How MicroStrategy Turned Bitcoin Into A Corporate Strategy

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

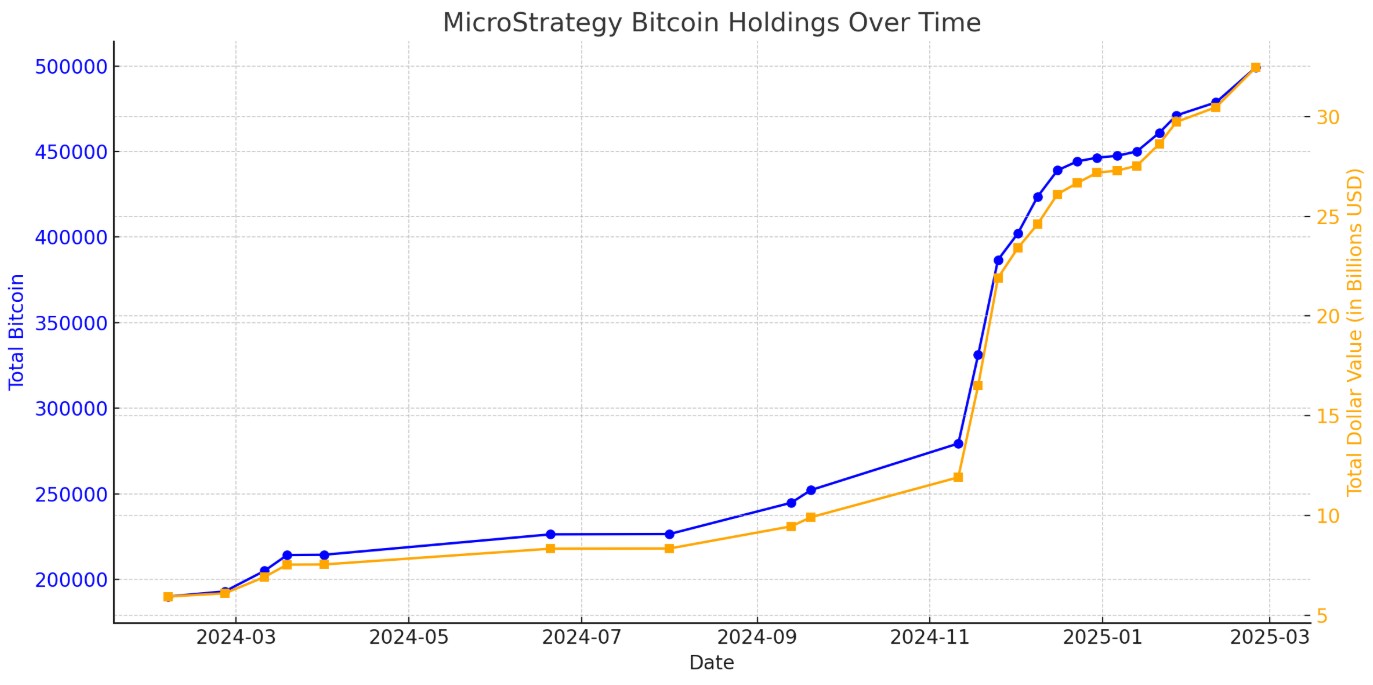

MicroStrategy (now known as Strategy) transformed from a traditional software firm into a Bitcoin-heavy strategy company, using its balance sheet to gain massive crypto exposure. Instead of parking cash in low-yield assets, it leveraged debt and equity to buy over 550,000 Bitcoins, turning digital scarcity into a financial engine. This became not just an investment, but a new corporate model.

MicroStrategy’s Bitcoin play is not just about stacking coins. It is about challenging how companies manage their cash when trust in fiat is stretched. Instead of parking funds in low-yield assets, they went the other way, turning their balance sheet into a high-risk high-reward engine powered by digital scarcity. And this was not a single wild bet. It was done with full belief and strategy, which is part of how the company thinks now. In this article, we will analyze MicroStrategy’s Bitcoin strategy, with key details into the way the company thinks.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

What is MicroStrategy?

