Will Gold Ever Reach $3,000 an Ounce?

The price of gold could reach $3,000 by the year 2030 but is unlikely to reach $10,000 any time soon. Traders Union estimates gold will be worth $1903.05 USD per ounce by the end of 2024, and $2585.25 USD by the end of 2032. Bloomberg expert analysts have predicted that the price of gold could hit $3000 by the end of 2024. Legendary investor Peter Schiff believes gold will hit $5000 per ounce in the coming years.

Gold has a reputation as a stable storage of wealth, which many traders use to hedge against inflation, for speculation, and to physically own something of value. Its unique price behavior and opportunities for diversification make gold a financial asset that continuously attracts the attention of investors the world over. So a question that is always on gold investors’ minds is – how much will gold be worth in the future?

In this article, we attempt to answer questions about the future value of gold, explaining whether gold will go up or down, and if gold can reach $3000 and $5000.

-

How much is $3000 worth of gold?

At the time of writing, 1 USD is worth 0.0005 XAU (ounces of gold), and one ounce of gold is valued at $2,034.94. So, $3000 in US dollars is equal to 1.47 XAU.

-

How high could gold go?

According to our forecasts here at Traders Union, gold could be valued at $1,903.05 by the end of 2024, and $2,150.55 by 2029’s end. The price of gold hit a record high of $2,135 in December 2023, so it could grow even further this year. Looking into the distant future, gold is expected to be unsustainable to mine by 2050, so as a finite resource the potential for its value could be astronomic.

-

Can we trade gold online?

Yes, there are plenty of ways to do so. You can purchase physical gold through one of the many gold dealers online, or by trading gold ETFs, CFDs, derivatives contracts (like options or futures), and stocks in gold mining companies.

-

What is XAU/USD?

XAU/USD is the Forex symbol for the gold index, representing the exchange rate of one ounce of gold versus the US dollar. On the periodic table, the symbol for gold is Au, and the X means ‘index’, which combine to form XAU, the value of an ounce of gold. USD is the US dollar on currency exchanges.

Is gold expected to go higher?

It can be incredibly difficult to predict the future price of gold. The constant ebb and flow of supply and demand are constantly changing due to evolving mining production or jewelry and industrial demand. Gold is directly impacted by global economic conditions, geopolitical developments, currency strength, investor sentiment, and more. To be able to accurately speculate on the future price of gold, you must consider a huge amount of fundamentals, including but not limited to:

-

Inflation: Gold is often considered a hedge against inflation. During periods of rising inflation, investors may turn to gold to preserve wealth. So as a result, periods of high inflation tend to correlate with higher gold prices.

-

U.S. Dollar Value: There is an inverse relationship between the value of the U.S. dollar and the price of gold. When the dollar weakens, gold becomes relatively cheaper for holders of other currencies. But when the dollar strengthens, it can buy more of other currencies and commodities, leading to reduced demand for gold and higher gold prices.

-

Safe-Haven Demand: Gold is often seen as a safe-haven asset during times of geopolitical tension or economic uncertainty. Investors may flock to gold in times of crisis, such as war. Following Russia’s invasion of Ukraine, the price of gold skyrocketed by roughly 15% in one month. Similarly, gold has seen a nearly 14% price rise since the Israel-Gaza conflict began.

-

Gold Reserves: Central banks hold gold as part of their foreign exchange reserves. Changes in central bank buying or selling activities can influence prices.

-

Macro-Economic Data: Economic growth or contraction can impact gold prices. Additionally, high unemployment or economic instability can drive investors toward gold.

-

Market Speculation: Derivatives trading and other forms of speculative trading in gold futures and options markets can lead to short-term price volatility.

