Fidelity's Crypto Investments: An Overview

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

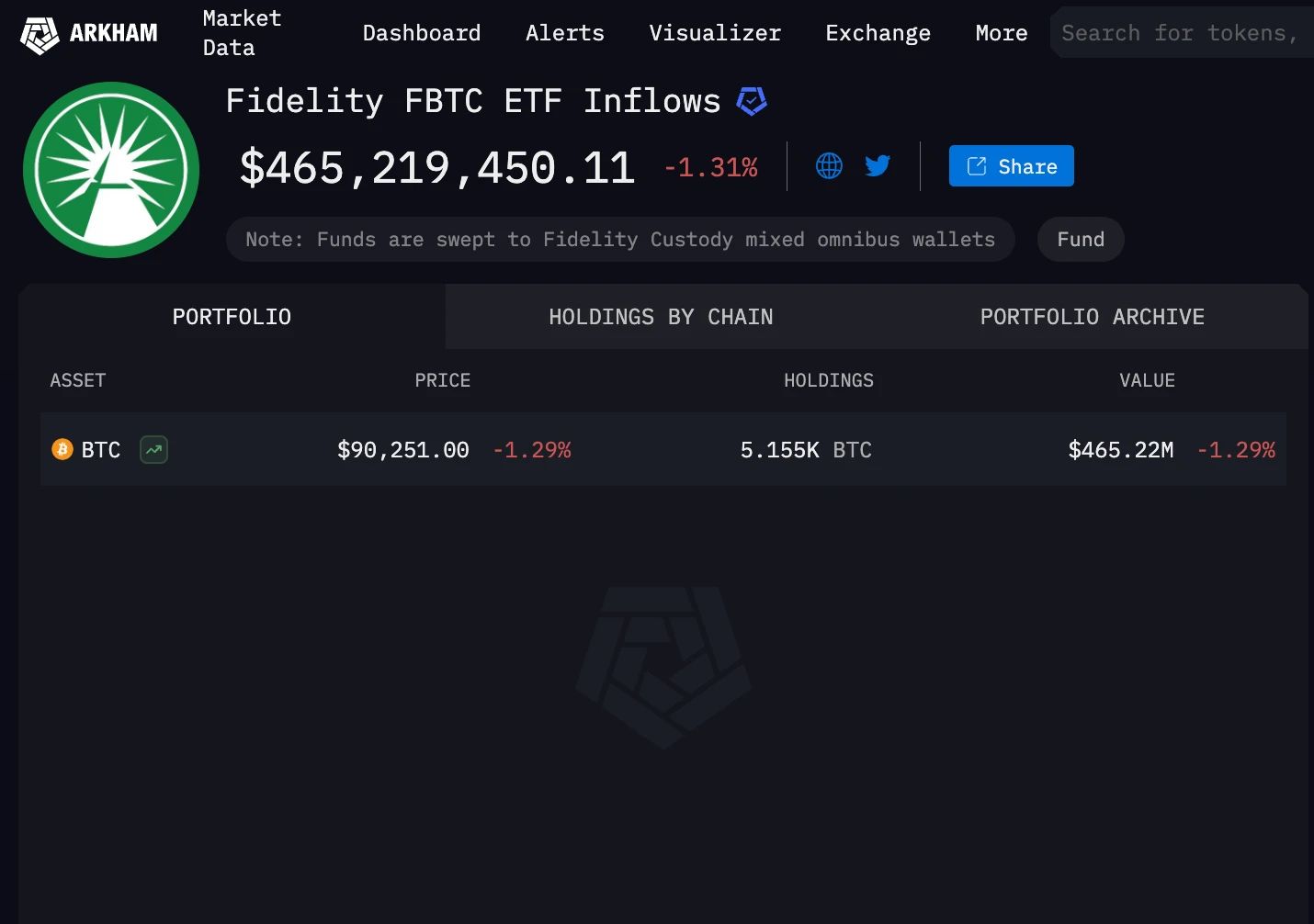

Fidelity Investments has expanded its cryptocurrency services, allowing investors to buy and sell digital currencies through multiple avenues. Fidelity has been a strong advocate for Bitcoin, offering direct trading and custodial services to institutional clients for an extended period. The portfolio holds 5,155 BTC, with total Bitcoin reserves valued at $465.22 million.

Fidelity Investments has become a well-known name in the cryptocurrency world. With deep roots in institutional finance, the firm offers straightforward crypto services, including direct trading, ETFs, and secure storage. By making digital assets more accessible to both individual and institutional investors, Fidelity has played a key role in shaping how cryptocurrencies are used and accepted.

