According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $5

- MetaTrader4

- 2020

Our Evaluation of Vault Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Vault Markets is a broker with higher-than-average risk and the TU Overall Score of 4.81 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Vault Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Vault Markets is one of the leading CFD [contract for (price) differences] brokers. It has many advantages, including a wide variety of assets, the use of MT4, and its own mobile application. There are many deposit and withdrawal options, and the initial deposit is one of the lowest. Traders have access to flexible leverage, negative balance protection, and basic training, represented by articles, books, and podcasts. The broker does not have demo accounts. Moreover, it does not provide other options for passive income, except for a referral program. Vault Markets’ activity is not completely transparent, although it is regulated by the Financial Services Conduct Authority (FSCA). Notwithstanding, the broker can be recommended for review.

Brief Look at Vault Markets

Vault Markets offers CFDs on currencies, cryptocurrencies, indices, stocks, commodities, energies, and metals while traders use MetaTrader 4 (MT4). The broker has its own mobile application for managing accounts and viewing trades and markets. Demo accounts are not available. There are eleven live and three micro accounts, which differ in the minimum deposit, spread, leverage, and available instruments. Spreads start from 0 pips, leverage is up to 1:1000. The minimum deposit is $5 or $100. The main account currencies are ZAR, USD, or TZS. There are FAQs and a collection of articles on the broker's website, and the company's experts conduct a podcast on Spotify. The broker offers a referral program that allows you to receive up to 10% of the deposit from the most recently invited client.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Low entry threshold. The minimum deposit is $5, quick registration, and MT4;

- Individualized offer. No other broker offers a choice of eleven live accounts;

- High-profit potential. There are hundreds of CFDs from five groups and the possibility to trade with leverage up to 1:1000;

- Work comfort. The broker's own mobile application allows you to always keep up-to-date with the market;

- Passive income. Each user can become a member of the referral program and receive additional profit;

- Wide coverage. Even though the broker focuses on the African continent, it provides its services to residents of most countries worldwide;

- Modern service. Technical support works 24/7, there are several call centers, email live chat, and WhatsApp.

- The broker’s activity is not completely transparent, since fees on a zero spread account are not known in advance, and there is no information on withdrawal fees on the website;

- The functionality does not fully meet modern standards, in particular, clients cannot open demo accounts;

- Limited options for additional income, as the broker offers only a referral program, without MAM or PAMM accounts, or copy trading.

TU Expert Advice

Author, Financial Expert at Traders Union

Vault Markets offers CFDs across various asset classes, including currencies, cryptocurrencies, indices, stocks, commodities, energies, and metals, utilizing MetaTrader 4 and a proprietary mobile platforms. The broker provides multiple account types, providing individualized trading conditions, with minimum deposits of $5. Traders benefit from extensive leverage up to 1:1000, flexible deposit and withdrawal methods, and access to market analysis tools. Additionally, Vault Markets provides a referral program and educational resources with articles and podcasts.

However, Vault Markets faces drawbacks including the absence of demo accounts and limited transparency regarding specific fees and withdrawal costs. Its regulatory oversight by the FSCA may not satisfy traders prioritizing top-tier regulations. The lack of copy trading and passive income options may also not appeal to traders seeking these features. The broker may be more suitable for experienced traders comfortable with high leverage and those based in Africa, but may not be ideal for those prioritizing rigorous regulation or passive income features.

- You are comfortable with high leverage. Vault Markets offers leverage up to 1:1000, which can be attractive to experienced traders seeking to magnify their profits.

- You are based in Africa. Vault Markets has a strong focus on the African market and provides various deposit and withdrawal options specifically designed for clients in Africa.

- Regulatory oversight is a priority for you. Vault Markets is not regulated by any major financial authorities, which may raise concerns about the security of your funds and fair trading practices.

- You are looking for a broker offering additional income options or features. Vault Markets has limited options for additional income, providing only a referral program without MAM or PAMM accounts, or copy trading.

