Best Crypto Futures and Options Exchanges In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, If you are too busy to read the entire article and want a quick answer, the best crypto derivatives exchange is OKX. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- A high level of liquidity allows you to quickly complete transactions.

- The ability to trade cryptocurrencies around the clock from any device.

Best crypto futures and options exchanges:

- OKX - Best automated trading solutions (copy trading, easy bot integration)

- 3Commas - Platform providing automated trading bots and portfolio management across exchanges

- Revox - A decentralized Web3 protocol offering AI-driven automation of trades and asset management, powered by the $REX token.

- Bybit - Best for active traders (trading fees from 0, strong futures liquidity)

- Binance - Best liquidity in top coins (highest BTC and ETH volume, as well as average liquidity)

Crypto futures and options trading allows investors to speculate on the future price movements of cryptocurrencies. Unlike spot trading, which involves the direct purchase of assets, futures and options provide a way to leverage trades and potentially amplify returns.

These financial instruments have gained popularity due to their ability to hedge risk and diversify trading strategies. This article aims to explore the best platforms for trading crypto futures and options, comparing key features and offering insights for both beginners and advanced traders.

Best crypto futures and options exchanges: a comprehensive guide

To assist in selecting the right exchange, we've compiled a comparison table highlighting key metrics across the top platforms.

| OKX | 3Commas | Revox | Bybit | Binance | |

|---|---|---|---|---|---|

|

Spots |

Yes | Yes | Yes | Yes | Yes |

|

Options |

Yes | Yes | Yes | Yes | Yes |

|

Futures |

Yes | Yes | Yes | Yes | Yes |

|

Perpetual contracts |

Yes | Yes | Yes | Yes | Yes |

|

Min. Deposit, $ |

10 | 10 | No | 1 | No |

|

Coins Supported |

329 | No | 415 | 638 | 415 |

|

Spot Taker fee, % |

0,1 | No | 0,1 | 0,1 | 0,1 |

|

Spot Maker Fee, % |

0,08 | No | 0,1 | 0,1 | 0,1 |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Key factors to consider when choosing an exchange

Security and regulation

Regulated exchanges provide additional layers of safety for traders, ensuring that they comply with international standards.

Trading fees

Trading fees can significantly impact profitability. Make sure you analyze all the components of trading fees, and not only trade commissions. This will help you gain a clearer picture of the costs involved and you will be able to plan your trades better.

Leverage options

Leverage allows traders to control larger positions with a smaller amount of capital. However, it also increases risk. If your strategy requires you to use leverage, make sure to compare the exchanges based on this metric.

User interface and experience

A user-friendly interface can enhance the trading experience. For beginners, simple and intuitive platforms can make all the difference to gain that momentum right at the start of their trading journey.

Liquidity

High liquidity ensures that traders can execute large orders without significantly affecting the asset’s price. Ideally, the more popular the exchange and the traded cryptocurrency, the higher is its liquidity.

Customer support

Reliable customer support is important for resolving issues promptly. Make sure you test the customer support mechanism of the crypto exchange before making the final choice.

Crypto futures and options market overview

Asset allocation

Different exchanges offer varying selections of cryptocurrencies for futures and options trading. Understanding asset allocation is crucial for traders to diversify their portfolios and manage risk effectively.

Commonly traded assets. Most exchanges offer futures and options on major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Coin-margined vs. USDT-margined contracts.

Coin-margined contracts. These contracts use cryptocurrencies (e.g., BTC, ETH) as collateral. The profit and loss are also settled in the same cryptocurrency.

USDT-margined contracts. These use Tether (USDT) as collateral. The profit and loss are settled in USDT or USD Coin (USDC), providing a stablecoin base which can reduce volatility risks associated with holding cryptocurrencies.

Market trends and conditions

This section analyzes current trends and conditions, providing insights into the factors influencing the market.

Bull and bear markets. Crypto markets go through cycles of bull (rising prices) and bear (falling prices) markets. Recognizing these cycles can help traders position themselves appropriately. For instance:

Influencing factors:

Regulatory news. Government policies and regulations significantly impact market trends. Positive regulations can boost prices, while crackdowns can lead to declines.

Technological advancements. Innovations in blockchain technology and new use cases for cryptocurrencies can drive market trends.

