Can You Really Cloud Mine USDT? Real Payouts Or Scam

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

USDT cannot be mined through traditional methods, yet many platforms misleadingly claim to offer free USDT cloud mining. These setups often promise unrealistic returns with little to no effort, but they rarely explain how profits are actually made. More often than not, they lack transparency and operate without any regulatory oversight. Instead of falling for such offers, those interested in earning passive income with USDT should explore legitimate options like staking or liquidity mining on well-known DeFi platforms.

USDT is not mined like traditional cryptocurrencies — it is issued by the company Tether when clients deposit fiat currency, with tokens minted on a one-to-one basis. Despite this, several platforms aggressively promote so-called “USDT cloud mining,” promising daily profits and instant payouts. But how realistic are these offers — and what really lies behind the flashy dashboards, signup bonuses, and promises of passive income?

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Dangers of USDT cloud mining

Many of these services mimic real crypto investment tools but provide no access to actual blockchain activity. A typical USDT cloud mining site might show users a fake earnings dashboard with fabricated data that mimics real transactions. Once you sign up, you’ll usually be pushed toward a paid plan or asked to pay a withdrawal fee. If you don’t comply, the platform will block access or lock your account entirely.

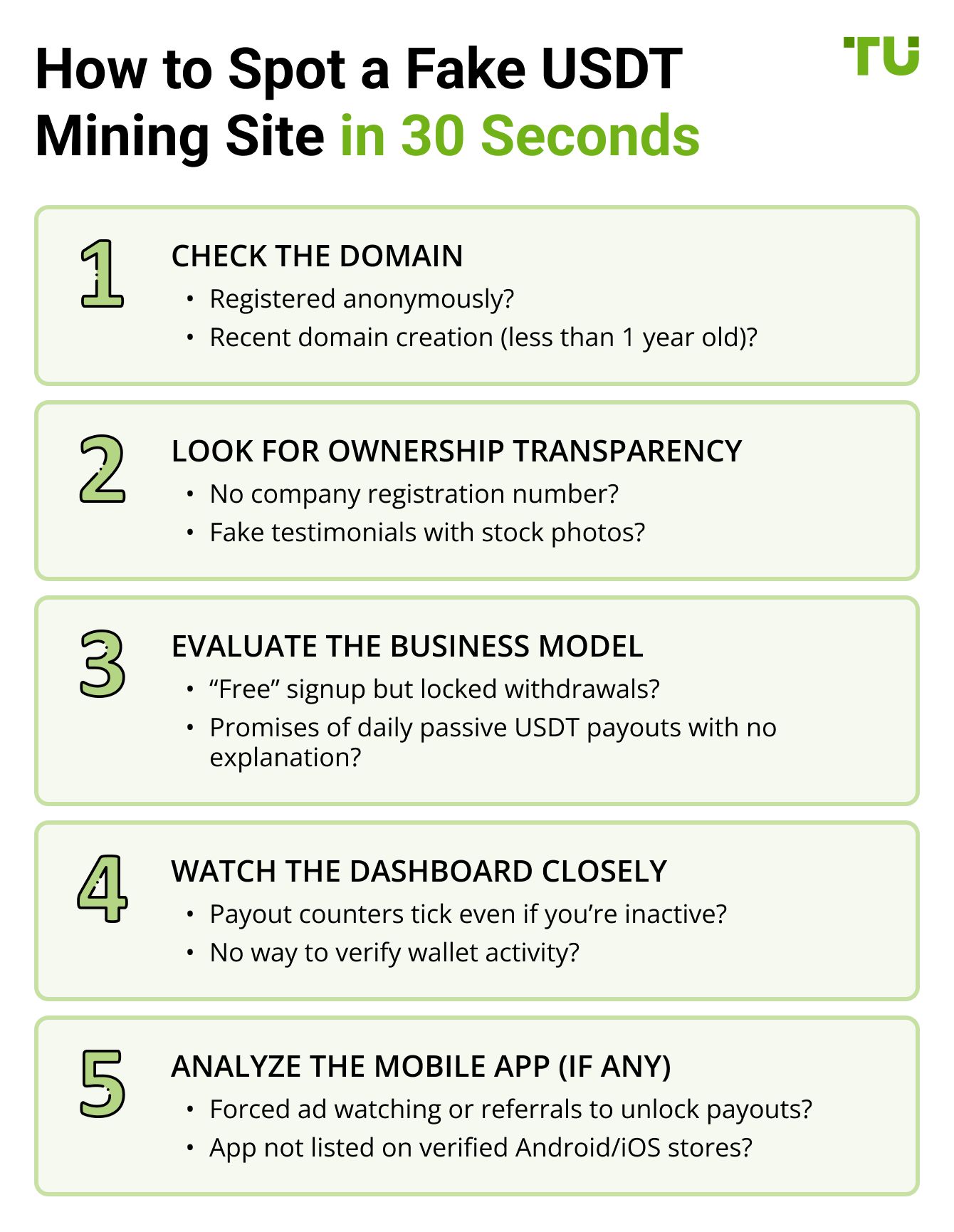

One red flag across nearly every cloud mining of USDT site is the total absence of transparency. You’ll find no legal business names, no clear company registration, and often no legitimate contact options. A quick domain search will usually show that these websites were registered anonymously, often via offshore services. These sites also tend to disappear within months, only to resurface under different names using the same design templates. Many of the older versions have even been flagged in scam databases.

