The Graph AI: Is The Graph An AI Coin & A Good Investment?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The Graph (GRT) is a blockchain indexing protocol, but its connection to AI is indirect. Here are key points about its AI role and investment potential:

Not a direct AI coin. It focuses on blockchain data indexing.

Supports AI-driven analytics. Helps AI models access blockchain data.

Strong Web3 infrastructure. Powers dApps with fast data retrieval.

Price depends on adoption. More usage could increase demand.

Highly volatile investment. Subject to market fluctuations.

Long-term growth potential. Expanding blockchain use may help.

Finding blockchain data used to be like searching for a needle in a haystack. The Graph AI changes that by working like a real-time search engine for blockchain, organizing data so users can access it easily. DeFi platforms, AI tools, and Web3 apps use it to quickly find and analyze on-chain data.

So, is The Graph related to AI? It’s not an AI model itself, but it helps AI process blockchain data. Unlike AI-focused cryptocurrencies like SingularityNET’s AGIX, its indexing system helps AI-powered blockchain apps run efficiently. Here’s how The Graph connects to AI, its technology, and whether it’s a good investment.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Understanding the Graph

Imagine searching for a book in a library with no catalog — everything is messy and hard to find. That’s how blockchain data used to be. The Graph changes this by working like a search engine for blockchain, organizing data so decentralized apps (dApps) can access it easily.

At its core, The Graph lets developers quickly find blockchain data. Instead of scanning entire blockchains manually, dApps use smart indexing to fetch data fast. This helps smart contracts run smoother and makes blockchain applications more responsive.

The system runs on subgraphs, which store and organize blockchain data for Web3 apps. Anyone can create, share, or query these subgraphs, keeping the network open and decentralized. The Graph token (GRT) rewards those who maintain the system, like indexers, curators, and delegators.

By structuring blockchain data, The Graph helps AI understand and use blockchain data. This makes it easier for AI tools to process Web3 data and build more advanced applications.

| Month | Minimum Price, $ | Average Price, $ | Maximum Price, $ |

|---|---|---|---|

| August 2025 | 0.055 | 0.061 | 0.067 |

| September 2025 | 0.055 | 0.061 | 0.067 |

| October 2025 | 0.056 | 0.062 | 0.068 |

| November 2025 | 0.056 | 0.062 | 0.068 |

| December 2025 | 0.056 | 0.063 | 0.069 |

The Graph’s relationship with AI

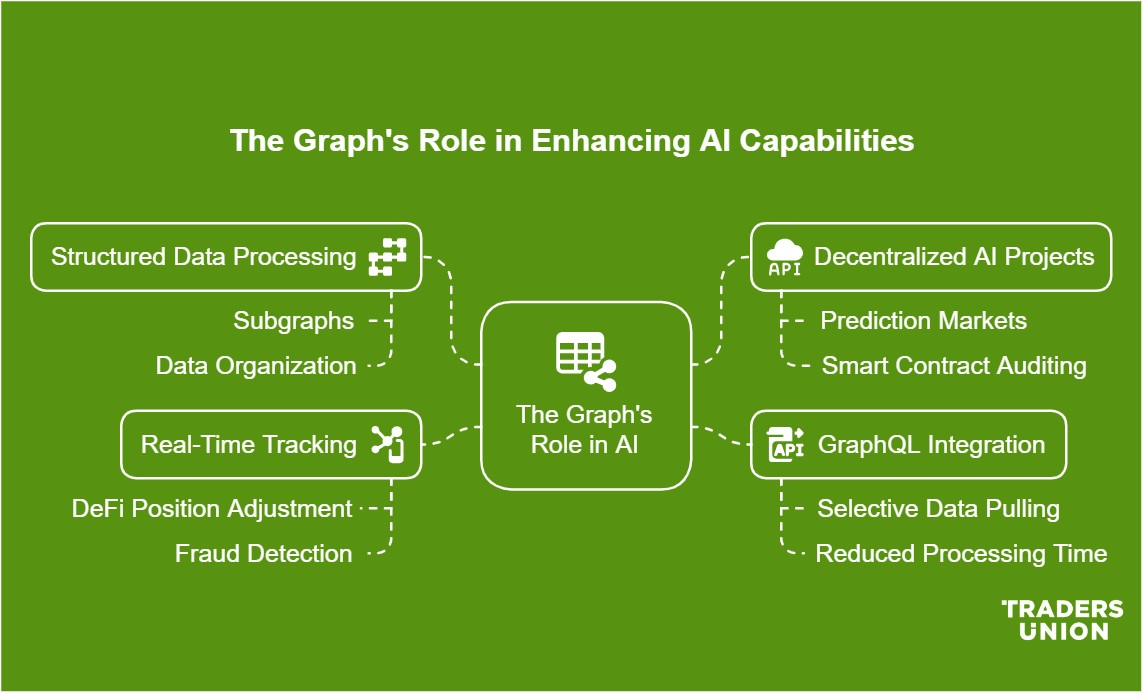

The Graph isn’t just a blockchain indexing tool — it helps AI understand Web3 data better in ways most people miss. Here’s how The Graph connects with AI beyond the obvious use cases.

