According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- EUR 1

- CFDWebClient

- Flatex Next (mobile app)

- BaFin

- ECB

- ESMA

- 2020

Our Evaluation of ViTrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ViTrade is a moderate-risk broker with the TU Overall Score of 5.57 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ViTrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

ViTrade is a German broker, which may be attractive to traders from Germany who prefer working through a domestic intermediary due to several legislative and regulatory peculiarities.

Brief Look at ViTrade

ViTrade is a trading brand of FlatexDEGIRO Bank AG, a banking and brokerage holding firm that has been operating under the supervision of the BaFin regulator since 2006. ViTrade offers trading in securities and derivatives, including approximately 600 CFDs, with more than 50 being CFDs on currency pairs. ViTrade accounts can only be opened by clients of FlatexDEGIRO Bank, Germans and residents of other European Union countries. According to the requirements of the EU regulator ESMA (European Securities and Markets Authority), all clients are classified as retail or professional, which triggers the differences in trading conditions and available protection tools.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- High reputation and stable financial indicators of the parent bank;

- A reliable market maker regulated in the EU (Société Générale as a broker);

- No minimum investment amount after opening an account;

- Trading CFDs on various types of assets and futures through a single account;

- Long and short positions in CFDs on more than 600 underlying assets;

- CFD transactions on currencies, indices, commodities, and interest rate futures without additional fees;

- Free provision of educational materials tailored to the specific needs of the trader.

- The broker's website lacks online chat and educational materials;

- ViTrade does not offer popular trading platforms like MetaTrader;

- High spreads and a minimum fee for trading CFDs on futures, stocks, and volatility indices amounting to EUR 5.

TU Expert Advice

Author, Financial Expert at Traders Union

ViTrade provides trading diverse instruments, including CFDs on currency pairs, stocks, indices, bonds, and commodities, from a single account. It offers leverage up to 1:30 and operates through its proprietary CFDWebClient and Flatex Next platforms. With no minimum investment requirement, traders can benefit from enhanced market access and free educational materials. The broker is regulated by BaFin, ECB, and ESMA, which ensures compliance with EU trading standards.

However, ViTrade's services present some drawbacks, such as high spreads and the absence of popular trading platforms like MetaTrader. Limited client support, notably the lack of live chat, may also affect users seeking immediate assistance. The broker may be more suited to experienced traders who prioritize trading a wide range of derivatives and are comfortable with its platform tools. While suitable for some, ViTrade may not meet the needs of traders who highly value lower fees or advanced third-party trading platforms.

ViTrade Trading Conditions

| 💻 Trading platform: | CFDWebClient, Flatex Next (mobile app) |

|---|---|

| 📊 Accounts: | CFD Demo, CFD Account |

| 💰 Account currency: | EUR |

| 💵 Deposit / Withdrawal: | Bank transfer |

| 🚀 Minimum deposit: | 1 EUR |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2-0,5 pips |

| 🔧 Instruments: | CFDs on currency pairs, stocks, indices, bonds, precious metals, commodities, ETFs, ETCs, futures on indices and interest rates, warrants, volatility indices |

| 💹 Margin Call / Stop Out: | 80%/50% |

| 🏛 Liquidity provider: | Société Générale, Commerzbank, Morgan Stanley, HSBC, Goldman Sachs, UBS, Vontobel, BNP Paribas, and others |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Société Générale acts as the executing broker |

| 🎁 Contests and bonuses: | No |

The ViTrade broker provides access to trading with over 600 CFDs with trading leverage up to 1:30 from a single account. There is no minimum capital requirement to start trading derivatives, but the account must maintain the necessary margin. Trading hours are from 2:00 to 22:00 (GMT+1) on Frankfurt Stock Exchange working days. Traders can use a demo account to practice various trading strategies, test new ideas, and explore analytical tools.

