Can I buy and sell ChatGPT stock?

Top commission-free stock broker - eToro

No, it is currently not possible to directly invest in ChatGPT as it is not a publicly traded entity.

ChatGPT, a powerful language model developed by OpenAI, has garnered significant attention for its advanced conversational capabilities. However, when it comes to investing in ChatGPT directly, it is important to note that ChatGPT is not a publicly traded entity and does not have its own stock. As an AI language model, ChatGPT's availability is primarily through OpenAI's platform and subscription plans. While you cannot invest in ChatGPT itself, there are alternative investment options in the AI industry, such as investing in companies that utilize AI technology or specialized AI-focused funds. This article explores the possibilities and provides insights into investing in the AI sector as a whole.

What is OpenAI’s ChatGPT?

ChatGPT, developed by OpenAI, is an impressive language model that has gained significant attention in the tech industry. OpenAI, founded in 2015 by renowned individuals such as Elon Musk, Sam Altman, and Greg Brockman, focuses on cutting-edge research and development in artificial intelligence.

ChatGPT stands out for its ability to simulate human-like conversations through advanced natural language processing algorithms. It possesses the remarkable capability to comprehend and generate human language in a manner that is incredibly close to human-level fluency. This language model's sophistication has positioned it as one of the most advanced language models in existence today.

The potential impact of ChatGPT on various industries, including healthcare, finance, and retail, is considerable. Many organizations are already exploring the implementation of ChatGPT to enhance their operations and customer interactions. The model's natural language abilities have captured the attention of users, as it not only comprehends questions effectively but also provides responses that mimic human conversation.

During its initial public testing phase, which commenced on November 30, 2022, ChatGPT experienced a remarkable response. Over a million individuals engaged with the chatbot within the first week. Users were astounded by the model's natural language capabilities, appreciating its aptitude for understanding inquiries and delivering human-like responses.

ChatGPT: An overview

Founders |

Assets for copy trading Greg Brockman, Sam Altman, Ilya Sutskever, Wojciech Zaremba, and many others |

Developed by |

Assets for copy trading OpenAI (Open Artificial Intelligence) |

Established in |

Assets for copy trading 2015 |

Model Type |

Assets for copy trading Language Model |

Language |

Assets for copy trading English |

Knowledge Cutoff for Model 3.5 |

Assets for copy trading September 2021 |

Public Testing |

Assets for copy trading Launched on November 30, 2022 |

User Engagement |

Assets for copy trading Over a million users engaged within the first week of public testing |

Potential Impact |

Assets for copy trading Significant potential impact on industries such as healthcare, finance, and retail |

How can you invest in ChatGPT?

While ChatGPT, developed by OpenAI, is widely recognized in the field of artificial intelligence, it is important to note that its shares are not currently available for public trading. However, there are alternative avenues to participate in the AI industry and potentially benefit from its growth.

Many publicly traded companies are actively utilizing AI technology and making significant investments in this field. By investing in these companies, you can indirectly gain exposure to the advancements and innovations happening in the AI industry.

