According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $77

- MetaTrader4

- MetaTrader5

- Trading conditions are regulated by the broker

- Up to 1:200

Our Evaluation of The Concept Trading

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

The Concept Trading is a prop trading firm with higher-than-average risk and the TU Overall Score of 3.98 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by The Concept Trading clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

The Concept Trading offers accounts with high balances for professional trading in over-the-counter markets. To begin the testing process, a minimum deposit of $77 is required, while other prop trading firms offer free demo accounts.

Brief Look at The Concept Trading

The Concept Trading company specializes in proprietary (prop) trading services, providing traders with funding to trade derivatives. Available financial instruments include fiat and cryptocurrencies, indices, stocks, options, and commodities. The leverage is up to 1:200. Clients who have reached the target profit and have not violated the rules get accounts with deposits from $1,125 to $20,000,000. In August 2021, the company was licensed by ASIC (Australian Securities and Investments Commission), which is still active. Additionally, the company has offices in the UK and Indonesia. The Concept Trading offers funding to traders worldwide, except residents of North Korea and Iran.

- There are no daily loss limit requirements.

- The broker holds a license from ASIC.

- Prop accounts with a one-time deposit starting from $77 with a discount coupon option.

- Affiliate program offers payouts of up to 10% of the referral's payment.

- Trading on MetaTrader 4 and 5 platforms with leverage up to 1:200.

- Provision of accounts with balances up to $20 million.

- The possibility of fixing payments of 90% of the income received.

- Demo is only available after depositing for the tariff plan.

- Under the standard profit distribution model, The Concept Trading takes 50% of the trader's profit.

- Complex account hierarchy with specific scaling rules.

TU Expert Advice

Author, Financial Expert at Traders Union

The Concept Trading offers prop trading services with a range of financial instruments, including Forex, cryptocurrencies, indices, stocks, options, and commodities. It utilizes MetaTrader 4 and 5 platforms, with leverage available up to 1:200. The firm provides account types with a minimum deposit starting from $77 and offers a scalability plan up to $20 million. Additionally, the absence of daily loss limits and the availability of accounts supporting significant trading volume are notable advantages.

However, The Concept Trading has drawbacks, such as its complex account hierarchy with specific scaling rules and a profit split model where traders retain only 50% of earnings unless a certain profit threshold is met. Due to these constraints, this company may be more suited to experienced traders who can effectively manage high-profit targets and are comfortable with the associated fee structures. Overall, while it offers ample trading opportunities, it may not be ideal for those seeking low-cost entry or extensive hand-holding.

