 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 20% | 25% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of TMS Brokers

Since the company was incorporated more than 20 years ago and is successfully developing under the supervision of the Polish regulator, there are no doubts about the stability and innovation of its technological base. The broker offers virtual servers and micro-service architecture. It also insures its clients’ funds and holds them separately from its own capital. In addition to active trading and a partnership program, TMS Brokers offers a multi-currency e-wallet with an international transfer option. Internet connections are secured by SSL protocols. The KYC/AML (Know Your Client/Anti Money Laundering) procedures are used to verify the broker’s clients, who can connect several authentication levels. The order execution speed is up to 30 ms.

TMS Brokers by the numbers:

-

Minimum deposit is €0;

-

6 groups of financial instruments;

-

Spreads start from 0 pips;

-

3 deposit and withdrawal methods;

-

Maximum leverage is 1:200;

-

Been in the market for over 20 years.

TMS Brokers is a universal broker for active trading

First, the broker’s universality is defined by an extensive pool of assets that includes thousands of CFDs on indices, commodities, and cryptocurrencies in addition to currency pairs and stocks. The instrument diversity provides for using different trading strategies and methods. The broker doesn’t set any restrictions, thus traders can scalp, hedge, trade on newsfeeds, and use advisors and algorithmic trading. Also, a large pool provides for risk diversification, since it gives an opportunity to build a balanced investment portfolio. Given an objectively low entry threshold, the above are the best conditions for both novice traders and experienced market participants. The company offers a moderate leverage that provides for increasing the profit potential even with a small capital.

Useful functions by TMS Brokers:

-

Online quotes. All instruments available to TMS Brokers’ clients are displayed in a summary table. It shows the sell price, purchase price, spread, and trend for each of them. Information is updated online without delays, reflecting the current market situation;

-

Economic calendar. It is the main fundamental analysis tool. The table includes political and economic events that may affect quotes. For each event, the affected asset and forecast are indicated;

-

Education. Novice traders can learn the basics of technical and fundamental analyses. The website also contains materials for traders of intermediate and professional levels.

Advantages:

A free demo account is available for exploring the broker and improving traders’ skills;

No minimum deposit requirements for a live account, spreads from 0 pips, and no trading fees;

The broker's pool includes currency pairs, stocks, and CFDs of four classes;

MT5 and TMS Brokers’ apps are available for trading;

Technical support is available by phone, email, and on social media.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i