What Is A Direct Stock Purchase

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Direct Stock Purchase Plans (DSPPs) offer investors a unique way to buy shares directly from a company, bypassing brokers and avoiding related fees. With the growing interest in direct investment methods, DSPPs present an accessible and cost-effective option for new and seasoned investors.

DSPP allows investors to purchase company shares directly from the company itself, without the intervention of a broker. These plans are designed to facilitate investment for individual investors by offering a direct path to stock ownership.

DSPPs were introduced as a way for companies to attract individual investors and provide a steady source of capital. Over time, as online brokerages reduced their fees, the popularity of DSPPs fluctuated. However, they remain a valuable tool for long-term, incremental investment.

How direct stock purchase plans work

DSPPs give you the chance to buy company shares directly, skipping brokers altogether. If you're someone who likes the idea of long-term investing without worrying about extra fees, this could be for you. Some companies even make it easier by letting you invest in fractions of a share, so you don’t need to have the full amount for a whole share. It's a good fit if you prefer making small, steady investments, often set up automatically from your bank account.

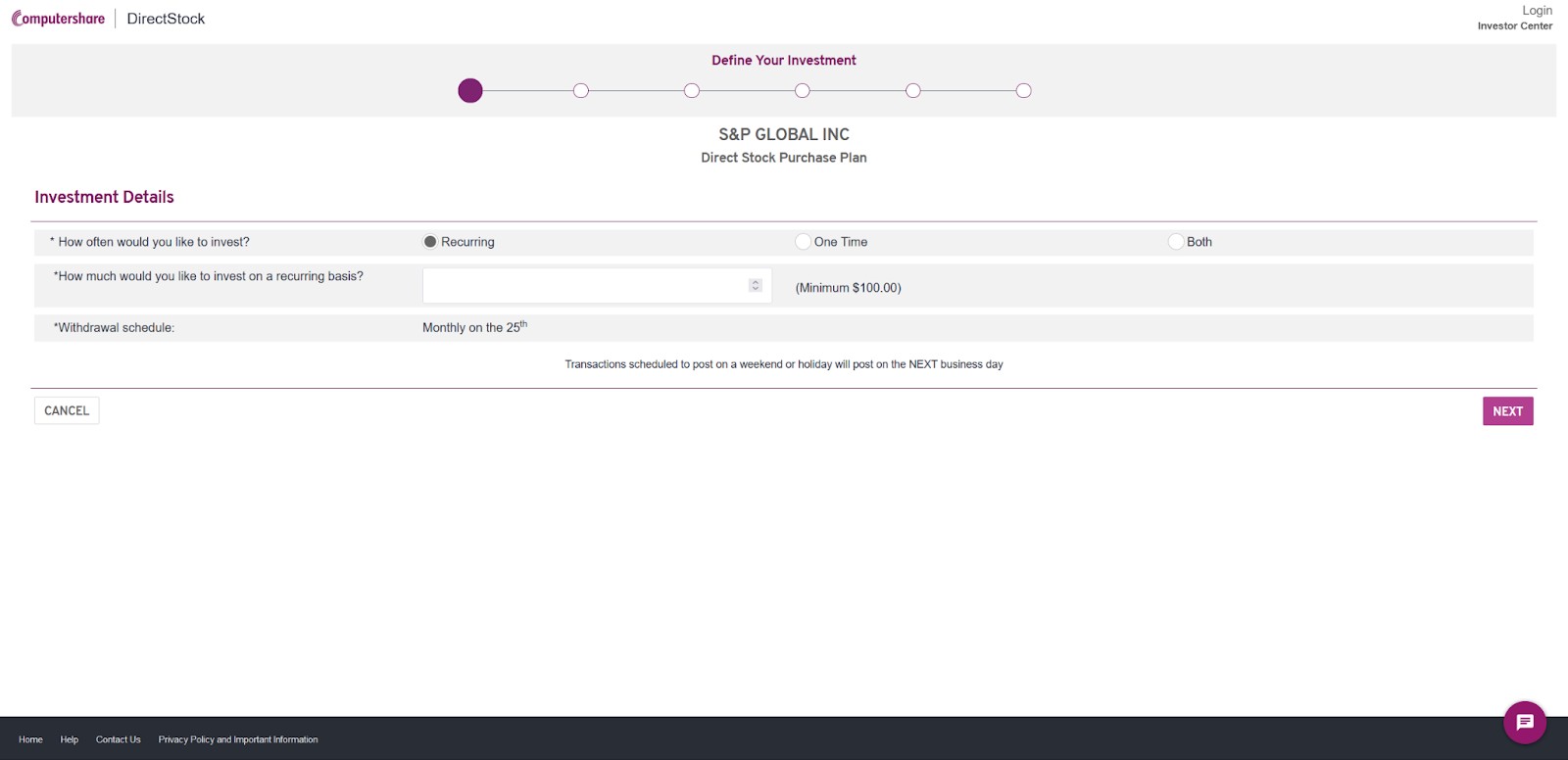

Setting up a DSPP account involves a few straightforward steps. Investors typically need to establish an account with the company or its designated agent, meet a minimum initial investment, and set up ongoing contributions. These contributions can be made via automated clearing house (ACH) transfers or checks. Additionally, many DSPPs offer the option to reinvest dividends (DRIP), allowing investors to automatically purchase additional shares with their dividends.

How to start investing in DSPPs

To begin investing in DSPPs, follow these steps:

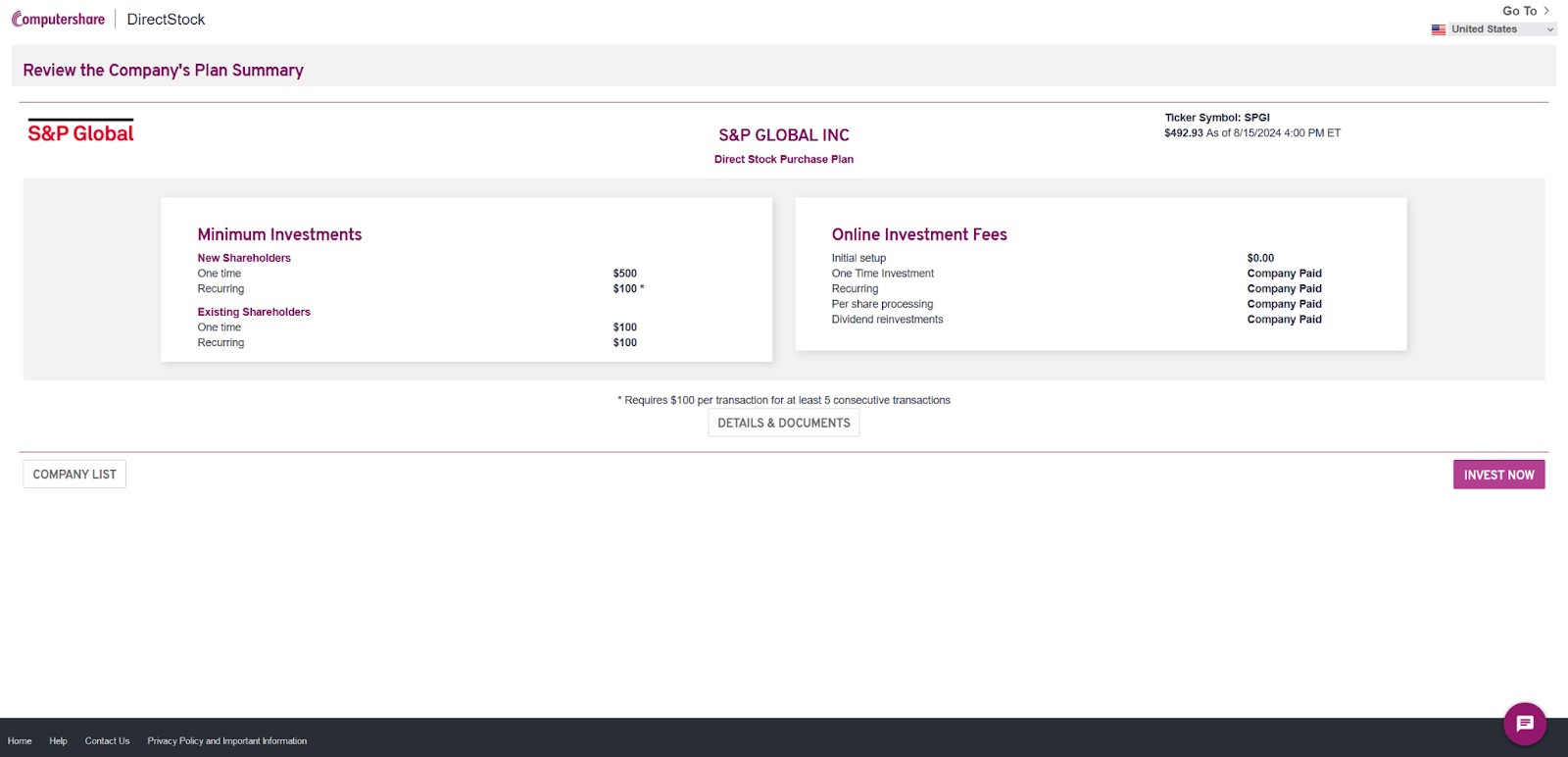

Finding companies offering DSPPs. Check the investor relations section of company websites. Companies offering DSPPs will have a dedicated section for the same, which would also cover the program details. We have presented S&P Global’s DSPP program specifics for your reference below.

Enrollment process. Complete the necessary forms to enroll.

Setting up automatic payments. Arrange for regular contributions via ACH transfers.

Monitoring investments. Regularly check your investment’s performance and make adjustments as needed.

Taxation when participating in a DSPP

Recall: DSPP participants are required to declare their income from dividends, capital gains and any other income related to such investments. For example, in the U.S., there is a Form 1099-DIV for reporting dividends and a Form 1099-B for reporting stock sales. Fiscal policies in DSPP programs have specifics that may vary from jurisdiction to jurisdiction, but the basic tax obligations are as follows:

Capital Gains Tax

If you sell shares purchased through a DSPP at a price higher than the price at which you purchased them, you must pay Capital Gains Tax. In most coun/ries, the rate of Capital Gains Tax depends on how long you have owned the shares

Example: You bought shares in a company through the DSPP for $10 000 (or £10 000). Two years later you sell them for $15 000 (£150 000). The capital gain is $5000 (£50 000).

In the US: tax is calculated at 0%, 15% or 20% depending on your total income. In this case, you have to pay $750 ($5000 × 15%). In the UK: the tax rate depends on your total income and taxpayer status: for basic rate taxpayer - 10%, for higher rate taxpayer - 20%. In this case, £500 (£5000 × 10%) should be paid at the basic rate.

Dividend Tax Dividend Tax

If a company pays dividends on shares that you purchased through the DSPP, this income is taxable.

