Galaxy Digital Crypto Investments: An Overview

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Galaxy Digital holds a diversified crypto portfolio with major assets like Bitcoin, Ethereum, and Solana, alongside stablecoins for liquidity. Beyond investing, it runs a Bitcoin mining facility, backs over 220 startups, and launched a $113M early-stage fund. Its initiatives include stablecoin partnerships, secure custody tech, and gaming ventures through Galaxy Interactive. The firm’s strategy balances innovation and stability.

Galaxy Digital, founded by Mike Novogratz, is one of the key industry leaders in the crypto space. The firm operates as a diversified financial services company focused on cryptocurrencies and blockchain investments. Through its investment division, Galaxy Digital's collection of cryptocurrency holdings includes strong and diverse investments across different areas of the market, such as blockchain-based financial services, core and scaling blockchain networks, and digital art and collectibles markets.

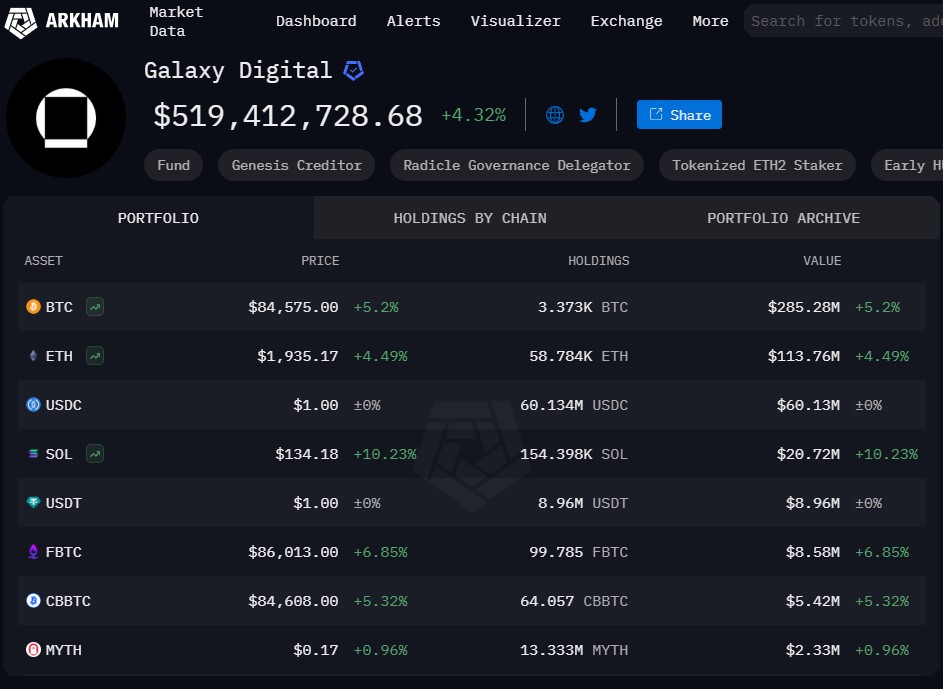

Breakdown of Galaxy Digital cryptocurrency holdings

Galaxy Digital focuses on backing promising blockchain projects while holding a mix of top cryptocurrencies and stable assets. Its portfolio includes major names like Bitcoin, Ethereum, and Solana, along with stablecoins for added stability. By spreading out its investments, the firm aims to balance long-term growth with easy access to funds, helping manage market ups and downs.

| Asset | Price | Holdings | Value |

|---|---|---|---|

| Bitcoin (BTC) | $84,575.00 | 3.373K BTC | $285.28M |

| Ethereum (ETH) | $1,935.17 | 58.784K ETH | $113.76M |

| USD Coin (USDC) | $1.00 | 60.134M USDC | $60.13M |

| Solana (SOL) | $134.18 | 154.398K SOL | $20.72M |

| Tether (USDT) | $1.00 | 8.96M USDT | $8.96M |

| Ignition FBTC (FBTC) | $86,013.00 | 99.785 FBTC | $8.58M |

| Coinbase Wrapped BTC (CBBTC) | $84,608.00 | 64.057 CBBTC | $5.42M |

| Mythos (MYTH) | $0.17 | 13.333M MYTH | $2.33M |

Galaxy Digital's Crypto venture: Expanding market influence

Galaxy Digital has been a trailblazer in the crypto space, engaging in ventures that are both innovative and influential. Here are some specialized insights into their unique initiatives:

Early-stage venture fund. In July 2024, Galaxy Digital launched its inaugural Galaxy Ventures Fund I LP, securing an initial close of $113 million. This fund is dedicated to investing in early-stage companies developing crypto protocols, software infrastructure, and financial applications.