Breakdown of Fidelity’s cryptocurrency holdings

Fidelity Investments has been actively expanding its presence in the digital assets space, offering a range of products and services to cater to both institutional and individual investors. Their exposure to crypto is directly derived from their product offerings.

Crypto ETFs and Funds. Beyond FBTC and FETH, Fidelity offers thematic ETFs such as the Crypto Industry and Digital Payments ETF (FDIG) and the Metaverse ETF (FMET). These funds enable investors to gain exposure to companies involved in the digital assets ecosystem and the emerging metaverse sector.

Blockchain Investments. Fidelity has been actively investing in blockchain technology. In June 2024, Fidelity International tokenized a money market fund on JPMorgan’s Onyx Digital Assets blockchain, enhancing efficiency in collateral management.

Bitcoin (BTC).Fidelity has been a long-time supporter of Bitcoin, providing direct trading and custodial services for institutional clients. There are 5.155K BTC in the portfolio. Total Bitcoin savings - $465.22M.

Fidelity Advantage Bitcoin ETF (FBTC) and Fidelity Ethereum ETF (FETH): Key investment vehicles

Fidelity's Advantage Bitcoin ETF (FBTC) and Ethereum ETF (FETH) provide an easy way to invest in these leading cryptocurrencies without the hassles of buying them directly. You can even include these ETFs in your RRSPs and TFSAs, allowing your investments to grow without immediate taxes. This makes it simpler for anyone looking to add cryptocurrencies to their investment mix.

Security is a top priority when it comes to digital currencies, and Fidelity ensures this by using top-notch measures. Most of the assets are kept in cold storage, keeping them safe from online hacks. Plus, both FBTC and FETH are offered in Canadian and U.S. dollars, making them appealing to a wide range of investors with different currency preferences.

Financial impact and market reactions

Fidelity Investments, a privately held firm predominantly owned by Abigail Johnson and her family, has quietly established itself as a formidable force in the financial industry. In 2024, Fidelity reported an operating income of $10.3 billion, surpassing industry giants like BlackRock and Blackstone. This impressive performance is largely attributed to its $5.9 trillion asset management division, with significant contributions from its passive investment arm, Geode Capital Management.

Notably, the Fidelity 500 Index Fund alone manages $639 billion in assets, underscoring the firm's substantial market influence. Beyond asset management, Fidelity's integrated approach, encompassing retail brokerage, wealth management, and workplace savings plans, has created a diversified revenue stream, positioning it as a potential leader in the global investment landscape.

Market reactions to Fidelity's strategic maneuvers have been notably positive. The firm's expansion into active exchange-traded funds (ETFs) has resonated well with European wealth managers, especially amid regulatory and cost pressures. A recent survey indicated that 61% of intermediary distributors plan to increase their allocations to active ETFs over the next 18 months, a trend that Fidelity has adeptly capitalized on by launching new active ETF products. This proactive approach not only meets the evolving demands of investors but also solidifies Fidelity's competitive edge in a rapidly changing financial environment. Let’s now look at how Fidelity aids investors in the market:

$0 commission trades

Fidelity lets investors trade crypto without extra fees, making it easier for people to get started without worrying about high costs. The platform keeps costs low so more people can invest, whether they’re first-time traders or big institutions.

Personalized wealth management with Fidelity

A real person helps you map out your financial future with Fidelity’s advisory services. Whether it’s planning for retirement, cutting down taxes, or making sure your money is passed down properly, the advice you get is built around your unique situation and goals.

Comprehensive planning

Fidelity goes beyond just investing. They help people prepare for the future, from retirement to passing down wealth, while making sure rising healthcare costs and tax-efficient investing strategies are covered.

Investment management tailored to goals

Fidelity builds investment plans made to fit your risk level, long-term plans, and investing style. The team actively monitors portfolios, adjusting as needed to keep your investments on track.

Specialized offerings and tax-smart strategies

Keeping more of your profits by cutting down on taxes is a key part of Fidelity’s approach. They offer specialized accounts for targeted investments and provide access to bonds and fixed-income options for a balanced portfolio.

Trust services for estate planning

Fidelity helps families set up trusts and handle estate planning the right way. Whether you need a trustee or help making sure your wealth is handled properly, their services keep everything running smoothly.

