According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- WebTrader

- SVGFSA

- 2021

Our Evaluation of Ultima Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Ultima Markets is a moderate-risk broker with the TU Overall Score of 6.1 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Ultima Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Ultima Markets offers generally favorable collaboration conditions. This broker boasts narrow spreads and reasonable trading fees while providing a sufficient range of assets to enable traders to diversify their trading styles and methods. The high-leverage option enhances profit potential. However, educational resources are basic and text-based, and there are few specialized tools or current analytics. The main drawback is the lack of transparency regarding certain fees. Nonetheless, new clients can start with a free demo account and receive attractive bonuses on user accounts. Additionally, the platform offers two types of partnership programs: IB and CPA (Cost per Action).

Brief Look at Ultima Markets

Ultima Markets is a Forex and CFD broker offering a pool of over 250 trading instruments, including currency pairs, precious metals, energy and other commodities, indices, cryptocurrencies, and stock contracts. It provides a free demo account for platform exploration and practice, along with three live account types: Standard, ECN, and ECN Pro. Spreads start from 1 pip on the Standard account and 0 pips on ECN accounts. There is no commission on Standard accounts, while on other accounts, it is $5 or $3 per full lot. This broker offers flexible leverage up to 1:2,000. Ultima Markets claims that all trades are routed through the Equinix NY4 data center, ensuring execution speeds as fast as 20 milliseconds.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- No minimum deposit required for the demo account, with live accounts starting from $50;

- A diverse asset pool spanning seven different groups, allows clients flexibility in trading strategies;

- Three types of live accounts for highly customized options;

- Low spreads starting from 0 pips and reasonable commissions minimize trading costs;

- Accessibility across various devices, including desktops, tablets, and smartphones;

- Basic educational materials, an economic calendar, and a trading calculator facilitate market interaction;

- Round-the-clock technical support via call center, email, and live chat, including weekends.

- The absence of traditional passive income options like copy trading and MAM and PAMM accounts;

- Limited transparency, as this company does not address withdrawal fees;

- Restrictions on residents of certain countries, including China, Romania, Singapore, Malaysia, Iran, and others.

TU Expert Advice

Financial expert and analyst at Traders Union

This broker has been in the market for several years, but many experts note a lack of transparency. You won't find any registration and regulation information on the website. However, registered users have access to this information. This broker is officially registered in Saint Vincent and the Grenadines, and the FSA regulates its activities.

Ultima Markets may not offer outstanding conditions, but in many aspects, this company can compete with the top players in the industry. For instance, it offers spreads on ECN accounts directly from liquidity providers without additional markups, starting at 0 pips. On Standard accounts, the spreads are also quite low, and there's no trading fee. On other accounts, it's within the range of $3-5, which is quite advantageous.

In total, this broker offers more than 250 assets. This is an impressive number, especially considering that assets are divided into seven groups, which are currency pairs, precious metals, energy and other commodities, indices, cryptocurrencies, and CFDs on stocks. The leverage varies depending on the chosen asset, with the highest leverage available for currency pairs at 1:2,000. Few companies provide such substantial leverage, which significantly increases risks along with profit potential.

There is a free demo account, but that's hardly surprising. However, the low starting deposit of just $50 on a Standard account is a competitive advantage. The presence of two partner programs, IB and CPA, is also noteworthy. Both programs offer attractive benefits. With CPA, you can earn up to $1,200 for each referred client. Unfortunately, copy trading and MAM and PAMM accounts are not available. Additionally, the platform lacks news and analytics, and there are very few tools for independent analysis, forecasting, and process automation.

Like any other broker, Ultima Markets has its pros and cons. However, in this case, the drawbacks are not critical. Therefore, after considering the cumulative factors, the platform can be recommended for exploration.

- You appreciate low spreads starting from 0 pips and reasonable commissions that help minimize trading costs, allowing for more cost-effective trading.

- You are looking for a diverse asset pool spanning seven different groups. This diversity provides clients with flexibility in trading strategies by offering a wide range of tradable instruments.

- Limited transparency is a concern for you. Ultima Markets does not address withdrawal fees, and if transparency on fees is crucial for your decision-making, the lack of information on withdrawal fees may pose a drawback.

- You are a resident of certain countries with restrictions. Ultima Markets imposes restrictions on residents of specific countries, including China, Romania, Singapore, Malaysia, Iran, and others.

Ultima Markets Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Ultima Markets Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4, WebTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, ECN, ECN Pro |

| 💰 Account currency: | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, electronic payment systems, cryptocurrency wallets |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:2000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Currency pairs, precious metals, energy resources, commodities, indices, cryptocurrencies, CFDs on stocks |

| 💹 Margin Call / Stop Out: | N/A |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Free demo account and three user accounts, low entry threshold and tight spreads, reasonable commissions, two broker platforms and a mobile app, multiple funding and withdrawal options |

| 🎁 Contests and bonuses: | Yes, including the rebates from Traders Union |

Usually, when a broker provides various live accounts, they vary not just in trading terms but also in the minimum deposit needed. Ultima Markets adheres to this concept. So, for a Standard account, a minimum of $50 is mandatory, while for ECN and ECN Pro accounts, you must deposit at least $500 and $20,000, respectively. Leverage, on the other hand, is adaptable, allowing the trader to select their preferred level. Nevertheless, it's important to note that leverage differs depending on the asset type. The highest trading leverage is typically offered for currency pairs, reaching up to 1:2,000. This broker's technical support boasts two clear advantages: it's available 24/7, and you can reach out to their staff via phone, email, or live chat.

