Tether Bitcoin Holdings In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

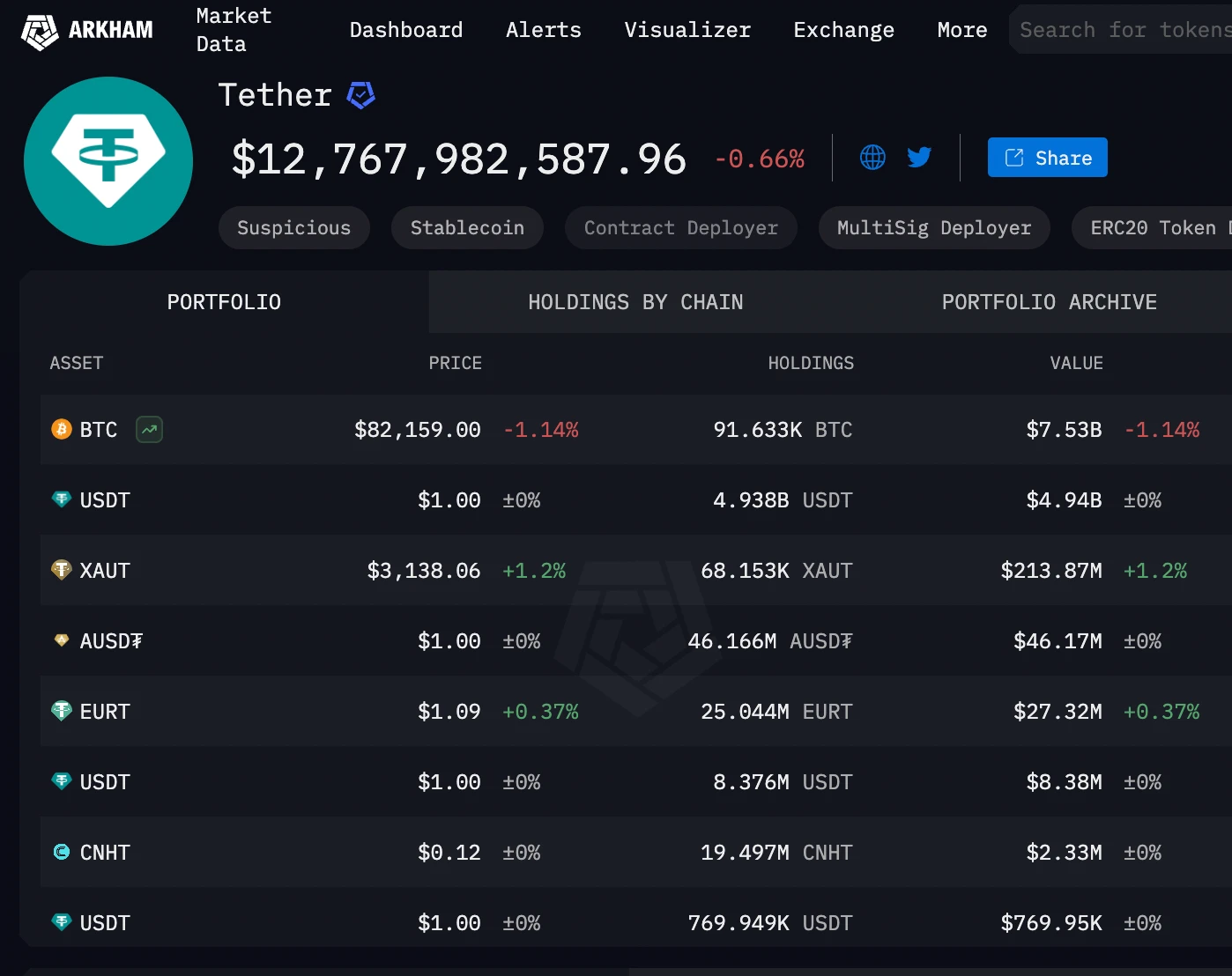

Tether currently holds approximately 91.633 BTC, with an estimated value just under $7.53 billion based on recent market prices. This approach strengthens USDT’s reserve base but also brings concerns around price volatility and potential regulatory challenges. As of March 2025, Tether controls roughly 63% of the stablecoin market, giving it significant influence over both stablecoin liquidity and Bitcoin price trends. Traders should remain alert to risks like market manipulation, shifting regulations, and the long-term stability of Tether’s reserve practices.