The Concept Trading Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5 |

|---|---|

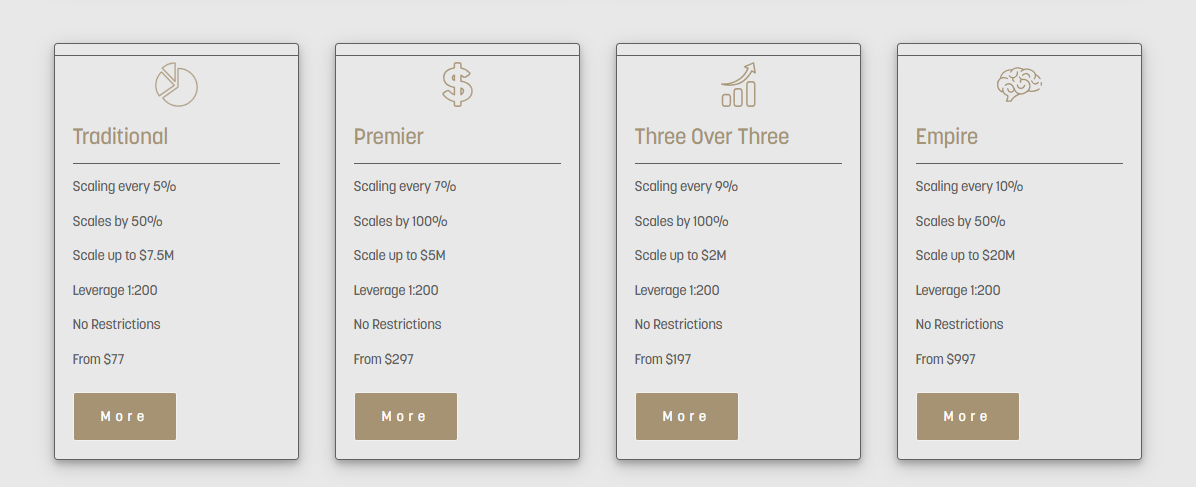

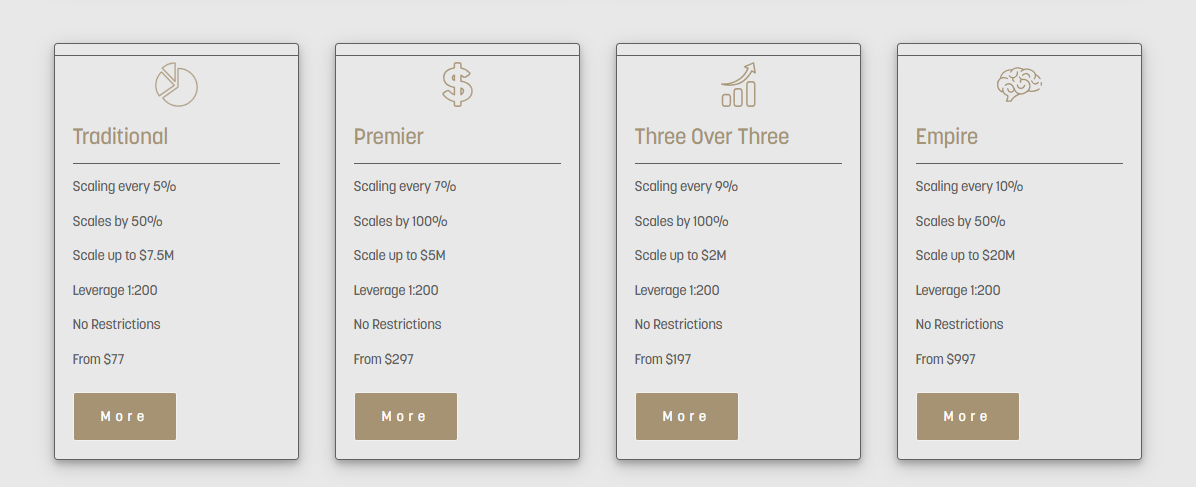

| 📊 Accounts: | Traditional, Premier, Three Over Three (including 3 On the Tree, 4 On the Floor, Automatic, and Paddle), and Empire), |

| 💰 Account currency: | USD, AUD |

| 💵 Deposit / Withdrawal: | Deposit: PayPal, Credit Cards, CryptopayWithdrawal: bank transfer, Wise, PayPal, Cryptopay |

| 🚀 Minimum deposit: | $77 |

| ⚖️ Leverage: | Up to 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 (МТ4), and 0.001 (МТ5) |

| 💱 EUR/USD spread: |

On MT4 accounts from 0.9 pips; On MT5 accounts from 0.0 pips; |

| 🔧 Instruments: | Currency pairs (major, minor, crosses, exotics), FX index, energies, cryptocurrencies, metals, indices, commodities, stocks, options. |

| 💹 Margin Call / Stop Out: | 75%/50% |

| 🏛 Liquidity provider: | Liquidity providers of LCM-FX and Kubera Markets brokers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant (MT4) and Market (MT5) |

| ⭐ Trading features: | Trading conditions are regulated by the broker |

| 🎁 Contests and bonuses: | Discount coupons |

The Concept Trading’s clients can trade with leverage up to 1:200, however, the company strictly monitors adherence to risk management rules. Clients with significant turnover are required to use stop-loss orders and not to allocate more than 1% of the total account balance in a single trade. If these rules are violated and a trader exceeds the maximum allowable drawdown level, their account is closed with no possibility of recovery. Each client can simultaneously trade on three accounts.

The Concept Trading Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

The Concept Trading provides access to funding up to $50 000 000, with challenges requiring at a minimum of No time limits trading days. The entry-level plan starts at $97, min but the fee is non-refundable.