Ultima Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

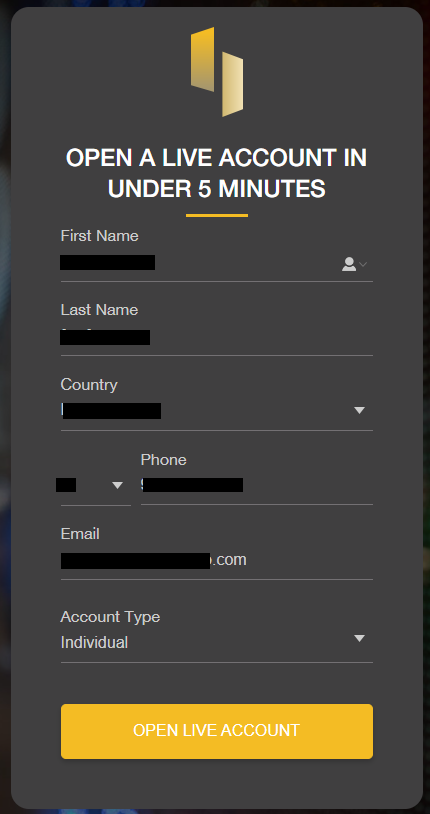

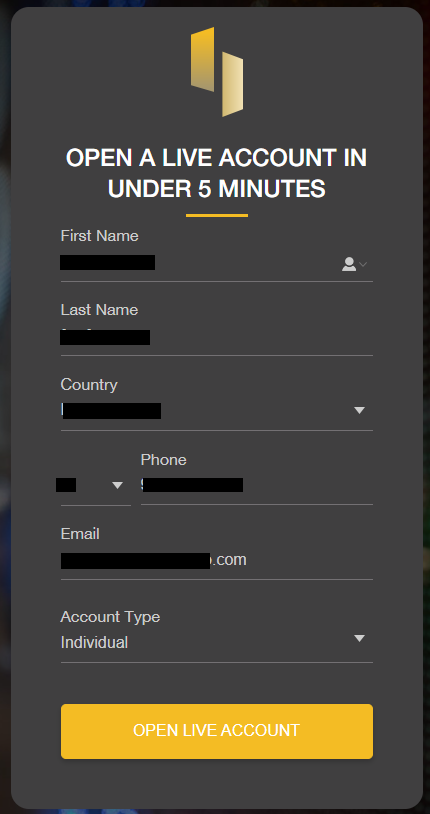

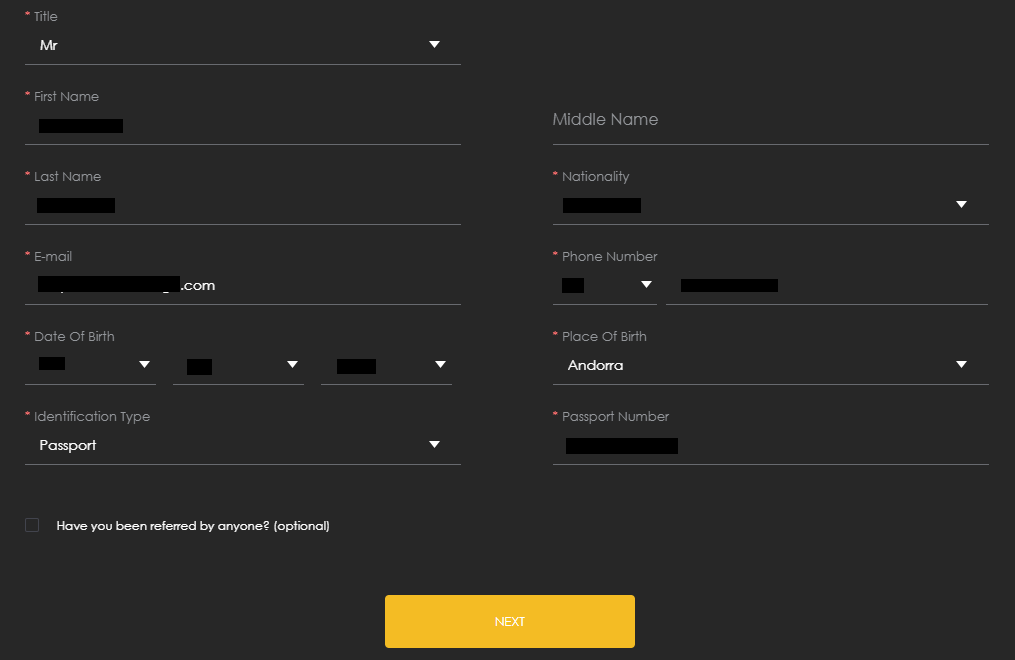

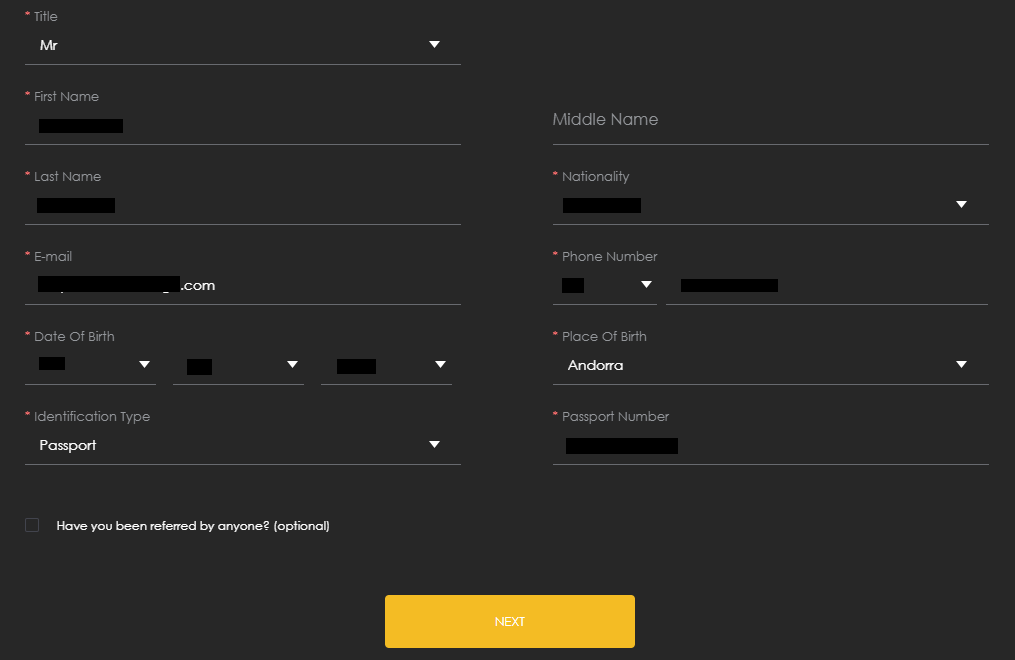

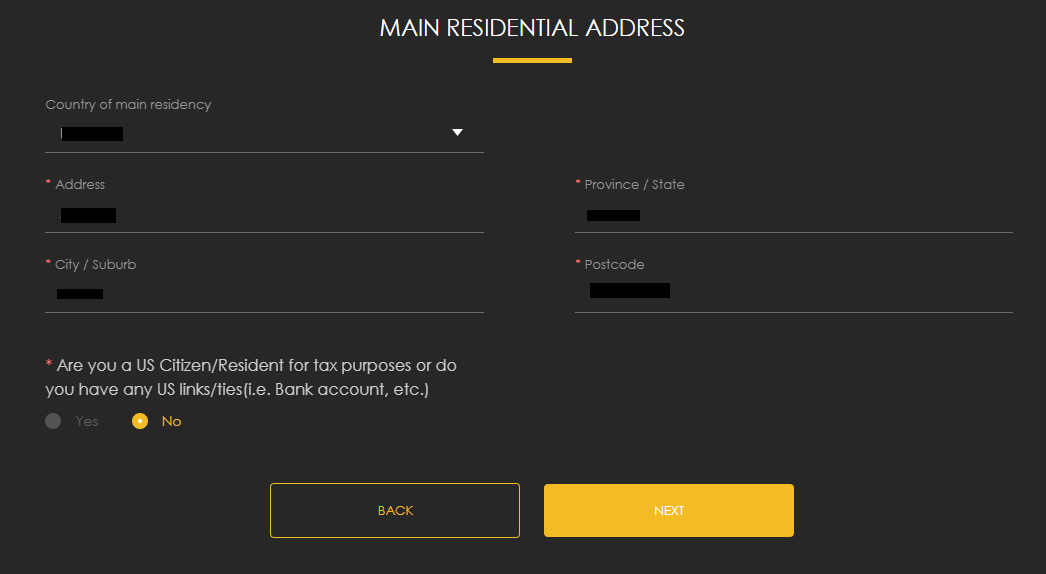

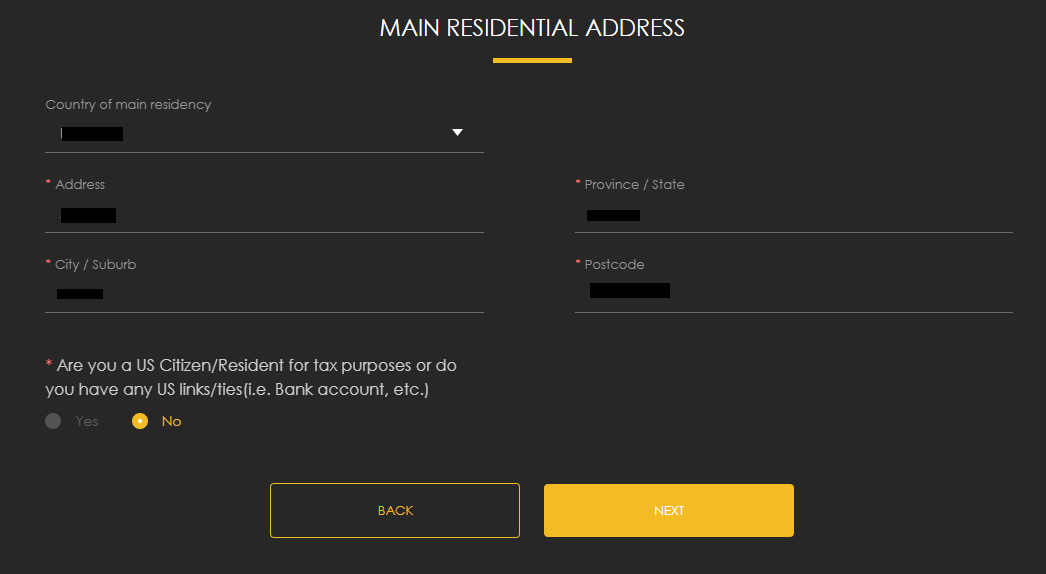

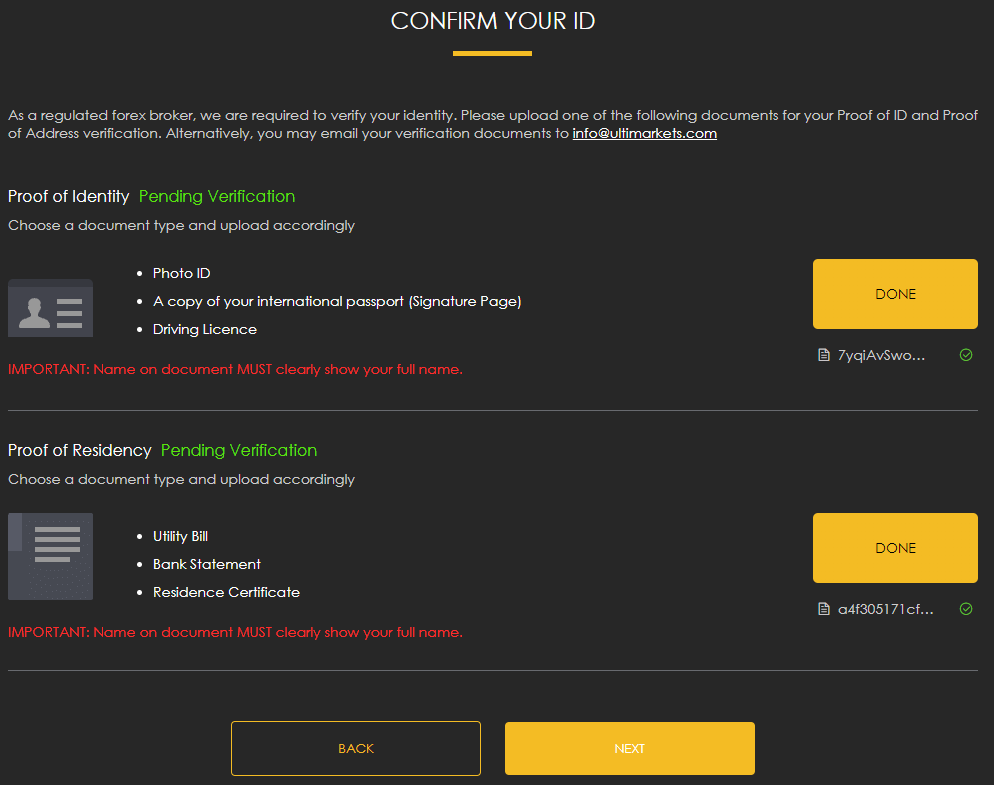

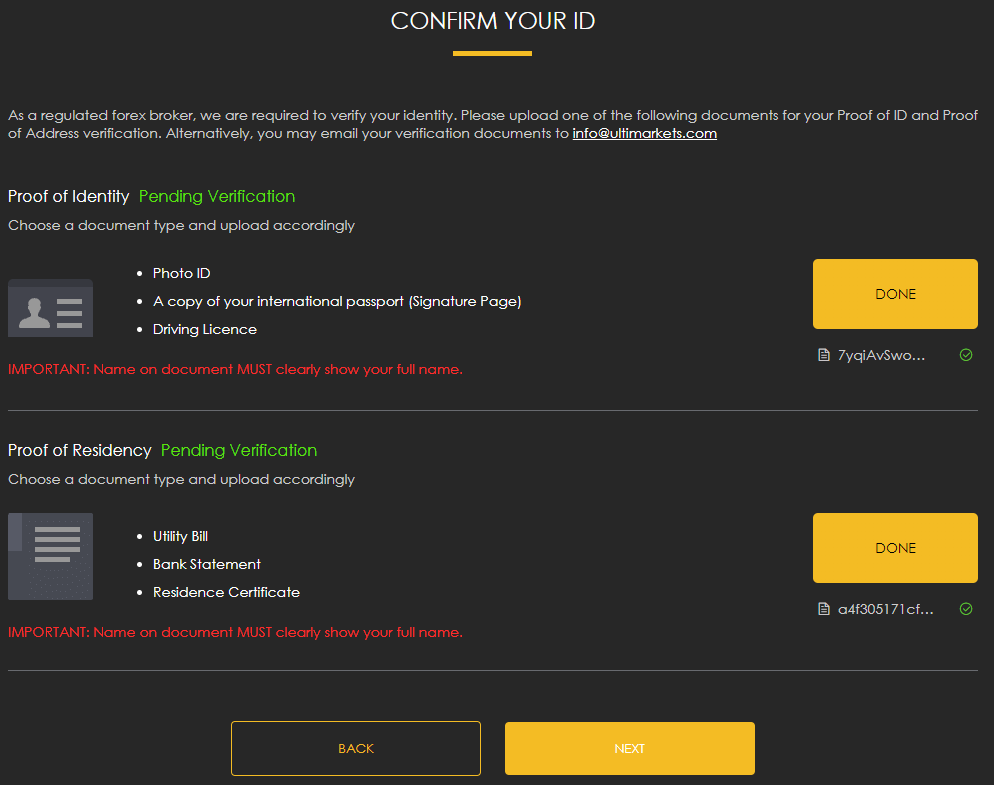

Trading Account Opening

To initiate collaboration with Ultima Markets, register on their official website and complete the verification process. Following that, you can open a user account, fund it, download the trading platform, and begin making trades. TU experts have compiled the below step-by-step guide on the registration process to assist you. Additionally, the TU team will provide a brief overview of additional features in the user account.

Visit this broker's website. Choose your preferred language from the top of the screen. In the upper right corner, click the "Register" button.

Enter your first and last name. Select your country of residence. Provide your phone number and email address. Choose the account type — individual or corporate. Click "Open a user account”.

For the initial registration step, input additional details such as your salutation, birthdate, birthplace, and nationality. Choose a document from the provided list for identity verification and enter its number. If you possess dual citizenship, mark the appropriate checkbox. Proceed by clicking “Next”.

