Best Crypto Cashback Programs For 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best crypto cashback programs are:

Lolli, Cashback Rate: Up to 30%, Withdrawal Limit: $15 minimum

Fold, Cashback Rate: 2-20%, Withdrawal Limit: None

Crypto.com Visa Card, Cashback Rate: 1-5%, Withdrawal Limit: None

CoinRebates, Cashback Rate: 1.5-20%, Withdrawal Limit: $10

StormX, Cashback Rate: Up to 87.5%, Withdrawal Limit: $10

Crypto cashback programs allow users to earn cryptocurrency on purchases they make at participating merchants. Instead of receiving traditional currency, you earn Bitcoin, Ethereum, or other cryptocurrencies as rewards. These programs are gaining popularity as they offer an easy way to dip your toes into the world of crypto without making direct investments.

In this guide, we’ll explore the best crypto cashback programs in 2025, explain how they work, and provide step-by-step instructions on maximizing your earnings. We’ll also highlight the pros and cons, discuss risks, and share expert advice to help you make informed decisions.

Best crypto cashback programs

Most platforms operate by partnering with online stores or merchants. When you shop through these platforms, they receive a commission, a percentage of which is passed on to you in the form of crypto rewards. Let’s now take a look at the top programs:

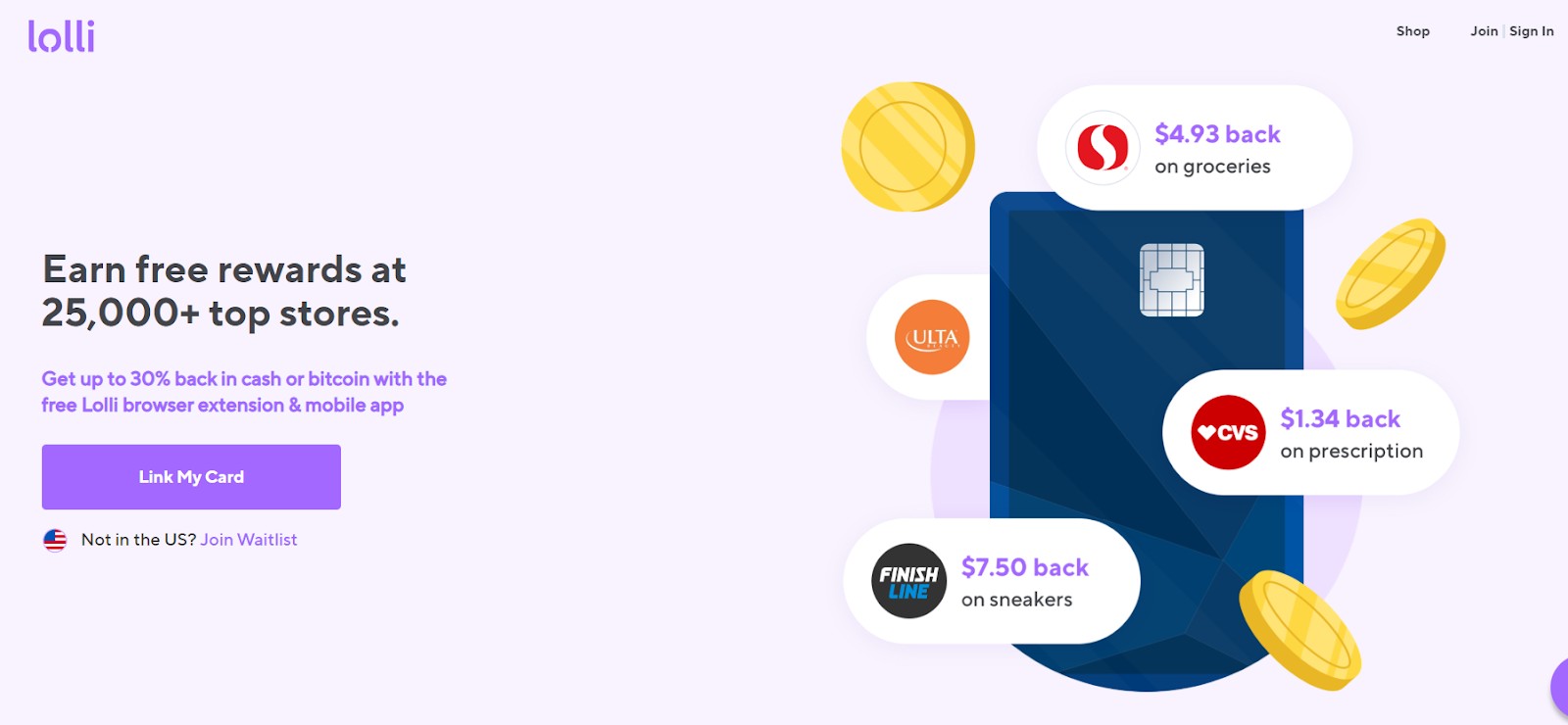

Lolli

Lolli is one of the most popular platforms for earning Bitcoin cashback. It partners with major online retailers such as Nike, Sephora, and Walmart, allowing users to earn up to 30% cashback. Lolli operates through a browser extension, making it simple to use when shopping online. The platform has a minimum withdrawal limit of $15, and users can transfer their earnings to a Bitcoin wallet once this threshold is reached.

