Explore Digital Options Trading with Powerful Tools & Real-Time Execution

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Digital options are a type of risky derivative instrument that allows traders to speculate on the future price movement of an asset. They differ from binary options in a few ways, including their expiration times, payouts, and trading strategies. Digital options provide traders with increased flexibility, who can use trend-following, reversal trading near support/resistance, and news-based trading strategies for trading market-driven moves.

Digital options are a powerful investment tool that offers traders significant potential for reward and increased flexibility when trading the financial markets. By combining features of traditional options with digital technology, digital options provide investors with an opportunity to make profits from correctly predicting price movements in various assets.

This article will cover how digital options work, as well as provide examples of call-and-put options, guidance about regulations, and whether it is worth investing in this particular asset class. Keep reading.

What are digital options?

Digital options are high-risk derivative instruments that let traders speculate on asset price movements. They offer flexibility by allowing investors to choose strike prices and expiration dates, tailoring trades to their strategy. With leveraged exposure, even small price changes can lead to significant profits, making digital options a popular choice for experienced traders seeking high returns.

How do digital options work?

The technical workings behind digital options involve complex mathematical equations known as Black-Scholes models. This model takes into account factors such as time remaining until expiration, strike price, implied volatility, and risk-free rate when calculating potential outcomes for trades placed with digital options brokers.

Strike price. A strike price is the predetermined price at which an asset can be bought or sold when trading options.

Time to expiration. The period between the trade's start and its end when the outcome is determined.

Implied volatility. The market’s expected price movement, indicating potential risk and reward.

Risk-free rate. The return on a risk-free investment, influencing the asset's future value in options pricing.

Market trends. Price patterns that help traders predict future market movements.

Liquidity. How easily an asset can be bought or sold without affecting its price.

Leverage. Using borrowed funds to increase potential returns, though it also raises risks.

Types of digital options

Depending on whether traders expect prices to rise or fall, they can choose between two main types of digital options: digital put options and digital call options.

Digital put options

A digital put option lets traders profit by predicting if an asset’s price will fall below a specific level (the strike price) within a set time. If this happens, the trader receives a fixed payout, regardless of how much the price drops.

For success, traders must analyze market trends, consider expiry times, and manage risk factors like liquidity and leverage.

Example: You purchase a digital put option with a $100 strike price, expiring in one month. If the asset’s price falls below $100, even by a small margin, you’ll receive a fixed payout.

Digital call options

A digital call option allows traders to profit if an asset’s price rises above the strike price before expiration. If the price meets or surpasses the strike price, the trader earns a payout.

Example: Gold trades at $1,280 at 1 PM. You buy a call option with a $1,300 strike price, expecting gold to rise by 3 PM. If gold trades above $1,300 at 3 PM, you earn a profit. If not, you face a loss.

Advanced types of digital options

As traders gain experience, they often explore more advanced digital options to maximize profit potential. These options go beyond basic trading by offering unique ways to speculate on market movements. Let’s break down some popular types and how they work.

Ladder options. Traders place trades across multiple strike prices, with each level offering a potential payout if the price reaches or surpasses that level. This approach works well in volatile markets where prices move unpredictably.

Up/Down options. This straightforward option involves predicting if the asset’s price will end above or below its current level at expiration. It’s ideal for beginners due to its simplicity.

One-Touch options. Traders speculate whether the asset’s price will touch a predetermined level at least once before expiration. Success doesn’t require the price to stay there, only to reach the level.

Range options. This type involves predicting whether the asset’s price will stay within a specified range throughout the trade period. Traders profit if the price remains inside the set boundaries when the contract ends.

Digital options vs. binary options

Payout flexibility. Digital options let you set payouts based on strike prices, making them great for managing risk, unlike binary options with fixed returns.

Market depth visibility. With digital options, you get access to more detailed market data, making it easier to decide when to enter or exit trades, unlike binary options.

Strike price customization. Digital options let you choose different strike prices in one trade, helping you build multiple profit strategies, unlike the fixed nature of binary options.

Premium trading. In digital options, you can sell your trade before it expires if the market moves in your favor, giving you a flexible way out compared to binary options’ all-or-nothing model.

Non-binary outcomes. Unlike binary options, where you either win or lose, digital options offer variable returns depending on how far the market moves beyond your strike price.

How to start trading digital options

Trading digital options can be rewarding, but understanding the risks is crucial. Here’s a simple guide to get started:

Learn the basics. Study different digital options, including expiration times and strike prices. Understand how they work to make smarter trading decisions.