Vault Markets Trading Conditions

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Vault 50, Vault 100, Vault 200, Vault No Bonus, Vault Swap Free, Vault Zero, Vault 1000, Vault 24/7, Vault Micro, Micro Bonus 100%, and Micro Bonus 200% |

| 💰 Account currency: | ZAR, USD, and TZS |

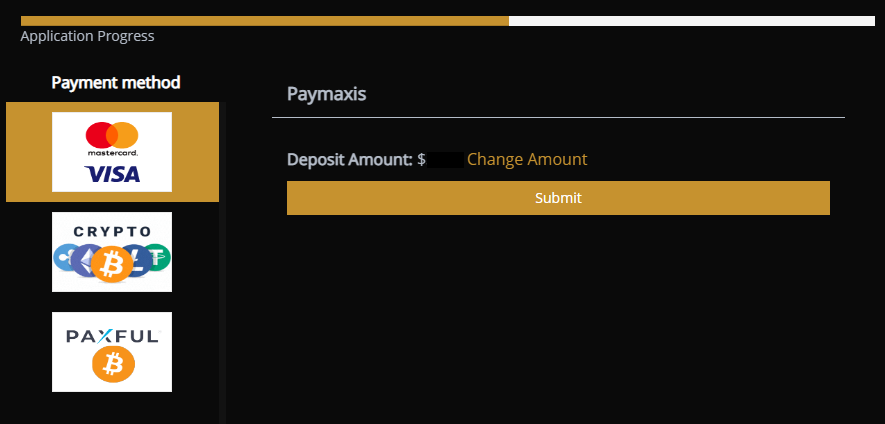

| 💵 Deposit / Withdrawal: | Visa and MasterCard cards, Payfast, Airtel, Alphapo, M-Pesa, Ozow, Paxful, Tigo Pesa, Stitch, crypto wallets, and bank transfers |

| 🚀 Minimum deposit: | $5 or R10 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currencies, cryptocurrencies, indices, stocks, commodities, energies, and metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: |

No demo accounts; Three micro accounts; Eight standard accounts; Low entry threshold; Large number of assets; High leverage; Fast order execution; Trading on MT4; The broker's own mobile app; Many deposit/withdrawal methods |

| 🎁 Contests and bonuses: | Yes |

As a rule, if a broker offers several trading accounts, the minimum deposit for them is different. Vault Markets has four minimum deposit options; they are $5, $100, R10, or R50 depending on the account type. The maximum leverage also depends on the selected account, it is either 1:500 or 1:1000. Traders can choose the size of leverage themselves or trade without it at all. Technical support is represented by call centers, email, live chat on the website, and WhatsApp. According to the broker, technical support works 24/7.