Global stablecoin collaboration. In November 2024, Galaxy Digital joined forces with companies like Robinhood and Kraken to introduce the Global Dollar Network. This initiative aims to accelerate the worldwide adoption of stablecoins, providing economic benefits to its partners.

Strategic portfolio investments. Galaxy Ventures has invested in over 220 portfolio companies, focusing on cutting-edge founders, technologies, and business models across software infrastructure, financial applications, protocols, and consumer use cases.

Bitcoin mining operations. Galaxy Digital operates a state-of-the-art Bitcoin mining facility in Dickens County, Texas, known as Helios. This facility emphasizes quality infrastructure and access to low-cost energy, serving as a cornerstone of their successful mining operations.

Custodial technology services. Through its Digital Infrastructure Solutions, Galaxy offers enterprise-grade custody platforms for financial institutions, ensuring secure management of blockchain-based assets without relying on third-party custody.

Interactive media investments. Galaxy Interactive, a division of Galaxy, is a stage-agnostic venture capital franchise focused on companies operating at the intersection of content, finance, and technology, with an emphasis on gaming and virtual worlds.

Financial impact and market reactions

In November 2024, Galaxy Digital's hedge fund strategy saw an impressive 43% jump, bringing its annual growth to 90%. This surge happened mainly because investors expected friendlier crypto regulations after Donald Trump's election win. The hope for upcoming policy changes sparked a big surge in digital currencies, with Bitcoin breaking past the $100,000 mark for the first time.

In January 2024, the U.S. Securities and Exchange Commission (SEC) gave the green light to 11 Bitcoin ETFs, making it easier for more people to invest. This move boosted confidence in Bitcoin and helped its price soar by 130% that year, pushing the total value of major cryptocurrencies to $3.5 trillion. Galaxy Digital's smart moves helped it ride this wave, cementing its top spot in crypto investments.

Ethical considerations and regulatory scrutiny

Galaxy Digital operates in a high-stakes regulatory landscape, facing complex ethical and compliance challenges that most overlook. Here are some lesser-known insights:

Regulatory arbitrage risks. Galaxy Digital operates across multiple jurisdictions, but shifting regulations can force sudden exits or restructuring, impacting investors and project partnerships.

Shadow compliance pressure. Even when not explicitly targeted, Galaxy must adjust to regulatory shifts that impact banking partners, liquidity providers, and trading desks, creating unseen constraints.

Token classification dilemmas. Holding certain tokens can be risky as they may retroactively be classified as securities, leading to compliance headaches or forced divestment.

Hidden counterparty exposures. Unlike traditional finance, crypto firms deal with opaque counterparties. Galaxy has to assess risks that aren’t always clear from balance sheets or public records.

Whale manipulation scrutiny. Large holdings in Bitcoin, Ethereum, and other assets mean Galaxy’s trades can move markets, drawing attention from regulators who monitor price manipulation concerns.

Custody challenges for institutions. Managing crypto at scale involves security risks, regulatory hurdles, and insurance gaps that traditional finance doesn’t face, requiring constant adaptation.

Galaxy Digital's cryptocurrency strategy

Galaxy Digital's cryptocurrency strategy leverages its expertise across various sectors to drive innovation and adoption in the digital asset space. Here's an overview:

Integrated business model. Galaxy Digital operates across three main divisions: Global Markets, Asset Management, and Digital Infrastructure Solutions. This structure allows the firm to offer a comprehensive suite of services, from trading and lending to asset management and blockchain infrastructure development, providing clients with end-to-end solutions in the digital asset ecosystem.

Strategic partnerships. By collaborating with traditional financial institutions, Galaxy Digital bridges the gap between conventional finance and the crypto world. These partnerships facilitate the development of innovative financial products, such as cryptocurrency exchange-traded funds (ETFs), making digital assets more accessible to a broader range of investors.

Focus on blockchain infrastructure. Beyond cryptocurrencies, Galaxy Digital invests in the underlying blockchain technology. By supporting projects that enhance blockchain scalability, security, and interoperability, the firm aims to drive the next wave of technological innovation in the industry.