Tether (USDT), the world's largest stablecoin issuer, has been adding more Bitcoin (BTC) to its reserves to strengthen its financial backing. Originally, Tether supported USDT with assets like cash, Treasury bills, and commercial paper, but it has diversified to include Bitcoin to protect against market fluctuations. Now it is among the top institutional Bitcoin holders.

Breakdown of Tether’s Bitcoin holdings

Tether’s Bitcoin acquisition strategy has been aggressive. Key data points include:

Total Bitcoin holdings. Tether holds approximately 91.633 BTC.

Market value. Around $7.53 billion.

Accumulation strategy. Tether has been acquiring Bitcoin since October 2022, with notable purchases including 8.889 BTC in April 2024 and 1.305 BTC in December 2024.

In addition to Bitcoin, the company's portfolio also includes:

USDT: ~4.95B USDT across multiple addresses, worth ~$4.95B.

XAUT: 68.15K XAUT worth $213.87M – gold-backed token.

AUSDT: 46.17M AUSDT valued at $46.17M.

EURT: 25.04M EURT worth $27.32M – euro-pegged stablecoin.

CNHT: 19.5M CNHT worth $2.33M – yuan-pegged stablecoin.

The strategic move: Why Tether is buying Bitcoin

Tether’s Bitcoin accumulation isn’t just a headline — there are deeper reasons behind this move that traders often overlook.

Here's what’s really happening:

Hedging against fiat risk. Tether holds a massive amount of U.S. Treasuries, and BTC acts as a hedge if fiat-linked assets lose confidence or value.

Building trust with crypto-native users. Holding Bitcoin signals alignment with the values of decentralization and financial sovereignty, especially among long-time crypto believers.

Creating liquidity for extreme volatility. Tether can use BTC reserves as deep-pocket liquidity in case of major redemptions or market stress.

Positioning for long-term asset growth. With limited BTC supply and halving cycles, Tether is betting on appreciation to quietly strengthen its reserves over time.

Insulating against U.S. regulatory pressure. Bitcoin is global and harder to restrict than fiat or U.S. assets, offering Tether a degree of off-grid resilience.

Boosting its own influence in crypto markets. With enough BTC, Tether can sway sentiment or even act strategically in the market to stabilize its own ecosystem.

Financial impact and market reactions

When Tether buys Bitcoin, it’s more than just a treasury move — it subtly shifts liquidity, sentiment, and dominance across the crypto space.

Bitcoin’s floor gets quietly reinforced. Large purchases by Tether act as invisible buy pressure, supporting BTC price zones that retail traders often overlook.

Stablecoin dominance influences altcoin seasons. When Tether locks value into BTC, it temporarily reduces USDT liquidity — often slowing down risk-on moves into altcoins.

Institutional traders front-run Tether moves. Some pros scan on-chain wallets tied to Tether to anticipate buy activity, trading ahead of it for profit.

BTC becomes a synthetic reserve anchor. Tether holding BTC links stablecoin trust to Bitcoin’s health, making BTC price volatility more than just a chart — it’s now a reserve risk factor.

Ethical considerations and regulatory scrutiny

The conversation around Tether buying Bitcoin isn't just about finance — there are deeper ethical and legal layers people need to understand.

Tether’s purchases can skew market behavior. When a single issuer holds tens of thousands of BTC, it can move the market without disclosing its intent, raising transparency concerns.

It creates a self-reinforcing liquidity loop. Buying Bitcoin to back a stablecoin that’s used to buy more Bitcoin introduces a circular system vulnerable to collapse if confidence drops.

Undisclosed reserve weightings raise fairness questions. Retail traders don’t always know how much BTC is backing USDT at any time, making it harder to assess true risk.

Lack of real-time audits allows shadow exposure. Without third-party verification, it’s hard to know whether the reserves actually hold what Tether claims — this opens the door to legal and ethical problems.

Future outlook: What’s next for Tether?

As Tether’s influence continues to grow, here are some lesser-known developments and insights that traders should seriously pay attention to:

Expect more non-USD stablecoin launches. Tether is likely to issue stablecoins tied to regional currencies like the Mexican Peso or Brazilian Real to tap into emerging market demand.

Tether may push into Bitcoin-backed lending. With billions in BTC, Tether could build its own crypto lending desk, bypassing traditional finance entirely.