What these schemes all have in common is that they simulate the experience of mining without doing anything on-chain. There’s no way to verify payouts, no proof of any real asset movement, and every deposit tends to trigger a chain of extra charges. These can range from service fees to ID verifications, all of which aim to extract more money. So far, there have been no proven cases of users successfully withdrawing funds from any of these platforms.

Mobile apps for “USDT cloud mining”

But not all USDT cloud mining sites are scams. Some platforms use a legitimate model tied to other mineable assets. Most people think USDT cloud mining for free means tapping a few buttons on an app and watching Tether roll in passively. But what often gets missed is how these apps actually work. Legitimate USDT cloud mining models don’t mine Tether itself, since Tether is a stablecoin, not a mineable asset. What these platforms really do is lease out backend processing power tied to Proof-of-Work coins like Bitcoin, and then convert your share of the mining rewards into USDT. Free apps use limited CPU credit or ad-based mining pools to offer entry without upfront investment, but the real challenge lies in payout thresholds and sustainability.

A key detail most beginners overlook is how USDT cloud mining app models are monetized. Many of the free apps on Android or iOS run reward-based systems where users must watch ads or invite friends to earn mining speed boosts. However, only a handful are linked to actual mining infrastructure. The truly functional apps often allow hash rate purchases using in-app wallets, while masking deeper risks like withdrawal delays or backend liquidity issues. Unless the app is audited or transparent about the origin of mined funds, it's likely a high-risk passive income trap.

One fascinating trend is the shift toward gamified interfaces in cloud powered free USDT mining apps. Instead of charts and dashboards, users now interact with mining pets, simulated vaults, or animated drilling rigs. These visual tricks increase daily logins but often mask poor economics. The UX may feel fun, but the backend usually offers tiny daily returns, often under 0.1 percent, unless you buy premium speed. That means the user is usually the product, not the customer. Real value lies in platforms that show you exactly how hash power is allocated and what tokens are mined on your behalf.

It's also worth noting that cloud mining of stablecoins like USDT is sometimes just a clever front for other financial products. Several apps claiming to offer USDT cloud mining for free are actually staking wrappers or disguised HYIP (high-yield investment program) platforms. The key sign is unrealistic daily returns with minimal KYC or infrastructure proof. If there’s no mention of mining pool IDs, power consumption reports, or on-chain payouts, you're not mining, you’re funding a Ponzi. Stay sharp, especially when apps promise easy USDT just for tapping a screen.

| App Name | Monetization Model | Withdrawal Possible? | Smart Contract Verified? | Risk Level |

|---|---|---|---|---|

| USDT Miner App | Ads, referrals, in-app purchases | (threshold & delays) | No | High |

| Tether Mining Sim | Gamified UX, fake boosters | (fake confirmations) | No | Very High |

Alternatives to cloud USDT mining and how to actually earn

Although USDT isn’t a mineable asset in the traditional sense, several practical financial tools allow users to earn returns denominated in USDT. Rather than chasing unrealistic promises tied to free USDT mining cloud schemes, it’s more effective to explore legitimate alternatives that offer real value.

Liquidity mining on DeFi platforms

One proven method is to provide USDT to liquidity pools on decentralized protocols. These pools support token swaps, and liquidity providers earn a share of the transaction fees. Often, platforms also offer rewards in governance tokens, which users can convert back to USDT. For those looking for USDT cloud mining sites but seeking real results, this form of yield farming is a transparent and reliable route.

Key facts:

supply USDT to a liquidity pool on a decentralized exchange, like Uniswap, Curve, or PancakeSwap;

earn a share of trading fees (~2–8% APY from fees) + potential token rewards;

take bonus governance tokens (e.g., CRV, CAKE, BAL).

Staking through centralized platforms

Several exchanges give users the opportunity to earn interest on USDT deposits. This is not liquidity mining but more aligned with lending or platform-run yield programs. For individuals interested in passive income without diving into DeFi, this model offers a dependable alternative to unreliable free USDT cloud mining services. Annual returns typically range between 3% and 12%, depending on the lock-up duration and platform policies.