MicroStrategy (now known as Strategy) started out as a tech company focused on business analytics but has taken a dramatic turn that has caught the attention of both investors and crypto followers. Today, it is known not just for its software but also for betting big on Bitcoin. If you are new to this space, MicroStrategy is a great example of how a company can take a bold direction and change the game.

Company overview and history

MicroStrategy was launched in 1989 by Michael Saylor and Sanju Bansal. Their goal was to help businesses understand and use their data better. The company grew quickly in the world of business intelligence and landed big-name clients like Visa and Coca-Cola.

A few things that shaped its early journey

Based in Virginia, MicroStrategy became known for its enterprise-level software solutions.

It went public in 1998 and reached a massive valuation during the early internet boom.

In 2000, it ran into financial trouble due to accounting issues but recovered after cleaning up its operations.

Over time, it built a steady business helping companies make better decisions using data.

Transition from software to Bitcoin investment

In 2020, MicroStrategy made a move no one expected. It started investing its cash into Bitcoin instead of holding on to dollars. This was not just a small shift but a complete change in how the company thought about value and future growth.

Why MicroStrategy went all in on Bitcoin

The company believed holding cash was risky because of rising inflation.

Michael Saylor saw Bitcoin as a safer way to protect company money in the long run.

Their first Bitcoin purchase was worth $250 million and it marked the beginning of something big.

What happened after that

MicroStrategy started using loans and selling bonds to buy even more Bitcoin.

It created a separate company, MacroStrategy, just to hold and manage its crypto.

The move attracted attention from both Wall Street and crypto fans alike.

What this means for its identity

Now MicroStrategy is part software firm, part Bitcoin powerhouse.

Its share price often moves with Bitcoin, not just its earnings.

It now appeals to a very different group of investors than it did a few years ago.

Understanding MicroStrategy's Bitcoin acquisition approach

When MicroStrategy began buying Bitcoin, it did not do it halfway. The company followed a clear plan, putting serious money behind its belief that Bitcoin is a better way to hold value than cash. For beginners, this is a textbook example of how a company can go all in on a new asset while keeping its finances strong.

Initial investments and rationale

In August 2020, MicroStrategy made headlines by buying a large amount of Bitcoin. But this was not just a headline grab. The company was trying to protect its cash from losing value.

Here is what pushed the decision

Inflation was rising and returns on cash were almost nothing.

Bonds and gold did not seem exciting or useful for the long term.

CEO Michael Saylor believed Bitcoin was the best way to protect money from getting weaker.

How they started out

The first Bitcoin purchase was worth $250 million.

A second round added $175 million more just weeks later.

In total, they held over $400 million in Bitcoin within a short period.

This was not a trial run. It was the start of something big.

Methods of financing Bitcoin purchases

To keep buying Bitcoin without hurting the company’s core business, MicroStrategy came up with smart ways to raise money. It did not rely only on savings. Instead, it used a mix of stocks, bonds, and new types of shares.

Issuing common stock

The company sold new shares directly into the market whenever needed.

This gave them fresh funds without taking big financial risks.

Shareholders supported it because the Bitcoin bet made the company more valuable.

Convertible debt offerings

MicroStrategy raised money by giving out loans that could turn into shares later.

These loans had low interest and long timeframes.

It was a way to bring in cash without giving up control or selling assets.

Preferred stock sales

In 2024, the company tried something new by offering preferred shares.

These shares offered steady returns and were aimed at big investors.

It gave MicroStrategy a new pool of funds without adding regular debt.

Why it worked well

The company raised over a billion dollars using all these methods.

They never had to sell their Bitcoin to cover costs.

Each move was well-timed and showed that the company understood both markets and money.

Analyzing the financial implications

MicroStrategy’s decision to buy Bitcoin did not just change its strategy. It changed its entire financial identity. From how its balance sheet looks to how investors judge its value, everything now revolves around Bitcoin. Let us walk through how deep this shift really is.

Impact on MicroStrategy's balance sheet

MicroStrategy used to be a typical software company when it came to its finances. That is not the case anymore. Bitcoin now dominates the asset side of its books.

How the balance sheet has changed

As of 2025, MicroStrategy owns over 550,000 Bitcoins.

At current prices of about $95,000 per Bitcoin, this is worth over $52 billion.

Bitcoin now makes up nearly all of its assets, overshadowing software and services.