ViTrade Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

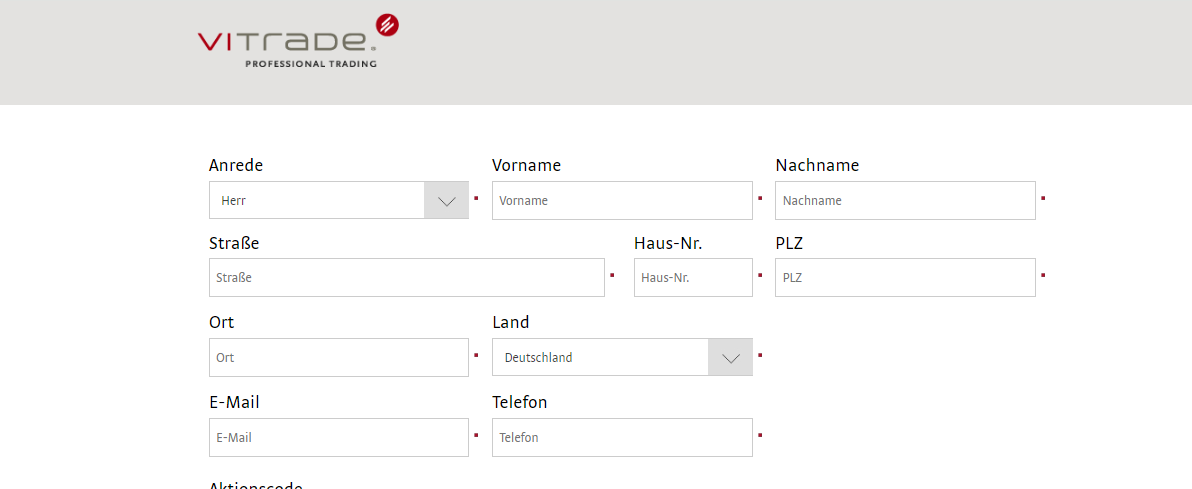

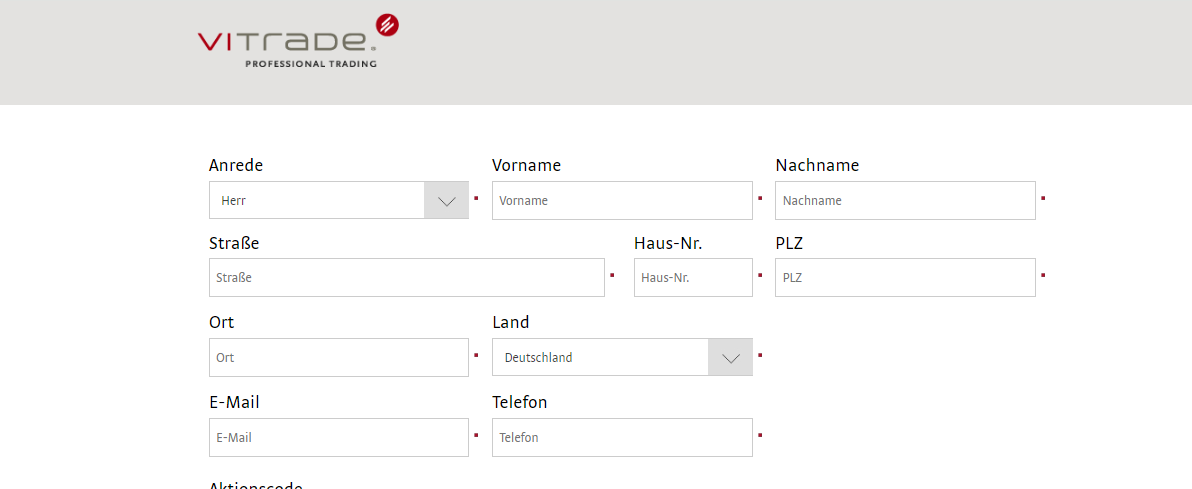

Access to the user account on the ViTrade website is granted after entering the client number and password. To obtain them, follow these steps:

Click on the red "Open an Account" button on the ViTrade website.

Complete the form to open a trading account. Provide your name, surname, address, country of residence, email, and phone number.

Next, print the forms that appear on the screen and enter the required information. Afterward, undergo the identification process using PostIdent and send the requested documents to the broker's specified address as indicated on the registration page. If you are a client of FlatexDEGIRO Bank, send the completed forms by mail. Alternatively, you can print the account opening application, fill it out there, and hand it to a bank employee.

After reviewing the application, a trading account and a depository account are opened. The company sends login details for the account by mail. Trading can be initiated after funding the account.

Regulation and safety

ViTrade has a safety score of 8.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record of less than 8 years

ViTrade Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

BaFin BaFin |

Federal Financial Supervisory Authority | Germany | Up to €20,000 | Tier-1 |

ViTrade Security Factors

| Foundation date | 2020 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker ViTrade have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of ViTrade with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, ViTrade’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

ViTrade Standard spreads

| ViTrade | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,7 | 1,4 | 0,5 |

Does ViTrade support RAW/ECN accounts?

As we discovered, ViTrade does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with ViTrade. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

ViTrade Non-Trading Fees

| ViTrade | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

To commence CFD trading through ViTrade, open an individual account with FlatexDEGIRO Bank AG either online or at its physical branch. Afterward, you can apply to open a trading account. There are no minimum requirements for the initial deposit, and the account is opened free of charge.

Account Types:

In addition to user accounts, ViTrade offers a free demo version of the trading platform with an unlimited duration and virtual starting capital of EUR 100,000.

ViTrade is a broker providing online trading services through reliable trading partners and collaborating with major liquidity providers.

Deposit and withdrawal

ViTrade received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

ViTrade offers limited payment options and accessibility, which may impact its competitiveness.

