How To Trade Cryptocurrency Options

In order to buy or sell crypto option:

-

1

Choose the type of option.

-

2

Select the strike price.

-

3

Select the expiration date.

-

4

Enter the quantity.

-

5

Review and submit your order.

Cryptocurrency options are a form of trading that has been increasing in popularity for those who seek freedom, flexibility, and the potential for high returns.

Trading options requires knowledge and understanding of the markets, as well as the ability to make informed decisions in a timely manner.

This guide provides a step-by-step approach to trading cryptocurrency options, from buying and selling Bitcoin options to tips for successful trading.

Start trading cryptocurrencies with ByBitWhat are cryptocurrency options?

Cryptocurrency options are a type of financial instrument that can be used to speculate or hedge risk on the crypto markets. They offer traders the potential to take advantage of market volatility and to manage their trading risks. Options can be used to limit losses or to maximize gains, depending on the trader’s strategy. They can be used to protect existing positions, to speculate on price movements, or to establish new positions.

Cryptocurrency options are contracts that provide the buyer with the right, but not the obligation, to buy or sell an underlying digital asset at an agreed-upon price within a specified time frame. They offer traders a way to hedge against market volatility, speculate on price movements, and strategize with more sophisticated market plays.

For example, let’s take a trader who anticipates an increase in the price of Bitcoin. They might purchase a call option with a strike price slightly above Bitcoin's current market price, e.g. $20,000, expecting it to rise.

If Bitcoin's price escalates beyond the strike price before the option expires, the trader can purchase Bitcoin at the lower strike price, potentially realizing a gain on the difference. Conversely, should the price decline, the trader's loss is confined to the premium paid for the option.

Options are a great way to increase trading success, by allowing traders to manage their risk and take advantage of market volatility.

To learn more, read our in-depth article on Options Trading: What is Options Trading and How does it Work.

How to trade cryptocurrency options

Trading cryptocurrency options requires strategic planning and a thorough understanding of the various steps involved. Here is a step-by-step guide to help you navigate the process:

-

1

Choosing a Crypto Exchange with Options Trading: Your first step is to select a reputable cryptocurrency exchange that offers options trading. Look for platforms that provide a robust trading interface, comprehensive support for various crypto options, and a solid track record for security and regulatory compliance. You can find a list of credible exchanges in our resource Where to Trade Crypto Options in 2023.

-

2

Opening an Account: Once you've chosen an exchange, you'll need to create an account. This will typically involve providing personal identification details to comply with Know Your Customer (KYC) regulations.

-

3

Funding Your Account: After your account is set up, you'll need to deposit funds. Depending on the exchange, you may have several funding options such as bank transfer, credit card, or transferring cryptocurrency from another wallet.

-

4

Understanding Option Contracts: Before placing your first options trade, you should familiarize yourself with the terms and mechanics of options contracts on your chosen platform. Pay special attention to the specific features offered, such as the types of options available (American vs. European), the expiration dates, and the strike prices.

Following these steps can help initiate your journey into the world of cryptocurrency options trading and make that first trade with a clearer perspective and a structured approach. Remember, options trading can be complex and carries significant risk, so proceed with caution and consider seeking advice from financial advisors if necessary.