This list only covers some of the factors impacting gold prices, but there are more. Despite the difficulties and uncertainties involved in predicting gold’s price in the future, experts at some of the largest banks and investment firms have made predictions about how much the price of gold will go up in the future:

-

J.P. Morgan forecasts gold to peak at $2,300 per ounce in 2025, driven by expected interest rate cuts by the Federal Reserve, a falling US dollar, and mounting investor concern over the Israel-Palestine and Ukraine-Russia conflicts

-

Bank of America predicted gold to trade close to $2,200 by December 2024, based on the USD’s limited upward movement, recent declines in yields, and a positive Commitment of Traders (CoT) report.

-

Multinational investment bank Morgan Stanley said “Now may be a good time to add it to your portfolio,” citing a weak US dollar and global instability as a cause of rising gold prices. This was shortly before the current Middle East crisis, which has only driven gold prices up further.

Whichever investment bank you look to, the forecast for gold seems to be overwhelmingly bullish, mainly due to ongoing geopolitical instability, interest rate cuts, and the weakness of the US dollar. It may be a good time to invest in gold. To realize this idea, the article will help you: How to Buy Gold: Best Ways to Buy and Sell it Online

Can gold reach 3000?

Given the historical trajectory of gold, which has on a long enough time scale seen continuous growth, it is likely that gold will one day reach a value of $3000 – the question is when. US national debt is reaching record levels, leading investors to flock to gold. The ongoing and expanding conflict in the Middle East is also contributing to investor uncertainty and to their turning to gold as a safe-haven asset. For these reasons, Bloomberg expert analysts have predicted that the price of gold could increase by as much as 50% and hit $3000 by the end of 2024, following a rise to $2,700 in the first half of the year.

The gold price is in an uptrend that could last until 2030

If we only use technical analysis and look at chart trajectories of gold prices, we are likely to see gold rise to $3000 by 2030. Though there will be short-term price fluctuations, the overall long-term outlook indicates that the price will move to between $2000 to $3000 in the lead-up to 2030 and climb above $3000 at some point before that year.

Will gold ever reach 5,000 an ounce?

While it is entirely possible for gold to reach a value of $5000 an ounce at some point in the future, it’s not likely to happen any time soon according to most experts’ predictions. Gold predictions for the next several years are generally positive, but only few foresee gold reaching as much as $5000 before 2030.

However, some analysts are incredibly bullish on the future of gold. American stockbroker and financial commentator Peter Schiff is known as a very outspoken gold bull, and has publicly stated on multiple occasions that he believes gold will breach $5000 per ounce in the coming years. However, he has been saying this for over a decade and has been met with much scrutiny, so take his optimism with a pinch of salt.