Cashback Rate: Up to 30%

Supported Cryptos: Bitcoin

Withdrawal Limit: $15 minimum

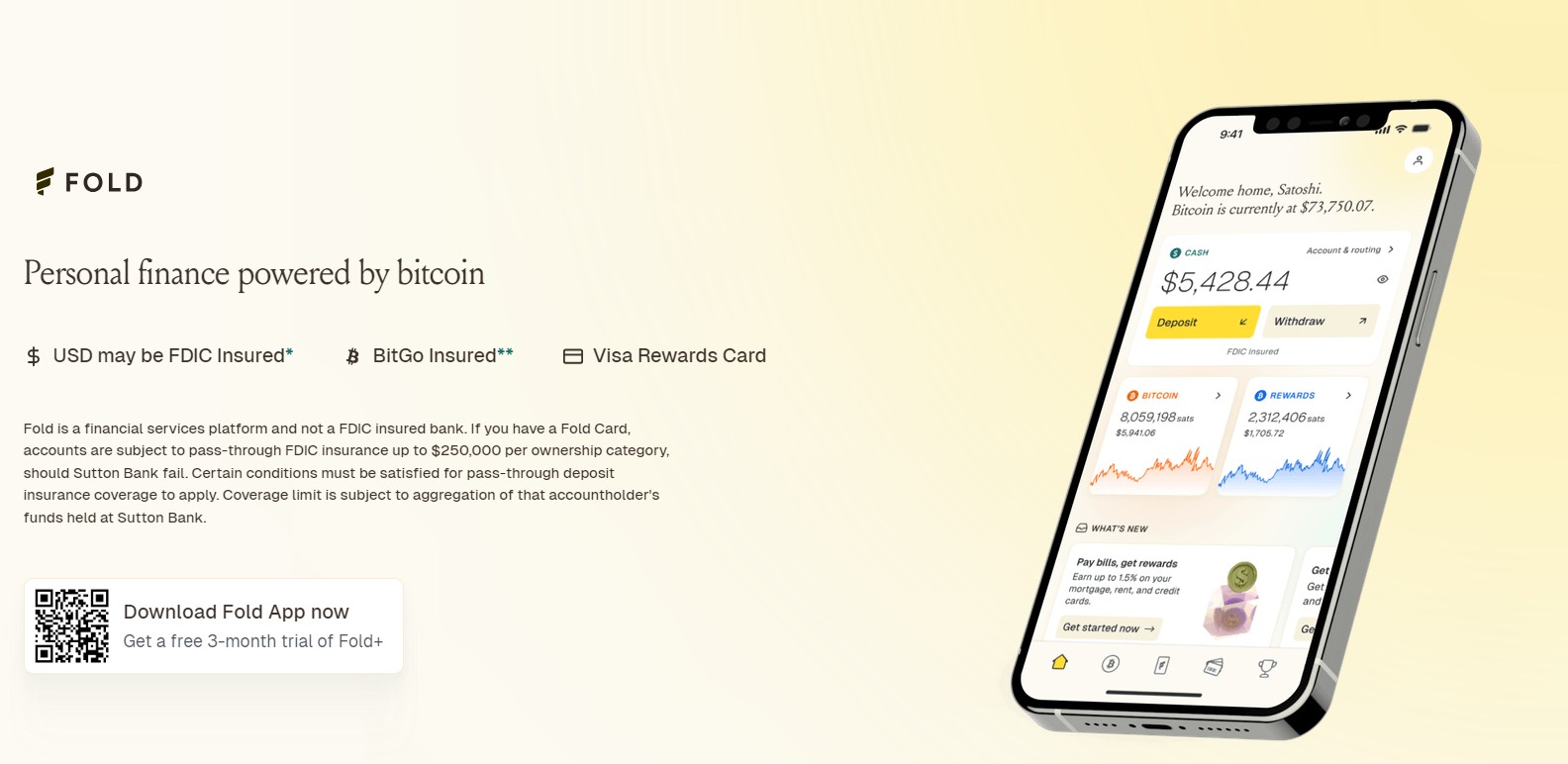

Fold

Fold is ideal for users who prefer earning Bitcoin on gift card purchases. The platform offers up to 20% cashback on prepaid gift cards for popular brands like Amazon, Airbnb, and Starbucks. Users can access Fold through a mobile app, and there is no minimum withdrawal limit, making it highly flexible. Fold is a favorite among frequent gift card buyers who want to spend and earn crypto at the same time.

Cashback Rate: 2-20%

Supported Cryptos: Bitcoin

Withdrawal Limit: None

Crypto.com Visa Card

Crypto.com Visa Card allows users to spend cryptocurrency and earn cashback in the platform’s native CRO token. Cashback rates range from 1% to 5% depending on the card tier, which requires staking CRO tokens. The higher tiers also come with perks like free Netflix, Spotify, and airport lounge access.

Cashback Rate: 1-5%

Supported Cryptos: CRO, Bitcoin, Ethereum

Withdrawal Limit: None (but requires CRO staking for higher rewards)

CoinRebates

CoinRebates is a leading crypto cashback platform that allows users to earn Bitcoin rewards for shopping at over 300 participating online retailers. With cashback rates ranging from 1.5% to 20%, CoinRebates offers a unique way for shoppers to accumulate Bitcoin by making everyday purchases from stores they already frequent, such as AliExpress, Best Buy, Target, New Balance, and Udemy.

Cashback Rate: 1.5-20%

Supported Cryptos: Bitcoin

Withdrawal Limit: Varies based on store policy

StormX

StormX stands out for its gamified experience and microtasking features, allowing users to earn crypto rewards by completing small jobs, surveys, or simply making purchases. It offers one of the highest cashback rates, up to 87.5% in Bitcoin, Ethereum, and STMX tokens. Users need to accumulate at least $10 to withdraw their earnings, and it’s an excellent option for those who want to combine shopping with fun tasks.

Cashback Rate: Up to 87.5%

Supported Cryptos: BTC, ETH, STMX

Withdrawal Limit: $10

You can compare the discussed options through the comparative table we have prepared below:

| Platform | Cashback Rate | Supported Cryptos | Withdrawal Limit | Best For |

|---|---|---|---|---|

| Lolli | Up to 30% | Bitcoin | $15 | Shopping at major online retailers |

| Fold | 2-20% | Bitcoin | None | Gift card purchases |

| Crypto.com Visa Card | 1-5% | CRO, BTC, ETH | None | Crypto debit card with perks and rewards |

| CoinRebates | 1.5-20% | Bitcoin | Varies based on store policy | In-store and online purchases |

| StormX | Up to 87.5% | BTC, ETH, STMX | $10 | Gamified experiences and microtasking |

Factors to consider before choosing a crypto cashback program

When selecting a crypto cashback platform, it’s important to weigh several factors:

Availability in your country. Not all platforms are available worldwide.

Supported cryptocurrencies. Some programs offer Bitcoin only, while others support multiple cryptos.

Partner stores and brands. Check if your preferred retailers are included.

Cashback rates. Compare the percentages offered by each platform.

Withdrawal limits and fees. Look out for minimum withdrawal amounts and any associated fees.

How to use crypto cashback programs

Step-by-step guide on using crypto cashback programs:

Choose a platform. Start by selecting a cashback platform that suits your needs. Popular choices include Lolli, Fold, and Bitcoin Rewards.

Sign up and link accounts. Once you’ve chosen a platform, sign up and link your payment methods, such as credit or debit cards.

Shop at partner merchants. Shop at participating stores, either through browser extensions or mobile apps, and earn cashback in crypto.

Earn and withdraw crypto. After reaching the withdrawal limit (usually $10 or more), you can transfer your crypto to your wallet.

Maximizing your earnings:

Use platforms that offer higher cashback percentages.

Keep an eye on promotions and special deals.

Combine crypto cashback with traditional rewards for double benefits.

What traders should consider

If you’re new to crypto cashback, simplicity is key. Start with user-friendly platforms like Lolli or Pei, which require minimal setup. Also, be mindful of crypto volatility. Since cashback is paid in cryptocurrency, its value can fluctuate, which could affect your overall earnings.