What this means for the numbers

Bitcoin is reported at cost or lowest value if prices drop, so assets look smaller than they are in bull runs.

This hides huge gains, but investors still see the upside and price it into the stock.

The company has borrowed money to buy more Bitcoin, pushing debt levels up significantly.

Liquidity looks weaker on paper, but Bitcoin gives some cushion if it needs to raise funds fast.

What investors are thinking

Some see MicroStrategy as a way to invest in Bitcoin without buying crypto directly.

Others worry that the accounting rules make it hard to see the real value and risk.

Stock performance relative to Bitcoin

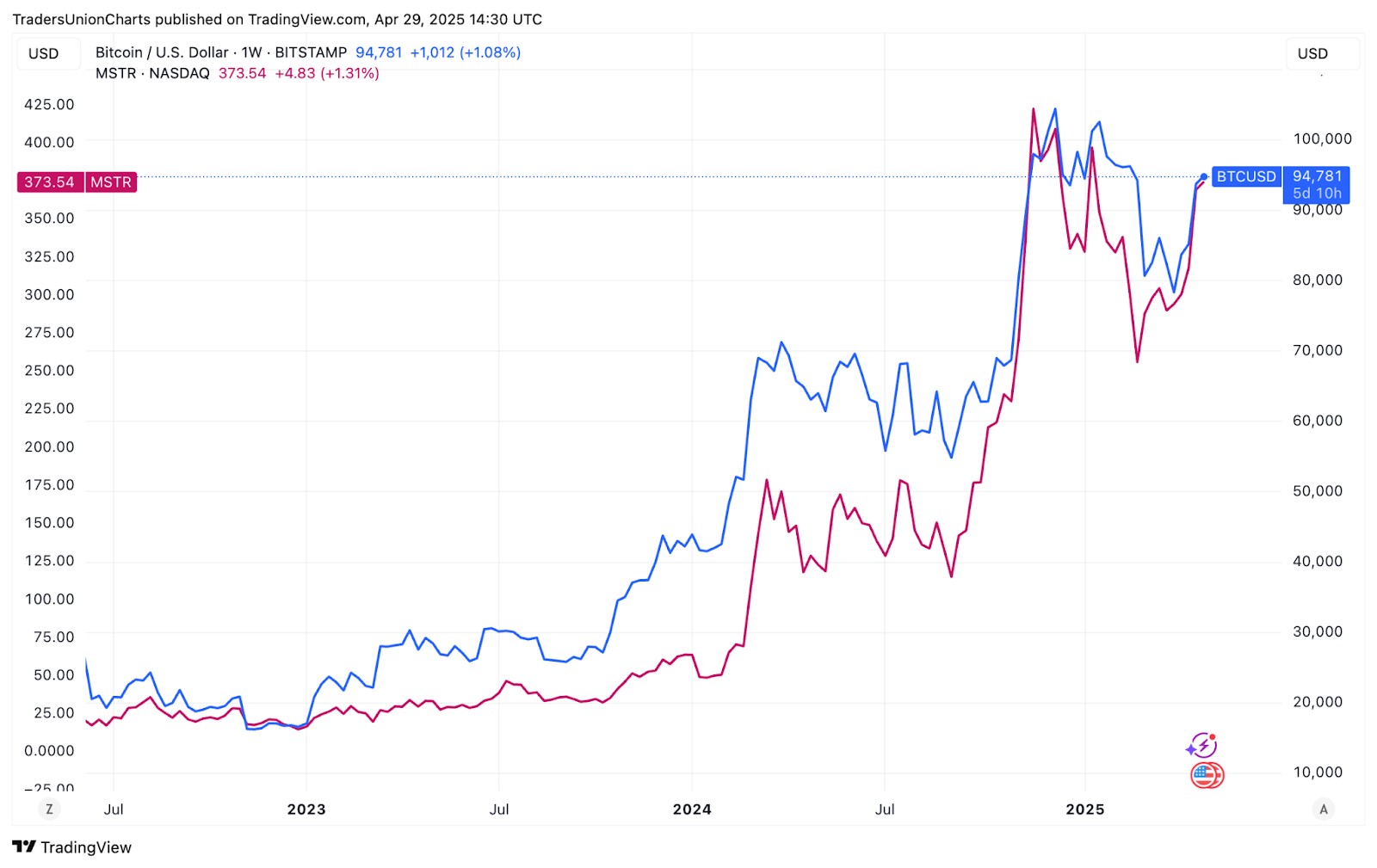

MicroStrategy’s stock does not behave like a regular tech stock anymore. It moves with Bitcoin. That makes it exciting for traders but tricky for long-term investors.