- High funding potential — up to $50 000 000

- Multiple scaling options

- Flexible trading rules and conditions

- No free evaluation option

- No demo account provided

The Concept Trading Challenge fees and plans

We compared The Concept Trading’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | Daily loss,% | Max. loss, % |

| Traditional |

|

|

|

|

|

| Empire |

|

|

|

|

|

| Xtreme |

|

|

|

|

|

| Premier |

|

|

|

|

|

What’s the minimum trading period for The Concept Trading’s challenge?

No minimum trading days. You can complete the challenge as soon as you reach the profit target.

Does The Concept Trading offer a free evaluation?

No, The Concept Trading does not offer a free evaluation option. If you’re looking for firms that do provide this feature, you may consider exploring other companies that support free challenge models, such as: Funded Trading Plus, Emerge Profit, City Traders Imperium.

Is instant funding available at The Concept Trading?

No, The Concept Trading does not offer instant funding. If this option is important to you, consider exploring other firms that provide instant funding models, such as: Hola Prime, Instant Funding, GoatFundedTrader.

Trading rules

The Concept Trading outlines the main rules for funded accounts, including a max. loss of 3% and a daily loss limit of 0%. The firm also restricts certain trading strategies, which are detailed below.

- News trading allowed

- Flexible leverage up to 1:200

- Trading bots (EAs) allowed

- Strict max loss

- Copy trading not allowed

The Concept Trading trading conditions

We compared The Concept Trading’s leverage and trading conditions with competitors to help you better understand how it measures up.

| The Concept Trading | Hola Prime | SabioTrade | |

| Max. loss, % | 3 | 5 | 6 |

| Max. leverage | 1:200 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | No | No | No |

Deposit and withdrawal

The Concept Trading earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at The Concept Trading meet most standard requirements and are in line with what many prop firms provide.

- PayPal supported

- Bank сard deposits and withdrawals

- Weekly payouts

- USDT (Tether) supported

- Limited deposit and withdrawal options

- Wise not supported

- Limited base currency options

Deposit and withdrawal options

To help you evaluate how The Concept Trading performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

The Concept Trading Payment options vs Competitors

| The Concept Trading | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | Yes | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared The Concept Trading with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| The Concept Trading | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | Yes | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | Yes | Yes | No |

What base account currencies are available?

The Concept Trading offers the following base account currencies:

Trading Account Opening

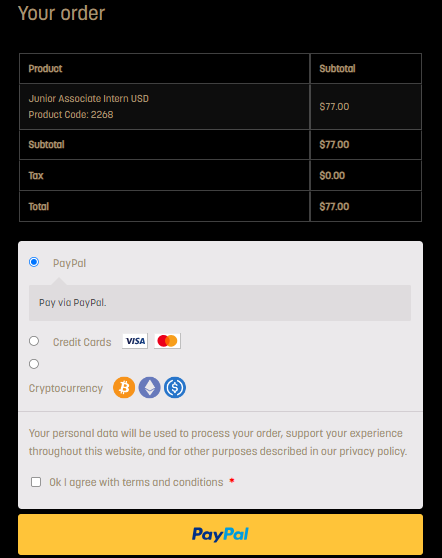

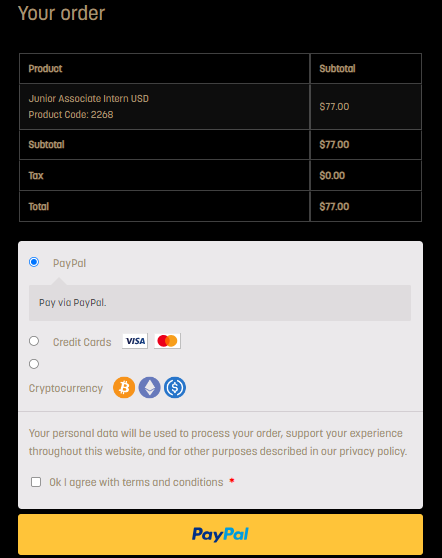

To create an account on The Concept Trading website, complete a short questionnaire and make a one-time payment. Here's a detailed guide with screenshots:

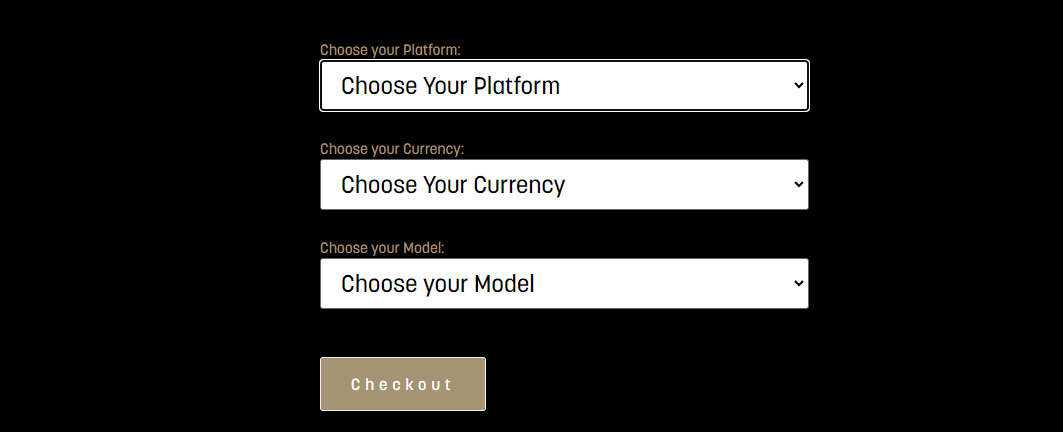

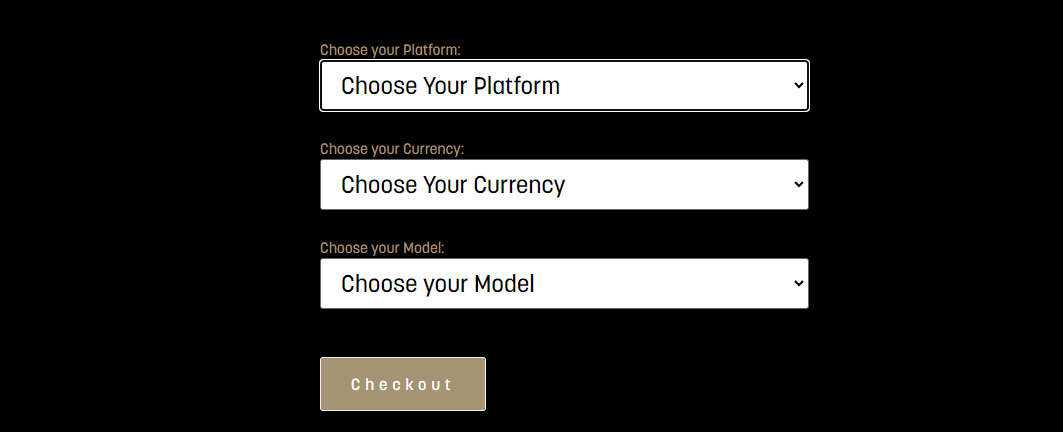

Go to the Prop Trading section on the website to view all available tariff plans.

Click on "More" under the selected plan to view its terms and conditions, as well as the account opening form. From the dropdown menus, select the trading platform (MT4/MT5) and account currency (ex., USD/AUD). Specify the account level as the initial deposit amount depends on it.