How to buy and sell Bitcoin options

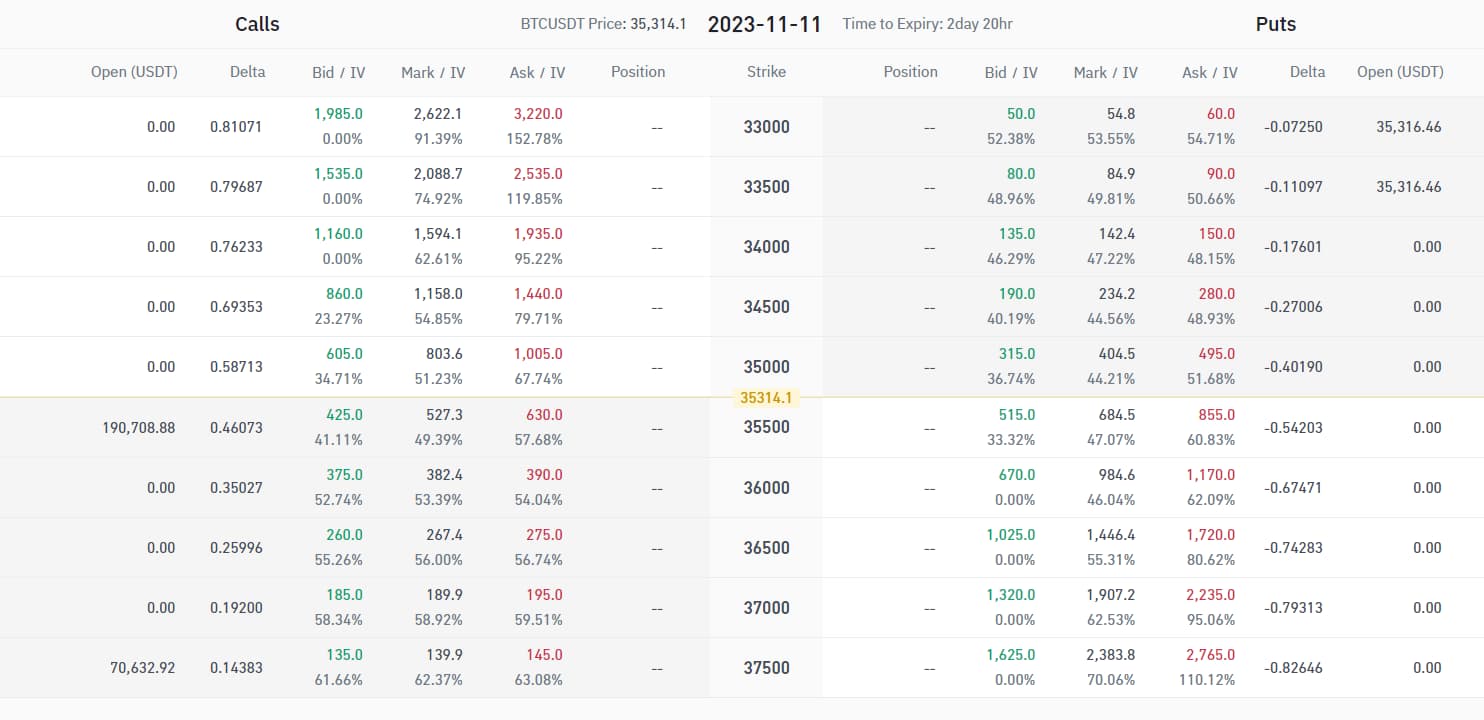

Buying and selling Bitcoin options can be an intricate process, but with a systematic approach, traders can execute their trades efficiently. Below is a step-by-step guide using the information typically found on an options trading platform, as illustrated in the provided image.

-

1

Choose the type of option: Determine whether you're bullish or bearish on Bitcoin. If you’re bullish, look to buy a call option. Conversely, if you anticipate a price decline, consider a put option. The image shows two columns, one for calls and one for puts, signifying the two main types of options.

-

2

Select the strike price: The strike price is the price at which you can exercise your option. Choose a strike price that aligns with your market forecast and risk tolerance. In the provided image, the strike prices are listed in the middle column, allowing you to select an appropriate level. For example, if the current BTC/USDT price is 35,314.1, you might select a strike price of 35,000 for a call.

-

3

Enter the expiration date: Options are time-sensitive, and you must select an expiration date for your contract. This is the deadline by which you need to exercise your option. In the image, the time to expiry is shown, allowing you to make a choice based on how far in the future you expect the price movement to occur.

-

4

Enter the quantity: Decide on the number of contracts you wish to purchase. Each contract represents a certain amount of the underlying asset.

-

5

Review and submit your order: Before finalizing your trade, scrutinize the order details. Check the bid and ask prices, implied volatility (IV), and the delta, which indicates the change rate between the price of the option and a $1 change in the price of the underlying asset.

Best crypto exchanges

Benefits And Risks of Crypto Options Trading

Cryptocurrency options trading provides both opportunities and risks that traders should be aware of.