Reserve disclosures might become more dynamic. Don’t be surprised if Tether starts offering live or real-time reserve snapshots to combat transparency criticisms.

Partnerships in underbanked regions could explode. Tether’s next growth wave may come from countries with weak fiat systems and high mobile penetration, not from Western markets.

On-chain treasury management will evolve. Tether might start optimizing reserves using DeFi tools or real-time swaps rather than static wallets.

CBDC policies could force strategic pivots. As central banks roll out digital currencies, Tether may need to reposition itself as a layer above CBDCs, not a rival.

Risks and warnings

While Tether’s BTC strategy presents opportunities, risks remain:

Bitcoin volatility. BTC’s price fluctuations could impact USDT perceived stability, especially if BTC’s market value drops significantly.

Regulatory crackdowns. Governments may impose stricter controls on stablecoin issuers holding volatile assets, potentially restricting Tether’s BTC strategy.

Market manipulation claims. Skepticism remains regarding Tether’s role in BTC price trends and liquidity management.

Reserve composition risk. Heavy reliance on BTC introduces market exposure, which could impact USDT’s peg during extreme market downturns.

Tether’s bitcoin reserves quietly shape USDT strength and market liquidity

Most people look at Tether as just a stablecoin issuer — but they miss a key market-moving detail: Tether is one of the largest Bitcoin holders globally. This isn't just about storing reserves — Tether’s Bitcoin holdings subtly anchor market liquidity.

Unlike corporate treasuries that hold BTC for speculation or brand signaling, Tether uses BTC as a high-liquidity reserve that backs USDT in a more decentralized, durable way. This makes every move it makes on-chain — buying, holding, or even transferring — impactful to sentiment across the crypto space.

Here’s what beginners often overlook: Tether’s Bitcoin strategy creates feedback loops. If Bitcoin pumps, the BTC value on Tether’s books rises, reinforcing confidence in USDT’s reserve backing. That strengthens USDT’s peg, which fuels more demand in stablecoin-dominated DeFi markets.

The result? Bitcoin volatility can ripple through the entire ecosystem, not just the BTC chart. For new traders and investors, understanding who holds the assets — not just how much — is key. Tether’s BTC wallet isn't just a vault — it’s a live wire connected to global crypto liquidity.

Conclusion

Tether’s Bitcoin holdings represent a bold step in stablecoin evolution, reinforcing USDT’s backing while raising critical questions about transparency and regulatory oversight. The continued accumulation of BTC strengthens Tether’s reserve structure, providing an added layer of security for investors. However, concerns about volatility and regulatory scrutiny cannot be overlooked. Traders and institutional investors must assess how Tether’s BTC strategy aligns with broader financial trends and crypto market dynamics.

The increasing role of Tether blockchain investments in asset diversification suggests a long-term commitment to integrating digital assets into the global financial ecosystem. As USDT adoption expands and Bitcoin reserves grow, the impact on market liquidity and stablecoin dominance will be significant. Understanding Tether’s strategy is essential for anyone navigating the evolving landscape of digital finance.

FAQs

Does Tether earn yield or interest from its Bitcoin holdings?

No, Tether doesn’t generate yield directly from Bitcoin the way it might from U.S. Treasuries. BTC in reserves acts more like a long-term hedge or liquidity buffer than an income asset. It’s about holding value, not earning on it.

Can Tether sell its Bitcoin during market crashes?

Technically yes — but selling during a crash could risk spooking the market further. Tether is likely to treat its BTC more like an emergency reserve, tapping it only under extreme liquidity pressure.

Is Tether’s Bitcoin stored on public wallets?

Some wallets believed to be tied to Tether are monitored by on-chain analysts, but Tether doesn’t officially disclose wallet addresses. This limits full transparency around real-time BTC movements or balances.

How do Tether’s BTC holdings compare to other stablecoin issuers?

Tether is unique in holding such a large amount of Bitcoin. Other stablecoins like USDC and BUSD rely mostly on cash and Treasuries. Tether’s crypto-heavy reserves give it a more decentralized — but also more volatile — profile.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Ray Dalio is the founder of Bridgewater Associates, one of the world's largest and most successful hedge fund firms. His investment principles, outlined in his book "Principles: Life and Work," have been influential in guiding his investment strategy and the culture of his firm. Dalio is also known for his economic research and predictions, which have garnered significant attention in the financial industry.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.