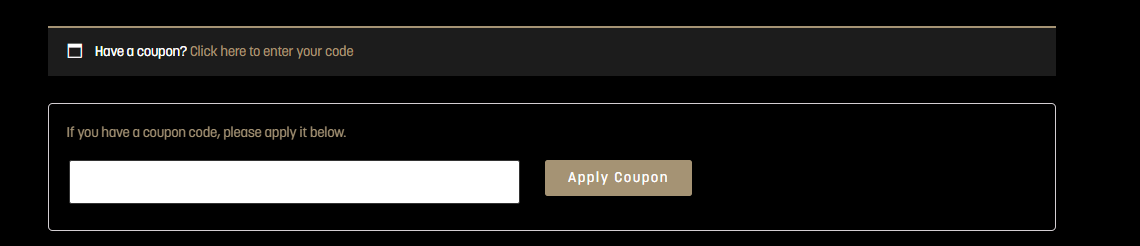

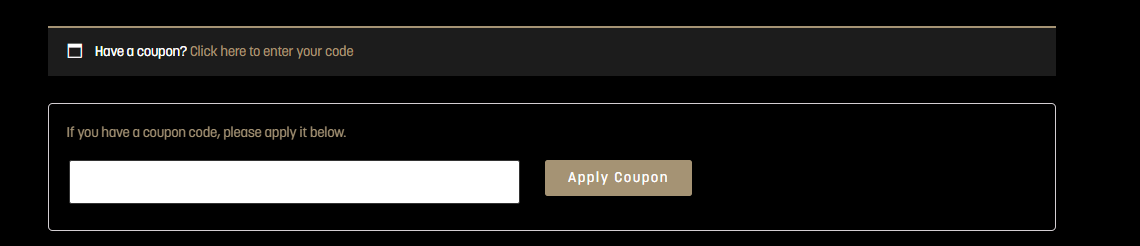

If you have a discount coupon for payment, enter its promo code in the corresponding field.

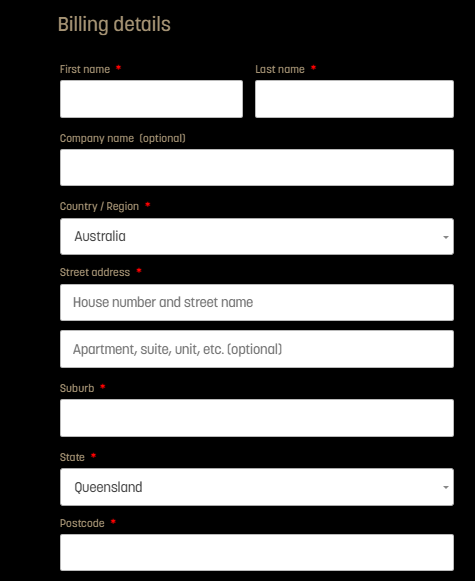

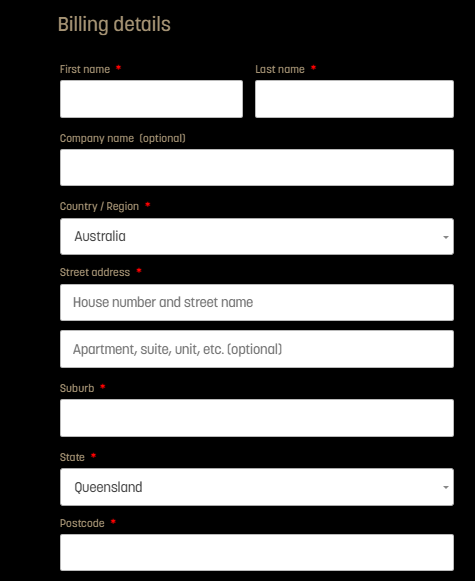

Next, fill out a short form. The company requests personal information, phone number, email, and residential address. All data must be real because you'll need to verify it later using documents, special codes, or links.

The payment amount is generated automatically. Select the payment system and agree to the terms of service.