Vault Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

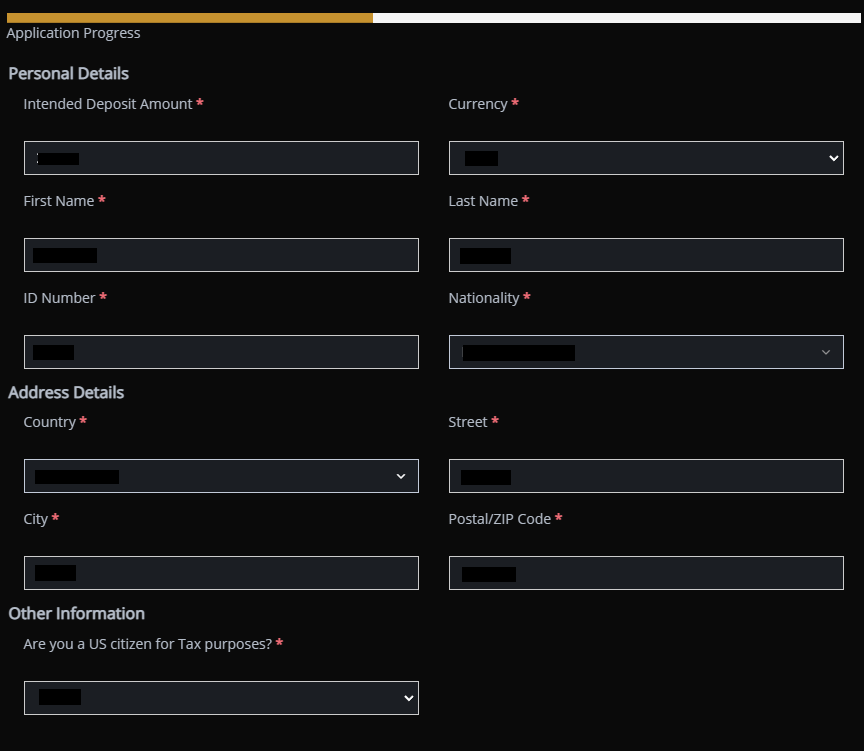

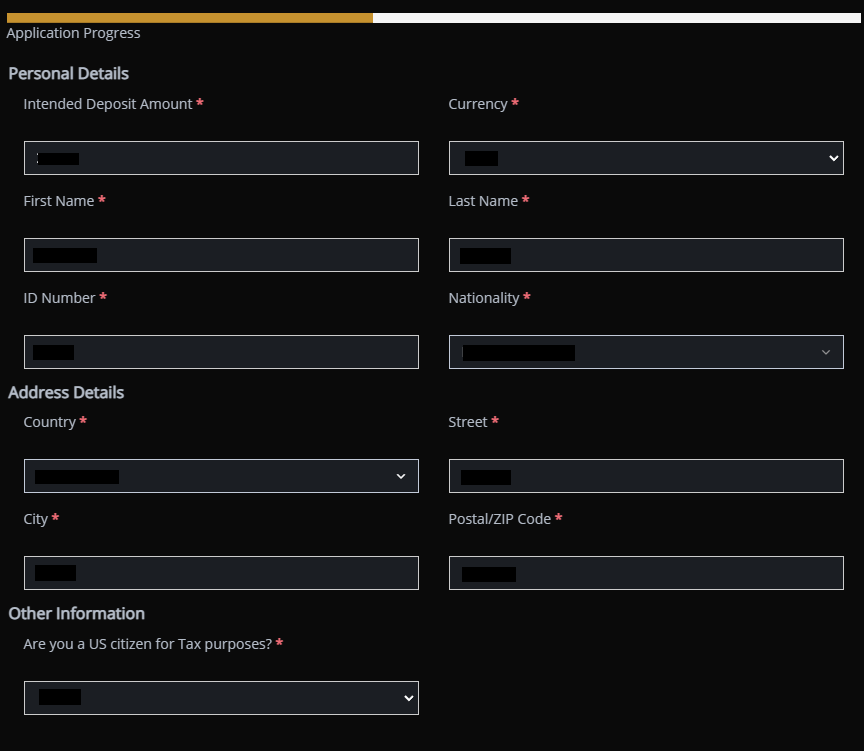

Trading Account Opening

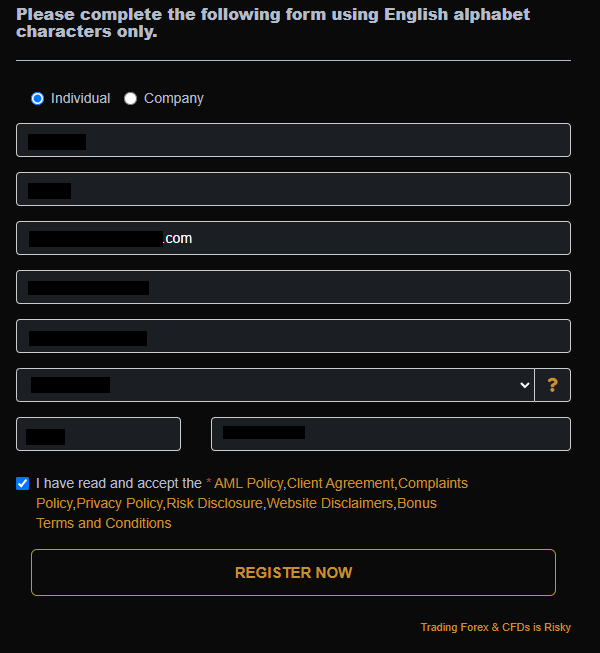

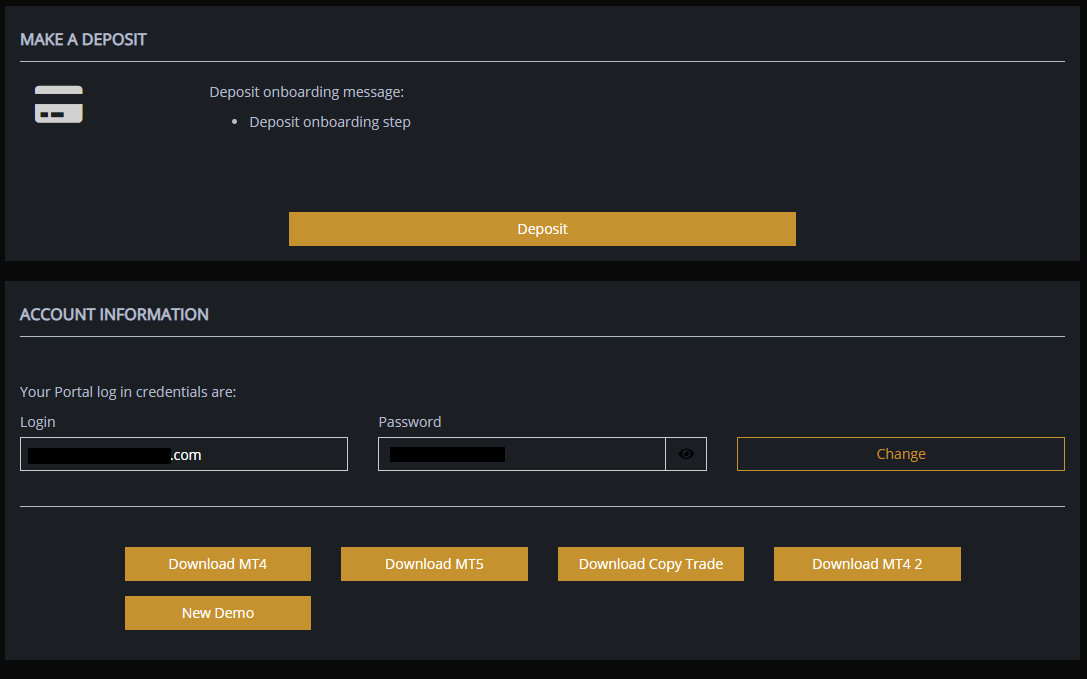

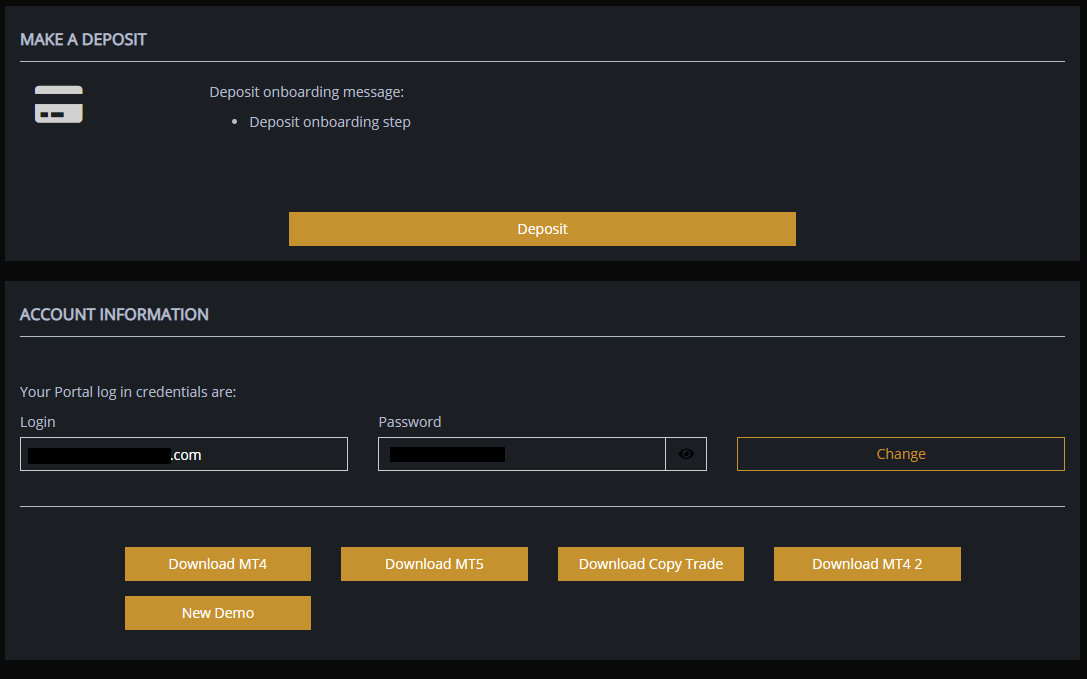

To start working with this broker, register on its official website to get a user account. Next, verify, open a live account, download