Example: You receive dividends of $1000 from stock you purchased through a DSPP.

In the US: qualified dividends are taxed at 0%, 15%, or 20%, depending on your total income. At the average rate of 15%, you'll need to pay $150 ($1000 × 15%). In the U.K.: rates in 2025 cf=s 8.75% for a basic rate taxpayer, 33.75% for a high-income taxpayer, and 39.35% for additional income. So, at the basic rate, the dividend tax would be £87.50 (£1000 × 8.75%).

Discount tax

If a company offers its employees or DSPP members a discount on the purchase of shares, this discount is added to total income and taxed at the ordinary rate.

Tax on reinvested dividends

Even if you use the dividends you receive to purchase additional shares through a DSPP reinvestment plan, the amount is still considered taxable income.

Tax on the sale of stock

When you decide to sell shares purchased through a DSPP, you may be charged capital gains tax. Depending on how long you've held the shares, the rate of tax may vary.

Share Inheritance Tax

If you inherit shares acquired through a DSPP, you are subject to an inheritance tax, the rate and terms of which vary from jurisdiction to jurisdiction.

Example: You inherit $50 000 worth of stock from a relative who purchased it through a DSPP.

In the US: there is a federal inheritance tax exemption of $12.92 million for 2025. If the value of the inheritance exceeds this value, heirs will have to pay federal inheritance tax, which can be as high as 40%. In the UK: there is an inheritance tax threshold of £325 000 (for 2025). If the inheritance exceeds this threshold, the heirs are liable to pay inheritance tax at a rate of 40%.

These examples demonstrate how tax may apply when participating in a DSPP. It is important to consult a tax advisor or specialist for up-to-date and accurate information as tax laws may change.