5 ChatGPT alternative stocks that you should consider investing in

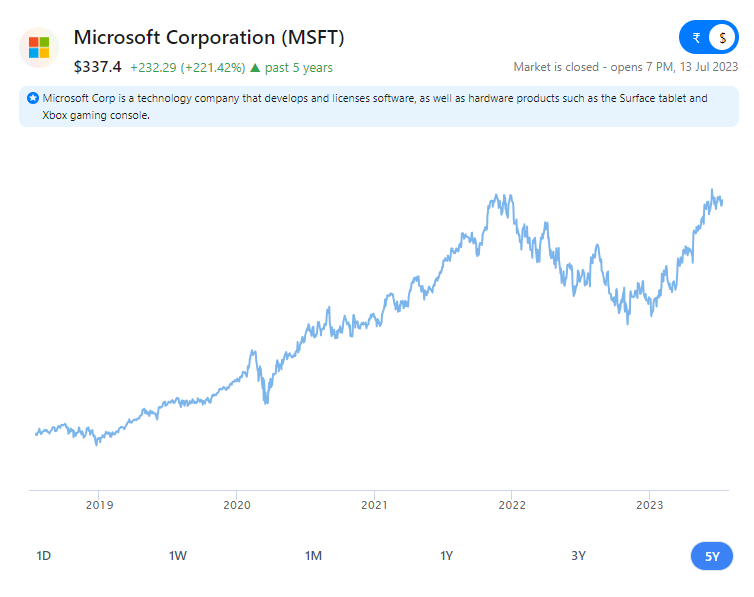

Microsoft (MSFT):

Microsoft, a tech giant with diverse revenue streams, has partnered strategically with OpenAI, making significant investments in ChatGPT. The company sees AI as the next major computing platform and has integrated OpenAI's tools into products like Azure. Microsoft's focus on ChatGPT is particularly evident in its ambitions for Bing, as it aims to compete with Google in the search engine market. With its strong market presence and commitment to AI, Microsoft offers investors exposure to the growing AI industry.

Microsoft (MSFT) stock chart

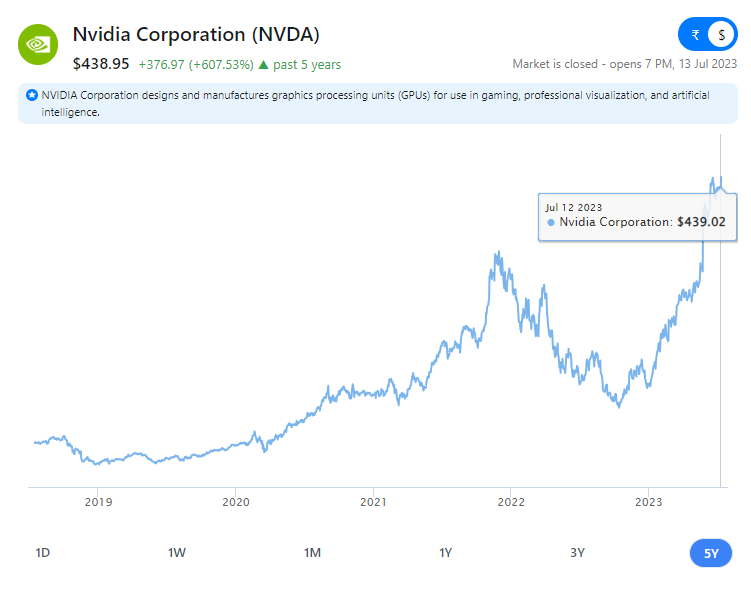

NVIDIA (NVDA):

NVIDIA has experienced remarkable stock growth due to its graphics processing chips, which are crucial in gaming, self-driving cars, and AI applications. As AI demands powerful computing capabilities, NVIDIA's chips outperform competitors. The company's GPUs played a significant role in training ChatGPT, and they continue to support OpenAI's chatbot. NVIDIA is a leader in graphics processing units for various devices and focuses on AI, automotive electronics, gaming, and mobile devices. Its AI-specific chips make it a key player in the AI revolution, making NVIDIA an attractive investment option.