the trading platform, and install it on your device. Below are detailed instructions on registration and a description of features of the user account prepared by TU experts.

Go to the broker's official website and click the "Register" button in the upper right corner.

Choose an individual or institutional account. Enter your first and last names, email address, and phone number. Make up a password and enter it twice. Agree to conditions of the website by ticking the box below and click the "Register Now" button.

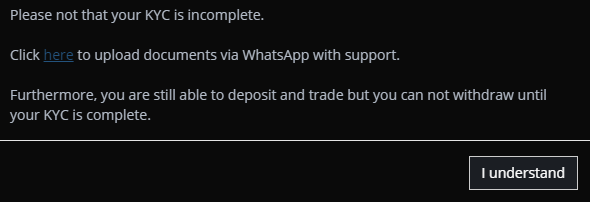

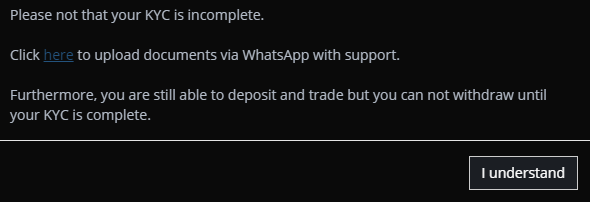

The warning of incomplete identity verification will appear on the screen. To complete it, send scans/photos of the required documents to the broker. Click the link in the notification and you will be taken to WhatsApp. Follow the manager's instructions.