Best brokers to trade gold

Gold price predictions for next 5 years

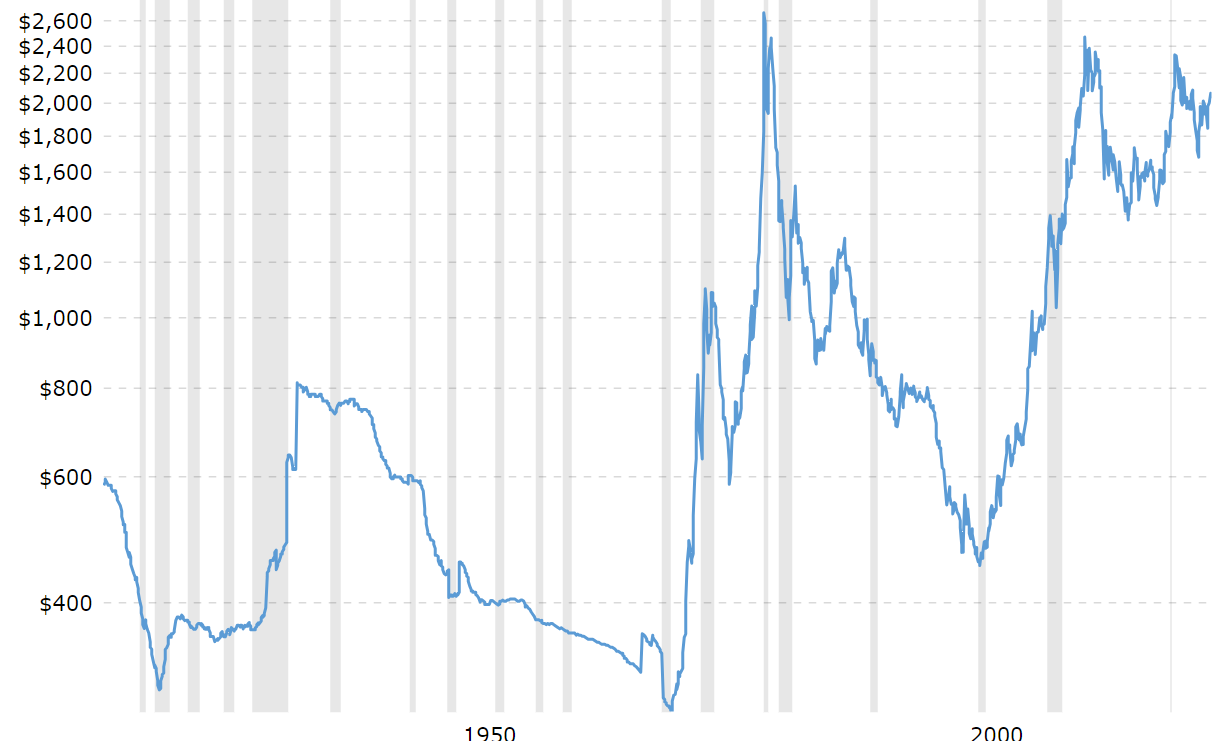

At the time of writing, gold is sitting at $2,034.94, after hitting an all-time high of $2,135.39/oz in December 2023, not adjusting for inflation. When prices are adjusted for inflation, that was gold’s highest price since 2020, when gold reached $2,325.19. Before that, gold reached a peak of $2,471.05 in August 2011. But the all-time high price of gold, when adjusted for inflation, was in February 1980, when gold hit $2,542 due to soaring inflation and interest rates.

Figure 1 Gold prices over past century adjusted for inflation (Source: macrotrends.net)

As gold is a finite resource, and its value is largely determined by the current supply in the world and global demands for it, it will likely continue rising in value. Considering gold is currently lower than its all-time high of 1980, it’s not unrealistic to expect to see new all-time highs in the coming months or years. A continued rise would likely need continuing global instability, more US debt, a weakening dollar, and other factors that are difficult to foresee.

Some of the more bullish analysts predict huge gains for gold in the coming years. Bloomberg Intelligence Strategist Mike McGlone believes gold could be headed for $7000 in the next five years, based on his own technical and fundamental analysis of past price movements. He predicts that the recent rapid growth of the stock market will slow down, and lead investors to turn to gold.

At Traders Union, our forecast for gold prices over the next five years is more conservative, and many would argue - more realistic. You can see our predictions below.

| Year | Price in the middle of the year | Price at the end of the year |

|---|---|---|

| 2024 | $2293.22 | $2290.42 |

| 2025 | $2105.52 | $2127.22 |

| 2026 | $2367.92 | $2224.92 |

| 2027 | $2283.82 | $2358.82 |

| 2028 | $2244.02 | $2342.02 |

| 2029 | $2448.22 | $2537.92 |

| 2030 | $2996.32 | $2863.12 |

| 2031 | $2827.62 | $2809.62 |

| 2032 | $2792.22 | $2972.62 |

| 2033 | $3019.62 | $3083.32 |

We continuously analyze gold prices and update forecasts based on our analysts’ predictions, which you can see in more detail here: Gold (XAU) price prediction for 2024, 2025, 2030.

Conclusion

Although gold, like most assets, is difficult to predict the future price of, it’s likely to continue to rise in the long-term. It could reach highs of $2650 to $3000 by the year 2030, or by more bullish estimates even $7000 – though don’t hold your breath for that. Gold is a sound safe-haven investment that is particularly useful for hedging against inflation, and with all the geopolitical instability in the world right now, it may be a good time to invest in gold.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.