On the benefits side, options allow traders to speculate on market moves without having to fully commit capital. Options also provide leverage, allowing traders to control a larger position for a smaller upfront cost. For those with directional views, options enable traders to profit from anticipated price rises with call options or falls with put options. Properly structured options strategies can help limit downside exposure as well.

However, options also involve substantial risks. Cryptocurrency markets are very volatile and options decay rapidly due to time. If the market moves against an options position, the entire investment could be lost quickly. Traders must correctly predict direction and magnitude of moves. The leverage provided by options is a double-edged sword, as losses are also amplified. Options buyers face strict expiration dates by which they must be in the money. Selling options also exposes traders to unlimited losses if the market moves past the strike price. Trading with leverage can indeed increase your profits, but it can also amplify your losses if not managed properly. Choose a crypto leverage trading platform based on your individual trading needs and level of experience.

Overall risk management is critical with options. Traders must size positions appropriately based on their risk tolerance and market comprehension. Options are not appropriate for passive or tactical investing and demand a strong understanding of the underlying factors that drive cryptocurrency prices. With the right approach, options can provide powerful tools, but they are risky instruments that require diligent risk management.

Tips for trading cryptocurrency options

To achieve consistent success in trading, it is important to understand the volatility of the cryptocurrency market. Volatility can be both a blessing and a curse for traders. If you understand the direction of the market and predict the fluctuations in prices, you can increase your profits. However, if you don’t manage your risk accordingly, you can also suffer significant losses.

Make sure to do your due diligence and set risk management strategies. These strategies should be tailored to your individual objectives and risk tolerance.

For example, if you are a conservative investor, it may be wise to set a stop-loss order that will limit your losses to a certain amount. On the other hand, if you are more aggressive, you may want to set a target price for your option. Knowing your own risk tolerance and having a strategy in place to manage your risk is key to successful trading.

If you’re a beginner, a good rule of thumb is to start with small investments.

How is crypto options trading different from traditional options trading?

While crypto and traditional options both let traders speculate on price movements, there are some key differences in how they work.

Volatility is off the charts in crypto - the prices bounce all over the place way more than stocks. This means the options pricing doesn't always behave the same way. Liquidity can also be thinner at times, making it harder to fill large orders without moving the market.

Regulation is still taking shape too. Each country has its own approach, so what's allowed may not be consistent. And unlike normal markets that stop after hours, crypto never sleeps. You have to be ready for price swings any time of day or night.

Fundamentals are a bigger wild card in crypto too. The prices react more to random tweets or headlines versus traditional measures like earnings. And different cryptos live or die by factors like their project development or exchange listings.

The option choices aren't as robust either. Expirations are further apart and there's less granularity in strike prices. This limits some common strategies. Pricing models also have to account for each coin's own unique DNA rather than applying textbook assumptions.

At the end of the day, cryptocurrencies are still like the frontier compared to traditional assets that have been around decades longer. The options just amplify that risk-reward dynamic. If you go in aware of these contrasts, you'll have better expectations going forward.

Conclusion

Cryptocurrency options can be a profitable way to trade digital assets. However, it is important to remember that options trading is risky. You could lose your entire investment if the price of the cryptocurrency moves against you.

FAQs

What is the crypto options trading strategy?

A crypto options trading strategy involves using contracts to buy or sell a cryptocurrency at a predetermined price, providing a way to hedge, speculate, or gain leveraged exposure to the asset.

How do you trade crypto options on Binance?

On Binance, you trade crypto options by:

-

1

Going to Binance Options and opening an Options account

-

2

Transferring funds to your wallet

-

3

Selecting the asset

-

4

Choosing between Call and Put options

-

5

Choosing the price, amount, order type, and clicking “buy”

How risky are crypto options?

Crypto options carry a high level of risk due to the volatility of cryptocurrency markets and the time-sensitive nature of options contracts.

Is there options for crypto?

Yes, there are options available for cryptocurrencies, allowing traders to speculate on future price movements or hedge current holdings.

Glossary for novice traders

-

1

Yield

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

-

2

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

5

Crypto trading

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).