For more experienced users, consider using multiple platforms to diversify your earnings. Advanced traders should also be mindful of the tax implications associated with earning crypto rewards, as these may vary depending on your country of residence.

Also, before using any crypto cashback program, check the legal requirements in your country. Additionally, consider the tax implications of earning cryptocurrency. In some countries, you may need to report these earnings as taxable income.

Pros and cons of using crypto cashback programs

- Pros

- Cons

Earn free crypto on everyday purchases.

Wide range of participating stores and merchants.

Accessible way for beginners to start accumulating cryptocurrency.

Crypto volatility can affect the value of your rewards.

Some platforms are not available globally.

Withdrawal limits and fees may restrict access to funds.

Alternatives for crypto cashback programs

Crypto cashback cards. Earn cashback rewards in cryptocurrency for everyday purchases, with rates varying by card tier and spending volume.

Staking rewards. Lock up your crypto holdings to support network operations and earn annual percentage yields (APY).

Referral programs. Invite others to join the platform and receive a share of their trading fees or bonus rewards.

Trading competitions. Participate in contests for active traders and earn prizes in crypto for achieving high trading volumes.

Liquidity mining. Provide liquidity to platform pools and earn a share of trading fees or additional tokens.

P2P cashback. Receive cashback on fees for peer-to-peer transactions like buying or selling crypto directly with other users.

Savings and lending. Deposit crypto into savings accounts or lending programs to earn interest.

These features offer flexible ways to maximize earnings on crypto exchanges based on your activity and preferences.

| Coins Supported | Demo | Min. Deposit, $ | Spot Taker fee, % | Spot Maker Fee, % | P2P | Staking | Affiliate program | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| 329 | Yes | 10 | 0,1 | 0,08 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| 278 | No | 10 | 0,4 | 0,25 | No | Yes | Yes | Open an account Your capital is at risk. |

|

| 250 | No | 1 | 0,5 | 0,25 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| 72 | Yes | 1 | 0,2 | 0,1 | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| 1817 | No | No | 0 | 0 | No | No | Yes | Open an account Your capital is at risk. |

Risks and warnings

As with any crypto-related endeavor, there are risks involved:

Crypto volatility. The value of your cashback rewards may fluctuate based on market conditions.

Security concerns. Be cautious when linking your financial accounts to cashback platforms. Ensure the platform has strong security measures in place.

Regulatory risks. Some countries have stricter regulations on cryptocurrency. Make sure the program is legal in your region.

Platform shutdowns. As these are relatively new platforms, some may go out of business, resulting in potential loss of funds.

Think of it like staking or a long-term investment

When you earn Bitcoin or other cryptocurrencies as cashback, it’s tempting to withdraw immediately or exchange it for fiat currency, especially if the market spikes. But the true power of these programs lies in holding onto your rewards for a while, letting the market work in your favor.

A cashback program isn’t just a way to save a little on purchases; it's also an entry point into the broader crypto market, where the value of what you earn could grow over time. Think of it like staking or a long-term investment. Every time you make a purchase, you're incrementally building your crypto portfolio.

That said, always be mindful of the volatility. I’ve seen the market turn quickly, both for the better and the worse. So, a balanced approach is critical. Keep some rewards liquid if you think you might need to cash out, but don’t be afraid to hold onto a portion as a long-term strategy.

Conclusion

Crypto cashback programs are a smart way to earn extra Bitcoin or other cryptocurrencies without direct investment, and they fit seamlessly into your daily spending.

But like any form of crypto, rewards come with risks. The value of your cashback can rise or fall with the market, so holding onto your rewards for the long term can lead to higher gains, though it's crucial to stay informed and withdraw when needed.

In trading, discipline and patience are key, and the same applies here. Over time, those small bits of cashback could grow into significant profits if you play the long game wisely. In the end, crypto cashback programs offer a low-risk way to accumulate valuable crypto, and they’re a perfect addition to any trader’s strategy.

FAQs

How do I withdraw my cashback?

Most platforms allow withdrawals to crypto wallets once a minimum balance is reached.

Are there fees involved?

Some platforms charge withdrawal or conversion fees, so it’s important to check before you sign up.

What happens if the price of crypto drops after I earn cashback?

The value of your rewards will decrease in line with the market, making crypto volatility a key consideration.

Do I need to complete KYC (Know Your Customer) to use these platforms?

Some platforms, like Lolli, require minimal or no KYC, while others may require verification, especially for withdrawals.

Is there a way to track my crypto cashback earnings over time?

Most platforms offer tracking via their apps or browser extensions, allowing you to monitor your accumulated cashback and withdrawal history.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.