Looking at how the stock moves

The share price went from about $140 to over $900 between 2020 and 2024 as Bitcoin soared.

It often moves nearly one-to-one with Bitcoin, showing a very tight link.

When Bitcoin drops, MicroStrategy’s stock sometimes falls even harder because of all the leverage it used to buy crypto.

What this means for investors

People are watching Bitcoin charts more than software earnings when they look at MicroStrategy.

Fast price moves are great for short-term trades but can be stressful for long-term holders.

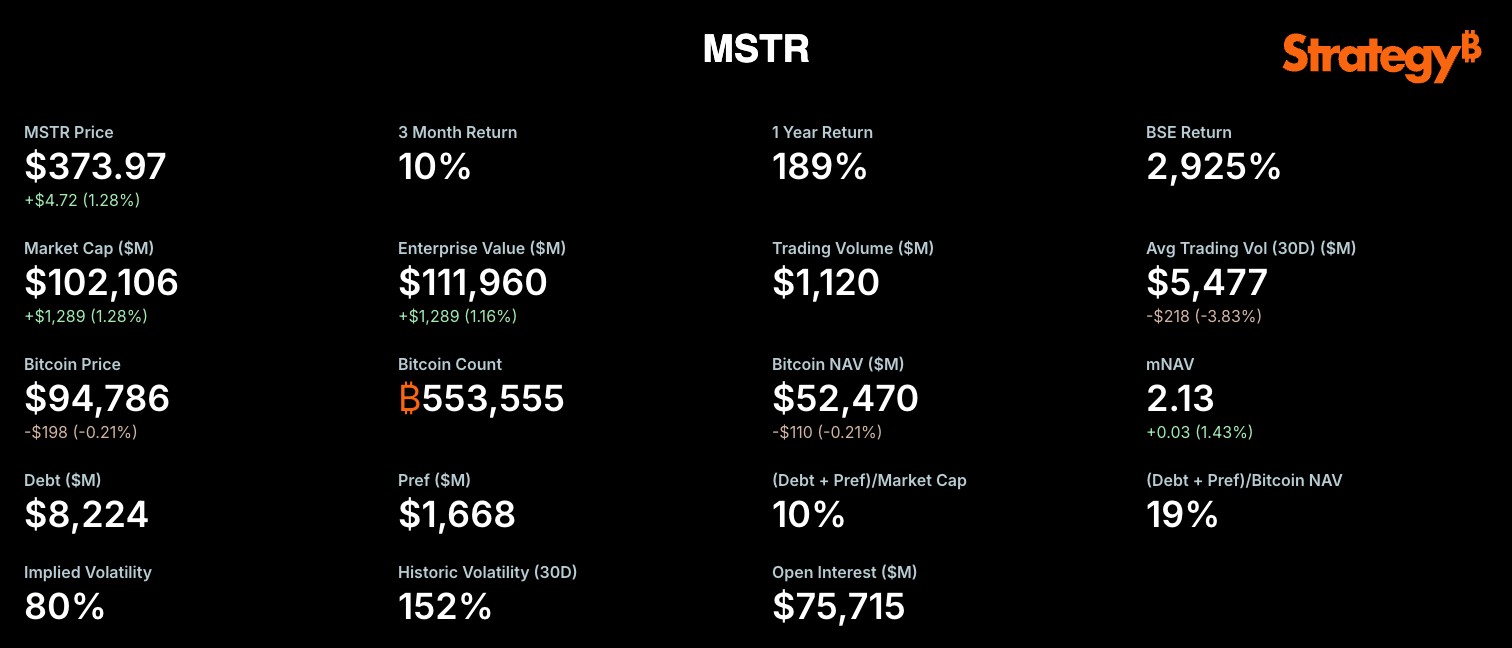

Market capitalization and valuation metrics

Trying to figure out what MicroStrategy is worth is no longer a simple task. It is a mix of a tech company and a massive Bitcoin holder.