Choose a broker. Open an account with a reputable broker offering competitive fees, reliable platforms, and essential trading tools like stop-loss orders.

| Digital options | Min. deposit | Min. trade size | Min. Payout (%) | Max. Payout (%) | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | 100 | 0.01 | 70 | 95 | 6.83 | Open an account Your capital is at risk. |

|

| Yes | 5 | 1 | 50 | 128 | 9.4 | Open an account Your capital is at risk. |

|

| No | 5 | 1 | 17 | 95 | 8.7 | Open an account Your capital is at risk. |

|

| No | 250 | 0.01 | 70 | 95 | 5.52 | Open an account Your capital is at risk. |

|

| No | 250 | 1 | No | 100 | 4.12 | Study review |

Why trust us

We at Traders Union have analyzed binary options brokers for over 14 years, evaluating them based on 40+ objective criteria. Our expert team of 50+ professionals regularly updates a Watch List of 25+ brokers, assessing key factors such as payout rates, trade types, deposit and withdrawal conditions, and platform features. We focus on trading conditions and available trading instruments to empower traders to make informed choices. Before selecting a broker, we encourage traders to review its trading conditions, supported assets, and withdrawal policies. Remember that binary options brokers are unregulated in most countries, which carries additional risks. Always conduct independent research and verify terms directly with the broker.

Learn more about our methodology and editorial policies.

Set trading goals. Define clear goals based on your strategy, whether it’s scalping or swing trading. Pick appropriate expiry times for your trades.

Monitor performance. Track your trades regularly by comparing profits against your investment. Adjust your strategy as needed to meet your goals.

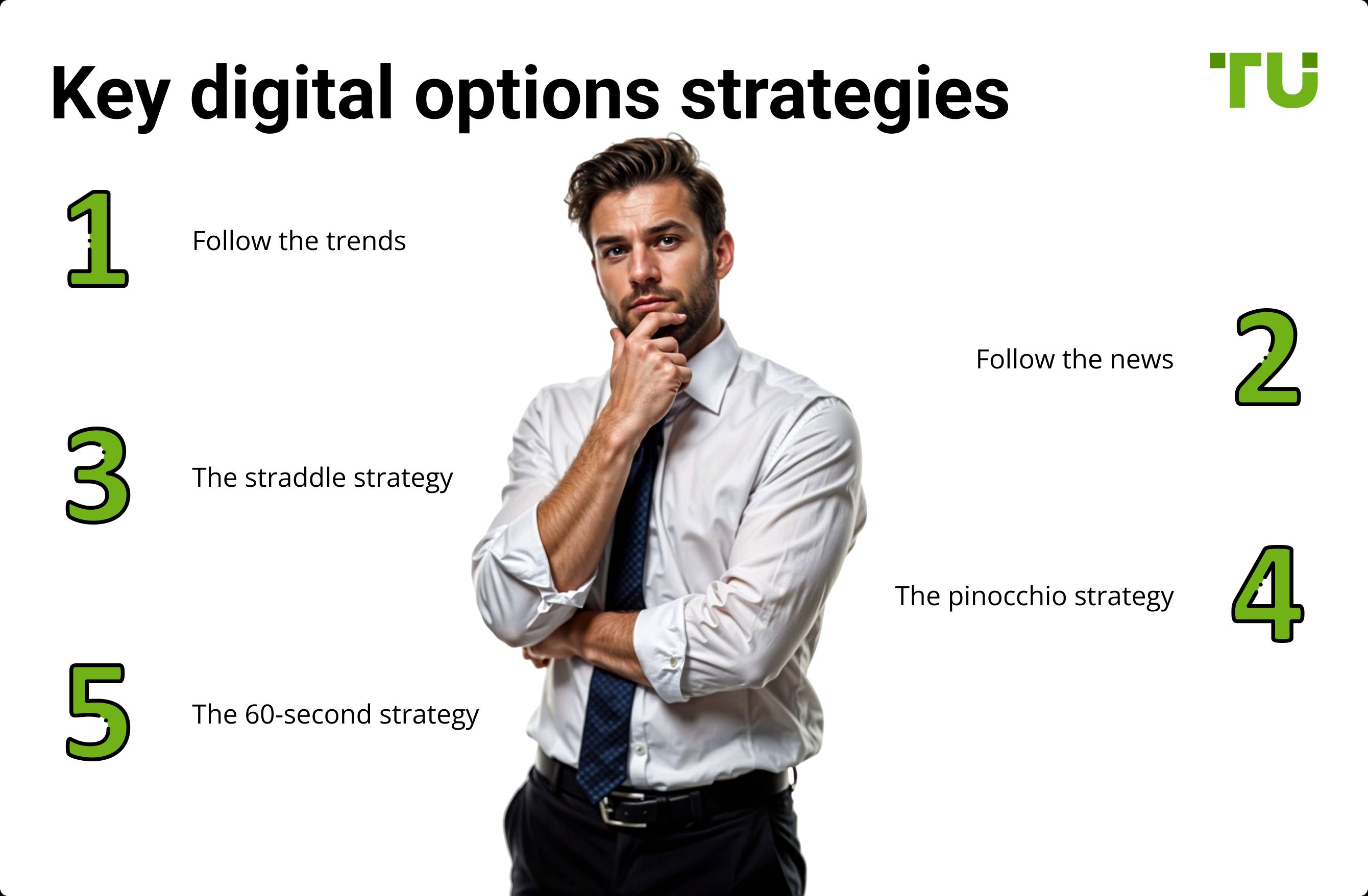

Digital options strategies

Successful digital options trading requires more than luck; it demands smart strategies. Let’s explore some of the most effective digital options strategies.

