Hut 8 Mining Review | All You Need To Know

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Hut 8 Mining Corp. stands out as a prominent Bitcoin mining company recognized for its cutting-edge strategies, dedication to sustainability, and substantial mining capabilities. Based in North America, the company manages some of the largest and most advanced mining operations in the region.

Hut 8 Mining Corp. is a top-tier Bitcoin mining company dedicated to maximizing mining efficiency while prioritizing sustainability. As one of the largest publicly traded Bitcoin mining firms, Hut 8 is a key player in the rapidly evolving blockchain industry. This article offers an in-depth analysis of the company, exploring its operations, performance, and investment potential.

History of the Hut 8 Mining

Established in 2017, Hut 8 Mining has grown into one of North America’s largest cryptocurrency mining companies. Headquartered in Canada, the company specializes in Bitcoin mining, emphasizing the use of sustainable energy solutions. Publicly listed since 2018, Hut 8 has expanded its operations by adopting cutting-edge technologies and forging strategic partnerships. Renowned for maintaining significant Bitcoin reserves, the company remains committed to innovation and environmental sustainability within the cryptocurrency mining industry.

Hut 8 Mining road map:

2017: Established as Hut 8 Mining Corp., focusing on Bitcoin mining.

2018: Listed on the Toronto Stock Exchange, becoming one of the first publicly traded crypto mining companies.

2020: Implemented renewable energy initiatives to reduce environmental impact.

2025: Hut 8 Mining reached a hash rate of 7.2 EH/s, solidifying its position as a leader in sustainable Bitcoin mining.

Who is the owner of Hut 8 mining?

Hut 8 Mining is a publicly traded company, meaning it is owned by its shareholders. As of February 2024, the Chief Executive Officer is Asher Genoot, who succeeded Jaime Leverton. The company's Board of Directors includes Chairman Bill Tai and other members.

Where can I buy company shares/products?Hut 8 Mining Corp. shares can be purchased through brokerage platforms. We have listed the top options for purchasing these shares.

| Hut stock | Demo | Account min. | Interest rate | Basic stock/ETF fee | Foundation year | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | Yes | No | No | $3 per trade | 2007 | Open an account Via eOption's secure website. |

|

| Yes | No | No | 1 | Zero Fees | 2014 | Open an account Via Wealthsimple's secure website. |

|

| Yes | No | No | 0,15-1 | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | 2015 | Study review | |

| Yes | Yes | No | 4,83 | 0-0,0035% | 1978 | Open an account Your capital is at risk. |

|

| Yes | No | No | 0,01 | Zero Fees | 2011 | Study review |

Interesting facts

Hut 8 Bitcoin holdings. With approximately 10,096 BTC as of Q1 2025, Hut 8 maintains one of the largest reserves among Bitcoin mining companies.

Operational upgrades. Hut 8 is upgrading its mining fleet with shipments starting January 2025. The upgrades will improve efficiency to 19.9 joules per terahash to lower energy use.

Vega project progress. The 205 MW Vega project is on track, with energization expected by Q2 2025. This project is expected to boost their mining power significantly.

Financial moves. In October 2024, Hut 8 converted a $38 million loan into equity at $16.39 per share. This helped reduce debt and improve financial stability.

Market buzz. There has been a noticeable increase in call option trades, indicating growing investor confidence in the company’s performance.

AI data center rumors. Speculation suggests Hut 8 might be involved in a $12 billion AI data center project, possibly partnering with Meta. If true, this would diversify its focus beyond crypto mining.