Key facts:

deposit USDT on platforms like Binance, Bybit, OKX, Crypto.com;

choose between flexible or locked staking plans (e.g., 30–90 days);

earn ~3% to 12% APY, depending on duration and platform terms;

funds typically protected by internal risk controls and, in some cases, insured.

Cloud mining of other coins with USDT payouts

Many platforms also let users lease computational resources to mine cryptocurrencies. The profits are generated in the base coin and then automatically converted to USDT before payout. Though this isn’t technically a USDT cloud mining service, it provides a stable and predictable way to earn in Tether while avoiding direct exposure to volatile coins.

Key facts:

use platforms like NiceHash, Bitdeer, or Genesis Mining;

mine real cryptocurrencies (e.g., Bitcoin), receive payouts in converted USDT;

monitor profitability based on network conditions and contract duration;

ideal for those who want mining exposure but prefer stable USDT earnings.

Cashback and farming programs on CEX platforms

Some centralized exchanges run cash back events and farming programs that reward users in USDT for completing simple actions like registering, completing KYC, or holding specific tokens. For traders seeking alternatives to unreliable Tether cloud mining claims, these campaigns offer a safer, verified path to earning.

Key facts:

join events or complete tasks on platforms like Bybit, KuCoin, Gate.io;

earn instant or time-locked USDT bonuses (typically $1–$20 per task);

stake native tokens or stablecoins to participate in farming events;

zero risk of deposit loss; ideal for beginners seeking no-investment options.

Instead of chasing misleading or fraudulent promotions labeled as free cloud mining USDT, users would benefit more from exploring DeFi platforms, centralized staking options, or cloud mining services that pay in USDT. These alternatives provide a more secure and sustainable way to grow crypto holdings without relying on hype-driven schemes. Below we have presented the top platforms supporting these alternatives.

| Foundation year | USDT | Staking | Yield farming | NFT | Crypto bonuses | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| 2017 | Yes | Yes | Yes | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| 2011 | Yes | Yes | Yes | Yes | Yes | No | 8.48 | Open an account Your capital is at risk. |

|

| 2016 | Yes | Yes | Yes | Yes | Yes | Malta Financial Services Authority | 8.36 | Open an account Your capital is at risk. |

|

| 2018 | Yes | Yes | No | No | Yes | No | 7.41 | Open an account Your capital is at risk. |

|

| 2012 | Yes | Yes | Yes | Yes | No | No | 6.89 | Open an account Your capital is at risk. |

Check real wallet activity before trusting any USDT cloud mining website or free earning offer

A lot of beginners looking for a USDT cloud mining website get distracted by sleek dashboards and fake payout counters. But the smartest thing you can do is dig deeper. Use a block explorer to check if the site’s wallet is actually active. If the flow of funds looks static or artificial, you’re probably just watching an animation, not earning anything. Many of these platforms create the illusion of mining without real-time payouts or any computational backing. Don’t rely on shiny buttons. Look at what the blockchain says.

Now here’s the part that most users overlook: some websites offering free cloud mining of USDT are really just harvesting your data. While you’re watching your fake balance grow, the site might be collecting your IP info, browser activity, or device ID. If you’re forced to invite others or complete odd tasks just to “unlock” your wallet, that’s a red flag. Trustworthy platforms let you connect a real wallet and withdraw without hoops. If you can’t trace where the money’s coming from, it’s not mining, it’s a trap.

Conclusion

The issuance mechanism of USDT does not support mining, so services offering “USDT cloud mining” are not aligned with technical reality. Earning income in USDT involves alternative tools with verifiable models. These include decentralized liquidity pools, staking on centralized platforms, and cloud mining of other cryptocurrencies with payouts in USDT. When selecting a method, it is necessary to assess the fund distribution logic and technical infrastructure. Using auditable contracts, transparent reporting, and traceable reward structures reduces exposure to capital loss.

FAQs

How can I verify if a platform actually pays out in USDT

Check for a smart contract address, transaction history, and blockchain explorer records. If earnings appear only in the user dashboard and not on-chain, it's a simulation.

Is it possible to earn USDT without using DeFi or mining

Yes, by offering digital services or content priced directly in USDT, such as subscriptions, consulting, licensing, or access to data.

What risks are associated with automatic conversion to USDT

Risks include hidden fees, unfavorable exchange rates, and lack of control over when value is locked in.

What does fixed income in USDT mean and how is it backed

It refers to a predetermined payout in nominal terms, independent of market fluctuations. It’s backed by internal fund allocation or contractual commitments.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

A Ponzi scheme may be defined as a fraudulent scheme in which the perpetrators attract investors and pay them a relatively small profit from new investors just before the criminals abscond with the overwhelming bounty of the funds.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.