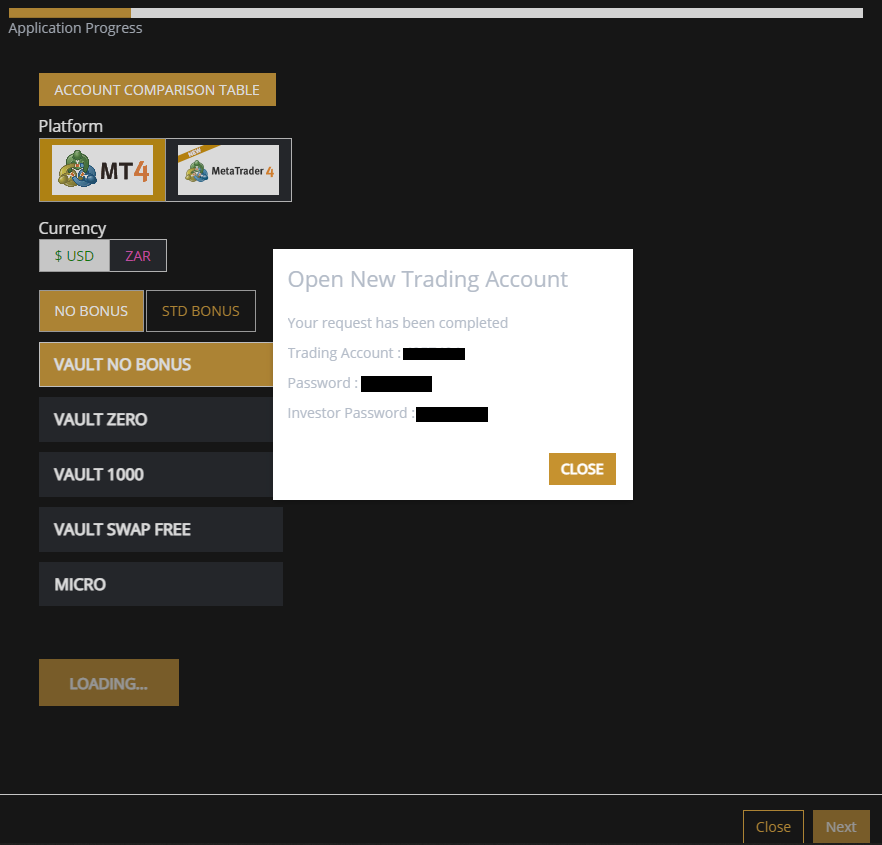

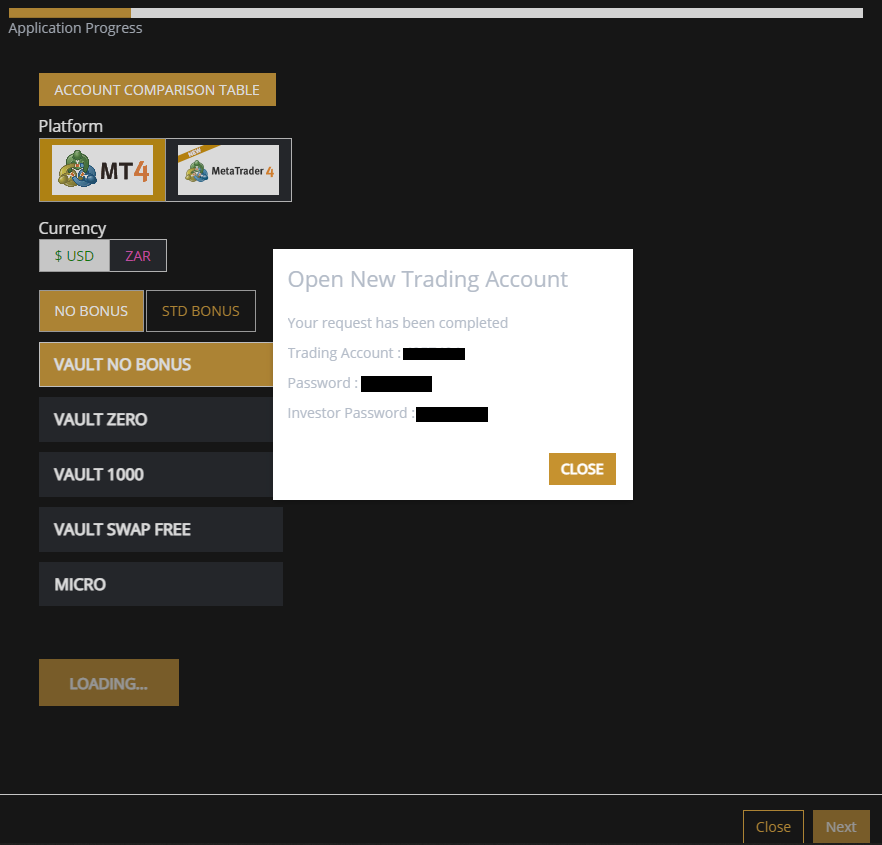

Select the account type, trading platform, and currency. Click the "Open Live Account" button. You will immediately receive registration data for entering the platform.

Provide additional information about yourself by answering a few questions. Click the "Next" button after completing each block.