Specify your residence and complete address. Check the corresponding option if you are a U.S. citizen. Click “Next".

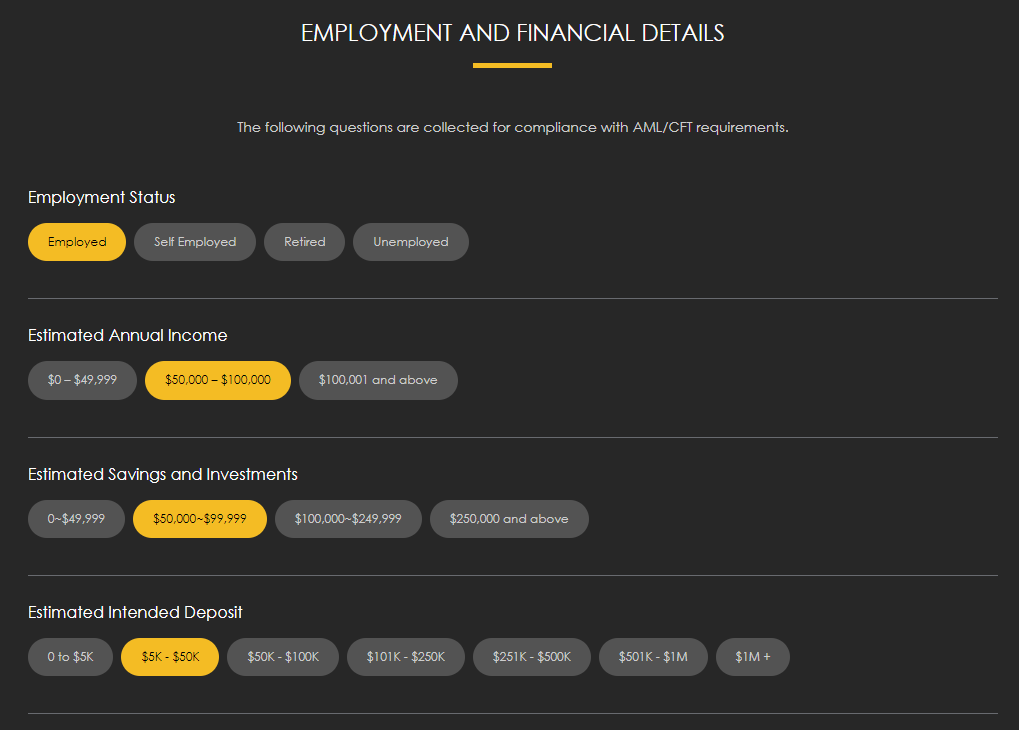

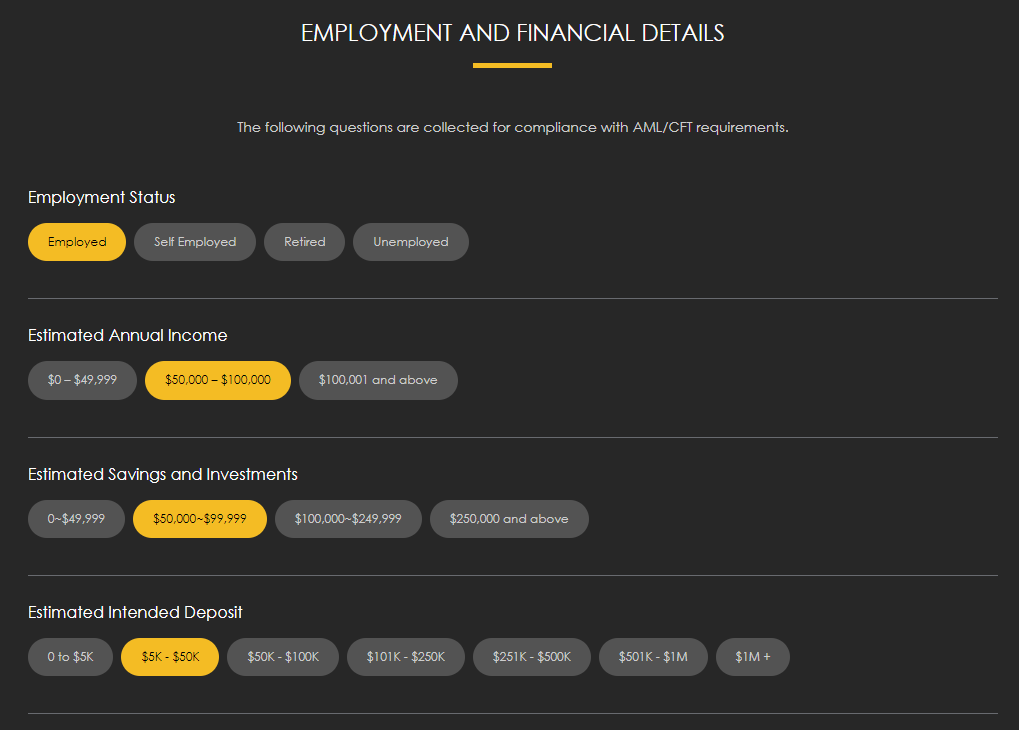

Answer a few questions about your financial capabilities and trading experience. This broker requires these answers for statistical purposes, and they will not affect anything. Click “Next".