AI models need structured blockchain data. AI has trouble using blockchain data because it’s messy and spread across different chains. The Graph organizes this data into subgraphs, making it easier for AI tools to process.

Decentralized AI projects depend on The Graph. AI projects running on decentralized networks, like prediction markets or smart contract auditing, need quick, accurate blockchain data. The Graph makes sure AI tools don’t have to rely on a single company for data.

GraphQL helps AI process blockchain faster. Without scanning entire blockchains, AI can use GraphQL queries to pull only the data it needs. This cuts down on processing time so AI can react faster.

AI-powered apps can track blockchain in real-time. By integrating with The Graph, AI-powered apps can track blockchain in real-time and make decisions — like adjusting DeFi positions or spotting fraud — without human input.

The Graph as an AI coin

Many people assume The Graph is just another blockchain indexing tool, but its real power lies in how it bridges blockchain data with AI-driven applications. Unlike most blockchain projects, The Graph isn’t just storing and retrieving data — it’s structuring it in a way that AI models can actually use, making blockchain more accessible to machine learning and automation.

GRT isn't just for indexing. While most see it as a data retrieval tool, its structured subgraphs allow AI models to process blockchain data efficiently. This makes it one of the few blockchain projects with direct AI utility.

The real value is in data structuring. AI models need clean, organized data to work properly. The Graph doesn’t just fetch blockchain data — it filters, categorizes, and standardizes it, making it readable for AI.

AI-driven DeFi strategies are possible. With The Graph’s ability to quickly organize blockchain data, AI can analyze past transactions, identify market trends, and optimize DeFi trading strategies in real time.

GRT rewards aren’t just for miners. Unlike traditional crypto mining, The Graph rewards curators and indexers who structure data properly. This means the network actively improves as more users refine and maintain AI-friendly data sources.

The Graph vs. other AI crypto projects

The Graph (GRT) isn’t an AI model, but it plays a crucial role in AI-powered blockchain applications. By providing decentralized data indexing and querying, it supports AI-driven analytics, DeFi platforms, and Web3 applications.

To understand how The Graph AI integration stacks up against top AI-focused cryptos, we’ve put together a detailed comparison of its use cases, advantages, and market position.

| Feature | The Graph (GRT) | SingularityNET (AGIX) | Fetch.ai (FET) | Ocean Protocol (OCEAN) |

|---|---|---|---|---|

| Core Purpose | Blockchain data indexing | AI marketplace for developers | AI automation for DeFi & blockchain | Data sharing & monetization for AI |

| How It Supports AI | Structures blockchain data for AI models & dApps | AI services marketplace for Web3 | AI-driven automation & smart contracts | AI models access & trade data |

| Direct AI Involvement? | No, but it enables AI apps | Yes, AI-focused | Yes, AI-powered | Yes, AI-driven |

| Key Use Cases | AI-powered dApps, smart contracts, blockchain queries | Decentralized AI services, Web3 automation | AI-powered DeFi, data automation | AI data access & monetization |

| Role in Web3 | Infrastructure layer for AI-powered blockchain applications | AI development & deployment | AI-driven economy | AI-powered data exchange |

Is the Graph a good investment?

Most people looking at The Graph (GRT) as an investment focus on token price trends, but the real metric to watch is query fees. The Graph isn't just another blockchain project — it’s the backbone of decentralized data indexing, and its success hinges on how much demand there is for querying blockchain data. Instead of tracking GRT’s price action, a smarter approach is watching whether more developers and dApps are actually paying for queries. If usage grows, indexers will need more GRT to stake, reducing supply and creating organic demand.

Another overlooked factor is how The Graph handles competition from centralized data providers. Right now, many dApps still rely on free, centralized APIs for blockchain data instead of paying for decentralized indexing. This means that GRT’s value depends less on general crypto trends and more on Web3’s push toward full decentralization. If The Graph can prove that its decentralized indexing is both cost-effective and censorship-resistant, adoption will follow. But if dApps keep using centralized alternatives, demand for GRT could stagnate — even if the broader crypto market is booming.

Key factors that make GRT a strong investment

Most people look at The Graph (GRT) like any other crypto asset, but what really determines its long-term value is its role in decentralized data infrastructure. Here are key insights that go beyond the usual speculation.

Query fees drive real demand. GRT isn’t just a speculative asset — it fuels blockchain data indexing. Every time developers use The Graph’s network to fetch data, they pay fees in GRT. If adoption increases, demand for the token rises naturally, making it less dependent on market hype.

Staking mechanics reduce sell pressure. Unlike many tokens that circulate freely, a large portion of GRT is locked up by indexers, curators, and delegators who stake to earn rewards. This means fewer tokens are actively traded, which can help stabilize price swings during market downturns.