- Minimum deposit below industry average

- Low minimum withdrawal requirement

- Bank wire transfers available

- No withdrawal fee

- Wise not supported

- BTC payments not accepted

- USDT payments not accepted

What are ViTrade deposit and withdrawal options?

ViTrade offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making ViTrade less competitive for those seeking diverse payment options.

ViTrade Deposit and Withdrawal Methods vs Competitors

| ViTrade | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are ViTrade base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. ViTrade supports the following base account currencies:

What are ViTrade's minimum deposit and withdrawal amounts?

The minimum deposit on ViTrade is $1, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact ViTrade’s support team.

Markets and tradable assets

ViTrade offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 60 Forex pairs.

- Indices trading

- Commodity futures are available

- Crypto trading

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by ViTrade with its competitors, making it easier for you to find the perfect fit.

| ViTrade | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | Yes | Yes | No |

Investment options

We also explored the trading assets and products ViTrade offers for beginner traders and investors who prefer not to engage in active trading.

| ViTrade | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

The company provides phone numbers on its website for residents of Germany and other countries. Separate numbers are specified for existing and potential clients. Technical support is available from Monday to Friday: assistance to clients is provided from 8:00 to 22:00, while traders interested in the services can reach out from 9:00 to 18:00 (GMT+1). The broker's office is located in Berlin.

Advantages

- Support in both German and English.

- Phone assistance is available even from abroad

Disadvantages

- No support on Saturdays and Sundays

- No online chat on the company's website

- Support is not provided through messengers

Ways to contact ViTrade:

Phone;

Email (depending on the account status).

There is also a contact form in the contact section for assistance via phone or email.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address | FlatexDEGIRO Bank AG, Joachimsthaler Straße 12, 10719 Berlin, Deutschland |

| Regulation | BaFin, ECB, ESMA |

| Official site | https://www.vitrade.de/english/ |

| Contacts |

Education

The company offers a free 14-day training course on CFD trading. The sessions are conducted interactively online and help traders master the basics of trading derivatives, as well as thoroughly understand the trading platform. The course topic is chosen by the individual ordering it, and this can be any ViTrade client. All details and the registration form can be found in the broker's Akademie section.

ViTrade offers a virtual trading (demo) account to traders for practice and familiarization with the broker’s platform without the risk of losing real money.

Comparison of ViTrade with other Brokers

| ViTrade | Eightcap | XM Group | RoboForex | Octa | 4XC | |

| Trading platform |

CFDWebClient, Flatex Next (mobile app) | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, OctaTrader | MT5, MT4, WebTrader |

| Min deposit | $1 | $100 | $5 | $10 | $25 | $50 |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:40 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 1 point | From 0 points | From 0.8 points | From 0 points | From 0.6 points | From 0 points |

| Level of margin call / stop out |

80% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 25% / 15% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | Yes | No | No |

Detailed review of ViTrade

Broker ViTrade offers a wide range of trading instruments, educational services, as well as technical and client support. Its clients have access to trading on various global financial exchanges, derivative markets, and Forex. The company provides proprietary trading platforms, convenient mobile applications for managing accounts and orders, as well as a web platform for browser-based trading.

ViTrade by the numbers:

Over 1,200 CFD instruments;

The parent company has been operating for over 15 years and serves 2.6 million clients in 16 countries;

Regulated by three financial supervisory authorities;

Deposit insurance of up to EUR 100,000 per client.

ViTrade is a German broker with functional online trading platforms

Société Générale acts as the market maker for ViTrade and the operator of the trading platform for order placement. ViTrade is a broker and bank that is among the top four in the French financial market. Traders can use any device with internet access to execute transactions, although ViTrade does not have desktop platforms. The company offers CFDWebClient for browser-based trading; and for mobile applications, it offers Flatex Next for Android and iOS.

The platforms include essential graphic tools for quality market analysis, such as a newsfeed, Limit, Stop, Stop Loss, Trailing Stop Loss, Take Profit, One-Cancels-Other-Order (OCO), and If-Done-Order. If trading CFDs through the mobile app or web platform is not possible, clients can place orders by phone during the broker's working hours which are from 8:00 to 22:00 (GMT+1).

Useful functions of ViTrade:

Email newsletters with financial news and reports;

Daily market analysis;

Free interactive training for clients;

Demo mode for a user account to acquaint a trader risk-free with the broker's trading platforms and conditions.

Advantages:

ViTrade employs modern technologies to enhance the trading experience, such as high-speed order execution and advanced data encryption methods;

The broker offers a demo account, allowing traders to test strategies, familiarize themselves with the platform's functionality, and gain experience in trading financial markets;

ViTrade platforms provide a wide range of financial instruments for trading in over-the-counter market conditions;

The opportunity for personalized training with individual advice and recommendations from professional traders;

ViTrade clients have access to various assets, including CFDs on currency pairs, stocks, indices, commodities, and other financial instruments, enabling the diversification of investment portfolios.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i