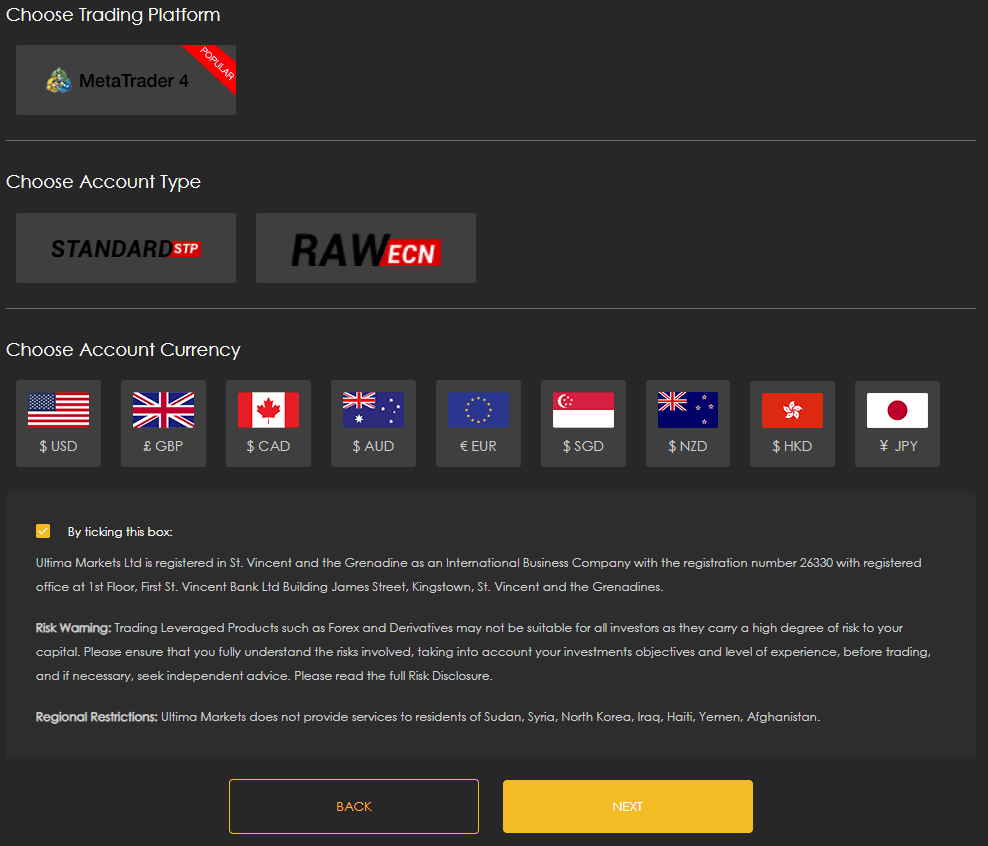

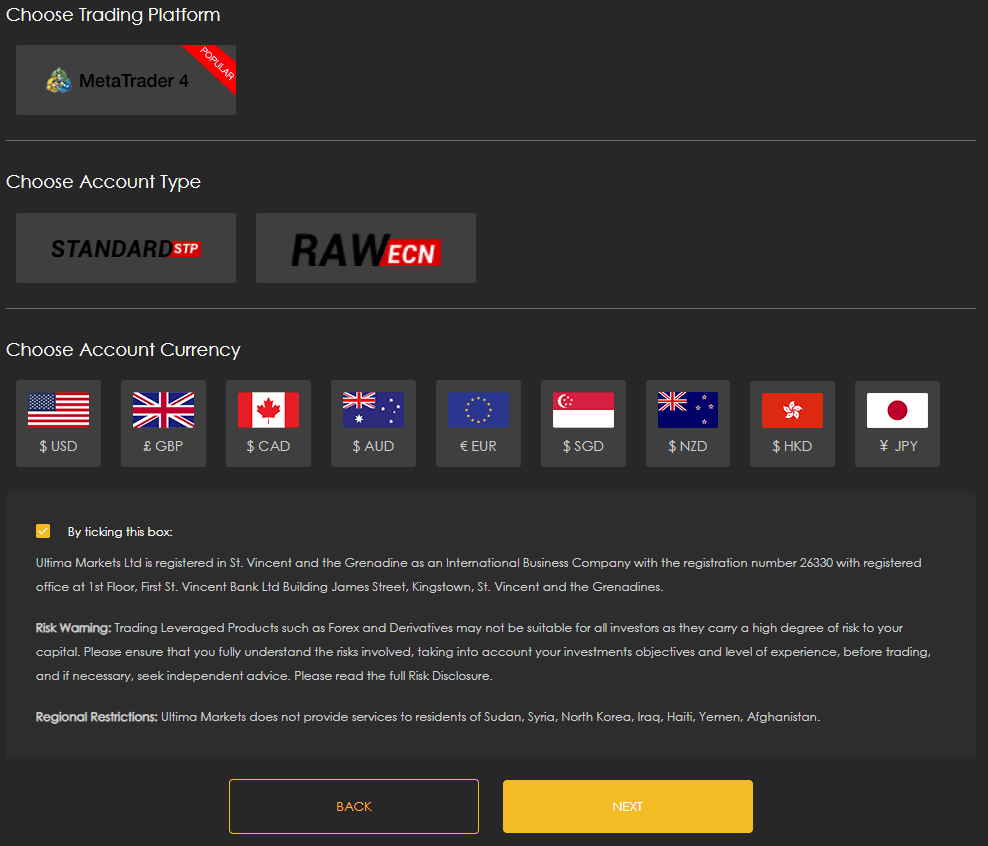

Select the trading platform (only MT4) and the account type — standard or ECN. Then specify the account currency, which is available in USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, and JPY. Agree to the terms of cooperation by checking the box at the bottom. Click “Next".

Upload scans/photos of the documents confirming your identity and residency. Pay attention to the comments. Click “Next".