Market sentiment. Public perception and media coverage can create bullish or bearish sentiments, influencing trading volumes and prices.

Industry supply and demand

Supply and demand dynamics play a critical role in price movements. This section offers an overview of these dynamics and their impact on futures and options markets.

Supply factors:

Mining and minting. The supply of cryptocurrencies is often determined by mining or minting processes. For example, Bitcoin has a fixed supply of 21 million coins, which impacts its price as it approaches this limit.

Token burns and reductions. Some projects reduce the supply of their tokens through burns or halving events, like Bitcoin's halving, which decreases the rate at which new Bitcoins are created.

Demand factors:

Adoption rates. Increased adoption by businesses, institutions, and consumers can drive up demand. For instance, Ethereum’s demand surged with the rise of decentralized finance (DeFi) applications.

Market speculation. Traders and investors speculating on future price movements can lead to increased demand, impacting the prices significantly.

Impact on futures and options markets:

Volatility. High volatility in supply and demand leads to increased trading volumes in futures and options markets as traders seek to hedge risks or speculate on price movements.

Liquidity. Greater demand for futures and options contracts enhances liquidity, making it easier for traders to enter and exit positions without significant price slippage.

Risks and warnings

Volatility and market risk

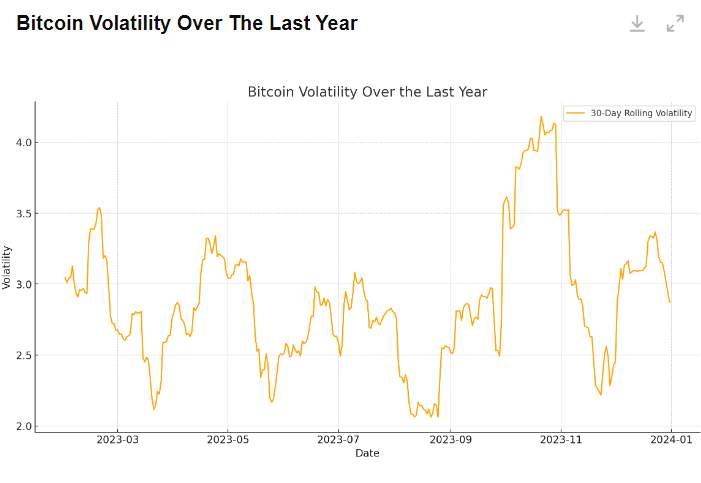

Crypto markets are notorious for their volatility, characterized by rapid and unpredictable price swings. This volatility can create substantial profit opportunities but also significant risks. One effective way to manage volatility is through risk management strategies such as setting stop-loss orders, diversifying your portfolio, and avoiding over-leveraging.

The chart below shows Bitcoin's 30-day rolling volatility over the last year. It highlights periods of high and low volatility, providing insights into how Bitcoin's price has fluctuated and the potential risks involved in trading it.

Regulatory risks

Governments and regulatory bodies worldwide are still developing frameworks to govern cryptocurrency trading. These regulations can impact market dynamics, such as trading volumes, liquidity, and overall market sentiment.

For example, regulatory actions like banning crypto exchanges, restricting the use of cryptocurrencies, or imposing stringent KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements can alter the trading environment drastically.

Security risks

Hacks, phishing attacks, and other cyber threats have historically resulted in the loss of millions of dollars worth of cryptocurrencies.

Exchanges should implement multiple layers of security, including two-factor authentication (2FA), cold storage for the majority of their funds, and regular security audits. Traders should also follow best practices, such as using strong, unique passwords, enabling 2FA, and being cautious of phishing attempts.