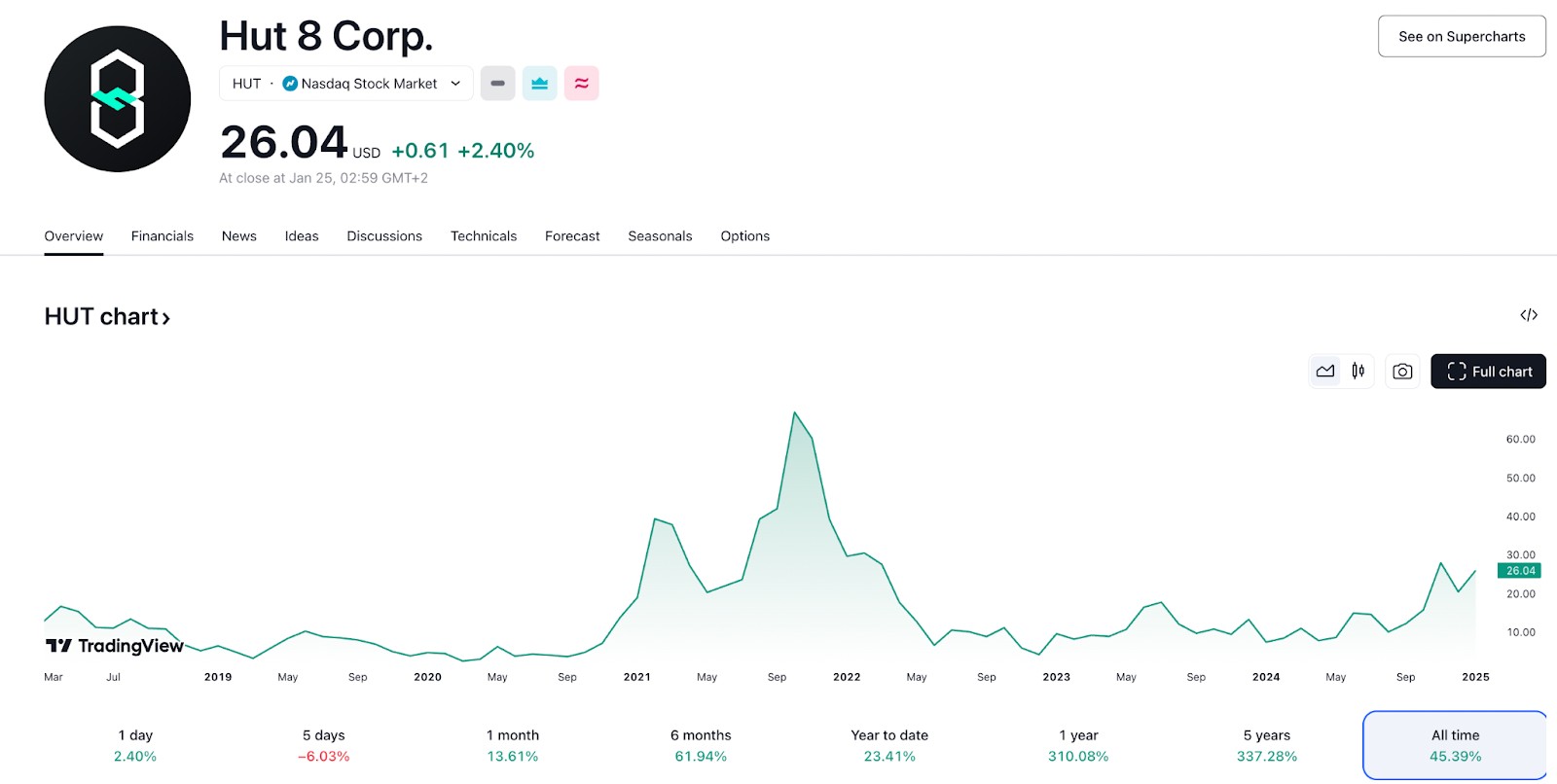

Stock performance. The company’s stock is currently priced at $23.50. This reflects a dip due to recent Bitcoin price fluctuations.

Key features of Hut 8 Mining

Diversified operations. Hut 8 isn’t just a Bitcoin miner. They run high-performance computing (HPC) data centers in British Columbia and Ontario that offer cloud services, colocation, and connectivity. These centers support advanced tech needs like AI, machine learning, and visual effects rendering.

Energy infrastructure expertise. Hut 8 takes a proactive approach to managing energy costs. Their in-house energy team focuses on optimizing usage with tools like forward hedging and purpose-built energy curtailment software to lower costs and boost efficiency.