Competes with centralized APIs. Many dApps still rely on free or low-cost centralized APIs for blockchain data. As Web3 expands and censorship concerns grow, The Graph’s decentralized approach could become the industry standard, forcing more projects to integrate GRT-powered indexing.

Protocol upgrades improve efficiency. The Graph is constantly upgrading, reducing query costs and improving indexing speeds. Unlike blockchains that rely purely on network effects, The Graph’s tech improvements directly impact usage, making it more attractive for developers.

Here’s how you can buy the GRT token from reputable crypto exchanges:

| GRT supported | Min. Deposit, $ | Coins Supported | Demo account | Spot Taker fee, % | Spot Maker Fee, % | P2P Taker Fee, % | P2P Maker Fee, % | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 10 | 329 | Yes | 0,1 | 0,08 | 0 | 0 | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 10 | 278 | No | 0,4 | 0,25 | Not supported | Not supported | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 1 | 250 | No | 0,5 | 0,25 | 0,16 - 0,20 | 0,10 - 0,16 | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 1 | 72 | Yes | 0,2 | 0,1 | 0,2 | 0,1 | 7.41 | Open an account Your capital is at risk. |

|

| Yes | No | 1817 | No | 0 | 0 | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Potential risks to consider

Most people think GRT’s risks are just about price volatility, but the real dangers lie in how the network functions and adapts to competition. Here are some overlooked risks that could affect its long-term value.

Centralized data is still cheaper. Many dApps use free or low-cost centralized APIs instead of paying for The Graph’s indexing. If major projects don’t migrate, GRT’s demand may never grow as expected.

Query fees may not be sustainable. The ecosystem relies on query fees to drive value, but if pricing isn't competitive, developers may avoid it, limiting GRT’s long-term adoption.

Protocol changes could hurt indexers. The Graph constantly evolves, but if updates reduce indexers' earnings or make it harder to participate, it could lead to fewer active nodes and weaker network security.

Staking rewards may shrink. As more GRT gets staked, the rewards get diluted. If staking becomes less attractive, participation could drop, affecting the network’s decentralization.

Governance is still token-weighted. The biggest GRT holders control decisions, which could lead to centralization and policies that favor large investors over the broader community.

GRT’s future in AI depends more on data ownership than hype

A lot of people assume The Graph is an AI coin because it helps process blockchain data, but AI itself doesn’t need GRT — it needs structured, queryable datasets. GRT’s biggest opportunity in 2025 isn’t AI hype — it’s powering decentralized data. Letting AI models access blockchain data without depending on a single company or API could be a game-changer. If AI projects move toward decentralized data, GRT could become a key player — not because it powers AI, but because AI needs reliable, tamper-proof blockchain data.

Something people don’t talk about is whether The Graph’s indexing system can keep up with AI’s data needs. Right now, AI systems prefer centralized storage because it’s faster, while The Graph’s indexing process is slower but decentralized. If The Graph makes querying data cheaper and faster, it could be a big deal for AI projects using blockchain data. But if AI developers stick with centralized options for efficiency, The Graph could struggle, even if its tech aligns better with Web3 ideals. Instead of getting caught up in AI buzzwords, investors should ask: Can The Graph actually keep up with decentralized data demand?

Conclusion

The Graph AI indexing system plays a critical role in powering AI-driven blockchain applications. It transforms messy blockchain data into structured, accessible information, helping AI models, smart contracts, and dApps function efficiently.

Unlike AI-first cryptos such as SingularityNET, the Graph is a data indexing powerhouse that supports AI development. It’s a foundational layer rather than an AI-driven token. If you believe in the growth of AI and blockchain, the Graph token (GRT) powers one of the most crucial infrastructures in Web3.

As AI-powered Web3 applications evolve, the Graph’s importance will likely grow. Whether you're an investor, developer, or AI enthusiast, GRT is a project worth watching.

FAQs

Is the Graph related to AI?

Yes, but not as an AI model itself. The Graph AI indexing system helps AI-powered blockchain applications access structured data. It organizes and retrieves blockchain records, making them usable for machine learning models, smart contracts, and AI-driven dApps.

Is the Graph an AI coin?

No, but it plays a key role in AI integration with blockchain. Unlike AI-first tokens like SingularityNET (AGIX) or Fetch.ai (FET), the Graph acts as a data indexing tool that helps AI projects analyze and retrieve blockchain information.

Is the Graph (GRT) a good investment?

It depends on your belief in AI and blockchain growth. The Graph is one of the most essential indexing protocols for Web3, and its demand could rise as AI-powered dApps expand. However, market volatility and competition are factors to consider.

What makes the Graph different from other AI crypto projects?

Unlike AI-specific coins, the Graph provides decentralized indexing for blockchain data, making it accessible to AI applications. It doesn’t generate AI models but serves as a crucial infrastructure layer for AI-driven dApps.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.