NVIDIA (NVDA) stock chart

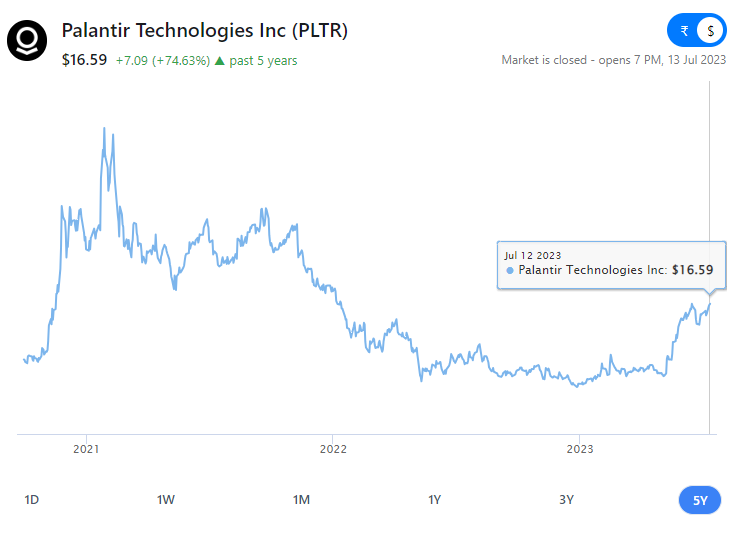

Palantir Technologies Inc. (PLTR):

Palantir, a $32 billion software company, has been involved in AI even before ChatGPT gained mainstream attention. Its chatbots and data analytics solutions have attracted interest from governments seeking improved decision-making capabilities. Palantir is expanding its chatbot services to cater to business owners, diversifying its client base beyond governments. The company has witnessed significant growth in its stock price, driven by the increasing adoption of chatbots in businesses. With strong revenue growth and rising earnings, Palantir has become a profitable company with promising prospects for investors.

Palantir Technologies Inc. (PLTR) stock chart

Google (GOOG):

Google, operating as Alphabet Inc. (GOOG), presents itself as a robust investment opportunity with a distinct edge over a singular technology investment like ChatGPT. Alphabet’s diverse portfolio, with its Google Services offering a suite of products that touch nearly every aspect of digital life such as Search, Android, YouTube, and Google Cloud, provides a hedge against the risks associated with narrower, less diversified investments.

The company’s financial performance has historically been strong, which speaks to its resilience and strategic positioning. Even in the face of new competition in internet search, Google has maintained a dominant position in the market, a testament to its innovative capabilities and the strong moat it has built around its core services.

With its “Strong Buy” average rating and a positive stock price forecast, investing in Alphabet shares is backed by optimistic market sentiment, reflecting its potential for continued growth.

The competitive landscape is changing with the advent of AI like ChatGPT, but Alphabet’s comprehensive approach to technology and the internet positions it well to either integrate such new technologies or compete against them. Its extensive research and development in AI and other technological frontiers further solidify its stance as a formidable player in the tech space.

Intel (INTC):

Intel Corporation (INTC) presents a potentially strong investment alternative for those looking to diversify their portfolio outside of companies like OpenAI, the creator of ChatGPT. While Intel's stock has experienced significant volatility, the fact that it is trading near five-year lows can be seen as an attractive entry point for investors seeking value in the semiconductor industry, which continues to show robust demand and growth potential.

Despite facing stiff competition from rivals, Intel remains a major player in the market with a diverse product line that spans from client computing to AI, networking, and autonomous driving through its Mobileye segment. The company's efforts to pivot into new areas such as contract chip manufacturing reflect its strategy to adapt to the rapidly changing tech landscape.

Financially, Intel has demonstrated strength with a significant increase in earnings, and it continues to innovate, especially in the realm of AI, where it offers a suite of hardware and software solutions. However, it’s crucial to recognize that Intel does not directly compete with ChatGPT or OpenAI's core business of AI language models. Instead, Intel could be considered a complementary investment, providing hardware that powers the infrastructure behind AI technologies.

As with any investment, potential investors should conduct thorough research and consider their investment goals and risk tolerance before investing in Intel stock.

What’s the impact of ChatGPT?

The impact of OpenAI's ChatGPT is far-reaching and can be analyzed from various perspectives, including its technical evolution, reception by the public and AI community, and implications for AI research and development.

