Best Currencies To Invest In Pakistan In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

These currencies can help Pakistani investors protect value, diversify holdings, and plan for long-term growth.

U.S. dollar good for saving stability. Widely used, stable, and easy to convert.

Euro helps balance the currency mix. Diversifies risk beyond the US dollar.

Swiss franc safe in tough markets. Holds value during global uncertainty.

British pound good long-term storage. Strong currency with historical resilience.

Chinese yuan backed by strong ties. Rising due to China–Pakistan trade.

Many Pakistanis turn to foreign currencies as a way to shield their savings from inflation and the weakening rupee. Picking the right currency can help you stay ahead financially, especially during unstable times.

The best choice depends on what you’re aiming for — safety, growth, or a mix of both. If you value stability, go for trusted options like the US dollar or Swiss franc. If you're more focused on long-term gains, emerging market currencies or even Bitcoin might be worth exploring. This guide breaks down your options based on where Pakistan’s economy is headed in 2025.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Best currencies to invest in Pakistan

Here are some best currencies to invest in Pakistan:

U.S. Dollar (USD)

The U.S. Dollar (USD) is the official currency of the United States and the world’s primary reserve currency. Backed by the world’s largest economy, it is used in global trade, commodities, and finance

Why it’s suitable

Easiest to access and liquidate. USD is widely available in Pakistan through banks, exchanges, and remittance services.

Strong hedge against rupee depreciation. Historically, the dollar has consistently outpaced the PKR in value, offering long-term protection.

Preferred by institutions and the public. Even businesses in Pakistan hold USD to hedge against inflation and uncertain macroeconomic trends.

- Pros

- Cons

Stability during local economic shocks. The dollar holds firm even when local markets are volatile, making it a safe fallback.

Accepted across borders. Whether you're traveling, investing, or saving, USD is globally recognized and accepted.

Backed by global demand. From oil to tech, most international trades settle in USD, keeping its demand — and value — high.

Limited upside potential. USD is built for safety, not aggressive growth, so returns remain modest.

Strict local regulations. The State Bank of Pakistan monitors dollar inflows and outflows, which can lead to tighter access.

Exchange rate dependence. Timing matters — buying at the wrong rate can limit future gains or magnify short-term losses.

Euro (EUR)

The Euro (EUR) is the official currency of the Eurozone, used by 20 European Union countries. It’s one of the world’s most traded and trusted currencies, backed by strong economies like Germany and France.

Why it’s suitable

Diversifies away from USD dominance. Holding euros helps reduce overexposure to dollar-linked assets, which dominate remittances and local reserves in Pakistan.

Strong policy-driven backing. The European Central Bank (ECB) maintains stable monetary policies, which helps protect EUR against sudden inflation spikes.

Stable against regional volatility. Unlike currencies tied to oil or single economies, the Euro reflects the performance of multiple nations, balancing out political or economic shocks.

- Pros

- Cons

Relatively low volatility. The EUR usually avoids sharp, erratic swings, offering a smoother value curve for investors seeking predictability.

Easy access in Pakistan. Most local banks, Forex outlets, and digital platforms support EUR exchange and transfers with decent liquidity.

Backed by diversified economies. The currency’s strength isn’t reliant on one nation — it benefits from the collective economic power of the Eurozone.

Exchange rate risk vs. USD. Since global trade is largely USD-based, any euro appreciation or depreciation can impact conversions or cross-border transactions.

Not ideal for quick speculation. Its stability can be a downside for traders looking for fast gains from price movements.

Policy shifts affect value. ECB decisions on interest rates or inflation control can lead to slow, unpredictable currency adjustments.

Swiss Franc (CHF)

The Swiss Franc (CHF) is the official currency of Switzerland and Liechtenstein. Known for its financial stability and safe-haven status, it is backed by strong institutions and low national debt. It’s one of the few currencies that often strengthens during global uncertainty, attracting investors seeking protection from market volatility.