Expanding projects. The company has ambitious plans to manage over 1 gigawatt (GW) of energy capacity. This includes acquisitions and new projects, like a recently announced site in the Texas Panhandle.

Revenue diversity. While mining remains a key focus, about 30% of Hut 8’s revenue comes from traditional, fiat-based services. This helps them remain stable amid crypto market fluctuations.

How to start using Hut 8 Mining

Hut 8 Mining Corp. is not a consumer-facing platform but offers opportunities for investors and stakeholders:

Invest in Hut 8 stock. Available on TSX and NASDAQ under the ticker symbol HUT.

Understand their model. Familiarize yourself with Hut 8’s blockchain technology and its impact on the cryptocurrency ecosystem.

Monitor updates. Follow Hut 8’s official website and press releases for operational updates and performance reports.

How Hut 8 Mining Corp. operates

Hut 8's crypto mining operations employ state-of-the-art ASIC mining rigs to validate Bitcoin transactions on the blockchain network. Its operations are supported by:

Aim for steady growth. Hut 8 Mining Corp. focuses on sustainable growth, investing in green practices and cutting down on energy bills. Their use of clean energy sources gives them an edge over competitors by reducing long-term costs, which is crucial for beginners looking for companies with a forward-thinking approach.

Building a long-term asset base. Hut 8 not only mines Bitcoin but also holds a large Bitcoin stash as part of their long-term strategy. This means they’re benefiting from both mining operations and Bitcoin’s potential appreciation as an asset. As a beginner, this shows how mining companies can be successful by balancing production with asset management.

Taking advantage of price dips. Hut 8 buys Bitcoin strategically during market dips, growing their reserves without relying solely on mining. This approach strengthens their financial strength and allows them to profit from Bitcoin's price movements. Understanding this practice helps beginners recognize how miners can capitalize on market timing.

Building up resources. Hut 8 continually invests in its infrastructure, ensuring it can scale up operations efficiently. This makes them one of the most adaptable players in the mining market. Beginners should look for companies that prioritize scalability, as this ensures long-term success and competitiveness.

Appealing to big investors. Hut 8’s approach of holding and accumulating Bitcoin makes them attractive to institutional investors, helping them benefit from the growing demand for Bitcoin. For beginners, this is a reminder of how institutional interest can boost a company's performance and influence Bitcoin’s price.

Hut 8 mining's diversification and energy strategies can benefit beginners

For beginners thinking about investing in Hut 8 Mining, an important thing to consider is how well the company adjusts to market changes. Hut 8 isn’t just about Bitcoin mining; they also offer digital asset storage and hosting, giving them multiple ways to make money. This helps guard against the ups and downs of cryptocurrency prices. By diversifying their income streams, they reduce their reliance on Bitcoin’s volatile market, making Hut 8 a more stable choice for new investors.

Another thing to look at is Hut 8’s approach to energy use. With energy costs on the rise, how the company manages its power consumption is crucial. Hut 8 is focused on using energy wisely, partnering with renewable energy providers, and optimizing their mining hardware to stay cost-effective. For beginners, understanding how Hut 8 minimizes risks related to energy costs gives the company an edge over competitors who may not be as proactive in managing their energy usage.

Summary

Hut 8 Mining Corp. is recognized as one of the most reliable names in the cryptocurrency mining industry. Leveraging innovative infrastructure, advanced blockchain technology, and a strong commitment to sustainability, the company remains at the forefront of the sector. Its focus on energy-efficient operations and transparent reporting positions it as an appealing option for investors. However, factors such as Bitcoin price volatility should be carefully evaluated.

FAQs

What does Hut 8 Mining Corp. do?

Hut 8 specializes in Bitcoin mining, blockchain transaction validation, and digital asset accumulation.

Who is the owner of Hut 8 Mining?

Andrew Kiguel founded Hut 8 Mining.

What is Hut 8’s merger date?

Hut 8 finalized a merger in March 2024 to expand its digital infrastructure capabilities.

How to buy Hut 8 stock?

Purchase HUT stock via TSX or NASDAQ-listed platforms.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.