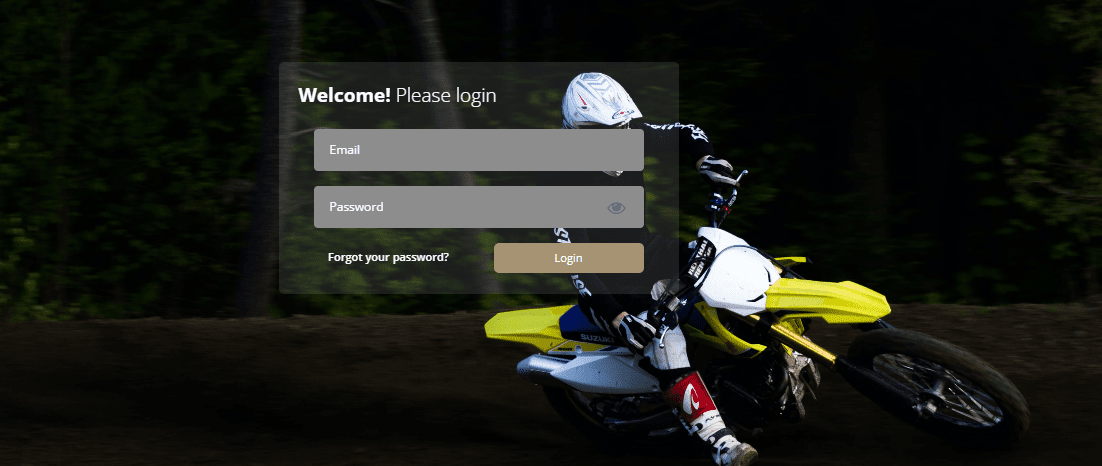

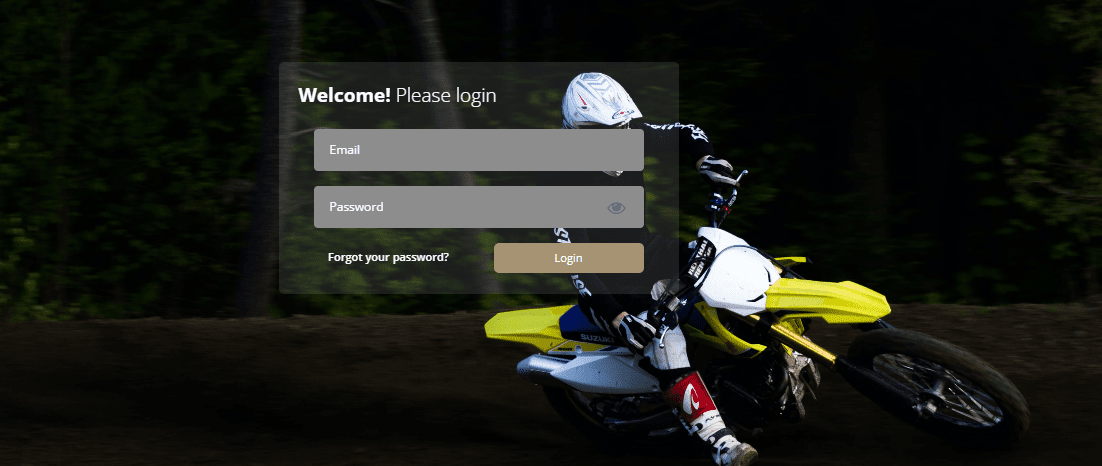

To log in to your account, click the "Dashboard" button at the top of the website. Enter your email and password from the email in the form.

Regulation and safety

The activity of The Concept Trading is regulated by the Australian Securities & Investments Commission. As a private limited company, The Concept Trading with shares is registered under ACN 652 938 399.

A client can file a complaint if the prop firm violates any of the terms of the commercial agreement. It will be processed by a special department that operates under ASIC's complaint resolution rules. If the client's claim remains unsatisfied, they can turn to the Australian Financial Complaints Authority (AFCA). This organization acts as an independent party in resolving disputes between financial companies and their clients.

Advantages

- Licensed by the ASIC.

- Disputes are resolved by independent auditor AFCA

- Verification can be completed after receiving funding.

Disadvantages

- Executing brokers are regulated in offshore jurisdictions

- If a trading account is blocked, The Concept Trading reserves the right to deny the trader a re-evaluation attempt

- Negative balance protection is only available on retail trader accounts

Markets and tradable assets

The Concept Trading has a score of 7/10, reflecting a strong variety of markets and assets available for trading.

- Forex trading supported

- Crypto trading available

- Indices available

- Options not supported

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by The Concept Trading with two leading competitors to highlight the differences in market access.

| The Concept Trading | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

The Concept Trading isn't focused on serving investors, although it doesn't prohibit the use of passive strategies to grow capital. The company allows copy trading, the use of expert advisors (EAs) and robots. In general, traders have access to any investment solutions offered by the broker servicing their accounts.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

The Concept Trading’s affiliate program:

-

Under the terms of the affiliate program, a client of The Concept Trading who invites another person receives compensation only after the referral purchases one of the service packages. The following commission rates apply for 1-5 referrals: 5% of the purchase amount; for 6-19, 7%; for 20 or more, 10%. If the referral makes an additional payment within 180 days, the referring partner receives 5% of the transaction amount.