Why it’s suitable

Holds value during global crises. CHF tends to rise when other currencies fall, making it ideal for portfolio protection.

Switzerland’s low inflation adds stability. The Swiss economy is built on conservative policies that preserve purchasing power over time.

Strict monetary policy limits surprise shifts. The Swiss National Bank is cautious and transparent — fewer unexpected rate decisions or policy swings.

- Pros

- Cons

High trust among global investors. Institutions see CHF as a stable anchor in risk-off environments.

Strong banking and legal systems. Financial privacy, strict regulation, and solid governance boost long-term confidence.

Low volatility in the long term. CHF rarely sees wild swings, making it easier to plan longer-term trades or savings.

Negative interest rates until recently. Holding CHF in savings or bonds often brought low or even negative returns.

Slow growth can limit upside. Because it’s built for safety, it doesn’t benefit much from global rallies.

Heavily influenced by Eurozone moves. CHF often reacts to EUR trends, which can reduce its independence for traders.

British Pound (GBP)

The British Pound (GBP) is the official currency of the United Kingdom and one of the oldest currencies still in use. Known for its deep liquidity and global influence, it plays a key role in international trade, central bank reserves, and Forex markets, especially during the London session.

Why it’s suitable

Strong ties to major economies. GBP often reacts to both UK and global news, making it ideal for traders who like macro-driven setups.

High volatility in specific hours. The London-New York overlap offers sharp price moves for intraday and news-based strategies.

Clear reaction to economic data. GBP tends to respond clearly to Bank of England decisions and UK-specific releases like CPI or GDP.

- Pros

- Cons

Tight spreads during peak hours. Liquidity in the London session means low costs for scalpers and day traders.

GBP pairs offer rich trade setups. Especially GBP/USD and GBP/JPY, which tend to show strong trends and large intraday swings.

Backed by strong institutions. The UK has a well-developed financial system that supports the pound’s long-term stability.

Sensitive to Brexit-related sentiment. Even post-Brexit, political news can trigger unexpected GBP volatility.

Sharp moves on central bank surprises. Bank of England policy shifts often cause whipsaw reactions, catching unprepared traders off guard.

Can be unforgiving during low liquidity. Outside London hours, spreads widen and price movements become less predictable.

Chinese Yuan (CNY)

The Chinese Yuan (CNY), also known as Renminbi (RMB), is China’s official currency and one of the most heavily traded globally. Managed tightly by the People’s Bank of China, the Yuan plays a key role in international trade and is increasingly used in global reserves and cross-border payments.

Why it’s suitable

China's global trade dominance. As China remains a major exporter, the Yuan’s relevance grows for investors wanting exposure to the world’s second-largest economy.

Gradual internationalization of the Yuan. China is steadily opening capital markets, making CNY more accessible and liquid through Hong Kong and other offshore centers.

Shift in global reserve strategy. Central banks are diversifying reserves beyond the dollar, and many are now adding Yuan for geopolitical and hedging reasons.

- Pros

- Cons

Tied to a strong trade surplus. China’s massive export engine gives the Yuan structural strength, backed by real demand.

Low correlation to Western currencies. CNY can offer portfolio protection when USD or EUR face volatility.

Increasing role in digital payments. With the rise of China’s e-CNY (digital yuan), the currency is gaining a tech edge in global financial systems.

Tightly controlled by the state. The Chinese government controls capital flows and sets daily exchange rate bands, limiting free market influence.

Limited convertibility. Despite progress, the Yuan still faces restrictions on how freely it can be exchanged abroad.

Exposure to political and policy shifts. Trade tensions, regulatory crackdowns, or sudden policy changes can create unpredictable volatility in CNY value.

Understanding the economic situation in Pakistan

Pakistan’s economy in 2025 is seeing sharp contrasts — some numbers are encouraging, while others raise real concerns. Remittances jumped to $3.1 billion in February, thanks mostly to workers in Saudi Arabia and the UAE who are now sending back record amounts. These inflows are helping ease pressure from imports and giving the central bank more breathing room on the reserves front.