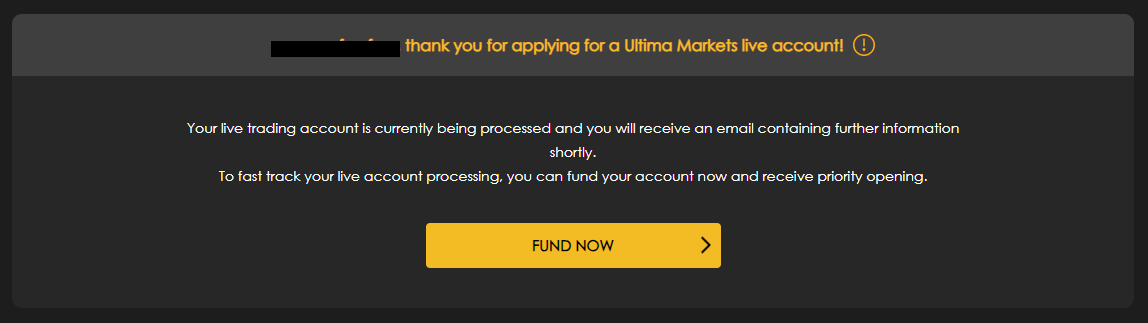

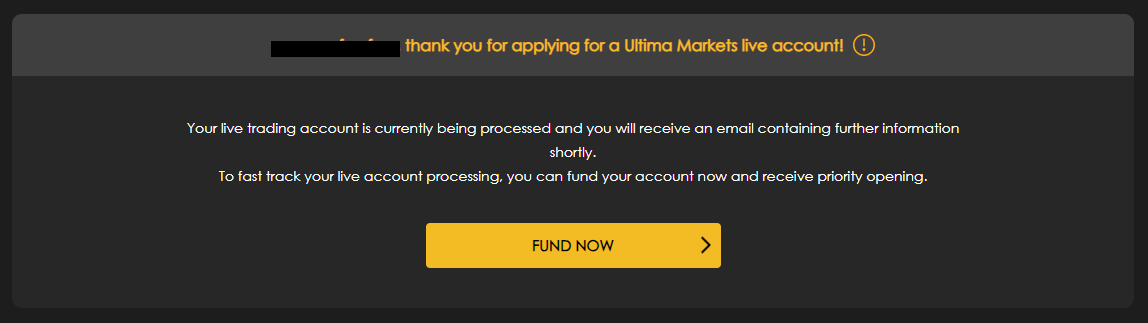

Wait for the verification process to complete. Once specialists confirm the authenticity of the documents you provided, you will receive a notification by email, and you will be able to access all the platform's functions.

Click "Deposit funds now". Choose the deposit method. Please note that deposit methods may vary depending on your region. Then, follow the on-screen instructions.

Visit the "Downloads" section, where you can download the suitable version of the trading platform and install it on your device. For convenient account management, you also have the option to download this broker's mobile application. Once you've done this, launch the trading platform, input your registration details, and begin trading.

Functions of the Ultima Markets user account:

-

Home Page. This section allows traders to access summarized information regarding their active accounts and ongoing trades;

-

Accounts. Within this segment, users can initiate or terminate both user and demo accounts;

-

Funds. In this area, traders can conduct financial transactions, including deposits, withdrawals, and internal transfers;

-

Profile. This block is dedicated to personal information updates and security settings;

-

Downloads. Traders are provided with the option to download the MT4 trading platform and this broker's proprietary mobile application.

Regulation and safety

Ultima Markets has a safety score of 8.2/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- No negative balance protection

- Track record of less than 8 years

Ultima Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

Ultima Markets Security Factors

| Foundation date | 2021 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Ultima Markets have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- Deposit fee applies

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Ultima Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Ultima Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Ultima Markets Standard spreads

| Ultima Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,7 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Ultima Markets RAW/ECN spreads

| Ultima Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,50 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Ultima Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Ultima Markets Non-Trading Fees

| Ultima Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0-0,5 | 0 | 0 |

| Withdrawal fee, % | 0-1 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Typically, when a broker provides various account types, traders need to take time to select the one that suits them best. In the case of Ultima Markets, the Standard account is the most versatile option. It comes with no trading fee, and the variable spread starts from 1 pip. To open a Standard account, you only need $50. For the ECN account, a $500 deposit is required, offering raw spreads starting from 0 pips but with a fee of $5 per full lot, which is in line with industry standards. The ECN Pro account offers a lower fee of $3 per lot and also has raw spreads starting from 0 pips, but it necessitates a substantial initial deposit of $20,000. Therefore, when choosing an account, traders should consider their preferred trading strategies, goals, and financial capacity.

Account types:

For traders new to this broker, it is advisable to begin with a demo account. This allows for an exploration of the platform's capabilities and the refinement of trading strategies without any financial risks. Afterward, users can opt for one of the live accounts, deposit funds, and engage in full-fledged trading.

Deposit and withdrawal

Ultima Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Ultima Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Low minimum withdrawal requirement

- Supports 5+ base account currencies

- BTC available as a base account currency

- Bank wire transfers available

- PayPal not supported

- Deposit fee applies

- Withdrawal fee applies

What are Ultima Markets deposit and withdrawal options?

Ultima Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT, Ethereum.

Ultima Markets Deposit and Withdrawal Methods vs Competitors

| Ultima Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Ultima Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Ultima Markets supports the following base account currencies:

What are Ultima Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Ultima Markets is $500, while the minimum withdrawal amount is $40. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Ultima Markets’s support team.

Markets and tradable assets

Ultima Markets offers a limited selection of trading assets compared to the market average. The platform supports 500 assets in total, including 80 Forex pairs.