Technical evolution:

ChatGPT is an advanced iteration of GPT-3.5, a series of large language models released by OpenAI. It underwent fine-tuning using reinforcement learning from human feedback (RLHF), a technique that involved gathering input from a diverse group of individuals who rated the model's responses. The training aimed to make ChatGPT helpful, truthful, non-toxic, and able to clarify its identity as an AI system. Additionally, it was fine-tuned specifically to excel in dialogue and assistant-like tasks, such as asking follow-up questions and declining inappropriate requests. This fine-tuning process enhanced ChatGPT's accessibility and usability

Reception:

The launch of ChatGPT took many by surprise and quickly gained widespread popularity. Despite utilizing existing technology, it received positive feedback from both the general public and the AI community. One of its standout features was the ability to provide nuanced responses, including admitting mistakes, challenging incorrect assumptions, and rejecting inappropriate demands

Future developments:

OpenAI has expanded ChatGPT's functionality through plugins, enabling it to access external knowledge sources and databases, including the web. This opens up new possibilities and may potentially reshape how people search for information online. There are concerns that this advancement could impact established search engines like Google, prompting users to alter their search behavior

Why invest in AI stocks?

Investing in AI stocks offers compelling reasons driven by growth potential, diversification opportunities, future relevance, and long-term investment prospects.

Growth potential:

The global AI industry is poised for exponential growth. Projections indicate that the industry, which was valued at $59.67 billion in 2021, is anticipated to reach $422.37 billion by 2028 (source: Zion Market Research). This tremendous growth trajectory presents an attractive opportunity for investors to capitalize on the potential returns generated by investing in AI stocks

Diversification:

AI encompasses a broad range of companies and sectors. Investment options in the AI field span hardware companies facilitating AI program development, firms collecting valuable data for AI applications, providers of essential programming toolkits, and businesses incorporating AI into their products and services. This diversity enables investors to diversify their portfolios and mitigate risk by spreading investments across different areas of the AI ecosystem

Future relevance:

AI has already begun to shape various aspects of our daily lives, influencing search engine algorithms, personalized recommendations, and even delivery services. Investing in AI stocks aligns portfolios with the future direction of technology and society. As AI continues to advance and permeate more industries, companies operating in this space are likely to experience increased demand and relevance, potentially driving growth in their stock value

Long-term investment:

While AI technology is still evolving, its potential impact is profound. Investing in AI stocks necessitates a long-term perspective, as the technology may not deliver immediate massive wealth but holds considerable potential for future returns. As AI continues to mature and find application across industries, companies at the forefront of AI development and innovation may experience substantial growth over time

It's important to note that investing in AI stocks, like any investment, carries risks. Market dynamics, competition, regulatory factors, and technological advancements can impact the performance of individual stocks and the overall AI sector. Therefore, investors should conduct thorough research, evaluate the fundamentals of the companies they consider investing in, and carefully assess their risk tolerance and investment objectives before making investment decisions in the AI space.

What factors should you consider before investing in AI stocks?

Company research:

Thoroughly research the AI company you're considering to understand its role in the sector, track record, and public perception

Ethical considerations:

Evaluate the company's approach to ethical concerns such as privacy and bias, as these factors can impact your investment

Avoiding hype and overestimation:

Be cautious of hype surrounding AI and avoid overestimating its capabilities, recognizing that AI is powerful but not a universal solution

Type of company:

AI stocks can be divided into large tech companies with AI investments and smaller companies focused solely on AI development, with the latter often requiring partnerships for commercialization

Financial metrics:

Assess the company's financial operations, including debt, profitability, cash flow, and earnings per share, to gauge its financial health and growth potential

Management team:

Consider the expertise and vision of the company's management team, as their leadership can impact the company's long-term success

Best stock brokers

FAQs

Is it possible to invest in ChatGPT?

No, it is currently not possible to directly invest in ChatGPT as it is not a publicly traded entity.

What is the stock symbol for ChatGPT?

There is no specific stock symbol for ChatGPT as it is not a publicly traded stock.

Is chat ETF a good investment?

The performance of any ETF, including chat ETFs, can vary based on market conditions and the composition of the ETF. It is recommended to research and evaluate the specific chat ETF's holdings, management, and performance history before considering it as an investment.

What is the best AI stock to invest in?

Determining the best AI stock to invest in depends on various factors, including individual investment goals, risk tolerance, and market conditions.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Copy trading

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

-

5

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).