GDP is expected to grow 3.0% this year — not huge, but solid considering where the country was just a year ago. Inflation dropped to 1.5% in February, the lowest in almost 10 years, finally giving people some relief on daily expenses. This drop allowed the central bank to cut interest rates again, down to 12% in January. But even with this progress, Pakistan still has over $22 billion in debt repayments due this year, which keeps the pressure high. Balancing debt payments with day-to-day economic needs is still the toughest job for those calling the shots.

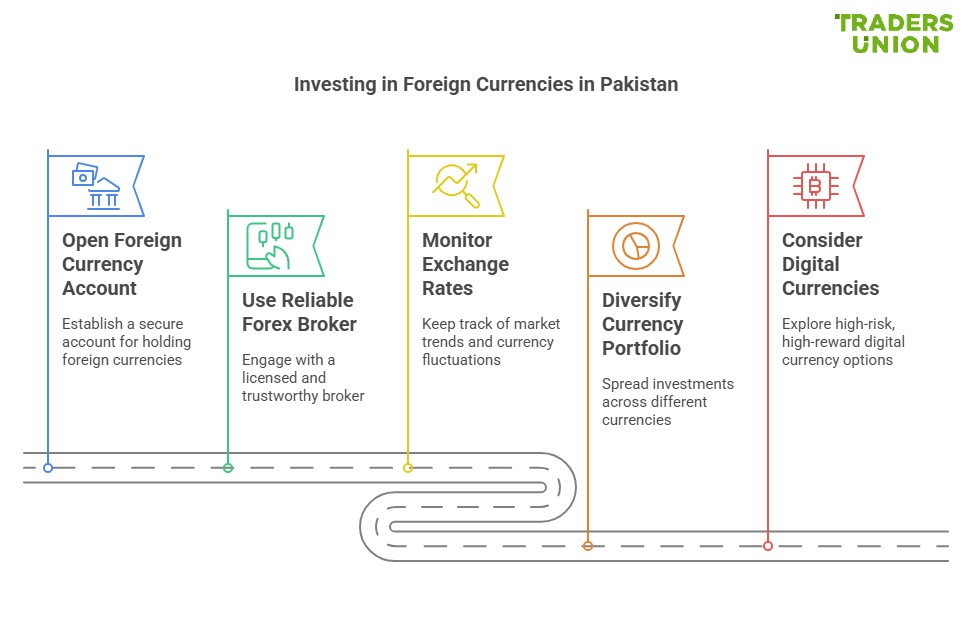

How to invest in foreign currencies in Pakistan

Here’s how to invest in a foreign currency in Pakistan:

Step 1: Open a foreign currency account

Foreign currency accounts let you safely hold and use popular currencies like USD, EUR, or GBP. These accounts are a practical option if you want to keep foreign funds or make international payments without conversion hassles.

Step 2: Use a reliable exchange or Forex broker

Pick a Forex broker that’s licensed in Pakistan so your trades stay legal and protected. Working with registered brokers keeps you safe from fraud and ensures that your money is handled properly.

Here are some of the best Forex brokers in Pakistan:

| Currency pairs | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | ECN Commission | Demo | Deposit fee, % | Withdrawal fee, % | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 100 | 10 | 1:2000 | 0,6 | 1,5 | 3 | Yes | No | No | FCA, CySEC, FSA (Seychelles), FSCA, BVI FSC, CBCS, CMA | 8.9 | Open an account Your capital is at risk.