- 500 assets for trading

- 80 supported currency pairs

- Indices trading

- Crypto trading not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by Ultima Markets with its competitors, making it easier for you to find the perfect fit.

| Ultima Markets | Plus500 | Pepperstone | |

| Currency pairs | 80 | 60 | 90 |

| Total tradable assets | 500 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Ultima Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Ultima Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Can you deposit funds from a Visa card while in Europe? What are the withdrawal costs for a U.S. resident with a bank account? Are there any trading restrictions? Traders often have various inquiries. Sometimes, they encounter genuine issues or unique situations, but more frequently, it's a simple misunderstanding stemming from a lack of transparency on the platform and minimal information regarding the terms of collaboration. In any event, users often reach out to technical support. Their ongoing relationship with the broker hinges on receiving prompt solutions to their queries. However, if technical support is slow to respond or lacks competence, traders might grow disheartened and consider switching to a competitor. To prevent this, Ultima Markets provides three communication channels, which are phone, email, and live chat. All are operational around the clock, seven days a week.

Advantages

- Three contact options are available: phone, live chat, and email

- Managers are available 24/7

- Technical support is competent and responds quickly

Disadvantages

- During peak hours, the call center is often overloaded

Are you currently engaged with Ultima Markets or contemplating becoming its client? Regardless of your status, if you encounter a problem or have a question, don't hesitate to contact technical support. It's accessible even for those who haven't yet registered. Here are the available contact channels:

Call center;

Email;

Live chat on their website and in the user account.

Additionally, there's a chat feature in the mobile app. This broker maintains a presence on various social platforms, including LinkedIn, Facebook, X (formerly Twitter), and Instagram. You can also reach out to their technical support managers through these channels. Following this company's profiles is advisable to be apprised of their notifications.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | 1st Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines |

| Regulation | SVGFSA |

| Official site | https://www.ultimarkets.com/ |

| Contacts |

+1 784 485 6124

|

Education

Achieving success in trading requires a balance between consistent practice and solid theoretical knowledge. Seasoned traders understand this principle and, as a result, they continually engage with e-books and participate in expert-led webinars. Furthermore, every trader begins their journey somewhere, and some users approach brokers without any prior trading experience. Hence, certain platforms provide basic or advanced training, including comprehensive educational courses. Ultima Markets recognizes that most new clients already possess some familiarity with financial markets. For beginners, it offers fundamental trading knowledge in the form of a series of concise articles.

If a broker's client has no prior knowledge of trading, the "Introduction to Forex" section helps them gain a general understanding and basic skills. However, for those with even a little prior trading experience, the platform may not offer anything valuable.

Comparison of Ultima Markets with other Brokers

| Ultima Markets | Eightcap | XM Group | RoboForex | Markets4you | LiteFinance | |

| Trading platform |

MT4, WebTrader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5 | MT4, MT5, MultiTerminal, Sirix Webtrader |

| Min deposit | $50 | $100 | $5 | $10 | No | $10 |

| Leverage |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | 7.00% |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points | From 0.5 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 20% | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed review of Ultima Markets

As Ultima Markets uses the Equinix NY4 data center, it's unlikely to encounter performance issues or execution speed reductions due to technical reasons. Furthermore, the platform employs a microservices architecture, providing it with flexibility and stability. This broker has its infrastructure for its IB and CPA services, which have been supported for many years and are continually modernized. Its advanced security system goes beyond SSL certificates. Ultima Markets is known for keeping its funds separate from user funds. Overall, Ultima Markets meets all the criteria of a modern brokerage company.

Ultima Markets by the numbers:

$50 is the minimum deposit;

Raw spreads start from 0 pips;

Commission on the ECN Pro account is $3 per lot;

1:2,000 is the maximum leverage;

250+ financial instruments.

Ultima Markets is a Forex and CFD broker with favorable trading conditions

For a trader, it's essential that a platform can provide them with as many assets as possible, and of varying types. This allows for the creation of a diversified investment portfolio, thereby reducing primary risks. Additionally, the greater the number of assets, the wider a trader's strategic opportunities. Ultima Markets excels in asset choices, offering currency pairs, precious metals, energy resources, commodities, indices, cryptocurrencies, and stock contracts, totaling more than 250 trading instruments. Another crucial aspect is leverage, which traders can select for themselves. With increased leverage comes not only more significant risk but also the potential for higher profits. In this case, the maximum leverage is 1:2,000, a rare find in the industry. Finally, traders can work through the MT4 and WebTrader platforms, making trading accessible from both desktop and mobile devices. This broker also provides a proprietary mobile app for complete account control.

Useful functions of Ultima Markets:

Ultima Markets App. This broker's proprietary mobile app enables users to open and close accounts, deposit and withdraw funds, and track earnings from partner programs. However, trading within the app is not available;

IB and CPA partnership programs. Every client of this company, whether an individual or a legal entity, can obtain an additional income source. No capital investment is required; only high online activity is necessary, with regular payouts;

Economic calendar and calculator. Basic tools for fundamental analysis and the automation of trade-related routines are available on this broker's website and in the user account.

Advantages:

To initiate collaboration with this broker, a mere $50 deposit is sufficient for a user account; a demo account is opened for free;

Raw spreads start from 0 pips and a regular spread from 1 pip; the $5 and $3 fees on ECN and ECN Pro accounts are average or even more favorable than average in the market;

The availability of 250 assets across 7 groups allows for the creation of diversified portfolios and the utilization of a wide range of strategic decisions;

This broker does not restrict its clients’ trading methods. They can scalp, hedge, trade on news events, and use trading advisors;

Various deposit and withdrawal options, including bank accounts and cards, electronic transfer systems, and cryptocurrency wallets, are accessible.

Latest Ultima Markets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i