Pros and cons of DSPPs

- Pros

- Cons

Cost-effective investment method. Without broker fees, DSPPs provide a low-cost way to start investing.

No brokerage fees. Direct purchasing eliminates the need for intermediaries.

Fractional share purchases. Investors can buy partial shares, making it easier to invest small amounts.

Benefits for long-term investors. DSPPs are ideal for those with a long-term investment strategy.

Special perks for shareholders. Some companies offer additional perks, such as invitations to events or special offers.

Limited control over purchase dates. Purchases are often made on specific dates set by the company.

Potential lack of portfolio diversification. DSPPs focus on single companies, which may limit diversification.

Difficulty in selling shares without a broker. Selling DSPP shares can be more challenging without a broker.

Fees associated with selling shares. Some DSPPs may have fees for selling shares.

If you are not comfortable with the downsides of DSPPs, it would be wiser to cut costs through other ways instead of eliminating brokers. To help you do the same, we have compared the top brokers that make investing cheaper for you through one way or the other in the table below:

| Demo | Account min. | Signals (Alerts) | Research and data | Basic stock/ETF fee | Min. stock/ETF fee | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | No | Yes | Yes | $3 per trade | $3 per trade | Open an account Via eOption's secure website. |

|

| No | No | Yes | Yes | Zero Fees | Zero Fees | Open an account Via Wealthsimple's secure website. |

|

| No | No | No | Yes | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | Study review | |

| Yes | No | Yes | Yes | 0-0,0035% | $1,00 | Open an account Your capital is at risk. |

|

| No | No | No | Yes | Zero Fees | Zero Fees | Study review |

Eligibility requirements for DSPPs

Eligibility criteria can vary but often include:

Minimum age requirement. Typically, investors must be at least 18 years old.

Residency requirement. Some plans may be restricted to residents of certain countries.

Share ownership requirement. Some DSPPs require investors to already own at least one share.

Employment requirement. In certain cases, only employees of the company can participate.

Some companies also offer small discounts through DSPPs

If you're buying shares through Direct Stock Purchase Plans (DSPPs), take advantage of companies that let you buy at a discounted price. Some big corporations will sell shares directly to you for less than what they're going for on the stock market, often with a 1-5% discount.

As a beginner, this gives you a chance to grow your stock holdings at a lower cost, especially if you’re buying regularly over time. While the discount might seem small, it adds up, and when the stock price goes up, you've already given yourself a head start on returns.

Also, look out for plans that let you reinvest dividends automatically. Instead of taking dividends as cash, you can use them to buy more shares without extra fees or commissions. For someone just starting out, this can make building your investments easier, as the reinvested dividends help grow your stock holdings faster.

Over time, this snowball effect can turn into serious growth, with your dividends earning even more dividends. It’s a smart way to keep your investments growing without much extra effort.

Summary

A Direct Stock Purchase Plan (DSPP) allows investors to purchase company stock directly from the company without going through a broker. These plans often have lower fees and minimum purchase requirements, making them accessible for individual investors.

DSPPs typically offer the option to reinvest dividends automatically, which helps in building a larger investment over time through compounding. They are a convenient and cost-effective way to invest in a company's stock, particularly for long-term investors.

FAQs

What companies have DSPP?

Many companies offer Direct Stock Purchase Plans (DSPP), including big names like Coca-Cola, ExxonMobil, and Procter & Gamble. You can invest directly without needing a broker.

What is the biggest risk in direct stocks?

The main risk in direct stock investments is market volatility, which can cause the value of your shares to drop, potentially leading to losses.

Are there any fees associated with DSPPs?

While DSPPs generally have lower fees compared to traditional brokerage accounts, there may still be some costs involved, such as setup fees, purchase fees, or fees for selling shares. However, these are usually minimal.

How to transfer DSPP shares?

You can transfer DSPP shares through your brokerage account or by completing a stock transfer form with the company’s transfer agent.

Related Articles

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

A brokerage fee, also known as a commission, is a fee charged by a brokerage or financial institution for facilitating and executing financial transactions on behalf of clients. Brokerage fees are typically associated with services related to buying or selling assets such as stocks, bonds, commodities, or mutual funds.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.