What to look at now

Market value often rises or falls with Bitcoin, not with business profits.

Sometimes the market cap is about 20 to 30 percent more than the Bitcoin it holds, meaning people still value the tech side of the company.

Common ratios like price to sales look inflated, but that is because people see Bitcoin in the mix.

A better way to understand the value

You cannot use just one method to judge the company anymore.

Analysts often split it in two: value the software side the usual way, and add the current value of Bitcoin on top.

Risks associated with the Bitcoin-centric strategy

MicroStrategy’s Bitcoin journey is ambitious, but it is not without serious risks. These risks stretch across the company’s finances, investor trust, and future planning. If you are thinking about how bold decisions play out in real business, this section breaks it down in plain terms.

Volatility of Bitcoin prices

Bitcoin is famous for big gains, but also for sudden crashes. That creates a rollercoaster for MicroStrategy’s stock and financial position.

Why it matters so much

Bitcoin has lost more than half its value in short spans, especially during 2021 and 2022.

When that happens, MicroStrategy’s balance sheet looks weaker because its biggest asset is worth less.

The stock usually falls even harder than Bitcoin because investors get nervous about the company’s debt and strategy.

Some real-world examples

In 2022, Bitcoin dropped from above $60,000 to under $30,000.

MicroStrategy’s stock fell more than 65 percent in the same period.

What this means for investors

It is tough to stay confident when prices jump up and down so fast.

Big investors might avoid MicroStrategy simply because they cannot deal with Bitcoin swings.

Leverage and debt obligations

MicroStrategy borrowed a lot of money to keep buying Bitcoin. That works well in a rising market but gets tricky when things slow down.

The company now has over $8.2 billion in total debt.

Much of it comes from loans that can turn into shares later and are due in the next five to six years.

What it could lead to

High debt puts pressure on the company if Bitcoin prices drop.

Paying interest and handling loan terms becomes harder in a bear market.

What could go wrong

If Bitcoin falls too much, lenders might worry and tighten terms.

MicroStrategy might need to take tough steps like selling assets or issuing even more stock.

Potential for shareholder dilution

MicroStrategy has raised a lot of money by selling new shares. While it helps them buy more Bitcoin, it also spreads the pie thinner.

What has already happened

Since 2020, the number of shares has more than doubled.

The company used at-the-market offerings to bring in over $1 billion.

Why investors care

More shares mean each one you own is worth a smaller part of the company.

Unless Bitcoin jumps, you may end up owning less value over time.

A closer look for long-term investors

Track both the stock price and how many shares exist.

A rising share count can cancel out gains if you are not paying attention.

Regulatory and market risks

Bitcoin still lives in a legal grey zone in many countries. Any big rule change could shake MicroStrategy’s plans.

What to watch out for

Governments may limit how much Bitcoin companies can hold or force new taxes.

Accounting rules might change and make it harder to report value or profits clearly.

More paperwork and legal hurdles could slow down operations.

Bigger market risks

If one major Bitcoin exchange has trouble, prices could fall overnight.

A drop in global demand could make it harder for MicroStrategy to rely on Bitcoin’s long-term strength.

What this could mean ahead

A new rule or tax could make the whole strategy less profitable.

The company’s future now partly depends on what regulators decide about crypto.

Diverse perspectives on MicroStrategy's approach

MicroStrategy’s Bitcoin move has got people talking. Some see it as smart and forward-looking, while others feel it is risky and too dependent on one volatile asset. Let us look at the mix of praise, doubts, and how the market has been reacting to it.

Supportive analyst views

A number of analysts believe MicroStrategy is on the right track and say it is creating a new kind of corporate model that blends finance and technology.

What they are saying

A Bitcoin play with extra upside. Some analysts say MicroStrategy acts like a turbo-charged way to invest in Bitcoin. They point out how the company uses its own capital and borrowing to magnify gains.

Strong returns to back the belief. Over the last year, MicroStrategy's stock has gained over 100 percent, showing that many investors are behind the strategy.