Thought leadership and research. Galaxy Digital produces in-depth research and insights on market trends, regulatory developments, and technological advancements. This commitment to thought leadership not only informs their strategic decisions but also educates the broader community about the evolving digital asset landscape.

Commitment to regulatory engagement. Understanding the importance of a clear regulatory framework for the growth of digital assets, Galaxy Digital actively engages with policymakers and regulators. This proactive approach ensures that the firm's operations align with evolving legal standards and contributes to shaping policies that foster industry growth.

If you wish to begin your crypto investing journey, the first step is to open an account with a reputed crypto exchange. We have researched the market and prepared a list of the top crypto exchanges for beginners. You can compare them through the table below and choose one for yourself:

| Crypto | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Copy trading | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2017 | 10 | 329 | 0,1 | 0,08 | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2004 | No | 1817 | 0 | 0 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Future outlook: What’s next for Galaxy Digital in crypto?

As the crypto industry matures, Galaxy Digital is expected to make significant strategic moves to maintain its dominance:

Expand institutional crypto adoption. The firm aims to increase institutional participation by offering new investment products and regulatory-compliant solutions. With over $500M in assets, its credibility among traditional financial players continues to grow.

Increase investment in tokenization. Real-world asset tokenization is a growing trend. Galaxy Digital plans to expand its exposure to tokenized bonds, real estate, and commodities, mirroring institutional demand for blockchain-powered financial products.

Enhance liquidity reserves. With $60.13M in USDC and $8.96M in USDT, Galaxy Digital is well-positioned to handle market volatility while ensuring smooth operational liquidity.

Growth in DeFi and Web3 Sectors. The company is expected to invest further into Web3 startups and DeFi platforms, strengthening its position in decentralized finance and emerging blockchain applications.

New Crypto ETFs and derivatives. Galaxy Digital is actively advocating for new exchange-traded funds (ETFs) and derivative products, providing investors with regulated exposure to crypto assets.

Risks and warnings

Investors considering Galaxy Digital or its associated assets should be aware of:

Market risks. Crypto volatility can lead to rapid losses.

Regulatory challenges. Uncertain global policies could impact investment strategies.

Security concerns. The crypto industry remains a target for hacks and fraud.

Liquidity issues. Some investments may have limited liquidity, making exits difficult.

Galaxy Digital secretly buys crypto and bets on future market leaders

Galaxy Digital doesn't just hold crypto — it actively shapes market movements through strategic positioning that most investors overlook. One key insight is its focus on illiquid but high-potential assets. While most firms stick to highly tradable coins like Bitcoin and Ethereum, Galaxy often takes positions in lower-volume tokens before they gain mainstream traction.

This means they’re not just betting on existing market leaders — they're setting the stage for future dominance by acquiring undervalued assets and building infrastructure around them. For a beginner, this is a lesson in early positioning — the biggest returns don’t come from following trends but from identifying them before the rest of the market does.

Another crucial but little-known strategy is Galaxy’s use of OTC (over-the-counter) trading to control market impact. When a big player like Galaxy Digital makes a move, the price of an asset can spike or drop dramatically.

To avoid this, they often accumulate large holdings privately through OTC desks instead of public exchanges, allowing them to enter and exit positions without causing volatility. Beginners can take a page from this playbook — learning to monitor OTC activity can reveal where smart money is flowing before it reflects on charts, giving you an edge in predicting the next big market moves.

Conclusion

Galaxy Digital has established itself as a dominant force in the cryptocurrency industry, with a diversified portfolio spanning Bitcoin, Ethereum, DeFi, NFTs, and blockchain infrastructure. While its influence continues to grow, investors should remain mindful of risks associated with market volatility and regulatory challenges.

FAQs

What cryptocurrencies are in Galaxy Digital’s portfolio?

Galaxy Digital holds Bitcoin, Ethereum, Solana, Avalanche, Polkadot, and investments in DeFi projects like Aave and Uniswap.

How much is Galaxy Digital’s crypto portfolio worth?

The value fluctuates with market conditions, but Galaxy Digital manages billions in digital assets across various investment funds and direct holdings.

Is Galaxy Digital a good investment?

While Galaxy Digital offers exposure to the crypto market, investors should assess its risks, including volatility and regulatory uncertainty, before investing.

What is Galaxy Ventures?

Galaxy Ventures is the investment arm of Galaxy Digital that funds blockchain startups and emerging crypto projects with high growth potential.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.