Follow the trends

This strategy involves tracking the asset's price movements to spot upward or downward trends. If the price shows an upward trend, traders may choose to buy, while a flat line suggests looking for another asset. Though safer, this method offers smaller returns compared to riskier strategies.

Follow the news

Keeping up with market news helps predict how asset prices will move. Major announcements, product launches, or industry updates can influence market behavior. This approach is beginner-friendly as it requires less technical analysis.

The straddle strategy

Use this strategy when expecting significant market announcements. Buy both call and put options before the announcement to profit from expected price swings. This way, traders can earn regardless of whether the price rises or falls.

The pinocchio strategy

This strategy bets against the current market trend, expecting a reversal. Traders use candlestick charts to see if the market is bearish or bullish. A downward wick indicates buying a call option, while an upward wick suggests a put option.

The 60-second strategy

This fast-paced strategy involves trading binary options with a 1-minute expiration. Traders rely on technical analysis to predict short-term price movements. While it offers quick profits, the risk of loss is equally high due to market volatility.

Are digital options legit?

Digital options regulation ensures investor protection and market stability by enforcing strict rules on brokers. Licensed brokers must meet capital requirements, segregate client funds, maintain transaction records, and provide clear risk disclosures before executing trades.

Regulations differ globally:

United Kingdom (FCA): The Financial Conduct Authority (FCA) banned digital options for retail clients to protect investors from high-risk products.

Australia (ASIC): The Australian Securities and Investments Commission (ASIC) prohibited binary options trading for retail clients, limiting access to regulated platforms.

United States (CFTC/SEC): Digital options are legal but only through regulated providers. Brokers must comply with standards set by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Before trading, ensure your broker is properly regulated to trade safely and avoid fraud.

Digital options risks

Digital options come with high risk due to unpredictable market conditions. Traders must be ready for potential losses, as profits are never guaranteed. Success depends on how well they monitor ever-changing market trends and adjust strategies accordingly. Here are the key risk factors that affect digital options:

Pricing complexities. Digital options often involve complicated price calculations that require deep market understanding. Beginners should focus on volatility and interest rate impacts instead of relying solely on strike prices.

Hidden liquidity traps. Low trading volumes can trap traders, making it difficult to exit positions at desired prices. Check how many people are trading and trade during peak hours to avoid this.

Unexpected market shocks. Events like breaking news can cause extreme price swings. Keep an eye on upcoming events and set alerts to manage unexpected risks.

Expiry manipulation. Some brokers may adjust asset prices near expiry times, affecting payouts. Stick to regulated brokers with transparent policies.

Psychological burnout. The fast-paced nature of digital options can lead to decision fatigue and emotional trading. Set personal trading limits and take breaks frequently.

Trade digital options with niche assets and market swings

Digital options aren’t just simple bets on price movement — they can change how you trade if used smartly. Try focusing on assets in specific industries like renewable energy or tech, where prices often move after product launches or big news. This can give you good times to buy or sell without getting caught up in the usual market hype. Start with small trades to see how the market moves and learn faster without risking too much.

Another clever trick is using digital options when prices swing after big announcements, like central bank interest rate changes. These moves can create quick trading chances if you act fast. Watch both price changes and how many traders are involved to spot market turns early. This way, you’re not just guessing where prices will go — you’re ready when the market overreacts and bounces back.

Conclusion

Digital options offer an exciting yet risky way to trade financial markets by speculating on asset price movements. With flexible strike prices, customizable expirations, and high return potential, they appeal to experienced traders. However, success requires a deep understanding of market trends, strategic planning, and disciplined risk management. Before trading, choose a regulated broker, learn key strategies like trend-following and hedging, and be prepared for market volatility to maximize profit potential while limiting losses.

FAQs

What is a digital option?

A digital option is an option in which the strike price can be manually set. As long as the market price of the underlying asset exceeds the strike price, the traders will receive a fixed payout.

How does digital option work?

Digital options offer a fixed payout if the underlying market price exceeds a predetermined threshold, called the strike price. Traders can profit from correct predictions about an asset's future price by using digital options.

What is the difference between binary option and digital option?

Binary options combine the power of price increases with the power of digital options. An option with a digital component has a return based on how far its price moves from its strike price, rather than having a fixed return.

Are options good for beginners?

It may seem risky or complex to beginner investors, so they often stay away from options trading. However, novice investors can use some basic options strategies to protect their downside and hedge market risks.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

The strike price in binary options is the price at which the underlying asset is valued at the expiration of the option.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.