Select a deposit method and specify the amount. Follow the instructions on the screen to deposit money.

Complete the account registration by answering a few more questions. Wait for the completion of verification of provided information and documents. On the main page of the user account, you will see links to download the MT4 trading platform and other distributives, such as MT5, but it is currently not supported (coming soon). After installing the platform on your device, enter the previously received registration data and start trading.

Additional features of Vault Markets’ user account:

Traders can track the market situation for each of the available assets on the charts located on the right of the screen;

Functions for opening and closing live accounts are available (you can only have one account of each type);

Traders can deposit and withdraw funds through the user account. Also, internal transfers are possible and you can view the transactions archive;

Here users can change personal details and adjust security parameters;

Buttons for direct communication with technical support are located here;

All of the listed functions are also presented in the broker's mobile app, which is available for download in the "Mobile App" section of the website.

Regulation and safety

Vault Markets has a safety score of 6.3/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

Vault Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

Vault Markets Security Factors

| Foundation date | 2020 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Vault Markets have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Vault Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Vault Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Vault Markets Standard spreads

| Vault Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Vault Markets RAW/ECN spreads

| Vault Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Vault Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Vault Markets Non-Trading Fees

| Vault Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

For traders who decide to work with Vault Markets, the most important task at the start is to choose the account that’s best for you. Account types that have the word "Bonus" or the numbers "50", "100", or "200" in their names offer standard trading conditions with a 1 pips spread. Their peculiarity is that traders receive an additional 50%, 100%, or 200% of the first deposit. The Vault No Bonus account gives the same trading conditions but without bonuses. Vault Zero, as the name implies, allows you to trade with a zero spread, however, an additional fee is charged for each trade. Vault Swap Free (Islamic) accounts do not have swaps. Vault 1000 differs in leverage, which is 1:1000. Vault 24/7 is the only account type where you can trade every day without any restrictions, including weekends. Finally, Micro account types provide the opportunity to trade in cents, but not in dollars, that is, trades are executed with proportionally smaller amounts.

Account types:

If traders have not previously worked with a broker, they usually would open a demo account. However, Vault Markets does not have demo accounts, these are replaced by micro accounts, and you can choose the one with a great deposit bonus. After users have studied the platform and experimented with strategies, they open live accounts in accordance with their trading preferences.

Deposit and withdrawal

Vault Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Vault Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Bank card deposits and withdrawals

- Minimum deposit below industry average

- Bank wire transfers available

- USDT payments not accepted

- Wise not supported

- BTC not available as a base account currency

What are Vault Markets deposit and withdrawal options?

Vault Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, M-Pesa.

Vault Markets Deposit and Withdrawal Methods vs Competitors

| Vault Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Vault Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Vault Markets supports the following base account currencies:

What are Vault Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Vault Markets is $5, while the minimum withdrawal amount is $0. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Vault Markets’s support team.

Markets and tradable assets

Vault Markets offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 40 Forex pairs.

- Crypto trading

- 40 supported currency pairs

- Indices trading

- No ETFs

- Copy trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Vault Markets with its competitors, making it easier for you to find the perfect fit.

| Vault Markets | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Vault Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Vault Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Traders constantly face situations they cannot resolve on their own. Sometimes it can be a real problem when trading, depositing, or withdrawing funds. It is important to provide clients with prompt and competent assistance, otherwise, traders are very likely to be disappointed and leave for a competitor. To prevent this, brokers organize technical support that works in a convenient mode and is available through several communication channels. Vault Markets is a great example of this. Client service can be contacted by phone, email, live chat, or instant messenger. Specialists work 24/7. That is, traders can get help from managers at any time. Reviews prove technical support to be highly competent.

Advantages

- All main communication channels are available

- Non-clients of the broker can contact technical support

- Support works 24/7

Disadvantages

- Call centers are located in South Africa, Namibia, and Tanzania, calls from other regions are quite expensive

Whether you are a client of Vault Markets or just going to work with it, you can contact client service at any time by the following channels:

-

three call centers;

-

email;

-

live chat on the website and in the user account;

-

WhatsApp - Vault Markets.