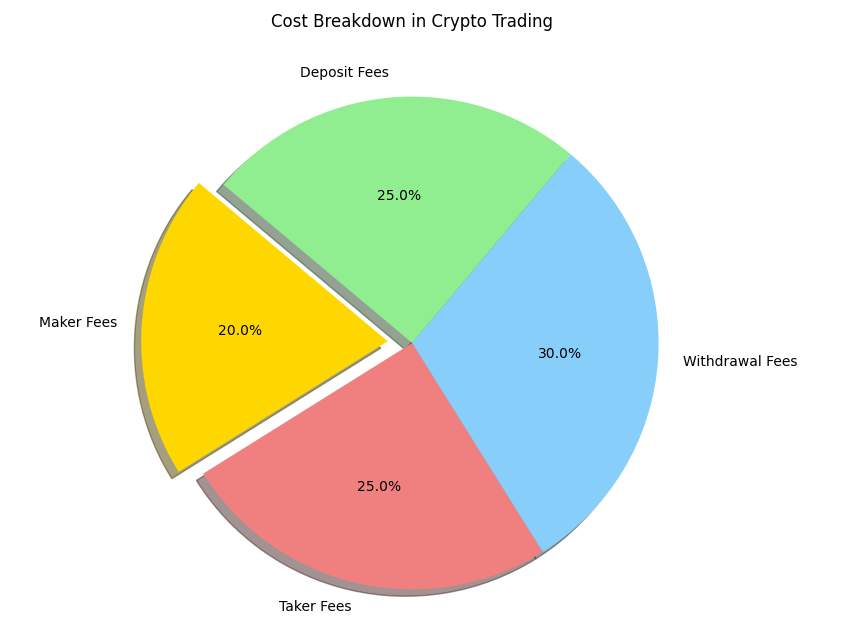

Trader’s costs

Understanding the various costs involved in trading is important for profitability. This section breaks down different types of fees and compares them across exchanges.

Hidden costs

Hidden costs can erode profits. Make sure to read the fine print and understand these costs to save yourself from a surprise later.

Withdrawal and deposit fees

Withdrawal and deposit fees can vary significantly between exchanges. We have compared this metric for the top exchanges in the table in the above section. You can refer to the same when making a choice.

Always stay updated on the market trends and regulatory changes

As a seasoned trader with many years of experience navigating the crypto markets, I can tell you that choosing the best crypto futures and options exchange can make or break your trading game.

First and foremost, security is non-negotiable. You want to ensure that the exchange you choose has robust security measures in place. Look for platforms that have a strong track record of safeguarding users’ funds and personal information. Regulated exchanges often provide an additional layer of security, so I always prefer those that comply with international standards.

Next, consider the trading fees. High fees can eat into your profits, especially if you’re making frequent trades. Compare the maker and taker fees across different exchanges. Some platforms offer lower fees if you hold their native tokens, which can be a good way to save money if you plan to trade regularly.

Leverage options are another critical factor. Leverage can amplify your gains, but it also increases your risk. I usually recommend starting with lower leverage and gradually increasing it as you become more comfortable and experienced.

Finally, always stay updated on the market trends and regulatory changes. The crypto market is highly dynamic, and what works today might not work tomorrow. Subscribe to updates from trusted sources and continuously educate yourself.

Methodology for compiling our ratings of crypto exchanges

Traders Union applies a rigorous methodology to evaluate crypto exchanges using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

Trading instruments. Exchanges are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

Trading platforms. Exchanges are assessed based on the variety, quality, and features of platforms offered to clients.

Extra services. Unique value propositions and useful features that provide traders with more options for yield generation.

Other factors like brand popularity, client support, and educational resources are also evaluated.

Conclusion

Choosing the right crypto futures and options exchange involves several crucial factors. Security and regulation ensure your funds are safe and the platform operates within legal frameworks. Trading fees directly impact your profitability, making it essential to compare maker and taker fees across exchanges. Leverage options can amplify your gains but also your risks, so it's important to select an exchange that offers suitable leverage for your risk tolerance.

FAQs

Are crypto futures and options trading risky?

Yes, trading crypto futures and options is inherently risky due to high volatility and leverage. It's important to have a good risk management strategy.

Do I need to undergo KYC to trade crypto futures?

Most reputable exchanges require Know Your Customer (KYC) verification to trade crypto futures and options.

What fees are involved in trading crypto futures and options?

Fees can include maker and taker fees, funding rates, and withdrawal fees. These vary by exchange; for example, Binance's maker fee starts at 0.02%.

Can beginners trade crypto futures and options?

Yes, beginners can trade, but it's recommended to start with educational resources and practice on demo accounts offered by platforms.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

In trading, a supply and demand zone refers to specific price levels on a chart where there is an imbalance between buyers (demand) and sellers (supply). A demand zone represents a price area where buying interest is strong, potentially leading to price increases, while a supply zone indicates an area where selling interest is significant, possibly resulting in price declines.