Funds are paid out once a week. You can use them to buy tariff plans/pay commissions or withdraw them by bank/cryptocurrency transfer, PayPal, and or Wise. At the beginning of a new month, the previously connected number of referrals is reset.

Customer support

The company's website does not specify the support service's working hours. We sent several questions via email on a weekday and received responses within 2 hours.

Customer Support Service

Advantages

- Communication with support via Discord

- Assistance over the phone

Disadvantages

- A request of a call-back is not available

- Limited selection of messengers.

- Chat on the website allows communication only with a bot

If a trader needs assistance, they can use the following channels to contact a representative of The Concept Trading:

-

Chatbot on the website.

-

Phone numbers for the UK, Australia, and Indonesia.

-

Email addresses from the contact section.

-

Discord messenger.

-

Social media platforms Instagram, LinkedIn, Facebook, Twitter.

Representatives of The Concept Trading do not provide information on trading conditions, as this is handled by employees of executing broker companies.

Contacts

| Registration address | The Concept Trading UK Ltd, Bartle House, Oxford Court, Manchester M2 3WQ, United Kingdom |

|---|---|

| Regulation | ASIC |

| Official site | https://theconcepttrading.com/ |

| Contacts |

+61 7 4599 3855, +62 21 2550 2471, +441613991892

|

Education

The Concept Trading is focused on collaborating with professional traders who do not require training. The FAQs section gathers important rules and requirements of the company for potential clients.

Individual mentoring sessions can be arranged to enhance trading skills. The cost of such a service is up to $97 for a 30-minute session.

Comparison of The Concept Trading to other prop firms

| The Concept Trading | FundedNext | Hola Prime | SabioTrade | E8 Markets | Lark Funding | |

| Trading platform |

MetaTrader4, MetaTrader5 | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MT5, Match Trader | cTrader, DXTrade |

| Min deposit | $77 | $32 | $48 | $119 | $33 | $60 |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:50 |

From 1:1 to 1:50 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.9 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

75% / 50% | No | No | 100% / 50% | No | 110% / 100% |

| Order Execution | Market Execution, Instant Execution | N/a | Market Execution | Market Execution | No | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of The Concept Trading

The Concept Trading is a young prop trading company, but its team has over 20 years of experience in financial markets. Its clients receive funding to trade on the most convenient platform for trading, MetaTrader. There are no restrictions on trading styles and strategies, which, combined with the use of leverage, allows traders to significantly expand their opportunities. For its client-oriented solutions, The Concept Trading was recognized as the Best Australian Prop Trading Company of 2023 at the Global Banking & Finance Awards.

The Concept Trading by the numbers:

-

The company has 3 registered offices.

-

The company offers 18 types of accounts.

-

Leverage is up to 1:200.

-

There are over 300 financial instruments for trading.

-

Simultaneous trading on 3 accounts.

The Concept Trading is a company that specializes in prop trading

The company does not set limits on daily drawdowns, but traders must adhere to maximum drawdown requirements. For different accounts, the value ranges from 5% to 10%. Additionally, The Concept Trading does not set time limits for completing the evaluation as it ends once the trader reaches the profit target. While the company doesn't impose penalties for prolonged task completion, accounts are closed after 6 months of inactivity, as The Concept Trading is interested in traders engaging in regular trading.

Clients can use any strategy. If a trader successfully trades on the company's funds in the real market, their account balance increases by 50%-100% after reaching a profit target of 5%-10% of the existing capital. Prop traders receive 50% of their earned profits on all accounts. A client can increase payout rates and fix income at 90% if they don't wish to raise the account level and the amount of allocated funding.

The Concept Trading’s analytical services:

-

A blog with market technical analysis.

-

Individual online sessions with trading coaches.

-

Profiles on Instagram, Facebook, and Twitter with market data, newsfeeds, and useful information for traders.

Advantages:

Traders can open trades of any volume.

No requirements on the number of simultaneously open orders.

Cryptocurrency trading is available 24/7.

Convenient and fast deposit methods.

No penalties for inactive trading

Account opening within 24 hours.

Verification is not mandatory during the evaluation stage. Documents can be uploaded after switching to a real account or before submitting the first withdrawal request.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i