The broker has official profiles on Twitter, Facebook, YouTube, Instagram, TikTok, and Spotify. There you can also contact managers and get help. Subscribe to the profiles to keep up-to-date with the news of the broker.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address |

177 9th Avenue Highlands, North Johannesburg, Highlands North, Gauteng, 2092 9th Floor, Skycity Mall, University Road, Dar es Salaam, Tanzania Unit 3b, South Port, Hosea Kutako Drive, Windhoek, Namibia |

| Official site | https://vaultmarkets.trade/ |

| Contacts |

+255 742 297 685

+26 481 368 2400 +27 10 449 6045 |

Education

Experienced traders are well aware that it is not enough to trade regularly, they also need theoretical training. After all, the market is constantly changing, old methods lose their effectiveness, and new concepts and approaches are needed. Usually, the lack of knowledge is eliminated through the study of eBooks, communication with colleagues on specialized forums, and participation in webinars. Some brokers, for their part, even hold lectures in physical offices for traders. Whereas, others have only basic FAQs, and this cannot be considered a disadvantage, because brokers are not required to educate traders. Strictly speaking, users come to trade, not to learn. However, in addition to the FAQs, Vault Markets also offers a collection of articles and eBooks in PDF format, the list of which is constantly updated. The main source of up-to-date information for traders is the podcasts hosted on Spotify by this broker's experts.

Many brokers that offer educational materials focus on novice traders. However, Vault Markets publishes information that is equally useful for traders of various levels. Podcasts cover a variety of topics, from the basics of candlestick analysis to unique life hacks for CFD trading in highly active markets.

Comparison of Vault Markets with other Brokers

| Vault Markets | Eightcap | XM Group | RoboForex | FxPro | NPBFX | |

| Trading platform |

MetaTrader4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4 |

| Min deposit | $5 | $100 | $5 | $10 | $100 | $10 |

| Leverage |

From 1:1 to 1:1000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:200 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0.4 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 25% / 20% | No / 30% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed review of Vault Markets

The broker entered the world market only recently. The US dollar is among the basic currencies, but ZAR and TZS also comprise the account currency, because the company focuses primarily on Africa. It has offices in several African countries and is regulated there. Given the fast execution of orders and a high-quality mobile application, it is logical to note that the broker has an excellent technological stack. Integration with MetaTrader 4 is good. For two years of work, no significant technical problems have been recorded, and the broker has not been hacked. Methods for securing users’ funds and information include SSL protocols for secure connection and other solutions.

Vault Markets by the numbers:

-

11 live accounts;

-

A $5 minimum deposit;

-

Maximum leverage is 1:1000;

-

First deposit bonus is up to 200%;

-

Payments under the referral program are up to 10%.

Useful services offered by Vault Markets:

-

Vault Markets Mobile App. The broker's proprietary mobile application allows you to fully control your account. You can open and close accounts, deposit and withdraw funds, make internal transactions, receive reports, and follow the market. The only thing not available here is trading;

-

Vault Markets Hub. This service is a system of charts that display the real-time positions of certain assets. Data comes directly from the TradingView online trading platform;

-

DMA (Direct Market Access). DMA technology has only recently become a part of trading systems. It is an electronic trading infrastructure that provides traders with direct access to the market. That is, there are no delays.

Advantages:

The broker offers eleven live account types. This guarantees the most individualized offer and comfortable trading conditions for everyone;

There is no demo account, but there are micro accounts (also called cent accounts). This is a great opportunity to understand the potential of trading with Vault Markets and practice;

Trading on MetaTrader 4 is available. It is easy to learn, has high functionality, and, most importantly, is easily customizable due to hundreds of plug-ins;

Spreads on standard accounts start from 1 pips, no other fees are charged. Fees are only withheld on zero-spread accounts. That is, traders’ expenses are low, especially if you use bonuses in the form of rebates from Traders Union;

Technical support is represented by several call centers, email, live chat, and instant messengers. It is available 24/7.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i