|

|

| 57 | 5 | 1:1000 | 0,7 | 1,2 | 3,5 | Yes | No | No | CySEC, FSC (Belize), DFSA, FSCA, FSA (Seychelles), FSC (Mauritius) | 9.1 | Open an account Your capital is at risk. |

|

| 60 | 10 | 1:500 | 0,8 | 1,4 | 3,5 | Yes | No | No | SVGFSA | 8.69 | Open an account Your capital is at risk. |

|

| 61 | No | 1:500 | Not supported | Not supported | 3 | Yes | No | No | VARA, AFSA, NBG, MiCAR | 8.5 | Open an account Your capital is at risk. |

|

| 55 | 100 | 1:500 | 0,4 | 1,2 | 3 | Yes | No | 1-3 | ASIC, FSCA, FSC Mauritius | 8.7 | Open an account Your capital is at risk. |

Step 3: Monitor exchange rates & market trends

Currency rates change all the time depending on what’s happening globally. From policy shifts to political drama, many factors can shake the market and affect what you pay or earn.

Staying updated helps you exchange money at better times and avoid bad deals. Use news apps, Forex platforms, and bank alerts to stay ahead and time your moves wisely.

Step 4: Diversify your currency portfolio

Putting money in different currencies can help balance out your gains and losses. When one currency dips, another might be rising — and that mix helps keep your overall risk lower.

Stick to strong currencies but also explore riskier ones for more upside. Combining both adds stability to your investments while leaving room for growth.

Step 5: Consider digital currencies

If you're open to more risk, crypto like Bitcoin can offer growth — but it’s a wild ride. Digital currencies don’t behave like traditional ones and can swing sharply in either direction.

Always research platforms and invest only what you’re comfortable losing. With crypto, smart decisions start with preparation and a healthy dose of caution.

Pakistani investors can profit from remittance-driven currencies and overlooked carry trade gems

While most beginners are told to stick to major currencies like USD or EUR, a smarter play in the Pakistani context is to track the remittance corridors that affect inflows into Pakistan. Focus on currencies from countries with large Pakistani expatriate communities.

Another strategic edge is to leverage carry trade opportunities with lesser-known but high-interest currencies like the Turkish Lira (TRY) or Indonesian Rupiah (IDR). While these currencies might seem volatile, pairing them with PKR or using them in triangular arbitrage trades through digital Forex platforms can allow savvy investors to pocket interest differentials, especially when PKR inflation is on the rise. Combine this with local platforms offering multi-currency holdings, and you’ve got yourself a flexible, growth-oriented portfolio that’s grounded in Pakistan’s unique financial dynamics.

Conclusion

Investing in foreign currencies can be a smart way to protect and grow your wealth in Pakistan. Safe options like USD and EUR provide stability, while CHF and BTC offer growth potential. The right choice depends on your financial goals and risk tolerance.

Diversifying investments and staying informed about market trends is key to maximizing returns. With the right strategy, foreign currency investments can be a valuable part of your financial plan.

FAQs

How does ESG trading affect access to global capital for Pakistani businesses?

ESG-focused trading can actually boost foreign interest in Pakistani firms that meet sustainability standards. Investors and funds with ESG mandates are more likely to allocate capital to businesses with transparent environmental and governance practices, opening new funding doors for local companies that adopt responsible policies.

Can I use PayPal or Wise balances to invest in foreign currencies from Pakistan?

While you can hold balances in different currencies, platforms like PayPal or Wise aren’t designed for active currency investing. They’re more for payments and transfers. For actual returns or currency speculation, you'll need a proper Forex broker or a multi-currency investment platform.

Are there any tax implications for holding or trading foreign currencies in Pakistan?

Yes — foreign currency gains may fall under capital gains tax if they’re part of structured investments or trading activities. Passive holding in a foreign currency account is less likely to trigger taxes, but it’s best to consult a tax advisor to stay compliant with changing regulations.

How can I protect my foreign currency investments if Pakistan tightens capital controls?

Capital controls can limit how you access or move your money. To stay safe, consider using regulated offshore accounts or digital wallets with legal foreign holdings. Avoid keeping all your funds in one place — and stay updated on SBP policy changes.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).