Growing recognition. The company was recently added to the Nasdaq-100, a sign that the market sees it as more than just a niche Bitcoin bet.

Critical opinions and concerns

Not everyone is convinced. Some experts are openly skeptical, saying the company is taking on too much risk without enough balance.

Concerns that keep coming up

Rising debt levels. Critics worry that the money borrowed to buy Bitcoin could backfire if prices fall hard. It adds pressure on future earnings.

Some say the model looks unstable. A few commentators on social media and finance circles have compared the setup to a system that needs new money or rising Bitcoin prices to stay afloat.

What if the rules change? If regulators put limits on how much Bitcoin firms can hold or change the tax rules, it could disrupt MicroStrategy’s entire approach.

Investor sentiment and market reactions

Investors seem divided. Some are excited about the upside while others are cautious about the wild swings and long-term risk.

What has been happening in the market

The stock moves with Bitcoin. When Bitcoin rises, MicroStrategy’s stock often jumps even faster. But when it drops, the fall is just as sharp or worse.

Valuation swings. Sometimes, the company’s market value is higher than the value of the Bitcoin it holds. That shows people still believe in its software side or expect Bitcoin to rise.

Worries about dilution. The company has issued a lot of new shares to raise money. That means each share is a smaller piece of the pie now, which concerns some investors.

For interested investors: If your main goal is to gain exposure to Bitcoin, investing directly in the asset itself is often a better choice than buying MicroStrategy (MSTR) stock. While MSTR holds a large amount of Bitcoin on its balance sheet, owning Bitcoin directly gives you full control without the added risks tied to the company’s stock price and operations.

To invest directly in Bitcoin, you will need to open an account with a trusted cryptocurrency exchange. In the comparison table below, we have listed the top brokers and crypto platforms. You can review their features side-by-side to find the one that best matches your needs and trading style.

| BTC | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Copy trading | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2017 | 10 | 329 | 0,1 | 0,08 | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2004 | No | 1817 | 0 | 0 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

MicroStrategy used Bitcoin as a leverage tool not just a store of value

What most people overlook is that MicroStrategy did not just hold Bitcoin. They used it as collateral and made it part of a bigger strategy. They saw Bitcoin as something useful, not just an investment to sit on.

They raised money through low-interest debt and used that to gain more exposure without chasing price or pushing the market up. That is a smart choice. Whether you are running a company or managing personal capital, this is a lesson in how to use your money better and make an asset work for you in multiple ways.

There is also a part few people talk about: how they handled timing. They did not try to buy the dip perfectly or sell into rallies. They just kept adding during corrections and let the bigger trend play out. If you look closely, it was not just faith in crypto. It was faith in the strategy itself. They used the ups and downs as part of the plan. That is what makes this approach more than a trade. It was a structural bet designed to thrive in chaos.

Conclusion

MicroStrategy’s Bitcoin strategy is not just a risky bet on crypto. It is a real-world example of how to rethink the way a company uses its money. They built something around a belief with big upside, and made market swings useful instead of scary. Whether it works out or not, they proved that Bitcoin can be more than just a trade. It can be part of how a company operates. Cash became conviction. Chaos became an advantage. And that shift might be the real lesson here.

FAQs

What is Michael Saylor's prediction for bitcoin price?

Michael Saylor has publicly stated he believes Bitcoin could eventually reach $1 million, viewing it as a long-term store of value superior to gold. He sees institutional adoption and limited supply as key drivers.

Is MicroStrategy overvalued?

MicroStrategy’s valuation is heavily tied to the price of Bitcoin rather than its core software business. Whether it's overvalued depends on one’s outlook on Bitcoin and the premium investors are willing to pay for its exposure.

Will MicroStrategy go bust?

MicroStrategy carries significant financial risk due to its leveraged Bitcoin holdings. While it remains solvent for now, extreme drops in Bitcoin’s price could strain its balance sheet if not managed carefully.

Is MSTR a meme stock?

MSTR is not a traditional meme stock, but its price has seen retail-driven surges due to its strong Bitcoin connection. Like meme stocks, it sometimes trades more on sentiment than fundamentals.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

A bear market is a period of time in which an investment asset, such as stocks, bonds, or commodities, experiences a decline in price for an extended period of time.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.