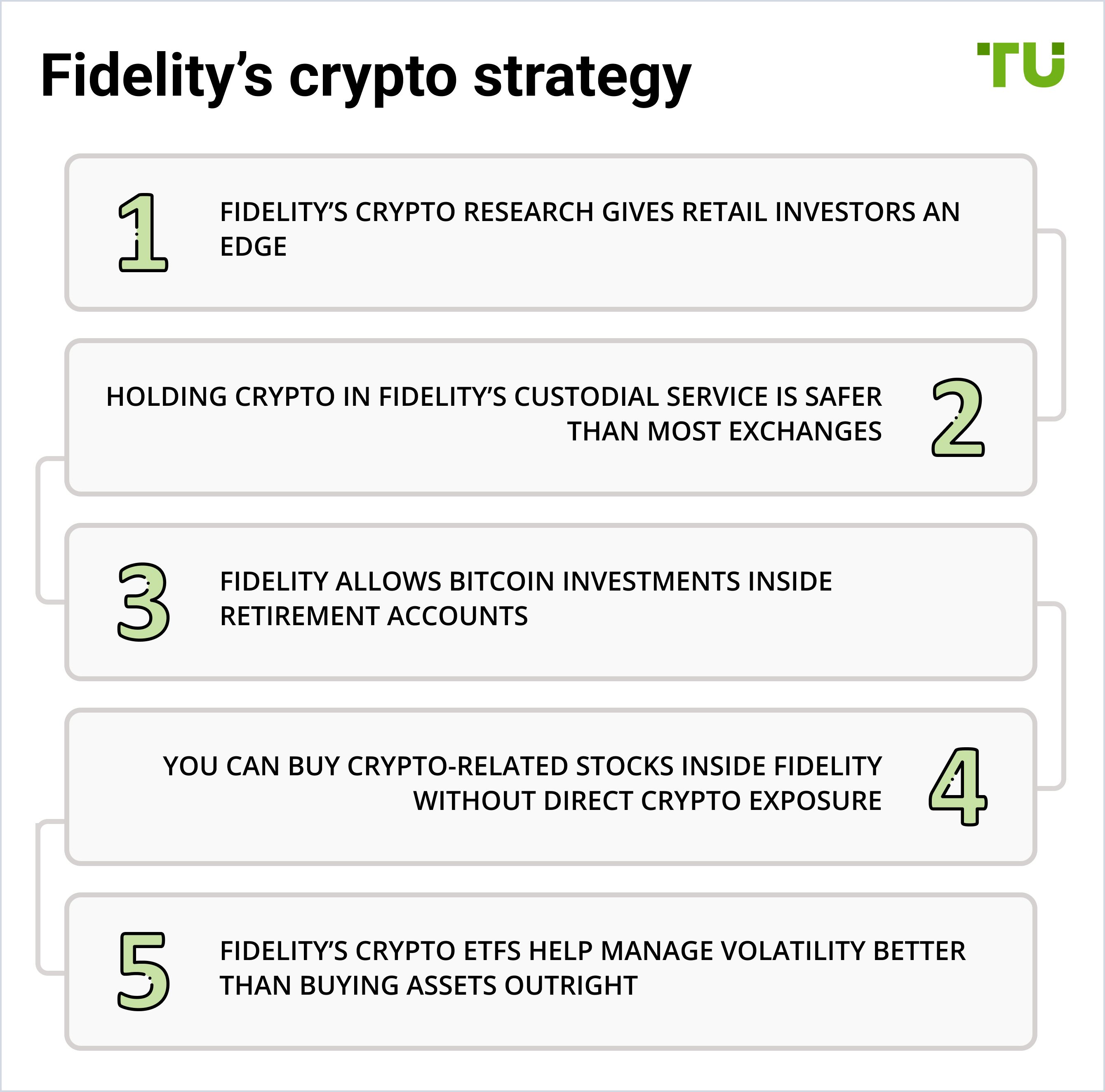

Fidelity’s cryptocurrency strategy

Fidelity’s approach to cryptocurrency goes beyond just buying and selling — there’s a deeper strategy at play that many investors overlook.

Fidelity’s crypto research gives retail investors an edge. Most people don’t realize that Fidelity produces deep-dive research reports on crypto trends, institutional adoption, and blockchain innovation. These reports, often used by hedge funds and big players, are also available to everyday investors. Instead of relying on social media hype, tap into this data to make informed decisions.

Holding crypto in Fidelity’s custodial service is safer than most exchanges. Unlike popular retail exchanges, Fidelity’s institutional-grade custody service is designed to withstand extreme volatility and security threats. This means assets are stored in a way that significantly reduces the risk of hacks and operational failures — something smaller platforms struggle with.

Fidelity allows Bitcoin investments inside retirement accounts. While most people think of Bitcoin as a short-term trade, Fidelity lets you hold it in a 401(k) or IRA. This is a game changer for long-term investors because it allows them to gain exposure to Bitcoin’s potential upside while benefiting from tax-advantaged growth.

You can buy crypto-related stocks inside Fidelity without direct crypto exposure. If you’re unsure about holding Bitcoin or Ethereum, Fidelity offers a way to invest in crypto’s growth indirectly. You can buy stocks of blockchain infrastructure companies, mining firms, and firms developing digital asset solutions. This strategy reduces direct risk while still capturing upside.

Fidelity’s crypto ETFs help manage volatility better than buying assets outright. Instead of dealing with the rollercoaster ride of crypto markets, ETFs smooth out volatility by spreading investments across multiple assets. Fidelity’s ETFs are designed to give exposure to Bitcoin and Ethereum without requiring you to navigate private keys or custody risks.

Future outlook: What’s next for Fidelity in crypto?

Fidelity isn’t just offering crypto — it’s making sure digital assets become part of everyday money moves. Here’s where they could go next.

Tokenized assets will change investing forever. When stocks, real estate, and funds go digital, buying and selling will be instant, cheaper, and even let you own small shares of things that used to be out of reach.

Retirement accounts will quietly go crypto. More people will start stacking crypto in their retirement accounts without even realizing it. Fidelity is already rolling out Bitcoin in 401(k)s, and soon, Ethereum and other crypto investments could follow.

Stablecoins and digital cash will be Fidelity’s next move. Fidelity might roll out its own digital cash or connect to stablecoins so moving between crypto and regular investments happens in seconds, not days.

AI-driven crypto portfolios will take off. Imagine an investing plan that updates itself, shifting money into the best crypto options without you lifting a finger. With AI, investors won’t have to stress over which crypto to hold — smart systems will adjust for them.

Staking rewards will create new passive income streams. Holding crypto could soon feel more like a high-interest savings account, paying out rewards just for keeping it in your portfolio. Fidelity could make this mainstream by offering easy staking options.

Decentralized finance (DeFi) will be simplified for mainstream investors. DeFi is complicated, but Fidelity could make earning interest or borrowing against crypto as easy as using your bank’s app. A secure, insured way to use DeFi could bring in millions of new users.

Risks and warnings

Market volatility. Crypto prices can fluctuate significantly, impacting Fidelity’s crypto-based investments.

Regulatory risks. Changes in regulations may affect Fidelity’s ability to offer certain crypto services.

Security concerns. Despite strong security measures, digital assets remain a target for cyber threats.

Two smart moves Fidelity crypto investors are using to beat market swings

Most beginners stress over which crypto to buy, but the real advantage with Fidelity’s crypto portfolio is how you spread your investments. Instead of just picking a mix of coins, look at which ones tend to move in opposite directions. Some altcoins actually climb when Bitcoin takes a hit. By putting part of your portfolio into these, you can cushion losses without just holding stablecoins. This isn’t basic diversification — it’s a way to stay ahead of market swings with less stress.

Here’s another pro move: use Fidelity’s tax tools to turn losses into an advantage. Most traders freak out and sell when prices drop, but if you sell at a loss on purpose, you can cut your tax bill and buy back in at a lower price. Fidelity makes this easy by letting you set up automatic tax-loss harvesting, so you don’t have to time it manually. It’s not just about making money — it’s about keeping more of it in your pocket.

Conclusion

Fidelity has emerged as a significant player in the crypto investment space, offering a variety of digital asset services tailored to retail and institutional investors. With Bitcoin and Ethereum at the core of its crypto portfolio, the firm continues to push for mainstream adoption. However, regulatory challenges and market volatility remain key considerations for investors. By leveraging Fidelity’s ETFs, blockchain investments, and zero-commission trades, investors can navigate the evolving digital asset landscape with greater confidence.

FAQs

What cryptocurrencies are in the Fidelity crypto portfolio?

Fidelity’s portfolio primarily includes Bitcoin (BTC), Ethereum (ETH), and blockchain investment products.

How much is Fidelity’s crypto portfolio worth?

Exact figures vary, but Fidelity manages billions in crypto assets through its digital asset division and ETFs.

Is Fidelity’s Bitcoin ETF a good investment?

The Fidelity Advantage Bitcoin ETF (FBTC) offers a secure way to gain exposure to Bitcoin, but investors should assess risk factors before investing.

What is Fidelity Digital Assets?

Fidelity Digital Assets is the company’s institutional-grade crypto trading and custodial service, catering to professional investors and corporations.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.